Pepperstone vs FP Markets: Which One Is Best?

Through our team’s comprehensive analysis of forex trading, we explored the capabilities of Pepperstone and FP Markets, identifying them as leading contenders in the brokerage arena. Both brokers offer a strong variety of currency pairs, commodities, and indices, along with MetaTrader 4 and 5 platforms. Our review discusses their differences. Read the full review for more.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors. Here are five noticeable differences between Pepperstone and FP Markets:

- Pepperstone is regulated in more regions, including the UK, Cyprus, Germany, Australia, Dubai, Kenya, and the Bahamas.

- Pepperstone offers a wider range of trading platforms, including MetaTrader 4, MetaTrader 5, and cTrader.

- Pepperstone boasts lower average spreads and is considered superior in terms of customer service.

- FP Markets is regulated in Europe, Australia, and St Vincent and the Grenadines.

- FP Markets offers MetaTrader 4 and MetaTrader 5.

- FP Markets offers a proprietary trading platform called IRESS, which is only available for Australian traders.

1. Lowest Spreads And Fees – Pepperstone

Spreads

In this section of our review, we will touch-base into the lowest spreads and fees offered by Pepperstone and FP Markets. These features are important for traders seeking cost-effective trading solutions. Reduced spreads lead to lower transaction costs, benefiting high-frequency traders significantly. Additionally, competitive fees attract more clients, resulting in higher trading volumes and increased revenue for brokers. This harmonious relationship enhances the overall trading experience, making it more profitable and appealing for both traders and brokers.

Low spreads and low trading costs account are important factors to take into account for forex traders, especially when scalping and Pepperstone promise both. Both Pepperstone and FP Markets have some of the tightest spreads and lowest of all forex brokers in the industry. Both brokers offer a EUR/USD of 0.1. For AUD/USD, Pepperstone offers 0.1, whereas FP Markets offers 0.3. Consecutively, both currencies have an average industry spread of 0.22 and 0.47. In regard to commission rates, both Pepperstone and FP Markets offer, the former, $3.50 and the latter a $3.00.

| RAW Account | Pepperstone Spreads | FP Markets Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 0.47 | 0.50 | 0.75 |

| EUR/USD | 0.10 | 0.10 | 0.22 |

| USD/JPY | 0.2 | 0.3 | 0.38 |

| GBP/USD | 0.2 | 0.4 | 0.53 |

| AUD/USD | 0.1 | 0.3 | 0.47 |

| USD/CAD | 0.40 | 0.40 | 0.56 |

| EUR/GBP | 0.2 | 0.3 | 0.55 |

| EUR/JPY | 1.1 | 0.8 | 0.80 |

| AUD/JPY | 0.9 | 0.8 | 0.96 |

| USD/SGD | 1 | 1.1 | 2.29 |

Commission Levels

For this portion, both brokers offer a competitive commission rates. Pepperstone offers a $3.50 while FP Markets have a $3.00, these are reasonable rates and still in the average industry rate compared to other brokers. However, in regard to minimum deposit, this is where these two brokers differ. Pepperstone offers a $0 minimum deposit, but their recommended deposit is $200. Whereas, for FP Markets, they offer a minimum of $100 the same amount with the recommended deposit, which is lower than Pepperstone’s recommended deposit. You have to take in account that a higher deposit can provide more flexibility and better risk management, but may be less accessible for new traders. Both brokers’ lower recommended deposit makes it more appealing for those starting out or with limited funds, offering a more inclusive trading environment.

| USD | AUD | GBP | EUR | |

|---|---|---|---|---|

| Pepperstone | $3.50 | $3.50 | £2.25 | €2.60 |

| FP Markets | $3.00 | N/A | £2.25 | €2.75 |

Try the Pepperstone vs FP Markets fee calculator below based on the most popular forex pairs and base currencies.

Standard Account Fees

In this portion, the standard account spreads for both Pepperstone and FP Markets come with the rate of 1.10 in EUR/USD, while for AUD/USD, both offer a rate of 1.20. For FP Markets, their overall average spread is 1.38 compared to Pepperstone’s 1.35, both are still within the standard average spread. Please keep in mind that the industry average spread for major currency pairs typically ranges from 1.2 to 1.6 pips. Therefore, spreads of 1.35 and 1.38 are considered reasonable and competitive within the industry standards.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.10 | 1.10 | 1.30 | 1.30 | 1.30 |

| 1.18 | 1.45 | 1.40 | 1.49 | 1.60 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 1.20 | 1.30 | 1.30 | 1.50 | 1.10 |

| 0.83 | 0.83 | 1.08 | 1.14 | 1.19 |

| 1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

| 1.40 | 1.90 | 1.30 | 1.60 | 1.50 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-01

Pepperstone topped FP Markets in terms of low spreads on forex and CFDs. At Pepperstone, forex traders can enjoy interbank spreads from 0.0 pips and price quotes derived from institutional-grade liquidity providers, no dealing desk and ECN trading conditions. The real-time market-leading pricing, along with the raw spreads, can satisfy high-frequency traders and can easily accommodate all types of scalping trading strategies.

Our Lowest Spreads and Fees Verdict

Our team’s verdict for this category took us to this point that Pepperstone dominates this section this is in light to their lowest spreads and fees.

Pepperstone ReviewVisit Pepperstone]

*Your capital is at risk ‘72% of retail CFD accounts lose money’

2. Better Trading Platform – Pepperstone

Brokers that offer superior trading platforms in the forex market are strongly endorsed. They provide advanced charting tools, real-time market data, and lightning-fast execution speeds. These platforms improve trading with a user-friendly interface, customization, strong security, automated and social trading, and access to various financial instruments, enabling informed and efficient trades.

| Trading Platform | Pepperstone | FP Markets |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | Yes |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

Metatrader

This section explores the MetaTrader platforms, acclaimed as the benchmark in trading technology. MetaTrader 4 (MT4) is favored for its robust security, backed by a vast user community and compatibility with numerous brokers. Meanwhile, MetaTrader 5 (MT5) emerges with enhanced features and an expanded array of Contracts for Difference (CFDs), signaling its potential as the preferred option for the future as MT4 gradually diminishes in prominence. In this case, both brokers as truly competitive in this field owing to their platforms. Both have MT4 and 5, as well as other platforms such as cTrader, TradingView, copytrading, and their proprietary platforms, these are highly needed in forex trading.

Our forex expert team simply compared the trading platforms of these two brokers, reviewing tools, order execution speed, research, ECN technology, social trading, and mobile capabilities.

FP Markets’ forex apps let you manage trading accounts on iPhone and Android, offering only MT4 and MT5. Traders can also use MetaTrader Webtrader to access their accounts via browsers.

Advanced Platforms

cTrader is a top trading platform providing direct interbank market access for algorithmic forex trading. It features a customizable interface, detachable charts, extensive back-testing, and advanced order options on iOS, Android, WebTrader, and desktop. Retail investors will benefit from valuable tools from both reviewed brokers. Aside from this platform, Pepperstone also offer copytrading by Pepperstone, cTrader Copy MetaTrader Signals, Expert Advisors and cTrader Automate. Meanwhile, FP Markets have MetaTrader Signals, Myfxbook AutoTrade, MetaTrader Signals, Expert Advisors, and their proprietary platform IRESS.

We can clearly see here that Pepperstone provides diverse copy and social trading tools for MetaTrader (MT4 and MT5) users, allowing access to 3 social platforms and 3 exclusive copy trading platforms. In contrast, FP Markets only offers MyFxBook AutoTrade for automated trading. Pepperstone’s third-party services offer more choices and trading opportunities.

Pepperstone and FP Markets offer mobile trading apps for forex. Pepperstone’s mobile experience on iOS and Android includes MT4, MT5, and cTrader, featuring real-time FX quotes, advanced charting, one-tap trading, a user-friendly interface, and over 50 default indicators.

Copy Trading

trading is important in forex as it enables beginners to replicate strategies of successful traders, enhancing learning and profitability. It saves time by allowing automatic trade execution without constant market monitoring. And both brokers’ copy trading platforms, Pepperstone’s (copy trading by Pepperstone), and FP Markets’ (MetaTrader Signals) are truly competitive and helpful to traders in the business.

Third-Party Plugins

Pepperstone offers advanced trading tools, including 28 Smart Trader Tools for MT4 and MT5 and Autochartist with pattern recognition and market reports. FP Markets provides the MetaTrader 4 Trader Toolbox with 12 tools and also includes Autochartist for both MT4 and MT5.

Forex Trade Execution

Pepperstone’s No Dealing Desk model offers faster order execution at 30ms versus FP Markets’ 37ms. Its ECN pricing model connects clients to liquidity providers for reduced slippage. Real execution speeds show Pepperstone at 85ms compared to FP Markets’ 95ms. FP Markets provides DMA through its IRESS platform.

Our Better Trading Platform Verdict

Based on the range of platforms offered, accessibility, usability, execution speed, third-party plugins, technical tools, social trading integration and mobile trading apps, Pepperstone steal the show in this category this is due to their better trading platform.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

3. Superior Accounts And Features – Pepperstone

In the industry of forex trading, choosing brokers with superior accounts and features is highly advantageous. Brokers provide customized options for traders, featuring competitive spreads, low commissions, and advanced tools. They also offer demo accounts, swap-free alternatives, and diverse financial instruments. Enhanced features like social trading, automated trading, and excellent customer support improve the trading experience and foster client loyalty.

In our Pepperstone vs FP Markets comparison, we evaluate which Australian forex broker offers the better trading account for your needs. Pepperstone and FP Markets offer these 2 retail investor accounts:

In our Pepperstone vs FP Markets comparison, we evaluate which Australian forex broker offers the better trading account for your needs. Pepperstone and FP Markets offer these 2 retail investor accounts:

- Standard account with no commissions and mark-up spreads

- Commission-based account with raw spreads derived directly from the Interbank market

Additional Account Types

Pepperstone

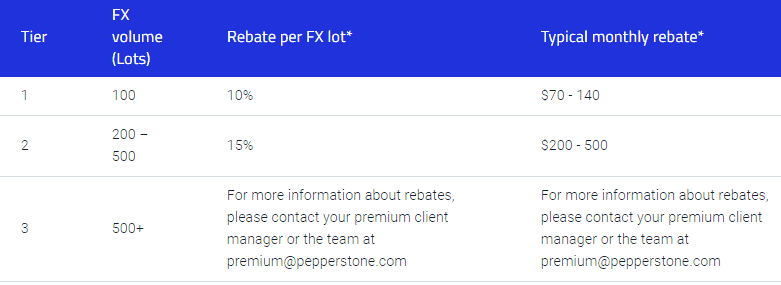

Pepperstone has 3 other account types available. These include:

- Muslim traders via the Islamic account (swap-free) which can be with either Standard or Razor Account

- Professional money managers via PAMM and MAM trading accounts (supports 3 allocation methods including lot, percentage, and proportional)

- Active traders (via Premium Client account) which discount provided you meet minimum trading volume requirements. (see table below)

FP Markets

Australian FP Markets clients can choose from three IRESS accounts for trading, but the minimum deposit is steep at AUD $50,000, along with a $55 monthly fee. IRESS, suited for DMA share trading, is not available outside Australia. FP Markets also provides a Sharia-compliant Islamic account, charging a swap commission or administrative fee up to $33 instead of interest.

| Pepperstone | FP Markets | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | Yes |

| Active Traders | Yes | Yes |

| Spread Betting (UK) | Yes | No |

Our Superior Accounts and Features Verdict

Overall, Pepperstone came first in our star scoring system as it pertains to both beginner traders and professional traders, that is why we give them our hats off on this category owing to their superior accounts and feature.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – Pepperstone

The ultimate trading experience is provided by brokers who are committed to simplifying the forex trading journey for traders. They deliver a blend of advanced trading platforms, lightning-fast execution speeds, competitive spreads, and outstanding customer support. Essential components enable traders to make informed decisions, execute trades easily, and manage accounts confidently. A user-friendly interface, educational resources, and diverse tools enhance the trading experience, making it more enjoyable and profitable.

Pepperstone excels in platform range, particularly MetaTrader 4, while FP Markets is favored for its diverse CFD offerings.

- Pepperstone is recognised as the best broker for MT4 trading.

- FP Markets is highlighted as the best broker for CFD trading.

- Pepperstone also excels in automation, with tools like Capitalise.ai enhancing the trading experience.

- Both brokers offer user-friendly interfaces, but the choice of platform can influence a trader’s preference.

After comparing both platforms, it’s clear each broker serves different trader needs. However, Pepperstone offers a better overall trading experience and ease of use with its tools and platform.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| Pepperstone | 77ms | 2/36 | 100ms | 10/36 |

| FP Markets | 225ms | 31/36 | 96ms | 8/36 |

Our Best Trading Experience and Ease Verdict

So, our team finally decided which broker steals the show, Pepperstone definitely took our attention and takes the cake with ease, this is due to their best trading experience and ease.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – Pepperstone

Strengthening trust and regulation in the forex trading industry is imperative. This crucial element guarantees a secure and transparent trading environment. Regulated brokers ensure trader safety against fraud, boosting confidence and encouraging investment. Reliable brokers attract more clients and enhance their reputation through strong oversight.

Pepperstone Trust Score

FP Markets Trust Score

We can see here that both brokers are well-regulated by reputable authorities, making them safe. Pepperstone and its divisions are authorized for online trading in tier-one and offshore jurisdictions.

- Australia – Pepperstone Australia – by the Australian Securities and Investments Commission (ASIC)

- United Kingdom – Pepperstone UK – by the Financial Conduct Authority (FCA)

- Europe – the Cyprus Securities and Exchange Commission (CySEC)

- Germany – BaFin

- UAE – Pepperstone AE – by the Dubai Financial Services Authority (DFSA)

- Kenya – the CMA

- Internationally – Pepperstone Markets – by the Securities Commission of the Bahamas (SCB)

Meanwhile, FP Markets and its corporate divisions are regulated in the following jurisdictions:

- Australia – First Prudential Markets Pty Ltd – by the ASIC

- Europe – First Prudential Markets Ltd – by the Cyprus Securities Exchange Commission (CySEC)

- Internationally – First Prudential Markets LLC, an entity registered in St. Vincent and the Grenadines

Money Protection

Clearly, both brokerages ensure client funds are segregated and secured in reputable banks. Only Pepperstone provides Negative Balance Protection for retail clients under FCA, ASIC, and CySEC regulations. The Best Forex Brokers in Australia also use an automated margin call system to liquidate positions if equity falls below 50% of margin requirements, protecting against total investment loss.

We have an automated stop-out policy designed to minimise your losses and to take action before the market moves further against your open contracts – Pepperstone.

Pepperstone provides retail clients with risk management tools like Stop Loss orders to safeguard positions against market shifts. A strict money management approach is recommended. The FCA offers investor protection of up to GBP 85,000 through the FSCS.

| Pepperstone | FP Markets | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) BaFin (Germany) CYSEC (Cyprus) | ASIC (Australia) CYSEC (Cyprus) |

| Tier 2 Regulation | DFSA (Dubai) | |

| Tier 3 Regulation | SCB (Bahamas) CMA (Kenya) | FSA-S (Seychelles) FSC-M (Mauritius) FSCA (South Africa) |

Reviews

As shown below, Pepperstone has a Trustpilot rating of 4.4 out of 5 from over 3,000 reviews, with 81% of users giving it 5 stars. FP Markets, on the other hand, boasts an even higher rating of 4.9 out of 5, based on more than 8,800 reviews, with 94% of users awarding it 5 stars. While both brokers are well-regarded, FP Markets stands out for its near-perfect user satisfaction and consistently positive feedback. Pepperstone remains a top choice for active traders, but FP Markets earns broader acclaim for its service quality and reliability.

Our Stronger Trust and Regulation Verdict

Having reached this portion, our team can easily surmise that Pepperstone stands out in this category this is in light of their stronger trust and regulation. FYI: Pepperstone is licensed in many jurisdictions and is a global leader in retail FX, ensuring fund safety and a fair trading environment for clients.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

6. Most Popular Broker – Pepperstone

Pepperstone gets searched on Google more than FP Markets. On average, Pepperstone sees around 110,000 branded searches each month, while FP Markets gets about 49,500 — that’s 55% fewer.

| Country | Pepperstone | FP Markets |

|---|---|---|

| Australia | 8,100 | 1,900 |

| Brazil | 6,600 | 590 |

| United Kingdom | 5,400 | 2,400 |

| Thailand | 4,400 | 720 |

| United States | 4,400 | 1,600 |

| Malaysia | 4,400 | 720 |

| Kenya | 4,400 | 590 |

| Germany | 3,600 | 1,300 |

| Colombia | 3,600 | 260 |

| Mexico | 3,600 | 170 |

| Hong Kong | 3,600 | 170 |

| South Africa | 2,900 | 2,400 |

| India | 2,900 | 2,900 |

| Spain | 1,900 | 1,600 |

| Italy | 1,900 | 12,100 |

| Mongolia | 1,900 | 10 |

| Singapore | 1,600 | 590 |

| Indonesia | 1,600 | 590 |

| Peru | 1,600 | 70 |

| Turkey | 1,600 | 720 |

| Pakistan | 1,300 | 1,300 |

| Nigeria | 1,300 | 590 |

| Argentina | 1,300 | 140 |

| Bolivia | 1,300 | 30 |

| France | 1,000 | 880 |

| United Arab Emirates | 1,000 | 480 |

| Taiwan | 1,000 | 210 |

| Ecuador | 1,000 | 70 |

| Chile | 1,000 | 70 |

| Netherlands | 880 | 480 |

| Philippines | 880 | 390 |

| Dominican Republic | 880 | 70 |

| Vietnam | 720 | 320 |

| Morocco | 720 | 590 |

| Poland | 720 | 720 |

| Canada | 720 | 1,600 |

| Tanzania | 720 | 110 |

| Japan | 480 | 140 |

| Portugal | 480 | 210 |

| Cyprus | 480 | 480 |

| Costa Rica | 480 | 20 |

| Algeria | 390 | 210 |

| Bangladesh | 390 | 720 |

| Egypt | 390 | 210 |

| Sweden | 390 | 210 |

| Venezuela | 390 | 110 |

| Uganda | 390 | 70 |

| Ethiopia | 390 | 110 |

| Botswana | 390 | 50 |

| Sri Lanka | 320 | 140 |

| Switzerland | 320 | 480 |

| Austria | 320 | 170 |

| Panama | 320 | 20 |

| Cambodia | 320 | 210 |

| Saudi Arabia | 260 | 210 |

| Ireland | 260 | 90 |

| Ghana | 260 | 70 |

| Jordan | 260 | 70 |

| Greece | 210 | 1,900 |

| New Zealand | 170 | 40 |

| Uzbekistan | 140 | 70 |

| Mauritius | 110 | 20 |

8,100 1st | |

1,900 2nd | |

6,600 3rd | |

590 4th | |

5,400 5th | |

2,400 6th | |

4,400 7th | |

1,600 8th |

Similarweb shows a similar story when it comes to February 2024 website visits with Pepperstone receiving 1,273,000 visits vs. 482,000 for FP Markets.

Our Most Popular Broker Verdict

Pepperstone is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – Pepperstone

Top product range and extensive CFD markets is definitely a go-to for traders in the business of forex trading. This feature enables traders to diversify portfolios and profit from varying market conditions. Brokers with diverse financial instruments, like forex, commodities, and cryptocurrencies, enhance trading opportunities and experiences.

Both brokerages focus on Forex trading with true ECN/STP conditions. They offer 7 asset classes, but Pepperstone has a clear advantage with over 180 instruments compared to FP Markets’ 140.

| CFDs | Pepperstone | FP Markets |

|---|---|---|

| Forex Pairs | 94 | 63 |

| Indices | 27 | 19 |

| Commodities | 33 Commodities 7 Metals, 4 Energies, 9 Softs, 13 Hard | 4 Metals (vs USD, AUD, EUR) 4 Energies 5 Softs |

| Cryptocurrencies | 44 | 12 |

| Share CFDs | 1,200+ | 10000+ (with IRESS) 814 (with MT5) |

| ETFs | 95 | 46 |

| Bonds | No | 2 |

| Futures | 42 | No |

| Treasuries | 7 | 2 |

| Investments | No | No |

Forex Trading With Pepperstone And FP Markets

Pepperstone offers leveraged trading with 94 currency pairs, while FP Markets offers 61. Pepperstone supports forex trading on MetaTrader 4, MetaTrader 5, and cTrader across Standard and ECN accounts. FP Markets clients only use MT4 and MT5 for FX trading.

FX traders can speculate on the price movement of the following popular FX pairs:

- EUR/USD, GBP/USD, AUD/USD, USD/JPY, USD/CAD and USD/CHF with 0.0 pip spreads on Pepperstone’s Razor Account and FP Markets’ Raw Spread Account.

- Minors such as EUR/GBP with a minimum spread of 0.0 pips on Pepperstone’s Razor Account and 0.2 pips on FP Markets’ Raw Account

- Exotics such as USD/SGD with a minimum spread of 0.5 pips on Pepperstone’s Razor Account and 0.8 pips on FP Markets’ Raw Account

Cryptocurrency Trading

Pepperstone offers 44 cryptocurrencies for trading with up to 1:2 leverage in Australia and Europe with no commissions. However, retail accounts under FCA regulation cannot trade them. Both brokers offer Bitcoin, Bitcoin Cash, Litecoin, Ethereum, and Ripple, while Pepperstone also provides Dash, unavailable with FP Markets.

CFD Trading

CFDs are complex instruments that involve a high risk of losing capital rapidly as leverage is used. Both brokers offer a good range of CFDs covering several asset classes, including:

- Stocks – FP Markets offers two options – first, direct market access to over 10,000 Shares CFDs traded on 9 major exchanges through its Iress platform; second, access to 54 Shares CFDs through its MetaTrader 5 platform. FP Markets also offers access to real Stocks traded on the Australian Securities Exchange only. In comparison, Pepperstone offers CFDs on 64 US Shares, which can be traded with commissions as low as $0.02 per share on its MetaTrader 5 platform

- Stock Indices – CFDs on 14 major indices with Pepperstone vs CFDs on 12 stock indices with FP Markets

- Commodities – CFDs on 13 Energies and Soft Commodities, 7 Metal pairs with Pepperstone vs 5 Commodity CFDs contracts and 4 CFD contracts on Spot Metals with FP Markets

- Currency Index – CFDs on 3 currency indices (USDX, EURX and JPYX) with Pepperstone versus 1 tradable currency index with FP Markets

Our review has found that none of the two brokerages has ETFs or Bonds included in their CFD product list.

Our Top Product Range and CFD Markets Verdict

This time around, we can see that FP Markets finally dominates this category thanks to their top product range and CFD markets. FP Markets clients can access over 10,000 stocks and various trading instruments.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

8. Superior Educational Resources – Pepperstone

Superior educational resources is the key to the success of a trader in the business of forex trading. This feature offers traders extensive learning resources in forex trading, such as webinars, articles, videos, and courses. These materials equip traders to make informed decisions and improve their strategies, promoting continuous learning and long-term success.

Pepperstone:

Pepperstone provides extensive educational resources like webinars, seminars, and tutorials for both beginners and experienced traders, along with eBooks, articles, and market analysis support.

- Offers a comprehensive range of educational materials.

- Provides webinars, seminars, and tutorials for traders.

- Features a dedicated section for beginner traders.

- Includes advanced trading strategies for experienced traders.

- Has a rich library of eBooks and articles.

- Supports traders with market analysis and insights.

FP Markets:

FP Markets offers diverse educational resources, including webinars, workshops, and a novice section with advanced trading insights. It provides trading eBooks, daily market analysis, and multilingual webinars.

- Provides a diverse range of educational resources.

- Conducts regular webinars and workshops for traders.

- Has a section dedicated to novice traders.

- Offers insights into advanced trading techniques.

- Features a collection of trading eBooks and guides.

- Equips traders with daily market analysis.

- Webinars in multiple languages that cover all types of traders, on a regular basis.

Our Superior Educational Resources Verdict

Based on our team’s testing, we can easily say that Pepperstone outshines the challenger in this category by the reasone of superior educational resources.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

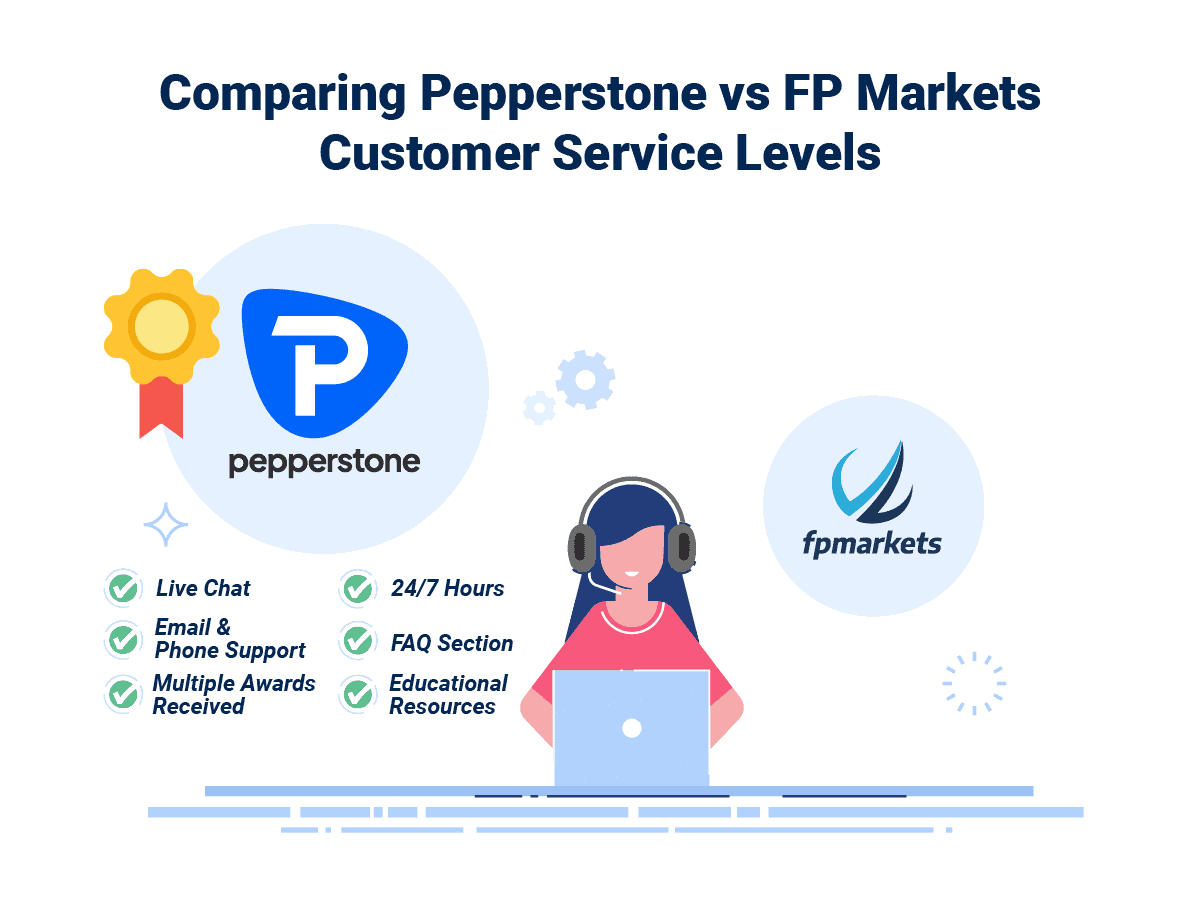

9. Superior Customer Service – Pepperstone

Superior customer service is another feature a broker can hand over to their clients in the business of forex trading. This feature is crucial for providing traders with timely support, ensuring a confident trading experience. It includes 24/7 live chat, phone, and email support in multiple languages, helping resolve issues quickly and enhancing satisfaction and trust in the broker.

Both forex brokers provide multilingual 24/5 customer support through live chat, email, and phone. Pepperstone ranked #1 for Forex Trading Support (Europe) and received awards for client relationship management. We were impressed by the quick and precise responses from their live chat regarding ECN pricing and Shares CFD commissions. Clients can also reach Pepperstone via +613 9020 0155 or Australia’s toll-free number 1300 033 375.

Additionally, Pepperstone has provided an online messaging form in the “Contact Us” section on its website.

| Feature | Pepperstone | FP Markets |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/7 |

| Multilingual Support | Yes | Yes |

Our Superior Customer Service Verdict

Evidently, Pepperstone excels in the category as a result of their superior customer service which outclasses the challenger as we put the education and analysis tools side by side.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

10. Better Funding Options – A Tie

Enhanced funding options provide traders with increased flexibility and convenience in their trading activities. These options include bank transfers, credit/debit cards, digital wallets like PayPal, Skrill, Neteller, and cryptocurrencies. Offering low- or no-fee methods allows traders to manage accounts and deposit/withdraw funds easily, enhancing their trading experience.

Based our dedicated team’s research and study, both Pepperstone and FP Markets allow traditional funding methods like debit or credit card by Visa or MasterCard and bank transfer. Other shared payment methods include the following electronic wallets:

- PayPal

- POLi

- BPay

- Skrill

- Neteller

Additionally, Pepperstone also supports Union Pay. In comparison, FP Markets clients can fund their trading account by using some extra funding options like:

- PayTrust (local bank transfer)

- Fasapay

- OnlinePay

- Klarna

- Broker to broker

- Nganluong.vn (Vietnamese clients)

- Directa24 (South America)

As for FP Markets withdrawal fees, depending on the funding method used, you can expect to pay up to 1.5%. With Pepperstone, you don’t have to worry about any type of withdrawal fees.

Pepperstone will not charge any deposit fees or withdrawal fees, regardless of the payment method chosen by clients. In comparison, FP Markets will not charge any deposit fees, but there will be a withdrawal fee associated with some of the funding options.

| Funding Option | Pepperstone | FP Markets |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | Yes |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Our Better Funding Options Verdict

In this section, we can surmise that both FP Markets and Pepperstone are tied due to their better funding options.

11. Lower Minimum Deposit – Pepperstone

Lower minimum deposit requirements are a fantastic enhancement for forex brokers, making the market more accessible to a broader spectrum of traders, including novices and individuals with limited capital. This feature allows traders to enter the market with a smaller investment, reducing financial barriers and promoting inclusivity. It encourages participation and offers a chance to gain experience without a large initial investment.

Pepperstone has a lower minimum deposit of $0, while FP Markets requires $100. Plus500’s minimum varies by currency, with EUR having a €100 minimum. Despite FP Markets’ higher minimum, it remains reasonable since Pepperstone suggests $200 to start trading.

| Minimum Deposit | Recommended Deposit | |

| Pepperstone | $0 | $200 |

| FP Markets | $100 | $100 |

Our Lower Minimum Deposit Verdict

Technically, Pepperstone claims the crown in this category this is in account of their lower minimum deposit that gives an added push to be considered as the better option here.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

So Is FP Markets or Pepperstone The Best Broker?

Pepperstone outperforms almost in all category in this review all because it offers better trading conditions in terms of lower average spreads, greater trust factors, trading platform range, and superior customer service.

The table below summarises the key information leading to this verdict:

| Categories | Pepperstone | FP Markets |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ❌ |

| Better Trading Platform | ✅ | ❌ |

| Superior Accounts And Features | ✅ | ❌ |

| Best Trading Experience And Ease | ✅ | ❌ |

| Stronger Trust And Regulation | ✅ | ❌ |

| Most Popular Broker | ✅ | ❌ |

| Top Product Range And CFD Markets | ❌ | ✅ |

| Superior Educational Resources | ✅ | ❌ |

| Superior Customer Service | ✅ | ❌ |

| Better Funding Options | ✅ | ✅ |

| Lower Minimum Deposit | ✅ | ❌ |

Pepperstone: Best For Beginner Traders

Pepperstone is better suited for beginner traders due to its comprehensive range of educational materials, user-friendly platforms, and dedicated customer support.

Pepperstone: Best For Experienced Traders

Pepperstone is the preferred choice for experienced traders, offering a wider range of tradable financial instruments and a proprietary trading platform, IRESS, exclusive for Australian traders.

FAQs Comparing Pepperstone Vs FP Markets

Does FP Markets or Pepperstone Have Lower Costs?

Pepperstone generally offers lower costs compared to FP Markets. On average, Pepperstone’s spreads start from 0.13 pips for the EUR/USD pair, while FP Markets offers spreads from 0.1 pips for the same pair. However, it’s essential to consider other fees and charges that may apply. For a more detailed comparison of low-cost brokers, you can check out our guide on the lowest spread forex brokers in the UK.

Which Broker Is Better For MetaTrader 4?

Both FP Markets and Pepperstone offer MetaTrader 4, but Pepperstone is renowned for its enhanced MT4 features and faster execution speeds. They have invested in infrastructure to ensure traders get the best out of the MT4 platform. For those keen on diving deeper into MT4 offerings, our comprehensive list of the best MT4 brokers can provide more insights.

Which Broker Offers Social Trading?

Pepperstone offers social trading features, allowing traders to copy strategies from experienced traders. FP Markets, on the other hand, doesn’t have a robust social trading platform. Social trading can be a game-changer, especially for new traders. If you’re interested in exploring more about this, our guide on the best social trading platforms is a great place to start.

Does Either Broker Offer Spread Betting?

Pepperstone offers spread betting, while FP Markets does not. Spread betting is a popular form of trading in the UK, allowing traders to bet on the direction of market movements without owning the underlying asset. For those interested in exploring the best platforms for spread betting, especially on MT4, our comprehensive guide on the best MT4 spread betting brokers in the UK is a great resource.

What Broker is Superior For Australian Forex Traders?

In my opinion, FP Markets stands out as the superior choice for Australian forex traders. Both FP Markets and Pepperstone are ASIC regulated, ensuring a high level of trust and security for traders. While Pepperstone is an excellent broker with global recognition, FP Markets was founded in Australia and has a deep understanding of the local market. For those keen on diving deeper into the offerings for Australian traders, our detailed list of the Best Forex Brokers In Australia provides more insights.

What Broker is Superior For UK Forex Traders?

For UK traders, I believe Pepperstone has the edge. Both brokers are FCA regulated, ensuring they adhere to the stringent regulations set by the UK’s financial authority. However, while FP Markets is an Australian-based broker, Pepperstone, although founded overseas, has made significant inroads in the UK market, offering tailored services for UK traders. If you’re a UK trader looking for a platform with a great mobile experience, our guide on the best forex trading apps in the UK can be a valuable resource.

Article Sources

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

What is the minimum withdrawal amount from FP Markets?

FP Markets do not a have any withdrawal amounts however 3rd part payment systems may have the own withdrawal minimums.