Go Markets vs Pepperstone: Whis One Is Best?

We review and compare GO Markets vs Pepperstone for 2026, using what we consider to be the key features when selecting a broker to help you choose.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors. Here are five noticeable differences between GO Markets and Pepperstone:

- GO Markets offers 14+ Cryptocurrency CFDs, while Pepperstone offers 12+.

- GO Markets provides 1190+ stockbroking options, whereas Pepperstone doesn’t specify a number.

- GO Markets requires a minimum account opening balance of AUD $500, while Pepperstone requires a minimum deposit of $200.

- GO Markets includes a complimentary ‘Dedicated Account Manager’ for assistance, while Pepperstone doesn’t offer this for all clients.

- Pepperstone offers more currency pairs than GO Markets, including major, minor, cross, and exotic pairs.

1. Lowest Spreads And Fees: Pepperstone

| Spreads | EUR/USD | USD/JPY | AUD/USD | GBP/USD |

|---|---|---|---|---|

| Go Markets Standard Account | 1.2 | 1.2 | 1.3 | 1.5 |

| Pepperstone Edge Standard | 1.16 | 1.25 | 1.27 | 1.49 |

| Go Markets Go Plus | 0.2 | 0.2 | 0.3 | 0.5 |

| Pepperstone Edge Razor | 0.16 | 0.25 | 0.27 | 0.49 |

Spreads Observation

Looking at the spreads, we can see that standard accounts of both GO Markets and Pepperstone have wider spreads than the Electronic Communication Network (ECN) type of accounts (i.e. GO Markets Plus and Pepperstone Razor). The spreads are wider because 1 pip is added to the spread. 1 pip is the equivalent of $10.

Both GO Markets and Pepperstone offer ECN-style trading accounts. Pepperstone’s ECN-style account is called Razor account, which GO Markets calls their GO Markets Plus. While neither are ‘true’ ECN brokers, they offer ECN pricing as they directly connect you with liquidity providers via ECN networks who quote you with competitive spread prices. There is No Dealing Desk Brokers, or price requotes in their ECN process; instead, the brokers charge a commission.

GO Markets Commission

GO Markets charges an industry-low AUD $6.00 round trip ($3.00 one way) commission with each standard lot traded for its GO Plus account. This AUD$3.00 will be converted to your account currency when trading.

GO Markets quotes in AUD as they are an Australian forex broker.

Pepperstone Commission

Pepperstone varies its commission charges depending on the trading platform you are using.

MetaTrader 4 Side Trip Commission For Each Standard Lot

- AUD $3.5

- USD $3.76

- EUR €2.61

- GBP £2.29

- NZD $4.75

- CAD $3.50

- SGD $4.55

MetaTrader 5 Side Trip Commission For Each Standard Lot

Same as above except for

- USD $3.50

cTrader

- charge of 7 units for each standard lot. This charge is in the base currency when trading a currency pair. ie AUDJPY = AUD$7.00 per lot

Calculating Your Cost

If the account currency is USD, then it is quite simple to calculate the dollar cost of the currency trade. Using USDCAD as an example and trading with mini-lots (i.e. 0.1), you will have the following basic cost:

GO Markets Standard

1 USD x 1.70 pip = 1.70 USD + $0 commission = $1.70 USD.

GO Markets Go Plus

1 USD x 0.70 pip = 0.70 USD + $0.60 commission = $1.30 USD.

Pepperstone Edge Standard

1 USD x 1.64 pip = 1.64 USD + $0 commission = $1.64 USD.

Pepperstone Edge Razor

1 USD x 0.64 pip = 0.64 USD + $0.70 commission = $1.34 USD.

Note 1: To convert to Standard lots, multiply your result by 10. To convert to a micro-lot, divide your lot by 10.

Note 2: If the account currency is not USD, then you need to convert the currency to USD. This means calculations will be different; however, GO Plus, followed by Pepperstone Edge, will still have the lowest expenses.

Note 3: GO Markets average spreads are only to the first decimal. Average spreads are likely to have been rounded.

Compare Pepperstone Razor vs Standard Accounts with Pepperstone.

Other Costs

Swap / Rollover / Overnight / Holding fees – When you maintain your position for a currency pair overnight, then you will incur a swap fee. Swap rates or charges will vary by currency pair, which are released each week by the financial institution the broker works with.

To calculate the rate, multiply the swap long or swap short by the number of lots you’re trading with. i.e. if the swap long is 6.0 points and you hold 1 lot (10,0000 units) overnight, then you will receive 0.60 pips for the lot. In dollar terms, your account will receive $6 per rollover (0.60 x 10).

If you are an intermediate trader, then we recommend either the GO Markets Plus account or the Pepperstone Edge Razor account. ECN pricing accounts offer lower spreads and are cheaper than Standard accounts despite the cost of commissions.

We feel both GO Markets and Pepperstone ECN accounts are excellent solutions for investors wanting narrow spreads with low fees. If you plan to be a regular trader, then the lower commission GO Markets charge may represent a significant saving over time; however, there are three main things to consider:

- Spreads for specific currency pairs may be cheaper with Pepperstone than GO Markets, which could negate any savings through commission.

- Pepperstone offers more forex pairs, so you will want to check if GO Markets offer the currency pairs you intend to trade with

- GO markets require a higher minimum balance than Pepperstone. This means you could be taking on higher debt than you wish to when leverage is taken into account.

With these considerations taken into account, we recommend Pepperstone Edge Razor Account.

Other Considerations For Costs/Savings

If you are a high-volume trader, then you can gain further savings by joining the GO Markets volume trading rebate program or Pepperstone’s Active Trader program.

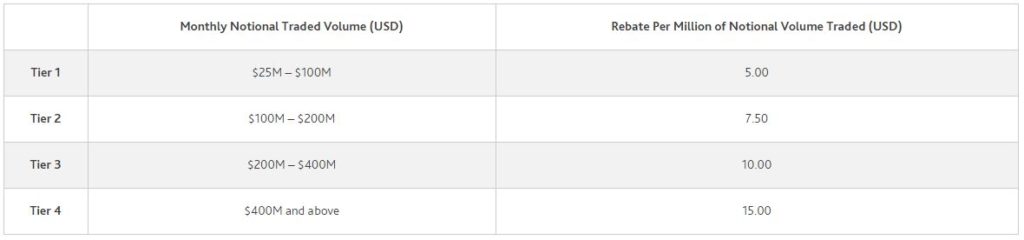

GO Markets Volume Trading Rebate

If your trade volumes meet GO Markets requirements, then you will receive a cash rebate once a month.

Both Standard and GO Markets Plus account holders can claim the rebate.

Pepperstone Active Trader Program

If you are a Pepperstone Edge Razor account holder and trade sufficiently high volumes of forex, consider joining the Pepperstone active trader program. Investors will receive their rebates the next day and can use them for trade immediately.

Investors in the active trader program will also receive the following benefits:

- Priority Client Support (this is the same as GO Markets ‘Dedicated account manager’.)

- Advanced Insights and Reports, such as access to Pepperstone’s market analysts and daily Autochartist signals.

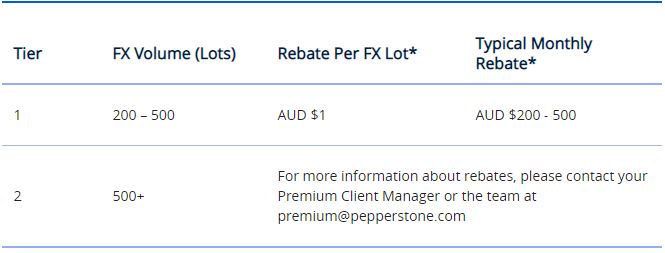

Standard Account Spreads

When it comes to standard account spreads, there’s a noticeable difference between GO Markets and Pepperstone. GO Markets has a consistent spread across most forex pairs, averaging around 1.5. On the other hand, Pepperstone has a slightly lower average spread, coming in at around 1.2.

In my opinion, Pepperstone offers a more cost-effective option for traders, especially those dealing with large volumes. The lower spread can significantly reduce trading costs over time. However, it’s important to note that the industry average spread is slightly higher than both GO Markets and Pepperstone, averaging around 1.5.

| Standard Account | GO Markets Spreads | Pepperstone Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.19 | 1.35 | 1.6 |

| EUR/USD | 0.9 | 1.1 | 1.2 |

| USD/JPY | 1.1 | 1.2 | 1.4 |

| GBP/USD | 1 | 1.2 | 1.6 |

| AUD/USD | 1 | 1.1 | 1.5 |

| USD/CAD | 1.3 | 1.4 | 1.8 |

| EUR/GBP | 1.1 | 1.2 | 1.5 |

| EUR/JPY | 1.5 | 2.1 | 1.9 |

| AUD/JPY | 1.4 | 1.9 | 2.1 |

Standard Account Analysis Updated February 2026[1]February 2026 Published And Tested Data

This suggests that both GO Markets and Pepperstone offer competitive rates, with Pepperstone having a slight edge. But remember, the spread is just one aspect of trading costs. Other factors, such as commission fees and account types, can also impact your overall trading expenses. So, it’s essential to consider these aspects when choosing a forex broker.

Our Lowest Spreads and Fees Verdict

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

2. Better Trading Platform: Tie

Both GO Markets and Pepperstone offer MetaTrader 4 and MetaTrader 5. Commonly called MT4 and MT5, this forex trading platform software is made by MetaQuotes Software. Despite the name, MT4 and Mt5 target different markets, so MT5 should not be considered an upgrade of MT4. We will look at the features and differences of each platform.

| Trading Platform | GO Markets | Pepperstone |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | Yes |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

Each broker offers MT4 and MT5 on Windows, Mac PCs, IOS, Android tablets, and mobile, with desktop, webtrader, and mobile trading apps available. MT4 is the most popular platform worldwide, and more brokers offer this platform than any other. The popularity of MT4 means traders can move brokers without needing to familiarise themselves with a new trading platform.

MT5 has many features not available in MT4. It is built to allow investors to trade with derivatives that have a central exchange.

MT4 And MT5 Trading Platform – GO Markets And Pepperstone

Available on Windows and Mac, IOS and Android tablets and mobiles, MT4 is the most used platform worldwide. More brokers offer this platform than any other platform, which means a trader can move brokers without needing to familiarise themselves with a new trading platform.

Key Differences between MT4 and MT5 that matter

- MT4 is built only for forex. MT5 is built for forex, CFDs, stocks, bonds, options and futures. This is because MT5 allows trading through an exchange, but MT4 does not.

- No hedging rule: America does not allow hedging or FIFO trading. MT5 is built to meet USA regulations. MT4 orders are kept separate, while MT5 orders are aggregated together. This can make algorithmic trading with expert advisors more difficult.

- MQL5 is not backwards compatible with MQL4. MT4 uses MQL4 for OOP programming, which is good for EAs and GUI customisation. MQL5 is not backward compatible.

MT4 vs MT5 Differences

| Features | MT4 | MT5 |

|---|---|---|

| Expert Advisors | Yes | Yes |

| Hedging | Simultaneous | FIFO + Netting |

| Inbuilt Indicators | 30 | 38 |

| Market Depth | No | Yes |

| Economic Calender | No | Yes |

| Exchange Trading | No | Yes |

| Derivatives | Forex, Commodities, Indices, Metals | Forex, CFDs, Shares, Bond, Options, Futures, Metals, Indices, Commodities. |

| Pending Orders | 4 - Buy Stop, Buy Limit, Sell Limit, Sell Stop | 6 - Buy Stop, Buy Limit, Sell Limit, Sell Stop, Buy Stop Limit, Sell Stop Limit |

| Language | MQL4 | MQL5 |

| Execution Speed | Fast | Faster |

| Timeframes | 9 | 21 |

| Order Execution Types | 3 | 4 |

| Partial Order Filling Policies | No | Yes |

| Technical Analysis Tools | 2000 Free Customer Indicators, 700 paid. | 44 Analytical Objects, Unlimited Charts |

Unless you need to be compliant with the USA ‘no hedging’ rule or you wish to trade derivatives other than forex, then MT4, we recommend MT4. Mt4 is a simpler trading platform to use, provides all the tools you will need for forex trading, and allows hedging.

Add-On Features For MT4

Both GO Markets and Pepperstone have an MT4 add-on package to give users extra tools to enhance their user experience. The add-on includes some of these features that are built into MT5 (see our table comparison), such as the economic calendar.

Our Better Trading Platform Verdict

GO Markets calls their add-on ‘MT4 Genesis’ while Pepperstone calls their add-on ‘Smart Trader Tools’. Both products are essentially the same. Add-on features include a correlation matrix, market manager and sentiment trader. Sentiment trader is a popular tool used in social trading that allows you to see trades made by other forex investors.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

3. Superior Accounts and Features: GO Markets

Comparison Of Account Types

| Account Type | Go Markets Standard | Go Markets Plus+ | Pepperstone Standard | Pepperstone Razor |

|---|---|---|---|---|

| Spreads From | 1.0 Pips | 0.0 Pips | 1.0 Pips | 0.0 Pips |

| Commission | $0 | AUD $6.0 Round Trip | $0 | $7.0 Round Trip |

| Minimum Trade Size | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Leverage | 500:1 Maximum | 500:1 Maximum | 500:1 Maximum | 500:1 Maximum |

| Expert Traders Allowed | Yes | Yes | Yes | Yes |

| Hedging Allowed | Yes | Yes | Yes | Yes |

| Scalping Allowed | Yes | Yes | Yes | Yes |

| Minimum Deposit | AUD $200 | AUD $500 | $200 | $200 |

| Level of Support | 24/5 | 24/5 | 24/5 | 24/5 |

| Dedicated Account Manager | Yes | Yes | No | No |

| Currency Pairs | 50 | 50 | 92 | 92 |

| Tradeable Instruments | 90+ | 90+ | 70+ | 70+ |

| Execution | STP | ECN + STP | STP | ECN + STP |

The features of all four accounts we reviewed are very similar. The main differences are:

- Standard Accounts for each broker do not charge commission, while ‘ECN’ Style accounts do charge commission. Pepperstone charges a higher commission than GO Markets.

- GO Markets Plus account requires a minimum account opening balance of AUD $500 to open (or equivalent in your local currency).

- Pepperstone accounts require a minimum deposit of $200 to open an account. However, they do not enforce this.

- GO Markets includes a complimentary ‘Dedicated Account Manager’. A personal account manager can help you with setting up your account and resolving trading issues without the need to go through customer support.

- Pepperstone offers more currency pairs than GO Markets, including major pairs, minor pairs, crosses and exotic pairs.

- Pepperstone also offers a Swap fee account or Islamic account. This account is for Muslims who need to comply with sharia law. This account can be requested from the customer support team.

Verdict: If you are new to trading, then it may be beneficial to start with a Standard Account. Although we have shown standard accounts do cost more than an ECN ‘style’ account, investors do not need to worry about calculating commissions into their expenses and instead just focus on improving their trading skills.

| GO Markets | Pepperstone | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | No | Yes |

| Active Traders | Yes | Yes |

| Spread Betting (UK) | No | Yes |

Our Superior Accounts and Features Verdict

When it comes to the standard account, we recommend GO Markets over Pepperstone because you have a dedicated account manager who can help you get started. To view more visit our Pepperstone Fees page.

GO Markets ReviewVisit GO Markets

*Your capital is at risk ‘72% of retail CFD accounts lose money’

4. Best Trading Experience And Ease: Tie

When it comes to the trading experience and ease of use, both GO Markets and Pepperstone have their unique strengths. From our in-depth analysis, we observed that Pepperstone stands out with its MetaTrader 4 (MT4) platform, being recognised as the best MT4 broker. This is a testament to their commitment to providing traders with a seamless and efficient trading environment.

- Pepperstone is recognised as the best MT4 broker.

- Our testing also highlighted Pepperstone’s excellence in automation, with features like Capitalise.ai.

- GO Markets, on the other hand, offers a dedicated account manager, ensuring personalised assistance for traders.

- Both brokers are committed to providing a top-notch trading experience, but the choice ultimately depends on individual preferences.

Our Best Trading Experience and Ease Verdict

Having personally tested various platforms, we can vouch for the fact that the right broker can make a significant difference in your trading journey. Whether you’re a beginner or a seasoned trader, it’s essential to choose a broker that aligns with your trading goals and offers the tools and resources you need.

GO Markets ReviewVisit GO Markets

*Your capital is at risk ‘72% of retail CFD accounts lose money’

5. Stronger Trust And Regulation: Pepperstone

A broker with stronger trust and regulation are, simply, the most reputable and competitive in the industry of forex trading. These brokers ensure a secure and transparent trading environment for traders.

Pepperstone Trust Score

GO Markets Trust Score

Regulations

Both brokers fall under the Australian Securities and Investment Commission – ASIC Regulation.

- Go Markets operates with Australian Financial Services Licence 254963

- Pepperstone operate with Australian Financial Services Licence 414530

The regulation with ASIC means the broker needs to keep your money in a segregated account with a top-tier bank and handle your investments securely.

Additionally, Pepperstone is regulated in the UK by the Financial Conduct Authority (FCA) as well as in Dubai by the DFSA, Kenya by the CMA, The Bahamas by the SCB, Europe by CySEC and in Germany by BaFin.

FCA regulation will only apply to traders in the UK who are signed up to Pepperstone UK. FCA regulations require that leverage be restricted to 30:1 for retail traders. and that the broker provides Negative Balance Protection.

| Go Markets | Pepperstone | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) CYSEC (Cyprus) | ASIC (Australia) FCA (UK) BaFin (Germany) CYSEC (Cyprus) |

| Tier 2 Regulation | DFSA (Dubai) | |

| Tier 3 Regulation | FSA-S (Seychelles) FSC-M (Mauritius) | SCB (Bahamas) CMA (Kenya) |

Reviews

As shown below, GO Markets has a Trustpilot rating of 4.6/5, based on almost 700 reviews. Pepperstone holds a slightly lower score of 4.5/5 based on over 3,000 reviews. GO Markets enjoys a higher rating with fewer reviews, while Pepperstone has broader user feedback and a solid reputation overall.

Our Stronger Trust and Regulation Verdict

If you are a high-volume trader, Pepperstone may allow you to trade like a professional trader. As a professional trader, you can trade with a leverage of 500:1, but you won’t receive negative balance protection.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

6. Most Popular Broker – Pepperstone

Pepperstone gets searched on Google more than GO Markets. On average, Pepperstone sees around 135,000 branded searches each month, while Go Markets gets about 74,000 — that’s 45% fewer.

| Country | Go Markets | Pepperstone |

|---|---|---|

| Malaysia | 210 | 9,900 |

| Brazil | 2,400 | 8,100 |

| India | 480 | 6,600 |

| South Africa | 20 | 6,600 |

| Thailand | 140 | 5,400 |

| Indonesia | 140 | 5,400 |

| Colombia | 12,100 | 4,400 |

| Vietnam | 27,100 | 4,400 |

| United States | 480 | 4,400 |

| Turkey | 880 | 4,400 |

| United Kingdom | 260 | 3,600 |

| Argentina | 880 | 3,600 |

| Poland | 260 | 2,900 |

| Germany | 110 | 2,900 |

| Philippines | 2,400 | 2,900 |

| United Arab Emirates | 210 | 2,400 |

| Bangladesh | 170 | 2,400 |

| Egypt | 10 | 2,400 |

| Algeria | 390 | 1,900 |

| Pakistan | 70 | 1,600 |

| Peru | 1,000 | 1,600 |

| Italy | 320 | 1,600 |

| Mexico | 110 | 1,600 |

| Spain | 260 | 1,300 |

| Cyprus | 210 | 1,300 |

| Singapore | 210 | 1,300 |

| Nigeria | 90 | 1,300 |

| Tanzania | 140 | 1,300 |

| Hong Kong | 70 | 1,000 |

| Saudi Arabia | 390 | 1,000 |

| Morocco | 9,900 | 1,000 |

| Venezuela | 320 | 1,000 |

| France | 140 | 1,000 |

| Uzbekistan | 1,000 | 880 |

| Ecuador | 480 | 880 |

| Canada | 30 | 720 |

| Netherlands | 20 | 720 |

| Australia | 20 | 720 |

| Portugal | 40 | 590 |

| Chile | 10 | 590 |

| Japan | 10 | 590 |

| Jordan | 170 | 480 |

| Taiwan | 40 | 480 |

| Bolivia | 390 | 480 |

| Sri Lanka | 30 | 480 |

| Dominican Republic | 210 | 480 |

| Kenya | 10 | 480 |

| Sweden | 20 | 390 |

| Ghana | 10 | 390 |

| Uruguay | 30 | 390 |

| Cambodia | 70 | 390 |

| Switzerland | 90 | 390 |

| Uganda | 30 | 390 |

| Ethiopia | 50 | 320 |

| Botswana | 10 | 320 |

| Costa Rica | 10 | 320 |

| Austria | 90 | 260 |

| Greece | 50 | 260 |

| Mongolia | 50 | 210 |

| New Zealand | 10 | 210 |

| Ireland | 140 | 210 |

| Panama | 10 | 170 |

| Mauritius | 20 | 170 |

9,900 1st | |

1,600 2nd | |

8,100 3rd | |

590 4th | |

5,400 5th | |

590 6th | |

4,400 7th | |

27,100 8th |

Similarweb shows a similar story when it comes to August 2025 website visits with Pepperstone receiving 1,474,000 visits vs. 65,983 for Go Markets.

Our Most Popular Broker Verdict

Pepperstone is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets: GO Markets

Both brokers offer a good collection of CFDs for trading. GO Markets offers 350+ instruments, and Pepperstone offers 150+ instruments.

Pepperstone CFDs

In addition to Forex, Pepperstone offers the following for trading CFDs.

- 14 major Index CFDs

- 60 top quality Shares CFD from NYSE at 0.02c a share

- Precious metals, including Gold and silver, are traded against USD or Euro with no commission

- Platinum and palladium traded against USD and no commission

- Energies with a minimum trade size of 10c per pip

- 5 Cryptocurrencies, including Bitcoin, Bitcoin Cash, Ethereum, Dash and Litecoin, traded against USD.

- Currency Index CFD – 6 major currencies, including Euro, JPY, and GBP against USD (not available via Pepperstone UK)

Please note: As of 2022, those in the UK are unable to trade cryptocurrency with Pepperstone or other forex brokers. The FCA recently changed regulation, enforcing a ban on retail traders’ trading crypto.

GO Markets CFDs

- 200+ Shares CFD from ASX, 80+ NYSE shares and NASDAQ from 0.08% per share per side (ASX) and US$0.02 per share per side

- 13 indices and 2 Futures CFD

- Gold and silver metals

- Spot gold and silver

- Spot WTI and Brent crude oils

- 5 Cryptocurrencies, including Bitcoin, Ethereum, Litecoin, Bitcoin Cash, and Ripple

Our Top Product Range and CFD Markets Verdict

GO Markets ReviewVisit GO Markets

*Your capital is at risk ‘72% of retail CFD accounts lose money’

8. Superior Educational Resources: Pepperstone

Education is a cornerstone for any trader, be it a novice or an expert. Both GO Markets and Pepperstone have invested significantly in this area, ensuring their clients have access to top-tier educational resources. From our analysis, here’s how the two brokers compare:

- GO Markets offers a comprehensive range of educational materials, including webinars, tutorials, and e-books.

- Pepperstone, on the other hand, provides an extensive library of video tutorials, market analysis, and expert-led webinars.

- Both brokers offer demo accounts, allowing traders to practice and hone their skills without any financial risk.

- GO Markets has a dedicated section for beginner traders, ensuring they get a solid start in their trading journey.

- Pepperstone’s educational content is frequently updated, ensuring traders have access to the latest market insights.

- Both brokers also offer advanced training for seasoned traders, covering complex strategies and market analysis techniques.

Our Superior Educational Resources Verdict

Considering the depth and range of resources offered by both, Pepperstone slightly edges out with its frequently updated content and extensive video library.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

9. Superior Customer Service: Tie

Both GO Markets and Pepperstone are leaders when it comes to customer service.

Pepperstone Customer Support

Pepperstone only has a dedicated customer account manager if you are part of the Pepp erstone active trader program; however, general customer support is available 24/5. Investors can contact Pepperstone via live chat, phone or email. Toll-free calls are available in Australia and the UK, while a local number is available in Thailand.

erstone active trader program; however, general customer support is available 24/5. Investors can contact Pepperstone via live chat, phone or email. Toll-free calls are available in Australia and the UK, while a local number is available in Thailand.

Pepperstone has won numerous awards for customer service, including Best ‘Forex Trading Support’ from UK Forex in 2018 and ‘Customer Service from Investment Trends in 2017

Customer Service Features

- Learn to Trade – Pepperstone has a range of web pages that cover topics such as “How does forex

work”, “Basic Terminology”, “Fundamental Analysis”, and “Technical Analysis”, so you can read and learn about different aspects of forex.

work”, “Basic Terminology”, “Fundamental Analysis”, and “Technical Analysis”, so you can read and learn about different aspects of forex. - Webinars – Every week or 2, an expert on forex will host a webinar. The expert presents a topic and is available to answer any questions you may have.

- Trading Guides – Pepperstone has an exhaustive list of guides that take you through all aspects of trading. You can sign up for automatic delivery to your inbox when a new guide is available.

- Support – Manuals taking users through steps or actions to perform trading tasks, such as depositing or withdrawing funds for each type of funding method, are available.

- FAQ – Traders can search in the FAQ for any questions they may have.

- Glossary – a list of keywords and their definitions is available.

Demo Account

Pepperstone offers a demo account. The demo account is much the same as on offer by GO Markets. Free 30-day trial with $50,000 of virtual funds.

| Feature | Go Markets | Pepperstone |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/5 | 24/7 |

| Multilingual Support | Yes | Yes |

GO Markets Customer Service

We already spoke about all customers having a ‘dedicated account manager’; however, GO Markets has other features that make them one of the best.

Contacting Customer Support – GO Markets

Customer support with GO Markets is available 24/5, Monday to Friday. You can contact GO Markets through live chat via their website or via phone. GO Markets not only has customer support in Australia that traders can call via a toll-free number but also in the UK and China. An international number in Australia is available for traders from any other country who require assistance. Email contact is also available when you have questions outside customer support hours.

Customer Service Features

FAQ – GO Markets has a section that will answer common forex and trading questions.

Education – GO Markets has several free education tools to help with your forex education. These include:

- Free Forex Education Course – This course has two sections, each with 3 modules that cover the essentials of forex. Section 1 covers an introduction to forex, while section 2 covers more advanced topics. The course consists of an online video and tutorial, a live group classroom webinar and opportunities for you to ask questions for which answers will be provided.

Demo Accounts

- GO Markets offer a free 30-day trial demo account for both the MT4 and MT5 platform. The demo account has $50,000 in virtual funds, so you can test your trading strategies and use real-time market data.

Our Superior Customer Service Verdict

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

10. Better Funding Options: Pepperstone

Funding options play a pivotal role in a trader’s journey, offering flexibility and ease of transactions. Both GO Markets and Pepperstone understand this and have provided a plethora of options to cater to their diverse clientele. From our analysis, it’s evident that both brokers have made significant efforts to ensure their clients have multiple avenues for deposits and withdrawals.

However, when it comes to the sheer variety of options, there are some differences. Here’s a comparative table showcasing the funding options available for both brokers:

| Funding Option | GO Markets | Pepperstone |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | No | Yes |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Our Better Funding Options Verdict

While both brokers offer a commendable range of funding options, Pepperstone slightly edges out GO Markets with a broader spectrum of choices, especially with the inclusion of PayPal and Bitcoin.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

11. Lower Minimum Deposit: Tie

In the world of forex trading, starting capital can be a significant factor for many traders, especially those just dipping their toes into the market. A lower minimum deposit requirement can be a game-changer, allowing traders to begin their journey without a hefty initial investment. Both GO Markets and Pepperstone have recognised the importance of this and have set their minimum deposit requirements to be incredibly trader-friendly.

Here’s a quick glance at the minimum deposit amounts for both brokers:

| | Minimum Deposit | Recommended Deposit |

| Go Markets | $200 | $200 |

| Pepperstone | $0 | $200 |

It’s commendable to see brokers removing financial barriers and making forex trading accessible to a broader audience. Such a move not only fosters trust but also encourages novice traders to take the leap without the worry of a significant financial commitment.

Our Lower Minimum Deposit Verdict

Both GO Markets and Pepperstone offer a $0 minimum deposit, making them equally attractive for traders looking for a low-entry barrier.

GO Markets ReviewVisit GO Markets

*Your capital is at risk ‘72% of retail CFD accounts lose money’

Is Go Markets or Pepperstone The Best Broker?

Pepperstone is the winner because of its comprehensive range of services, frequently updated educational content, and a broader spectrum of funding options. The table below summarises the key information leading to this verdict:

| Criteria | Go Markets | Pepperstone |

|---|---|---|

| Lowest Spreads And Fees | No | Yes |

| Better Trading Platforms | Yes | Yes |

| Superior Accounts And Features | Yes | No |

| Best Trading Experience | Yes | Yes |

| Stronger Trust And Regulation | No | Yes |

| CFD Product Range And Financial Markets | Yes | No |

| Superior Educational Resources | No | Yes |

| Better Customer Service | Yes | Yes |

| More Funding Options | No | Yes |

| Lower Minimum Deposit | Yes | Yes |

GO Markets: Best For Beginner Traders

GO Markets is better suited for beginner traders due to its dedicated section for novice traders and comprehensive educational materials.

Pepperstone: Best For Experienced Traders

Pepperstone stands out for experienced traders because of its advanced trading platforms, extensive product range, and frequently updated market insights.

FAQs Comparing GO Markets Vs Pepperstone

Does Pepperstone or GO Markets Have Lower Costs?

Pepperstone is often celebrated for its competitive spreads, having been awarded as the Best Low Spread No Commission Forex Broker. Conversely, GO Markets stands out for its commendable features for Euro traders, being recognised as the Lowest Commission Forex Broker for EUR Traders. In February 2026, Pepperstone’s standard account showcased some of the industry’s lowest spreads without any added commission on trades. Meanwhile, GO Markets offers an ECN-style trading environment, boasting minimum spreads that can go as low as 0.0 pips, coupled with a commission fee of AUD $6 round turn for Euro traders. For a comprehensive breakdown of spreads and costs, consider checking out our Lowest Commission Brokers page.

Which Broker Is Better For MetaTrader 4?

Pepperstone stands out as the top choice for MetaTrader 4, excelling in spreads, execution speed, and platform features. In the fast-paced world of trading, Pepperstone’s rapid execution on MT4 is a game-changer. Their exceptional service and support further enhance their reputation. For those keen on diving deeper into why Pepperstone shines among the best MT4 brokers, our detailed review provides all the insights.

Which Broker Offers Social Trading?

Both Pepperstone and GO Markets provide platforms that support social and copy trading. Social trading has become a popular way for traders, especially beginners, to leverage the strategies of experienced professionals. If you’re keen to explore the best brokers offering these services, our comprehensive guide on the best copy trading platforms can provide further insights.

Does Either Broker Offer Spread Betting?

GO Markets does not offer spread betting, while Pepperstone does. Spread betting is a popular trading method in the UK. If you’re interested in exploring more about spread betting, you might want to check out the best brokers for spread betting.

What Broker is Superior For Australian Forex Traders?

In my opinion, Pepperstone is superior for Australian Forex traders. Both GO Markets and Pepperstone are ASIC regulated, ensuring a high level of security for traders. While GO Markets was founded in Australia, Pepperstone was founded overseas but has since established a strong presence in Australia. For a comprehensive list, you can visit the Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

Personally, I believe Pepperstone holds an edge for UK Forex traders. Both brokers are FCA regulated, which is crucial for ensuring the safety of funds. GO Markets is an international broker, while Pepperstone was founded overseas but has made significant inroads in the UK market. For those looking for the Best Forex Trading Apps in UK, this might be of interest.

Article Sources

No commission account spread proprietary testing data and published website spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

What was your real experience with deposits and withdrawals — smooth and fast, or delays?

Both brokers have a smooth and fast deposits and withdrawals.