Pepperstone vs Trader's Way 2026

Pepperstone and Trader’s Way both have a strong foothold in forex, but they cater to very different traders. This guide breaks down their platforms, pricing, products and more so you can decide which broker matches your style.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Before I get into the full breakdown, here’s a quick overview of how the two brokers compare across the fundamentals:

- Pepperstone offers lower spreads and fees, with spreads starting as low as 0.0 pips on major pairs.

- Pepperstone stands out as on of the best MT4 brokers in the industry

- Trader’s Way has more account types tied to each trading platform they offer

- Trader’s Way offers several crypto payment options if you prefer speed and anonymity outside the traditional funding methods

- Pepperstone has better customer support and educational resources

1. Lowest Spreads And Fees – Pepperstone

Keeping costs low is one of the few things you actually have control over as a forex trader and it directly impacts long-term profitability. With the Raw account, which most serious traders end up using, you get the tightest pricing possible and you pay a fixed commission per lot.

Pepperstone’s Raw account, for example, consistently delivers near-zero spreads on EUR/USD, with a round-trip commission of around $7 per standard lot. Trader’s Way charges a lower USD commission rate ($3 per side or $6 round trip) but its spreads are wider across the majors.

RAW Account Spread | |||||

|---|---|---|---|---|---|

| 0.30 | 0.40 | 0.10 | 0.20 | 0.10 |

| 0.50 | 0.80 | 0.50 | 0.60 | 0.70 |

| 0.14 | 0.25 | 0.02 | 0.27 | 0.03 |

| 0.60 | 0.65 | 0.08 | 3.50 | 0.35 |

| 0.23 | 0.20 | 0.06 | 0.30 | 0.27 |

| 0.10 | 0.20 | 0.00 | 0.70 | 0.20 |

| 0.30 | 0.50 | 0.10 | 0.30 | 0.20 |

| 0.30 | 0.20 | 0.10 | 0.30 | 0.20 |

| 0.40 | 1.40 | 0.10 | 0.50 | 0.40 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-01

| Broker | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| Pepperstone | 3.5 | 3.5 | 2.25 | 2.6 |

| Tradersway | 3 | N/A | N/A | N/A |

So even though Trader’s Way charges a lower commission, you’re still losing more on every trade because of that wider spread. That might not sound like much, but if you’re placing dozens or hundreds of trades a month, those small differences compound fast.

Over time, Pepperstone’s razor-thin spreads create a clear cost advantage especially if you’re trading actively.

Standard Account

I usually recommend the Standard account to newer traders because it offers a straightforward way to get into the market. The cost is built entirely into the spread, so you don’t have to worry about calculating commissions or dealing with a complex fee structure.

In my experience, this simplicity allows beginners to focus on learning how forex trading works without getting bogged down in execution costs you don’t fully understand yet.

However, this account type isn’t the cheapest as brokers usually add a markup to the spread to cover their fees.

Looking at Pepperstone’s Standard account, I can say that it’s hands down one of the most competitive I’ve seen for a spread-only model. On EUR/USD, it averages around 1.1 pips while TradersWay averages a wider 1.4 pips. And Pepperstone offers much tighter spreads across the majors as you can see from CompareForexBrokers’ database.

| EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY | Average Overall | |

|---|---|---|---|---|---|---|---|---|---|

| Pepperstone | 1.1 | 1.3 | 1.3 | 1.2 | 1.4 | 1.2 | 1.8 | 1.5 | 1.35 |

| TradersWay | 1.4 | 1.6 | 2.1 | 2.5 | 2.6 | 2.5 | 2.6 | 4.9 | 2.53 |

Verdict

Your overall trading costs (spreads, commission and fees) across both Raw and Standard accounts will be lower with Pepperstone.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

2. Better Trading Platform – Pepperstone

The trading platform connects you to the currency markets and is essentially your control tower. Most serious brokers offer a bunch of platforms to cater to different trader needs.

Pepperstone offers MT4, MT5, cTrader, TradingView and a few proprietary platforms including CopyTrading by Pepperstone for copy trading and Pepperstone Trading App.

I personally prefer their MT4 setup because it combines the standard MT4 features with powerful Smart Trader Tools add-ons and Pepperstone’s pricing and execution technology. It’s no wonder I still rate them as the best MT4 broker out there.

Basically, you’ve got over 85 built-in indicators at your disposal e.g RSI, MACD, Bollinger Bands. You can also download or code thousands of custom indicators to build a trading environment that actually fits how you trade.

Charts are fully interactive and customizable, with multiple timeframes and layouts. For scalpers and news traders, one-click trading straight from the chart is available to help you react instantly to price moves without fumbling through menus.

And thanks to MQL4 integration, you can build and run Expert Advisors (EAs) to fully automate your strategy. If you want 24/7 reliability, they even provide VPS hosting with ultra-low latency, so your bots keep firing even when your computer is off.

Trader’s Way platform offering is similar to Pepperstone, only that they lack TradingView and their own proprietary platforms.

If you’re a staunch MetaTrader user I think you’ll find MT4’s analytical tools sufficient for everyday trading. You get 9 timeframes to analyse the dynamics of quotations in details and over 50 built-in technical indicators.

The added ECN access is also a nice touch, allowing you to plug directly into interbank liquidity and enjoy fast execution and no dealer interference. Moreover, you can enjoy fast and convenient one-click trading in MT4 and MT5 with the QuickDeal tool.

cTrader is a great alternative for the MetaTrader platforms but it’s more popular with experienced traders who prioritize transparency and fast execution. Trader’s Way version has a QuickTrade interface that allows you to place orders directly from Market Watch or TradeWatch, or trade straight from the chart.

Speaking of charting, you get all the tools necessary for effective technical analysis, including all major trend indicators, oscillators, volatility measures and other major indicators.

I appreciate the platform’s Level II Pricing which shows you real-time liquidity for each currency pair, with volume available at every price level. It gives you a clearer picture of the market helping you gauge how prices might move before they even show on the chart.

For copy and social trading, Trader’s Way has partnered with MetaQuotes and FxStat, letting you follow other traders’ strategies directly into your own account.

| Trading Platform | Pepperstone | Trader's Way |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | Yes |

| TradingView | Yes | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | No |

I’ve created a software questionnaire with six questions to help you find the best trading platform for your style.

Verdict

Pepperstone offers better trading platforms with more choice, faster execution, and powerful add-ons that Trader’s Way can’t match.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

3. Superior Accounts And Features – Tradersway

Pepperstone offers two CFD account types, both of which can be accessed via the trading platforms I’ve mentioned above. The key difference between them is in the way you’re charged for trading CFDs on FX markets.

First off you have the Standard account where all fees (apart from any overnight funding) are included in the spread and you pay no commission. But you should note that shares and ETFs carry a small per-share charge that starts at 0.02 USD for US equities.

Then there’s the Razor (Raw) account with raw spreads starting from 0.0 on FX and you pay a fixed, transparent commission of 3.50 USD per lot per side. All the non-FX markets are charged the same way they are on Standard, so you only switch to commission pricing where it actually helps.

Both accounts feature useful risk management tools such as stop-losses, trailing stops, take-profit, and price alerts that give you real control over your positions.

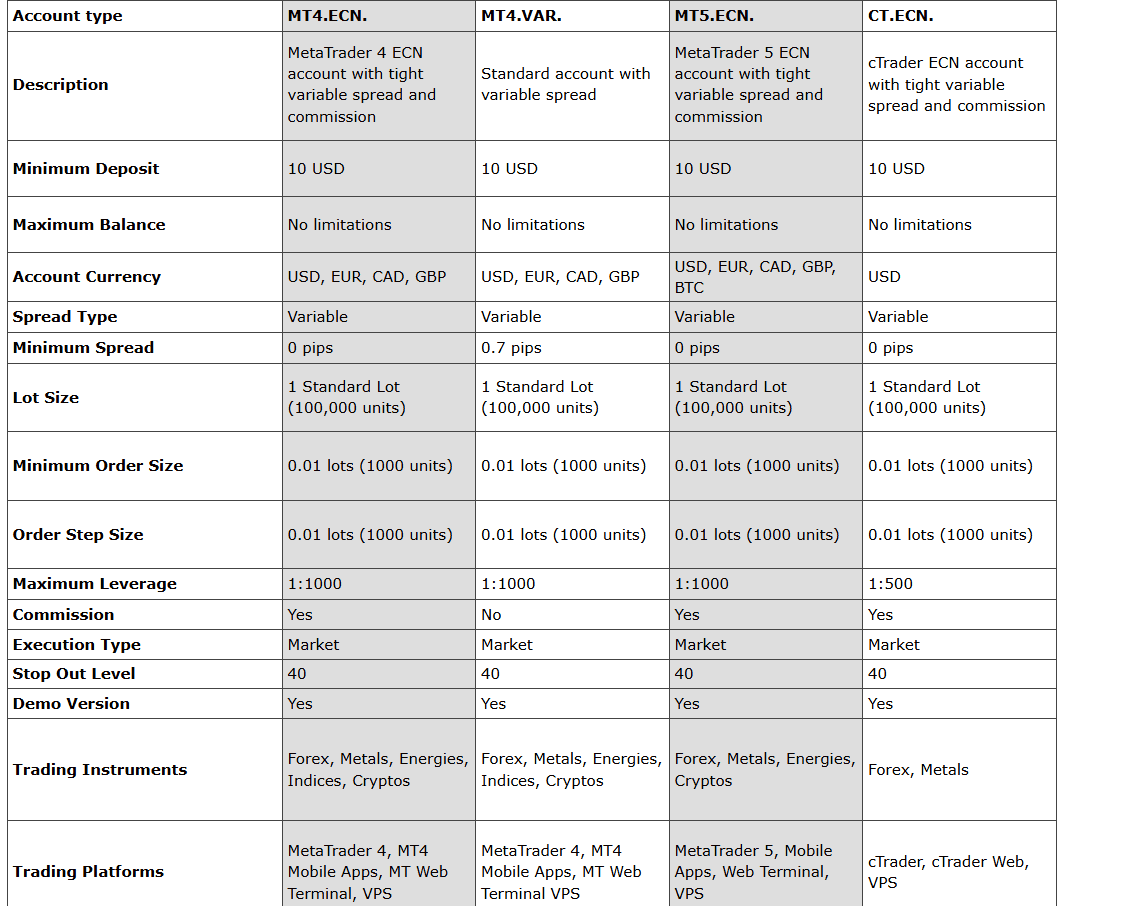

Trader’s Way gives you four main account types, each tied to a specific platform. MT4 specifically offers MT4.ECN with raw spreads plus commission and MT4.VAR which has variable spreads starting from 0.7 pips and no commission.

If you prefer MT5, the MT5.ECN account mirrors the ECN model on the newer platform. Same raw spreads, same commission structure, but with all the added firepower MT5 brings.

cTrader ECN (CT.ECN) is designed to take advantage of cTraders top features like speed, transparency, and Level II pricing. It runs on variable spreads from zero pips with commission added on top and leverage is up to 1:500.

Stop-out levels are set at 40%, and demo versions are available for testing across all accounts.

Unfortunately, swap-free option is only available on MT4.VAR, so if you’re trading under Islamic finance rules, that’s your only path here.

| Pepperstone | Trader's Way | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | No |

| Active Traders | Yes | No |

| Spread Betting (UK) | Yes | No |

Verdict

Trader’s Way is ahead on account variety and features.

4. Best Trading Experience And Ease – Pepperstone

A broker’s execution speed and reliability generally determine if you’ll have a good or bad trading experience.

Pepperstone has built its reputation on execution and the numbers back it up. Limit orders average 77 milliseconds, which is good enough for 2nd place out of around 36 brokers I tested. Market orders average 100ms, ranking them 10th overall. That’s lightning fast in retail terms, and it’s why scalpers and algo traders keep gravitating toward Pepperstone.

Trader’s Way appeared slower in my tests, ranking much lower with limit orders averaging 198ms and market orders at 214ms. In volatile markets, those extra milliseconds may lead to negative slippage.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| Pepperstone | 77ms | 2/36 | 100ms | 10/36 |

| Tradersway | 198ms | 29/36 | 214ms | 32/36 |

Verdict

Pepperstone’s trading experience is much better offering faster execution and smoother account management.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – Pepperstone

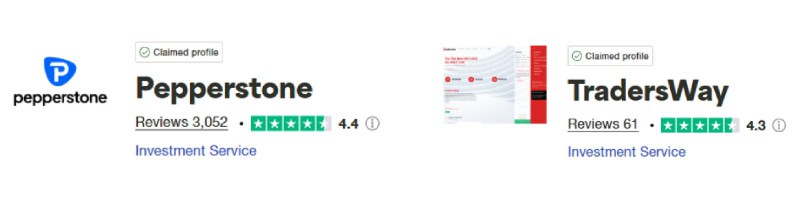

I used three main factors to determine a broker’s trust level: regulation, reputation and reviews. Pepperstone got a trust score of 91/100 in my reviews while Trader’s Way managed 47/100.

Pepperstone Trust Score

Trader’s Way Trust Score

Regulations

Pepperstone is one of the most heavily regulated brokers in the Forex and CFD trading industry. They hold tier-one licenses with ASIC in Australia, the FCA in the UK, BaFin in Germany, and CySEC in Cyprus.

On top of that, they’re covered by mid-tier regulators like the DFSA in Dubai, and even operate under tier-three oversight in the Bahamas and Kenya. This kind of regulatory footprint is the backbone of why Pepperstone is highly trusted by hundreds of thousands of traders globally.

| Pepperstone | |

|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) BaFin (Germany) CYSEC (Cyprus) |

| Tier 2 Regulation | DFSA (Dubai) |

| Tier 3 Regulation | SCB (Bahamas) CMA (Kenya) |

I wouldn’t say the same for Trader’s Way as they operate out of the Commonwealth of Dominica with no top-tier regulation whatsoever. That’s a major red flag as it means you won’t have the same protections around client funds, dispute resolution, or transparency.

In fact, Trader’s Way has already had a brush with law, stemming from compliance issues. In 2016 they were hit with a cease-and-desist order in Missouri for operating without authorisation.

Reviews

Pepperstone has a significantly larger review base and a slightly higher score, suggesting broader and more consistent customer satisfaction, with a Trustpilot score of 4.4 out of 5. Trader’s Way, on the other hand, shows decent ratings but with fewer reviews and a higher proportion of critical feedback, Trustpilot score of 4.3 out of 5.

Verdict

If you want reliability, investor protection, and a broker that’s held to the highest standards globally, you go with Pepperstone.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

6. Most Popular Broker – Pepperstone

Looking at 2024 Google branded search data, Pepperstone dominates across every major market.

| Country | Pepperstone | Trader's Way |

|---|---|---|

| Australia | 8,100 | 390 |

| Brazil | 6,600 | 30 |

| United Kingdom | 5,400 | 260 |

| United States | 4,400 | 2,900 |

| Malaysia | 4,400 | 20 |

| Thailand | 4,400 | 20 |

| Kenya | 4,400 | 40 |

| Germany | 3,600 | 70 |

| Hong Kong | 3,600 | 10 |

| Mexico | 3,600 | 40 |

| Colombia | 3,600 | 70 |

| India | 2,900 | 1,000 |

| South Africa | 2,900 | 320 |

| Italy | 1,900 | 30 |

| Spain | 1,900 | 40 |

| Mongolia | 1,900 | 10 |

| Singapore | 1,600 | 10 |

| Turkey | 1,600 | 20 |

| Indonesia | 1,600 | 30 |

| Peru | 1,600 | 20 |

| Pakistan | 1,300 | 90 |

| Nigeria | 1,300 | 90 |

| Argentina | 1,300 | 20 |

| Bolivia | 1,300 | 10 |

| France | 1,000 | 390 |

| Taiwan | 1,000 | 10 |

| United Arab Emirates | 1,000 | 20 |

| Chile | 1,000 | 10 |

| Ecuador | 1,000 | 20 |

| Netherlands | 880 | 50 |

| Philippines | 880 | 20 |

| Dominican Republic | 880 | 10 |

| Canada | 720 | 320 |

| Vietnam | 720 | 10 |

| Morocco | 720 | 10 |

| Poland | 720 | 30 |

| Tanzania | 720 | 50 |

| Portugal | 480 | 20 |

| Japan | 480 | 20 |

| Cyprus | 480 | 20 |

| Costa Rica | 480 | 10 |

| Sweden | 390 | 10 |

| Algeria | 390 | 10 |

| Bangladesh | 390 | 40 |

| Egypt | 390 | 20 |

| Botswana | 390 | 20 |

| Uganda | 390 | 10 |

| Ethiopia | 390 | 10 |

| Venezuela | 390 | 10 |

| Austria | 320 | 10 |

| Switzerland | 320 | 20 |

| Sri Lanka | 320 | 10 |

| Cambodia | 320 | 10 |

| Panama | 320 | 10 |

| Saudi Arabia | 260 | 10 |

| Ireland | 260 | 10 |

| Ghana | 260 | 20 |

| Jordan | 260 | 10 |

| Greece | 210 | 10 |

| New Zealand | 170 | 10 |

| Uzbekistan | 140 | 10 |

| Mauritius | 110 | 10 |

8,100 1st | |

390 2nd | |

6,600 3rd | |

30 4th | |

4,400 5th | |

2,900 6th | |

3,600 7th | |

40 8th |

People don’t type in a broker’s name unless they already know it, or they’ve heard about it enough to check it out. Traders flock to the Australian broker because it’s widely covered in financial media, and trusted by hundreds of thousands of traders.

Verdict

Pepperstone is the most popular broker worldwide, with far higher search demand and brand recognition than TradersWay across every major market.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – Pepperstone

Among the brokers with the broadest range of CFD markets I’ve come across is Pepperstone. If your focus is on currency pairs you’ll find the 94 forex pairs offer a lot of opportunities compared to the 41 Trader’s Way has.

Pepperstone still goes on far more in the other markets including indices and commodities like metals, energies and agricultural products.

Even in newer markets like crypto, Pepperstone still has the upper hand with 37 digital assets, compared to just 9 at Trader’s Way.

And if you want even more opportunities Pepperstone has you covered with 1,200+ shares, ETFs, and futures, which Trader’s Way doesn’t offer at all.

| CFDs | Pepperstone | Tradersway |

|---|---|---|

| Forex Pairs | 94 | 41 |

| Indices | 27 | 7 (MT4) |

| Commodities | 33 Commodities 7 Metals, 4 Energies, 9 Softs, 13 Hard | 2 Metals 2 Energies |

| Cryptocurrencies | 44 | 9 |

| Share CFDs | 1,200+ | No |

| ETFs | 95 | No |

| Bonds | No | No |

| Futures | 42 | No |

| Treasuries | 7 | No |

| Investments | No | No |

Verdict

Pepperstone leads on product range, offering a wider selection of CFD products.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

8. Superior Educational Resources – Pepperstone

I value Pepperstone’s commitment to trader education as they don’t just throw a few guides on a webpage and call it a day.

Traders of all levels are covered so if you’re just starting out, you’ll benefit from the guides and videos that cover the fundamentals of forex.

The live webinars are for seasoned traders. Here professional analysts dissect complex topics in forex trading like market psychology, technical strategy, and risk managementThey even host live trading sessions, so you can see theory applied in real time.

At Trader’s Way, there’s virtually nothing for beginners or intermediates, no structured courses, and no in-house analysis team. At best, you’ll find a basic market calendar and the occasional blog post, but nothing that genuinely helps you build skill.

Verdict

Pepperstone invests in long-term trader education, ensuring you understand the markets, build strategies, and stay sharp as conditions change.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

9. Superior Customer Service – Pepperstone

Pepperstone runs a 24/7 support desk, unlike Trader’s Way and many other brokers that offer 24/5 support. That means if you’re trading markets like crypto that are open on weekends, you’ll have someone on the other end if you need urgent assistance.

Support is available through live chat (both human and bot), email, and even WhatsApp, with multilingual coverage across their global client base. Their service consistently ranks #1 in Investment Trends surveys, topping categories like overall client satisfaction, value for money, platform navigation, and trade execution quality.

Trader’s Way offers the same support channels (except WhatsApp) plus multilingual support but honestly, their service quality is poor and responses often feel generic.

| Feature | Pepperstone | Tradersway |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/5 |

| Multilingual Support | Yes | Yes |

Verdict

Pepperstone delivers superior customer service with 24/7 multilingual support, expert staff, and top client satisfaction ratings.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

10. Better Funding Options – Pepperstone

Pepperstone supports a massive range of base currencies, meaning you don’t have to worry about recurring conversion fees eating into your profits. They take Visa, Mastercard, bank transfers, PayPal, Neteller, Skrill, and even offer region-specific methods like POLi and BPAY in Australia and New Zealand.

Crypto and other digital wallets are also supported, so no matter where you are or how you prefer to move money, there’s usually a seamless option.

Trader’s Way offers the basics (bank cards, wire transfer, Neteller, Skrill) but instead of region-specific methods, they focus on crypto payments e.g Bitcoin, Ether.

| Funding Option | Pepperstone | Tradersway |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | No |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | No |

| Klarna | No | No |

Verdict

Pepperstone offers better and more secure funding options, including regional methods with more base currencies.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

11. Lower Minimum Deposit – Pepperstone

Both Pepperstone and TradersWay let you open an account with no minimum deposit, so technically you could start trading with just a few dollars. Trader’s Way even promotes a $10 recommended deposit, which might sound attractive if you’re testing the waters. However, ten bucks in a live trading account is gone the second you place a single position of any size. In my view, it’s more of a marketing hook than a serious trading option.

Pepperstone takes a more realistic approach with no minimum deposit but recommends $200 which is a sensible starting point. That’s enough to actually manage risk, open positions in micro-lots, and start building good trading habits without blowing the account on trade one.

| Minimum Deposit | Recommended Deposit | |

|---|---|---|

| Pepperstone | $0 | $200 |

| Tradersway | $0 | $10 |

Verdict

Pepperstone wins here because the $200 recommended deposit guideline gives you a sustainable path rather than chasing the illusion of trading seriously on $10.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

Our Final Verdict On Which Broker Is The Best: Trader’s Way or Pepperstone?

Pepperstone comes out on top across every major category I’ve covered from pricing and platforms to regulation, customer support and product range.

| Categories | Pepperstone | Tradersway |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ❌ |

| Better Trading Platform | ✅ | ❌ |

| Superior Accounts And Features | ❌ | ✅ |

| Best Trading Experience And Ease | ✅ | ❌ |

| Stronger Trust And Regulation | ✅ | ❌ |

| Most Popular Broker | ✅ | ❌ |

| Top Product Range And CFD Markets | ✅ | ❌ |

| Superior Educational Resources | ✅ | ❌ |

| Superior Customer Service | ✅ | ❌ |

| Better Funding Options | ✅ | ❌ |

| Lower Minimum Deposit | ✅ | ❌ |

Best For Beginner Traders

Pepperstone is better for beginner traders, offering extensive educational resources and a $0 minimum deposit.

Best For Experienced Traders

Pepperstone stands out as the best choice for traders who already know their way around the market because of their competitive razor account, advanced trading platforms and comprehensive product range.

FAQs Comparing Pepperstone Vs Trader's Way

Does Pepperstone or Trader's Way Have Lower Costs?

Pepperstone typically offers lower overall trading costs. While Trader’s Way offers low raw account commissions on USD, Pepperstone makes up the difference with tighter spreads across both standard and raw accounts. On high-volume pairs like EUR/USD, Pepperstone spreads can drop as low as 0.1 pips. For a full breakdown of who’s offering the best rates, Check out this guide on the Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

If you’re relying on MT4 for scalping, EAs, or advanced charting, Pepperstone provides more power straight out of the box. For a closer look at the top MT4 setups in the market, check out this list of the best MT4 brokers.

What Broker is Superior For Australian Forex Traders?

I recommend Pepperstone as they’re ASIC-regulated, have deep local roots, and offer more firepower across platforms, tools, and liquidity. Add in their long-standing reputation and institutional-grade infrastructure and you’ve got a broker built for serious Aussie traders. Check out our Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

Pepperstone is the best broker for traders in the UK because they’re FCA-regulated which means strict oversight, client money protection, and negative balance safeguards. If Pepperstone doesn’t feel like the right fit, I’ve put together a full list of the Best Forex Brokers In UK so you can compare alternatives side by side.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert