IC Markets vs XTB 2025

The comparison between IC Markets and XTB presents a captivating challenge, as both brokers offer competitive platforms and features. However, only one can emerge victorious! Join us as we conduct an in-depth review to determine the ultimate winner in this forex trading showdown.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Allowed but not supported

Overall

Our full comparison covers the 10 most important trading factors between IC Markets and XTB. Here are ten noticeable differences:

- IC Markets offers an average raw spread of 0.02 for EUR/USD.

- IC Markets has an average raw spread of 0.23 for GBP/USD.

- IC Markets charges a commission (USD Base) of $3.50.

- IC Markets provides access to MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader platforms.

- IC Markets is regulated by ASIC (Australia), FCA (UK), and others.

- XTB offers an average raw spread of 0.9.

- XTB is regulated by FCA (UK), CYSEC (Cyprus).

- XTB offers xStation and MT4.

- XTB doesn’t specify a commission.

- XTB has an average raw spread of 0.14.

1. Lowest Spreads And Fees – IC Markets

In forex trading, minimizing costs is essential, particularly for high-frequency traders. Low spreads decrease transaction costs, while competitive fees draw in more clients, thereby enhancing trading volumes and benefiting brokers.

IC Markets and XTB stand out as leading forex brokers, renowned for their attractive trading conditions and diverse selection of financial instruments. Established in 2007, IC Markets is an Australian broker celebrated for its exceptionally low spreads and rapid execution speeds. XTB, founded in 2002 and based in Poland, is recognized for its intuitive trading platforms and extensive educational resources. Both brokers serve traders of all experience levels, offering a broad variety of currency pairs, including EUR, USD, and AUD.

IC Markets stands out with variable spreads starting at 0.0 pips on forex pairs, alongside commissions of up to $7 per lot traded. This pricing structure is highly advantageous for traders who prioritize tight spreads and clear fee structures.

XTB also offers competitive pricing, featuring variable spreads from 0.3 pips on forex pairs. For European traders, it provides zero-commission trading on real stocks and ETFs for monthly volumes up to €100,000, with a subsequent 0.2% commission for higher volumes. This framework is particularly appealing to those seeking a diverse range of instruments at attractive costs.

Recent trends in the forex market show that the EUR/USD pair has been undergoing a medium-term bullish trend reversal, with weekly chart closes surpassing critical resistance levels as of February 17, 2025. Similarly, the AUD/USD pair has demonstrated a bullish reversal, signaling promising opportunities for traders.

Staying updated on these market shifts is vital for traders looking to leverage favorable conditions and refine their trading strategies.

Spreads

IC Markets provides exceptionally competitive spreads, boasting a EUR/USD spread of just 0.02, in stark contrast to XTB’s 0.09 and the industry average of 0.22. For AUD/USD, IC Markets offers a spread of 0.03, while XTB sets it at 0.13, with the industry average at 0.47. In general, IC Markets maintains an average spread of 0.29, well below XTB’s 0.46 and the industry average of 0.75. These remarkably low spreads establish IC Markets as a highly appealing choice for traders seeking cost-effective trading conditions.

XTB and IC Markets are both STP brokers that follow an ECN pricing model. Unlike market makers that set their bid-ask prices and use their own liquidity to fill orders, STP/ECN brokers use multiple sources of external liquidity to determine spreads and fill orders.

| RAW Account | IC Markets Spreads | XTB Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 0.29 | 0.46 | 0.75 |

| EUR/USD | 0.02 | 0.09 | 0.22 |

| USD/JPY | 0.14 | 0.14 | 0.38 |

| GBP/USD | 0.23 | 0.14 | 0.53 |

| AUD/USD | 0.03 | 0.13 | 0.47 |

| USD/CAD | 0.25 | 0.18 | 0.56 |

| EUR/GBP | 0.27 | 0.14 | 0.55 |

| EUR/JPY | 0.3 | 1.4 | 0.80 |

| AUD/JPY | 0.5 | 1.7 | 0.96 |

| USD/SGD | 0.85 | 0.25 | 2.29 |

Commission Levels

IC Markets offers a competitive commission fee of $3.50 per lot, while XTB currently does not disclose a specific commission fee. When it comes to minimum deposits, XTB requires $250, whereas IC Markets has a more accessible requirement of $200. Each broker suggests recommended deposits of $250 and $200, respectively, and neither imposes funding fees. Furthermore, both brokers accommodate traders who adhere to Islamic finance principles by offering SWAP-free accounts.

| USD | AUD | GBP | EUR | |

|---|---|---|---|---|

| IC Markets | $3.50 | $4.50 | £2.50 | €2.75 |

| XTB | $4.00 | N/A | £3 | €3.50 |

Standard Account Fees

IC Markets provides a compelling cost advantage with standard account fees, offering a spread of just 0.62 for EUR/USD and 0.77 for AUD/USD. In contrast, XTB’s spreads are significantly higher, at 0.90 for EUR/USD and 1.30 for AUD/USD. This stark comparison underscores IC Markets’ appeal for traders who prioritize minimizing their trading expenses.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.00 | 1.00 | 1.27 | 1.20 | 1.10 |

| 0.90 | 1.30 | 1.40 | 1.40 | 1.40 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 1.20 | 1.30 | 1.30 | 1.50 | 1.10 |

| 1.18 | 1.45 | 1.40 | 1.49 | 1.60 |

| 1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

| 1.40 | 1.90 | 1.30 | 1.60 | 1.50 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 12/01/2025

Our Lowest Spreads and Fees Verdict

Unmistakably, IC Markets come up trumps thanks to their lowest spreads and fees.

<IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

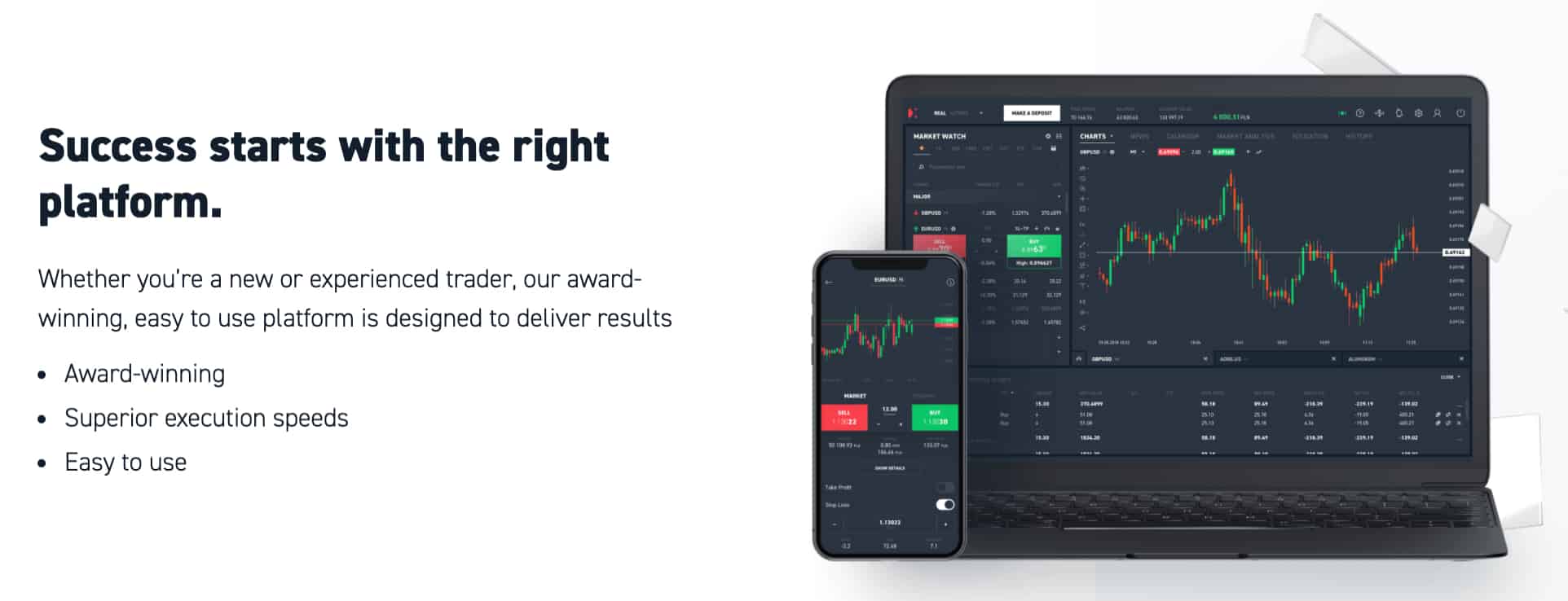

2. Better Trading Platform – IC Markets

A quality forex trading platform is essential, focusing on real-time data, advanced charts, and fast execution. IC Markets and TMGM provide user-friendly designs, customizable features, and strong security while supporting automated and social trading. Both offer diverse financial instruments and tools for traders, but which broker excels? Let’s explore!

IC Markets and XTB stand out as two premier forex brokers, each providing a diverse array of trading platforms and tools tailored to various trading styles. IC Markets, established in 2007 and based in Australia, is renowned for its low spreads and rapid execution speeds. Meanwhile, XTB, founded in 2002 and headquartered in Poland, is celebrated for its intuitive trading platforms and extensive educational resources. Both brokers offer traders access to a broad selection of currency pairs, such as EUR, USD, and AUD, solidifying their status as favored options within the trading community.

| Trading Platform | IC Markets | XTB |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | No |

| cTrader | Yes | No |

| TradingView | Yes | No |

| Copy Trading | Yes | No |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

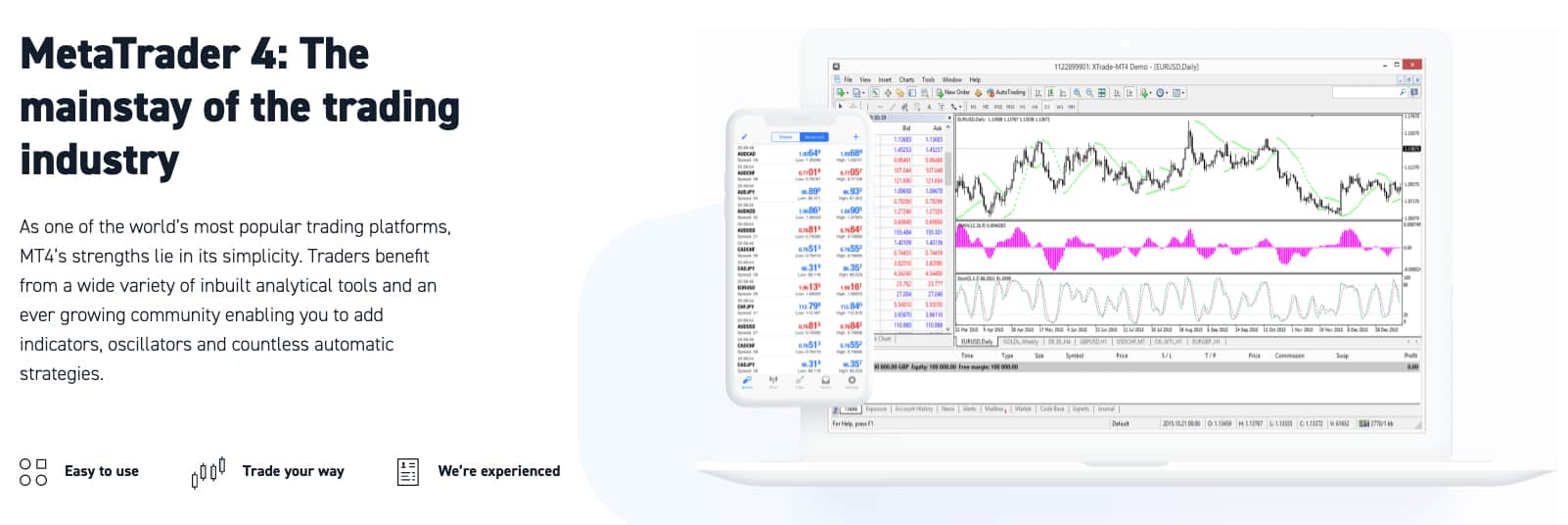

MetaTrader

IC Markets features the three leading trading platforms in the industry: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. MT4 is particularly popular among retail investors due to its robust algorithmic trading capabilities, enabling users to automate their trades through Expert Advisors (EAs). It offers essential tools like single-currency backtesting for EAs, sophisticated charting options, risk management features with four types of pending orders, and seamless integration with social trading platforms such as ZuluTrade and Myfxbook.

On the other hand, MT5 is a comprehensive multi-asset platform that broadens market access to stock CFDs and comes equipped with enhanced features, including multi-currency backtesting, an expanded array of charting tools, and an economic calendar to facilitate fundamental analysis. Meanwhile, cTrader, which is accessible to IC Markets Raw Spread account holders, delivers institutional-grade trading conditions, characterized by deep liquidity and superior charting and technical analysis resources.

Advanced Platforms

XTB provides investors with exclusive access to its sophisticated trading platform, xStation, in addition to the widely-used MetaTrader 4 (MT4). xStation is a dynamic multi-asset platform accessible via mobile app, desktop application, or web, boasting a comprehensive suite of charting tools, market sentiment analysis, an economic calendar, and crucial risk management features with essential order types. On the other hand, MT4 at XTB offers a robust selection of trading tools that rivals those found at IC Markets, making it an ideal option for clients looking to automate their trading strategies using Expert Advisors.

shares.

Copy Trading

IC Markets and XTB both offer robust copy trading options, empowering traders to replicate the strategies of seasoned investors. IC Markets utilizes the MT4 platform, which seamlessly integrates with social trading platforms such as ZuluTrade and Myfxbook, enhancing the copy trading experience. Meanwhile, XTB’s xStation platform also facilitates copy trading, granting users access to a vibrant community of traders and the opportunity to adopt their successful strategies.

IC Markets and XTB provide powerful trading platforms and tools tailored to a variety of trading styles. IC Markets distinguishes itself with competitive spreads and cutting-edge trading tools accessible on MT4, MT5, and cTrader. Meanwhile, XTB captivates traders with its intuitive xStation platform and extensive educational resources, making it the perfect choice for those seeking a comprehensive trading experience. As forex trading trends evolve in 2025, both brokers are exceptionally equipped to address the diverse requirements of traders, particularly those focused on EUR, USD, and AUD currencies.

Please note that MT4 is not available to clients outside Europe and is signed up to the IFSC-regulated branch.

Our Better Trading Platform Verdict

Without a doubt, IC Markets takes home the crown in this category due to their better trading platform.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

3. Superior Accounts And Features – A Tie

When selecting a forex broker, account quality is crucial. IC Markets and TMGM provide accounts for various trading styles, offering competitive spreads, low commissions, and advanced tools. They also feature demo accounts, swap-free options, and access to diverse financial instruments. Enhanced options like social trading and strong support enhance the experience. But which broker excels?Let’s take a closer look at their offerings and find out which one suits you best!

IC Markets and XTB are prominent forex brokers, each providing an array of account types and trading platforms tailored to diverse trading styles. Founded in 2007, IC Markets, an Australian-based broker, is celebrated for its low spreads and rapid execution speeds. On the other hand, XTB, established in 2002 and headquartered in Poland, is recognized for its intuitive trading platforms and extensive educational resources. Both brokers offer access to a comprehensive selection of currency pairs, including EUR, USD, and AUD, solidifying their status as favored choices among traders.

Account Types and Trading Styles

Your trading experience and style will guide your choice of account. For beginners venturing into the trading world, standard accounts offer a straightforward pricing structure, freeing you from the complexities of fee calculations. Conversely, if you’re aiming to implement scalping, day trading, or algorithmic strategies, ECN accounts are the perfect fit.

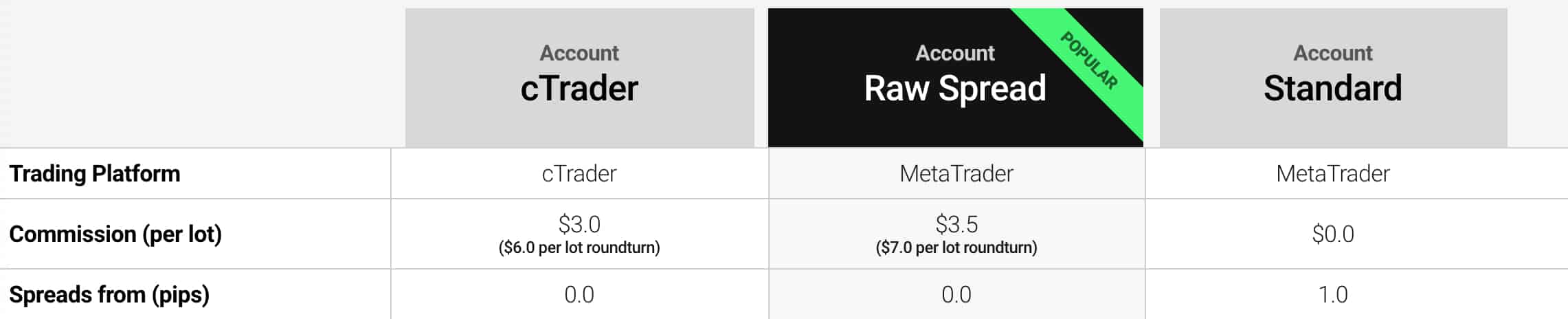

IC Markets – Raw vs Standard Accounts

IC Markets provides traders with two account types for CFD and forex trading: the Standard and Raw account.

With the Standard Account, you enjoy commission-free trading with spreads starting at 1.0 pips. In contrast, the Raw Spread Account offers ECN spreads as low as 0.0 pips but comes with a commission fee starting at $3 per lot per side.

When you sign up for a Raw account, the commission you’ll owe varies based on the trading platform you choose to use. For cTrader users, the fee is $3 per side for every 100,000 units traded, while MetaTrader 4 and MT5 users incur a slightly higher commission of $3.50 per side for the same volume.

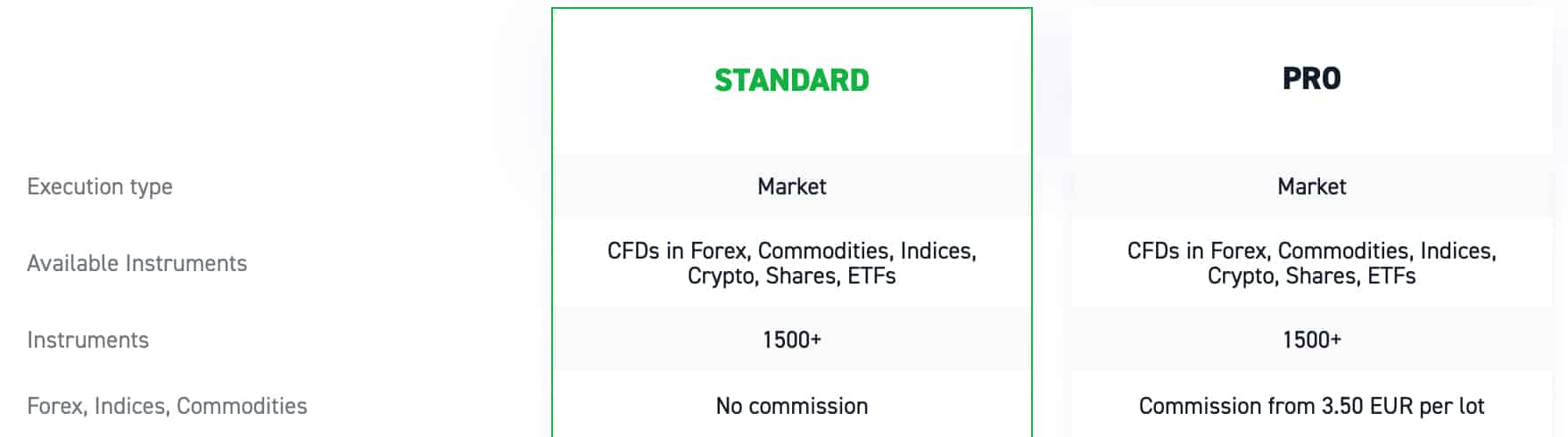

XTB – Standard vs Pro Accounts

XTB presents two types of accounts along with the flexibility of choosing between commission and commission-free pricing structures. However, the Pro commission account is restricted to select traders, and minimum spreads depend on the trader’s location.

Standard Account: Enjoy low forex spreads without any commission fees.

Pro Account: Benefit from ultra-tight forex spreads with a commission of EUR 3.50 per side for every 100k traded.

Islamic Accounts

As a forex trader adhering to Islamic finance principles, you have the option to open an Islamic Account with either broker. Since Islamic traders are prohibited from engaging in interest-based transactions according to Sharia Law, these accounts are designed to be swap-free, meaning they do not carry any interest-based overnight financing fees (swap rates).

Demo Accounts

Both brokers provide demo accounts, allowing you to navigate their platforms and trading conditions without any financial risk before committing real money. These demo accounts serve as an excellent risk management tool; beginners can familiarize themselves with trading, while seasoned traders can experiment with various strategies under realistic conditions.

| IC Markets | XTB | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | Yes |

| Active Traders | Yes | No |

| Spread Betting (UK) | No | No |

XTB: Offers a demo account on both xStation and MetaTrader 4 (MT4), giving you four weeks of access and a generous $100,000 virtual trading balance to work with.

IC Markets: Provides demo accounts on MT4, MetaTrader 5, and cTrader, boasting no limitations on account balance or duration, thereby granting you unlimited access to hone your trading skills.

Our Superior Accounts and Features Verdict

Finally, we have a neck to neck result for this category thanks to IC Markets and XTB’s superior accounts and features.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – IC Markets

A rewarding trading experience relies on the right tools and support. IC Markets and TMGM offer top platforms, fast execution, competitive spreads, and strong customer support, aiming for trader success. Advanced trading tools significantly impact both beginners and experienced traders. Which broker offers the best experience?Let’s break it down and see which one comes out on top!

IC Markets and XTB stand out as leading forex brokers, each providing a diverse array of platforms and tools tailored to various trading preferences. Established in 2007, IC Markets is an Australian broker renowned for its low spreads and exceptionally fast execution speeds. On the other hand, XTB, founded in 2002 and based in Poland, is celebrated for its intuitive trading platforms and robust educational offerings. Both brokers grant traders access to a broad selection of currency pairs, including the EUR, USD, and AUD, solidifying their status as favored choices in the trading community.

Trading Experience and Ease

In exploring trading experiences and ease of use, we thoroughly examined both IC Markets and XTB. IC Markets boasts an impressive selection of platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, providing traders with the flexibility to select the platform that best suits their preferences. Conversely, XTB presents xStation and MT4, both of which are equally user-friendly and intuitive, ensuring a seamless trading experience.

Platform Highlights

IC Markets stands out as the top choice for MT5 trading, thanks to its cutting-edge charting technology and advanced order management capabilities, catering effectively to active traders. On the other hand, XTB’s xStation is renowned for its intuitive interface combined with robust charting tools. It provides an extensive charting package, market sentiment insights, and an economic calendar, making it an outstanding option for both novice and seasoned traders alike.

Account Features

Our testing revealed that IC Markets boasts a remarkable standard account distinguished by its features and user-friendliness. This account provides commission-free spreads beginning at just 1.0 pips, one-click trading options, and a minimal deposit requirement of $200. While both brokers provide educational resources, XTB slightly outshines the competition with its extensive library of video tutorials and webinars. XTB’s educational offerings encompass a diverse array of video courses, trading strategies, and market updates, equipping traders with essential insights and knowledge to enhance their trading experience.

After evaluating all pertinent factors and conducting our own hands-on tests, it is evident that both IC Markets and XTB provide powerful trading platforms and tools that accommodate a range of trading styles. IC Markets is distinguished by its sophisticated MT5 trading platform and flexible account options, whereas XTB shines with its intuitive xStation platform and extensive educational materials. As we look ahead to the evolving forex trading trends of 2025, both brokers are exceptionally equipped to cater to the diverse requirements of traders, especially those focused on EUR, USD, and AUD currencies.

Our Best Trading Experience and Ease Verdict

Our dedicated team can surmise that IC Markets steals the show in this field owing to their best trading experience and ease.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – A Tie

A smooth trading experience relies on the right tools and support. IC Markets and TMGM offer top platforms, fast execution, competitive spreads, and strong customer support. Their user-friendly interfaces and educational resources cater to both beginners and seasoned traders. But which broker offers the best experience?Let’s break it down and see which one comes out on top!

IC Markets and XTB are two prominent forex brokers, each offering a variety of platforms and tools to cater to different trading styles. IC Markets, established in 2007, is an Australian-based broker known for its low spreads and fast execution speeds. XTB, founded in 2002, is a global broker headquartered in Poland, recognized for its user-friendly trading platforms and comprehensive educational resources. Both brokers provide access to a wide range of currency pairs, including EUR, USD, and AUD, making them popular choices among traders.

XTB Trust Score

IC Markets Trust Score

This section reveals that XTB boasts a superior trust rating of 62, surpassing IC Markets’ rating of 53. However, we won’t solely depend on trust and ratings; instead, let’s examine how these brokers perform in terms of their platforms and features.

Financial Regulation

Both brokers are overseen by a number of top-tier financial authorities, including CySEC, and have a strong presence in Europe. As forex and CFDs are considered complex instruments with a high risk of losing money, it is best to start trading with a regulated broker that provides strong risk management tools. Regardless of the broker or subsidiary you sign up to, your trading account balance will be kept in a separate account from the broker’s operational capital. Segregated client funds are common practice for most brokers around the world to protect retail investor account balances in case a broker becomes insolvent.

IC Markets Financial Regulation

IC Markets is a top broker based out of Sydney, Australia, but regulated by three major financial authorities around the world:

- Australia: Regulated by the Australian Securities and Investments Commission (ASIC).

- Europe: Regulated by the Cyprus Securities and Exchange Commission (CySEC).

- Global: Regulated by the Seychelles Financial Services Authority (FSA).

IC Markets Risk Management

As well as being a CySEC and ASIC-regulated broker, IC Markets offers risk management tools in the form of order types. Order types help you reduce the high risk of trading by allowing you to set limits on losses while maximizing profits. Depending on the trading platform you choose, pending order types such as stop-loss orders, trailing stops, limit orders, and take profits will be available.

XTB Financial Regulation

XTB is a London-based broker, yet has a brick-and-mortar presence in over 10 different countries. In terms of regulatory oversight, XTB subsidiaries follow the financial regulations set by five major financial authorities around the world:

- The UK: Regulated by the Financial Conduct Authority (FCA).

- Poland: Regulated by the Polish Financial Supervision Authority (KNF).

- Spain: Regulated by the National Securities Market Commission of Spain (CNMV).

- Elsewhere in Europe: Regulated by the Cyprus Securities and Exchange Commission (CySEC).

- Global: Regulated by the International Financial Services Commission of Belize (IFSC).

XTB Risk Management

XTB also offers pending order types like IC Markets, yet the broker also offers traders based in the UK or Ireland negative balance protection. FCA-regulated brokers must provide negative balance protection as an FCA requirement, meaning you can never enter into a negative trading balance and end up in debt to your broker.

| IC Markets | XTB | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) CYSEC (Cyprus) | FCA (UK) CYSEC (Cyprus) |

| Tier 2 Regulation | DFSA (Dubai) CMNV (Spain) KNF (Poland) | |

| Tier 3 Regulation | FSA-S (Seychelles) SCB (Bahamas) | FSC-BZ |

Reviews

IC Markets enjoys an outstanding Trustpilot rating of 4.8 out of 5, based on over 46,000 reviews. XTB, in contrast, has a more modest Trustpilot score of 4.0 out of 5, with over 2,000 reviews. IC Markets stands out for its consistently high user satisfaction, while XTB offers solid features but receives more varied feedback.

Our Stronger Trust and Regulation Verdict

Both brokers are deadlocked in this category. This is attributed to their enhanced trust and regulations enforced by financial regulators, which offer a range of risk management tools.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

6. Most Popular Broker – XTB

XTB gets searched on Google more than IC Markets. On average, XTB sees around 368,000 branded searches each month, while IC Markets gets about 246,000 — that’s 33% fewer.

| Country | IC Markets | XTB |

|---|---|---|

| Poland | 2,900 | 135,000 |

| Portugal | 1,000 | 40,500 |

| Spain | 6,600 | 27,100 |

| France | 4,400 | 18,100 |

| Germany | 5,400 | 12,100 |

| Brazil | 4,400 | 9,900 |

| Vietnam | 8,100 | 5,400 |

| Chile | 720 | 5,400 |

| United Kingdom | 33,100 | 4,400 |

| Italy | 3,600 | 4,400 |

| Colombia | 3,600 | 3,600 |

| Thailand | 8,100 | 2,400 |

| United States | 6,600 | 2,400 |

| Peru | 1,600 | 2,400 |

| United Arab Emirates | 4,400 | 1,900 |

| Mexico | 2,400 | 1,900 |

| Netherlands | 2,400 | 1,600 |

| India | 8,100 | 1,300 |

| Switzerland | 1,600 | 1,300 |

| Argentina | 1,300 | 1,300 |

| Morocco | 4,400 | 1,000 |

| Saudi Arabia | 1,900 | 1,000 |

| Austria | 720 | 1,000 |

| Algeria | 2,400 | 880 |

| Ecuador | 1,000 | 880 |

| Canada | 2,400 | 720 |

| Egypt | 1,600 | 720 |

| Bolivia | 260 | 720 |

| Nigeria | 3,600 | 480 |

| Sweden | 1,300 | 480 |

| Turkey | 1,300 | 480 |

| Ireland | 880 | 480 |

| South Africa | 9,900 | 390 |

| Japan | 1,300 | 390 |

| Jordan | 590 | 390 |

| Australia | 6,600 | 320 |

| Malaysia | 3,600 | 320 |

| Indonesia | 3,600 | 320 |

| Philippines | 2,400 | 320 |

| Dominican Republic | 1,000 | 320 |

| Venezuela | 720 | 320 |

| Costa Rica | 390 | 320 |

| Cyprus | 880 | 260 |

| Pakistan | 5,400 | 210 |

| Greece | 720 | 210 |

| Hong Kong | 2,400 | 170 |

| Cambodia | 170 | 170 |

| Singapore | 3,600 | 140 |

| Taiwan | 1,000 | 140 |

| Bangladesh | 1,900 | 110 |

| Uzbekistan | 1,000 | 110 |

| Sri Lanka | 2,900 | 90 |

| Kenya | 2,400 | 70 |

| Ghana | 880 | 70 |

| Tanzania | 320 | 70 |

| Panama | 260 | 70 |

| New Zealand | 210 | 50 |

| Uganda | 720 | 40 |

| Ethiopia | 720 | 30 |

| Mauritius | 480 | 20 |

| Botswana | 260 | 20 |

| Mongolia | 720 | 10 |

2,900 1st | |

135,000 2nd | |

1,000 3rd | |

40,500 4th | |

6,600 5th | |

27,100 6th | |

5,400 7th | |

12,100 8th |

Similarweb shows a similar story when it comes to February 2024 website visits with XTB receiving 7,682,000 visits vs. 2,425,000 for IC Markets.

Our Most Popular Broker Verdict

XTB is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – XTB

Having a diverse range of products in forex trading is crucial. IC Markets and TMGM provide access to various CFDs, including forex, commodities, indices, and cryptocurrencies, allowing traders to diversify and adapt to market changes. This variety benefits day traders, swing traders, and long-term investors by enhancing flexibility and profit potential. Which broker offers the best product range for different strategies? Let’s break it down and see how they compare!

IC Markets CFD Range

IC Markets offer an excellent range of CFDs ranging from minor currency pairs to Bitcoin and bonds. As mentioned, if you want to trade Share CFDs, you will need to use MetaTrader 5, while only forex and indices are available on cTrader.

- 60 currency pairs

- 23 indices

- 19 commodities

- 120+ shares

- 6 bonds

- 4 futures

- 10 cryptos

Choosing the right forex broker necessitates careful consideration of the range of available CFDs (Contracts for Difference), as this is essential for diversifying your portfolio and taking advantage of different market conditions. XTB distinguishes itself by offering an extensive selection of products, granting traders access to a wide variety of instruments.

XTB’s CFD Range:

- Forex Pairs: 57

- Indices: 42

- Commodities: 23

- Stocks: 1,846

- ETFs: 119

- Cryptocurrencies: 25

This exceptional range exceeds that of numerous competitors, including IC Markets, providing traders with greater opportunities to capitalize on diverse asset classes. This variety not only enriches the trading experience but also makes it more dynamic and flexible, catering to a wide array of strategies.

As of February 2025, the forex market has seen notable movements:

- EUR/USD: The Euro has strengthened against the U.S. Dollar due to positive economic data from the Eurozone, trading at 1.15.

- AUD/USD: The Australian Dollar has weakened, influenced by domestic economic challenges and global commodity price fluctuations, currently at 0.65.

These trends underscore the critical need for access to a diverse array of instruments, empowering traders to adeptly navigate and take advantage of evolving market dynamics.

| CFDs | IC Markets | XTB |

|---|---|---|

| Forex Pairs | 61 | 48 |

| Indices | 25 | 30 |

| Commodities | 4 Metals (Gold vs 6 currencies) (Silver vs 3 currencies) 8 Softs 5 Energies | 7 Metals 6 Energies 10 Softs |

| Cryptocurrencies | 23 | 10+ |

| Share CFDs | 2100+ | 1848 |

| ETFs | No | 155 |

| Bonds | 9 | 3 |

| Futures | Yes | No |

| Treasuries | 9 | 3 |

| Investments | Yes | No |

Our Top Product Range and CFD Markets Verdict

Finally, XTB steals the show in this category by the reason of their top product range and CFD markets.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

8. Superior Educational Resources – IC Markets

In forex trading, knowledge is crucial alongside choosing the right broker. IC Markets and XTB offer extensive educational resources for all traders, including webinars, articles, and video tutorials. Quality education helps traders make informed decisions, enhance strategies, and succeed in the market, making continuous learning essential for long-term success.

IC Markets and XTB provide educational resources aimed at helping traders enhance their skills and remain updated on market trends. However, the extent and availability of these resources differ between the two brokers. A solid educational foundation can benefit traders of all experience levels, from beginners to those refining advanced strategies.

IC Markets offers a comprehensive educational experience, featuring regular webinars, detailed tutorials, a variety of e-books, and structured courses for various skill levels. Traders also have access to daily market analysis and 24/7 customer support for educational questions. Conversely, XTB’s educational resources are more limited, with occasional webinars, fewer e-books, and basic courses primarily designed for beginners. Market analysis is updated weekly, and customer support is available only during business hours.

IC Markets is noted for its extensive and consistent educational support, making it a suitable option for traders who prioritize ongoing learning. XTB provides foundational education but may be less extensive for traders seeking advanced insights. When selecting between these brokers, traders may want to reflect on the level of educational support they require to improve their trading knowledge in the dynamic forex market.

IC Markets:

- Webinars: Regularly hosts educational webinars.

- Tutorials: Offers detailed tutorials for both beginners and advanced traders.

- E-books: Provides a range of e-books covering various trading topics.

- Courses: Comprehensive courses available for different trading levels.

- Market Analysis: Daily market analysis to keep traders informed.

- Support: 24/7 customer support to assist with educational queries.

XTB:

- Webinars: Occasional webinars available.

- Tutorials: Limited tutorials mainly for platform usage.

- E-books: Few e-books focused on basic trading concepts.

- Courses: Basic courses targeting new traders.

- Market Analysis: Weekly market analysis updates.

- Support: Customer support available during working hours.

Our Superior Educational Resources Verdict

Based on our team’s scoring, IC Markets outperforms the other in this category due to their superior educational resources.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

9. Superior Customer Service – IC Markets

In forex trading, excellent customer service is crucial. Reliable support ensures traders receive timely assistance via live chat, phone, or email. Top brokers like IC Markets and XTB offer 24/7 multilingual support for a seamless experience. Quick issue resolution boosts trader confidence and trust. This review examines how IC Markets and XTB manage customer service in the fast-paced forex market.

IC Markets and XTB stand out as leading forex brokers, each offering an array of platforms and tools designed for various trading strategies. Established in 2007, IC Markets is an Australian broker renowned for its razor-thin spreads and lightning-fast execution speeds. Meanwhile, XTB, founded in 2002 and headquartered in Poland, is celebrated for its intuitive trading platforms and extensive educational resources. Both brokers grant access to a diverse selection of currency pairs, including EUR, USD, and AUD, solidifying their status as favored options among traders.

IC Markets boasts award-winning customer support available through live chat, phone, and email. Their dedicated customer service team is accessible 24/7, ready to assist traders with any questions. Furthermore, IC Markets provides an array of resources to enhance your knowledge of forex and CFD trading.An excellent range of educational resources and research tools are freely available on the broker’s website, including:

- Economic calendar

- Market analysis blog

- Forex calculators

- A comprehensive FAQ

- Video tutorials and webinars

- An intro 10-part trading course

- Forex glossary

XTB Customer Support

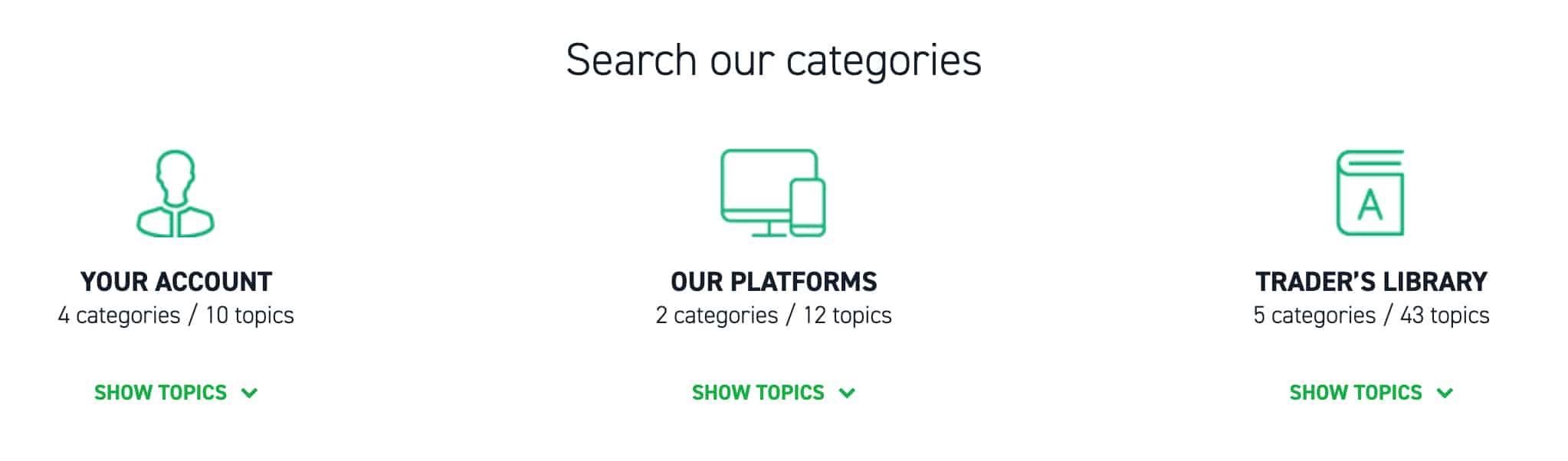

XTB boasts a robust global presence with 14 offices, primarily focused in Europe. You can easily reach their customer service team through phone, live chat, or email, available around the clock from Monday to Friday. Much like IC Markets, XTB provides an extensive selection of educational resources designed to enhance your trading knowledge. Their Trading Academy features courses for all levels—basic, intermediate, and expert—covering topics such as fundamental analysis, xStation, and MT4 tutorials. Additionally, users of the xStation mobile app can enjoy exclusive access to premium content. Along with the Trading Academy, the following educational resources are available:

- Live webinars

- Help Centre

- Articles

| Feature | IC Markets | XTB |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 12/5 |

| Multilingual Support | Yes | Yes |

IC Markets and XTB provide exceptional customer support and educational resources designed to empower traders on their journey to success. IC Markets distinguishes itself with round-the-clock customer service and a wealth of educational materials. Meanwhile, XTB shines with its international reach and a comprehensive Trading Academy. As forex trading trends evolve in 2025, both brokers are strategically positioned to cater to the varied needs of traders, especially those focused on EUR, USD, and AUD currencies.

Our Superior Customer Service Verdict

IC Markets is riding high in this niche thanks to their superior customer service.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

10. Better Funding Options – IC Markets

Funding a forex trading account should be easy and affordable. IC Markets and XTB offer various deposit and withdrawal methods, including bank transfers, cards, digital wallets like PayPal, Skrill, and even cryptocurrencies. These options help traders manage costs and focus on market opportunities. This review will compare the funding options of both platforms for convenience and efficiency in forex trading.

IC Markets and XTB stand out as leading forex brokers, each presenting a diverse array of funding options designed to meet various trading requirements. Established in 2007, IC Markets is an Australian-based broker celebrated for its exceptionally low spreads and rapid execution speeds. On the other hand, XTB, founded in 2002 and headquartered in Poland, is a global broker acclaimed for its intuitive trading platforms and extensive educational resources. Both brokers offer a broad spectrum of currency pairs, including EUR, USD, and AUD, solidifying their reputation as favored options among traders.

IC Markets Funding

Regardless of whether you select a Standard or Raw Spread account type, IC Markets mandates a minimum deposit of $200 and provides 11 base currencies for account setup:

- AUD

- USD

- JPY

- EUR

- NZD

- SGD

- GBP

- CAD

- HKD

- CHF

- RMB

IC Markets offers an outstanding array of 15 funding options with no associated fees. Additionally, the broker does not impose any withdrawal fees, except for international bank wire transfers, which carry a $20 charge. Funding methods include:

- Credit and Debit Cards: Visa and Mastercard

- Wire Transfer and Broker to Broker

- Thai and Vietnamese Internet Banking

- e-Wallets: PayPal, Neteller, Neteller VIP, Skrill, UnionPay, Bpay, FasaPay, POLi, Rapidpay, and Klarna.

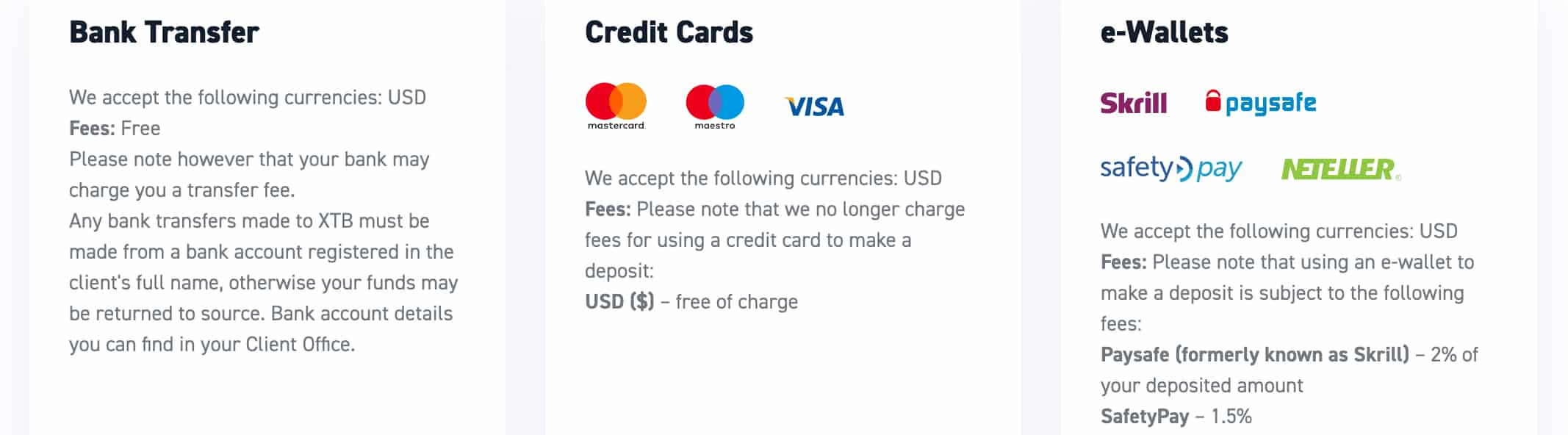

XTB Funding

To begin trading with XTB, you need to make a minimum initial deposit of £250, €250, or $250. Depending on your location and the specific XTB subsidiary you choose, you can set up your trading account using EUR, USD, GBP, or HUF as your base currency. A selection of funding methods is available:

- Wire and Bank Transfer: No fees

- Credit Card: Visa, Mastercard, and Maestro, no fees

- e-Wallets: Skrill, Paysafe, PayPal, SafetyPay, PayU, and Neteller with fees between 1-2%, availability varies depending on your location.

IC Markets and XTB provide a diverse array of funding options to suit various trading requirements. IC Markets distinguishes itself with an extensive selection of free funding methods and a lower minimum deposit threshold. In contrast, XTB offers flexibility through multiple base currencies and various funding methods, although certain e-wallet options may come with fees. As forex trading trends evolve in 2025, both brokers are well-equipped to address the diverse needs of traders, especially those focused on EUR, USD, and AUD currencies.

When withdrawing funds from your XTB account, withdrawals amounting to less than $50 will be charged a fee of $30. Otherwise, withdrawals are fee-free.

| Funding Option | IC Markets | XTB |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | Yes |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | No |

| Klarna | No | No |

Our Better Funding Options Verdict

With 11 base currency options and over 15 fee-free funding methods, IC Markets is the clear winner regarding account opening and funding.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

11. Lower Minimum Deposit – A Tie

Forex trading can start with a low investment due to lower minimum deposits, making it accessible for beginners and those with limited capital. This allows traders to gain experience with minimal risk, promoting inclusivity and a learning environment. This review will examine how IC Markets and XTB accommodate traders with different budgets and if their deposit requirements suit entry-level investors.

Exploring Minimum Deposits: IC Markets vs. XTB

When selecting a forex broker, the minimum deposit requirement plays a crucial role in a trader’s decision-making process. A lower initial deposit significantly increases accessibility to the market, particularly for beginners or those experimenting with new strategies. Both IC Markets and XTB acknowledge this importance, presenting competitive deposit structures tailored to diverse trader needs. IC Markets stands out for its low barrier to entry and flexible funding options, while XTB strikes an excellent balance between affordability and high-end trading features.

For many traders, particularly those new to the field, a lower minimum deposit acts as a risk-friendly entry point into forex trading. It enables them to become acquainted with market movements, refine their strategies, and build confidence without a hefty upfront investment. Both IC Markets and XTB ensure this accessibility, delivering robust trading conditions that allow even small-scale traders to enjoy institutional-grade execution and liquidity.

Ultimately, the decision between IC Markets and XTB hinges on individual trading objectives. If affordability and flexibility are paramount, IC Markets may be the ideal choice. Conversely, for those attracted to a more extensive array of premium tools and resources, XTB offers a compelling alternative. Regardless of the selection, both brokers provide a sturdy foundation for traders eager to confidently navigate the forex market.

Both IC Markets and XTB recognise the significance of this factor. Here’s a snapshot of their offerings:

| Minimum Deposit | Recommended Deposit | |

| IC Markets | $200 | $200 |

| XTB | $0 | $250 |

Our Lower Minimum Deposit Verdict

Once again, we have a draw in this category, IC Markets and XTB are both neck to neck this is in light of their lower minimum deposit.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

Our Final Verdict On Which Broker Is The Best: XTB or IC Markets?

IC Markets is the winner because it consistently outperforms XTB in several key areas, as evidenced by our comprehensive comparison. The table below summarises the key information leading to this verdict:

| Categories | IC Markets | XTB |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platform | Yes | No |

| Superior Accounts And Features | Yes | Yes |

| Best Trading Experience And Ease | Yes | No |

| Stronger Trust And Regulation | Yes | Yes |

| Top Product Range And CFD Markets | No | Yes |

| Superior Educational Resources | Yes | No |

| Superior Customer Service | Yes | No |

| Better Funding Options | Yes | No |

| Lower Minimum Deposit | Yes | Yes |

Best For Beginner Traders

For novice traders, IC Markets offers a more comprehensive educational platform and user-friendly interface.

Best For Experienced Traders

For seasoned traders, IC Markets provides advanced tools and features that cater to their sophisticated trading needs.

FAQs Comparing IC Markets Vs XTB

Does XTB or IC Markets Have Lower Costs?

IC Markets generally offers lower costs compared to XTB. Their competitive spreads, especially on major pairs like EUR/USD, make them a preferred choice for many traders. For a more detailed breakdown of low commission brokers, you can refer to this comprehensive list of Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both XTB and IC Markets offer MetaTrader 4, but IC Markets is often favoured for its advanced MT4 tools and features. If you’re keen on exploring more about MT4 brokers, here’s a list of the best MT4 brokers to guide you.

Which Broker Offers Social Trading?

IC Markets provides options for social trading, allowing traders to follow and copy the strategies of professionals. Social trading can be a game-changer, especially for beginners. For those interested in diving deeper into this topic, here’s a comprehensive guide on the best social trading platforms.

Does Either Broker Offer Spread Betting?

XTB offers spread betting for its UK clients. This form of trading is tax-free in the UK and is a popular choice among traders looking to capitalise on market movements without owning the underlying asset. If you’re keen on exploring more about spread betting, here’s a comprehensive guide on the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, IC Markets stands out for Australian forex traders. Being ASIC regulated and founded in Australia, they have a deep understanding of the local market and its traders’ needs. Their platform offers a wide range of tools and features tailored for the Australian audience. If you’re an Australian trader or looking to trade in the Australian market, here’s a detailed guide on the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

Personally, I believe XTB has an edge for UK forex traders. They are FCA regulated and have a strong presence in the UK market. Their platform is user-friendly, and they offer a range of tools and resources tailored for UK traders. If you’re trading in the UK or considering it, here’s a comprehensive guide on the Best Forex Brokers In UK.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert