IC Markets vs City Index: Which One Is Best?

IC Markets and City Index are closely matched, but is one truly superior to the other? One of these brokers often stands out thanks to its remarkable features, platforms and services. Discover which one aligns better with your trading needs as we take a deeper investigation into the comparison.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 10:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our comprehensive comparison covers the 10 most important trading factors. Here are five key differences between IC Markets and City Index:

- IC Markets offers lower average spreads for major pairs like EUR/USD.

- IC Markets excels in automated trading, supporting platforms like MetaTrader 4 and 5.

- IC Markets is preferred for its advanced technology and faster execution speeds.

- City Index has a stronger focus on educational resources and trader support.

- City Index provides a broader range of CFDs and spread betting options.

1. Lowest Spreads And Fees – IC Markets

When evaluating forex brokers, it’s essential to consider various factors such as spreads, commission levels, and standard account fees. These elements significantly impact the overall trading experience and profitability. This review will provide a detailed comparison between IC Markets and City Index, emphasizing their spreads, commission structures, and fees associated with standard accounts. By examining these key factors, we aim to equip you with a thorough understanding of what each broker brings to the table, empowering you to make a well-informed decision in light of the latest trends and insights in forex trading.

Spread

IC Markets is known for offering some of the lowest spreads in the industry. IC Markets offers exceptional spreads for EUR/USD, ranging from just 0.02 to 0.1 pips, which are markedly lower than the industry’s average spread of 0.22 pips. Similarly, for AUD/USD, IC Markets offers spreads starting from 0.03 pips, compared to the average industry spread of 0.47 pips. City Index also offers competitive spreads, but they tend to be slightly higher than those of IC Markets. For example, City Index’s spreads for EUR/USD and AUD/USD are generally around 0.16 pips and 0.97 pips, respectively.

| RAW Account | IC Markets Spreads | City Index Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 0.29 | 0.67 | 0.75 |

| EUR/USD | 0.02 | 0.16 | 0.22 |

| USD/JPY | 0.14 | 0.6 | 0.38 |

| GBP/USD | 0.23 | 0.18 | 0.53 |

| AUD/USD | 0.03 | 0.97 | 0.47 |

| USD/CAD | 0.25 | 0.43 | 0.56 |

| EUR/GBP | 0.27 | 0.47 | 0.55 |

| EUR/JPY | 0.3 | 0.46 | 0.80 |

| AUD/JPY | 0.5 | 0.54 | 0.96 |

| USD/SGD | 0.85 | 2.2 | 2.29 |

Commission Levels

Both IC Markets and City Index offer attractive and competitive commission rates. IC Markets charges a commission of $3.50 per lot for its Raw Spread account. City Index, on the other hand, charges a commission of $2.50 per lot for its standard accounts. While both brokers offer similar commission rates, IC Markets’ lower spreads can result in overall lower trading costs for traders.

| USD | AUD | GBP | EUR | |

|---|---|---|---|---|

| IC Markets | $3.50 | $4.50 | £2.50 | €2.75 |

| City Index | $2.50 | $3.50 | N/A | N/A |

Try the IC Markets vs City Index fee calculator below based on the most popular forex pairs and base currencies.

Standard Account Fees

IC Markets’ standard account offers spreads starting from 1.0 pips on EUR/USD, with no additional commissions. This account type allows traders to access raw pricing with a spread that covers all trading costs. City Index’s standard account also offers competitive spreads, starting from 1.0 pips on major forex pairs. It’s important for traders to take into account that City Index’s standard account may come with extra fees, such as inactivity charges, when assessing their total trading expenses.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 0.82 | 0.83 | 1.27 | 1.03 | 0.94 |

| 0.70 | 2.20 | 1.10 | 1.10 | 0.60 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 1.40 | 1.60 | 1.80 | 1.80 | 1.60 |

| 1.18 | 1.45 | 1.40 | 1.49 | 1.60 |

| 1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

| 1.40 | 1.90 | 1.30 | 1.60 | 1.50 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 11/01/2025

Both IC Markets and City Index offer competitive trading conditions, but there are distinct differences in their account features. IC Markets stands out with its lower spreads and transparent commission structure, making it a cost-effective choice for many traders. City Index stands out with its attractive spreads and enhanced trading tools, creating a dynamic trading environment suited for both novice and seasoned traders alike. As the forex trading landscape evolves, both brokers are dedicated to providing exceptional services and competitive trading conditions to their clients. Whether your focus lies on lower spreads, commission rates, or superior trading tools, IC Markets and City Index deliver compelling offerings tailored to every trader’s needs.

Our Lowest Spreads and Fees Verdict

Indisputably, IC Markets Raw outperforms the contender in this category due to lowest spreads and fees.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

2. Better Trading Platform – IC Markets

When evaluating forex brokers, it’s essential to consider the range of trading platforms, advanced tools, and copy trading features they offer. These elements significantly impact the overall trading experience and profitability. This review will provide an in-depth comparison of IC Markets and City Index, highlighting their MetaTrader solutions, advanced trading platforms, and copy trading features. By examining these elements, we aim to equip you with a thorough understanding of each broker’s offerings, enabling you to make a well-informed decision aligned with the latest trends and insights in forex trading.

| Trading Platform | IC Markets | City Index |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | No |

| cTrader | Yes | No |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

Our expert team has designed a cutting-edge questionnaire with six targeted questions to help you discover the trading platform that perfectly matches your style.

MetaTrader

IC Markets provides access to the three most popular mainstream trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. These platforms are celebrated for their intuitive interfaces, sophisticated charting tools, and robust support for automated trading through algorithmic trading robots, including Expert Advisors on MT4 and MT5, as well as cBots on cTrader. In addition, City Index provides MetaTrader 4 along with its own proprietary HTML5 web trader platform and the advanced AT Pro desktop trading platform. MT4 is available as mobile apps, desktop, and web trader platforms, making it ideal for automated trading with Expert Advisors, as well as scalping and day trading strategies.

Advanced Platforms

IC Markets enhances the trading experience with advanced trading tools available on MT4, MT5, and cTrader. These resources encompass sophisticated charting tools, effective risk management options such as price alerts and various order types, as well as social trading platforms like ZuluTrade and Myfxbook. All platforms permit hedging, day trading, and scalping strategies. Additionally, IC Markets offers a VPS service for running automated trading strategies 24/7. City Index provides a range of trading tools suited to different levels of trading experience and styles. Their exclusive web trader platform and trading apps cater to beginners, while the AT Pro desktop platform is tailored for advanced traders in need of robust analytical tools.

Copy Trading

IC Markets and City Index both offer alluring copy trading features. At IC Markets, traders can take advantage of MetaTrader Signals, ZuluTrade, Myfxbook, and cTrader Copy, enabling them to follow and replicate the strategies of successful traders with ease. City Index provides access to Trading Central, a leading investment research provider that offers trade ideas and analysis. City Index also enhances its offerings through social trading, collaborating with various third-party providers that allow traders to leverage the knowledge and skills of experienced professionals.

Both IC Markets and City Index provide powerful trading platforms along with an array of advanced features to meet diverse trading requirements. However, IC Markets distinguishes itself with the inclusion of the cTrader platform and a wider selection of sophisticated trading tools, positioning it as an outstanding option for traders who prioritize rapid execution and extensive analytical capabilities. City Index, with its proprietary web trader and AT Pro platforms, offers a user-friendly and customizable trading experience. Both brokers are consistently evolving to align with the latest trends in forex trading, delivering competitive and comprehensive solutions for their clients. Whether you seek advanced trading tools, copy trading features, or an intuitive user interface, IC Markets and City Index have tailored offerings for every trader’s needs.

Our Better Trading Platform Verdict

IC Markets‘ definitely on top of the world right now thanks to their better trading platform.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

3. Superior Accounts And Features – IC Markets

In the world of forex trading, the execution methods and pricing structures of brokers significantly influence a trader’s entire experience. IC Markets utilizes an ECN (Electronic Communication Network) execution model, offering transparency and direct market access, while City Index functions as a market maker, operating under a different set of principles. Each model presents unique advantages that can impact traders in various ways.These differences impact spreads, commissions, and overall trading conditions, making it essential for traders to choose based on their strategies and preferences.

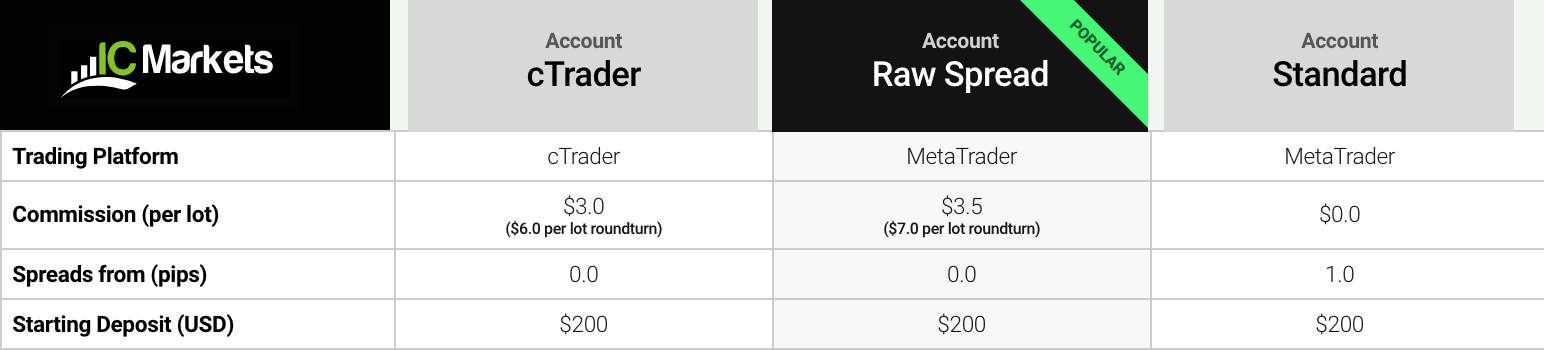

City Index, as a market maker, offers commission-free forex trading, where the cost is embedded in the spread. City Index utilizes its internal liquidity to establish its own bid-ask prices, which results in traders not having the flexibility of selecting from various account options or pricing structures. On the other hand, IC Markets follows an ECN pricing structure with no dealing desk execution, accessing 25+ liquidity providers to ensure competitive spreads. IC Markets provides two main account options: the Raw Spread Account and the Standard Account. The Raw Spread Account features incredibly tight spreads beginning at 0.0 pips, with commissions that differ by trading platform—$3.50 per side per 100k on MetaTrader and $3 per side per 100k on cTrader. In contrast, the Standard Account operates without commissions and offers spreads starting at 1.0 pip, making it perfect for traders seeking a straightforward pricing model.

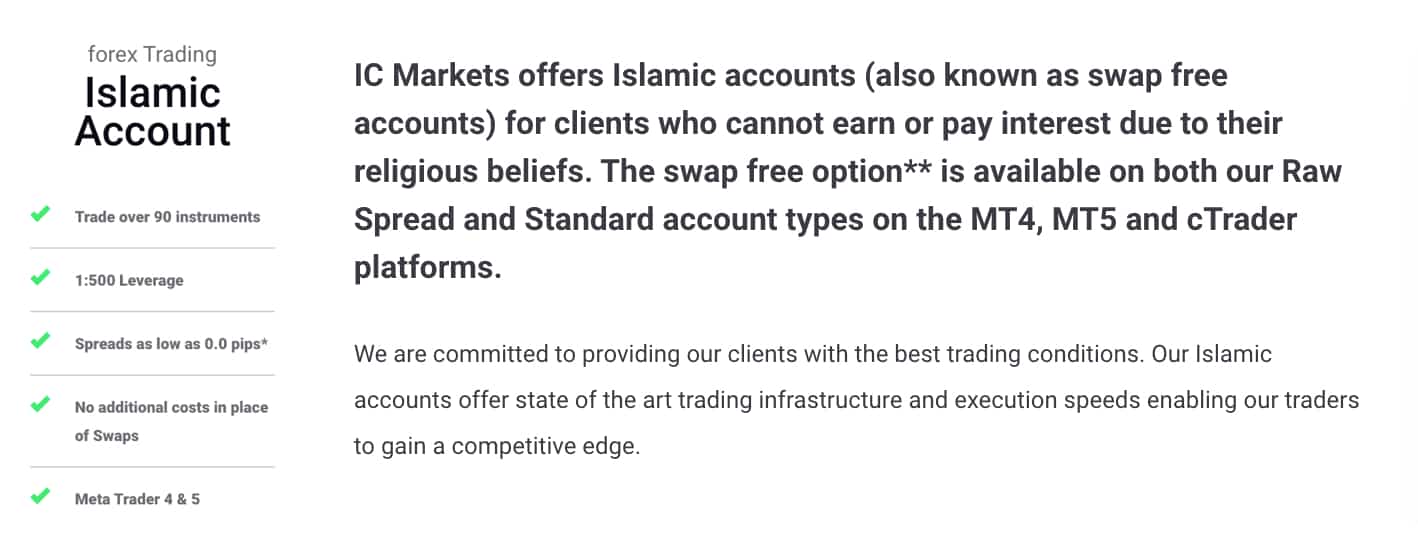

For traders with unique requirements, IC Markets distinguishes itself by offering a range of enhanced account features. It offers an Islamic account with no swap fees, replacing them with an administration charge to comply with Shariah law—an option City Index does not provide.

City Index, an FCA-regulated broker, offers spread betting services specifically tailored for traders in the UK and Ireland. One of the key benefits of spread betting is the tax advantage it provides, as profits are exempt from capital gains tax. Both brokers also feature demo accounts, which serve as an invaluable resource for traders looking to hone their strategies and gain confidence in navigating platform functionalities, all within a risk-free setting. Choosing between IC Markets and City Index ultimately depends on whether a trader prioritizes ECN execution with tighter spreads and flexible account types or a market-making model with built-in commission-free pricing and spread betting capabilities.

Demo Accounts

Both IC Markets and City Index offer demo accounts where you test out trading strategies and platforms in a risk-free environment. Demo accounts make are a great risk management tool regardless of whether you are a beginner or an experienced trader.

| IC Markets | City Index | |

|---|---|---|

| Standard Account | Yes | No |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | No |

| Active Traders | Yes | No |

| Spread Betting (UK) | No | Yes |

Our Superior Accounts and Features Verdict

Evidently, IC Markets is having its moment in the spotlight thanks to their superior accounts and features.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – IC Markets

An exceptional trading experience involves not just order placement but also the right tools, speed, and support in the forex market. Key factors include advanced platforms, quick execution, competitive spreads, and customer service. Top brokers provide a seamless interface, educational resources, and effective trading tools to improve decision-making and profitability. We will compare how IC Markets and City Index offer optimal trading environments for all traders.

In comparing IC Markets and City Index, it’s evident that both brokers have unique strengths designed to cater to varying trading styles. IC Markets is renowned for its ECN trading model, offering traders exceptionally tight spreads and direct access to vast liquidity pools. This feature is especially appealing to high-frequency traders and scalpers seeking an advantage in fast-paced markets. Furthermore, IC Markets stands out with its MetaTrader 5 (MT5) platform, acclaimed for its superior capabilities in executing advanced trading strategies, algorithmic trading, and providing robust technical analysis tools.

Conversely, City Index utilizes its extensive market-making expertise, built over decades, to deliver a seamless and dependable trading experience, especially for those who favor a fixed-spread environment. Its proprietary trading platform is lauded for its intuitive design, making it accessible for beginners while still providing the advanced tools that seasoned traders need. While IC Markets excels with its raw pricing model and execution speed, City Index offers a more structured approach, prioritizing trust and stability. Both brokers maintain a competitive advantage in the forex market, but the ultimate choice hinges on a trader’s unique strategy and preferred platform.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| IC Markets | 134ms | 16/36 | 153ms | 22/36 |

| City Index | 95ms | 12/36 | 131ms | 14/36 |

Our Best Trading Experience and Ease Verdict

IC Markets truly takes the cake in this portion thanks to best trading experience.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – A Tie

In forex trading, trust and regulation are essential. A broker’s credibility relies on compliance with financial standards, ensuring a secure environment. Regulated brokers protect client funds and promote fair trading, reducing fraud risk. This oversight builds trader confidence and boosts market activity, making strong regulatory credentials a necessity for serious traders’ long-term success.

City Index Trust Score

IC Markets Trust Score

Regulation and Trustworthiness: How IC Markets and City Index Compare

Choosing a forex broker necessitates a focus on trust and regulation, as these elements significantly influence the safety and transparency of a trader’s experience. IC Markets and City Index are both highly regarded in the industry, operating within stringent regulatory guidelines established by leading financial authorities. While both brokers ensure compliance with high standards, their regulatory oversight and investor protections vary depending on the jurisdiction they operate in. Based on their trust scores, City Index holds a slight edge with a rating of 64, compared to IC Markets’ score of 53. However, both remain strong contenders in the market, offering traders a secure environment for forex and CFD trading.

IC Markets: A Globally Regulated ECN Broker

IC Markets is esteemed as one of Australia’s leading forex brokers, supported by regulation from several respected financial authorities. It operates under the supervision of the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC) within the European Union, and the Seychelles Financial Services Authority (FSA) for its international clientele. Traders signing up under ASIC or CySEC-regulated branches benefit from negative balance protection and additional investor safeguards, such as ESMA’s compensation scheme. Furthermore, IC Markets prioritizes financial security by maintaining all client funds in segregated bank accounts, effectively safeguarding against the misuse of trader deposits.

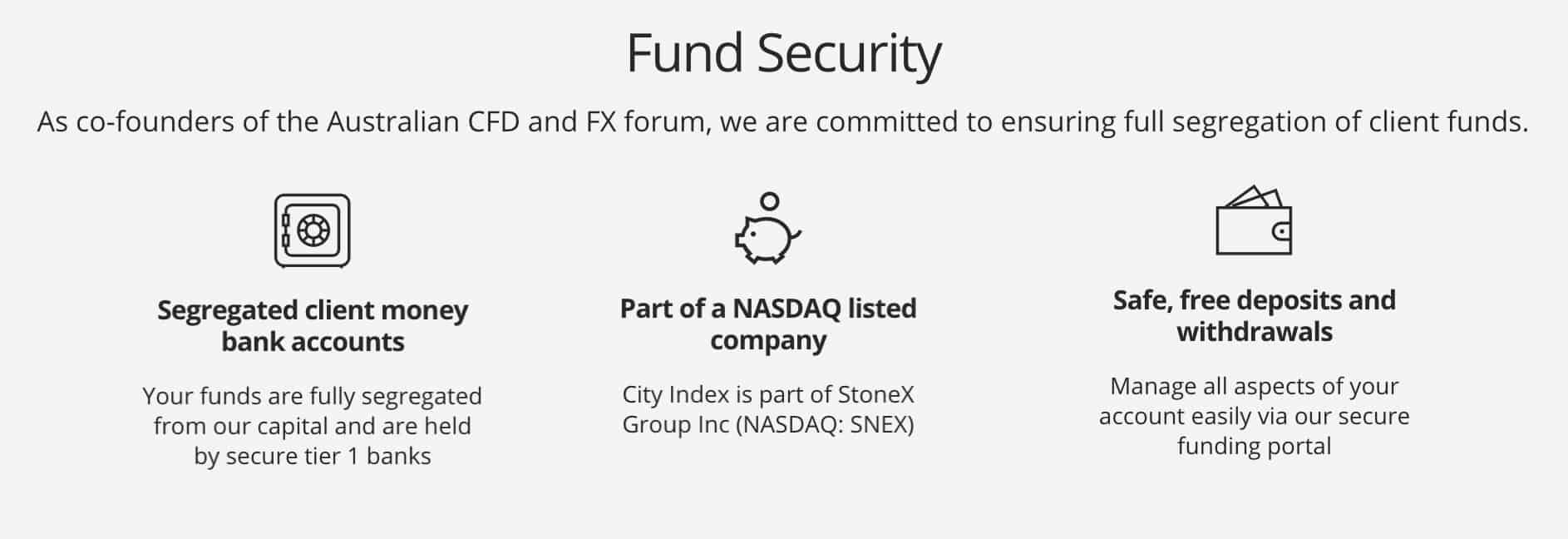

City Index, established in 1983, has built a strong reputation as a reliable market maker broker. City Index, a subsidiary of GAIN Capital—a publicly traded firm on the New York Stock Exchange—meets stringent regulatory disclosure standards. The broker is governed by three prominent financial authorities: the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Monetary Authority of Singapore (MAS). While all three regulators require the segregation of client funds, only the FCA offers essential safeguards such as negative balance protection and investor compensation policies, delivering an extra level of security for traders in the UK.

IC Markets and City Index both provide traders with a regulated and transparent trading environment, yet the extent of investor protection differs based on the regulatory jurisdiction. Traders who prioritize FCA-backed safeguards may prefer City Index, whereas those seeking an ECN trading experience with enticingly competitive spreads are likely to favor IC Markets. Regardless of preference, both brokers remain reputable choices in the forex trading industry.

| IC Markets | City Index | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) CYSEC (Cyprus) | ASIC (Australia) FCA (UK) MAS (Singapore) |

| Tier 2 Regulation | ||

| Tier 3 Regulation | FSA-S (Seychelles) SCB (Bahamas) |

Reviews

IC Markets enjoys a strong reputation on Trustpilot, boasting an impressive score of 4.8 out of 5 from over 46,000 reviews, reflecting high customer satisfaction, especially for its low spreads and fast execution.

City Index, in contrast, has a Trustpilot rating of 4.2 out of 5 based on around 400 reviews, with users expressing mixed experiences regarding platform reliability and customer support.

Our Stronger Trust and Regulation Verdict

It’s a deadlock for both brokers, IC Markets and City Index, in this category, this is in light of their stronger trust and regulation.

City Index ReviewVisit City Index

Your capital is at risk ‘68% of retail CFD accounts lose money with City Index’

6. Most Popular Broker – IC Markets

IC Markets gets searched on Google more than City Index. On average, IC Markets sees around 246,000 branded searches each month, while City Index gets about 9,900 — that’s 95% fewer.

| Country | IC Markets | City Index |

|---|---|---|

| United Kingdom | 33,100 | 4,400 |

| South Africa | 9,900 | 90 |

| India | 8,100 | 590 |

| Thailand | 8,100 | 40 |

| Vietnam | 8,100 | 40 |

| Spain | 6,600 | 50 |

| United States | 6,600 | 390 |

| Australia | 6,600 | 1,000 |

| Germany | 5,400 | 140 |

| Pakistan | 5,400 | 40 |

| France | 4,400 | 70 |

| United Arab Emirates | 4,400 | 40 |

| Brazil | 4,400 | 40 |

| Morocco | 4,400 | 20 |

| Italy | 3,600 | 50 |

| Colombia | 3,600 | 20 |

| Malaysia | 3,600 | 110 |

| Singapore | 3,600 | 720 |

| Indonesia | 3,600 | 90 |

| Nigeria | 3,600 | 70 |

| Poland | 2,900 | 90 |

| Sri Lanka | 2,900 | 10 |

| Netherlands | 2,400 | 40 |

| Mexico | 2,400 | 10 |

| Philippines | 2,400 | 30 |

| Canada | 2,400 | 50 |

| Hong Kong | 2,400 | 40 |

| Algeria | 2,400 | 10 |

| Kenya | 2,400 | 30 |

| Saudi Arabia | 1,900 | 20 |

| Bangladesh | 1,900 | 20 |

| Switzerland | 1,600 | 30 |

| Peru | 1,600 | 10 |

| Egypt | 1,600 | 20 |

| Argentina | 1,300 | 10 |

| Sweden | 1,300 | 40 |

| Turkey | 1,300 | 50 |

| Japan | 1,300 | 90 |

| Taiwan | 1,000 | 50 |

| Portugal | 1,000 | 30 |

| Ecuador | 1,000 | 10 |

| Dominican Republic | 1,000 | 10 |

| Uzbekistan | 1,000 | 10 |

| Ireland | 880 | 30 |

| Cyprus | 880 | 20 |

| Ghana | 880 | 10 |

| Austria | 720 | 10 |

| Greece | 720 | 20 |

| Chile | 720 | 10 |

| Venezuela | 720 | 10 |

| Uganda | 720 | 10 |

| Ethiopia | 720 | 10 |

| Mongolia | 720 | 10 |

| Jordan | 590 | 10 |

| Mauritius | 480 | 10 |

| Costa Rica | 390 | 10 |

| Tanzania | 320 | 10 |

| Bolivia | 260 | 10 |

| Panama | 260 | 10 |

| Botswana | 260 | 10 |

| New Zealand | 210 | 10 |

| Cambodia | 170 | 10 |

33,100 1st | |

4,400 2nd | |

9,900 3rd | |

90 4th | |

8,100 5th | |

590 6th | |

8,100 7th | |

40 8th |

Similarweb shows a similar story when it comes to February 2024 website visits with IC Markets receiving 2,425,000 visits vs. 216,000 for City Index.

Our Most Popular Broker Verdict

IC Markets is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – A Tie

In forex and CFD trading, access to a broad selection of financial instruments is key to building a well-diversified portfolio. Brokers with diverse assets—forex, commodities, indices, and cryptocurrencies—offer traders flexibility in varying market conditions. This variety helps capitalize on opportunities, hedge risks, and adapt strategies, enhancing the overall trading experience.

| CFDs | IC Markets | City Index |

|---|---|---|

| Forex Pairs | 61 | 84 |

| Indices | 25 | 40+ |

| Commodities | 4 Metals (Gold vs 6 currencies) (Silver vs 3 currencies) 8 Softs 5 Energies | 6 Metals 8 Energies 13 Softs |

| Cryptocurrencies | 23 | 5+ |

| Share CFDs | 2100+ | 4700+ |

| ETFs | No | 4 |

| Bonds | 9 | 11 |

| Futures | Yes | No |

| Treasuries | 9 | 11 |

| Investments | Yes | No |

A broker’s product offering plays a vital role for traders in pursuit of diverse market opportunities. IC Markets and City Index offer an extensive selection of forex and CFD instruments, providing traders with access to a wide variety of asset classes.Although both brokers provide competitive trading environments, they each possess unique strengths that cater to different trading styles. Each broker provides a diverse range of forex pairs, indices, commodities, and cryptocurrencies, thoughtfully designed to meet the unique strategies and risk preferences of different traders.

IC Markets stands out as a well-rounded broker, offering a broad range of forex pairs, cryptocurrencies, and indices. Traders have the opportunity to engage with a wide range of currency pairs, including major, minor, and exotic options, alongside premier indices such as the FTSE 100 and Nasdaq 100.Crypto enthusiasts will appreciate the availability of Bitcoin, Ethereum, and other digital assets, allowing them to capitalize on market volatility. The broker’s diverse selection ensures traders have the flexibility to execute multiple strategies across different financial instruments.

On the other hand, City Index excels in share CFDs, boasting thousands of stocks from global markets.Traders focused on equities will find City Index to be an attractive option, as it offers access to leading companies across diverse sectors. Furthermore, the broker boasts a robust selection of commodities, bonds, futures, and interest rate instruments, making it an excellent choice for those seeking alternative investment opportunities. This diversified product selection makes City Index particularly attractive to those who want to trade beyond forex and indices.

Although IC Markets and City Index offer a wide range of services, they both lack exchange-traded funds (ETFs), which could be a crucial factor for traders looking to gain exposure to diversified investment portfolios. However, both brokers compensate with their unique strengths, making them competitive choices depending on a trader’s specific market focus. Whether focusing on forex and cryptocurrency trading or engaging with share CFDs and futures, both IC Markets and City Index provide a comprehensive and enriching trading environment for both retail and professional traders.

Our Top Product Range and CFD Markets Verdict

Once again, it’s a stalemate for both IC Markets and City Index, thanks to their top product range and CFD markets.

City Index ReviewVisit City Index

Your capital is at risk ‘68% of retail CFD accounts lose money with City Index’

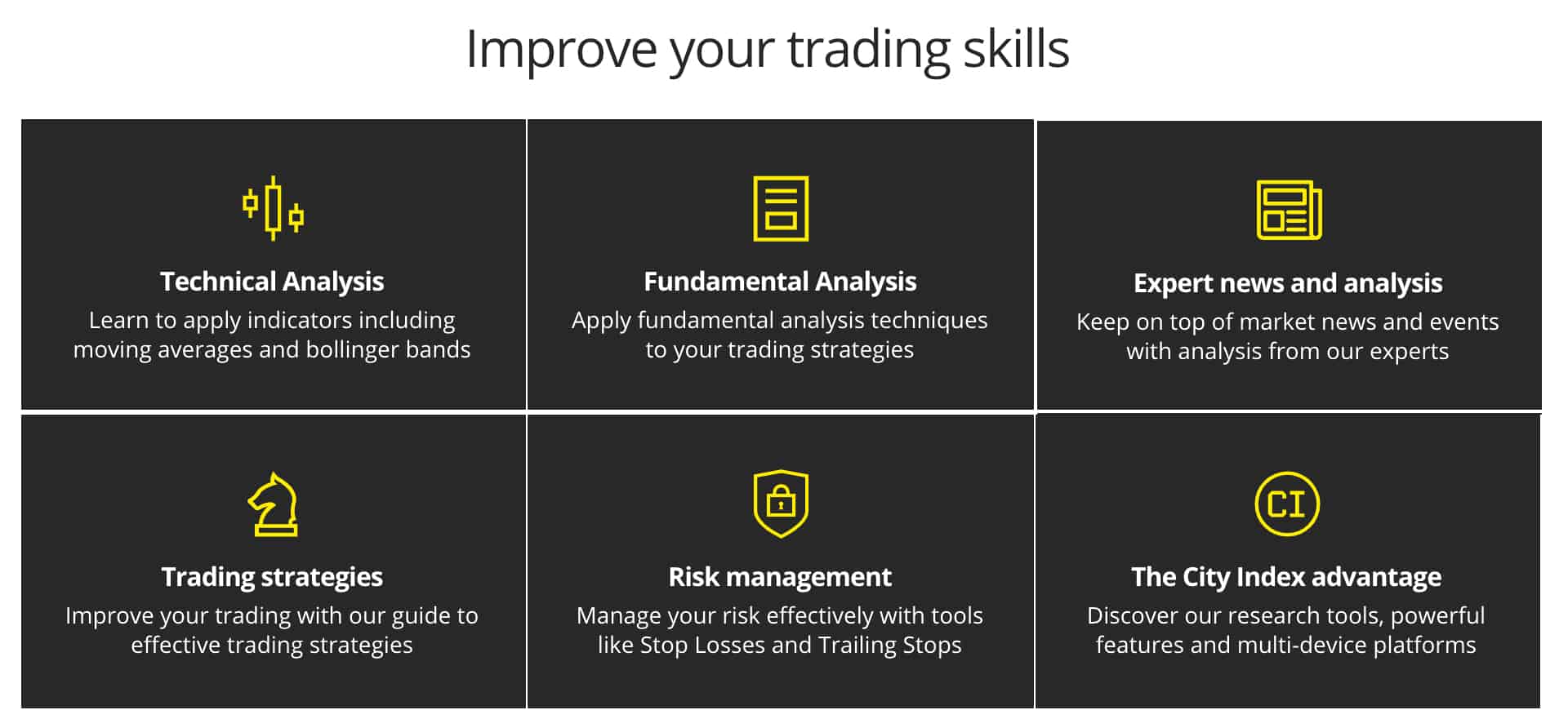

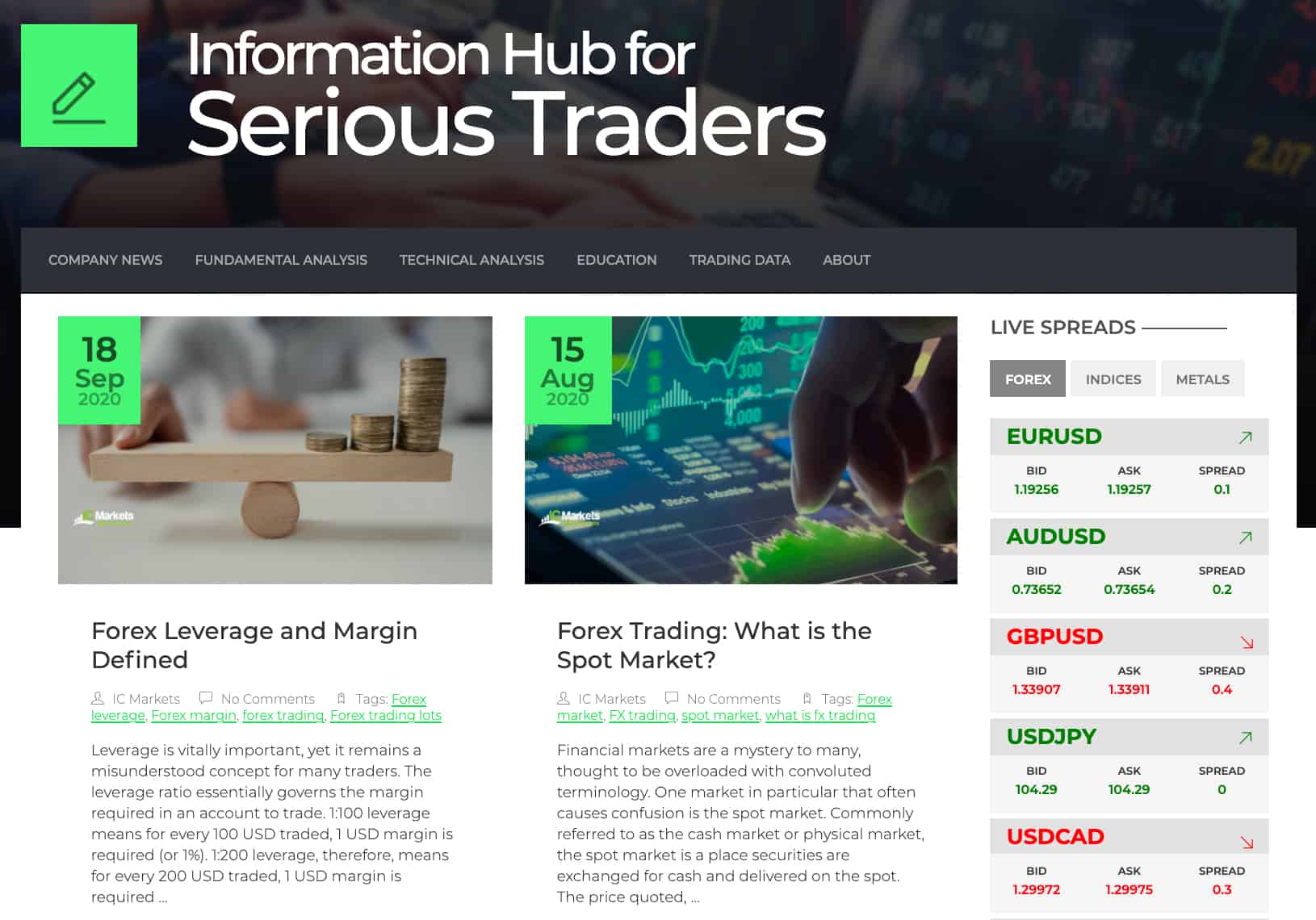

8. Superior Educational Resources – IC Markets

In forex trading, knowledge is essential. Quality educational resources shape a trader’s development, from beginners to experienced traders. Brokers providing webinars, articles, tutorials, and courses equip traders to make informed decisions confidently. A solid educational foundation boosts trading skills and long-term adaptability. Access to such content helps traders stay updated on trends, improve risk management, and enhance market understanding, increasing their chances of success.

Educational resources are essential for traders aiming to refine their skills and maintain a competitive edge in the constantly changing forex market. Both IC Markets and City Index understand this necessity and have developed comprehensive learning materials to support their clients. Traders on both platforms benefit from an extensive array of educational resources, including webinars, video tutorials, articles, and seminars, all aimed at significantly improving their trading skills. Additionally, both brokers offer demo accounts, allowing users to practice trading strategies in a risk-free environment before committing real capital.

Where IC Markets sets itself apart is in the breadth of its educational offerings. Unlike City Index, IC Markets provides E-books and structured courses, giving traders a more in-depth and structured learning experience. These supplementary resources are invaluable for newcomers seeking a comprehensive step-by-step guide to forex trading, as well as for seasoned traders aiming to hone and enhance their strategies. This advantage makes IC Markets a slightly stronger choice for those who prioritize ongoing education in their trading journey.

City Index, while lacking in E-books and courses, still delivers a robust selection of learning tools. The broker regularly hosts seminars featuring industry experts, ensuring that traders gain valuable market insights and professional guidance. For traders who value direct engagement and live interactions, these seminars serve as an outstanding opportunity to broaden their knowledge and expertise.

Both brokers acknowledge the critical role of education in forex trading and offer essential resources to empower traders in navigating the markets effectively. However, for those seeking a more structured and comprehensive learning experience, IC Markets’ inclusion of E-books and courses gives it a slight edge in the realm of trader education.

Our Superior Educational Resources Verdict

IC Markets is having its day in the sun, thanks to their superior educational resources.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

9. Superior Customer Service – IC Markets

In forex trading, reliable customer support is crucial. A broker’s timely, knowledgeable assistance helps traders confidently tackle challenges. Effective support through 24/7 live chat, phone, or email fosters trust and enhances the trading experience. For traders seeking long-term success, a responsive support team is essential.

Customer support is vital to a trader’s experience, and IC Markets excels in this regard by providing 24/7 assistance through phone, live chat, and email. This ensures that traders can access timely support, regardless of market hours or time zones.

On the other hand, City Index falls slightly behind, providing customer service only five days a week, 24 hours a day. While still reliable, this limitation may be a disadvantage for traders who need immediate support over the weekend when markets remain active in certain regions.

| Feature | IC Markets | City Index |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/5 |

| Multilingual Support | Yes | Yes |

When it comes to educational resources, both brokers offer valuable materials to help traders enhance their knowledge. City Index provides free access to its trading academy, which includes structured courses covering fundamental and technical analysis.

IC Markets provides an extensive array of educational resources, featuring trading tutorials, engaging video lessons, and a thorough collection of archived webinars. Their information hub covers essential trading topics such as risk management, trading psychology, and platform tutorials for MetaTrader 4. IC Markets offers an extensive library of educational resources, perfectly designed for both novice and seasoned traders eager to sharpen their strategies and stay updated on the latest market trends.

Our Superior Customer Service Verdict

IC Markets is on top of the world right now, this is in light of their superior customer service.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

10. Better Funding Options – IC Markets

Access to a wide array of convenient funding options is truly important for traders seeking to manage their accounts effortlessly. Brokers that provide various deposit and withdrawal methods—including traditional bank transfers, credit and debit cards, and cutting-edge digital wallets like PayPal, Skrill, and Neteller—enhance the overall trading experience. Additionally, some platforms accommodate cryptocurrency transactions, aligning with the increasing demand for decentralized finance. With low or no transaction fees and rapid processing times, traders can concentrate on executing trades without facing delays or financial strain. Opting for a broker with outstanding funding options can greatly boost both trading efficiency and financial flexibility.

IC Markets and City Index recognize the crucial role that seamless and efficient funding options play in enhancing the trading experience, enabling traders to easily deposit and withdraw funds. As a globally respected forex broker, IC Markets offers an extensive array of payment methods. Traders can choose from bank transfers, credit and debit cards, and widely used e-wallets like PayPal, Skrill, and Neteller for their transactions. Additionally, IC Markets offers support for multiple currencies, making transactions smoother for international traders. With rapid processing times and minimal fees, IC Markets ensures that traders can manage their capital efficiently without unnecessary delays.

City Index, renowned for its robust presence in the UK and other significant markets, offers a diverse array of funding options specifically designed to cater to its clientele. Traders can fund their accounts using bank transfers, credit and debit cards, and secure online banking services. Although City Index doesn’t provide as many e-wallet options as IC Markets, it makes up for it with a seamless deposit and withdrawal process that prioritizes reliability and transparency. Both brokers prioritize financial security and regulatory compliance, reinforcing trader confidence in managing their funds effectively.

The table below provides a comprehensive comparison of the funding options available with both brokers:

| Funding Option | IC Markets | City Index |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | Yes |

| Skrill | Yes | No |

| Neteller | Yes | No |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Our Better Funding Options Verdict

Based on our dedicated team’s in-depth research, IC Markets truly excels in this niche by the reason of better funding option.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

11. Lower Minimum Deposit – City Index

For traders, brokers with lower minimum deposits in forex trading increase accessibility for all traders, especially beginners with limited capital. This attracts more participants, allowing them to gain real-world experience and develop strategies. Additionally, it provides flexibility to test various accounts and conditions with minimal risk, promoting responsible risk management as traders gradually invest more as they gain confidence.

City Index distinguishes itself with a remarkable $0 minimum deposit, positioning it as one of the most accessible brokerages for traders eager to venture into the forex market without a hefty financial obligation. Although immediate funding of accounts is not mandatory, a minimum deposit of $50 may be required for certain payment methods, such as credit cards or PayPal. This flexible approach is particularly beneficial for beginners or those testing the platform before committing larger amounts. By eliminating high entry barriers, City Index appeals to a broader range of traders, fostering greater market participation.

The table below shows City Index’s minimum deposit by region and payment method.

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £100 Minimum Deposit | $100 Minimum Deposit | €100 Minimum Deposit | $150 |

| Paypal | £50 Minimum Deposit | $50 Minimum Deposit | €50 Minimum Deposit | $150 |

| Bank Wire | £0 Minimum Deposit | $0 Minimum Deposit | €0 Minimum Deposit | $150 |

| Skrill | N/A | N/A | N/A | N/A |

In contrast, IC Markets has established a minimum deposit requirement of $200. Though this amount is higher, it guarantees that traders possess adequate capital to manage their positions effectively and meet margin requirements. This standardization across all payment methods provides consistency and transparency for traders, particularly those engaged in high-frequency or institutional trading. While the elevated deposit requirement might discourage some newcomers, IC Markets stands out as a favored option for seasoned traders due to its dedication to delivering institutional-grade liquidity and exceptionally tight spreads.

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £200 Minimum Deposit | $200 Minimum Deposit | €200 Minimum Deposit | $200 |

| Paypal | £200 Minimum Deposit | $200 Minimum Deposit | €200 Minimum Deposit | $200 |

| Bank Wire | £200 Minimum Deposit | $200 Minimum Deposit | €200 Minimum Deposit | $200 |

| Skrill | £200 Minimum Deposit | $200 Minimum Deposit | €200 Minimum Deposit | $200 |

While the minimum deposit is an important factor when choosing a broker, it should not be the sole consideration. The factors that significantly influence the selection of a broker in line with your trading strategy include trading conditions, platform features, spreads, and execution speed. For instance, City Index offers a lower entry barrier, making it an attractive option for those seeking a flexible beginning. In contrast, IC Markets, with its higher deposit requirement, is tailored for traders who prioritize deep liquidity and advanced execution capabilities. Ultimately, the right broker depends on your trading goals, capital availability, and preferred trading conditions.

In summary, here are both brokers’ deposit requirements and recommendations:

| Minimum Deposit | Recommended Deposit | |

| IC Markets | $200 | $200 |

| City Index | $0 | $150 |

Our Lower Minimum Deposit Verdict

Without a doubt, City Index outperforms the challenger in this cataegory thanks to their lower minimum deposit.

City Index ReviewVisit City Index

Your capital is at risk ‘68% of retail CFD accounts lose money with City Index’

So Is City Index or IC Markets The Best Broker?

IC Markets emerges as the winner in almost all these categories by surpassing City Index in nearly all key areas we assessed. The table below summarises the key information leading to this verdict:

| Categories | IC Markets | City Index |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platform | Yes | No |

| Superior Accounts And Features | Yes | No |

| Best Trading Experience And Ease | Yes | No |

| Stronger Trust And Regulation | Yes | Yes |

| Top Product Range And CFD Markets | Yes | Yes |

| Superior Educational Resources | Yes | No |

| Superior Customer Service | Yes | No |

| Better Funding Options | Yes | No |

| Lower Minimum Deposit | No | Yes |

IC Markets: Best For Beginner Traders

IC Markets is the ideal choice for beginner traders due to its comprehensive educational resources and user-friendly platform.

IC Markets: Best For Experienced Traders

IC Markets stands out as the preferred broker for experienced traders, offering advanced tools and a wide range of funding options.

FAQs Comparing IC Markets Vs City Index

Does City Index or IC Markets Have Lower Costs?

IC Markets generally offers lower costs compared to City Index. They are renowned for their competitive spreads, especially in major currency pairs. For instance, the EUR/USD spread starts from just 0.1 pips. For a deeper dive into low commission brokers, you can check out this comprehensive guide on Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both City Index and IC Markets support MetaTrader 4, but IC Markets is often preferred for its enhanced MT4 features and tools. They offer a seamless trading experience with faster execution speeds. If you’re keen on exploring more about MT4 brokers, here’s a list of the best MT4 brokers to consider.

Which Broker Offers Social Trading?

IC Markets offers social trading features, allowing traders to copy strategies from experienced traders. This feature is beneficial for those new to trading or those looking to diversify their strategies. To understand more about the world of social trading, you might find this guide on the best social trading platforms quite insightful.

Does Either Broker Offer Spread Betting?

City Index offers spread betting, a popular form of trading in the UK. This allows traders to bet on the direction of market movements without owning the underlying asset. For those interested in exploring spread betting further, here’s a comprehensive guide on the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, IC Markets is the superior choice for Australian forex traders. Not only is IC Markets ASIC regulated, ensuring a high level of trust and security, but it was also founded in Australia. This gives them a deep understanding of the local market and the needs of Australian traders. For those looking to delve deeper into the Australian forex market, this Best Forex Brokers In Australia offers valuable insights.

What Broker is Superior For UK Forex Traders?

From my perspective, City Index stands out for UK forex traders. Being FCA regulated, City Index ensures a high level of security and trustworthiness. Additionally, it was founded in the UK, which means they have a profound understanding of the UK trading environment and its nuances. For those keen on exploring more about the UK forex market, here’s a list of the Best Forex Brokers In UK.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert