IC Markets vs FOREX.com: Which One Is Best?

In this review, we will determine which of the two brokers will take home the gold. Both offer outstanding features and robust platforms, but only one can emerge as the champion. Curious to find out which broker prevails? Then take a deep dive into the review for all the insights.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

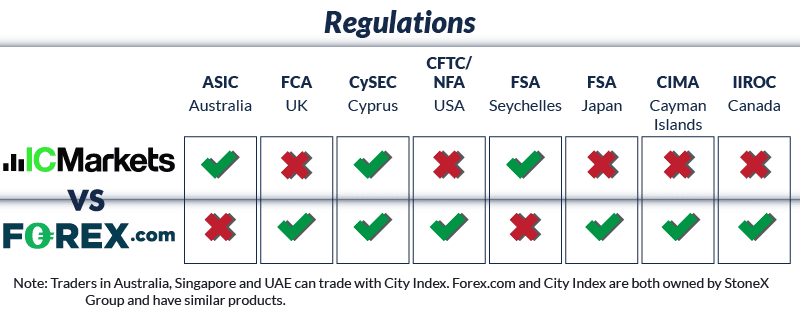

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Futures 6.25:1

Minor Pairs 17:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors. Here are seven noticeable differences between IC Markets and FOREX.com:

- FOREX.com offers more FX pairs (91 vs 63).

- FOREX.com offers MT4, TradingView, and their proprietary platform.

- FOREX.com is regulated by CFTC, NFA, IIROC, FSA, CySEC, FCA, and CIMA.

- IC Markets boasts lower spreads and commissions for retail traders.

- IC Markets provides platforms like MetaTrader 4, MetaTrader 5, and cTrader.

- IC Markets recorded 3.1 million visits in August 2022.

- IC Markets is regulated by ASIC, CySEC, and FSA.

1. Lowest Spreads And Fees – IC Markets

Low spreads and competitive fees are important for efficient trading. Lower spreads cut transaction costs, appealing to scalpers and high-frequency traders. Cost-effective brokers draw more clients, boosting trading activity. Reducing overhead allows traders to increase profits, making low-fee brokers essential for long-term success.

When evaluating forex brokers, consider spreads, commission levels, and account fees, as they impact trading experience and profitability. In this review, we will compare IC Markets and FOREX.com, focusing on their spreads, commission levels, and standard account fees. We aim to give you a clear understanding of each broker’s offerings to help you make informed decisions based on current forex trading trends.

Spreads

IC Markets is known for offering some of the lowest spreads in the industry. For EUR/USD, IC Markets provides spreads as low as 0.02 pips, compared to FOREX.com’s 0.17 pips, with the average industry spread being 0.22 pips. For AUD/USD, IC Markets offers spreads starting from 0.03 pips, while FOREX.com’s spreads are 0.3 pips, against the average industry spread of 0.47 pips. These tight spreads make IC Markets an attractive option for traders looking to minimize trading costs.

| RAW Account | IC Markets Spreads | FOREX.com Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 0.29 | 0.59 | 0.75 |

| EUR/USD | 0.02 | 0.17 | 0.22 |

| USD/JPY | 0.14 | 0.35 | 0.38 |

| GBP/USD | 0.23 | 0.29 | 0.53 |

| AUD/USD | 0.03 | 0.3 | 0.47 |

| USD/CAD | 0.25 | 0.65 | 0.56 |

| EUR/GBP | 0.27 | 0.42 | 0.55 |

| EUR/JPY | 0.3 | 0.68 | 0.80 |

| AUD/JPY | 0.5 | 1.11 | 0.96 |

| USD/SGD | 0.85 | 1.3 | 2.29 |

Commission Levels

IC Markets and FOREX.com both offer competitive commission rates, yet they have distinct differences. IC Markets charges a commission of $3.50 per lot, significantly lower than FOREX.com’s $6.00 per lot. The minimum deposit for IC Markets is set at $200, while FOREX.com requires only $100. However, IC Markets recommends a deposit of $200, whereas FOREX.com suggests a more substantial recommended deposit of $1,000. Both brokers excel in offering no funding fees, enhancing their appeal as cost-effective options for traders.

Standard Account Fees

When it comes to standard account fees, IC Markets stands out with highly competitive spreads, starting at just 0.62 pips for EUR/USD. In contrast, FOREX.com offers wider spreads of 1.20 pips for the same pair. For AUD/USD, IC Markets has a spread of 0.77 pips, whereas FOREX.com’s spread is 1.40 pips. These significant disparities underscore the cost-effectiveness of IC Markets’ standard account, particularly for traders who regularly engage with these currency pairs.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.00 | 1.00 | 1.27 | 1.20 | 1.10 |

| 1.20 | 1.30 | 1.30 | 1.50 | 1.10 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 0.50 | 0.60 | 0.70 | 0.90 | 0.70 |

| 1.18 | 1.45 | 1.40 | 1.49 | 1.60 |

| 1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

| 1.40 | 1.90 | 1.30 | 1.60 | 1.50 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 12/01/2025

Ultimately, both IC Markets and FOREX.com present appealing trading opportunities, yet they exhibit notable differences in their account features. IC Markets shines with its narrower spreads and clear commission structure, making it a budget-friendly option for many traders. On the other hand, FOREX.com offers a lower minimum deposit requirement paired with a higher recommended deposit, creating an inviting pathway for newcomers in the trading arena. As the forex trading environment continues to evolve, both brokers remain dedicated to delivering exceptional services and competitive conditions to their clients. Whether your focus is on minimizing spreads, managing commission costs, or enhancing account accessibility, IC Markets and FOREX.com cater to the diverse needs of every trader.

Our Lowest Spreads and Fees Verdict

Our dedicated team surmises that IC Markets come up trumps in this category due to their lowest spreads and fees.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

2. Better Trading Platform – FOREX.com

A top forex trading platform merges advanced technology with user-friendly features. It offers advanced charting, real-time insights, and fast execution for seamless trading. Customizable options, automated trading, and diverse financial instruments enhance strategy refinement. Strong security ensures a reliable experience.

| Trading Platform | IC Markets | FOREX.com |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | No |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

IC Markets and FOREX.com are reputable forex brokers that deliver a variety of platforms and trading tools designed to accommodate diverse trading styles and preferences. IC Markets offers access to MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, whereas FOREX.com provides MT4, TradingView, NinjaTrader, and its own proprietary platform. In this review, we will thoroughly compare IC Markets and FOREX.com, examining their spreads, commission structures, and standard account fees. This analysis aims to equip you with the most recent insights and trends in the forex trading industry for 2025.

Spreads

IC Markets stands out in the industry for its exceptionally low spreads, making it a compelling choice for traders seeking to reduce their trading costs. For the EUR/USD pair, IC Markets offers spreads as low as 0.02 pips, significantly lower than FOREX.com’s 0.13 pips and the average industry spread of 0.28 pips. Similarly, for the AUD/USD pair, IC Markets begins at just 0.03 pips, compared to FOREX.com’s 0.31 pips and the industry average of 0.45 pips. These competitive spreads position IC Markets as a prime option for savvy traders.

Commission Levels

IC Markets and FOREX.com both offer competitive commission rates, but there are key distinctions to consider. IC Markets imposes a commission of $3.50 per lot, while FOREX.com charges $6.00 per lot. When it comes to minimum deposit requirements, IC Markets asks for $200, whereas FOREX.com has a minimum of $100. However, IC Markets recommends a deposit of $200, while FOREX.com advises traders to deposit $1,000 for optimal trading. Importantly, both brokers do not charge funding fees, making them attractive options for cost-conscious traders.

Standard Account Fees

In terms of standard account fees, IC Markets stands out with competitive spreads starting at just 0.62 pips for EUR/USD, whereas FOREX.com offers a spread of 1.20 pips. For AUD/USD, IC Markets also excels with a spread of 0.77 pips compared to FOREX.com’s 1.40 pips. These significant disparities emphasize the cost advantages that IC Markets provides, making it an ideal choice for traders who regularly engage with these currency pairs.

Both IC Markets and FOREX.com present compelling trading conditions, yet they exhibit notable differences in their account features. IC Markets distinguishes itself with lower spreads and a clear commission structure, making it an economical option for numerous traders. Conversely, FOREX.com appeals to newcomers with its lower minimum deposit requirement and higher recommended deposit, facilitating easier access to the market. As the forex trading environment progresses, both brokers are dedicated to providing exceptional services and competitive trading conditions. Whether your focus is on minimizing spreads, optimizing commissions, or enhancing account accessibility, both IC Markets and FOREX.com cater to the diverse needs of all traders.

Our Better Trading Platform Verdict

Undeniably, FOREX.com takes home the crown in this niche owing it to their better trading platform.

FOREX.com ReviewVisit FOREX.com

*Your capital is at risk ‘76% of retail CFD accounts lose money’

3. Superior Accounts And Features – IC Markets

Choosing the right trading account is crucial for a trader’s success. Feature-rich accounts offer customized options like competitive spreads, low commissions, and advanced tools, catering to various trading styles. Brokers often provide demo accounts, swap-free options for Islamic traders, and a wide range of financial instruments. Premium features such as social trading, automated trading, and dedicated support enhance the trading experience. A well-structured account ensures seamless execution and builds trader confidence and loyalty.

In the competitive and busy world of forex trading, both IC Markets and FOREX.com provide account features tailored to cater to a variety of trader preferences.

IC Markets:

- Raw Spread Account: Provides ultra-low spreads, with the average EUR/USD spread at 0.1 pips. A commission of $3.50 per lot per side is applicable.

- Standard Account: Features spreads starting from 0.8 pips with no additional commissions.

- Minimum Deposit: A minimum deposit of $200 is required to commence trading.

FOREX.com:

- RAW Pricing Account: Offers spreads as low as 0.0 pips on major pairs, accompanied by a $7 commission per $100,000 traded.

- Standard Account: Provides spreads starting from 1.2 pips without any commission charges.

- Minimum Deposit: The initial deposit requirement is at least $100; however, a deposit of $2,500 is recommended for enhanced flexibility and risk management.

In summary, IC Markets attracts traders looking for minimal spreads with its Raw Spread Account, whereas FOREX.com provides flexibility with a lower initial deposit and competitive spreads through its Standard Account. Ultimately, the best choice hinges on personal trading strategies and capital allocation preferences.

| IC Markets | FOREX.com | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | Yes |

| Active Traders | Yes | Yes |

| Spread Betting (UK) | No | No |

Our Superior Accounts and Features Verdict

IC Markets shines in this portion on the account of superior accounts and features.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – IC Markets

A top-tier trading experience combines advanced technology, fast execution, and competitive pricing. The best forex brokers focus on user-friendly platforms, tight spreads, and reliable support, enabling confident market navigation. Access to trading tools, educational resources, and advanced charting enhances decision-making, boosting performance and fostering long-term success in forex.

In 2025, the forex trading landscape continues to evolve, driven by technological advancements, tighter regulatory frameworks, and shifting trader preferences. The ultimate trading experience today relies on a powerful blend of state-of-the-art trading platforms, lightning-fast execution speeds, razor-thin spreads, and responsive customer support. As algorithmic and AI-driven trading continues to soar in popularity, traders increasingly seek seamless integration of automation, sophisticated risk management tools, and real-time market analytics to maintain their competitive edge.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| IC Markets | 134ms | 16/36 | 153ms | 22/36 |

| FOREX.com | 98ms | 13/36 | 88ms | 4/36 |

IC Markets and FOREX.com both recognize these trends and have adapted accordingly. IC Markets stands out as a premier option, offering raw spread accounts and exceptional execution on MetaTrader 5 (MT5) and cTrader, which makes it particularly appealing to high-frequency traders and scalpers. In contrast, FOREX.com sets itself apart with its proprietary platform that utilizes AI-driven insights, providing retail traders with advanced analytics and customizable trade automation. As more brokers adopt AI-powered trading signals and institutional-grade liquidity, the competition for the most user-friendly trading platform intensifies, significantly influencing the future landscape of forex trading.

Our Best Trading Experience and Ease Verdict

IC Markets reigns supreme in this portion this is due to their best trading experience and ease.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – A Tie

In forex trading, brokers having a strong regulation and trust are the foundation of a secure and transparent trading environment. Brokers operating under strict regulatory oversight must adhere to stringent standards, safeguarding traders from fraud and unethical practices. This not only instills confidence among traders but also fosters a more active and engaged trading community. A well-regulated broker earns a strong reputation, attracting more clients and reinforcing its market presence. In this review, we’ll explore how IC Markets and FOREX.com measure up in terms of trust, compliance, and the regulatory safeguards they offer to traders.

IC Markets Trust Score

FOREX.com Trust Score

For traders in forex trading, when evaluating the safety and reliability of a forex broker, regulatory oversight is a crucial factor. The 2025 forex trading insights reveal that FOREX.com boasts a robust trust rating of 81, significantly higher than IC Markets’ score of 53. This disparity is largely attributed to FOREX.com’s comprehensive regulatory framework. Effective regulation is crucial for promoting transparency, safeguarding investors, and ensuring adherence to financial standards. We classify regulators into tier-one and tier-three categories, with tier-one regulators exemplifying the highest level of oversight, while tier-three regulators typically encompass offshore jurisdictions.

IC Markets is regulated by two top-tier authorities: the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC), along with a third-tier regulator, the Financial Services Authority (FSA) in Seychelles. This structure provides direct protection for traders in Australia and the European Union through ASIC and CySEC, while clients located outside these regions are governed by the Seychelles entity, which offers less robust investor safeguards. In comparison, FOREX.com boasts regulatory oversight from several premier authorities, including the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) in the US, the Investment Industry Regulatory Organisation of Canada (IIROC), the Financial Services Agency (FSA) in Japan, the Financial Conduct Authority (FCA) in the UK, and CySEC within the EU. Furthermore, it enjoys regulation from the Cayman Islands Monetary Authority (CIMA) as an additional level of oversight.

| IC Markets | FOREX.com | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) CYSEC (Cyprus) | FCA (UK) CIRO (CANADA) NFA/CFTC (USA) CYSEC (Cyprus) |

| Tier 2 Regulation | JFSA (Japan) | |

| Tier 3 Regulation | FSA-S (Seychelles) SCB (Bahamas) | CIMA (Cayman) |

Given its extensive regulatory reach, FOREX.com stands out as the ideal choice for traders in highly regulated markets such as the United States, Canada, and the UK, where IC Markets is not an option. Conversely, IC Markets is favored by traders in Australia, Europe, and various offshore markets due to its attractive trading conditions. It’s important to note that FOREX.com does not operate in Australia, Singapore, or the UAE; however, traders in these regions can access similar offerings through its sister company, City Index, which complies with local financial regulations. Ultimately, the decision between these two brokers hinges on the trader’s location and regulatory preferences, with FOREX.com providing broader global accessibility while IC Markets excels in particular markets.

Reviews

IC Markets and FOREX.com both enjoy strong reputations on Trustpilot, but IC Markets holds a slight edge in overall customer satisfaction. IC Markets is rated 4.8 out of 5 from over 46,000 reviews, with users consistently praising its fast trade execution, low spreads, and responsive support. FOREX.com also performs well, with a score of 4.6 out of 5 from around 2,200 reviews, earning high marks for professional customer service and platform reliability.

Our Stronger Trust and Regulation Verdict

It’s deadlock for both FOREX.com and IC Markets this is in light both of their stronger trust and regulation.

FOREX.com ReviewVisit FOREX.com

*Your capital is at risk ‘76% of retail CFD accounts lose money’

6. Most Popular Broker – IC Markets

IC Markets gets searched on Google more than FOREX.com. On average, IC Markets sees around 246,000 branded searches each month, while FOREX.com gets about 22,200 — that’s 90% fewer.

| Country | IC Markets | FOREX.com |

|---|---|---|

| United Kingdom | 33,100 | 880 |

| South Africa | 9,900 | 590 |

| Thailand | 8,100 | 140 |

| India | 8,100 | 1,900 |

| Vietnam | 8,100 | 170 |

| Spain | 6,600 | 170 |

| United States | 6,600 | 6,600 |

| Australia | 6,600 | 210 |

| Germany | 5,400 | 720 |

| Pakistan | 5,400 | 720 |

| France | 4,400 | 260 |

| United Arab Emirates | 4,400 | 320 |

| Brazil | 4,400 | 110 |

| Morocco | 4,400 | 110 |

| Italy | 3,600 | 140 |

| Singapore | 3,600 | 90 |

| Colombia | 3,600 | 140 |

| Malaysia | 3,600 | 170 |

| Indonesia | 3,600 | 390 |

| Nigeria | 3,600 | 480 |

| Poland | 2,900 | 170 |

| Sri Lanka | 2,900 | 50 |

| Netherlands | 2,400 | 140 |

| Hong Kong | 2,400 | 90 |

| Mexico | 2,400 | 210 |

| Canada | 2,400 | 1,000 |

| Philippines | 2,400 | 170 |

| Algeria | 2,400 | 90 |

| Kenya | 2,400 | 320 |

| Saudi Arabia | 1,900 | 140 |

| Bangladesh | 1,900 | 210 |

| Egypt | 1,600 | 90 |

| Peru | 1,600 | 70 |

| Switzerland | 1,600 | 70 |

| Turkey | 1,300 | 320 |

| Argentina | 1,300 | 110 |

| Sweden | 1,300 | 90 |

| Japan | 1,300 | 590 |

| Portugal | 1,000 | 40 |

| Taiwan | 1,000 | 40 |

| Ecuador | 1,000 | 40 |

| Uzbekistan | 1,000 | 110 |

| Dominican Republic | 1,000 | 70 |

| Cyprus | 880 | 30 |

| Ireland | 880 | 40 |

| Ghana | 880 | 90 |

| Austria | 720 | 110 |

| Greece | 720 | 50 |

| Chile | 720 | 50 |

| Venezuela | 720 | 50 |

| Uganda | 720 | 70 |

| Ethiopia | 720 | 110 |

| Mongolia | 720 | 10 |

| Jordan | 590 | 30 |

| Mauritius | 480 | 20 |

| Costa Rica | 390 | 20 |

| Tanzania | 320 | 40 |

| Panama | 260 | 10 |

| Bolivia | 260 | 20 |

| Botswana | 260 | 30 |

| New Zealand | 210 | 30 |

| Cambodia | 170 | 40 |

33,100 1st | |

880 2nd | |

9,900 3rd | |

590 4th | |

8,100 5th | |

140 6th | |

6,600 7th | |

210 8th |

Similarweb shows a different story when it comes to February 2024 website visits with IC Markets receiving 2,425,000 visits vs. 1,779,000 for FOREX.com.

Our Most Popular Broker Verdict

IC Markets is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – FOREX.com

In the industry of forex trading, brokers having a wide and varied selection of trading instruments is essential for traders looking to maximize opportunities across different market conditions. Brokers offering diverse CFDs—forex, commodities, indices, and cryptocurrencies—help traders build portfolios and leverage market volatility. A wide range of products boosts profit potential and strategy refinement. This review compares IC Markets and FOREX.com in market offerings and trading opportunities.

The financial instruments offered by the two brokers are contracts-for-differences (CFDs). These are a form of derivative, with underlying assets ranging from forex pairs to shares/ETFs/indices, commodities, and even cryptos.

| CFDs | IC Markets | FOREX.com |

|---|---|---|

| Forex Pairs | 61 | 91 |

| Indices | 25 | 17 |

| Commodities | 4 Metals (Gold vs 6 currencies) (Silver vs 3 currencies) 8 Softs 5 Energies | 2 Metals (6 Gold crosses (2 Silver crosses) 2 Energies 2 Softs |

| Cryptocurrencies | 23 | 8 |

| Share CFDs | 2100+ | 220 |

| ETFs | No | No |

| Bonds | 9 | No |

| Futures | Yes | No |

| Treasuries | 9 | No |

| Investments | Yes | No |

Our Top Product Range and CFD Markets Verdict

Based on our team’s research, FOREX.com claims the crown in this niche by reason of their top product range and CFD markets.

FOREX.com ReviewVisit FOREX.com

*Your capital is at risk ‘76% of retail CFD accounts lose money’

8. Superior Educational Resources – IC Markets

A well-rounded trading experience is built on a strong foundation of diverse product offerings and exceptional educational resources. Traders can diversify portfolios using various financial instruments like CFDs, adapting to market shifts. Access to educational resources such as webinars, articles, videos, and courses helps traders improve skills and strategies. Brokers provide tools for informed decision-making, fostering continuous learning for success in forex.

In the complicated and dynamic world of forex trading, education plays a pivotal role in a trader’s success. IC Markets boasts a comprehensive educational center that caters to traders of all skill levels, from beginners to seasoned professionals. Their extensive array of resources features live webinars, video tutorials that delve into fundamental concepts as well as advanced trading strategies, and consistently refreshed market analyses. This ensures that traders are equipped with real-time insights to make informed decisions. IC Markets boasts a comprehensive economic calendar that monitors significant market events, enabling traders to stay informed and anticipate market-moving news. In addition, their vast array of trading guides presents a variety of strategies and techniques, perfect for traders aiming to enhance their trading methods.

FOREX.com also delivers a strong educational platform, albeit with a slightly less extensive range of resources. They offer frequent webinars, covering a broad spectrum of trading topics and designed for traders of different experience levels. Although their video tutorial collection is not as extensive as that of IC Markets, it still effectively addresses key concepts to assist traders in navigating the forex landscape. FOREX.com’s market insights are valuable, providing traders with relevant and timely information to stay on top of global market trends. Moreover, their economic calendar effectively keeps traders updated on significant financial events, although it may lack the detail and user-friendliness found in IC Markets’ offerings. The broker’s trading guides concentrate on fundamental to intermediate strategies, making them perfect for individuals embarking on their forex journey or seeking to enhance their understanding.

Both brokers understand the importance of education in shaping a trader’s success. IC Markets provides an extensive array of educational resources that are especially advantageous for traders looking to deepen their understanding and enhance their strategies with advanced tools. In contrast, FOREX.com, although it offers valuable educational content, is likely more suited for novice traders or those who appreciate a simpler, more direct approach. In conclusion, while both brokers provide valuable educational materials, IC Markets stands out with its wider array of resources, which may appeal more to those looking for a deeper, more nuanced understanding of forex trading.

Our Superior Educational Resources Verdict

without a doubt, IC Markets truly tops this category on account of their superior educational resources.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

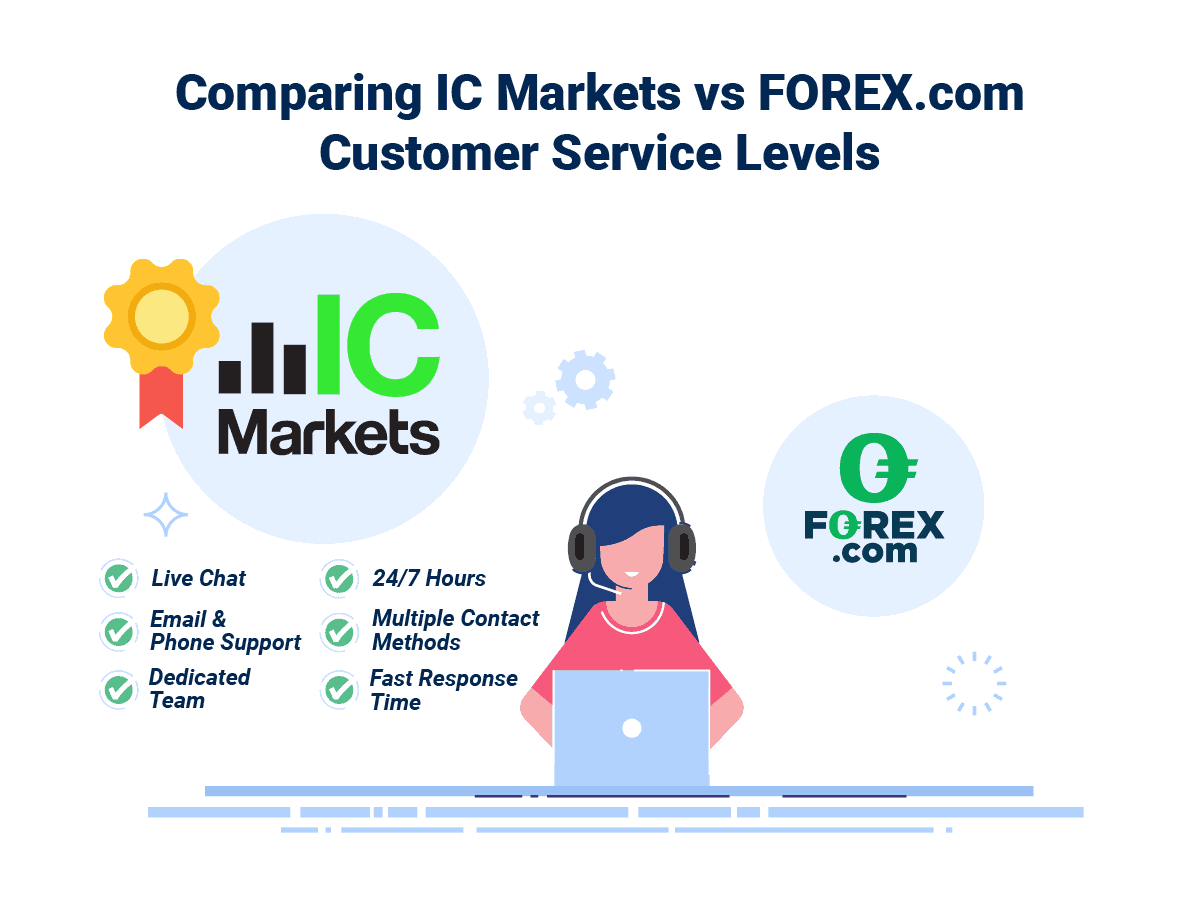

9. Superior Customer Service – IC Markets

When it comes to forex trading, exceptional customer service really takes the spotlight. It’s all about making sure traders feel supported and confident as they navigate the markets. Leading brokers provide 24/7 support through swift live chat responses, phone assistance, and informative email help, ensuring that any issues you may encounter are promptly addressed. And with multilingual support, traders from all over the world can get the help they need, whenever they need it. Great customer service not only helps resolve problems fast but also boosts satisfaction and builds trust, making for a smooth and stress-free trading experience.

IC Markets and FOREX.com are prominent players in the forex trading industry, each offering distinct services and support structures.

IC Markets:

- Support Services: IC Markets provides 24/7 support through multiple channels, including phone, email, and live chat. Their support team is known for swift response times, ensuring traders can connect through their preferred methods.

- Awards and Recognition: In February 2025, IC Markets was named the ‘Best Forex/CFD Broker in APAC 2024’ at the TradingView Awards, highlighting their commitment to delivering superior trading experiences.

- Educational Resources: IC Markets offers a comprehensive suite of educational tools tailored for both beginners and advanced traders. These include well-crafted guides, free demo accounts, regular webinars, and extensive research tools to support informed trading decisions.

- Research Tools: In May 2024, IC Markets integrated with TipRanks to enhance their research capabilities. This partnership provides clients with advanced tools like News Sentiment, Investor Sentiment, and Analyst Ratings, empowering traders with data-driven insights.

FOREX.com:

- Support Services: FOREX.com also offers 24/7 support through various channels, including phone, email, and live chat. While they provide a diverse range of contact options, response times may occasionally fluctuate.

- Educational Resources: FOREX.com provides a range of educational materials, including articles, videos, and webinars, to assist traders in enhancing their skills and knowledge.

- Research Tools: FOREX.com offers a variety of research tools, including market analysis, economic calendars, and trading news updates, to help traders stay informed about market trends.

Recent Developments:

Legal Challenges for IC Markets: In January 2025, Andrew Budzinski, the founder of IC Markets, faced multiple legal challenges, including a class action lawsuit alleging the sale of highly leveraged financial products without ensuring investors understood the risks. Budzinski has stated his intention to vigorously defend against these allegations.

| Feature | IC Markets | FOREX.com |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/5 |

| Multilingual Support | Yes | Yes |

In summary, both IC Markets and FOREX.com offer robust support services and educational resources. IC Markets distinguishes itself with rapid response times and recent accolades, such as the ‘Best Forex/CFD Broker in APAC 2024’ award. FOREX.com provides a diverse range of support options and educational materials, catering to a wide array of traders.

Our Superior Customer Service Verdict

Based on our team’s testing and scores, IC Markets offers superior customer service, ensuring traders receive prompt and high-quality support when needed.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

10. Better Funding Options – IC Markets

For traders in the forex trading industry, when it comes to funding your forex trading account, the more options, the better. A variety of funding methods allows traders to choose what suits them best, including bank transfers, credit/debit cards, and digital wallets like PayPal and Skrill. Some brokers also accept cryptocurrencies. With low or zero fees, these options ensure smooth deposits and withdrawals, helping traders focus on their trades.

When evaluating brokers like IC Markets and FOREX.com, it’s crucial to consider their funding options, as these can significantly impact your trading experience. Here’s an updated overview of the funding methods offered by both brokers:

IC Markets Funding Options:

IC Markets provides a diverse range of funding methods to accommodate various client preferences:

- Credit and Debit Cards: Accepted currencies include AUD, USD, EUR, CAD, GBP, SGD, NZD, JPY, HKD, and CHF. Deposits are typically processed instantly.

- PayPal: Available for multiple currencies with instant processing.

- Neteller and Skrill: Supported with instant processing times.

- UnionPay: Accepted for RMB deposits with instant processing.

- Wire Transfer: Available for various currencies, typically taking 2-5 business days to process.

- Bpay: Supported for AUD deposits with processing times between 12 to 48 hours.

- Broker to Broker: Available with processing times of 2-5 business days.

- POLI: Supported for AUD deposits with instant processing.

- Thai Internet Banking: Available for USD deposits with processing times of 15-30 minutes.

- Rapidpay: Supported for EUR and GBP deposits, with processing times up to 2 business days.

- Klarna: Available for EUR and GBP deposits with processing times up to 2 business days.

- Vietnamese Internet Banking: Supported for USD deposits with instant processing.

FOREX.com Funding Options:

FOREX.com also offers a variety of funding methods:

- Credit and Debit Cards: Accepted currencies include USD, EUR, GBP, CAD, JPY, CHF, AUD, and GBP. Deposits are typically processed immediately.

- Wire Transfer: Available for USD, EUR, GBP, CAD, JPY, CHF, AUD, and GBP. Processing times are up to 1-2 business days.

- Neteller and Skrill: Supported with immediate processing times.

Key Considerations:

- Fees: Both brokers do not charge fees for deposits. However, your bank or payment provider may impose fees, especially for international transactions.

- Processing Times: While many funding methods are processed instantly, wire transfers may take several business days.

- Currency Conversion: Deposits made in a currency different from your account’s base currency may incur conversion fees.

- Third-Party Payments: Both brokers require that deposits come from accounts in your name to comply with anti-money laundering regulations.

In summary, both IC Markets and FOREX.com offer a comprehensive range of funding options to suit diverse client needs. Understanding the specifics of each method, including processing times and potential fees, is essential for a seamless trading experience.

The table below provides a comprehensive comparison of the funding options available with both brokers:

| Funding Option | IC Markets | FOREX.com |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | No |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | No |

| Klarna | No | No |

Our Better Funding Options Verdict

IC Markets outperforms the contender in this category due to their better funding options.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

11. Lower Minimum Deposit – FOREX.com

A lower minimum deposit in forex trading broadens access for more traders, especially beginners or those with limited capital. It lowers the upfront investment, allowing new traders to practice and learn without significant financial risk, making forex more accessible for skill-building.

As of 2025, both IC Markets and FOREX.com offer accessible entry points for traders, each with their own funding structures.

IC Markets:

- Minimum Deposit: IC Markets requires a minimum deposit of $200 to open a trading account.

- Deposit and Withdrawal Fees: The broker does not charge fees for deposits or withdrawals.

FOREX.com:

- Minimum Deposit: FOREX.com has a lower minimum deposit requirement of $100.

- Deposit and Withdrawal Fees: Similar to IC Markets, FOREX.com does not impose fees on deposits or withdrawals.

Key Considerations:

- Global Applicability: The minimum deposit requirements are consistent across all regions for both brokers.

- Funding Methods: Both brokers support various funding methods, including bank transfers, credit/debit cards, and e-wallets. Processing times and availability may vary depending on the method and your location.

- Currency Conversion: Deposits made in a currency different from your account’s base currency may incur conversion fees.

- Third-Party Payments: Both brokers require that deposits come from accounts in your name to comply with anti-money laundering regulations.

In summary, while both IC Markets and FOREX.com offer accessible entry points for traders, FOREX.com provides a lower minimum deposit requirement, which may be advantageous for those with limited capital. It’s essential to consider the specific funding methods, potential fees, and processing times to determine which broker aligns best with your trading needs.

FOREX.com

| Minimum Deposit | GBP | USD | EUR | AUD |

|---|---|---|---|---|

| Credit Card / Debit Card | £100 | $100 | €100 | $100 |

| Bank Wire | £100 | $100 | €100 | $100 |

| Skrill | £100 | $100 | €100 | $100 |

| Neteller | £100 | $100 | €100 | $100 |

IC Markets

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £200 Minimum Deposit | $200 Minimum Deposit | €200 Minimum Deposit | $200 |

| Paypal | £200 Minimum Deposit | $200 Minimum Deposit | €200 Minimum Deposit | $200 |

| Bank Wire | £200 Minimum Deposit | $200 Minimum Deposit | €200 Minimum Deposit | $200 |

| Skrill | £200 Minimum Deposit | $200 Minimum Deposit | €200 Minimum Deposit | $200 |

| Minimum Deposit | Recommended Deposit | |

| IC Markets | $200 | $200 |

| FOREX.com | $100 | $1,000 |

Our Lower Minimum Deposit Verdict

Indisputably, FOREX.com secures first place in this portion by the reason of their lower minimum deposit.

FOREX.com ReviewVisit FOREX.com

*Your capital is at risk ‘76% of retail CFD accounts lose money’

Is FOREX.com or IC Markets The Best Broker?

IC Markets is having its moment in the spotlight due to having excellent features in a majority of the key areas that traders prioritise, such as spreads, fees, educational resources, customer service, and funding options. The table below summarises the key information leading to this verdict:

| Categories | IC Markets | FOREX.com |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platform | No | Yes |

| Superior Accounts And Features | Yes | No |

| Best Trading Experience And Ease | Yes | No |

| Stronger Trust And Regulation | Yes | Yes |

| Top Product Range And CFD Markets | No | Yes |

| Superior Educational Resources | Yes | No |

| Superior Customer Service | Yes | No |

| Better Funding Options | Yes | No |

| Lower Minimum Deposit | No | Yes |

IC Markets: Best For Beginner Traders

For those just starting out in the trading world, IC Markets offers a more comprehensive educational platform, making it the better choice for beginner traders.

IC Markets: Best For Experienced Traders

For seasoned traders looking for advanced tools and a wide range of trading options, FOREX.com might be the most suitable option. However, IC Markets still remains a strong contender due to its competitive offerings.

FAQs Comparing IC Markets Vs FOREX.com

Does FOREX.com or IC Markets Have Lower Costs?

IC Markets generally offers lower costs compared to FOREX.com. They are known for their competitive spreads, often starting from as low as 0.0 pips for major pairs. This makes them one of the top choices for traders looking for cost-effective trading. For a more detailed comparison on spreads and commissions, you can check out this comprehensive Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both IC Markets and FOREX.com offer MetaTrader 4, but IC Markets is often preferred for its seamless integration and advanced tools on the platform. MT4 is globally recognized for its user-friendly interface and comprehensive charting tools. If you’re keen on exploring more, this detailed review on the best MT4 brokers can provide further insights.

Which Broker Offers Social Trading?

IC Markets offers social trading features, allowing traders to copy strategies from experienced traders. Social or copy trading has become increasingly popular as it provides an opportunity for beginners to learn from seasoned traders. For those interested in diving deeper into the world of social trading, here’s a comprehensive guide on the best social trading platforms.

Does Either Broker Offer Spread Betting?

FOREX.com offers spread betting, while IC Markets does not. Spread betting is a popular form of trading in the UK, allowing traders to speculate on the price movements of financial instruments without owning the underlying asset. For those interested in exploring the best brokers for spread betting, especially on the MT4 platform, you can check out this comprehensive guide on the best MT4 spread betting brokers.

What Broker is Superior For Australian Forex Traders?

In my opinion, IC Markets stands out as the superior choice for Australian forex traders. Not only is IC Markets ASIC regulated, ensuring a high level of trust and security, but it’s also an Australian-founded broker. This gives them a deep understanding of the local market and the specific needs of Australian traders. Their competitive spreads, diverse trading platforms, and robust infrastructure make them a top choice. If you’re keen to explore more about the best brokers in Australia, here’s a detailed review of the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK traders, I personally believe FOREX.com has the edge. They are FCA regulated, which provides a significant level of trust and security for UK-based traders. While IC Markets is a strong contender globally, FOREX.com’s deep roots in the UK market and their comprehensive offerings tailored to UK traders give them an advantage. If you’re a UK trader looking for a platform that offers a seamless trading experience, you might want to check out this guide on the Best Forex Brokers In UK.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert