Pepperstone vs IG Group: Which One Is Best?

In this review of Pepperstone and IG Group, we will examine how these two brokers perform in the forex trading industry. Both have their own strengths and weaknesses, even with their top-notch features and platforms. We’ll gather all this information and dissect it piece by piece. Read on!

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Pro 2: 250:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 10:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors. Here are five noticeable differences between Pepperstone and IG Group:

- Pepperstone offers low STP + ECN broker spreads from 0.0 pips EUR/USD.

- Pepperstone provides MetaTrader 4, 5, and cTrader platforms.

- Pepperstone’s Razor Account offers tighter spreads with commission fees.

- Pepperstone allows trading automation on all its platforms.

- IG has market maker spreads from 0.6 pips.

- IG focuses on its proprietary platform and MT4.

- IG’s Standard Account has no commission but with wider spreads.

1. Lowest Spreads And Fees – Pepperstone

When we talk about trading costs, it’s essential to consider the lowest spreads and fees offered by brokers. This characteristic is crucial, as it greatly impacts the total cost of trading. Lower spreads reduce the disparity between the buying and selling prices of currency pairs, effectively lowering the cost per trade. This is especially beneficial for traders who engage in numerous transactions, enabling them to save on transaction fees and improve their overall profitability.

Spreads

In this section, we’ll examine the spreads and fees of both brokers. Pepperstone offers an impressive EUR/USD spread of 0.1 pips, while IG Group’s rate is slightly higher at 0.16 pips, compared to the standard industry spread of 0.28 pips. For AUD/USD, Pepperstone provides a rate of 0.1 pips, whereas IG Group’s rate stands at 0.29 pips, against an industry average of 0.45 pips. On average, the RAW account spread for Pepperstone is 0.47 pips, while IG Group’s is 0.74 pips, exceeding the industry standard of 0.72 pips. This comparison highlights Pepperstone’s competitive edge in terms of cost-efficiency for traders.

| RAW Account | Pepperstone Spreads | IG Group Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 0.47 | 0.74 | 0.72 |

| EUR/USD | 0.1 | 0.16 | 0.28 |

| USD/JPY | 0.2 | 0.24 | 0.44 |

| GBP/USD | 0.2 | 0.59 | 0.54 |

| AUD/USD | 0.1 | 0.29 | 0.45 |

| USD/CAD | 0.4 | 0.7 | 0.61 |

| EUR/GBP | 0.2 | 0.54 | 0.55 |

| EUR/JPY | 1.1 | 0.68 | 0.74 |

| AUD/JPY | 0.9 | 1.5 | 0.93 |

| USD/SGD | 1 | 2 | 1.97 |

Commission Levels

When evaluating the commission fees charged by both Pepperstone and IG Groups, it’s crucial to consider the specifics for each broker. Both brokers impose a consistent fee of $3.50 for transactions involving USD and AUD, ensuring uniformity in these currencies. However, there’s a notable difference when it comes to the euro: Pepperstone charges $3.50 for USD transactions and €2.60 for EUR transactions, while IG Groups charges $6.00 for USD transactions. Unfortunately, IG Groups’ fees for other currencies are not currently accessible and need to be updated by the broker itself.

In terms of minimum deposit, both Pepperstone and IG Groups offer a $0 minimum deposit, making them accessible to new traders. Additionally, both brokers provide SWAP free accounts, which can be beneficial for those looking to avoid overnight interest charges. Pepperstone stands out by offering no inactivity fees and no funding fees, whereas more information is needed from IG Groups regarding these fees.

When it comes to funding methods, Pepperstone is 16+ listed, while IG Groups is 4+ listed, indicating the range of payment options available. This can be a deciding factor for traders who prefer flexibility in funding their accounts.

Overall, Pepperstone appears to offer more favorable terms, especially with its lower fees and additional benefits. However, it’s essential to gather more information from IG Groups to make a fully informed decision.

| USD | AUD | GBP | EUR | |

|---|---|---|---|---|

| Pepperstone | $3.50 | $3.50 | £2.25 | €2.60 |

| IG Group | $6.00 | N/A | N/A | N/A |

Our committed team has developed the exclusive fee calculator below, which demonstrates that, in most cases, Pepperstone offers the lowest fees for RAW account types.

Standard Account Fees

For standard account spreads, the comparison shows that Pepperstone offers a spread of 1.10 pips for EUR/USD, while IG Group’s spread is slightly higher at 1.13 pips. For AUD/USD, Pepperstone offers a spread of 1.20 pips, whereas IG Group offers a more competitive spread of 1.01 pips. When it comes to EUR/GBP, GBP/USD, and USD/JPY, Pepperstone’s spreads stand at 1.40 pips for each pair. In contrast, IG Group’s spreads are 1.71 pips for EUR/GBP, 1.66 pips for GBP/USD, and 1.12 pips for USD/JPY.

This comparison highlights Pepperstone’s generally competitive spreads across most pairs, while IG Group offers slightly tighter spreads for specific pairs like AUD/USD. Traders should consider these differences when selecting a broker, as lower spreads can significantly impact trading costs and overall profitability.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.10 | 1.10 | 1.30 | 1.30 | 1.30 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 1.10 | 1.20 | 1.50 | 1.40 | 1.40 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 1.20 | 1.30 | 1.30 | 1.50 | 1.10 |

| 1.20 | 1.41 | 1.47 | 1.47 | 1.61 |

| 1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

| 1.52 | 2.08 | 1.46 | 1.87 | 1.67 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Finding a broker with tight spreads and low trading costs is a main consideration when trading forex. There are two key pricing structures and account types that both brokers offer to retail traders:

- Standard account types with commission-free trading

- ECN-style accounts with tighter spreads + commission fees

Our Lowest Spreads and Fees Verdict

For this portion, our team have assumed that Pepperstone steals the crown this is due to their lowest spreads and fees.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

2. Better Trading Platform – A Tie

A better trading platform is essential for forex traders, influenced by key factors for both brokers and traders. Brokers need competitive spreads, low fees, advanced platforms, and strong support. Traders require reliable market data, quick execution, and diverse tools to make informed decisions and manage risks. These elements combine for a seamless trading experience.

| Trading Platform | Pepperstone | IG Group |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | No |

| cTrader | Yes | No |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

We’ve developed a software questionnaire to help you find the platform that best suits your trading style. By answering six simple questions, we’ll recommend the optimal trading software tailored to your specific needs.

Metatrader

MetaTrader platforms, particularly MT4, are crucial for forex trading due to their security and simplicity. MT4’s user-friendly interface and technical tools make it popular among traders. However, MT5 is gaining traction with improved features, multi-asset support, and quicker execution, offering 38 technical indicators and 21 chart timeframes. MT5’s advanced programming language and extra pending order types enhance automated trading. While MT4 is still widely used, many traders are moving to MT5 for its flexibility and efficiency.

When choosing a trading platform, broker compatibility plays a crucial role in execution speed, asset variety, and overall user experience. Pepperstone offers both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), catering to a broad spectrum of traders. Meanwhile, IG Group limits its offerings to MT4, missing out on the advanced features of MT5, such as improved execution speed, more order types, and expanded asset support. Additionally, Pepperstone provides access to cTrader and TradingView, two powerful alternatives known for their advanced charting tools and intuitive interfaces—features that IG Group lacks. For traders seeking seamless integration with modern trading strategies, this flexibility gives Pepperstone a competitive edge.

Pepperstone offers copy and proprietary trading, enabling traders to emulate successful strategies, which is beneficial for beginners. In contrast, IG Group lacks these features, limiting options for automated or social trading. Access to multiple platforms is crucial in the evolving forex market, making Pepperstone a more adaptable choice for traders seeking execution and strategy optimization.

Advanced Platforms

cTrader is a strong alternative to MetaTrader for traders seeking direct market access (DMA) and high-speed execution. Unlike MT4 and MT5, which use dealing desk execution, cTrader connects directly to interbank liquidity for more transparency and tighter spreads. The platform offers a customizable interface, advanced order functions, and supports iOS, Android, WebTrader, and desktop. cTrader’s back-testing and cAlgo for algorithmic trading appeal to those prioritizing efficiency and control.

MT4 is user-friendly, MT5 offers multi-asset trading, but cTrader excels with Level II market depth, various order types, and quick processing, ideal for scalpers. It includes one-click trading, automated risk management, and many indicators. While MetaTrader is widely supported, cTrader suits those seeking institutional execution without a dealing desk. Choosing between MT4, MT5, and cTrader depends on trader priorities: ease of use, multi-asset access, or advanced DMA. MQL4 was limited in hedging, but MQL5 upgrades now allow multiple positions for the same symbol, unlike the earlier netting system in America.

Pepperstone offers MetaTrader 4 (MT4), MetaTrader 5 (MT5), Web Trader and cTrader trading platforms.

Smart Trader Tools

Pepperstone offers add tools for both MT4 and MT5, enhancing trading functionality through their Smart Trader Tools suite. Tools include:

Market Manager – This snapshot of account activity allows for better account management without accessing the trading terminal

Trade Terminal – This allows for more efficient order execution and analysis

Mini Market – This is the same as the trading terminal but only shows one market

Sentiment Trader – This allows you to see what other traders are doing on the market

Correlation Matrix – This tool will help you understand your market exposure and risk. It does this by showing connections between assets in different markets.

IG Trading Platforms

This broker offers a wide selection of trading platforms, including:

- IG proprietary trading platforms – for mobile, web and tablet

- The web-based platform ‘ProRealTime’ – a paid-for web-only platform

- L2 Dealer for professional traders with forex direct account

- MetaTrader 4 – the most popular trading platform in the world

The IG proprietary platform is known for being good for traders without high experience, thanks to its simple and user-friendly interface.

IG Platform Takeaways

- IG’s Platform is not available for Android tablets

- You can only trade from charts when using the web browser. It is not available for mobile and tablets

- Automation trading is not available

Observations about ProRealTime

- There is a $40 monthly fee to access ProRealTime. It is free if you meet the minimum trade volume a month.

- ProRealTime can only be used in a Web Browser.

MetaTrader 4

- MetaTrader 4 can access some charting features available on the IG Platform.

Copy Trading

Copy trading in forex lets beginners replicate trades of experienced professionals in real-time, enhancing performance and diversifying portfolios without constant market monitoring. Platforms like Pepperstone and IG Group provide access to skilled traders and analytical tools, reducing the learning curve and managing risk, which can increase profitability.

IG Group offers a comprehensive suite of trading tools and platforms designed to cater to both novice and experienced traders. Their offerings include MetaTrader Signals, Expert Advisors (EAs), Pro Real Time, and their proprietary IG Trading Platform and L2 Dealer. MetaTrader Signals provide actionable trading signals based on emerging chart patterns and key levels, while Expert Advisors automate trading strategies using algorithms. Pro Real Time offers advanced charting tools and automated trading capabilities, and the IG Trading Platform provides a user-friendly interface with a wide range of trading instruments.

On the other hand, Pepperstone is renowned for its advanced trading platforms, offering almost every cutting-edge tool available in the market. Their platforms are highly regarded for their robustness and versatility, making them a favorite among professional traders. However, one notable drawback is the expiry of demo accounts, which can be a limitation for traders who prefer extensive practice before committing real funds.

Despite this limitation, Pepperstone remains a strong competitor to IG Group, offering a wide array of features that ensure traders have access to the best tools for their trading strategies. Both platforms excel in their respective areas, but the choice ultimately depends on individual trading preferences and needs.

Our dedicated team therefore concludes that both brokers provide MetaTrader 4, our preferred platform. IG has more options, appealing to beginners with its clean interface. Pepperstone offers MetaTrader 5, which includes everything MT4 does and aims to attract users. MT5 may be better for long-term trading.

Our Trading Platform Verdict

Pepperstone come up trumps in this section thanks to their better trading platforms.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

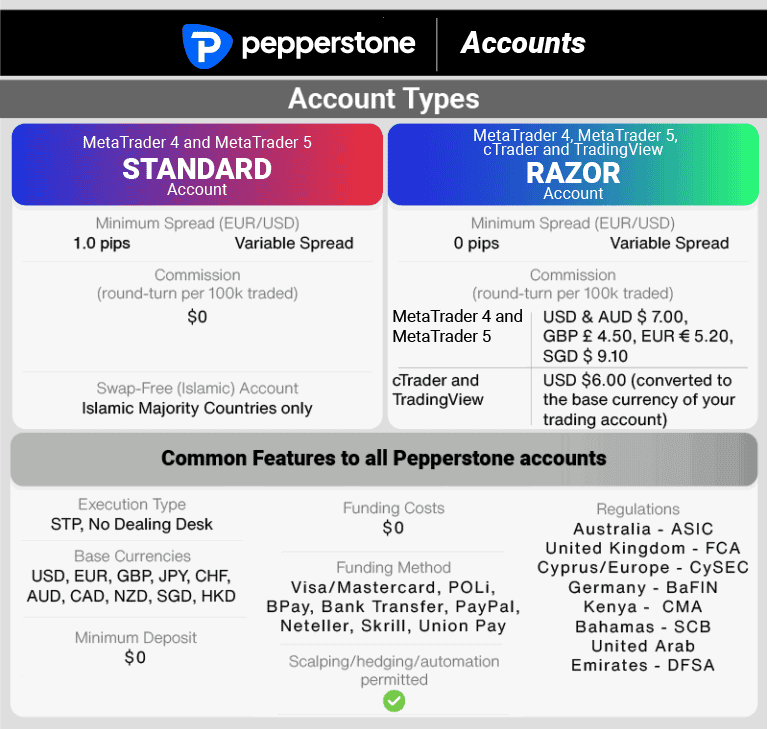

3. Superior Accounts And Features – Pepperstone

In this section for superior accounts and features, brokers offer tailored options like competitive spreads, low commissions, and advanced tools. They include demo accounts, swap-free options, and various financial instruments. Features like social and automated trading, along with strong customer support, enhance the trading experience and client loyalty.

Pepperstone Trading Accounts

Pepperstone Razor Account

This account has the lowest spreads among Pepperstone and IG accounts as it uses electronic communication network (ECN) style execution. The spreads you see here are set by the market without manipulation from dealing desks. When using MT4 and MT5, ECN style execution means you pay a commission fee of $7 (round-trip) for each standard lot you trade rather than pay through a wider spread.

If you are using cTrader, you pay a commission fee equal to 0.0035% of the base currency you are trading. For instance, if you are trading 100,000 units of the EUR/USD, you will pay €7 round turn. Even with a commission, trading costs will still be lower than all other account types.

Pepperstone Standard Account

The standard account is like the Pepperstone razor account but without a commission; costs are included in a spread increased by 0.6 pips. Thus, spreads on the standard account are 1.0 pips higher than those on the Razor account.

You can compare the two Pepperstone accounts on the Pepperstone Razor vs Standard accounts.

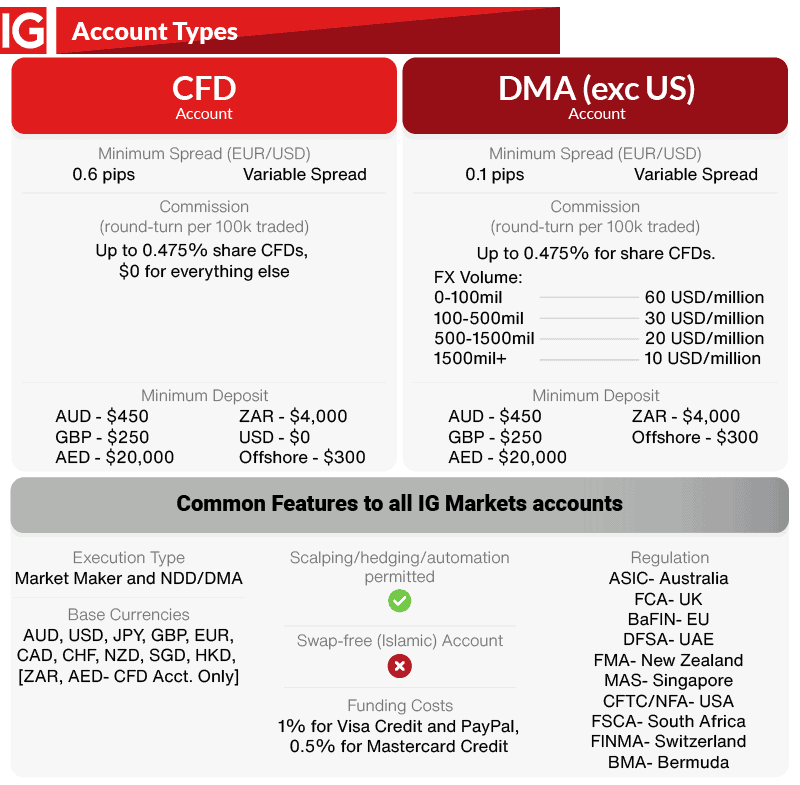

IG Trading Accounts

DMA account does not apply to the USA

IG Forex Direct

This account uses Direct Market Access (DMA), similar to ECN but with slight differences. Like Pepperstone’s Razor account, it has a commission fee per trade. It’s available only to professional traders, requiring consistent leveraged derivatives trading over the past year and net assets of $2.5 million or gross income over AUD$250,000 for the last two financial years.

Our review will not focus on this account as it is unlikely to apply to most of our clients due to high barriers to entry.

IG Standard Account

The IG Standard account functions as a market maker, profiting when you lose and losing when you profit. Their spreads are competitive but higher than ECN/DMA accounts, with no commission fees.

| Account Type | Pepperstone Standard | Pepperstone Razor | IG Markets Standard |

|---|---|---|---|

| Spreads From | 1.0 pips | 0.0 pips | 0.6 pips |

| Commission | $0 | MT4 USD $7.76 / AUD 7.00 AUD per lot MT5 USD/AUD $7.00 Round Turn per lots cTrader 7 unit per lot in base currency | $0 |

| Minimum Trade Size | 0.01 Lot (micro lots) | 0.01 Lot (micro lots) | 0.01 Lot (micro lots) |

| Leverage | ASIC 301 Maximum FCA Retail Traders: 30:1 Professional Traders 500:1 | ASIC 30:1 Maximum FCA Retails trader: 30:1 Professional traders: 500:1 | ASIC 30:1 Maximum FCA Retail traders: 30:1 Professional traders 222:1 |

| Expert Traders Allowed | Yes | Yes | Only on MT4 platform (for personal traders) |

| Hedging Allowed | Yes | Yes | Only on MT4 platform (for personal traders) |

| Scalping Allowed | Yes | Yes | Only on MT4 (for personal traders) |

| Minimum Deposit | $200 | $200 | $0 |

| Support | 24/7 | 24/7 | 24/5 |

| Currency Pairs | 60 | 60 | 90 |

| Tradeable Instruments | 70+ | 70+ | N/A |

| Execution | STP | ECN Style Pricing | Market Maker |

| Comments | Clients in UK and Europe under FCA regulation can choose retail account with leverage of 30:1 and Negative Balance Protection or Profession account with leverage of 500:1 and no negative balance protection | Clients in UK and Europe under FCA regulation can choose retail account with leverage of 30:1 and Negative Balance Protection or Profession account with leverage of 500:1 and no negative balance protection | Clients in UK and Europe under FCA regulation can choose retail account can choose leverage of 30:1 and negative balance protection. Professional trader can access leverage of 222:1 with no negative balance protection |

Pepperstone And IG Islamic Swap-Free Accounts

Both brokers offer a Swap Free trading account. These accounts are designed for Muslim traders who are not permitted to accept swaps. In place of swaps or rollover/holding interest, Pepperstone charges an admin fee every 10th day you hold your position open.

Key Differences To Note With Each Broker:

Minimum Initial Deposit – IG don’t require any funds to open an account. This allows you to take advantage of IG’s free demo accounts. To start trading, your account will need to meet margin requirements.

Automatic Trading – IG standard doesn’t allow expert advisors, scalping, or hedging on their proprietary platforms. If you want automatic trading, then you must trade using the MT4 platform. IG only allow MT4 on PC, not via the website. Pepperstone allows trading automation on all its platforms.

| Pepperstone | IG Group | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | No |

| Active Traders | Yes | No |

| Spread Betting (UK) | Yes | Yes |

Pepperstone Razor account traders can save up to 43% on commissions by joining the ‘Active Trader Program,’ which offers monthly rebates based on lots traded.

The Active trader program not only has rebates but also other benefits such as:

- Priority client support through a dedicated account manager

- Complementary VPS hosting

- Advanced insights and reports

Clearly, our team highly recommends Pepperstone’s Razor Account. ECN technology is great as it allows retail traders like yourself to link with liquidity providers and achieve the best possible spreads set by the market. ECN spreads are typically much tighter than you will find with the other accounts and methods of trade execution. Another benefit is this technology is all done electronically, which means you can use EAs (expert advisors) for automated trading and trade during “after hours”.

Our Superior Accounts and Features Verdict

Pepperstone, clearly, takes the cake in this category owing to their superior accounts and features.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – A Tie

In the industry of forex trading, an exceptional trading experience is the result of an integration of cutting-edge trading platforms, rapid execution speeds, competitive spreads, and reliable customer support. These factors enable traders to make informed decisions, execute trades easily, and manage their accounts effectively. A user-friendly interface, educational resources, and diverse trading tools enhance the trading experience, making it more enjoyable and profitable.

When it comes to the best trading experience and ease, both Pepperstone and IG Markets have their unique strengths. From our in-depth analysis and our own testing, we’ve found that Pepperstone stands out in certain areas while IG Markets shines in others. Here’s a breakdown of what we discovered:

- Pepperstone is highlighted as the best for MT4 trading, which is a testament to its user-friendly interface and robust features on this platform.

- For those who prefer MT5, it’s worth noting that IC Markets takes the crown, but that’s not to say Pepperstone doesn’t offer a commendable MT5 experience.

- Pepperstone also gets a nod for being the best for automation. With tools like Capitalise.ai, traders can automate their strategies with ease.

- On the other hand, when it comes to the best standard account offerings, IC Markets leads the pack.

Now, from a personal standpoint, I’ve always appreciated the flexibility and range of tools both brokers offer. Whether you’re a beginner or a seasoned trader, both platforms cater to your needs, ensuring a seamless trading experience. It’s all about finding which broker aligns best with your trading style and preferences.

| | Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank |

|---|---|---|---|---|

| Pepperstone | 77ms | 2/36 | 100ms | 10/36 |

| IG Group | 174ms | 26/36 | 141ms | 19/36 |

Our Best Trading Experience and Ease Verdict

In this case, it’s a close call for both brokers, this is in light of their best trading experience and ease.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – A Tie

In forex trading, establishing a secure and transparent environment relies heavily on strong trust and regulation. Traders benefit from competitive spreads, low fees, advanced platforms, fast execution, diverse funding options, and great customer support. Access to educational resources and tools also enhances the trading experience, enabling informed decisions.

Pepperstone Trust Score

IG Group Trust Score

Both Pepperstone and IG Markets are multi-regulated brokers, meaning they have subsidiaries regulated to offer financial trading services in various countries. Pepperstone is regulated by prominent authorities such as the Financial Conduct Authority (FCA) in the UK, Australian Securities and Investments Commission (ASIC) in Australia, Dubai Financial Services Authority (DFSA) in the UAE, Cyprus Securities and Exchange Commission (CySEC) in Cyprus, Capital Markets Authority (CMA) in Kenya, Securities Commission of The Bahamas (SCB) in The Bahamas, and Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) in Germany. This extensive regulatory coverage ensures high standards of safety and transparency for clients.

Similarly, IG Markets is regulated by multiple authoritative bodies, including the ASIC, FCA, Japan Financial Services Agency (JFSA), Securities and Futures Commission (SFC) in Hong Kong, Financial Sector Conduct Authority (FSCA) in South Africa, Monetary Authority of Singapore (MAS), Financial Markets Authority (FMA) in New Zealand, German Federal Financial Supervisory Authority (BaFin), and Swiss Financial Market Supervisory Authority (FINMA). This multi-regulatory oversight underscores IG Markets’ commitment to maintaining high standards of safety and transparency.

Pepperstone Regulation

Since 2020, Pepperstone has expanded its regulatory reach to include Kenya (CIMA), Germany & Austria (BaFin), Cyprus (CySEC), and the United Arab Emirates (DFSA). European mainland traders join Pepperstone’s Cyprus subsidiary, while German and Austrian traders use the German subsidiary. Traders outside Australia, Europe, Kenya, the UK, and the UAE join Pepperstone’s Bahamas subsidiary.

IG Markets Regulation

IG Markets is one of the most regulated online brokers, authorized in 10 different countries. Besides the UK (FCA) and Australia (ASIC), they are also regulated by the USA (CFTC, NFA), New Zealand (FMA), and Japan. Traders outside Europe/UK, UAE, Singapore, South Africa, Australia, New Zealand, and the USA join IG Markets’ Bermuda subsidiary.

| Pepperstone | IG Group | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) BaFin (Germany) CYSEC (Cyprus) | ASIC (Australia) FCA (UK) BaFin (Germany) FINMA (Switzerland) NFA/CFTC (USA) CYSEC (Cyprus) MAS (Singapore) FMA (New Zealand) |

| Tier 2 Regulation | DFSA (Dubai) | JFSA (Japan) DFSA (Dubai) |

| Tier 3 Regulation | SCB (Bahamas) CMA (Kenya) | BMA (Bermuda) FSCA (South Africa) |

Reviews

As shown below, Pepperstone has a higher Trustpilot score, indicating stronger user satisfaction. IG Group reflecting broader regulatory coverage and longer market presence. Both brokers are considered highly trusted, but they shine in different areas, Pepperstone in user experience, IG Group in regulatory robustness.

Our Stronger Trust and Regulation Verdict

Once again, for both Pepperstone and IG Groups, it’s a deadlock for these two brokers, as a result of their stronger trust and regulation.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

6. Most Popular Broker – Pepperstone

Pepperstone gets searched on Google more than IG Group. On average, Pepperstone sees around 110,000 branded searches each month, while IG Group gets about 97,080 — that’s 11% fewer.

| Country | Pepperstone | IG Group |

|---|---|---|

| Australia | 8,100 | 6,600 |

| Brazil | 6,600 | 170 |

| United Kingdom | 5,400 | 2,900 |

| Thailand | 4,400 | 320 |

| United States | 4,400 | 2,900 |

| Malaysia | 4,400 | 480 |

| Kenya | 4,400 | 90 |

| Germany | 3,600 | 5,400 |

| Colombia | 3,600 | 70 |

| Mexico | 3,600 | 90 |

| Hong Kong | 3,600 | 5,400 |

| South Africa | 2,900 | 2,400 |

| India | 2,900 | 4,400 |

| Spain | 1,900 | 110 |

| Italy | 1,900 | 8,100 |

| Mongolia | 1,900 | 10 |

| Singapore | 1,600 | 1,000 |

| Indonesia | 1,600 | 110 |

| Peru | 1,600 | 50 |

| Turkey | 1,600 | 320 |

| Pakistan | 1,300 | 1,000 |

| Nigeria | 1,300 | 90 |

| Argentina | 1,300 | 50 |

| Bolivia | 1,300 | 10 |

| United Arab Emirates | 1,000 | 260 |

| France | 1,000 | 14,800 |

| Taiwan | 1,000 | 480 |

| Ecuador | 1,000 | 20 |

| Chile | 1,000 | 50 |

| Netherlands | 880 | 480 |

| Philippines | 880 | 90 |

| Dominican Republic | 880 | 30 |

| Vietnam | 720 | 260 |

| Morocco | 720 | 260 |

| Poland | 720 | 90 |

| Canada | 720 | 320 |

| Tanzania | 720 | 20 |

| Japan | 480 | 140 |

| Portugal | 480 | 320 |

| Cyprus | 480 | 70 |

| Costa Rica | 480 | 10 |

| Algeria | 390 | 90 |

| Bangladesh | 390 | 50 |

| Egypt | 390 | 50 |

| Sweden | 390 | 3,600 |

| Venezuela | 390 | 10 |

| Uganda | 390 | 10 |

| Ethiopia | 390 | 10 |

| Botswana | 390 | 20 |

| Sri Lanka | 320 | 40 |

| Switzerland | 320 | 320 |

| Austria | 320 | 480 |

| Panama | 320 | 10 |

| Cambodia | 320 | 30 |

| Saudi Arabia | 260 | 1,000 |

| Ireland | 260 | 90 |

| Ghana | 260 | 20 |

| Jordan | 260 | 20 |

| Greece | 210 | 140 |

| New Zealand | 170 | 170 |

| Uzbekistan | 140 | 10 |

| Mauritius | 110 | 30 |

8,100 1st | |

6,600 2nd | |

4,400 3rd | |

320 4th | |

5,400 5th | |

2,900 6th | |

1,900 7th | |

8,100 8th |

Similarweb shows a different story when it comes to February 2024 website visits with Pepperstone receiving 1,273,000 visits vs. 9,438,000 for IG Group.

Our Most Popular Broker Verdict

Pepperstone is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – IG Group

For brokers having a diverse range of CFD products and access to various financial markets is truly essential in forex trading. This diversity helps traders expand portfolios and manage risks, maximizing profit potential. It also attracts more traders, increasing trading volume and boosting broker competitiveness.

Pepperstone CFDs

Pepperstone has a decent range of derivatives when it comes to trading contracts for difference (CFDs). CFDs available include:

- Indices – 24 equity index CFDs from Asia, Europe and the USA and 3 currency indices

- Commodities – These include precious metals, energies and soft commodities like Cocoa and Cotton.

- Cryptocurrencies – 44 CFDs, including Bitcoin, Ethereum, Dash, and Litecoin, as well as 3 cryptocurrency baskets.

If you are in the UK, Spread Betting is an option as an alternative to CFD trading.

IG CFDs

IG is one of the best online brokers if you are seeking an all-in-one broker for CFD trading. With IG, you can choose from the following:

- Shares CFD – You can choose from over 600 Australian and 8,000 international shares.

- Indices – over 31 global indices are available. 22 of these indices are available for trade 24 /7.

- Commodities – 26 major hard and soft commodity markets

- Cryptocurrencies – including Bitcoin, Ether, Litecoin, Ripple and Bitcoin Cash

- Options – are available for major indices, forex, etc.

- Interest Rates – you can trade interest rate movement in a range of global markets

- Bonds – You can hedge your bets against government bonds.

- ETP, ETF and IPOs – Exchange-traded products, funds, and initial public offerings are available.

- Spread Betting

| CFDs | Pepperstone | IG Group |

|---|---|---|

| Forex Pairs | 94 | 110 |

| Indices | 27 | 130 |

| Commodities | 33 Commodities 7 Metals, 4 Energies, 9 Softs, 13 Hard | 11 Metals 7 Energies 23 Softs |

| Cryptocurrencies | 44 | 13 (+ Crypto 10 Index) |

| Share CFDs | 1,200+ | 13000+ |

| ETFs | 95 | 2000+ |

| Bonds | No | 14 |

| Futures | 42 Futures | Yes |

| Treasuries | 7 | 14 |

| Investments | No | Yes |

If you are looking for a broker for trading cryptocurrency, then take a look at our Pepperstone vs EightCap. With 250 Cryptocurrencies, Eightcap presents a compelling option for CFD crypto trading.

In addition to CFDs, IG also offers share trading.

- Trading on the Australian Stock Exchange has a commission of $8 per share.

- You can choose from 10,000 global stocks, and these will cost US$10 per trade.

Through our teams in-depth research, we have found out that IG Group offers a far more extensive range of asset classes and, therefore, should be your choice if you are looking for an all-in-one broker.

Our Top Product Range and CFD Markets Verdict

Evidently, IG Group rules the roost in this category, as a result of their top product range and CFD markets.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

8. Superior Educational Resources – IG Group

In the industry of forex trading, education is of utmost importance. Access to educational resources is crucial, as they empower traders with the knowledge and skills required to make informed decisions. These resources offer insights into market dynamics, help develop strategies, and improve risk management, essential for both new and experienced traders to succeed in the forex market.

Both Pepperstone and IG Markets understand this and have invested significantly in their educational resources. From our in-depth analysis and our own testing, we’ve discerned some key differences in the educational offerings of these two brokers:

- Pepperstone offers comprehensive webinars, tutorials, and market analysis that cater to both beginners and seasoned traders.

- IG Markets, on the other hand, boasts an extensive library of video courses, articles, and interactive quizzes to enhance learning.

- While Pepperstone’s educational content is more focused on practical trading strategies, IG delves deep into the theoretical aspects of forex trading.

- IG Markets also provides a dedicated section for advanced traders, offering insights into complex trading techniques.

- Pepperstone’s risk management tools and educational content on the same are noteworthy.

- IG’s daily market updates and analysis give traders a competitive edge in understanding market movements.

In this part, our team have therefore concluded that IG Groups slightly edges out Pepperstone in terms of educational resources, offering a more comprehensive and diverse range of learning materials.

Our Superior Educational Resources Verdict

IG Groups ranks highest in this portion on account of their superior educational resources.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

9. Superior Customer Service – Pepperstone

Effective customer service and support play a crucial role in forex trading by addressing technical issues, delivering guidance and education, and offering emotional backing. Outstanding customer service elevates the trading experience and builds trust and confidence among traders, allowing them to navigate the market effortlessly. Such support is crucial for both beginners and experienced traders, playing a vital role in their success and enhancing their overall satisfaction.

Pepperstone Customer Support

Pepperstone offers award-winning customer service. Customer support is 24/7, and you can contact them via any of the following means: live chat, phone and email. You can call Pepperstone toll-free from within Australia.

Pepperstone Customer Service Features

Pepperstone has a wide range of additional features that form part of its superior customer service experience. These include:

- Education: Pepperstone’s education portfolio includes

- ‘Learn to Trade’: a collection of web pages covering a wide range of forex topics.

- Webinars: regular live webinars by forex experts that cover a range of forex topics. Webinar participants can ask the hosts questions during the webinar.

- Trading Guide: A large collection of forex trading guides is available that cover many aspects of forex trading. You can have these sent to your inbox on sign-up if you desire.

- User guides: support manuals that take users through all the steps they need to implement functions when using Pepperstone’s platform. For example, how to make a deposit or withdraw.

- FAQ: There is a searchable FAQ section available where you can find answers to questions you may have.

- Glossary – Pepperstone provides a list defining major trading words and terms

| Feature | Pepperstone | IG Group |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/7 |

| Multilingual Support | Yes | Yes |

IG Customer Support

IG has a good range of contact tools for customer support. These include Email, live chat, phone and even Twitter. Customer support is not quite 24/7 as it is from Saturday 1 pm to Saturday at 9 am.

IG Customer Service

It’s clear to see that Pepperstone and IG Markets provide essential support tools, including forums, glossaries, FAQs, and user guides. A standout feature of IG Markets’ customer service is their educational offering, known as the “IG Academy”. This comprehensive academy includes nine different trading courses in forex and derivatives trading, supplemented by learning tools such as webinars, booklets, videos, and mobile apps. The IG Academy is designed to cater to both beginners and experienced traders, providing a wide array of resources to enhance trading knowledge and skills. This robust educational support is a testament to IG Markets’ commitment to empowering traders through continuous learning.

We see here that both brokers offer excellent customer support and services; however, we found it hard to go past the features that Pepperstone offer. It is very comprehensive and provides just about any information you may need to not only use their products but trade successfully.

Our Superior Customer Service Verdict

Evidenlty, secures first place in this portion, by reason their superior customer service.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

10. Better Funding Options – Pepperstone

This section will explore the significance of enhanced funding options in forex trading. These features offer traders flexibility and convenience, with methods such as bank transfers, cards, digital wallets like PayPal, Skrill, Neteller, and cryptocurrencies. Multiple low or no-fee funding options enhance account management and improve the overall trading experience.

Aside from bank wire withdrawals, Pepperstone offers users a completely free experience when it comes to deposits and withdrawals. The platform supports a wide array of funding options, allowing users to choose from Skrill, Neteller, and PayPal, as well as credit and debit card transactions via Visa and MasterCard.

IG will charge you 1% for Visa and 0.5% for MasterCard. You will also incur a 1% charge when using PayPal, BPay, and Bank Transfer are free. It is important to note that when using debit, credit or PayPal for deposits, there is a minimum of $500

| Funding Option | Pepperstone | IG Group |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | Yes |

| Skrill | Yes | No |

| Neteller | Yes | No |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Our Better Funding Options Verdict

Pepperstone shines in this aspect this is due to their better funding options.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

11. Lower Minimum Deposit – A Tie

This section will explore how a lower minimum deposit in forex trading enhances market accessibility for a broader audience, including newcomers and those with limited funds. Allowing smaller investments lowers the financial barrier to entry, fostering inclusivity and providing traders the opportunity to gain experience without a hefty initial investment.

Both Pepperstone and IG Markets offer $0 minimum deposits, making them accessible to traders of all levels. Pepperstone’s minimum deposit is available for GBP, USD, EUR, and AUD via various payment channels. IG Markets also has no minimum deposit requirement, allowing traders to start with any amount.

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £0 Minimum Deposit | $0 Minimum Deposit | €0 Minimum Deposit | $0 |

| Paypal | £0 Minimum Deposit | $0 Minimum Deposit | €0 Minimum Deposit | $0 |

| Bank Wire | £0 Minimum Deposit | $0 Minimum Deposit | €0 Minimum Deposit | $0 |

| Skrill | £0 Minimum Deposit | $0 Minimum Deposit | €0 Minimum Deposit | $0 |

Alternatively, IG’s minimum requirement varies by region and payment method, as we lay out in the table below.

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £250 Minimum Deposit | $50 Minimum Deposit | €300 Minimum Deposit | $100 |

| Paypal | £250 Minimum Deposit | $50 Minimum Deposit | €300 Minimum Deposit | $100 |

| Bank Wire | £0 Minimum Deposit | $250 Minimum Deposit | €0 Minimum Deposit | $0 |

| Skrill | N/A | N/A | N/A | N/A |

| Minimum Deposit | Recommended Deposit | |

| Pepperstone | $0 | $200 |

| IG Group | $0 | $100 |

Our Lower Minimum Deposit Verdict

It’s a stalemate between these two brokers, Pepperstone and IG Groups, owing to their lower minimum deposit.

*Your capital is at risk ‘71% of retail CFD accounts lose money’

Is Pepperstone or IG Group The Best Broker?

Pepperstone excels in this niche thanks to its comprehensive trading platforms, competitive spreads, and robust educational resources. The table below summarises the key information leading to this verdict:

| Categories | Pepperstone | IG Group |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platform | Yes | Yes |

| Superior Accounts And Features | Yes | No |

| Best Trading Experience And Ease | Yes | Yes |

| Stronger Trust And Regulation | Yes | Yes |

| Top Product Range And CFD Markets | No | Yes |

| Superior Educational Resources | No | Yes |

| Superior Customer Service | Yes | No |

| Better Funding Options | Yes | No |

| Lower Minimum Deposit | Yes | Yes |

IG Group: Best For Beginner Traders

For those just starting out in the trading world, IG Group offers a more beginner-friendly environment with its extensive educational resources and intuitive platform.

Pepperstone: Best For Experienced Traders

For seasoned traders looking for advanced tools and competitive spreads, Pepperstone stands out as the preferred choice.

FAQs Comparing Pepperstone Vs IG Group

Does IG Group or Pepperstone Have Lower Costs?

Pepperstone generally offers more competitive spreads and lower costs. On average, traders can expect spreads as low as 0.0 pips on major currency pairs with Pepperstone. IG Markets, while competitive, tends to have slightly wider spreads. For a comprehensive breakdown of broker costs, you can check out this guide on the Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both brokers support MetaTrader 4, but Pepperstone is often highlighted for its enhanced MT4 experience. They offer advanced tools and features tailored for the platform. If you’re keen on diving deeper into the MT4 offerings of various brokers, this list of the best MT4 brokers might be of interest.

Which Broker Offers Social Trading?

IG Group offers a robust social trading platform, allowing traders to follow and copy the strategies of experienced traders. Pepperstone, on the other hand, doesn’t have a dedicated social trading platform but does offer tools that can be integrated with third-party social trading services. For those interested in exploring more about social trading platforms, here’s a comprehensive guide on the best social trading platforms.

Does Either Broker Offer Spread Betting?

IG Group offers spread betting services, allowing traders to speculate on price movements without owning the underlying asset. Pepperstone, on the other hand, does not provide spread betting. For those in the UK interested in exploring spread betting further, this comprehensive guide on the best spread betting brokers is a great resource.

What Broker is Superior For Australian Forex Traders?

In my opinion, Pepperstone stands out as the superior choice for Australian forex traders. Not only is Pepperstone ASIC regulated, but it’s also an Australian-founded company, ensuring a deep understanding of the local market. IG Group, while also ASIC-regulated, is headquartered overseas. Both brokers offer competitive spreads and a range of trading platforms, but there’s a certain comfort in trading with a home-grown broker. For a broader perspective on Australian forex brokers, you can check out this list of the Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK traders, I personally lean towards IG Group. They are FCA regulated and have a strong presence in the UK market. Pepperstone, while offering competitive services, is based overseas. IG Markets’ deep roots in the UK ensure they have a nuanced understanding of the needs of British traders. If you’re looking for more insights on the best platforms for UK traders, this guide on the Forex Brokers In UK is worth a read.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Which Pepperstone account is best?

The Razor account offer the lowest spreads and best overall value compared to the Standard account, even after commission costs are accounted for.

Are there any inactivity fees with IG for certain regions?

Yes there is, there is a monthly inactivity fee between $12 and $18 (varies by region) if no trades are made for 24 months.