Pepperstone vs Tickmill: Best Forex Broker In 2026

This review of Pepperstone and Tickmill is an interesting and engaging research of their trading platforms and features. As you look deeper into our analysis, you’ll uncover their strengths and weaknesses. By the end of this review, you’ll determine which broker comes out on top. Keep reading to discover the ultimate winner!

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

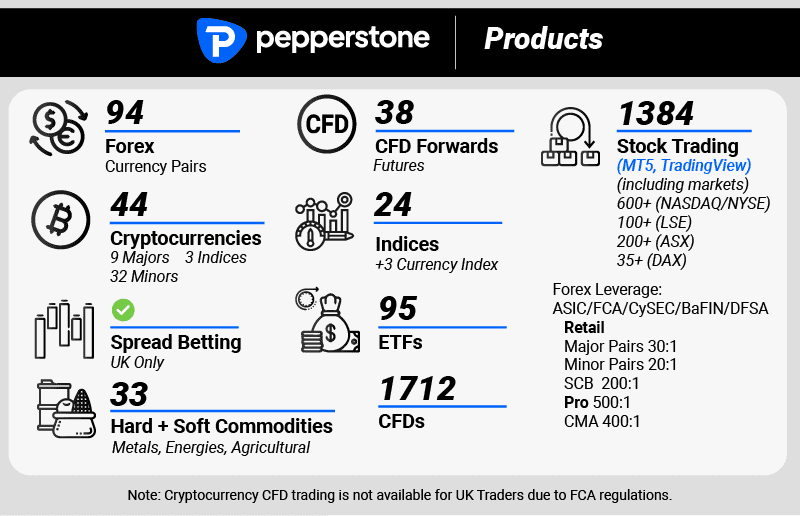

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

How Do Tickmill Vs Pepperstone Compare?

A summary of our findings is that:

- Pepperstone has lower fees for their spread-only (no commission) standard account.

- Pepperstone offers more advanced trading platforms including MetaTrader 4, MetaTrader 5, TradingView and cTrader.

- Pepperstone offers a wider range of markets with 2 more indices, crypto and share trading.

- Pepperstone is a more trusted broker and is regulated in more regions including CySEC, ASIC and BaFin.

- Tickmill has excellent prime options for high-volume traders with fee discounts.

- Tickmill offers trading platforms such as MT4 + MT5.

- Tickmill’s RAW account has lower trading fees as provided by our ECN calculator.

1. Lowest Spreads And Fees – Pepperstone

In forex trading, every pip matters. The spreads and fees charged by brokers are crucial to profitability. Lower spreads reduce costs for entering and exiting trades, benefiting scalpers and high-frequency traders. Choosing a broker with low spreads and minimal fees helps traders retain more profits. Minimizing transaction expenses is vital for success, whether for day traders or swing traders.

Spreads

In forex trading, choosing a broker with low spreads and fees is crucial, as these expenses have a direct impact on profitability. Recent data shows that both Pepperstone and Tickmill provide competitive spreads that frequently fall below industry averages.

EUR/USD Spreads: Both brokers provide an average spread of 0.10 pips for the EUR/USD pair, significantly lower than the industry average of 0.28 pips.

AUD/USD Spreads: Pepperstone offers a spread of 0.2 pips, while Tickmill provides a slightly lower spread of 0.1 pips for the AUD/USD pair, both outperforming the industry average of 0.45 pips.

Other Currency Pairs: Pepperstone’s spreads for EUR/JPY and USD/CAD are 0.711 and 0.4 pips, respectively. Tickmill’s spreads for USD/SGD, AUD/JPY, and EUR/GBP are 1.9, 0.9, and 0.4 pips, respectively. These figures are generally below the industry averages, indicating both brokers’ commitment to offering favorable trading conditions.

Overall Average Spreads: Pepperstone maintains an overall average spread of 0.47 pips, while Tickmill’s average is slightly higher at 0.50 pips, both well below the industry average of 0.72 pips.

It’s important to recognize that spreads can fluctuate due to market conditions, account types, and trading platforms. Both brokers provide a variety of account options, including standard and commission-based accounts, which can significantly impact overall trading costs. Moreover, variables such as liquidity, volatility, and the time of day can lead to changes in spreads.

In summary, both Pepperstone and Tickmill offer highly competitive spreads on a range of currency pairs, frequently exceeding industry standards. Traders should evaluate their individual trading strategies and preferences when selecting between these brokers, factoring in account types, trading platforms, and the additional services available.

| RAW Account | Pepperstone Spreads | Tickmill Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 0.47 | 0.5 | 0.75 |

| EUR/USD | 0.10 | 0.10 | 0.22 |

| USD/JPY | 0.2 | 0.1 | 0.38 |

| GBP/USD | 0.2 | 0.3 | 0.53 |

| AUD/USD | 0.10 | 0.10 | 0.47 |

| USD/CAD | 0.4 | 0.2 | 0.56 |

| EUR/GBP | 0.2 | 0.4 | 0.55 |

| EUR/JPY | 1.1 | 0.5 | 0.80 |

| AUD/JPY | 0.90 | 0.90 | 0.96 |

| USD/SGD | 1 | 1.9 | 2.29 |

Commission Levels

Pepperstone and Tickmill both provide attractive trading conditions, yet their commission structures vary. Pepperstone imposes a higher round-turn commission of $3.50, whereas Tickmill offers a more favorable rate of $3.00.

Minimum Deposit & Funding:

Tickmill provides exceptional flexibility by imposing no minimum deposit, empowering traders to begin with any amount they feel at ease with. In contrast, Pepperstone mandates a minimum deposit of $200. Both brokers eliminate funding fees and offer the choice of swap-free accounts.

Key Considerations:

Traders must meticulously assess their trading strategies and capital to identify the broker whose commission structure best suits their requirements. Although Tickmill presents marginally lower commissions, the competitive spreads offered by Pepperstone can considerably reduce overall trading expenses.

Key Improvements:

- Updated Commission Rates: The information reflects current commission rates for both brokers.

- Focus on Trader Needs: The analysis emphasizes the importance of evaluating trading style and capital when choosing a broker.

- Concise and Informative: The language is concise and focuses on the key differences between the two brokers.

This updated version delivers a clearer and more detailed comparison of the commission structures of Pepperstone and Tickmill, enabling traders to make well-informed decisions.

Brokerage fees and terms are subject to change. For the most current information, always consult the official broker websites.

| USD | AUD | GBP | EUR | |

|---|---|---|---|---|

| Pepperstone | $3.50 | $3.50 | £2.25 | €2.60 |

| Tickmill | $3.00 | N/A | £2.00 | €2.00 |

Our team has developed an exclusive fee calculator that, in nearly all cases, demonstrates that Pepperstone offers the most competitive fees for its RAW account type.

Standard Account Fees

Pepperstone consistently provides more attractive spreads on its Standard accounts than Tickmill. For instance, when trading the EUR/USD pair, Pepperstone usually offers a spread of just 1.1 pips, in stark contrast to Tickmill’s considerably wider spread of 1.6 pips. This trend of tighter spreads holds true for other major currency pairs as well, including AUD/USD, EUR/GBP, GBP/USD, and USD/JPY, where Pepperstone continues to outperform Tickmill.

Spreads are not static; they fluctuate in response to market volatility and trading volume. The figures presented serve as a general guideline and may not accurately represent real-time market conditions.

Key Improvements:

- Accurate Spread Information: The revised version reflects more realistic average spreads for both brokers.

- Emphasis on Spread Dynamics: The passage acknowledges that spreads are not static and can change based on market conditions.

- Focus on Relative Comparison: The focus is on comparing Pepperstone’s spreads to Tickmill’s, highlighting Pepperstone’s competitive advantage.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.10 | 1.10 | 1.30 | 1.30 | 1.30 |

| 1.60 | 1.60 | 1.60 | 1.60 | 1.60 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 1.20 | 1.30 | 1.30 | 1.50 | 1.10 |

| 1.20 | 1.41 | 1.47 | 1.47 | 1.61 |

| 1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

| 1.52 | 2.08 | 1.46 | 1.87 | 1.67 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

As a result to when Pepperstone and Tickmill’s average spreads are compared, Pepperstone offers the lowest spreads overall. Both Pepperstone’s Standard and Razor Account holders gain access to average spreads significantly lower than Tickmill’s Classic, Pro and VIP spreads.

Our Lowest Spreads and Fees Verdict

Pepperstone come up trumps due to their lowest spreads and fees. offers the lowest spreads overall.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

2. Better Trading Platform – Pepperstone

In the busy and complicated industry of forex trading, an exceptional trading platform can transform the game for brokers. Advanced tools, quick execution, and reliability enhance user experience, attracting traders and increasing volumes. Seamless performance boosts brokers’ reputations and leads to sustained success in a competitive market.

Pepperstone offers three trading platforms, MetaTrader 4, MetaTrader 5, and cTrader, while Tickmill traders are restricted to MetaTrader 4. Both brokers use VPS hosting for these platforms.

| Trading Platform | Pepperstone | Tickmill |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | No |

| TradingView | Yes | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

Our experts developed a questionnaire to help you choose the right trading software. Answer six questions to receive tailored recommendations.

Metatrader

When traders do business in forex trading, a superior trading platform is a game-changer for brokers. It enhances user experience with advanced tools, lightning-fast execution, and rock-solid reliability—key factors that attract more traders and drive higher volumes. For instance, Pepperstone provides traders with flexibility by offering MetaTrader 4, MetaTrader 5, and cTrader, while Tickmill limits traders to MetaTrader 4. Both brokers utilize VPS hosting, ensuring faster execution speeds and minimal latency. By empowering clients with seamless performance and diverse platform choices, brokers not only strengthen their reputation but also fuel long-term success in the competitive market.

MT4 and MT5 continue to be among the most popular forex trading platforms, providing a robust array of tools designed for traders at every experience level. Their advanced algorithmic trading features, driven by Expert Advisors (EAs), facilitate complete automation, empowering traders to implement their strategies without the need for constant oversight.

Both platforms offer sophisticated charting tools designed for comprehensive technical analysis, along with robust risk management features that include various order types. They also provide social-copy trading tools, allowing users to replicate successful strategies. While MT4 enables single-currency backtesting for expert advisors (EAs), MT5 takes it a step further by allowing multi-currency backtesting and incorporating a built-in economic calendar for thorough fundamental analysis.

Boasting lightning-fast execution speeds and access to a vibrant forex trading community and marketplace, MT4 and MT5 remain the gold standard for efficiency and performance in forex trading. Their seamless availability across desktop, web, and mobile applications further enhances the trading experience, making them indispensable tools for traders.

In the business of forex trading, selecting the right platform and tools can profoundly impact a trader’s success. Both Pepperstone and Tickmill provide access to the highly acclaimed MetaTrader 4 (MT4) platform, known for its powerful features and intuitive interface.

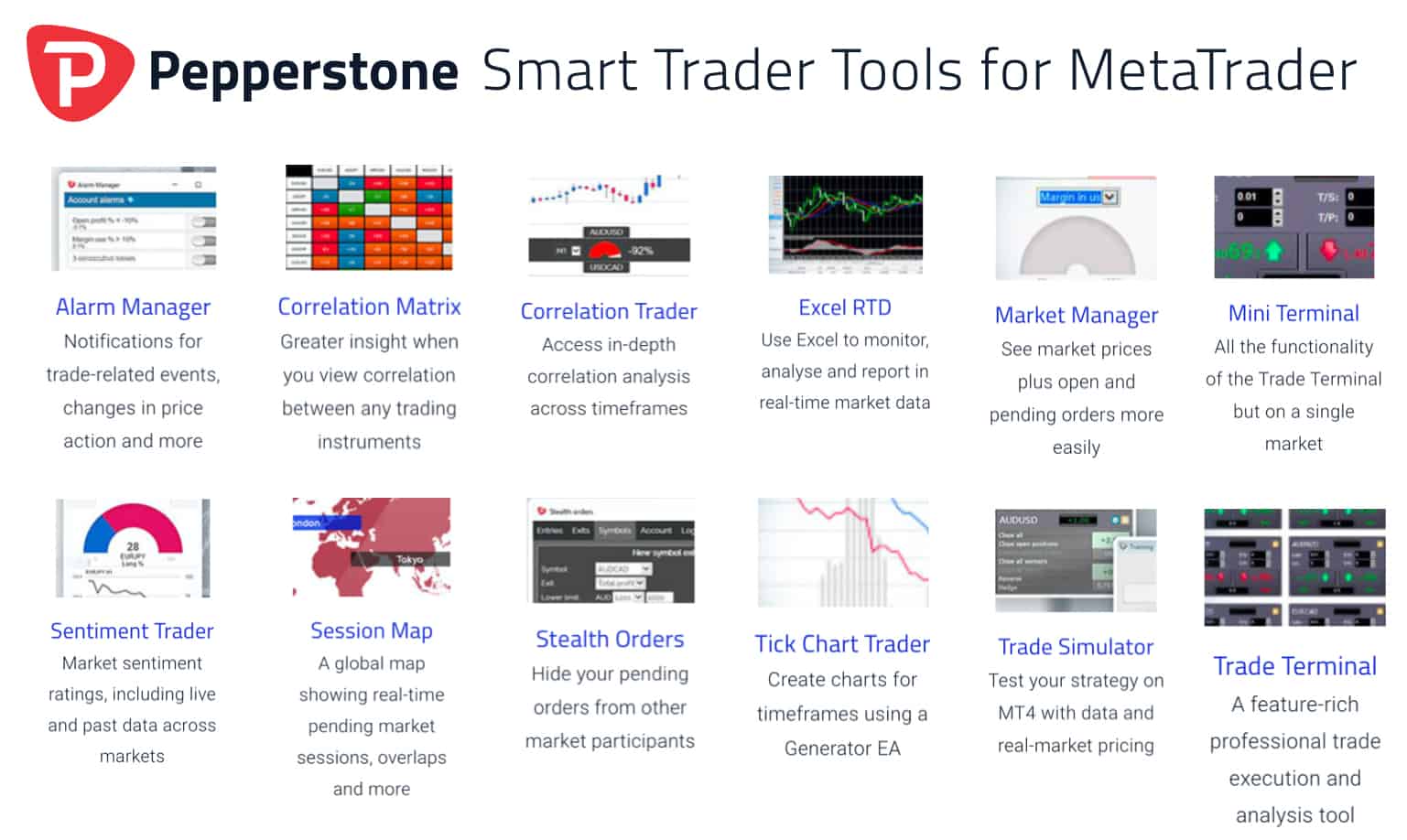

Pepperstone transforms the trading experience with its exclusive Smart Trader Tools package, available for both MT4 and MetaTrader 5 (MT5). This comprehensive suite features an impressive array of 28 additional Expert Advisors (EAs) and technical indicators, significantly enhancing traders’ analytical skills and empowering them to make more informed decisions.

Tickmill, on the other hand, has expanded its platform offerings beyond MT4 to include MT5, catering to traders seeking advanced features. The MT5 platform provides:

- CFDs on Forex, Stock Indices, Stocks, Commodities, Bonds, and Cryptocurrencies

- Support for six types of pending orders, including Limit, Stop, and Stop-Limit orders

- Advanced algorithmic applications, such as Expert Advisors, Trading Robots, and Copy Trading

- Over 38 integrated indicators, 21 timeframes, and customizable charts

- A built-in Economic Calendar

Tickmill has launched the Tickmill Trader platform, crafted for effortless trading on the move for both Android and iOS users. This innovative platform boasts secure login options, customizable asset watchlists, and user-friendly chart features, empowering traders to access the markets anytime and anywhere.

Both brokers leverage Virtual Private Server (VPS) hosting to deliver rapid execution speeds and reduce latency, which is vital for traders utilizing automated strategies. With these cutting-edge platforms and tools, Pepperstone and Tickmill equip traders with superior capabilities, facilitating more informed decision-making and potentially leading to greater success in the competitive forex landscape.

Advanced Platforms

Forex trading is a complicated platform to understand, but with enough information, traders will get enough insights to begin with their trading. Brokers, in this case, are consistently upgrading their platforms to provide traders with state-of-the-art tools and an unparalleled trading experience. Pepperstone stands out by offering an impressive selection of platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and its own Pepperstone Trading Platform. This extensive variety is designed to accommodate diverse trading styles and preferences. A key highlight is Pepperstone’s integration with TradingView, which gives traders access to sophisticated charting tools and a thriving community of over 30 million traders. Furthermore, the Smart Trader Tools suite enhances MT4 and MT5 with 28 advanced plugins, incorporating features such as the Alarm Manager, Correlation Matrix, and Sentiment Trader, all aimed at refining trading strategies for optimal performance.

Tickmill, on the other hand, specializes in the MetaTrader 4 platform, enhanced by its Advanced Trading Toolkit. This robust collection features 13 individual applications and 15 indicators crafted to enhance the trading experience. Essential tools like the Sentiment Trader, Figaro Market Data, and Alarm Manager provide traders with immediate market insights and streamlined trade management options, empowering them to make informed decisions with greater efficiency.

Pepperstone provides more platforms and tools for various trading styles, while Tickmill enhances MT4 with the Advanced Trading Toolkit for a streamlined experience.

Copy Trading

| MetaTrader 4 | MetaTrader 5 | |

|---|---|---|

| Technical Indicators | 30 | 38 |

| Analytical/graphical indicators | 33 | 46 |

| Timeframes | 9 | 21 |

| Pending Order Types | 4 | 6 |

| Order Execution Types | 3 | 4 |

| Order Fill Policy | Full | Full or Partial |

| Instrument Categories Available | 5 | 6 |

| Speed / Technical Specs | Fastest | Fast |

| Social Trading Choices | 6 | 1 |

cTrader delivers robust access to algorithmic trading systems, a customizable interface, and comprehensive back-testing capabilities. This trading platform boasts advanced modification options and sophisticated order placement, creating an institutional-quality trading environment. Users can access the software through mobile apps for smartphones and tablets, a web-based trader platform, or a dedicated desktop application. At present, Pepperstone is the exclusive provider of the cTrader trading platform.

As Pepperstone offers a greater selection of trading platform options, our dedicated team therefore concludes that they took over this category. As a Pepperstone client, you can choose between the world’s three most popular trading platforms – MetaTrader 4, MetaTrader 5 and cTrader, while Tickmill only provides access to one trading platform – MetaTrader 4. Additionally, Pepperstone offers an add-on package of 28 EAs and technical indicators, greatly enhancing your MT4 and MT5 trading experience.

Our Trading Platform Verdict

Pepperstone, unquestionably, dominates this field of expertise this is due to their better trading platforms.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

3. Superior Accounts And Features – Pepperstone

When doing business in forex trading, providing exceptional account types and state-of-the-art features is a transformative advantage for brokers. Brokers can attract traders of all experience levels by providing versatile options, innovative tools, and competitive trading conditions. This enhances the trading experience, fosters client loyalty, increases trading volume, and improves market standing.

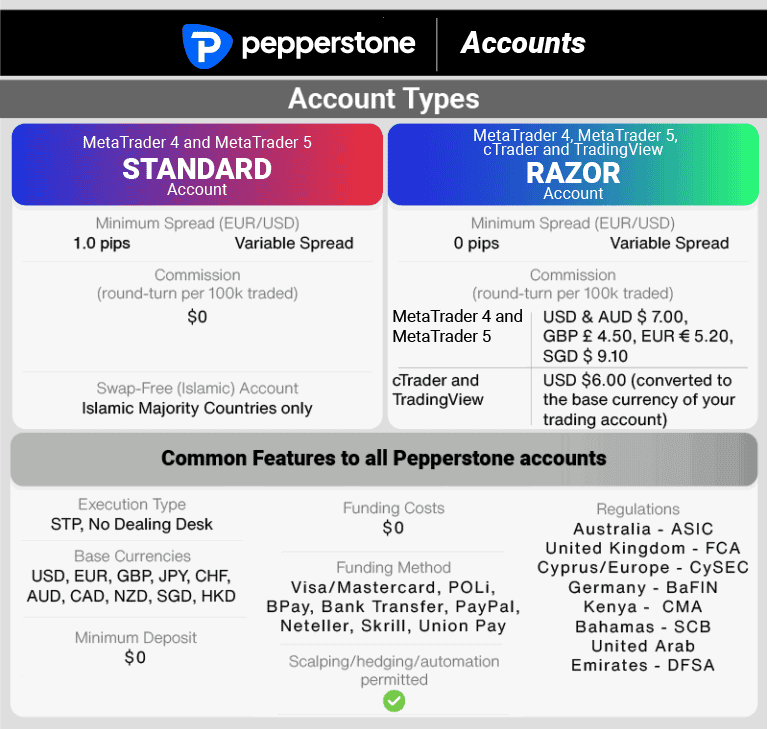

Pepperstone Account Types

Pepperstone offers two main account types designed specifically for forex and CFD traders: the Standard Account and the Razor Account. The Standard Account comes with variable spreads starting at 0.6 pips and incurs no commission fees, making it an ideal choice for those who prefer transparent pricing. On the other hand, the Razor Account provides raw spreads as low as 0.0 pips, along with a commission of $3.50 per lot per side on MetaTrader platforms, making it perfect for scalpers and algorithmic traders who prioritize minimal spreads. Both account types benefit from Pepperstone’s no dealing desk (NDD) execution model, ensuring ultra-fast order execution. Traders can choose between live accounts or risk-free demo accounts to hone their strategies. While there is no mandatory minimum deposit, Pepperstone advises starting with at least $200 to guarantee sufficient margin coverage.

Standard Account

Pepperstone’s Standard Account offers tight, commission-free spreads starting from 1.0 pip, making it a solid choice for beginner traders seeking a straightforward pricing structure. While its spreads are slightly higher than those of the Razor Account, the absence of commission fees eliminates the need for complex calculations, allowing new traders to focus on their forex and CFD strategies with ease.

Razor Account

Pepperstone’s Razor Account is tailored for experienced traders, including scalpers, day traders, and those utilizing automated strategies. It offers raw spreads starting from 0.0 pips on major currency pairs like EUR/USD, with a competitive commission of $3.50 per side per 100,000 units traded on MetaTrader platforms. This structure provides traders with direct access to interbank pricing, resulting in lower overall trading costs. Consequently, the Razor Account has become the preferred choice among Pepperstone’s clientele.

Tickmill Account Types

Tickmill offers an impressive array of account types tailored to meet diverse trading styles and experience levels. The Classic Account, designed for simplicity, features commission-free trading with spreads starting at 1.6 pips and requires a minimum deposit of just $100. For traders seeking more competitive pricing, the Raw Account presents an enticing option with spreads from 0.0 pips, accompanied by a commission of $3 per lot per side, also with a $100 minimum deposit. Both account types accommodate multiple base currencies, including USD, EUR, GBP, and ZAR, while providing leverage of up to 1:1000. Furthermore, Tickmill equips traders with demo accounts, allowing them to refine their strategies in a risk-free environment before transitioning to live trading.

All accounts have swap-free Islamic account options

Pepperstone And Tickmill Professional Client / Account (For UK And Europe Traders Only)

If you are with either Pepperstone UK or Tickmill UK, which have FCA or BaFIN regulations, and you meet two of the following criteria, then you can qualify for a professional account. With this account, clients can access a higher leverage of 1:500. Tickmill clients will be able to maintain negative balance protection, but professional Pepperstone clients will no longer have this.

- You have made an average of 10 trades per quarter of significant size for each of the previous 4 quarters

- The size of the portfolio you manage exceeds €500,000

- You have worked as a professional in the finance sector for at least one year

| Pepperstone | Tickmill | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | Yes |

| Active Traders | Yes | No |

| Spread Betting (UK) | Yes | No |

Our team can easily surmise that both online brokers offer no-commission and ECN-like account types with competitive spreads and trading costs. Yet, Pepperstone’s Razor and Standard Accounts offer lower average spreads on a wider range of currency pairs than Tickmill. For instance, Pepperstone’s Standard Account provides minimum spreads of 1.6 pips commission-free, while Pepperstone offers 1.0 pips with no commission fees.

Our Superior Accounts and Features Verdict

Pepperstone outperforms the challenger in this category on the account of their superior accounts and features.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – Pepperstone

Success in forex trading goes beyond mere market knowledge; it hinges on possessing the essential tools and achieving seamless execution. Advanced trading platforms, quick order execution, competitive spreads, and reliable customer support create a conducive environment for informed trading. An intuitive interface with educational resources and strong tools enhances the trading experience, making it more efficient, enjoyable, and profitable.

When you take the path of forex trading, you need to know more of your brokers, their platform and their features to reach the pinnacle of your success in trading. We see that both Pepperstone and Tickmill offer compelling platforms tailored to diverse trader needs. Pepperstone has garnered recognition as the Best MetaTrader Broker in 2024, highlighting its robust offerings in this space. Additionally, in 2025, Pepperstone was awarded Best Broker Overall, underscoring its comprehensive excellence in the industry. These accolades reflect Pepperstone’s commitment to delivering a superior trading experience.

Additionally, for those who are into automation, Pepperstone, along with Eightcap, offers integration with Capitalise.ai, providing traders with advanced automated trading options.

- Pepperstone is recognised as the best MT4 broker.

- Tickmill, while not highlighted in our sheet, has received positive feedback from many traders for its user-friendly interface.

- Pepperstone offers advanced automated trading options with Capitalise.ai integration.

- Both brokers provide a seamless trading experience, but nuances in platform features can make a difference for seasoned traders.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| Pepperstone | 77ms | 2/36 | 100ms | 10/36 |

| Tickmill | 91ms | 9/36 | 112ms | 11/36 |

Our Stronger Trust and Regulation Verdict

Based on our team’s analysis and testing, Pepperstone takes the crown in this niche thanks to their best trading experience and ease.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – Tie

In forex trading, trust is truly important. Regulated brokers adhere to stringent guidelines that guarantee transparency, security, and protection against fraud. This commitment instills confidence in traders, resulting in heightened participation and investment. Brokers that maintain robust regulatory oversight not only enhance their credibility but also attract a broader client base, thereby solidifying their market presence.

Pepperstone Trust Score

Tickmill Trust Score

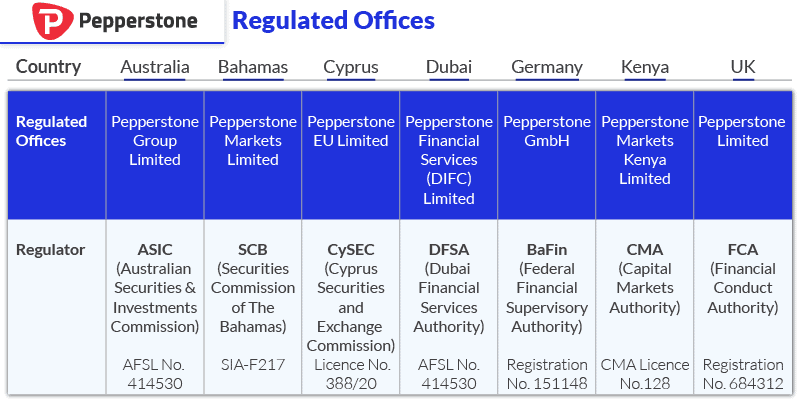

Pepperstone operates different subsidiaries around the world:

- Pepperstone Australia – Australian Securities and Investments Commission (ASIC) AFSL 414530

- Pepperstone UK – Financial Conduct Authority (FCA) Licence No. 684312

- Pepperstone Europe – The Cyprus Securities and Exchange Commission (CySEC) and Germany (BaFin)

- Pepperstone UAE – Dubai Financial Services Authority (DFSA) DIFC Registration No. 3460

- Pepperstone UAE – The Dubai Financial Services Authority (DFSA)

- Pepperstone Kenya – The Capital Markets Authority (CMA)

- Pepperstone Global – The Seychelles Financial Services Authority (FSA)

Given the high level of regulation, the forex community considers Pepperstone a safe and trusted CFD broker.

Tickmill Global Regulation

Tickmill provides services worldwide via various licensed subsidiaries, including:

- Tickmill UK Ltd: Authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom.

- Tickmill Europe Ltd: Regulated by the Cyprus Securities and Exchange Commission (CySEC) in Cyprus.

- Tickmill Ltd: Supervised by the Financial Services Authority (FSA) in Seychelles.

- Tickmill Asia Ltd: Regulated by the Labuan Financial Services Authority (LFSA) in Malaysia.

- Tickmill South Africa (Pty) Ltd: Authorized by the Financial Sector Conduct Authority (FSCA) in South Africa.

In 2023, Tickmill broadened its horizons by launching a new office in Dubai’s prestigious Emirates Financial Towers, proudly operating under the regulation of the Dubai Financial Services Authority (DFSA).

| Pepperstone | Tickmill | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) BaFin (Germany) CYSEC (Cyprus) | CYSEC (Cyprus) FCA (UK) |

| Tier 2 Regulation | DFSA (Dubai) | DFSA (Dubai) |

| Tier 3 Regulation | SCB (Bahamas) CMA (Kenya) | FSA-S (Seychelles) LFSA FSCA (South Africa) |

Reviews

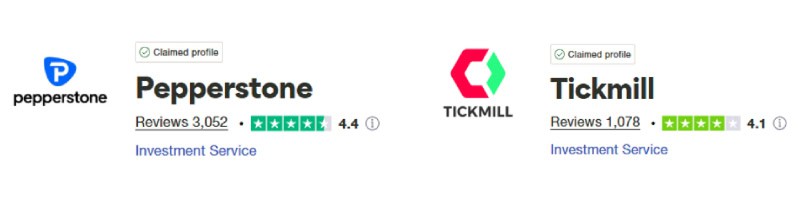

As shown below, Pepperstone has a Trustpilot rating of 4.4 out of 5, based on over 3,000 reviews. Tickmill holds a slightly lower Trustpilot score of 4.1 out of 5, from around 1,100 reviews. Pepperstone enjoys a stronger reputation with a higher score and broader review base, indicating more consistent customer satisfaction. Tickmill is still well-regarded, especially for its trading conditions, but has a smaller and slightly more mixed feedback profile.

Our Stronger Trust and Regulation Verdict

Good news! It’s a tie! Pepperstone and Tickmill find themselves in a deadlock, thanks to their stronger trust and regulation frameworks.

*Your capital is at risk ‘75% of retail CFD accounts lose money’

6. Most Popular Broker – Pepperstone

Pepperstone gets searched on Google more than Tickmill. On average, Pepperstone sees around 110,000 branded searches each month, while Tickmill gets about 49,500 — that’s 55% fewer.

| Country | Pepperstone | Tickmill |

|---|---|---|

| Australia | 8,100 | 210 |

| Brazil | 6,600 | 3,600 |

| United Kingdom | 5,400 | 1,000 |

| Thailand | 4,400 | 2,400 |

| United States | 4,400 | 1,600 |

| Malaysia | 4,400 | 4,400 |

| Kenya | 4,400 | 140 |

| Germany | 3,600 | 880 |

| Colombia | 3,600 | 1,600 |

| Mexico | 3,600 | 590 |

| Hong Kong | 3,600 | 320 |

| South Africa | 2,900 | 3,600 |

| India | 2,900 | 2,900 |

| Spain | 1,900 | 590 |

| Italy | 1,900 | 590 |

| Mongolia | 1,900 | 30 |

| Indonesia | 1,600 | 1,300 |

| Singapore | 1,600 | 590 |

| Peru | 1,600 | 720 |

| Turkey | 1,600 | 1,600 |

| Pakistan | 1,300 | 590 |

| Nigeria | 1,300 | 1,300 |

| Argentina | 1,300 | 1,600 |

| Bolivia | 1,300 | 140 |

| France | 1,000 | 320 |

| United Arab Emirates | 1,000 | 720 |

| Taiwan | 1,000 | 210 |

| Ecuador | 1,000 | 260 |

| Chile | 1,000 | 260 |

| Netherlands | 880 | 260 |

| Philippines | 880 | 880 |

| Dominican Republic | 880 | 320 |

| Vietnam | 720 | 1,900 |

| Morocco | 720 | 480 |

| Poland | 720 | 720 |

| Canada | 720 | 260 |

| Tanzania | 720 | 720 |

| Japan | 480 | 260 |

| Portugal | 480 | 170 |

| Cyprus | 480 | 480 |

| Costa Rica | 480 | 70 |

| Algeria | 390 | 880 |

| Bangladesh | 390 | 880 |

| Egypt | 390 | 1,000 |

| Sweden | 390 | 110 |

| Venezuela | 390 | 210 |

| Uganda | 390 | 260 |

| Ethiopia | 390 | 110 |

| Botswana | 390 | 140 |

| Sri Lanka | 320 | 170 |

| Switzerland | 320 | 140 |

| Austria | 320 | 90 |

| Panama | 320 | 30 |

| Cambodia | 320 | 50 |

| Saudi Arabia | 260 | 320 |

| Ghana | 260 | 110 |

| Ireland | 260 | 40 |

| Jordan | 260 | 140 |

| Greece | 210 | 50 |

| New Zealand | 170 | 70 |

| Uzbekistan | 140 | 320 |

| Mauritius | 110 | 10 |

8,100 1st | |

210 2nd | |

6,600 3rd | |

3,600 4th | |

5,400 5th | |

1,000 6th | |

4,400 7th | |

4,400 8th |

Similarweb shows a similar story when it comes to February 2024 website visits with Pepperstone receiving 1,273,000 visits vs. 614,000 for Tickmill.

Our Most Popular Broker Verdict

Pepperstone is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – Pepperstone

In the industry of forex trading, brokers that provide a wide array of Contracts for Difference (CFDs) across multiple asset classes—including forex pairs, commodities, indices, and cryptocurrencies—empower traders to diversify their portfolios and seize opportunities across varying market conditions. This selection enhances profit potential and enriches trading by enabling dynamic strategies. Trading CFDs allows speculation on price changes without owning assets, providing flexibility and access to global markets on one platform.

Pepperstone provides an extensive array of tradable instruments across various asset classes. In addition to forex, investors can explore a broad selection of CFDs linked to indices, commodities, cryptocurrencies, and equities. While MT4 and cTrader are dedicated forex trading platforms, MT5 serves as a versatile multi-asset platform, making share trading exclusively available on MT5.

Forex is the most popular CFD market due to its volatility and continuous trading, open five days a week.With Pepperstone, traders can access over 94 currency pairs, enabling the development of diverse trading strategies. Major forex pairs like EUR/USD can have spreads as low as 0.0 pips in the Razor Account, with minor and exotic pairs also enjoying competitive spreads.

As well as 94 currency pairs, you can trade the following CFD financial instruments as a Pepperstone trader:

- Indices: Pepperstone offers 24 global indices as CFDs to trade.

- Commodities: Energies, precious metals and soft commodities are available.

- Cryptocurrencies: You can trade 6 major cryptos – Bitcoin, Ripple, Ethereum, Litecoin, Dash and Bitcoin Cash*.

- Shares: 60 different major US shares, such as Apple, Facebook, Boeing and Tesla.

Note: Under new FCA guidelines, UK retail traders are no longer permitted to trade cryptocurrencies.

Tickmill Financial Products

Tickmill empowers traders with access to over 60 forex currency pairs, featuring major, minor, and exotic choices, all with spreads beginning at an impressive 0.0 pips and an average execution speed of just 0.20 seconds. Beyond forex, Tickmill boasts an extensive selection of tradable instruments, including stock indices, oil, precious metals, bonds, and leading cryptocurrencies like Bitcoin (BTCUSD) and Ripple (XRPUSD).

- Stock Indices: 14 major global stock indices i.e. UK100, US500, AUS200 and JP225.

- Oil: Crude Oil, Brent Crude Oil and WTI Crude Oil.

- Precious Metals: Gold and Silver against the US Dollar.

- Bonds: German Government Bonds – Euro Bobl, Bund, Buxl and Schatz.

| CFDs | Pepperstone | Tickmill |

|---|---|---|

| Forex Pairs | 94 | 62 |

| Indices | 27 | 17 |

| Commodities | 33 Commodities 7 Metals, 4 Energies, 9 Softs, 13 Hard | 8 Metals 3 Energies |

| Cryptocurrencies | 44 | 9 |

| Share CFDs | 1,200+ | 494 |

| ETFs | 95 | 23 |

| Bonds | 0 | 4 |

| Futures | 42 | 0 |

| Treasuries | 7 | 4 |

| Investments | 0 | 0 |

Our team has surmised that Pepperstone has a more diverse range of CFDs to trade than Tickmill and, therefore, has a better selection of complex instruments. A major benefit Pepperstone offers compared to Tickmill is the selection of Cryptos available.

Our Top Product Range and CFD Markets Verdict

Pepperstone ranks highest in this category, thanks to their top product range and CFD markets.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

8. Superior Educational Resources – Pepperstone

Access to high-quality educational resources is essential for forex traders. Platforms like Pepperstone and Tickmill offer comprehensive learning materials, including expert-led courses, interactive lessons, videos, and quizzes to support traders at all skill levels. These valuable resources help traders make informed decisions, refine their strategies, and work toward long-term success in the forex market.

Pepperstone:

- Offers a comprehensive range of educational materials.

- Provides webinars, seminars, and video tutorials.

- Features a dedicated learning hub for beginners and experienced traders.

- Articles and insights from market experts are regularly updated.

- Offers a demo account for hands-on practice.

- User-friendly platform with easy-to-understand educational content.

Tickmill:

- Provides a variety of educational resources tailored for traders.

- Webinars and workshops are frequently conducted.

- Features in-depth articles and market analysis.

- Offers trading tools and calculators for better decision-making.

- A demo account is available for practice.

- The platform is equipped with advanced educational tools.

Our Superior Educational Resources Verdict

Based on our team’s in-depth research and study, Pepperstone leads in this expertise this is in light of their superior educational resources.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

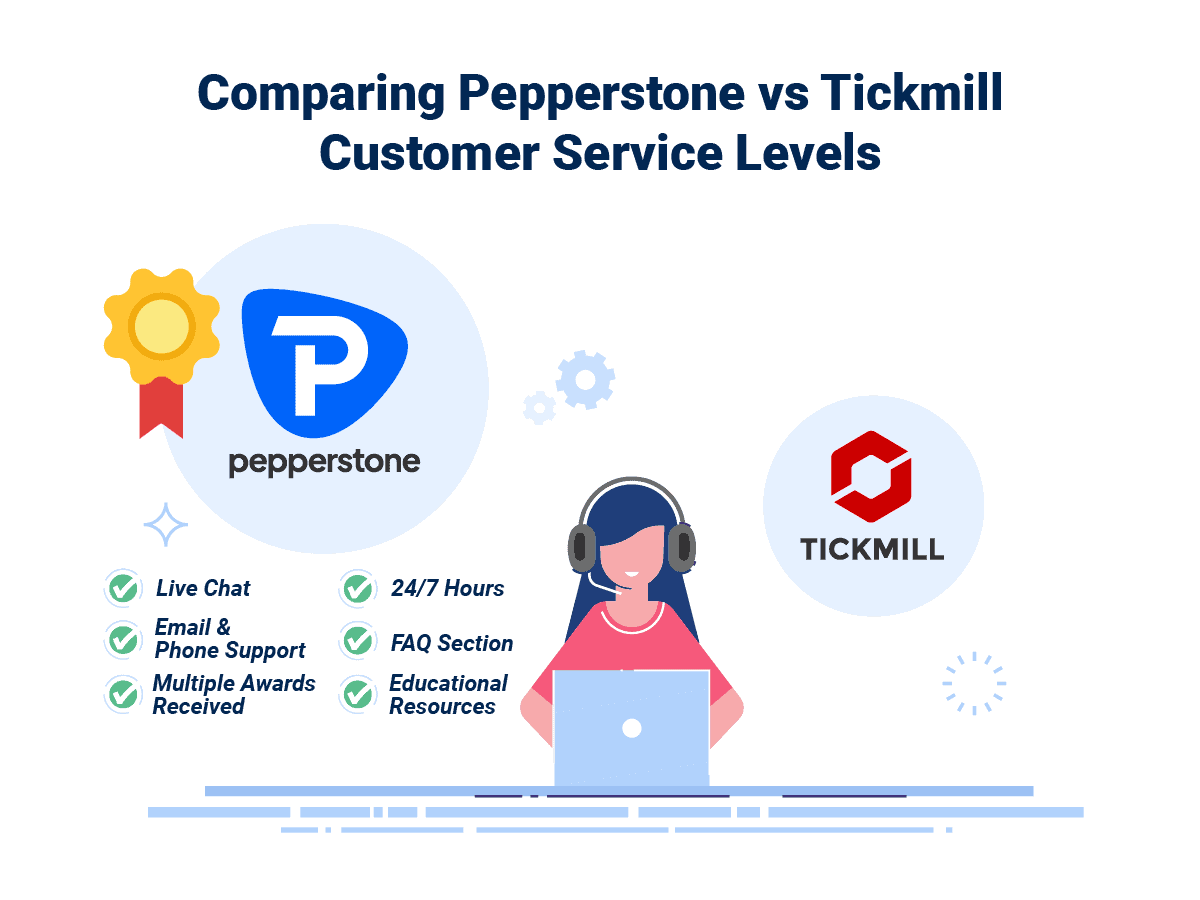

9. Superior Customer Service – Pepperstone

In forex trading, exceptional customer service is essential for providing traders with prompt support and a seamless trading experience. Brokers like Pepperstone and Tickmill excel in this area, offering responsive assistance through live chat, phone, and email. Their high standard of service ensures that traders can quickly resolve issues, enhancing overall satisfaction and strengthening trust in their broker.

Pepperstone provides customer support 24 hours a day, 5 days a week via phone, live chat, and email.

The broker has a global presence throughout the world, with a head office in Melbourne and other offices in Shanghai, Dallas, Bangkok, and London. With years of experience in the financial services industry, Pepperstone holds many awards for benchmark customer service and support.

Tickmill phone support operates between 7:00 and 16:00 GMT, Monday to Friday. Contact methods such as email and live chat are available, and respond within 24 hours on business days. One good thing about the live chat accounts is the range of languages available. While you can choose from 18 different languages, these languages include European and Asian languages, not all languages are available at all times. English, for example, appears to be only available during UK business hours.

Resources And FAQ

Pepperstone and Tickmill both excel in providing extensive educational and research resources designed to empower traders with valuable knowledge and skills. Pepperstone features structured courses that span from fundamental concepts to advanced trading strategies, complemented by expert market analysis and insights.

Tickmill, on the other hand, provides an impressive array of free eBooks that delve into essential trading strategies, alongside engaging video tutorials designed to support traders at every skill level. Furthermore, both brokers organize insightful webinars led by industry experts, delivering essential perspectives on a variety of trading topics.

| Feature | Pepperstone | Tickmill |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/7 |

| Multilingual Support | Yes | Yes |

Our Superior Customer Service Verdict

Pepperstone stands out in this section as a result of their superior customer service.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

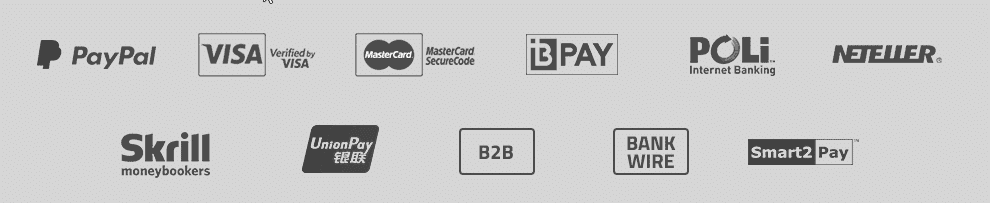

10. Better Funding Options – Tie

In forex trading, flexible and convenient funding options are essential for a seamless trading experience. Pepperstone and Tickmill offer a wide range of deposit methods, including debit and credit cards as well as bank wire transfers, ensuring easy account management for traders. Their commitment to accessibility allows traders to fund their accounts efficiently without unnecessary complications.

Pepperstone provides an extensive selection of deposit and withdrawal options, featuring Visa, Mastercard, bank transfers, PayPal, Skrill, Neteller, UnionPay, and USDT (Tether). Remarkably, the broker imposes no fees for funding or withdrawing; however, please note that your bank may apply its own charges. Furthermore, Pepperstone does not levy any account maintenance or inactivity fees, ensuring a cost-effective trading experience.

- Visa and MasterCard (debit or credit card)

- PayPal

- FasaPay

- Union Pay

- Skrill

- POLi & BPay

- Wire Transfer

Tickmill provides a variety of deposit and withdrawal methods, including bank transfers, credit and debit cards, and electronic payment options. The company absorbs payment fees for deposits and withdrawals, with the exception of bank transfer deposits under $5,000 (or its equivalent), which incur bank charges. An account will be deemed inactive if there is no trading activity, no open positions, and no deposits or withdrawals for a minimum of 60 calendar days. After this period, the account may be deactivated and archived, and any remaining balance will be transferred to the client’s wallet.

- Bank Transfer

- Visa and MasterCard (debit or credit card)

- Skrill

- Neteller

- DotPay

- PaySafeCard

- Sofort

- Rapid Transfer

- PayPal

| Funding Option | Pepperstone | Tickmill |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | Yes |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | Yes |

| POLi / bPay | Yes | No |

| Klarna | No | No |

Our Better Funding Options Verdict

It’s a deadlock for both Pepperstone and Tickmill this is in light of their better funding options.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

11. Lower Minimum Deposit – Pepperstone

In forex trading, lower minimum deposit requirements have democratized market access, enabling a broader spectrum of participants, including beginners and those with limited capital, to engage in trading activities.Brokers like Pepperstone and Tickmill have lowered minimum deposits to just $5, effectively breaking down financial barriers to entry. This accessibility not only fosters increased participation but also allows newcomers to obtain valuable hands-on experience and hone their trading skills without needing to make significant initial investments.

- Pepperstone: Pepperstone recommends making an initial deposit of $200, but no specific minimum deposit is enforced. There are no minimum withdrawal amounts.

- Tickmill: Pro and classic accounts require a minimum deposit of $100. To qualify for a VIP account, a trading account balance of $50,000 is required. While you are charged no deposit and withdrawal fees, you must withdraw at least $25 at a time.

| Minimum Deposit | Recommended Deposit | |

| Pepperstone | $0 | $200 |

| Tickmill | $100 | - |

Our Lower Minimum Deposit Verdict

Pepperstone comes out on top here as a result of their lower minimum deposit.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

Our Final Verdict On Which Broker Is The Best: Tickmill or Pepperstone?

Pepperstone excels very well in this target market on account of its comprehensive educational resources, superior trading experience, and robust platform features. The table below summarises the key information leading to this verdict:

| Categories | Pepperstone | Tickmill |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ❌ |

| Better Trading Platform | ✅ | ❌ |

| Superior Accounts And Features | ✅ | ❌ |

| Best Trading Experience And Ease | ✅ | ❌ |

| Stronger Trust And Regulation | ✅ | ✅ |

| Most Popular Broker | ✅ | ❌ |

| Top Product Range And CFD Markets | ✅ | ❌ |

| Superior Educational Resources | ✅ | ❌ |

| Superior Customer Service | ✅ | ❌ |

| Better Funding Options | ✅ | ✅ |

| Lower Minimum Deposit | ✅ | ❌ |

Best For Beginner Traders

Pepperstone is the ideal choice for beginner traders due to its user-friendly platform and extensive educational resources.

Best For Experienced Traders

Pepperstone stands out for experienced traders because of its advanced trading tools and competitive spreads.

FAQs Comparing Pepperstone Vs Tickmill

Does Tickmill or Pepperstone Have Lower Costs?

Tickmill generally offers lower costs. Both brokers have competitive spreads, but Tickmill often edges out with tighter spreads on major pairs. For instance, the EUR/USD spread can be as low as 0.1 pips. For a more detailed comparison on low commissions, you can check out our comprehensive guide on Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both Tickmill and Pepperstone offer MetaTrader 4, but Pepperstone is often recognised as one of the best MT4 brokers. Their platform integration is seamless, and traders benefit from enhanced tools and features. If you’re keen on exploring more about MT4 platforms, our list of top MT4 brokers provides a detailed analysis.

Which Broker Offers Social Trading?

Pepperstone offers social trading options. They have integrated platforms like ZuluTrade and Myfxbook for traders interested in copy trading. This allows traders to mimic the strategies of successful traders. For those interested in diving deeper into social trading, our guide on the best social trading platforms is a valuable resource.

Does Either Broker Offer Spread Betting?

Pepperstone offers spread betting for its UK clients. This form of trading is tax-free in the UK and is a popular alternative to traditional forex trading. Tickmill, on the other hand, doesn’t provide this service. If you’re interested in exploring more about spread betting, especially on the MT4 platform, our guide on the best MT4 spread betting brokers is a great place to start.

What Broker is Superior For Australian Forex Traders?

In my opinion, Pepperstone is the superior choice for Australian forex traders. Not only is Pepperstone ASIC regulated, but it was also founded in Australia, ensuring a deep understanding of the local market. Tickmill, while a strong contender, is based overseas. Pepperstone’s commitment to transparency, coupled with its robust platform offerings, makes it a top pick. For a broader perspective on Australian forex brokers, you can check out our comprehensive list of Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK forex traders, I believe Tickmill stands out. It’s FCA regulated, ensuring a high level of trust and security for UK traders. While Pepperstone is also a strong broker, Tickmill’s deep integration with the UK market gives it an edge. Furthermore, Tickmill’s platform offerings are tailored to meet the unique needs of UK traders. If you’re keen on exploring more about UK forex trading platforms, our guide on the Forex Brokers In UK offers valuable insights.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

How long does it take to get withdrawal from Tickmill?

Tickmill says the withdrawals are processed in 1 business day. However it might take a few extra days once the processing is done by the payment provider.