Hugo's Way vs IC Markets 2025

Hugo’s way is a new broker with no regulation taking on the established multi-regulated IC Markets We compared Hugosway vs IC Markets to determine which broker is best for spreads, account types and platforms. Read to see how each compares.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

How Do IC Markets Vs Hugo’s Way Compare?

Our full comparison covers the 10 most important trading factors. Here are five key differences:

- Hugo’s Way is a newer broker without regulation, whereas IC Markets is multi-regulated.

- IC Markets offers a commission of $3.50 (USD Base), while Hugo’s Way charges $5.

- IC Markets provides trading platforms like MetaTrader 4, MetaTrader 5, and cTrader, while Hugo’s Way offers only MetaTrader 4.

- Hugo’s Way operates from an offshore location without tier-one regulation, while IC Markets is regulated by ASIC and CySEC.

- IC Markets requires a minimum deposit of $200, whereas Hugo’s Way requires only $10.

1. Lowest Spreads And Fees: IC Markets

The lower you keep trading expenses, the more money you can extract from the global currency market. The difference between the bid price and the asking price, aka the spread, is the first cost traders need to pay for trading forex. One way to keep the relatively low costs of forex trading is to choose a broker with low spreads.

Our team of experts at Compare Forex Brokers has put side-by-side forex brokers Hugosway vs IC Markets to see which one offers lower spreads.

The Impact Of Higher Spreads On Your Profits

In the long run, the impact of higher spreads on your profits can be the fine line between profitability and losing. Only a half a pip lower spread can increase your profits by 90% (statistic based on taking 100 FX trades). Minimizing the forex spread can be one of the most effective ways to improve your bottom line.

To work out the real cost that comes in the form of the spread, we’re going to outline an example.

For example, we’re going to assume that your EUR/USD trading strategy has the following profit-and-loss ratios:

- The average win over the last 100 trades is 20 pips

- The average loss over the last 100 trades is 15 pips

Note* Without counting the spread, we can say this strategy has a positive expectancy.

If we go one step forward and assume the average spread you pay is 2 pips, it means that the spread cost is 10% of your profits. However, the difference between the average win and the average loss is 5 pips. So, in reality, your net gain per trade is only 5 pips.

If we go one step forward with our calculations, the spread cost for an average profit of 5 pips and paying 2 pips spread is 40% of your profit. If the spread increased by only 0.5 pips, the spread cost will account for 50% of your profits.

The more the spread increases, the more it will eat from your profits.

Note* Pepperstone is the only other brokerage trading firm that can compete with IC Markets spreads.

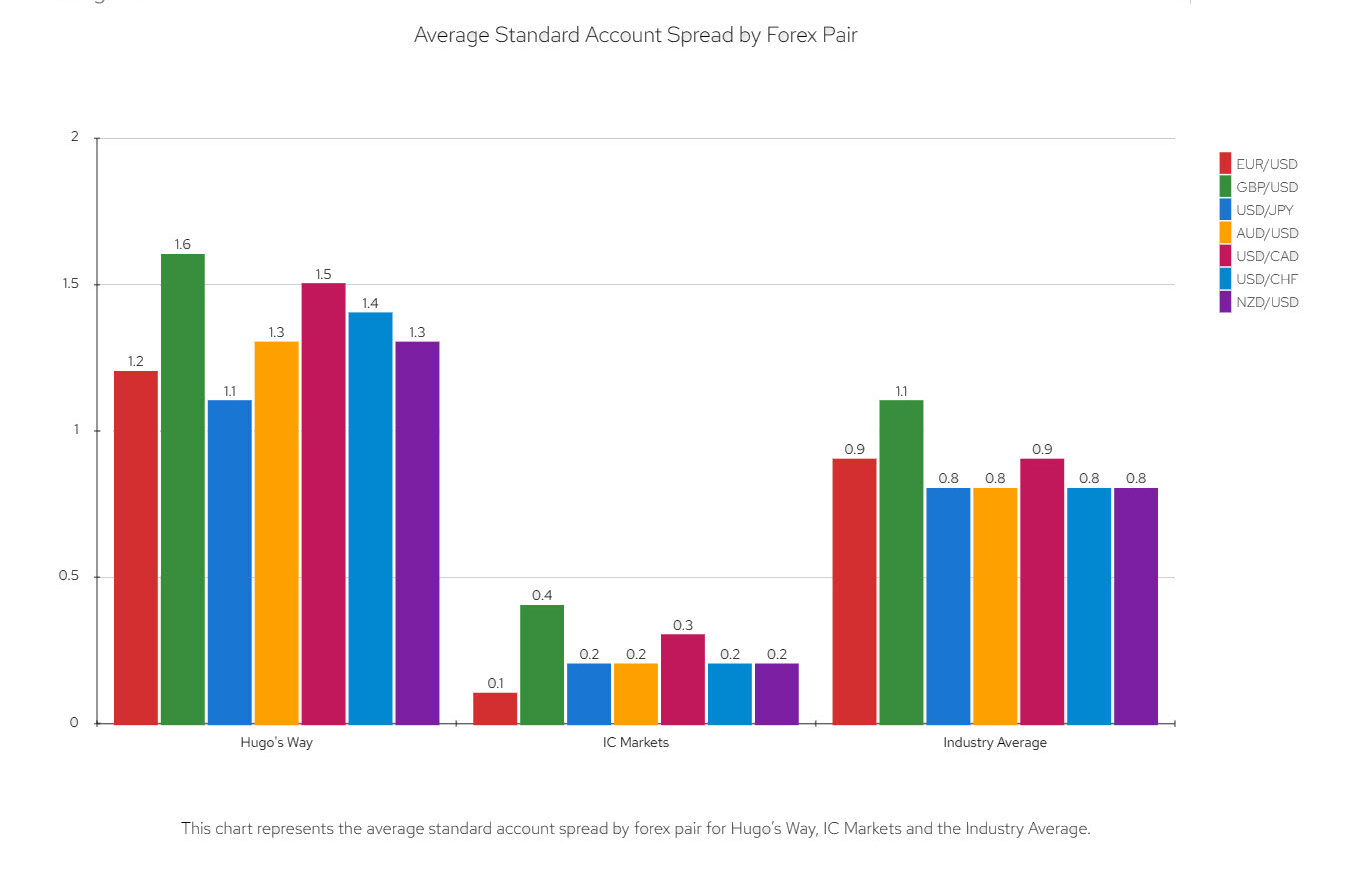

Standard Account Spreads

When comparing the standard account spreads of Hugo’s Way and IC Markets, it’s clear that there are some significant differences. Hugo’s Way has higher spreads across all forex pairs, with an average spread of 1.4 for USD/CHF and 1.6 for GBP/USD. On the other hand, IC Markets offers much lower spreads, with an average of 0.2 for most forex pairs.

In my opinion, IC Markets offers a more cost-effective option for traders, given their lower spreads. This is particularly important for frequent traders, as even small differences in spreads can add up over time. However, it’s worth noting that the choice of broker should also take into account other factors such as trading environment, trustworthiness, and customer service.

| Forex Pair | Hugo’s Way | IC Markets | Industry Average |

|---|---|---|---|

| EUR/USD | 1.2 | 0.1 | 0.9 |

| GBP/USD | 1.6 | 0.4 | 1.1 |

| USD/JPY | 1.1 | 0.2 | 0.8 |

| AUD/USD | 1.3 | 0.2 | 0.8 |

| USD/CAD | 1.5 | 0.3 | 0.9 |

| USD/CHF | 1.4 | 0.2 | 0.8 |

| NZD/USD | 1.3 | 0.2 | 0.8 |

Standard Account Analysis Updated July 2025[1]July 2025 Published And Tested Data

When comparing these brokers to the industry average, both Hugo’s Way and IC Markets offer competitive spreads. While Hugo’s Way’s spreads are slightly above the industry average, they are still within a reasonable range. IC Markets, with their exceptionally low spreads, stands out as a particularly cost-effective choice.

In conclusion, while both brokers offer competitive spreads, IC Markets stands out for its exceptionally low spreads. However, traders should consider other factors such as trading environment and customer service when choosing a broker.

Forex Broker With Low Spread

Over the past years, the forex industry has become a very competitive field. When you trade forex through the best forex brokers like IC Markets, you can enjoy raw spreads on currency pairs and many CFDs.

The Australian-based trading firm IC Markets offers two types of spreads, depending on the trading accounts you choose:

- Raw spreads from 0.0 pips (EUR/USD average spread is 0.1 pips) – commission-based account

- Marked-up spreads of 1 pip above the Interbank spread (EUR/USD average spread is 1.1 pips) – commission-free account

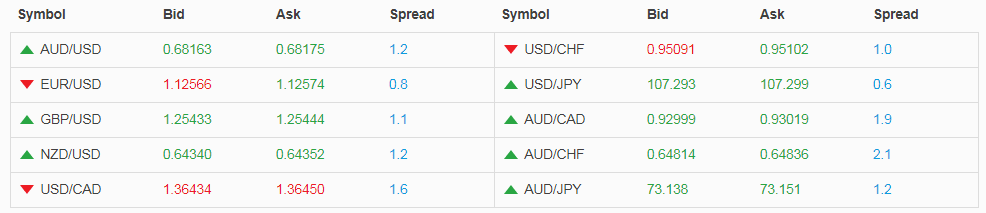

By comparison, Hugo’s Way offers forex traders higher spreads across its retail investor accounts. The Hugo FX website doesn’t provide potential clients with relevant information about the average forex spreads they offer. However, the live spreads revealed that Hugo’s Way offers worse trading conditions. The live EUR/USD spread is 0.8 pips.

Note* Hugosway vs IC Markets EUR/USD spread comparison shows that IC Markets EUR/USD spread is 0.7 pips tighter. In the long run, this can save you up to 14% of your profits.

Note* Hugosway vs IC Markets EUR/USD spread comparison shows that IC Markets EUR/USD spread is 0.7 pips tighter. In the long run, this can save you up to 14% of your profits.

Trading EUR/USD with an 0.1 spread (IC Markets) vs trading EUR/USD with an 0.8 pips spread (Hugosway):

- Average profit of 5 pips and 0.1 spread – the spread cost is 2% of your profits (IC Markets)

- Average profit of 5 pips and 0.8 spread – the spread cost is 16% of your profits (HugosWay)

In the spread comparison table below you can review Hugosway vs IC Markets spreads on the most popular currency pairs and CFDs.

| Spreads (6/15/2020) | IC Markets Raw Spreads | Hugo's Way Live Spreads |

|---|---|---|

| EUR/USD | 0.1 | 0.8 |

| GBP/USD | 0.4 | 1.1 |

| USD/JPY | 0.2 | 0.6 |

| AUD/USD | 0.2 | 1.2 |

| Gold | 1.0 | 0.32 |

| US SPX 500 Index | 0.6 | 0.9 |

| Bitcoin | 5.0 | 21.0 |

Note* On average, IC Markets spreads are 0.7 pips tighter than Hugo’s Way spreads. The largest forex spread difference was noted on AUD/USD (1.0 pips spread difference). The AUD/USD spread on IC Markets Raw spreads was 0.2 pips compare to 1.2 pips spread found with HugosWay.

Verdict

IC Markets is the winner in the low-spread category. Both FX brokers Hugo’s Way and IC Markets offer ECN prices, but our overall rating process revealed that forex traders can find better trading conditions with IC Markets. The 0.0 raw spreads offered by IC Markets are secured due to the 25 liquidity providers that keep the spread tight. Claim your free demo account today by clicking the button below.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

2. Better Trading Platform: IC Markets

A multi-functional, user-friendly and fast-responsive trading platform is what every trader seeks, no matter their knowledge or skill level. If you want to climb the ladder and become a successful trader, you need a trading platform that can assist you in achieving your goals.

Our team of experts factored in the various trading platforms offered by IC Markets and Hugosway.

With IC Markets, retail traders can choose from a selection of trading platforms, including:

- MetaTrader 4 trading platform – the world’s most popular forex platform

- MetaTrader 5 trading platform – next-generation platform

- cTrader trading platform – designed for high-speed trading

In comparison, Hugo’s Way offers its clients the MetaTrader 4 trading software only with “true ECN connectivity,” which allows clients to trade with Straight Through Processing (STP) execution model.

The trading software offered by IC Markets can be accessed via several devices. There is a downloadable desktop version for both Windows and macOS. Online trading can also be done via the web-based application MetaTrader WebTrader and cTrader Web.

Additionally, IC Markets offers trading on the go via fully functional forex trading apps (iOS and Android devices).

Note* Hugo’s Way’s MT4 is not compatible with macOS.

Hugo’s Way vs. IC Markets: Order Execution

IC Markets MetaTrader 4 server is located in the Equinix NY4 data centre, which ensures low latency, minimized possibility of slippage and an average order execution speed of 36.5 ms. Hugo’s Way, however, does not disclose specific execution speeds.

The exceptionally fast execution of trade orders ensures no requotes.

Note* Hugosway claims to have 50 different liquidity providers compared to IC Markets which streams its quotes from only 25 LPs.

Trading Platform Features

When it comes to a variety of analytical tools and MT4 platform features, IC Markets definitely offers a superior software solution.

MT4 platforms by both brokers have no limits on trade sizes, as the minimum lot size is 0.01. Also, both brokers allow news trading, scalping and hedging on their MT4 software. With IC Markets, there is no “first in, first out” rule.

Note* The FIFO rule says that if multiple positions are held involving the same currency pair, you need to close first the earliest position.

IC Markets’ MetaTrader 4 has no restrictions on limit orders. This means traders can place their Stop Loss and Take Profit orders at the closest pip distance possible from the current market price. This is not valid for Hugo’s Way’s MT4.

IC Markets allows access to a high-quality VPS service, which enables clients to run automated trading strategies 24/7 with the fastest possible connectivity to the broker’s trading servers. In comparison, Hugo’s Way does not provide access to a VPS service.

In order to improve the overall trading experience for its clients, IC Markets offers an extra set of advanced trading tools, previously not featured in the MT4 trading software. The set includes 11 applications (Alarm Manager, Correlation Matrix, Sentiment Trader, Stealth Orders among others) and 17 technical indicators (Candle countdown, Donchian, Keltner, Linear regression, Renko, Chart – in – Chart indicator among others).

In comparison, MetaTrader 4 by Hugo’s Way offers a rather limited set of features and technical analysis tools. There are 3 trade execution modes available (instant, request and market), 2 market orders, 4 pending orders, 2 stop orders and a Trailing Stop feature. There are no extra trading tools.

Social Trading Features

Another useful feature IC Markets clients can benefit from is copy trading platforms. Clients can copy leading traders from social networks operated by ZuluTrade and Myfxbook. In comparison, Hugo’s Way doesn’t provide clients with copy trading features. While Hugo’s Way doesn’t provide copy trading integrated into their software package, traders can use third-party software that is compatible with MT4.

Verdict

Overall, IC Markets offers a wider option of trading platforms, faster execution speed, no FIFO rule, high-quality VPS service and advanced trading tools. Traders looking for more than just the MT4 platform can satisfy their needs by opening an account with IC Markets.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

3. Superior Accounts And Features: IC Markets

In an attempt to reach out to a wider customer base, many Forex brokers offer multiple account types.

No matter what your trading experience or skill level, risk tolerance or financial objectives, retail clients will be able to choose a forex account that will suit their trading needs.

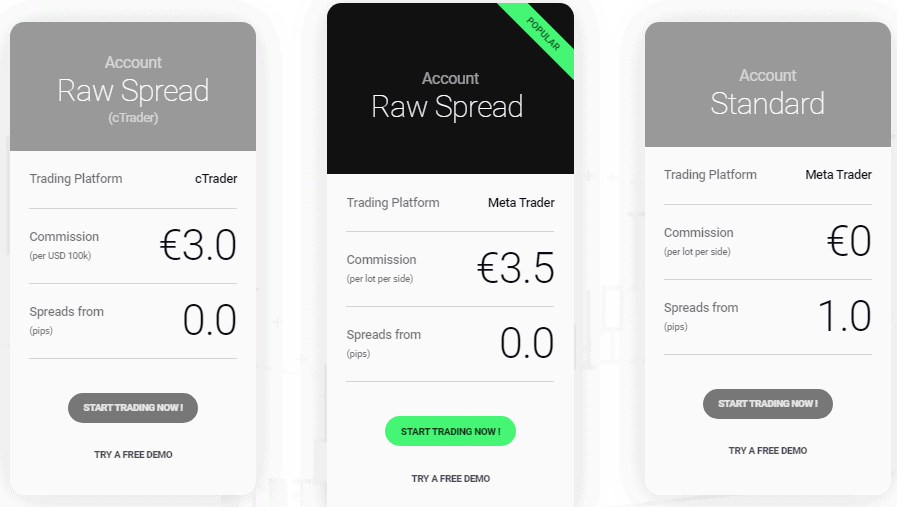

If we take IC Markets, which has proven to be one of the best Forex brokers globally, we should point out that it offers its clients a choice of three main live account types:

- Standard Account

- Raw Spread Account (MT4 and MT5)

- Raw Spread Account for cTrader

In comparison, Hugo’s Way, which is still in the early stages of its business experience, offers Forex traders only one live account type.

Hugo’s Way vs. IC Markets Review: Popular Account Types

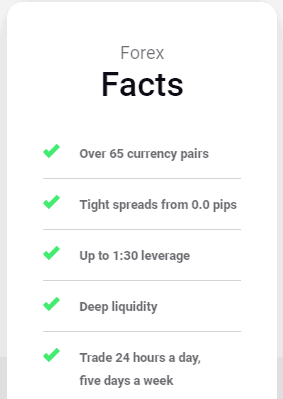

Over the years, IC Markets’ Raw Spread Account has become quite popular among retail traders. It allows for Forex trading with the lowest possible spreads (starting from 0.0 pips), while the average spread offered on major pairs such as EUR/USD is 0.1 pips (one of the lowest worldwide).

In comparison, Hugo’s Way’s MT4 ECN Account, which allows access to true ECN trading environment, has variable spreads, with the average spread on EUR/USD being around 0.7 pips (according to price data measured by Compare Forex Brokers).

IC Markets’ Raw Spread Account provides access to:

- 65 currency pairs – major FX pairs (EUR/USD, GBP/USD, etc.) minor FX pairs (EUR/GBP) and exotic pairs (USD/ZAR)

- 16 major Stock Indices (US E-mini S&P 500 and US DJIA Index)

- 19 commodities (energy, agriculture and metals)

- 6 bonds CFDs (5-Year US Treasury Note)

- 10 cryptocurrency CFDs (Bitcoin, Ethereum, Ripple, etc.)

- +152 stocks (Apple, Facebook or BHP) from global stock exchanges (ASX, NASDAQ, NYSE)

- 4 future CFDs (DXY – Dollar index)

- On the popular MetaTrader 4, MetaTrader 5 and cTrader platforms

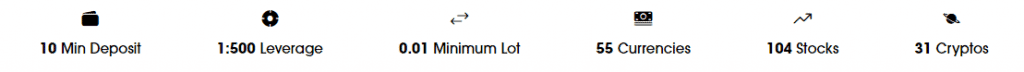

Hugo’s Way’s MT4 ECN Account provides access to 55 currency pairs and complex instruments (Contracts for Difference) on 31 Cryptocurrencies, 104 Stocks, 11 Stock Indices, 6 Metals, 3 Energies and 1 Future contract.

For a head-to-head comparison of Hugosway vs IC Markets range of markets see the table below.

| HugosWay Account | IC Markets Account | |

|---|---|---|

| Forex Currency Pairs | 55 | 65 |

| Stock Indices | 11 | 16 |

| Stocks | 104 | 152 |

| Metals | 6 | 5 |

| Energies | 3 | 5 |

| Cryptocurrency | 31 | 10 |

| Commodities | None | 7 |

| Futures | 1 | 4 |

| Bonds | None | 6 |

Note* IC Markets offers two additional assets classes (Bonds and Soft commodities) in comparison with Hugo’s Way.

Forex Account Features Comparison

IC Markets requires a minimum deposit of $200 and allows clients to use a maximum leverage of 1:30 for Forex in Australia and Europe (500:1 outside Australia and Europe). Hugo’s Way requires a minimum deposit of $10 and allows retail clients to use maximum leverage of 1:500 for Forex and Metals trading.

Since both brokers ensure deep liquidity and decent order execution speed, the Raw Spread Account and the MT4 ECN Account are appropriate choices for day traders, scalpers as well as traders using Expert Advisors.

We should also note that both brokers will charge a commission on their popular trading accounts. IC Markets will charge a commission of $6.00 per round turn for 1 Standard Lot traded, while Hugo’s Way will charge a commission of $10.0.

Note* HugosWay’s commission is almost double that of IC Markets’ commission.

| HugosWay Account | IC Markets Account | |

|---|---|---|

| Range of Account Types | 1 | 3 |

| Minimum Deposit | $10 | $200 |

| Account Currencies | 6 base currencies (EUR, USD, GBP, CAD, AUD, BTC) | 10 base currencies (EUR, USD, AUD, GBP, SGD, NZD, JPY, CHF, HKD, CAD) |

| Deposit Methods | 5 Funding Options (credit and debit card, VLoad, bank transfer, etc.) | 15 Funding Options (credit and depit cards, PayPal, Skrill, Neteller, Etc.) |

| Spread Type | Variable | Raw Spreads |

| Lot Sizes Available | Micro, Mini, Standard | Micro, Mini, Standard |

| Maximum Leverage | 1:500 | 1:500 |

| Commission | $5.00 Side-Way $10.00 Round-Turn | $3.00 Side-Way $6.00 Round-Turn |

| Forex Pairs | 55 | 65 |

| Trading Platforms | MetaTrader 4, WebTrader | MetaTrader 4, MetaTrader 5, cTrader, WebTrader |

| Swap Free Account | No | Yes |

| Expert Advisors | Yes | Yes |

| Scalping / Hedging | Yes | Yes |

| Margin Call | 100% | 120% |

| Stop Out Level | 70% | 80% |

Last but not least, IC Markets’ Raw Spread Account supports 10 base currencies (EUR, USD, AUD, GBP, SGD, NZD, JPY, CHF, HKD, CAD), while Hugo’s Way’s MT4 ECN Account supports 6 base currencies (GBP, USD, EUR, CAD, AUD, Bitcoin).

Both brokers offer a Free Demo Account, which allows retail clients to test trading strategies in real market conditions and to familiarize themselves with trading platform features and tools.

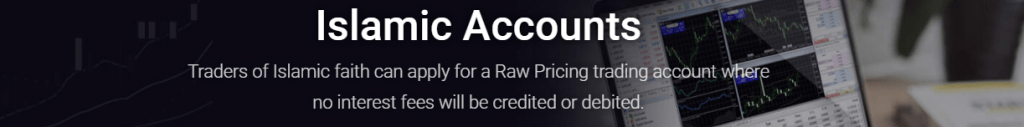

Forex Islamic Account

As for an Islamic Account option, at present, Hugo’s Way does not offer a Swap-free Account. However, clients of the Islamic faith can open such an account with IC Markets. The broker’s all three main account types support a swap-free account option, “where no interest fees will be credited or debited.”

Verdict

IC Markets’ range of account types has more features than Hugo’s Way. This is why, based on our star scoring system, IC Markets scored the most points being the overall winner in this category. Make sure you choose your trading account based on what type of trader you are and what are your trading needs.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

4. Best Trading Experience And Ease: IC Markets

When we dove into the trading experience and ease of use, we couldn’t help but notice the stark differences between Hugo’s Way and IC Markets. Hugo’s Way, being a newer broker, has a straightforward interface, but it might lack some of the advanced features that seasoned traders look for. On the other hand, IC Markets, with its years of experience, offers a more comprehensive trading experience. From our observations:

- IC Markets offers MT5, which is considered one of the best platforms for trading.

- Hugo’s Way primarily sticks to MT4, limiting its versatility for traders.

- IC Markets has been recognised for its standard account offering, making it a preferred choice for many.

- The execution speed, although not explicitly mentioned for Hugo’s Way, is something IC Markets prides itself on.

Now, after diving deep into our own testing and gathering insights, it’s evident that both brokers have their strengths. However, when it comes to the overall trading experience and ease of use, IC Markets seems to have an edge.

Verdict

IC Markets offers a superior trading experience compared to Hugo’s Way.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

5. Stronger Trust And Regulation: IC Markets

IC Markets Trust Score

Hugo’s Way Trust Score

The practice has shown numerous cases of unethical behaviour by Forex brokers over the past two decades, including client trading account manipulation, use of client funds as operating capital, rejection of client withdrawal requests, or simply cutting off any contact with clients.

Because of these and other cases of scams within the Forex industry, many traders may not be willing to put their trust in a Forex broker that lacks any regulation by a reputable authority.

IC Markets is one of the largest FX CFD providers in terms of Forex volume worldwide and has over 100,000 active clients. On a daily basis, IC Markets is processing over 500,000 transactions.

IC Markets conducts its business by following the strict regulatory standards imposed by two of the most reputable regulatory authorities globally:

- The Australian Securities and Investments Commission (ASIC), AFSL No. 335692

- Cyprus Securities and Exchange Commission (CySEC), Licence No 362/18

Disclaimer: To serve the needs of clients in other areas of the world, IC Markets Global is regulated in Seychelles by the Financial Services Authority (FSA) with licence No SD018.

In comparison, at present, Hugo’s Way is conducting its business operations from an offshore location with no tier-one regulator. As an offshore broker, Hugo’s Way is not licenced by any government financial authority. Trading with an unregulated broker comes with a high risk associated with fraudulent activities.

Note* Not all unregulated brokers are scams. Offshore forex brokers are the primary destination for United States residents looking for unrestricted access to forex trading. US traders have only a limited number of regulated forex brokers (OANDA, Forex.com or IG Markets) which is why offshore brokers may look attractive.

Hugo’s Way is taking the necessary steps and investigating different regulatory jurisdictions to ensure that our clients have the best cover possible.

The difference between regulated brokers vs unregulated brokers is that forex regulation gives you an extra level of security and protection of your money.

Forex Fund Safety

When it comes to client fund security, IC Markets assures that it keeps client money in Segregated Client Trust Accounts at AA-rated financial institutions such as National Australia Bank (NAB) and Westpac Banking Corporation (Westpac). Thus, the use of client funds for any operational expenses or purposes is not possible. Hugo’s Way also states that client funds are kept fully segregated from the broker’s bank accounts, but it does not provide more details.

Since Hugo’s Way claims to take client security seriously, it has added an extra layer of security for Forex traders, known as a Two-factor authentication (2FA). This way, clients’ trading accounts remain protected against any unauthorized access.

IC Markets does not offer 2FA, but on the other hand, it assures all electronic payments are processed via Secure Socket Layer (SSL) technology and are encrypted.

No Negative Balance Protection Policy

Along with all the above-mentioned advantages, however, there is one disadvantage. Both brokers do not seem to follow a Negative Balance Protection policy.

As a result, trading CFDs, which are high-risk derivative instruments with High Leverage Forex Brokers ratios, may lead to losses that exceed initial deposits on retail investor accounts. This generates the necessity for traders to use all other risk management tools that brokers offer to protect their active positions.

| Hugo's Way | IC Markets | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) CYSEC (Cyprus) |

|

| Tier 2 Regulation | ||

| Tier 3 Regulation | FSA-S (Seychelles) SCB (Bahamas) |

Verdict

The bottom line is that forex traders can enjoy higher protection with IC Markets. Regulated and licenced brokers ensure fair prices, transparent trading conditions, protection from fraud and the safety of funds.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

6. Most Popular Broker – IC Markets

IC Markets gets searched on Google more than Hugo’s Way. On average, IC Markets sees around 246,000 branded searches each month, while Hugo’s Way gets about 9,900 — that’s 95% fewer.

| Country | Hugo's Way | IC Markets |

|---|---|---|

| United Kingdom | 260 | 33,100 |

| South Africa | 70 | 9,900 |

| India | 40 | 8,100 |

| Thailand | 10 | 8,100 |

| Vietnam | 10 | 8,100 |

| Spain | 50 | 6,600 |

| United States | 6,600 | 6,600 |

| Australia | 50 | 6,600 |

| Germany | 50 | 5,400 |

| Pakistan | 30 | 5,400 |

| France | 50 | 4,400 |

| United Arab Emirates | 10 | 4,400 |

| Brazil | 40 | 4,400 |

| Morocco | 10 | 4,400 |

| Italy | 20 | 3,600 |

| Colombia | 40 | 3,600 |

| Malaysia | 10 | 3,600 |

| Singapore | 10 | 3,600 |

| Indonesia | 10 | 3,600 |

| Nigeria | 170 | 3,600 |

| Poland | 20 | 2,900 |

| Sri Lanka | 10 | 2,900 |

| Netherlands | 40 | 2,400 |

| Mexico | 70 | 2,400 |

| Philippines | 20 | 2,400 |

| Canada | 320 | 2,400 |

| Hong Kong | 10 | 2,400 |

| Algeria | 10 | 2,400 |

| Kenya | 20 | 2,400 |

| Saudi Arabia | 10 | 1,900 |

| Bangladesh | 10 | 1,900 |

| Switzerland | 20 | 1,600 |

| Peru | 10 | 1,600 |

| Egypt | 10 | 1,600 |

| Argentina | 30 | 1,300 |

| Sweden | 10 | 1,300 |

| Turkey | 10 | 1,300 |

| Japan | 10 | 1,300 |

| Taiwan | 10 | 1,000 |

| Portugal | 30 | 1,000 |

| Ecuador | 10 | 1,000 |

| Dominican Republic | 20 | 1,000 |

| Uzbekistan | 10 | 1,000 |

| Ireland | 10 | 880 |

| Cyprus | 10 | 880 |

| Ghana | 10 | 880 |

| Austria | 10 | 720 |

| Greece | 10 | 720 |

| Chile | 20 | 720 |

| Venezuela | 30 | 720 |

| Ethiopia | 10 | 720 |

| Uganda | 10 | 720 |

| Mongolia | 10 | 720 |

| Jordan | 10 | 590 |

| Mauritius | 10 | 480 |

| Costa Rica | 10 | 390 |

| Tanzania | 10 | 320 |

| Bolivia | 10 | 260 |

| Panama | 10 | 260 |

| Botswana | 10 | 260 |

| New Zealand | 20 | 210 |

| Cambodia | 10 | 170 |

2024 Monthly Searches For Each Brand

IC Markets - UK

IC Markets - UK

|

33,100

1st

|

Hugo’s Way - UK

Hugo’s Way - UK

|

260

2nd

|

IC Markets - India

IC Markets - India

|

8,100

3rd

|

Hugo’s Way - India

Hugo’s Way - India

|

40

4th

|

IC Markets - Spain

IC Markets - Spain

|

6,600

5th

|

Hugo’s Way - Spain

Hugo’s Way - Spain

|

50

6th

|

IC Markets - Germany

IC Markets - Germany

|

5,400

7th

|

Hugo’s Way - Germany

Hugo’s Way - Germany

|

50

8th

|

Similarweb shows a similar story when it comes to February 2024 website visits with IC Markets receiving 2,425,000 visits vs. 47,000 for Hugo’s Way.

Verdict

IC Markets is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets: IC Markets

When it comes to the range of products and CFD markets, both Hugosway and IC Markets have a lot to offer. However, the specifics of their offerings can vary significantly. To provide a clear comparison, we’ve compiled data from both our own testing and the information available on their respective websites.

| Product/Market | Hugosway | IC Markets |

|---|---|---|

| Forex Pairs | 55 | 60 |

| Commodities | 15 | 19 |

| Indices | 10 | 12 |

| Stocks | 100+ | 120+ |

| Cryptocurrencies | 30 | 35 |

| Bonds | 5 | 7 |

| Futures | 8 | 10 |

| ETFs | 10 | 12 |

| Metals | 5 | 6 |

| Energies | 4 | 5 |

| Agricultural | 3 | 4 |

From the table, it’s evident that IC Markets has a slightly broader range in most categories compared to Hugosway. This can be particularly advantageous for traders looking for diverse investment opportunities.

Verdict

Based on the range of CFDs and markets available, IC Markets appears to have a slight edge over Hugosway, offering traders a more extensive selection to choose from.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

8. Superior Educational Resources: Hugo’s Way

Hugo’s Way:

- Webinars: Hugosway offers regular webinars that cater to both beginners and advanced traders.

- E-books: A vast collection of e-books is available, covering various trading topics.

- Video Tutorials: Comprehensive video tutorials that cover essential trading strategies and tools.

- Trading Glossary: An extensive glossary that helps traders familiarize themselves with trading jargon.

- Market Analysis: Regular market analysis articles that provide insights into the current market trends.

- Customer Support: Dedicated customer support that assists traders in understanding the platform and tools.

IC Markets:

- Webinars: IC Markets also conducts webinars, but they are less frequent compared to Hugosway.

- E-books: A limited collection of e-books is available for traders.

- Video Tutorials: They offer a few video tutorials, but they are not as comprehensive as Hugosway.

- Trading Glossary: A basic glossary is available, but it’s not as detailed as Hugosway’s.

- Market Analysis: They provide market analysis, but it’s not as in-depth as Hugosway’s.

- Customer Support: Their customer support is responsive, but they lack the educational support that Hugosway offers.

Verdict

Based on our team’s testing, Hugosway offers superior educational resources compared to IC Markets.

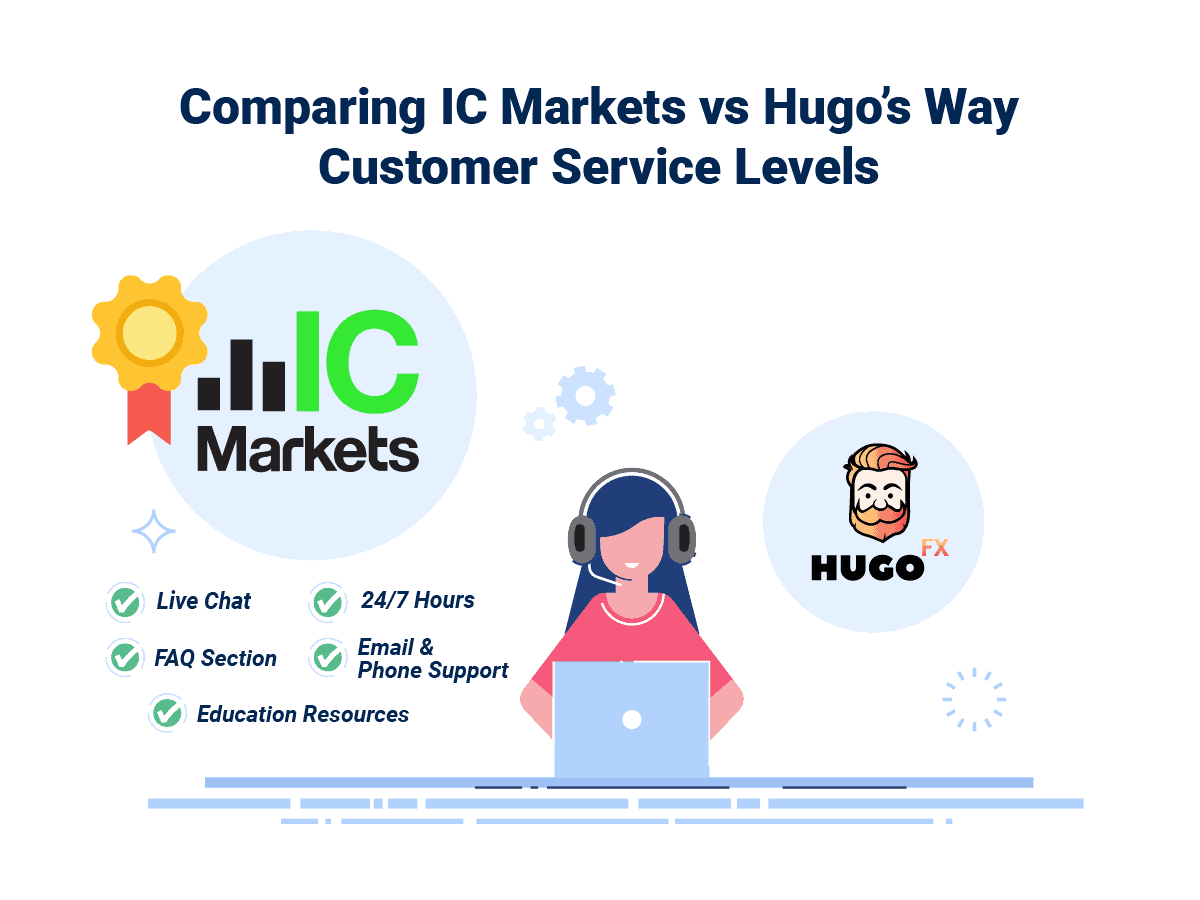

9. Superior Customer Service: IC Markets

Nowadays, a forex broker is expected to provide its clients with additional high-quality services that can come in the form of:

- Client support specialist

- Educational section

- In-house market analysis

Professional customer support service is another important aspect of any brokerage. It is always a good thing when clients can contact a dedicated user-friendly team of professionals if they are looking for a resolution to some technical or account-related issue or if they are simply willing to provide some feedback on the broker’s service.

Forex Customer Support

If an FX broker can’t offer reliable customer service and communication with its clients, you’re going to struggle to resolve any problem that might arise while trading. The first responsibility and duty of reliable FX customer support are to assist customers with all their inquiries and to be efficient. The main tasks of a client support specialist include:

- Answer all forex traders’ inquiries, requests and complaints

- Offer information about the financial services and products they offer

- Assist clients with the account application form

- The broker No Dealing Desk Brokers should be capable of opening and closing new and existing positions

The forex support team plays an integral role in the overall good standing of the forex brokerage trading firms. Before you choose a forex broker, make sure you test their technical support and see for yourself how you’re treated as a potential client.

With IC Markets, clients can take advantage of a 24/7 customer support service via 3 main channels of communication:

- Live chat

- Over the phone

Note* The broker’s dedicated support team can be reached either on the global phone number +61 (0)2 8014 4280.

Both brokers can assist their clients over the weekend, which is very handy, as most brokers are only offering support during market trading hours. By comparison, Hugo’s Way can only be contacted via live chat and email. Traders can get hold of Hugosway on the phone by requesting a “Request a Callback.”

Forex Educational Section

Aside from the customer service, you also need free forex educational resources to help you reach your trading goals. This is especially true if you’re a beginner trader, then you need to first put your trading foundation before risking any real money. Most brokers have their educational centres equipped with resources that are available for traders with different levels of trading experience:

- Beginner traders

- Intermediate traders

- Advanced Traders

Not all forex brokers provide training for their clients, and if this is something that you need, make sure you choose an FX broker that can satisfy your needs.

IC Markets does have a well-structured education section, covering topics such as Forex Trading, Technical Analysis, Fundamental Analysis, Risk Management, Trading Psychology and Trading Plan.

The broker also has a video section with tutorials about how to download a Demo Account, how to use the One-Click Trade Manager, and how to hedge orders in MetaTrader 4, among others.

In comparison, Hugo’s Way has provided only several education-oriented articles on general topics concerning the Forex market and the Crypto market.

Market Analysis

Forex brokers can offer their clients additional services to help them better navigate the financial market. This help can come in two forms:

- In-house market analysis by an in-house team of experts

- Third-party market analysis

A good team of in-house experts can keep you up to date with the latest forex news, help you determine which currency pair to buy and sell, spot new trading opportunities, understand the latest fundamental trends and many more market insights.

IC Markets provides insight into global markets in a set of daily publications, while Hugo’s Way does not offer such content. Additionally, IC Markets Web TV will give you more insights from the forex analysts at IC Markets. The short video analysis is recorded directly from the NYSE in collaboration with Trading Central.

Verdict

Comparing the customer support service, IC Markets is a better broker. Based on our assessment, IC Markets offers professional customer support, trading guides, in-house market analysis along daily market insights.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

10. Better Funding Options: IC Markets

After you submit your application form to open a forex brokerage account, funding your account is the next step before you can start trading with real money. Most brokers will offer more than one option to deposit and withdraw your money. However, besides the range of funding options, you should also take into consideration factors like:

- The average transfer time

- Deposit and withdrawal fees

- Intermediate bank fees

- Maximum and minimum limits on deposit and withdrawal

- Supported base currencies

- Check on forums if traders are reporting issues withdrawing the profits

With IC Markets, retail clients can choose from up to 16 different account funding options. In the meantime, Hugo’s Way allows 4 payment methods. But what definitely tilts the scales in favour of IC Markets on this front is the fact the Australian brokerage will not charge any additional fees on deposits and withdrawals.

Credit And Debit Card

Depositing by a Credit Card or a Debit Card by Visa or Mastercard is one of the popular methods offered by both brokers. Hugo’s Way requires a minimum deposit of $50 with this method and will charge no fees on withdrawals. With both brokers, withdrawals may take several business days to reach clients’ cards.

Bank Wire Transfer

Another frequently used method is bank wire transfer. IC Markets emphasizes that International Bank Wire Transfers will incur a processing fee of AUD 20 or equivalent currency, which will be deducted from clients’ withdrawal amount.

With Hugo’s Way, the minimum deposit allowed ranges between $50 and $100, depending on the bank. We should note that the offshore broker will charge a deposit fee of $25 for deposits of up to $5,000, while withdrawals will also incur a fee of $25!

Bitcoin Funding Method

Both brokers allow depositing with Cryptocurrencies such as Bitcoin. Hugo’s Way requires a minimum deposit of $50 with this method, while withdrawals will take 1 to 3 hours or 3 to 6 confirmations on the Blockchain. No fees will be charged on deposits, but the cryptocurrency networks will charge a small commission on withdrawals.

Note* IC Markets will process BTC deposits in about 1 – 2 hours.

Note* IC Markets will process BTC deposits in about 1 – 2 hours.

Additional Payment Options

Hugo’s Way also allows account funding with VLoad. The broker requires a minimum deposit of $10 and will charge a deposit fee of 3%. On the other hand, withdrawals are instant and fee-free. VLoad is not an available option with IC Markets.

However, the Australian company offers a variety of other account funding methods, including:

However, the Australian company offers a variety of other account funding methods, including:

- PayPal

- Skrill

- NETELLER

- NETELLER VIP

- UnionPay

- BPAY

- FasaPay

- Rapidpay

- POLi

- Klarna

- Broker to Broker

- Thai Internet Banking

- Vietnamese Internet Banking

Verdict

Our final verdict is that IC Markets is better than Hugo’s Way in the funding methods category. As a trusted global brand, IC Markets supports 15 different funding options with no deposit and withdrawal fees on the most popular payment methods.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

11. Lower Minimum Deposit: IC Markets

When it comes to starting your trading journey, the initial deposit can be a significant factor. Some traders prefer to start small, testing the waters before diving in, while others might be looking for platforms that allow them to begin without any deposit at all. Both Hugosway and IC Markets offer competitive minimum deposit requirements, but there are some differences to note.

Hugosway provides flexibility with its deposit options. For traders using BTC via Instacoins, the minimum deposit is $50. However, if you opt for Vload, the minimum deposit drops significantly to just $10. On the other hand, IC Markets stands out by offering a $0 minimum deposit for both its Standard and Raw accounts, making it an attractive option for those who want to start trading without any initial financial commitment.

| Broker | Minimum Deposit |

|---|---|

| Hugosway | BTC via Instacoins: $50, Vload: $10 |

| IC Markets | Standard: $0, Raw: $0 |

Verdict

When it comes to the lowest minimum deposit, IC Markets takes the lead with a $0 requirement for both its account types.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

Our Final Verdict On Which Broker Is The Best: IC Markets or Hugo’s Way?

IC Markets is the winner because of its comprehensive offerings, competitive spreads, robust trading platforms, and superior educational resources.

The table below summarises the key information leading to this verdict:

| Criteria | IC Markets | Hugo’s Way |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ❌ |

| Better Trading Platform | ✅ | ❌ |

| Superior Accounts And Features | ✅ | ❌ |

| Best Trading Experience And Ease | ✅ | ❌ |

| Stronger Trust And Regulation | ✅ | ❌ |

| Top Product Range And CFD Markets | ✅ | ❌ |

| Superior Educational Resources | ❌ | ✅ |

| Superior Customer Service | ✅ | ❌ |

| Better Funding Options | ✅ | ❌ |

| Lower Minimum Deposit | ✅ | ❌ |

Best For Beginner Traders

IC Markets is the ideal choice for beginner traders due to its user-friendly platform and comprehensive educational resources.

Best For Experienced Traders

For seasoned traders seeking advanced tools and tighter spreads, IC Markets remains the top pick.

FAQs Comparing Hugo's Way Vs IC Markets

Does IC Markets or Hugo's Way Have Lower Costs?

IC Markets generally offers lower costs compared to Hugo’s Way. They are known for their competitive spreads, especially on major currency pairs. For instance, the average spread for EUR/USD is often as low as 0.02. This makes them one of the top choices for traders seeking cost efficiency. For a more detailed comparison on low commissions, you can check out this comprehensive guide on Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both IC Markets and Hugo’s Way offer MetaTrader 4, but IC Markets is often preferred due to its advanced integration and additional features. Their version of MT4 is enhanced with superior execution speeds and tighter spreads. If you’re keen on exploring more about MT4 brokers, this detailed review of the best MT4 brokers might be of interest.

Which Broker Offers Social Trading?

IC Markets offers social trading features, allowing traders to copy strategies from experienced traders. Hugo’s Way, on the other hand, doesn’t have a prominent social trading platform. Social trading can be a game-changer, especially for beginners looking to leverage the expertise of seasoned traders. For those interested in diving deeper into social trading platforms, here’s a comprehensive overview of the best social trading platforms.

Does Either Broker Offer Spread Betting?

Neither IC Markets nor Hugo’s Way offer spread betting as a primary service. Spread betting is a unique form of trading popular in the UK, allowing traders to bet on the direction of market movements without owning the underlying asset. For those interested in spread betting, you might want to explore this comprehensive guide on the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, IC Markets stands out as the superior choice for Australian forex traders. Founded in Australia, IC Markets is ASIC regulated, ensuring a high level of trust and security for traders. Their deep liquidity and tight spreads make them a favourite among many Aussie traders. Moreover, being an Australian-founded broker, they have a keen understanding of the local market dynamics. For a broader perspective on Australian forex brokers, you can check out this detailed review of the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK traders, I believe IC Markets has the edge over Hugo’s Way. While neither broker is UK-founded, IC Markets is FCA regulated, which is a significant trust factor for UK traders. Their commitment to transparency, competitive spreads, and a robust trading platform makes them a top choice in the UK market. If you’re keen on exploring more about UK forex brokers, this comprehensive guide on the Best Forex Brokers In UK might be of interest.

Article Sources

No commission account spread proprietary testing data and published website spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert