FXCM vs Pepperstone: Which One Is Best?

In this review, we will explore the features and platforms offered by two prominent brokers, Pepperstone and FXCM, to enhance the trading experience for users. Each broker has its own advantages and disadvantages, and ultimately, one will emerge as the victor in this comparison. Stay with us to discover who claims the title!

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs: 33:1

0-50k 400:1

50k+ 200:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors. Here are five key differences:

- Pepperstone offers extremely competitive spreads.

- Pepperstone’s Standard and Razor account spreads are the cream of the crop.

- Pepperstone provides a wider range of trading platforms, including MetaTrader 4, MetaTrader 5, and cTrader.

- Pepperstone offers a broader range of CFDs and currency pairs.

- FXCM charges based on volume and initial deposit

- FXCM offers platforms like TradeStation and NinjaTrader 8.

- FXCM’s Active Trader account, despite its discounts.

1. Lowest Spreads And Fees – A Tie

Welcome to our comprehensive review of Pepperstone and FXCM, where we will explore which broker offers the most favorable spreads and fees in the forex trading landscape. Attracting more clients via cost-effective trading options is essential for increasing trading volumes and boosting broker revenue through commissions. Competitive pricing also enhances a broker’s reputation, appealing to cost-conscious traders.

Spreads

In the forex trading industry, Pepperstone offers a spread of 0.1 pips for EUR/USD, while FXCM has a higher spread of 0.3 pips, still within the average industry standard of 0.28 pips. For AUD/USD, Pepperstone provides a spread of 0.2 pips compared to FXCM’s 0.4 pips, which is just below the average industry standard of 0.45 pips. Considering the overall average spread, Pepperstone stands at 0.47 pips, significantly lower than FXCM’s 0.82 pips, which exceeds the average industry spread of 0.72 pips.

Pepperstone’s competitive spreads extend across other currency pairs, offering traders a cost-effective trading environment. In contrast, FXCM’s higher spreads on various currency pairs make it less attractive for traders seeking lower trading costs. This comparison underscores Pepperstone’s edge in providing tight spreads, enhancing profitability and appealing to both new and seasoned forex traders

| RAW Account | Pepperstone Spreads | FXCM Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 0.47 | 0.82 | 0.75 |

| EUR/USD | 0.1 | 0.3 | 0.22 |

| USD/JPY | 0.2 | 0.6 | 0.38 |

| GBP/USD | 0.2 | 0.9 | 0.53 |

| AUD/USD | 0.1 | 0.4 | 0.47 |

| USD/CAD | 0.4 | 0.6 | 0.56 |

| EUR/GBP | 0.2 | 0.7 | 0.55 |

| EUR/JPY | 1.1 | 0.8 | 0.80 |

| AUD/JPY | 0.9 | 1.1 | 0.96 |

| USD/SGD | 1 | 2 | 2.29 |

Try the FXCM vs Pepperstone fee calculator below based on the most popular forex pairs and base currencies.

Commission Levels

In this section, we observe that Pepperstone provides a commission rate of $3.50 per lot for both USD and AUD, which is competitive and reasonable in the forex trading industry. For GBP, Pepperstone charges a commission of £2.25 per lot, while for EUR, the rate is €2.60 per lot. These rates reflect Pepperstone’s commitment to offering cost-effective trading conditions across multiple currencies. In comparison, FXCM’s rates are higher, with a $4.00 commission per lot for both USD and AUD. Notably, FXCM does not offer commission rates for GBP and EUR, limiting its appeal to traders who prefer these currencies. Overall, Pepperstone’s lower commission rates and broader currency options provide traders with a more attractive and cost-efficient trading environment.

| USD | AUD | GBP | EUR | |

|---|---|---|---|---|

| Pepperstone | $3.50 | $3.50 | £2.25 | €2.60 |

| FXCM | $4.00 | $4.00 | N/A | N/A |

Standard Account Fees

Let’s take a deeper discussion into the standard account fees for both Pepperstone and FXCM. Pepperstone offers competitive spreads, with 1.10 pips for EUR/USD and 1.20 pips for AUD/USD. These rates remain consistent and reasonable, extending to other pairs such as EUR/GBP, GBP/USD, and USD/JPY at 1.40 pips. This positions Pepperstone as an attractive option for traders looking for cost-effective trading conditions.

In comparison, FXCM’s spreads are notably higher. For EUR/USD, FXCM charges 1.30 pips, while AUD/USD is set at 1.70 pips. The spread for EUR/GBP is significantly higher at 2.10 pips, with GBP/USD and USD/JPY at 1.40 and 1.50 pips respectively. This indicates that FXCM’s standard account fees are generally less favorable when compared to Pepperstone.

Overall, Pepperstone’s lower spreads across multiple currency pairs make it a more appealing choice for traders seeking to minimize trading costs and enhance profitability. This difference underscores the importance of choosing a broker with competitive rates to optimize trading strategies and returns.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.10 | 1.10 | 1.30 | 1.30 | 1.30 |

| 0.70 | 0.80 | 1.30 | 1.00 | 1.00 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 1.20 | 1.30 | 1.30 | 1.50 | 1.10 |

| 1.20 | 1.41 | 1.47 | 1.47 | 1.61 |

| 1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

| 1.52 | 2.08 | 1.46 | 1.87 | 1.67 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

In conclusion, FXCM has a slight commission advantage over Pepperstone, but experts believe this diminishes due to slippage and order execution speed. Pepperstone offers better liquidity, quotes, and faster execution. Open a demo account to trade forex with competitive quotes and low spreads.

Our Lowest Spreads and Fees Verdict

Our team concludes that both brokers, Pepperstone and FXCM, excel in their performance. They are closely matched, offering some of the lowest spreads and fees in the market.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

2. Better Trading Platform – Pepperstone

For those traders who will commence on their trading journey, it’s vital to recognize the significance of an exceptional trading platform.A superior platform is essential for brokers, improving user experience with advanced tools, swift execution, and reliable performance. This attracts more clients, boosts trading volume, and enhances the broker’s reputation. It also enables traders to make informed decisions, leading to greater success and satisfaction.

| Trading Platform | Pepperstone | FXCM |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | No |

| cTrader | Yes | No |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

Our team has developed a questionnaire to help you find the best trading software for your style based on six simple questions.

Metatrader

Pepperstone and FXCM offer robust forex trading software on multiple devices, featuring MetaTrader 4 (MT4). The key difference is that FXCM operates as a market maker, potentially creating conflicts of interest, while Pepperstone uses an ECN model for greater transparency.

Pepperstone offers more platforms, including MetaTrader 5 and cTrader, known for advanced features, while FXCM provides TradeStation, MT4, NinjaTrader 8, and ZuluTrade. Overall, Pepperstone’s ECN model and varied platform options make it a preferred choice among traders.

Pepperstone and FXCM both offer desktop and mobile trading platforms. FXCM has an edge with its proprietary TradeStation, featuring a customizable dashboard for tracking important currency pairs. Meanwhile, Pepperstone provides the comprehensive MetaTrader 5 and the advanced cTrader platform, regarded as one of the best for FX and CFDs trading.

Advanced Platforms

At Compare Forex Brokers, our expert team has meticulously evaluated the technological solutions provided by Pepperstone and FXCM to determine which forex broker offers superior trading platforms. When comparing both brokers side by side, it’s clear that they each present a diverse array of specialized trading platforms tailored to meet a variety of trading styles. To identify which platform stands out with the best features, our industry professionals conducted a thorough analysis of each trading platform offered by these two brokers.

This included characteristics such as:

- Multiple Order Types

- Advanced Charting Capabilities

- Selection of Built-in Indicators

- Automation

- Execution Speed

- Stability and Functionality

In addition to the quality of the trading platform, our experts added extra value to the popularity element. Using a popular trading platform adds the extra benefit of getting the chance to interact with other fellow traders and exchange trading tips and tricks.

Copy Trading

FXCM’s ZuluTrade is a premier copy trading platform that empowers forex traders to adopt a variety of trading strategies crafted by professional traders worldwide. It serves as the perfect solution for mirror traders seeking to subscribe to forex trade signals that are seamlessly replicated in their personal trading accounts.

Pepperstone offers some of the best social trading platforms with 6 mirror trading tools and social trading platforms:

- ZuluTrade

- MetaTrader Trading Signals

- Myfxbook

- Mirror Trader

- RoboX

- DupliTrade

The head-to-head comparison revealed that both forex brokers offer powerful analytical tools. Pepperstone took extra points in our star scoring system due to its superior collection of technical tools that include:

- Autochartist

- Smart Trader Tools (28 trading Apps)

- Risk management tools

- Pattern recognition tools

- Professional Trade Terminal

- Sentiment Trader

- Market Scanners

- Expert Advisors

- And many more

Pepperstone’s trading platforms offer the most essential technological features that every Forex trader requires. While FXCM provides the MetaTrader 4 platform, it unfortunately lacks access to the advanced tools available with Autochartist. However, FXCM makes up for this deficiency with its acclaimed trading platform, TradeStation, which has garnered numerous awards for its superior performance.

FXCM TradeStation offers robust chart tools, including:

- Real Volume

- Market Depth

- Trader Sentiment

- Custom layouts

- News Calendar integrated directly into the platform

- Strategy backtesting and optimisation solution

In conclusion, Pepperstone provides advanced forex tools that help traders identify opportunities amidst market noise. In comparison, FXCM offers limited tools but still has exclusive chart options. Our experts deem Pepperstone the winner in this area.

Open a demo account with Pepperstone and FXCM to explore their trading platforms. Click below for exclusive offers.

Our Better Trading Platform Verdict

In this category, our team has easily surmised that Pepperstone ranks the highest owing it to their better trading platform.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

3. Superior Accounts and Features – Pepperstone

Brokers offering superior accounts and features are essential for traders seeking success in the trading industry. They attract diverse traders, from beginners to experts, by offering flexibility and advanced tools. This improves client satisfaction and loyalty, increasing trading volumes and enhancing the broker’s reputation and competitiveness.

We compared forex brokers Pepperstone and FXCM, focusing on their account types. Both offer standard accounts for retail traders with various CFD products. They also provide accounts for active traders, including scalpers and algorithmic traders, with risk management and backtesting tools which are:

- Razor Account offered by Pepperstone

- Active Trader account offered by FXCM

Below, you can study the similarities and differences that come with the Pepperstone Razor account and the FXCM Active Trader account.

| Pepperstone | FXCM | |

|---|---|---|

| Forex Leverage | 30:1 | 30:1 |

| Crypto Leverage | 2:1 | 2:1 |

| Minimum Deposit | $200 | $25,000 |

| Commissions per 1 St lot | $3.5 | $2.5 |

| Scalping Allowed | YES | YES |

| Hedging Allowed | YES | NO |

| Pepperstone | FXCM | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | Yes |

| Active Traders | Yes | Yes |

| Spread Betting (UK) | Yes | Yes |

We can easily assume here that in comparison to both retail and commission-based accounts, Pepperstone’s CFD trading is slightly more beneficial. FXCM scored lower for its high $25,000 minimum deposit for Active Trader accounts, exceeding Oanda’s $20,000 requirement. Pepperstone excels in accessibility to premium accounts, with IC Markets matching its low entry level for such accounts.

Our Superior Accounts and Features Verdict

We can easily see here that Pepperstone takes the gold in this category thanks to their superior accounts and features.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – Pepperstone

When it comes to trading, the experience and ease of use are paramount. In forex trading, a best trading experience combines advanced platforms, fast execution, competitive spreads, and strong customer support. These elements enable informed decisions and efficient trade management. A user-friendly interface, educational resources, and diverse tools enhance the trading experience, making it enjoyable and profitable.

Through our comprehensive analysis and extensive testing, we have uncovered some intriguing insights that may pique your interest. For example, Pepperstone excels with its MetaTrader 4 platform, celebrated for its intuitive interface and robust features. In contrast, FXCM provides platforms such as TradeStation, which, although highly capable, may pose a steeper learning curve for certain users.

- Pepperstone: Known for its MetaTrader 4 platform, offering a seamless trading experience.

- FXCM: Offers platforms like TradeStation, which are feature-rich but might require some getting used to.

- Best for Automation: Our tests showed that both Pepperstone and Eightcap have integrated with Capitalise.ai, enhancing automated trading capabilities.

- Fastest Execution: Blackbull emerged as the broker with the fastest execution in our tests, ensuring timely trades.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| Pepperstone | 77ms | 2/36 | 100ms | 10/36 |

| FXCM | 188ms | 28/36 | 189ms | 29/36 |

Our Best Trading Experience and Ease Verdict

Based on our teams research and findings, Pepperstone outshines in this category this is due to their best trading experience and ease.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – Pepperstone

In the industry of forex trading, brokers that prioritize trust and regulatory compliance play a vital role in creating a secure and transparent trading environment. This cultivates trader confidence, draws in a larger client base, and nurtures enduring relationships. Furthermore, it acts as a safeguard against fraud, protecting traders’ investments and significantly boosting the broker’s reputation and competitive edge in the market.

Pepperstone Trust Score

FXCM Trust Score

Regulation

When we speak of forex trading, trust and regulation are truly important. Both FXCM and Pepperstone have carved out their reputations as leading brokers, each with unique characteristics that set them apart. FXCM has a storied history, having supported retail and professional traders since 1999. Despite overcoming significant hurdles, including a bailout to prevent bankruptcy, it remains listed on the New York Stock Exchange (NYSE: FXCM) and is regulated across multiple jurisdictions.

Conversely, Pepperstone, based in Melbourne, Australia, is situated on the historic grounds of the Australian Stock Exchange (ASX). It benefits from robust regulation by both the Australian Securities and Investments Commission (ASIC) and the UK’s Financial Conduct Authority (FCA). This dual oversight positions Pepperstone among the elite, ensuring compliance with the stringent standards upheld by two of the world’s most esteemed regulatory bodies.

| FXCM | Pepperstone | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) CYSEC (Cyprus) CIRO (CANADA) BaFin (Germany) | ASIC (Australia) FCA (UK) BaFin (Germany) CYSEC (Cyprus) |

| Tier 2 Regulation | FSCA (South Africa) ISA (Israel) | DFSA (Dubai) |

| Tier 3 Regulation | SCB (Bahamas) CMA (Kenya) |

Reviews

As shown below, Pepperstone holds a strong Trustpilot rating of 4.5 out of 5, based on over 3,000 reviews. FXCM has a Trustpilot score of 4.3 out of 5, based on 720 reviews. Pepperstone has a higher Trustpilot rating than FXCM, reflecting stronger overall customer satisfaction. While FXCM remains a solid option but shows more mixed feedback.

Our Stronger Trust and Regulation Verdict

It is easy to see here that Pepperstone comes up trumps thanks to their stronger trust and regulation this is due to their dual regulation from ASIC and FCA, making them the more trusted and regulated broker.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

6. Most Popular Broker – Pepperstone

Pepperstone gets searched on Google more than FXCM. On average, Pepperstone sees around 135,000 branded searches each month, while FXCM gets about 33,100 — that’s 75% fewer.

| Country | Pepperstone | FXCM |

|---|---|---|

| Malaysia | 9,900 | 390 |

| Brazil | 8,100 | 1,300 |

| India | 6,600 | 2,400 |

| South Africa | 6,600 | 210 |

| Thailand | 5,400 | 720 |

| Indonesia | 5,400 | 880 |

| Colombia | 4,400 | 2,400 |

| Vietnam | 4,400 | 480 |

| United States | 4,400 | 1,300 |

| Turkey | 4,400 | 480 |

| Argentina | 3,600 | 1,900 |

| United Kingdom | 3,600 | 480 |

| Poland | 2,900 | 480 |

| Philippines | 2,900 | 880 |

| Germany | 2,900 | 720 |

| United Arab Emirates | 2,400 | 480 |

| Bangladesh | 2,400 | 320 |

| Egypt | 2,400 | 50 |

| Algeria | 1,900 | 390 |

| Peru | 1,600 | 1,000 |

| Mexico | 1,600 | 170 |

| Pakistan | 1,600 | 480 |

| Italy | 1,600 | 390 |

| Spain | 1,300 | 170 |

| Cyprus | 1,300 | 110 |

| Tanzania | 1,300 | 110 |

| Singapore | 1,300 | 720 |

| Nigeria | 1,300 | 590 |

| Hong Kong | 1,000 | 320 |

| Saudi Arabia | 1,000 | 320 |

| Morocco | 1,000 | 590 |

| Venezuela | 1,000 | 90 |

| France | 1,000 | 20 |

| Ecuador | 880 | 210 |

| Uzbekistan | 880 | 880 |

| Canada | 720 | 90 |

| Netherlands | 720 | 110 |

| Australia | 720 | 210 |

| Portugal | 590 | 110 |

| Chile | 590 | 70 |

| Japan | 590 | 50 |

| Jordan | 480 | 1,000 |

| Taiwan | 480 | 210 |

| Sri Lanka | 480 | 260 |

| Bolivia | 480 | 260 |

| Dominican Republic | 480 | 30 |

| Kenya | 480 | 40 |

| Sweden | 390 | 110 |

| Switzerland | 390 | 110 |

| Ghana | 390 | 90 |

| Uruguay | 390 | 170 |

| Cambodia | 390 | 140 |

| Uganda | 390 | 50 |

| Ethiopia | 320 | 70 |

| Botswana | 320 | 70 |

| Costa Rica | 320 | 20 |

| Austria | 260 | 170 |

| Greece | 260 | 50 |

| Ireland | 210 | 70 |

| Mongolia | 210 | 50 |

| New Zealand | 210 | 40 |

| Panama | 170 | 30 |

| Mauritius | 170 | 10 |

9,900 1st | |

390 2nd | |

6,600 3rd | |

2,400 4th | |

4,400 5th | |

2,400 6th | |

3,600 7th | |

1,900 8th |

Similarweb shows a similar story when it comes to August 2025 website visits with Pepperstone receiving 1,474,000 visits vs. 354,426 for FXCM.

Our Most Popular Broker Verdict

Pepperstone is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – Pepperstone

A diverse range of CFD products and access to various financial markets are essential for forex trading. Diversity allows traders to expand portfolios and manage risks, enhancing profit potential through varying market conditions. It attracts more traders, increasing trading volume and improving brokers’ competitiveness.

Our leading industry experts used our due diligence process to establish which is the best forex broker in terms of financial markets and instruments available for trading. Both forex brokers Pepperstone and FXCM offer their clients a diversity of popular currency pairs and CFD instruments.

The table below shows side-by-side the range of CFD markets offered by Pepperstone and FXCM.

| CFDs | Pepperstone | FXCM |

|---|---|---|

| Forex Pairs | 94 | 42 |

| Indices | 27 | 16 |

| Commodities | 33 Commodities 7 Metals, 4 Energies, 9 Softs, 20 Hard | 3 Metals 5 Energies 3 Softs |

| Cryptocurrencies | 44 | 7 |

| Share CFDs | 1,200+ | 219 |

| ETFs | 95 | No |

| Bonds | No | 1 |

| Futures | 42 Futures | No |

| Treasuries | 7 | 1 |

| Investments | No | No |

Pepperstone and FXCM offer trading software solutions available on desktop (PC and Mac), web-based platforms (WebTrader), and mobile trading (iOS and Android), both providing MetaTrader 4 (MT4). The key difference lies in their trading conditions. FXCM operates as a market maker, taking the opposite side of trades, whereas Pepperstone uses an ECN infrastructure, directly matching orders in the interbank market for greater transparency. Additionally, Pepperstone offers MetaTrader 5 (MT5) and cTrader, while FXCM provides TradeStation, NinjaTrader 8 for spread betting, and ZuluTrade for social trading. Overall, Pepperstone’s ECN model and additional platform options, such as MT5 and cTrader, offer traders more flexibility and transparency, making it a preferred choice in the forex trading community.

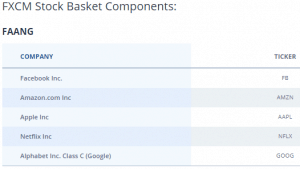

FXCM’s range of sector indices available on your FXCM trading account includes:

- Biotech

- FAANG

- CANNABIS

- Esports and Gaming

- China TECH

- China E-COMMERCE

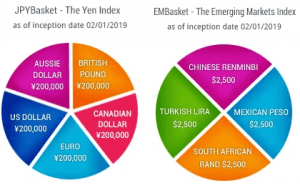

FXCM’s Stock Baskets includes 5 stocks and operates like other stock indices. While both brokers provide the US Dollar Index, FXCM also lets forex traders speculate on two additional currency indices.

FXCM’s Stock Baskets includes 5 stocks and operates like other stock indices. While both brokers provide the US Dollar Index, FXCM also lets forex traders speculate on two additional currency indices.

- Yen Index

- Emerging Market Index

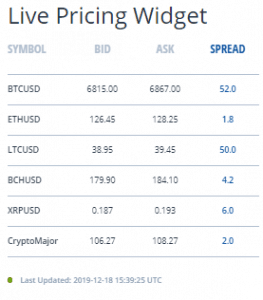

FXCM offers a cryptocurrency basket (CryptoMajors) as a market benchmark, while both forex brokers provide the same cryptocurrency options excluding the index.

- Bitcoin

- Ethereum

- Litecoin

- Bitcoin Cash

The only difference between Pepperstone and FXCM is that the Australian-based FX broker offers Dash, while the New York-headquartered forex broker offers Ripple as an alternative digital currency.

Our research indicates that Pepperstone offers superior trading conditions for the cryptocurrency market, excelling in both leverage and spreads compared to FXCM. Pepperstone emerges as the clear winner, boasting hundreds more CFDs than FXCM. For a comprehensive view of available instruments, visit both brokers’ websites. Additionally, make sure to review their webinars and educational materials to gain deeper insights into the full range of services provided to retail forex traders. Pepperstone’s competitive edge in leverage, spreads, and CFD offerings underscores its favorable position in the forex trading landscape.

Our Top Product Range and CFD Markets Verdict

Our team has surmised that Pepperstone outperforms here in light of their top product range and CFD markets.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

8. Superior Educational Resources – Pepperstone

Superior educational resources are important in the business of forex trading, offering webinars, articles, video tutorials, and structured courses. They equip traders with knowledge and skills for informed decisions, better strategies, and confident market navigation. Access to quality content promotes continuous learning and long-term trading success.

Based on our team’s research, we see that both FXCM and Pepperstone have invested significantly in this area, ensuring their clients have access to top-tier educational resources. From our analysis and our own testing, here’s a breakdown of what each broker offers:

- FXCM:

- Provides comprehensive educational content tailored for beginners.

- Offers webinars and seminars for hands-on learning.

- Features a rich library of research articles and trading guides.

- Pepperstone:

- Known for its in-depth video tutorials covering a range of topics.

- Provides market analysis and insights from industry experts.

- Offers a dedicated section for strategy development and risk management.

However, based on the scores from our testing, it seems there’s a clear winner in terms of educational offerings.

Our Superior Educational Resources Verdict

Clearly, we see that Pepperstone steals the crown on account of their superior educational resources making it the preferred choice for traders keen on continuous learning.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

9. Superior Customer Service – A Tie

Brokers excelling in customer service in forex trading provide timely support through 24/7 live chat, phone, and email, including multilingual assistance. This fosters a seamless trading experience, resolves issues quickly, enhances satisfaction, and builds trust.

Our review process required both forex brokers to offer multiple channels of communication with their clients. The customer support service at Pepperstone and FXCM is available on a 24/5 basis. Forex traders can contact the support teams of these two respected brokers by using one of the following means of communication:

- Live chat

- Phone

- SMS (available only to FXCM)

FXCM has a stronger international presence with 11 offices worldwide across 4 continents, including the United States, Canada, Australia, the UK, and Hong Kong.

Both forex brokers provide satisfactory to excellent experiences, with swift and relevant responses to questions. A key advantage of an FXCM account is its quality customer service.

| Feature | Pepperstone | FXCM |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/5 |

| Multilingual Support | Yes | Yes |

When assessing the quality of your interaction with the support team of these two forex brokers, we also took into consideration if Pepperstone and FXCM offer multilingual support. Our findings are as follows:

- Pepperstone supports 12 languages (English, Spanish, Arabic, Portuguese, Russian, Chinese and Vietnamese).

- FXCM supports +20 languages

Both forex brokers have gained industry-wide recognition through multiple awards that attest to the premier brokerage service offered by Pepperstone and FXCM.

Our team therefore concludes that the head-to-head comparison showed both forex brokers offering industry-leading service to their clients. Most forex traders appreciate the high standards and the commitment to provide an overall superior customer experience. Try your trading skills by opting for a demo account with your favourite forex broker and gain more experience before you risk real capital.

Our Superior Customer Service Verdict

We definitely have a tie here for both Pepperstone and FXCM this is due to their superior customer service.

*Your capital is at risk ‘62% of retail CFD accounts lose money’

10. Better Funding Options – Pepperstone

Brokers that provide superior funding options empower traders by offering them flexibility and convenience.These options include bank transfers, credit and debit cards, digital wallets like PayPal and Neteller, and cryptocurrencies. By offering various low or no-fee funding methods, brokers simplify account management, making deposits and withdrawals easier and improving the overall trading experience.

Pepperstone has more account funding and withdrawal options (9 vs. 6) compared to FXCM, which offers standard methods like debit/credit cards, bank wire transfers, and electronic wallets.

- Credit/debit cards

- EFT/bank wire

- Skrill

- Neteller

- Klarna

- Rapid Transfer

Our Pepperstone review showed that the Australian-based forex broker supports most of the range of funding options offered by FXCM and some more, including PayPal, POLi, BPay, Union Pay, and MasterCard.

| Funding Option | Pepperstone | FXCM |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | Yes |

| Skrill | Yes | Yes |

| Neteller | Yes | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Deposits And Withdrawal Fees

Our dedicated team has determined that the deposit and withdrawal fee structures of forex brokers Pepperstone and FXCM are strikingly similar. FXCM charges a $40 withdrawal fee for bank transfers, while both Pepperstone and FXCM have no deposit fees. For detailed info on Pepperstone’s fees, visit their Fees page.

Credit and debit card transfers are instant with both forex companies, while the bank transfers take the standard 2-3 business days before the funds are cleared into your forex trading account.

Deposit Currency Supported

Our team of experts assessed if Pepperstone and FXCM’s trading accounts offer deposits in different foreign currencies. The ideal forex broker will offer different base currencies to accommodate the needs of forex traders from around the world.

In our FXCM review assessment, we placed a negative score because FXCM only supports the major currencies:

- USD

- EUR

- GBP

By comparison, Pepperstone, an Australian forex broker, supports more currencies than others, including USD, EUR, GBP, JPY, AUD, CAD, CHF, HKD, SGD, and NZD for deposits.

Based on our research and studies, we therefore conclude that in terms of the deposit and withdrawal methods, supported currencies, and transaction fees, our team of industry experts views Pepperstone as the overall winner in this section. The only advantage FXCM can offer is that you can start trading on the foreign exchange market with a minimum deposit for a live account of $50.

Our Better Funding Options Verdict

In this category, we can easily surmise that Pepperstone outperforms the challenger due to their better funding options.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

11. Lower Minimum Deposit – Pepperstone

By offering lower minimum deposits, brokers enhance market accessibility for a diverse array of traders, including novices and those with constrained financial resources. This allows individuals to start trading with smaller investments, reducing financial barriers and fostering inclusivity. This encourages participation, enabling traders to gain experience and improve skills without a large initial investment.

Pepperstone has a lower minimum deposit of $0 than FXCM’s minimum of $50. These minimum amounts apply to all base currencies and most payment methods.

We have also discovered the deposit amount recommended by each broker.

| Minimum Deposit | Recommended Deposit | |

| Pepperstone | $0 | $200 |

| FXCM | $50 | $50 |

Our Lower Minimum Deposit Verdict

Pepperstone has excelled in this category, this is due to their lower minimum deposit, making it accessible for beginner traders. However, we still have to keep in mind that the broker recommends that aspiring traders begin with around $200 to effectively start their trading journey.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

Is Pepperstone or FXCM The Best Broker?

Pepperstone secures the top spot here because of its comprehensive offering across multiple key factors, including superior educational resources, better trading experience, and a broader product range.

The table below summarises the key information leading to this verdict:

| Categories | Pepperstone | FXCM |

|---|---|---|

| Lowest Spreads And Fees | Yes | Yes |

| Better Trading Platform | Yes | No |

| Superior Accounts And Features | Yes | No |

| Best Trading Experience And Ease | Yes | No |

| Stronger Trust And Regulation | Yes | No |

| Top Product Range And CFD Markets | Yes | No |

| Superior Educational Resources | Yes | No |

| Superior Customer Service | Yes | Yes |

| Better Funding Options | Yes | No |

| Lower Minimum Deposit | Yes | No |

Pepperstone: Best For Beginner Traders

For those just starting out in the trading world, Pepperstone offers a more beginner-friendly environment with its extensive educational resources and user-friendly platform.

Pepperstone: Best For Experienced Traders

For seasoned traders looking for advanced tools and a wider product range, Pepperstone stands out as the preferred choice.

FAQs Comparing FXCM vs Pepperstone

Does Pepperstone or FXCM Have Lower Costs?

Pepperstone generally offers lower costs compared to FXCM. They are known for their competitive spreads, which are often more advantageous than those of FXCM. For instance, Pepperstone’s Razor account offers spreads starting from 0.0 pips. For a more detailed comparison of broker costs, you can refer to this comprehensive guide on Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both Pepperstone and FXCM offer MetaTrader 4, but Pepperstone is often preferred for its seamless integration and enhanced features on this platform. They provide a user-friendly experience, making it easier for traders to navigate and execute trades. For traders specifically looking for the best MT4 experience, this list of top MT4 brokers can be a valuable resource.

Which Broker Offers Social Trading?

Pepperstone stands out when it comes to offering social or copy trading features. They have integrated platforms like ZuluTrade and Myfxbook, allowing traders to follow and replicate the strategies of professionals. This approach not only simplifies trading for beginners but also offers a way to diversify trading strategies. For more insights on social trading platforms, check out this comprehensive guide on the best social trading platforms.

Does Either Broker Offer Spread Betting?

FXCM offers spread betting services, especially catering to UK traders. Spread betting is a tax-efficient way of trading in the UK, and FXCM provides a platform tailored for this purpose. Those interested in diving deeper into spread betting can explore this comprehensive guide on the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, Pepperstone stands out as the superior choice for Australian forex traders. Founded in Melbourne, Australia, Pepperstone is ASIC regulated, ensuring they adhere to the stringent standards set by the Australian regulatory body. Their local presence, combined with a deep understanding of the Australian market, makes them a top pick. Moreover, they offer a wide range of trading instruments, including CFDs. For those keen on exploring more about Australian forex brokers, this detailed review of the Best Forex Brokers In Australia can be insightful.

What Broker is Superior For UK Forex Traders?

For UK traders, I believe Pepperstone offers a more comprehensive trading experience. While they are headquartered in Australia, they are also FCA regulated, ensuring they meet the high standards set by the UK’s regulatory body. Their commitment to transparency, combined with a robust trading platform, makes them a preferred choice for many in the UK. For a broader perspective on the best brokers in the UK, this comprehensive guide on the Best Forex Brokers In UK is worth a read.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert