IC Markets vs TMGM: Which One Is Best?

Reviewing the two brokers, IC Markets and TMGM, poses quite a challenge given their impressive features and platforms. However, one broker stands out, offering more than just mere features. Curious to discover which one it is? Continue reading to find out.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

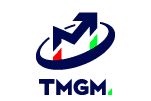

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors to help you make an informed decision between IC Markets and TMGM. Here are nine key differences:

- IC Markets offers lower spreads, ranging from 0.6 to 0.65 pips for EUR/USD.

- IC Markets is regulated by ASIC, CySEC, and FSA, providing broader regulatory coverage.

- IC Markets offers MetaTrader 4, MetaTrader 5, and cTrader platforms.

- IC Markets has a more extensive range of CFDs and forex pairs, offering 61 forex pairs and 18 cryptocurrencies.

- IC Markets has a higher TrustPilot score of 4.9/5 based on 24,000 reviews.

- TMGM lower spreads starts at 1.0 pips.

- TMGM is regulated by ASIC, FMA, and VFSC.

- TMGM offers MetaTrader and IRESS and soon MT5.

- TMGM has a score of 4.8/5 but with fewer reviews.

1. Lowest Spreads And Fees – IC Markets

Low spreads and fees in forex trading are essential, benefiting traders and brokers alike, especially scalpers. Competitive costs lead to increased market activity. This review compares IC Markets and TMGM on costs for optimal trade value. Let’s explore!

IC Markets and TMGM stand out as two leading forex brokers, celebrated for their competitive trading conditions and reliable platforms. Established in 2007, IC Markets has earned acclaim for its low spreads and exceptional liquidity, appealing to traders who prioritize tight pricing. On the other hand, TMGM, founded in 2013, has carved out a niche for itself by offering an extensive array of trading instruments and sophisticated trading tools. Both brokers boast regulation by top-tier authorities, providing their clients with a secure and trustworthy trading environment.

Spreads

| Standard Account | IC Markets Spreads | TMGM Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.09 | 1.20 | 1.7 |

| EUR/USD | 0.82 | 1.2 | 1.2 |

| USD/JPY | 0.94 | 1.4 | 1.5 |

| GBP/USD | 1.03 | 1.2 | 1.6 |

| AUD/USD | 0.83 | 1 | 1.6 |

| USD/CAD | 1.05 | 1.2 | 1.9 |

| EUR/GBP | 1.27 | 1.2 | 1.5 |

| EUR/JPY | 1.3 | 1.2 | 2.1 |

| AUD/JPY | 1.5 | 1.2 | 2.3 |

IC Markets boasts exceptionally competitive spreads, featuring an impressive EUR/USD spread of just 0.82, in stark contrast to TMGM’s 1.2 and well below the industry average of 1.2. For the AUD/USD pair, IC Markets offers a spread of 0.83, compared with TMGM’s 1.0, while the industry standard stands at 1.6. Overall, IC Markets achieves an average spread of 1.09, significantly lower than TMGM’s average of 1.20, both of which are under the industry average of 1.7.

Commission Levels

| USD | AUD | GBP | EUR | |

|---|---|---|---|---|

| IC Markets | $3.50 | $4.50 | £2.50 | €2.75 |

| TMGM | $3.50 | $3.50 | N/A | N/A |

Our incredible team has urgently developed this fee calculator, exclusive to our traders. Don’t forget to check it out right away. In most cases, it could be extremely helpful for traders. Don’t miss out!

IC Markets and TMGM both impose a commission fee of $3.50 per lot. Nonetheless, TMGM has a lower minimum deposit requirement of $100, while IC Markets requires a deposit of $200. In terms of recommended deposits, TMGM suggests $500, whereas IC Markets advises a minimum of $200. Both brokers also offer no funding fees and provide SWAP-free accounts.

Standard Account Fees

IC Markets offers more competitive standard account fees, charging only 0.62 for EUR/USD and 0.77 for AUD/USD. In contrast, TMGM’s standard account fees are higher, at 1.00 for EUR/USD and 1.11 for AUD/USD.

While both IC Markets and TMGM present attractive trading conditions, IC Markets distinguishes itself with its significantly lower spreads and superior liquidity. Conversely, TMGM appeals with a more accessible minimum deposit and a wider selection of trading instruments. Ultimately, traders should evaluate their specific trading requirements and preferences when selecting between these two brokers.

When you trade, two major brokerage costs you will pay are the spread cost and commission fees. Other fees you may come across include funding costs, currency conversion fees, and swap fees.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.00 | 1.00 | 1.27 | 1.20 | 1.10 |

| 1.00 | 1.11 | N/A | 1.32 | 1.09 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 1.20 | 1.30 | 1.30 | 1.50 | 1.10 |

| 1.18 | 1.45 | 1.40 | 1.49 | 1.60 |

| 1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

| 1.40 | 1.90 | 1.30 | 1.60 | 1.50 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 12/01/2025

Our Lowest Spreads and Fees Verdict

Our dedicated team of experts surmises that IC Markets come up trumps on the account of their lowest spreads and fees.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

2. Better Trading Platform – IC Markets

A top forex trading platform is essential for success, offering advanced tools, real-time data, quick execution, and user-friendly features. It enhances traders’ decision-making and efficiency. This review compares IC Markets and TMGM to assess their platforms in the competitive forex landscape.

IC Markets and TMGM are two prominent forex brokers that stand out for their competitive trading conditions and sophisticated trading platforms. Established in 2007, IC Markets has gained a reputation for its low spreads and high liquidity, attracting traders who value tight pricing. Meanwhile, TMGM, founded in 2013, has earned acclaim for its diverse array of trading instruments and intuitive platforms. Both brokers are regulated by top-tier authorities, guaranteeing a secure and reliable trading environment for their clients.

| Trading Platform | IC Markets | TMGM |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | No |

| TradingView | Yes | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

We have developed an effective software questionnaire to determine the platform that perfectly aligns with your trading style. By answering just six straightforward questions, we can confidently recommend the best trading software tailored to your specific needs.

MetaTrader

IC Markets and TMGM both offer access to the popular trading platforms MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are commonly used in the forex market. IC Markets includes 20 additional widgets in its MT4 offering, which could improve trading efficiency. In contrast, while TMGM offers both MT4 and MT5, it falls short of providing the same level of additional tools and customization features available through IC Markets.

Advanced Platforms

IC Markets distinguishes itself as a premier advanced trading platform with its cTrader offering, featuring Level II pricing and one-click trading capabilities. TMGM does not offer cTrader or TradingView as part of its platform options. Additionally, IC Markets supports myfxbook for automated trading, while TMGM provides Zulutrade for social trading.

Copy Trading

IC Markets offers powerful copy trading solutions via platforms such as cTrader Copy, ZuluTrade, and IC Social. These platforms empower traders to mirror the trades of seasoned investors, making them highly appealing to both beginners and experienced traders alike. Similarly, TMGM provides social trading and copy trading services, enabling users to track and adopt the strategies of more skilled traders.

IC Markets and TMGM both offer three platforms for you to choose between when trading, overlapping on MetaTrader.

Both IC Markets and TMGM present compelling trading conditions and a variety of trading platforms. IC Markets stands out with its sophisticated platform options, such as cTrader, and enhanced tools for MetaTrader 4. On the other hand, TMGM offers a robust selection of trading instruments and user-friendly interfaces, although it falls short in some of the advanced features that IC Markets provides. Ultimately, traders should carefully evaluate their specific trading requirements and preferences when selecting between these two brokers.

Our Better Trading Platform Verdict

IC Markets is riding high in this niche on account of their better trading platform.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

3. Superior Accounts And Features – IC Markets

The right account features are crucial in forex trading. IC Markets and TMGM provide various options for different styles, including tight spreads, low commissions, and advanced tools. They offer demo accounts, swap-free options, and a variety of instruments. Additionally, features like social and automated trading, along with strong support, enhance the trading experience. This review will explore what sets these brokers apart and their benefits for traders.

If you’re looking for a broker that provides a diverse range of account types and features, IC Markets is undoubtedly one of the best options available. They offer three primary account types:

- Standard.

- Raw Spread.

- cTrader Raw.

These platforms are expertly designed to cater to various trading styles and strategies. The Raw Spread account stands out with spreads starting from 0.0 pips, making it the ultimate choice for traders who prioritize tight pricing. Additionally, the cTrader Raw account is specifically crafted for scalpers and day traders, equipping them with advanced trading tools and features.

TMGM presents two primary account options:

- Edge.

- Classic.

The Edge account boasts more competitive spreads, albeit with a commission fee, while the Classic account eliminates commissions but has slightly wider spreads. Additionally, TMGM provides several features, including Islamic accounts and leverage of up to 400:1. Nevertheless, their range of account types is less varied than that of IC Markets, and they do not offer as many advanced trading features.

IC Markets and TMGM each possess unique strengths that cater to different trading styles. IC Markets excels with its diverse account types and advanced features, making it an ideal option for traders seeking flexibility and minimal spreads. On the other hand, while TMGM provides competitive spreads and a solid array of features, it may lack the same level of account variety. Ultimately, the decision between these two brokers hinges on your specific trading requirements and personal preferences.

| IC Markets | TMGM | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | Yes |

| Active Traders | Yes | Yes |

| Spread Betting (UK) | No | No |

Our Superior Accounts and Features Verdict

IC Markets, undeniably, takes the cake in this field due to their superior accounts and features

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – IC Markets

IC Markets and TMGM offer essential tools for forex trading, featuring advanced platforms, fast execution, and competitive spreads. They provide a user-friendly interface, educational resources, and robust trading tools for informed decision-making. Strong customer support fosters smooth account management, benefiting both beginners and experienced traders. Let’s explore how these brokers compare!

For anyone seeking a seamless trading experience, IC Markets stands out as the top choice. Their platforms, especially cTrader, deliver exceptional depth-of-market and lightning-fast execution speeds—essential for any scalper. Additionally, their partnerships with Myfxbook and ZuluTrade enhance social trading opportunities. With MetaTrader 4’s Advanced Trading Tools, featuring 20 different widgets, IC Markets takes your trading experience to the next level.

TMGM stands out as a formidable player in the market, boasting impressive tools like TradingCentral and HUBx. TradingCentral excels in offering comprehensive research, while HUBx effectively links fund managers with clients, creating a solid platform for those eager to diversify their trading strategies. Nonetheless, when comparing the two, IC Markets takes the lead with its wider array of tools, delivering a more enriched trading experience.

Both IC Markets and TMGM provide outstanding trading platforms and instruments. IC Markets excels with its sophisticated features and strategic partnerships, making it the perfect choice for traders looking for a streamlined and effective trading experience. On the other hand, while TMGM offers robust research tools, it may not provide the same extensive trading options as IC Markets. Ultimately, your decision between these two brokers will hinge on your unique trading requirements and preferences.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| IC Markets | 134ms | 16/36 | 153ms | 22/36 |

| TMGM | 94ms | 11/36 | 129ms | 13/36 |

Our Best Trading Experience and Ease Verdict

Clearly, we can see that IC Markets outshines the challenger in this niche owing it to their best trading experience.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – IC Markets

Flexible funding options are important for traders. As of February 20, 2025, IC Markets provides over 15 methods in 10 currencies without extra transaction fees. For TMGM, consult their website for details.

The EUR/USD pair approaches January’s resistance high of 1.0533, while the AUD/USD is under pressure from interest cuts and ties to China.

A variety of low-fee funding methods enhance account management and trading experiences.

IC Markets Trust Score

TMGM Trust Score

In the realm of trust and regulatory oversight, both IC Markets and TMGM showcase impressive credentials. IC Markets operates under the regulation of several authorities, including the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC). On the other hand, TMGM is licensed by ASIC and the Financial Markets Authority (FMA) in New Zealand, boasting a Trust Score of 83 out of 99 according to ForexBrokers.com, which marks it as “Trusted.”

Although specific trust scores for IC Markets are not easily accessible, its status as a multi-regulated entity indicates a robust compliance framework. It is essential to acknowledge, however, that IC Markets is currently entangled in legal disputes, including a class-action lawsuit and a Fair Work issue, which could influence perceptions of its trustworthiness and reliability. In light of these considerations, while both brokers exhibit strong regulatory oversight, traders should be diligent in their research to make informed decisions.

- IC Markets is regulated by ASIC (Australia), CySEC (Cyprus), and the FSA (Seychelles).

- TMGM is regulated by VFSC (Vanuatu) and ASIC (Australia).

- IC Markets has been in the industry since 2007, adding to its credibility.

- TMGM is relatively newer, founded in 2013, but has quickly gained a good reputation.

TMGM is also a trustworthy broker with ASIC regulation, but they lack the multiple regulatory bodies that IC Markets has. This gives IC Markets an added layer of security and trustworthiness that’s hard to beat.

| IC Markets | TMGM | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) CYSEC (Cyprus) | ASIC (Australia) FMA (New Zealand) |

| Tier 2 Regulation | ||

| Tier 3 Regulation | FSA-S (Seychelles) SCB (Bahamas) | VFSC FSC-M (Mauritius) |

Reviews

IC Markets is rated 4.8 out of 5 from over 46,000 reviews, with users frequently praising its fast execution, low spreads, and responsive support. TMGM, by comparison, has a score of 4.3 out of 5 based on around 900 reviews. IC Markets stands out for its scale and reliability, while TMGM offers a solid experience but with more varied feedback.

Our Stronger Trust and Regulation Verdict

IC Markets is definitely riding high in this category due to the stronger trust and regulation.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

6. Most Popular Broker – IC Markets

IC Markets gets searched on Google more than TMGM. On average, IC Markets sees around 246,000 branded searches each month, while TMGM gets about 18,100 — that’s 92% fewer.

| Country | IC Markets | TMGM |

|---|---|---|

| Australia | 33,100 | 720 |

| Brazil | 9,900 | 40 |

| United Kingdom | 8,100 | 1,600 |

| Thailand | 8,100 | 260 |

| United States | 8,100 | 1,600 |

| Malaysia | 6,600 | 1,900 |

| Kenya | 6,600 | 880 |

| Germany | 6,600 | 110 |

| Colombia | 5,400 | 140 |

| Hong Kong | 5,400 | 170 |

| Mexico | 4,400 | 70 |

| South Africa | 4,400 | 210 |

| India | 4,400 | 90 |

| Spain | 4,400 | 40 |

| Italy | 3,600 | 2,400 |

| Mongolia | 3,600 | 30 |

| Singapore | 3,600 | 90 |

| Indonesia | 3,600 | 590 |

| Peru | 3,600 | 320 |

| Turkey | 3,600 | 70 |

| Pakistan | 2,900 | 50 |

| Nigeria | 2,900 | 10 |

| Argentina | 2,400 | 20 |

| Bolivia | 2,400 | 1,000 |

| France | 2,400 | 30 |

| United Arab Emirates | 2,400 | 170 |

| Taiwan | 2,400 | 90 |

| Ecuador | 2,400 | 590 |

| Chile | 2,400 | 10 |

| Netherlands | 1,900 | 20 |

| Philippines | 1,900 | 20 |

| Dominican Republic | 1,600 | 10 |

| Vietnam | 1,600 | 20 |

| Morocco | 1,600 | 20 |

| Poland | 1,300 | 90 |

| Canada | 1,300 | 20 |

| Tanzania | 1,300 | 260 |

| Japan | 1,300 | 20 |

| Portugal | 1,000 | 2,400 |

| Cyprus | 1,000 | 10 |

| Costa Rica | 1,000 | 70 |

| Algeria | 1,000 | 10 |

| Bangladesh | 1,000 | 10 |

| Egypt | 880 | 70 |

| Sweden | 880 | 10 |

| Venezuela | 880 | 10 |

| Uganda | 720 | 10 |

| Ethiopia | 720 | 20 |

| Botswana | 720 | 10 |

| Sri Lanka | 720 | 10 |

| Switzerland | 720 | 10 |

| Austria | 720 | 10 |

| Panama | 720 | 20 |

| Cambodia | 590 | 10 |

| Saudi Arabia | 480 | 50 |

| Ireland | 390 | 10 |

| Ghana | 320 | 10 |

| Jordan | 260 | 10 |

| Greece | 260 | 10 |

| New Zealand | 260 | 10 |

| Uzbekistan | 210 | 110 |

| Mauritius | 170 | 70 |

33,100 1st | |

720 2nd | |

8,100 3rd | |

1,600 4th | |

6,600 5th | |

1,900 6th | |

5,400 7th | |

140 8th |

Similarweb shows a similar story when it comes to February 2024 website visits with IC Markets receiving 2,425,000 visits vs. 100,000 for TMGM.

Our Most Popular Broker Verdict

IC Markets is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – IC Markets

Access to diverse products is crucial in forex trading. IC Markets and TMGM provide extensive CFD markets, enabling trader portfolio diversification and profit opportunities through forex pairs, commodities, indices, and cryptocurrencies. A wide selection of instruments keeps trading dynamic and adaptable to various strategies, enhancing the trading experience for both short-term and long-term traders.

| CFDs | IC Markets | TMGM |

|---|---|---|

| Forex Pairs | 61 | 61 |

| Indices | 25 | 12 |

| Commodities | 4 Metals (Gold vs 6 currencies) (Silver vs 3 currencies) 8 Softs 5 Energies | 3 Metals 2 Energies |

| Cryptocurrencies | 23 | 12 |

| Share CFDs | 2100+ | 12000+ |

| ETFs | No | No |

| Bonds | 9 | No |

| Futures | Yes | No |

| Treasuries | 9 | No |

| Investments | Yes | No |

Product Range and CFD Markets

When evaluating IC Markets and TMGM, both brokers present an extensive selection of products and CFD markets. IC Markets features 61 forex pairs, matching TMGM’s offering, yet it distinguishes itself with 25 indices, significantly surpassing TMGM’s 12 indices.

Commodities

IC Markets stands out in the commodities sector with an extensive lineup that includes 4 metals (Gold paired with 6 currencies and Silver with 3 currencies), 8 soft commodities, and 5 energy products. In contrast, TMGM offers a more limited selection with just 3 metals and 2 energy products. This extensive variety available at IC Markets provides traders with a broader spectrum of choices when it comes to commodities.

Cryptocurrencies and Shared CFDs

IC Markets provides an impressive selection of 23 cryptocurrencies for trading, while TMGM offers 12. In the realm of shared CFDs, IC Markets features over 2,100 options, whereas TMGM stands out with more than 12,000 available shared CFDs.

Both IC Markets and TMGM present a wide array of products and CFD markets. However, IC Markets has a slight advantage in commodities and cryptocurrencies, while TMGM leads in shared CFDs. Traders should carefully evaluate their individual trading requirements and preferences when deciding between these two platforms.

Our Top Product Range and CFD Markets Verdict

IC Markets outshines the other because of their top product range and CFD markets.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

8. Superior Educational Resources – IC Markets

Education is crucial in forex trading, with IC Markets and TMGM providing extensive learning resources like webinars, articles, and courses. These help traders improve skills and strategies, fostering confidence in the market. Access to quality education benefits both beginners and experienced traders, promoting long-term success and a knowledgeable trading community.

| Feature | IC Markets | TMGM |

|---|---|---|

| Webinars | Yes | Yes |

| eBooks | Yes | No |

| Tutorials | Yes | Yes |

| Beginner Courses | No | Yes |

| Advanced Guides | Yes | Yes |

| One-on-One Training | No | Yes |

Superior Educational Resources

IC Markets and TMGM both excel in delivering a diverse array of educational resources that empower traders to enhance their skills and knowledge. IC Markets boasts an extensive suite of educational offerings, including webinars, e-books, tutorials, and in-depth guides designed for traders at every level, ensuring a comprehensive learning experience.

Conversely, TMGM also provides a strong selection of educational tools, featuring webinars, tutorials, introductory courses, advanced guides, and personalized one-on-one training sessions. These resources equip traders with the essential knowledge and skills needed to navigate the forex market with confidence. The individualized training sessions are especially valuable for those seeking tailored guidance and support.

Ultimately, both IC Markets and TMGM are committed to offering outstanding educational resources to their clients. While IC Markets presents a broad range of materials suitable for all traders, TMGM enhances its offerings with personalized training options. Traders should carefully evaluate their personal learning preferences and requirements when deciding between these two brokers.

Our Superior Educational Resources Verdict

Based on our in-depth research, IC Markets excels great in this niche due to their superior educational resources.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

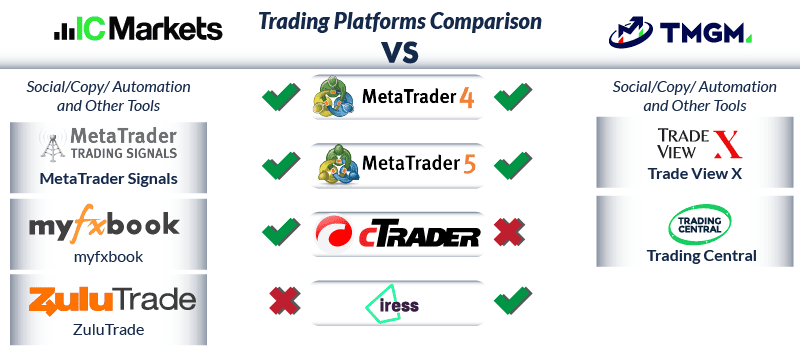

9. Superior Customer Service – IC Markets

Great customer support is vital in forex trading, and IC Markets and TMGM excel in this area. Their 24/7 support via live chat, phone, and email allows for timely assistance, while multilingual support facilitates global communication. Quick issue resolution boosts trader confidence and enhances the overall experience. A broker focused on excellent customer service fosters trust and long-term relationships. This review will explore how IC Markets and TMGM support their traders.

| Feature | IC Markets | TMGM |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/7 |

| Multilingual Support | Yes | Yes |

Customer Service Excellence

In the realm of customer service, both IC Markets and TMGM stand out with impressive accolades. IC Markets shines with a commendable rating of 8.20, while TMGM follows closely with a solid score of 8.0. Both brokers provide outstanding support across various channels, guaranteeing that traders receive prompt and effective assistance whenever needed.

LiveChat and Support

IC Markets and TMGM offer exceptional LiveChat support, with IC Markets utilizing a blend of human agents and automated bots, while TMGM emphasizes exclusively on human interactions. Both brokers boast impressive customer service expertise, with IC Markets receiving an excellent rating and TMGM also earning high praise. Their well-respected FAQ sections, knowledge bases, and help centers equip traders with extensive resources to address their inquiries effectively.

Support Hours and Availability

IC Markets and TMGM both provide exceptional customer support, with IC Markets offering 24/7 assistance and TMGM available 24/6. Both brokers engage actively on social media, allowing traders to access help across various platforms. Their dedication to customer service is reflected in their impressive ratings and positive feedback from users.

IC Markets and TMGM stand out in the realm of customer service by providing extensive support across multiple channels and consistently high ratings. Traders can anticipate reliable and knowledgeable assistance from both brokers, solidifying their positions as leading contenders in the forex trading industry.

Our Superior Customer Service Verdict

Unmistakably, IC Markets comes out on top in this field of expertise thanks to their superior customer service.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

10. Better Funding Options – IC Markets

In the forex trading environment, having flexible and convenient funding options is important for managing accounts effectively. IC Markets and TMGM both offer various deposit and withdrawal methods to accommodate their clients’ needs.

IC Markets provides several funding options, including bank transfers, credit/debit cards, and digital wallets such as PayPal, Skrill, and Neteller. Additionally, IC Markets does not charge extra fees for deposits or withdrawals, although traders may incur charges from intermediary banks for international transactions.

TMGM also offers various funding methods, including bank wire transfers, credit/debit cards, and multiple e-wallet options. This broker also does not impose any fees for deposits and withdrawals, though banks involved may have their own charges.

| Funding Option | IC Markets | TMGM |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | No |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Having access to multiple funding options with minimal fees can help traders manage their accounts more efficiently and facilitate a smoother trading experience.

Looking at recent forex market trends, the AUD/USD pair has shown notable movements. As of February 20, 2025, the Australian dollar has increased by over 4.7% from its yearly low, supported by a two-week rally reaching new highs for 2025. This trend suggests a bullish outlook, providing opportunities for traders interested in the AUD/USD pair.

On the other hand, the EUR/USD pair has been trading around the 1.0500 level, affected by a general rebound in the US dollar as traders adopt a cautious approach. This suggests a more bearish perspective for the euro against the US dollar, highlighting the importance of being informed about market developments when trading this pair.

Staying current on these currency trends is important for traders looking to leverage market movements and make informed trading decisions.

Our Better Funding Options Verdict

Our team has decided that IC Markets takes home the crown in this section due to their better funding option.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

11. Lower Minimum Deposit – TMGM

In the forex trading sector, lower minimum deposits provide access for more traders, particularly beginners or those with limited capital. By decreasing financial barriers, brokers facilitate entry into trading with lower upfront costs.

IC Markets requires a minimum deposit of $200 to start trading, which is viewed as a reasonable amount for accessing various financial instruments.

Conversely, TMGM offers a lower entry point with a minimum deposit of $100, allowing a wider range of traders to engage in the market.

TMGM has a lower minimum deposit of $100 vs $200 by IC Markets. Both brokers don’t charge fees for deposits and withdrawals, so either broker is a good option.

| Minimum Deposit | Recommended Deposit | |

| IC Markets | $200 | $200 |

| TMGM | $100 | $500 |

In terms of recent forex market trends, the AUD/USD pair has shown significant movements. As of February 20, 2025, the Australian dollar has increased by over 4.7% from its yearly low, with a two-week rally reaching new highs for 2025. This trend suggests potential opportunities for traders interested in the AUD/USD currency pair.

Meanwhile, the EUR/USD pair has been trading close to the 1.0500 level, affected by a US dollar rebound as traders remain cautious. This points to a more bearish perspective for the euro against the US dollar, underscoring the need for traders to stay updated on market developments when dealing with this pair.

Remaining informed about these currency trends is essential for traders looking to make informed trading decisions and capitalize on market movements.

Our Lower Minimum Deposit Verdict

Finally, we have come to decide that TMGM outperforms the contender in this category this is due to their lower minimum deposit.

So Is TMGM Or IC Markets The Best Broker?

IC Markets displays notable strengths across various categories compared to TMGM, including competitive fees, more advanced trading platforms, and effective customer service. The table below provides a summary of the key information supporting this assessment.

| Categories | IC Markets | TMGM |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platform | Yes | No |

| Superior Accounts And Features | Yes | No |

| Best Trading Experience And Ease | Yes | No |

| Stronger Trust And Regulation | Yes | No |

| Top Product Range And CFD Markets | Yes | No |

| Superior Educational Resources | Yes | No |

| Superior Customer Service | Yes | No |

| Better Funding Options | Yes | No |

| Lower Minimum Deposit | No | Yes |

IC Markets: Best For Beginner Traders

IC Markets is the better choice for beginner traders due to its comprehensive educational resources and user-friendly platforms.

IC Markets: Best For Experienced Traders

IC Markets also stands out for experienced traders, offering advanced tools and a wide range of markets.

FAQs Comparing IC Markets vs TMGM

Does TMGM or IC Markets Have Lower Costs?

IC Markets has lower costs. They offer spreads as low as 0.1 pips for EUR/USD. For more information on low-cost brokers, check out our guide on Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

IC Markets is better for MetaTrader 4 users. They offer advanced tools and faster execution speeds. For more details, visit our Best MT4 Brokers.

Which Broker Offers Social Trading?

IC Markets stands out in social trading, thanks to their partnerships with Myfxbook and ZuluTrade. If you’re keen to explore more, don’t miss our comprehensive guide on the best social trading platforms.

Does Either Broker Offer Spread Betting?

Sadly, neither IC Markets nor TMGM provides spread betting services. If this is a feature you’re after, you might want to check out our list of top spread betting brokers.

What Broker is Superior For Australian Forex Traders?

In my view, IC Markets is the top choice for Australian Forex traders. They’re not only ASIC-regulated but also founded in Australia, adding an extra layer of trust. For more insights, visit Best Forex Brokers In Australia page.

What Broker is Superior For UK Forex Traders?

For those in the UK, IC Markets is your best bet. They’re FCA-regulated and offer a broad range of markets, making them a reliable choice. For additional information, check out our guide on the best forex brokers in UK.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

What are the disadvantages of IC Markets?

While IC Markets is a good broker overall, like all brokers, there are some disadvantages. For starters, IC Markets is not regulated in the UK by the FCA, meaning traders based in the UK. We also find their live chat to be slow as far as customer support responsiveness goes.