IC Markets vs Plus500: Which One Is Best?

IC Markets and Plus500 are both exceptional choices, boasting impressive features and platforms that attract traders’ attention. However, our previous reviews have revealed that only one of them truly excels above the rest. Curious to find out which one it is? Join us for a comprehensive analysis.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors between IC Markets and Plus500. Here are nine key differences:

- IC Markets offers consistently tighter spreads, meaning lower trading costs.

- IC Markets provides a choice of MetaTrader 4, MetaTrader 5, and cTrader platforms.

- IC Markets’ Raw ECN Account features raw spreads from 0.0 pips and a commission of USD$3.5 per 100k traded.

- IC Markets emphasises execution speed and technology to manage slippage risks.

- IC Markets is regulated by ASIC, CySEC, and FSA, offering leverage up to 500:1.

- Plus500 offers a proprietary platform.

- Plus500 offers singular account type with no commission.

- Plus500 is regulated by multiple entities, including ASIC and FCA, with a maximum leverage of 300:1.

- Plus500 offers guaranteed stop-loss.

1. Lowest Spreads And Fees – IC Markets

In forex trading, minimizing costs can significantly impact your success. IC Markets and Plus500 excel with some of the lowest spreads and fees in the industry, making trading more accessible—particularly for frequent traders. Reduced spreads lead to lower transaction expenses, which can enhance profitability. Moreover, their competitive fees draw in a larger number of traders, boosting overall market activity. This powerful combination not only improves the trading experience but also makes forex trading more attractive to all participants. In this review, we will analyze how these brokers compare in terms of costs and assess whether they genuinely fulfill their commitment to affordable trading.

IC Markets, established in 2007 and headquartered in Australia, is a leading forex and CFD broker renowned worldwide for its competitive pricing, extensive selection of trading instruments, and cutting-edge trading technology. It is regulated by several top-tier financial authorities, including ASIC, CySEC, and FSA, and serves over 180,000 clients from more than 200 countries.

Plus500, established in 2008 and based in Israel, is a leading brokerage specializing in CFD trading. It boasts over 25 million registered traders across 50 countries and offers an intuitive proprietary platform. Plus500 is regulated by reputable entities such as the FCA, ASIC, and CySEC.

Spreads

IC Markets provides exceptionally tight spreads, featuring a EUR/USD spread of 0.82, while Plus500’s is 1.8, compared to an industry average of 1.2. For AUD/USD, IC Markets provides a spread of 0.83, while Plus500 offers 1.1, with the industry average being 1.5. IC Markets boasts an impressive average spread of 1.09, considerably outperforming Plus500, which has a spread of 1.75 that exceeds the industry average of 1.6.

| Standard Account | IC Markets Spreads | Plus500 Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.09 | 1.75 | 1.6 |

| EUR/USD | 0.82 | 1.8 | 1.2 |

| USD/JPY | 0.94 | 2.3 | 1.4 |

| GBP/USD | 1.03 | 2 | 1.6 |

| AUD/USD | 0.83 | 1.1 | 1.5 |

| USD/CAD | 1.05 | 2 | 1.8 |

| EUR/GBP | 1.27 | 1.6 | 1.5 |

| EUR/JPY | 1.3 | 4.1 | 1.9 |

| AUD/JPY | 1.5 | 4 | 2.1 |

Commission Levels

IC Markets charges a commission fee of $3.50 per trade, whereas Plus500 does not charge any commission fees. Plus500 sets a minimum deposit requirement of $100, though it recommends starting with $200. In contrast, IC Markets mandates both a minimum and recommended deposit of $200. Both brokers offer SWAP-free accounts and do not charge funding fees.

Standard Account Fees

For standard account fees, IC Markets offers a spread of 0.62 for EUR/USD and 0.77 for AUD/USD. In contrast, Plus500 has higher spreads, with 1.70 for EUR/USD and 1.40 for AUD/USD.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.00 | 1.00 | 1.27 | 1.20 | 1.10 |

| 0.90 | 1.00 | 1.50 | 1.60 | 1.70 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 1.20 | 1.30 | 1.30 | 1.50 | 1.10 |

| 1.18 | 1.45 | 1.40 | 1.49 | 1.60 |

| 1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

| 1.40 | 1.90 | 1.30 | 1.60 | 1.50 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 12/01/2025

Ultimately, IC Markets distinguishes itself with its tighter spreads and advantageous commission structure, positioning it as a compelling choice for traders in search of economical trading solutions. Plus500, on the other hand, offers a user-friendly platform with no commission fees, appealing to beginner traders. Both brokers are well-regulated and provide a range of trading instruments, ensuring a secure and diverse trading experience.

Our Lowest Spreads and Fees Verdict

Our dedicated experts surmises that IC Markets takes home the crown in this field due to their lowest spreads and fees.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

2. Better Trading Platform – IC Markets

In the world of forex trading, selecting the right platform is crucial for success. A premier trading platform provides advanced charting tools, real-time market data, and exceptionally fast execution speeds. It boasts user-friendly interfaces, extensive customization options, and robust security features. Furthermore, with support for automated and social trading, along with access to a diverse array of financial instruments, traders can approach the markets with assurance. Whether you’re just starting or are an experienced professional, the ideal platform empowers you to trade more intelligently and efficiently. In this review, we will explore IC Markets and Plus500 to determine which one emerges as the superior choice.

IC Markets, established in 2007 and based in Australia, is a renowned global forex and CFD broker celebrated for its attractive pricing, extensive selection of trading instruments, and cutting-edge trading technology. It is regulated by several top-tier financial authorities, including ASIC, CySEC, and FSA, and serves over 180,000 clients from more than 200 countries.

Founded in 2008 and headquartered in Israel, Plus500 has emerged as a premier brokerage firm specializing in CFD trading. With over 25 million registered traders in 50 countries, it delivers a user-friendly proprietary platform that enhances the trading experience. Plus500 is regulated by reputable entities such as the FCA, ASIC, and CySEC.

| Trading Platform | IC Markets | Plus500 |

|---|---|---|

| MetaTrader 4 | Yes | No |

| MetaTrader 5 | Yes | No |

| cTrader | Yes | No |

| TradingView | Yes | No |

| Copy Trading | Yes | No |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

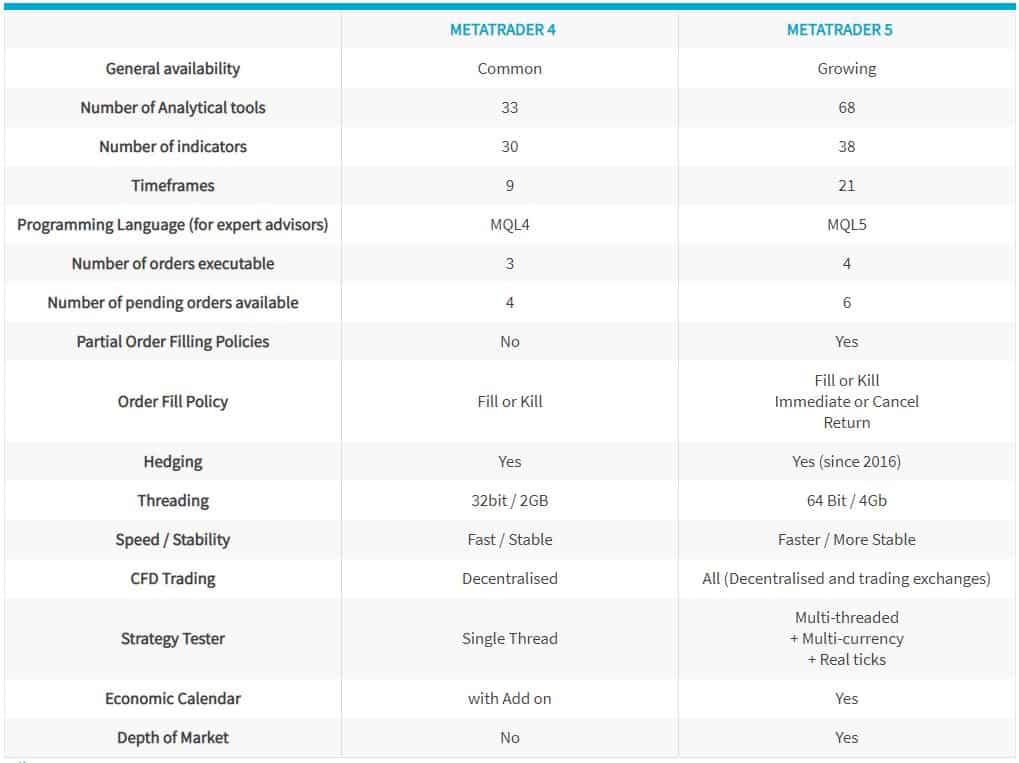

MetaTrader

IC Markets empowers its clients with a diverse selection of trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, each accessible via desktop, web, and mobile apps for both Android and Mac. MT4 continues to be favored for its user-friendly interface and robust community support, along with an extensive marketplace. Meanwhile, MT5 enhances the trading experience with improved features such as more detailed charts, advanced analytical tools, and the capability to trade an expanded range of CFDs, including stock CFDs. Additionally, IC Markets equips traders with sophisticated tools, boasting 20 unique features such as the Alarm Manager, Correlation Matrix, and Trade Simulator, ensuring a comprehensive trading experience.

Advanced Platforms

IC Markets’ cTrader platform is specifically designed for forex traders, boasting features such as depth of market, advanced take-profit and stop-loss levels, extensive customization options, and detachable charts. It also supports cAlgo, utilizing the C# programming language for automated trading. In contrast, Plus500 provides a proprietary trading platform that is accessible on iPhone/iPad, Android, Windows Mobile, Windows 10, and through its Web Trader interface. While this platform is user-friendly and intuitive, it does not support scalping, automated trading via EAs, or social trading functionalities.

product.

Copy Trading

IC Markets provides an excellent copy trading feature on its MetaTrader platforms, enabling traders to mimic the trades of experienced professionals. This functionality is especially advantageous for beginners eager to learn from seasoned experts. In contrast, Plus500 does not include copy trading options, concentrating instead on delivering a simple and user-friendly trading experience via its proprietary platform.

IC Markets excels with its extensive selection of trading platforms, including MetaTrader and cTrader, complemented by sophisticated trading tools and innovative copy trading features. On the other hand, Plus500, despite its absence of certain advanced functionalities, presents a highly user-friendly proprietary platform that is ideal for traders in search of a straightforward and intuitive trading experience. Both brokers are well-regulated and guarantee a secure trading environment, ensuring a trustworthy and diverse trading experience for users.

Our Better Trading Platform Verdict

Undeniably, IC Markets outshines the challenger in this category due to their better trading platform.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

3. Superior Accounts And Features – IC Markets

Looking for a forex broker that suits your trading style? IC Markets and Plus500 offer competitive spreads, low commissions, and advanced tools. They provide demo accounts, swap-free options, and various instruments, along with features like social trading and strong customer support. This review highlights what sets them apart to help you choose the best fit. Let’s begin!

IC Markets and Plus500 provide tailored trading solutions through their unique account types:

IC Markets Raw Spread Account: This account offers exceptional trading conditions with raw spreads beginning at 0.0 pips and an average of just 0.1 pips on EUR/USD pairs. A commission of $3.50 per lot per side is charged, and the minimum deposit required is $200. You can leverage your trades up to 500:1, depending on your regulatory jurisdiction. This account is versatile and accommodates a range of trading strategies, including scalping and the implementation of expert advisors.

Plus500 Account: Plus500 presents a streamlined trading experience with a single account type that boasts commission-free trading and competitive spreads starting at just 0.06 pips. A minimum deposit of $100 is required, and traders can enjoy leverage up to 300:1, adhering to regulatory guidelines. As a market maker, Plus500 serves as the counterparty to all trades, which may lead to slightly wider spreads when compared to ECN brokers.

IC Markets offers an impressive selection of trading platforms, including MetaTrader 4, MetaTrader 5, and cTrader, all optimized for a variety of devices. In contrast, Plus500 provides a proprietary platform that stands out for its user-friendly and intuitive design, though it may lack some advanced features such as support for expert advisors.

Risk Management: IC Markets prioritizes rapid execution speeds and cutting-edge technology to reduce risks such as slippage. Meanwhile, Plus500 provides a comprehensive range of risk management tools, including guaranteed stop-loss orders, a feature lacking in IC Markets’ offerings.

In noteworthy forex market developments, the Australian dollar (AUD) has plummeted to a near five-year low of 61.84 US cents. This decline is driven by factors such as looming global trade tensions and the strong performance of the U.S. economy. Analysts indicate that the Reserve Bank of Australia may contemplate interest rate cuts to bolster the economy amid these mounting challenges.

Traders engaged with EUR, AUD, and USD pairs must remain vigilant about key economic indicators and central bank policies. These factors can significantly influence trading strategies and contribute to market volatility.

| IC Markets | Plus500 | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | No |

| Swap Free Account | Yes | No |

| Active Traders | Yes | No |

| Spread Betting (UK) | No | No |

Our Superior Accounts and Features Verdict

IC Markets brings home the crown due to their superior accounts and features.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – IC Markets

Choosing the right trading platform is crucial. IC Markets and Plus500 offer advanced features, fast execution, and competitive spreads, along with user-friendly interfaces, solid customer support, and trading tools. Access to educational resources and risk management is important for both beginners and professionals. This review will compare these brokers to help you find the best fit for your trading style.

When it comes to trading platforms, both IC Markets and Plus500 offer unique advantages tailored to different trader preferences.

IC Markets shines with its robust support for the MetaTrader 5 (MT5) platform, acclaimed for its advanced features and flexibility. Traders can seamlessly access a diverse array of assets, including forex, stocks, commodities, and cryptocurrencies, all from one convenient platform. The MT5 platform boasts sophisticated charting tools, comprehensive technical analysis capabilities, and facilitates automated trading strategies, making it an ideal choice for both novice and seasoned traders alike. Moreover, IC Markets enhances the trading experience with competitive spreads starting at just 0.0 pips and minimal commission fees.

Plus500 boasts a proprietary trading platform that stands out for its user-friendly and intuitive interface. This platform facilitates a seamless trading experience across various devices, including web browsers, Windows PCs, smartphones, and tablets. With a keen emphasis on simplicity and ease of navigation, Plus500 is especially attractive to beginners. It features real-time quotes, interactive charts, and a suite of risk management tools, including guaranteed stop-loss orders, providing an added layer of protection for traders. Operating on a commission-free model with competitive spreads, Plus500 offers a diverse array of financial instruments, encompassing CFDs on forex, stocks, commodities, and cryptocurrencies.

In conclusion, IC Markets is the perfect choice for traders looking for a platform that offers advanced features, a diverse selection of tradable assets, and support for automated trading strategies. On the other hand, Plus500 is designed for those who value a user-friendly interface, an uncomplicated trading experience, and strong risk management tools. Ultimately, your decision between the two will hinge on your specific trading requirements and level of experience.

Our Best Trading Experience and Ease Verdict

Based on our team’s comprehensive testing and analysis, IC Markets ranks highest in this field owing it to their best trading experience and ease.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – Plus500

In forex trading, trust and regulation are crucial for a secure environment. Well-regulated brokers like IC Markets and Plus500 provide confidence through strict standards against fraud. This attracts more traders seeking reliable platforms. We’ll review their regulatory status, security measures, and overall trustworthiness to help you choose the right broker.

IC Markets Trust Score

Plus500 Trust Score

In this section, we see that Plus500 has a higher trust score of 71 over IC Markets’ 53.

IC Markets and Plus500 are both regulated by multiple authorities, providing different leverage options that vary according to jurisdiction.

IC Markets is regulated by:

- Australian Securities and Investments Commission (ASIC)

- Cyprus Securities and Exchange Commission (CySEC)

- Seychelles Financial Services Authority (FSA)

Under the regulations set by ASIC and CySEC, leverage is limited to a maximum of 30:1 for major forex pairs. In contrast, clients registered with the FSA in Seychelles can enjoy leverage of up to 500:1. This increased leverage is especially attractive to seasoned traders looking for enhanced market exposure.

Plus500 operates under several regulatory bodies, including:

- Australian Securities and Investments Commission (ASIC)

- Financial Conduct Authority (FCA) in the UK

- Cyprus Securities and Exchange Commission (CySEC)

- Financial Markets Authority (FMA) in New Zealand

- Monetary Authority of Singapore (MAS)

- Financial Sector Conduct Authority (FSCA) in South Africa

In these jurisdictions, leverage is typically limited to 30:1 for major forex pairs and 20:1 for minor pairs. Traders registered under the FSA (Seychelles) branch can access higher leverage, up to 300:1. Traders who meet certain criteria, including maintaining a portfolio of at least €500,000 and demonstrating a substantial history of trading activity, may be eligible to qualify as professional clients. This status allows them to access higher levels of leverage.

While higher leverage can amplify potential profits, it also increases the risk of significant losses. Both brokers implement risk management tools, including margin call systems and negative balance protection, to help safeguard traders’ funds. It’s essential for traders to recognize that these protective measures may not completely safeguard them from significant losses, particularly in highly volatile markets.

In recent forex market developments, the Australian dollar (AUD) has experienced notable fluctuations. The Reserve Bank of Australia (RBA) has recently lowered interest rates by 25 basis points to 4.10%, marking its first reduction since the 2020 pandemic.Despite this cut, the RBA signaled caution regarding further reductions. Following the announcement, the AUD steadied near two-month highs, trading at $0.6351. Analysts anticipate potential further cuts in the coming months, despite the RBA’s cautious stance.

Traders concentrating on EUR, AUD, and USD pairs must keep a close watch on economic indicators and central bank policies, as these factors can profoundly influence trading strategies and market volatility.

| IC Markets | Plus500 | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) CYSEC (Cyprus) | ASIC (Australia) FCA (UK) CYSEC (Cyprus) FMA (New Zealand) MAS (Singapore) |

| Tier 2 Regulation | DFSA (Dubai) EFSRA | |

| Tier 3 Regulation | FSA-S (Seychelles) SCB (Bahamas) | FSA-S (Seychelles) FSCA (South Africa) |

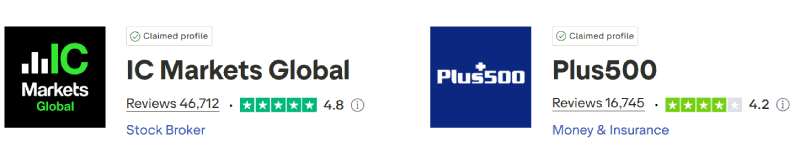

Reviews

As shown below, IC Markets holds an impressive rating of 4.8 out of 5, based on over 46,700 reviews. Plus500, on the other hand, has a solid rating of 4.2 out of 5, from over 16,700 reviews. IC Markets enjoys a stronger reputation on Trustpilot, with a higher score and more consistently positive feedback. Plus500 is generally well-regarded for ease of use but shows more variability in customer satisfaction.

Our Stronger Trust and Regulation Verdict

According to our team’s perspectives, Plus500 is having its moment in the spotlight due to their stronger trust and regulation.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

6. Most Popular Broker – Plus500

Plus500 and IC Markets each receive approximately 201,000 branded searches per month on Google, indicating similar levels of search interest

| Country | IC Markets | Plus500 |

|---|---|---|

| Poland | 3,600 | 18,100 |

| Thailand | 5,400 | 14,800 |

| India | 33,100 | 12,100 |

| Brazil | 6,600 | 9,900 |

| United Arab Emirates | 5,400 | 9,900 |

| Colombia | 6,600 | 6,600 |

| Pakistan | 5,400 | 6,600 |

| Hong Kong | 2,400 | 6,600 |

| Germany | 8,100 | 5,400 |

| Sweden | 1,600 | 5,400 |

| Canada | 880 | 3,600 |

| Austria | 720 | 3,600 |

| Peru | 4,400 | 2,900 |

| United Kingdom | 2,400 | 2,900 |

| Netherlands | 1,300 | 2,900 |

| Vietnam | 2,900 | 2,400 |

| Ghana | 590 | 2,400 |

| Mongolia | 210 | 1,900 |

| Bangladesh | 4,400 | 1,600 |

| Argentina | 8,100 | 1,300 |

| Italy | 1,600 | 1,300 |

| Indonesia | 3,600 | 1,000 |

| Spain | 1,300 | 1,000 |

| United States | 4,400 | 880 |

| Portugal | 880 | 880 |

| Panama | 260 | 880 |

| Greece | 720 | 720 |

| Taiwan | 2,400 | 480 |

| Jordan | 1,600 | 480 |

| Cyprus | 880 | 480 |

| Philippines | 5,400 | 320 |

| Singapore | 4,400 | 320 |

| Uzbekistan | 2,400 | 320 |

| Algeria | 1,600 | 320 |

| Bolivia | 1,600 | 320 |

| Turkey | 6,600 | 260 |

| Nigeria | 2,900 | 260 |

| Malaysia | 1,900 | 260 |

| Australia | 4,400 | 210 |

| Saudi Arabia | 2,400 | 210 |

| Ecuador | 2,400 | 210 |

| Morocco | 5,400 | 140 |

| Uruguay | 1,900 | 110 |

| Venezuela | 1,000 | 110 |

| Switzerland | 1,900 | 90 |

| Sri Lanka | 880 | 90 |

| Cambodia | 260 | 90 |

| Uganda | 260 | 90 |

| South Africa | 2,400 | 70 |

| Mexico | 1,600 | 70 |

| New Zealand | 590 | 70 |

| Dominican Republic | 390 | 70 |

| Ethiopia | 2,900 | 50 |

| Tanzania | 1,000 | 50 |

| Botswana | 880 | 50 |

| Costa Rica | 170 | 50 |

| Ireland | 1,000 | 40 |

| Chile | 720 | 20 |

| Kenya | 480 | 20 |

| Mauritius | 480 | 20 |

| Japan | 320 | 20 |

| Egypt | 260 | 20 |

| France | 590 | 10 |

18,100 1st | |

3,600 2nd | |

14,800 3rd | |

5,400 4th | |

12,100 5th | |

33,100 6th | |

9,900 7th | |

5,400 8th |

Similarweb shows a different story when it comes to August 2025 website visits with Plus500 receiving 6,096,000 visits vs. 2,290,000 for IC Markets.

Our Most Popular Broker Verdict

Plus500 is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

7. Top Product Range And CFD Markets – Plus500

A great trading experience includes tight spreads, fast execution, and a variety of markets. IC Markets and Plus500 provide diverse financial instruments like forex, commodities, indices, and cryptocurrencies, allowing traders to diversify portfolios. This review will evaluate their offerings to determine which broker best suits various trading strategies.

Plus500 offers over 2,800 CFD trading instruments, including cash and sector indices, commodities like Brent oil and gold, and cryptocurrencies such as Bitcoin and Ethereum. They provide CFDs on 1,800 shares from 20 markets, options, and ETFs for diverse portfolios. Recently, the EUR/USD pair gained slightly to 1.0450, while the AUD/USD fell below 0.6350 as the US Dollar strengthened. Traders should monitor these forex movements for strategic decisions.

IC Markets offers a range of CFD trading instruments, though slightly fewer than some competitors. Key offerings include:

Indices: 17 major indices (e.g., FTSE 100, S&P 200) with zero commissions.

Commodities: Over 20 CFDs in energies, precious metals, and soft commodities.

Cryptocurrencies: 10 options, including Bitcoin and Ethereum.

Bonds: 6 bonds with no commissions.

Futures: 4 global markets.

Shares CFDs: 2,100+ shares from major exchanges with specific fees.

In forex, EUR/USD shows modest gains around 1.0450 due to a weakening US Dollar, while AUD/USD stays near 0.6350 post a 25 basis point rate cut by the Reserve Bank of Australia. Traders must consider these factors and stay informed as market conditions can shift quickly.

Please note: the above CFDs are available to trade, yet the maximum leverage is capped. For example, you can trade major currency pairs with a maximum leverage of 30:1 under ASIC, FCA and CySEC regulations.

| CFDs | IC Markets | Plus500 |

|---|---|---|

| Forex Pairs | 61 | 65 |

| Indices | 25 | 65 |

| Commodities | 4 Metals (Gold vs 6 currencies) (Silver vs 3 currencies) 8 Softs 5 Energies | 5 Metals 7 Energies 10 Softs |

| Cryptocurrencies | 23 | 18 (+ Crypto 10) |

| Share CFDs | 2100+ | 11,000+ |

| ETFs | No | 97 |

| Bonds | 9 | - |

| Futures | Yes | No |

| Treasuries | 9 | - |

| Investments | Yes | No |

Our Top Product Range and CFD Markets Verdict

Evidently, Plus500 secures the top spot here thanks to their top product range and CFD Markets.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

8. Superior Educational Resources – IC Markets

Knowledge is important in forex trading. Quality educational resources enhance traders’ skills and confidence. From webinars to articles, continuous learning benefits all traders. This review examines IC Markets and Plus500’s educational support to help you choose the best broker for your trading needs.

Both IC Markets and Plus500 understand the vital role that educational resources play in empowering traders of all experience levels.

IC Markets:

- Educational Materials: Offers a comprehensive suite of resources, including webinars, video tutorials, and articles, catering to both beginners and advanced traders.

- Regular Updates: Maintains an updated blog featuring market analysis and news, helping traders stay informed about the latest market trends.

Plus500:

- User-Friendly Platform: Designed with simplicity in mind, making it accessible for beginners.

- Educational Content: Provides a range of video tutorials and a detailed FAQ section to address common trading questions.

Recent trends in the forex market show that the EUR/USD pair is trading below 1.0450, indicating a vulnerable Euro in anticipation of the upcoming Federal Open Market Committee (FOMC) minutes. Meanwhile, the AUD/USD pair remains bullish following an expected 25 basis point rate cut by the Reserve Bank of Australia (RBA) to 4.1%.

Both brokers deliver useful educational resources: IC Markets offers a wider array of materials, while Plus500 emphasizes user-friendly content. Together, they empower traders to navigate the forex market with enhanced confidence.

Our Superior Educational Resources Verdict

We can easily surmise that IC Markets dominates this arena owing it to their superior educational resources.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

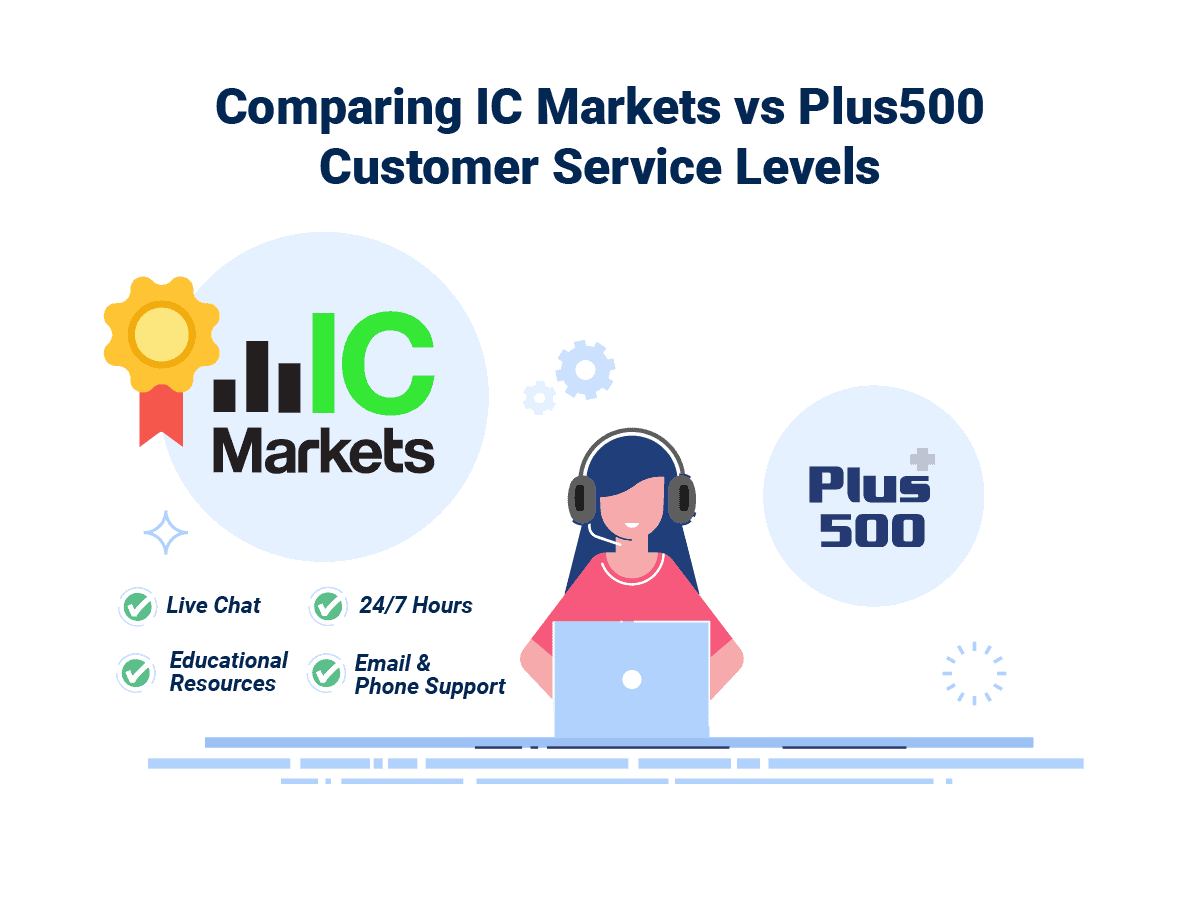

9. Superior Customer Service – IC Markets

Great customer service is crucial for a positive trading experience. Quick support from top forex brokers, available 24/7 via live chat, phone, and email, builds trader confidence. This review compares IC Markets and Plus500 on service quality, response times, and trader satisfaction to see which prioritizes traders best.

Every broker provides customer support via email and live chat around the clock throughout the week. Notably, IC Markets stands out by offering 24/7 phone support, while Plus500 does not provide any phone support at all.

| Feature | IC Markets | Plus500 |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/7 |

| Multilingual Support | Yes | No |

IC Markets and Plus500 both focus on providing traders with vital educational resources and exceptional customer support.

Educational Resources:

- IC Markets: Offers a comprehensive suite of educational materials, including webinars, video tutorials, and articles, catering to both beginners and advanced traders.

- Plus500: Provides a range of educational resources, such as videos, e-books, and webinars, to support beginner and intermediate traders.

Customer Support:

- IC Markets: Features a live chat service accessible through their platform and website, offering prompt assistance for both simple and complex inquiries.

- Plus500: Offers a live chat feature and an integrated email system within their web portal, providing timely support, though it may be less equipped to handle more technical questions.

Both brokers provide unlimited demo accounts, enabling traders to refine their strategies without any restrictions. Recently, the EUR/USD pair has been trading below 1.0450, indicating a weak Euro as we approach the release of the Federal Open Market Committee (FOMC) minutes.

The AUD/USD pair continues to show strength following the expected 25 basis point rate cut by the Reserve Bank of Australia (RBA), bringing the rate down to 4.1%.

In summary, IC Markets stands out for its comprehensive educational resources and exceptional customer support. In contrast, Plus500 delivers a user-friendly platform along with sufficient educational content and support, though there is room for improvement in its technical assistance services.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

10. Better Funding Options – IC Markets

Flexible funding options are crucial for forex trading accounts. Top brokers provide various methods like bank transfers, cards, e-wallets (PayPal, Skrill, Neteller), and cryptocurrencies, ideally with low or no fees. This allows traders to concentrate on trading. Quick, easy, and secure funding enhances the experience for deposits or withdrawals. This review compares IC Markets and Plus500 for the best funding options.

IC Markets and Plus500 have enhanced the trading experience for global users by offering a variety of convenient deposit and withdrawal options. IC Markets stands out with its extensive range, featuring bank transfers, credit/debit cards, and popular e-wallets such as PayPal, Skrill, and Neteller, ensuring flexibility for traders in various regions. Their commitment to rapid transaction processing significantly reduces downtime. On the other hand, Plus500 presents a more streamlined selection while still providing widely-used funding methods with efficient processing. Though both brokers prioritize cost-effective and user-friendly funding solutions, their strategies differ slightly. Let’s explore which platform delivers the superior funding experience for forex traders.

Here’s a table comparing the funding options of both brokers:

| Funding Option | IC Markets | Plus500 |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | Yes |

| Skrill | Yes | Yes |

| Neteller | Yes | No |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Our Better Funding Options Verdict

Based on our in-depth research, IC Markets is having its day in the sun on the account of their better funding options.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

11. Lower Minimum Deposit – Plus500

A lower minimum deposit enhances accessibility in forex trading for beginners, allowing small investments to gain experience without significant risk. This flexibility helps traders explore the market before increasing investments. In our review of IC Markets and Plus500, we’ll analyze their deposit requirements and determine which broker offers the best balance of affordability and trading opportunities for your style.

When comparing IC Markets and Plus500, one important distinction is the minimum deposit requirement, where Plus500 stands out by offering a lower threshold of just $100. This makes Plus500 significantly more accessible for traders who may have limited initial capital to invest compared to IC Markets, which requires a minimum deposit of $200. It’s worth noting that both brokers enforce these minimum deposit limits globally, regardless of the payment method selected by the trader. Thus, the choice between these two brokers can heavily influence a trader’s ability to enter the market based on their available funds.

Here’s a table showcasing the brokers’ minimum deposit amount and their recommended minimum deposit:

| Minimum Deposit | Recommended Deposit | |

| IC Markets | $200 | $200 |

| Plus500 | $100 | $100 |

Our Lower Minimum Deposit Verdict

Plus500 is on top of the world now by the reason of their lover minimum deposit.

*Your capital is at risk ‘80% of retail CFD accounts lose money’

Is Plus500 or IC Markets The Best Broker?

IC Markets, clearly, takes the cake in almost all category because it consistently outperforms Plus500 in several key areas, offering traders a comprehensive and reliable trading experience.

The table below summarises the key information leading to this verdict:

| Categories | IC Markets | Plus500 |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platform | Yes | No |

| Superior Accounts And Features | Yes | No |

| Best Trading Experience And Ease | Yes | No |

| Stronger Trust And Regulation | Yes | No |

| Top Product Range And CFD Markets | No | Yes |

| Superior Educational Resources | Yes | No |

| Superior Customer Service | Yes | No |

| Better Funding Options | Yes | No |

| Lower Minimum Deposit | No | Yes |

Plus500: Best For Beginner Traders

Plus500 is better suited for beginner traders due to its user-friendly platform and lower minimum deposit requirement.

IC Markets: Best For Experienced Traders

IC Markets stands out as the preferred choice for experienced traders, offering advanced tools, competitive spreads, and a solid trading environment.

FAQs Comparing IC Markets Vs Plus500

Does Plus500 or IC Markets Have Lower Costs?

IC Markets generally offers lower costs compared to Plus500. They are known for their tight spreads, especially on major currency pairs. For instance, the average spread for EUR/USD can go as low as 0.1 pips. This competitive pricing structure makes IC Markets a preferred choice for many traders. For a more detailed comparison of low commissions, you can check out this comprehensive guide of Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both IC Markets and Plus500 offer MetaTrader 4, but IC Markets is often preferred by traders for its advanced tools and seamless integration with the platform. Their version of MT4 comes with enhanced features and a range of customisable options. If you’re keen on exploring more about the best MT4 brokers, this detailed review of best MT4 brokers might be of interest.

Which Broker Offers Social Trading?

IC Markets offers social trading features, allowing traders to copy strategies from experienced traders. This feature is especially beneficial for beginners who are still finding their footing in the trading world. Social or copy trading bridges the gap between novice and expert traders, offering a platform for knowledge sharing and growth. For those interested in diving deeper into social trading platforms, here’s a comprehensive guide on the best social trading platforms.

Does Either Broker Offer Spread Betting?

Plus500 offers spread betting, while IC Markets does not. Spread betting is a popular trading method in the UK, allowing traders to speculate on the price movement of financial instruments without owning the underlying asset. It’s a tax-efficient way of trading, especially for UK residents. For those keen on exploring more about spread betting, this comprehensive guide on the best spread betting brokers in the UK is a great resource.

What Broker is Superior For Australian Forex Traders?

In my opinion, IC Markets stands out as the superior choice for Australian forex traders. Founded in Sydney, IC Markets is ASIC-regulated, ensuring a high level of trust and security for traders. Their deep liquidity, tight spreads, and advanced trading platforms make them a top pick for many Aussies. Plus500, while also offering a powerful trading environment, is headquartered overseas. If you’re an Australian trader looking for more insights, this detailed review of the Best Forex Brokers In Australia might be of interest.

What Broker is Superior For UK Forex Traders?

For UK traders, I personally believe Plus500 has a slight edge. They are FCA regulated, ensuring a high level of trust and adherence to stringent regulatory standards. While IC Markets offers a competitive trading environment, it’s not founded in the UK. Plus500’s user-friendly platform, combined with their comprehensive educational resources, makes them a preferred choice for many in the UK. For more insights on the best brokers in the UK, you might find this comprehensive guide on top UK trading platforms helpful.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

How long have IC Markets been around?

IC Markets was founded in Sydney, Australia in January 2007.

Do both allow scalping and hedging without limits?

NO, Plus500 does not allow scalping and only limited hedging. IC Markets are good for both scalping and hedging.

How do IC Markets and Plus500 differ in terms of regulation and investor protection?

Plus500 is a better choice for regulation if you are outside Australia or EU. They also provide a GSLO unlike IC Market but IC Markets is still a safe broker.