eToro vs IC Markets 2025

Both IC Markets and eToro offer spreads and fees that are superior from the other, as well as their features and platforms. But only eToro takes the lead in this review due to ease of use and trader experience.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors. Here are six noticeable differences between eToro and IC Markets:

- IC Markets offers tighter spreads, especially for major currency pairs like EUR/USD.

- IC Markets offers popular platforms like MetaTrader 4 and 5.

- IC Markets has a minimum deposit of $0.

- eToro’s minimum deposit varies by region, with some areas requiring up to $10,000.

- eToro’s primary platform focuses on social and copy trading.

- eToro provides a genuine Islamic trading account.

1. Lowest Spread And Fees – IC Markets

Maintaining a low cost spread and fees is important for a traders success in forex trading. Brokers with tight spreads and minimal fees appeal to traders, new or seasoned, by boosting their profitability and fostering active markets. IC Markets and eToro offer compelling features: IC Markets excel with their low spreads and swift execution, while eToro shines through its innovative social trading and their diverse instruments.

Spreads

Both eToro and IC Markets deliver competitive spreads for their major currency pairs. eToro has an average spreads for EUR/USD, GBP/USD and AUD/USD are 1.0, 2.0 and 1.0 pips, respectively, which is appealing to cost-conscious traders in the market. IC Markets excel with their tighter spreads on RAW accounts which offer a 0.02, 0.23, and 0.03 pips for the same pairs, which, clearly is outperforming the industry averages.

| Standard Account | eToro Spreads | IC Markets Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.5 | 1.09 | 1.7 |

| EUR/USD | 1 | 0.82 | 1.2 |

| USD/JPY | 1 | 0.94 | 1.5 |

| GBP/USD | 2 | 1.03 | 1.6 |

| AUD/USD | 1 | 0.83 | 1.6 |

| USD/CAD | 1.5 | 1.05 | 1.9 |

| EUR/GBP | 1.5 | 1.27 | 1.5 |

| EUR/JPY | 2 | 1.3 | 2.1 |

| AUD/JPY | 2 | 1.5 | 2.3 |

Commission Levels

In this segment, we see that eToro offers a commission-free forex trading model, which relies entirely on spreads to generate revenue, in which this benefits traders in the business seeking simplicity with no additional fees. On the other hand, ID Markets charges a $3.50 per lot per side on RAW Spread accounts, complementing its ultra-tight spreads, in which this appeals to traders in the market who prioritise cost-efficient, precise execution over fee simplicity.

Standard Account Fees

eToro requires a minimum deposit of $200 for the Australian clients and $50-$100 for EU clients, which offer fee-free funding methods and no inactivity charges. In the same way, IC Markets’ minimum deposit is $200, with no inactivity fees and diverse funding options, this makes both broker very accessible and more cost-effective for traders in the market who are into various budget needs.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.00 | 1.00 | 1.50 | 2.00 | 1.00 |

| 1.00 | 1.00 | 1.27 | 1.20 | 1.10 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 1.20 | 1.30 | 1.30 | 1.50 | 1.10 |

| 1.18 | 1.45 | 1.40 | 1.49 | 1.60 |

| 1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

| 1.40 | 1.90 | 1.30 | 1.60 | 1.50 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 12/01/2025

Finally, we can surmise that both IC Markets and eToro cater to different trading needs with their unique strengths. IC Markets excels in low spreads and fast execution, which is ideal for cost-conscious traders. Meanwhile, eToro’s commission-free model and social trading options suit traders who are lookin for simplicity and stratgegy replication. So in the end, choosing the right broker, most especially in these two, will depend on trader’s personal priorities.

Our Lowest Spreads and Fees Verdict

It is clear that IC Markets ranks highest in this category thanks to their lowest spreads and fees.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

2. Better Trading Platforms – A Tie

When choosing the right broker, one must look for excellence and superiority. In this review, having an excellent and superior forex trading platform will offer advanced charting tools, real-time data, and most of all swift execution that is paired with a secure, user-friendly interface for traders in the market. Both IC Markets and eToro excel in this segment as top brokers, which deliver tailored platforms, automated trading, and diverse instruments to enhance decision-making. Both brokers’ features elevate the trading experience for all trader profiles.

| Trading Platform | eToro | IC Markets |

|---|---|---|

| MetaTrader 4 | No | Yes |

| MetaTrader 5 | No | Yes |

| cTrader | No | Yes |

| TradingView | No | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

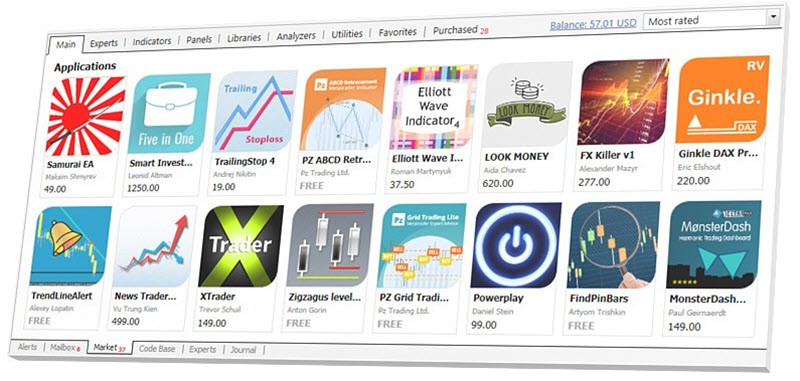

MetaTrader

Both IC Markets and eToro provide MetaTraders 4 and 5, this offers comprehensive features, as well as charting tools, and automated trading with Expert Advisors or EAs. These industry-standard platforms simplify transitions for traders switching brokers, as they require no new software learning. Also, both brokers ensure seamless trading experiences with these widely recognised and reliable platforms.

Advanced Platforms

We see that IC Markets offers MetaTrader platforms and the advanced cTrader, this is valued for its exceptional charting and functionalites for traders in the market, particularly in srrypto CFD trading. At the same time, eToro enhances user experience with their proprietary platform, which features social trading tools and market sentiment indicators. Clearly, both brokers cater to diverse traders, from beginners to seasoned.

Copy Trading

IC Markets joins in with ZuluTrade and Myfxbook just to provide a dynamic social trading options, this enables traders to replicate expert strategies with ease. At the same time, eToro also excel in copy trading through their proprietary platform, which allows traders to mirror top investor. Evidently, both brokers emphasise accessibility, which makes social trading ideal for beginners who are looking to enhance their trading experience.

Both IC Markets and eToro offer a powerful and strong trading platforms and superior tools that is tailored to trader’s diverse needs. IC Markets excel with cTrader and social trading collaborations,, while eToro provides an innovative proprietary platform with their social trading features. At the end, the choice of having which of these two will depend on traders’ individual priorities in regard to feature and platform such as charting tools, cryptocurrencies or strategy replication.

Trading Platform Comparison

MetaTrader 4

- eToro: No

- IC Markets: Yes

MetaTrader 5

- eToro: No

- IC Markets: Yes

cTrader

- eToro: No

- IC Markets: Yes

TradingView

- eToro: No

- IC Markets: Yes

Copy Trading

- eToro: Yes

- IC Markets: Yes

Proprietary Platform

- eToro: Yes

- IC Markets: Yes

Our Better Trading Platform Verdict

It’s neck to neck for both IC Markets and eToro this is in light to their better trading platform.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

3. Superior Accounts And Features – eToro

In this section, we will discuss both IC Markets and eToro’s accounts and features. Choosing the right broker for your trading journey is truly rewarding experience which is left to having the right broker that offer versatile feature and competitive pricing. Both eToro and IC Markets deliver on these essentials, which offer platforms with advanced tools, social trading and automation. Our dedicated team will one by one break down both brokers unique strengths and how these two cater for diverse trader preferences in the forex market.

| eToro | IC Markets | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | No | Yes |

| Swap Free Account | Yes | Yes |

| Active Traders | No | Yes |

| Spread Betting (UK) | No | No |

IC Markets excels with their MetaTrader platforms and the ever famous cTrader, which delivers a powerful charting tools and seamless support for automated trading. Additionaly, its partnership with ZuluTrade and Myfxbook enable a strong and powerful social trading platform. On the other hand, eToro’s proprietary platform redefines simplicity with its focus on a user-friendly interfaces and innovative copy-trading features, which empowers beginners and seasoned alike.

Trading Platform Comparison

MetaTrader 4

- eToro: No

- IC Markets: Yes

MetaTrader 5

- eToro: No

- IC Markets: Yes

cTrader

- eToro: No

- IC Markets: Yes

TradingView

- eToro: No

- IC Markets: Yes

Copy Trading

- eToro: Yes

- IC Markets: Yes

Proprietary Platform

- eToro: Yes

- IC Markets: Yes

Our in-depth research result says that both eToro and IC Markets stand out in their respective areas. IC Markets offers a powerful trading platforms and their ultra-tight spreads, which is perfect for the precision-focused trader. On the other hand, eToro’s accessible social trading and innovative design appeal to those seeking a seamless experience. So, still, in the end, a traders choice will always depend on their perspectives, syles, and their needs.

Our Superior Accounts and Features Verdict

eToro, clearly, takes the crown in this category due to their superior accounts and features.

4. Best Trading Experience – eToro

When taking the path to having a successful trading experience, this demands on having a platform that excels in technology, speed and user-friendly features. eToro and IC Markets shines in this category and they do in different ways. eToro has its social trading prowess and ease for beginners, while IC Markets hast its traditional platforms and advanced tools. Let’s dig deeper into the details.

We have here eToro which captivates new traders with its intuitive interface and copy trading, creating a social environment for newbie traders. IC Markets, on the other hand, dominates with their MetaTraders 4 and 5, this caters to seasoned traders who rely on technical tools and deep market analysis. This shows that each broker serves their unique trading styles expertly.

So for the final analysis, choosing the right platform lies on the traders’ style and tactics. And if a trader is all about community trading and looks for ease of use, eToro should be your match. But when we talk about tools with precision and with advanced technology, IC Markets is unbeatable. Our team surmises that when defining a traders’ goals and trade confidently, bog for the broker that aligns with your vision.

Our Best Trading Experience and Ease Verdict

We can easily surmise through the data given that eToro takes the lead in this segment this is due to their best trading experience and ease.

5. Stronger Trust And Regulation – A Tie

Trust and regulation are crucial for secure trading. A regulated broker ensures transparency and protects against fraud, boosting trader confidence. IC Markets and eToro are both under respected financial authorities, providing necessary security. A solid regulatory framework enhances client safety and broker reputation. Let’s compare the trust and oversight of IC Markets and eToro.

IC Markets Trust Score

eToro Trust Score

eToro confidently boasts a trust score of 72, outperforming IC Markets in this category, though both brokers excel. Each is firmly positioned in the top 10 for market share, whether measured by market capitalization or the number of active traders.

When it comes to popularity and user base, eToro takes the lead. Both IC Markets and eToro, founded in 2007, are considered veterans in the online forex and derivatives broker industry. Over the years, they’ve amassed large user bases and continuously grown. IC Markets received an impressive 3.3 million views on their main website in February 2022, making them one of the largest forex and CFD brokers worldwide. However, eToro is even more popular, with over 76 million visits during the same period, largely due to their significant presence in the UK.

Regulatory Comparison:

Tier 1 Regulation

- eToro: ASIC (Australia), CySEC (Cyprus), FCA (UK)

- IC Markets: ASIC (Australia), CySEC (Cyprus)

Tier 2 Regulation

- eToro: MFSA (Europe), ADGM (UAE), GFSC (Gibraltar)

- IC Markets: None

Tier 3 Regulation

- eToro: FSA-S (Seychelles)

- IC Markets: FSA-S (Seychelles), SCB (Bahamas)

| eToro | IC Markets | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) CYSEC (Cyprus) FCA (UK) | ASIC (Australia) CYSEC (Cyprus) |

| Tier 2 Regulation | MFSA (Europe) ADGM (UAE) GFSC (Gilbraltar) | |

| Tier 3 Regulation | FSA-S (Seychelles) | FSA-S (Seychelles) SCB (Bahamas) |

Both IC Markets and eToro are well-regulated, offering robust protections for traders. IC Markets is regulated by ASIC and CySEC, providing strong protection for traders in Australia and the EU. For international traders, IC Markets is also regulated by the FSA in Seychelles. eToro offers similar protections but goes a step further with FCA regulation in the UK, providing an extra layer of security for UK traders. Thus, UK traders may find eToro more appealing, while traders outside the UK will be safe with either broker. Staying updated with the latest forex trends and market news, including movements in EUR, AUD, USD, and GBP, will help traders make informed decisions on which platform to choose.

Reviews

IC Markets holds a significantly higher Trustpilot rating, with an impressive 4.8 out of 5 based on over 46,000 reviews, reflecting strong customer satisfaction, especially for fast trade execution and responsive support.

eToro, on the other hand, has a more moderate Trustpilot presence, with a score of around 4.2 out of 5, indicating decent user experience but with more mixed feedback regarding customer service and platform usability

Our Stronger Trust and Regulation Verdict

Again, it’s neck to neck for both IC Markets and eToro thanks to their stronger trust and regulations.

6. Most Popular Broker – eToro

eToro gets searched on Google more than IC Markets. On average, eToro sees around 823,000 branded searches each month, while IC Markets gets about 246,000 — that’s 70% fewer.

| Country | eToro | IC Markets |

|---|---|---|

| United Kingdom | 135,000 | 33,100 |

| Italy | 110,000 | 3,600 |

| France | 110,000 | 4,400 |

| Germany | 74,000 | 5,400 |

| Spain | 60,500 | 6,600 |

| United States | 33,100 | 6,600 |

| Australia | 27,100 | 6,600 |

| Netherlands | 18,100 | 2,400 |

| Colombia | 14,800 | 3,600 |

| United Arab Emirates | 14,800 | 4,400 |

| Mexico | 12,100 | 2,400 |

| Switzerland | 12,100 | 1,600 |

| Malaysia | 9,900 | 3,600 |

| India | 9,900 | 8,100 |

| Peru | 9,900 | 1,600 |

| Poland | 9,900 | 2,900 |

| Argentina | 8,100 | 1,300 |

| Taiwan | 8,100 | 1,000 |

| Philippines | 8,100 | 2,400 |

| Portugal | 8,100 | 1,000 |

| Austria | 8,100 | 720 |

| Ireland | 8,100 | 880 |

| Greece | 6,600 | 720 |

| Brazil | 5,400 | 4,400 |

| Chile | 5,400 | 720 |

| Sweden | 4,400 | 1,300 |

| Singapore | 3,600 | 3,600 |

| Canada | 3,600 | 2,400 |

| Morocco | 3,600 | 4,400 |

| Thailand | 2,900 | 8,100 |

| South Africa | 2,900 | 9,900 |

| Indonesia | 2,900 | 3,600 |

| Pakistan | 2,900 | 5,400 |

| Nigeria | 2,900 | 3,600 |

| Ecuador | 2,900 | 1,000 |

| Vietnam | 2,900 | 8,100 |

| Turkey | 2,400 | 1,300 |

| Bolivia | 2,400 | 260 |

| Dominican Republic | 1,900 | 1,000 |

| Cyprus | 1,900 | 880 |

| Costa Rica | 1,900 | 390 |

| New Zealand | 1,900 | 210 |

| Hong Kong | 1,600 | 2,400 |

| Japan | 1,600 | 1,300 |

| Egypt | 1,600 | 1,600 |

| Algeria | 1,300 | 2,400 |

| Venezuela | 1,300 | 720 |

| Saudi Arabia | 1,300 | 1,900 |

| Kenya | 1,000 | 2,400 |

| Bangladesh | 1,000 | 1,900 |

| Jordan | 1,000 | 590 |

| Cambodia | 880 | 170 |

| Ghana | 480 | 880 |

| Sri Lanka | 390 | 2,900 |

| Panama | 390 | 260 |

| Uganda | 260 | 720 |

| Ethiopia | 260 | 720 |

| Uzbekistan | 260 | 1,000 |

| Mauritius | 260 | 480 |

| Tanzania | 210 | 320 |

| Mongolia | 70 | 720 |

| Botswana | 70 | 260 |

135,000 1st | |

33,100 2nd | |

110,000 3rd | |

3,600 4th | |

74,000 5th | |

5,400 6th | |

27,100 7th | |

6,600 8th |

Similarweb shows a similar story when it comes to February 2024 website visits with eToro receiving 51,160,000 visits vs. 2,425,000 for IC Markets.

Our Most Popular Broker Verdict

eToro is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

7. CFD Product Range And Financial Markets – eToro

A diverse product range and extensive CFD markets allow traders to diversify and take advantage of varying market conditions. Brokers offering a wide selection—such as forex pairs, commodities, indices, and cryptocurrencies—enhance trading strategies and adaptability. Access to various instruments fosters a dynamic trading experience, helping traders confidently navigate market shifts. The right broker keeps choices open, making trading exciting and rewarding.

When it comes to forex trading, eToro and IC Markets stand out for their extensive product range and robust CFD markets. Traders confidently choose these platforms due to the impressive variety and depth of instruments available. Let’s delve into a detailed comparison of their offerings.

| CFDs | eToro | IC Markets |

|---|---|---|

| Forex Pairs | 55 | 61 |

| Indices | 20 | 25 |

| Commodities | 26 | 4 Metals (Gold vs 6 currencies) (Silver vs 3 currencies) 8 Softs 5 Energies |

| Cryptocurrencies | 114+ | 23 |

| Share CFDs | 1209 NYSE 884 NASDAQ 117 FrankFurt 285 LSE 42 Madrid 49 Zurich 26 Oslo 49 Stockholm 23 Copenhagen 20 Helsingki 135 Hong Kong 3 Lisbon 15 Brussels 1 Saudi Arabia 35 Amsterdam | 2100+ |

| ETFs | 300 | No |

| Bonds | No | 9 |

| Futures | No | Yes |

| Treasuries | No | 9 |

| Investments | Yes (US only) | Yes |

Comparison of CFDs Offered:

Forex Pairs

- eToro: 55

- IC Markets: 61

Indices

- eToro: 20

- IC Markets: 25

Commodities

- eToro: 26

- IC Markets: 4 Metals (Gold vs 6 currencies), Silver vs 3 currencies, 8 Softs, 5 Energies

Cryptocurrencies

- eToro: 114+

- IC Markets: 23

Share CFDs

- eToro: 1209 NYSE, 884 NASDAQ, 117 Frankfurt, 285 LSE, 42 Madrid, 49 Zurich, 26 Oslo, 49 Stockholm, 23 Copenhagen, 20 Helsinki, 135 Hong Kong, 3 Lisbon, 15 Brussels, 1 Saudi Arabia, 35 Amsterdam

- IC Markets: 2100+

ETFs - eToro: 300

- IC Markets: None

Bonds

- eToro: None

- IC Markets: 9

Futures

- eToro: None

- IC Markets: Yes

Treasuries

- eToro: None

- IC Markets: 9

Investments

- eToro: Yes (US only)

- IC Markets: Yes

Both eToro and IC Markets provide an impressive array of trading instruments tailored to meet diverse trading needs. eToro shines with its extensive selection of cryptocurrencies and share CFDs, making it an outstanding option for anyone eager to trade multiple assets. Meanwhile, IC Markets excels in forex pairs and offers unique instruments like bonds and treasuries, setting it apart in the market. The decision between the two platforms hinges on individual trading preferences and goals. By staying informed about the latest forex trends and market news, particularly regarding movements in EUR, AUD, USD, and GBP, traders can confidently determine which platform aligns best with their trading strategies.

Our Top Product Range and CFD Markets Verdict

Evidently, eToro brings home the gold in this segment due to their top product range and CFD markets.

8. Superior Educational Resources – IC Markets

Education is crucial for successful forex trading, with top brokers offering valuable resources like webinars, articles, and courses. These materials help both beginners and experienced traders enhance their skills and make informed decisions. Access to quality education fosters confidence and supports effective navigation of the forex market for long-term success.

eToro and IC Markets stand out as top choices for traders of all levels due to their exceptional educational resources. eToro excels with its regular webinars, extensive tutorials, and a diverse selection of e-books designed to elevate trading knowledge. It keeps users in the loop with the latest market news and analysis, guaranteeing traders have the information they need. The demo account offering virtual funds is an invaluable resource for newcomers to hone their skills without any financial risk. Moreover, eToro’s strong customer support guarantees that all educational inquiries are resolved swiftly and effectively.

eToro:

- Webinars: eToro offers regular webinars covering a range of topics for traders.

- Tutorials: Comprehensive tutorials are available for beginners to advanced traders.

- E-books: A variety of e-books are provided to enhance trading knowledge.

- News & Analysis: eToro keeps its users updated with the latest market news and analysis.

- Demo Account: A practice account with virtual money is available for new traders.

- Customer Support: eToro provides robust customer support to assist with educational queries.

IC Markets:

- Webinars: IC Markets conducts webinars to educate its users on various trading strategies.

- Tutorials: Detailed tutorials are available to guide traders at every level.

- E-books: IC Markets offers e-books that cover essential trading concepts.

- News & Analysis: Regular updates on market news and analysis are provided.

- Demo Account: Traders can practice with a demo account loaded with virtual funds.

- Customer Support: IC Markets ensures prompt customer support for all educational concerns.

IC Markets delivers an impressive range of educational resources that truly elevate the trading experience. Their webinars are expertly designed to impart knowledge on diverse trading strategies, catering to traders at every skill level. The detailed tutorials provide essential insights, while their e-books cover the foundational concepts critical for success. With regular updates on market news and analysis, traders are always informed and ready to make strategic decisions. Similar to eToro, IC Markets offers a demo account that allows traders to confidently practice with virtual funds. Their prompt and efficient customer support further ensures that all educational inquiries are addressed with the utmost professionalism.

Both eToro and IC Markets provide robust educational resources designed to empower traders. eToro distinguishes itself with its extensive collection of e-books and a dedicated emphasis on delivering the latest market news. Meanwhile, IC Markets shines in offering in-depth tutorials and webinars that effectively guide traders in implementing various strategies. Whichever platform you select, you’ll benefit from a wealth of educational tools that can significantly enhance your trading experience. Staying informed about the latest forex trends and market developments will also play a crucial role in making well-informed trading decisions.

Our Superior Educational Resources Verdict

Our dedicated team surmises that IC Markets come up trumps in this category by reason of their superior educational resources.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

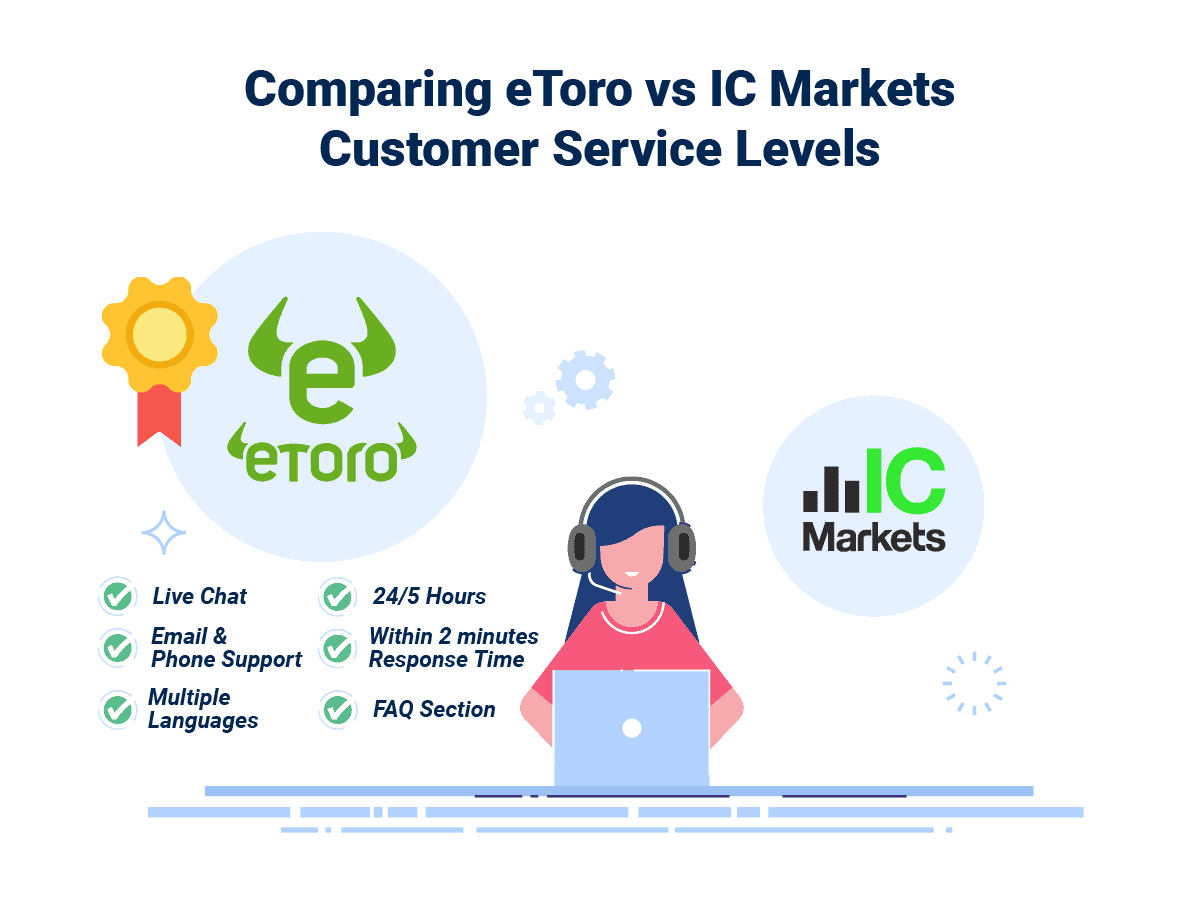

9. Better Customer Service – eToro

Great customer service is crucial in forex trading, aiding both beginners and experienced traders. Top brokers provide 24/7 support through various channels, ensuring quick responses and effective solutions. Strong customer support builds trust and satisfaction, making it essential when selecting a trading platform. In the fast-paced forex world, timely assistance can significantly impact trading outcomes.

In the realm of trading, exceptional customer service can significantly enhance a trader’s experience. Both eToro and IC Markets understand this imperative and have made significant investments in their customer support systems. Through our thorough analysis and comprehensive testing, we have identified key features that set these brokers apart in terms of customer service. While both provide strong support, there are nuanced differences that are worth exploring.

| Feature | eToro | IC Markets |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/5 | 24/7 |

| Multilingual Support | Yes | Yes |

Customer Support Features:

Live Chat Support

- eToro: Yes

- IC Markets: Yes

Email Support

- eToro: Yes

- IC Markets: Yes

Phone Support

- eToro: Yes

- IC Markets: Yes

Support Hours

- eToro: 24/5

- IC Markets: 24/7

Multilingual Support

- eToro: Yes

- IC Markets: Yes

Both eToro and IC Markets provide excellent customer support, but there are differences. eToro offers 24/5 live chat, ensuring traders from all time zones can get help whenever they need it. IC Markets, however, has a slightly faster response time and offers 24/7 support, making sure queries are addressed promptly at any time. Both brokers offer multilingual support, catering to a global audience. Ultimately, the choice between the two will depend on the trader’s specific needs and preferences. Staying updated with the latest forex trends and market news will further aid in making informed trading decisions.

Our Superior Customer Service Verdict

eToro, indisputably, dominates this segment this is due to their superior customer service.

10. More Funding Options – eToro

Flexible funding options greatly enhance forex trading. Traders benefit from fast, hassle-free deposits and withdrawals offered by top brokers through bank transfers, cards, digital wallets, and cryptocurrencies. Low or no transaction fees allow traders to concentrate on the markets rather than payment issues, leading to a smoother trading experience.

When it comes to funding methods, eToro offers more options for EU traders, including iDEAL and Trustly, making it a versatile choice. Both brokers provide the most popular funding methods, ensuring that traders can easily deposit and withdraw funds. Let’s look at the specific options offered by each broker.

| Funding Option | eToro | IC Markets |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | Yes |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | Yes | No |

| POLi / bPay | Yes | Yes |

| Klarna | Yes | No |

Funding Options:

– Credit Card:

- eToro: Yes

- IC Markets: Yes

– Debit Card:

- eToro: Yes

- IC Markets: Yes

– Bank Transfer:

- eToro: Yes

- IC Markets: Yes

– PayPal:

- eToro: Yes

- IC Markets: Yes

– Skrill:

- eToro: Yes

- IC Markets: Yes

– Neteller:

- eToro: Yes

- IC Markets: Yes

– Crypto:

- eToro: Yes

- IC Markets: Yes

– Rapid Pay:

- eToro: Yes

- IC Markets: No

– POLi / bPay:

- eToro: Yes

- IC Markets: Yes

– Klarna:

- eToro: Yes

- IC Markets: No

eToro undoubtedly offers a wider variety of funding methods, especially advantageous for EU traders with options like iDEAL and Trustly. On the other hand, IC Markets provides exclusive payment solutions tailored for Asian customers, including Vietnam and Thailand Internet Banking, FasaPay for Indonesia, and UnionPay for China. Both brokers excel in popular funding methods, guaranteeing convenience for traders globally. The decision between eToro and IC Markets will hinge on your specific funding preferences and geographical context. Staying attuned to the latest forex trends and market news is essential for traders to make well-informed decisions about their broker selection.

Our Better Funding Options Verdict

eToro, unquestionably, rides high in this segment thanks to their better funding options.

11. Lower Minimum Deposit – IC Markets

Forex trading can be accessible with low minimum deposits, allowing beginners to start small and gain experience while minimizing risk. This inclusivity encourages participation and strategic refinement without significant financial commitment, making it practical for gradual growth and manageable exposure

IC Markets has a $0 requirement for minimum deposits. Although opening an account does not necessitate a deposit, they suggest an initial deposit of $200 to meet margin requirements for leveraged trading. This approach provides flexibility for traders who prefer to start without an upfront cost while allowing for additional deposits to take advantage of leverage benefits.

| Minimum Deposit | Recommended Deposit | |

| eToro | $50 | $200 |

| IC Markets | $200 | $200 |

Minimum Deposits:

eToro:

- Minimum Deposit: $50 (set by region)

- Recommended Deposit: $200

IC Markets:

- Minimum Deposit: $0

- Recommended Deposit: $200

eToro and IC Markets provide various advantages based on a trader’s preferences and requirements. IC Markets offers a $0 minimum deposit, which may appeal to individuals looking to begin trading without an initial financial commitment, although a recommended deposit of $200 can assist in meeting trading margin requirements. Conversely, eToro has a minimum deposit of $50, which varies by region, making it accessible to new traders. Considering these aspects alongside your trading goals and strategies can aid in determining which platform suits your needs. Staying informed about current forex trends and market news can further support your decision-making.

Our Lower Minimum Deposit Verdict

Without any doubt, IC Markets, ranks highest in the category this is in light of their lower minimum deposit.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

So is IC Markets or eToro the Best Broker?

eToro dons the medal here because it consistently outperforms or matches IC Markets in several key areas, including trading experience, product range, and customer service. The table below summarises the key information leading to this verdict:

| Categories | eToro | IC Markets |

|---|---|---|

| Lowest Spreads And Fees | No | Yes |

| Better Trading Platform | Yes | Yes |

| Superior Accounts And Features | Yes | No |

| Best Trading Experience And Ease | Yes | No |

| Stronger Trust And Regulation | Yes | Yes |

| Top Product Range And CFD Markets | Yes | No |

| Superior Educational Resources | No | Yes |

| Superior Customer Service | Yes | No |

| Better Funding Options | Yes | No |

| Lower Minimum Deposit | No | Yes |

eToro: Best For Beginner Traders

eToro is the ideal choice for beginner traders due to its user-friendly interface and comprehensive educational resources.

IC Markets: Best For Experienced Traders

IC Markets stands out for experienced traders, especially those looking for tighter spreads and a robust trading platform.

FAQs Comparing eToro Vs IC Markets

Does IC Markets or eToro Have Lower Costs?

IC Markets generally offers lower costs compared to eToro. They are known for their tight spreads, especially on major currency pairs. For instance, the EUR/USD spread can be as low as 0.1 pips. This competitive pricing structure makes IC Markets a preferred choice for many traders. For a deeper dive into broker costs, you can explore Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both eToro and IC Markets support MetaTrader 4, but IC Markets is often favoured by traders specifically for its MT4 platform due to its advanced features and customizability. It offers a seamless trading experience with faster execution speeds. If you’re keen on understanding more about the top MT4 platforms, check out the definitive guide to the best MT4 brokers.

Which Broker Offers Social Trading?

eToro stands out for its pioneering social trading features. They introduced the concept of social trading, allowing traders to mirror the strategies of successful investors. This feature is especially beneficial for beginners who can gain insights from seasoned traders in real-time. For those keen on understanding the nuances of social and copy trading, here’s an in-depth analysis of the best copy trading platforms.

Does Either Broker Offer Spread Betting?

Neither eToro nor IC Markets offer spread betting as a primary service. Spread betting is a unique form of trading popular in the UK and some other regions, and not all brokers provide this service. If you’re keen on exploring brokers that specialise in spread betting, you might want to check out the top spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, IC Markets is the superior choice for Australian Forex traders. Founded in Sydney, IC Markets is ASIC-regulated, ensuring a high level of trust and security for Australian traders. Their deep liquidity and tight spreads make them a favourite among many. eToro, on the other hand, is an overseas-based broker that also operates in Australia. If you’re an Australian trader looking for more options, this comprehensive guide on the Best Forex Brokers In Australia might be of interest.

What Broker is Superior For UK Forex Traders?

Personally, I believe eToro has an edge for UK Forex traders. While both brokers operate in the UK, eToro is FCA-regulated, ensuring that UK traders have a secure trading environment. IC Markets, though offering a robust platform, is primarily based overseas. eToro’s platform, especially their mobile app, is user-friendly and offers a range of features tailored for UK traders. For those in the UK exploring platform options, this detailed review of the best forex trading apps might be helpful.

Article Sources

No commission account spread propiety testing data and published wesbite spread information, centralised on our Standard Account Spreads page.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Does IC Markets allow scalping?

Yes, IC Markets allows scalping. You will find most no dealing desk style brokers allow scalping.