IC Markets vs easyMarkets Which One Is Best?

We have done a comparison of IC Markets vs easyMarkets forex brokers to guide you in making an informed decision on the differences between each broker. We compared the main features to consider when choosing a broker.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

$3,000 (Premium)

$10,000 (VIP)

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors. Here are five noticeable differences between IC Markets and easyMarkets:

- IC Markets uses an Electronic Communication Network (ECN) Broker system, resulting in tighter spreads due to direct trading with liquidity providers.

- easyMarkets, a traditional market maker, sets its own bid and offer prices, leading to wider spreads as it takes on more risk with its funds.

- IC Markets charges a commission for each trade, whereas easyMarkets does not charge a commission and offers fixed spreads.

- Both brokers offer MetaTrader 4, but IC Markets also provides cTrader, while easyMarkets has its custom platform with unique risk management tools.

- IC Markets boasts faster execution speeds to reduce risks of slippage, while easyMarkets offers a range of risk management tools, including Deal Cancellation and Freeze Rate.

1. Lowest Spreads And Fees: IC Markets

When their average spreads are compared, it is noticeable that easyMarkets’ spreads are wider.

| Average Spreads (pips) | EUR/USD | USD/JPY | AUD/USD | GBP/USD |

|---|---|---|---|---|

| IC Markets (variable spreads) - RAW spreads account | 0.1 | 0.2 | 0.2 | 0.4 |

| easyMarkets platform (fixed spreads) - VIP account | 1.2 | 1.5 | 1.5 | 1.7 |

| easyMarkets MT4 (fixed spreads) - VIP account | 0.9 | 1 | 1.2 | 1.3 |

IC Markets is an Electronic Communication Network (ECN) Broker. This is why their spreads are tighter. This type of broker allows you to trade directly with liquidity providers with no interference from the brokers themselves. This means spreads quoted are lower because prices are obtained directly from the liquidity provider with no human intervention. ECN brokers charge a commission for each trade, so they rely on trading volume for earnings.

Traditional market maker like easyMarkets and Plus500, on the other hand, set their own bid and offer prices from which they will buy or sell. Market makers will quote higher prices because they do not typically cover their clients’ trades with liquidity providers. This means they need to cover the differences with their own money. Spreads are wider as the broker is taking on more risk with their funds.

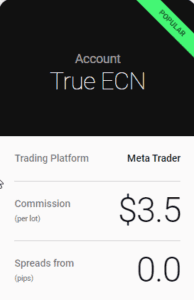

IC Markets Account Raw Spreads

IC Markets True ECN Account

As IC Markets is a broker using ECN pricing, they charge a commission when you buy and sell (i.e. $7 round trip) your trades. This is because IC Markets do not want to interfere with the spreads offered by the market, which allows them to keep spreads low. You can view the IC Markets Raw Spread vs Standard Accounts guide to understand the differences between the accounts they offer.

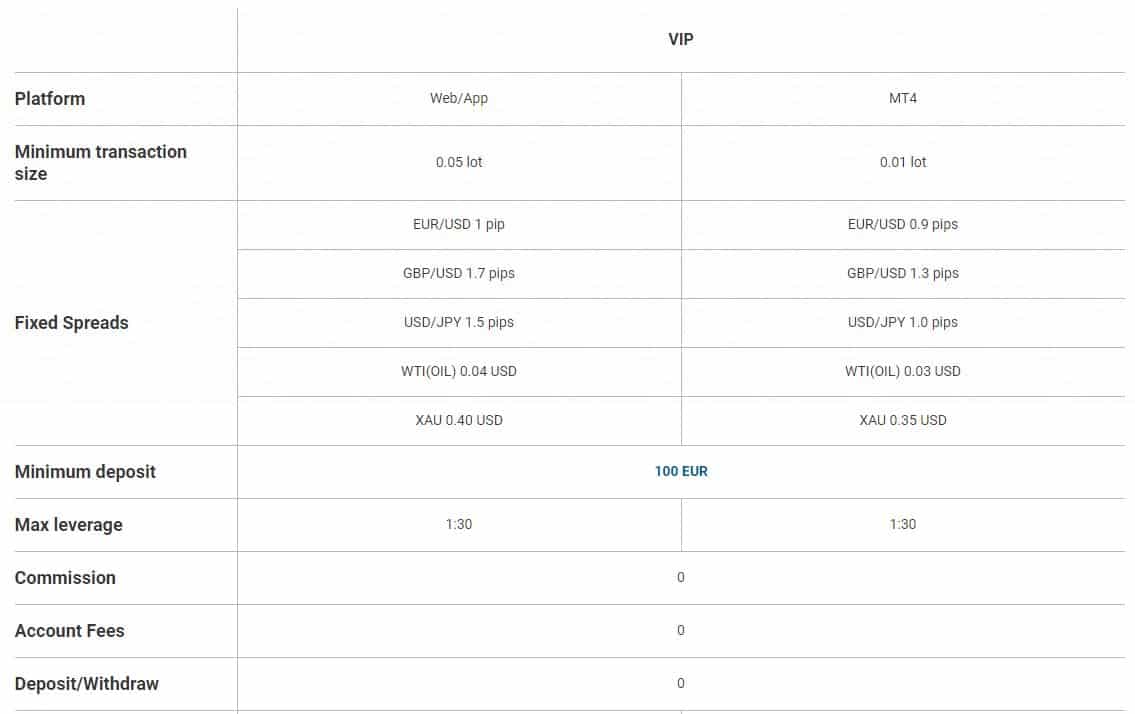

easyMarkets VIP Account

- Lot trade size is negotiable. Lots of 0.01 to 100 is the standard range

- No Commissions

- Leverage a maximum of 400:1 via its offshore, FSC-regulated branch in BVI. 30:1 is available in Australia, the UK and Europe with a retail account.

- 64 total Currency Pairs are available

- Expert Advisors (EAs) – available on MetaTrader 4 Platform only.

- Spreads are Fixed

easyMarkets average spreads are higher when compared with IC Markets, but they do not charge commission. One benefit of the trading model used by easyMarkets is that they used fixed spreads as opposed to variable spreads. Fixed spreads mean prices are predictable and do not change through the ordering process. This makes it a great option for inexperienced traders who may not understand price movements, especially in volatile markets.

Our Lowest Spreads and Fees Verdict

ECN accounts, such as those offered by IC Markets forex broker, offer smaller spreads and require less deposit. We recommend IC Markets when trading forex.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

2. Better Trading Platform: IC Markets

MetaTrader 4 is available on IC Markets and easyMarkets. IC Markets also offers another common platform in cTrader while easyMarkets offers their custom platform, which is called ‘easyMarkets’.

| Trading Platform | IC Markets | easyMarkets |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | No |

| TradingView | Yes | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

MetaTrader 4

MT4 is one of the most well-regarded forex trading platforms and is available with many brokers. MetaTrader 4 has the following benefits:

- Simple and straightforward interface with order management functionality that allows for fast ordering.

- Expert Traders (EA) facility for algorithmic trading. EAs are not offered on easyMarkets’ own platform.

- Offered by most brokers, which means there low barriers to switching to other brokers using the same platform.

Advanced Trading Tools With IC Markets

Advanced Trading Tools enhancement product gives traders extra trading features. To access these features, you need to be using the MetaTrader platform. Advanced Trading Tools contains some 20 features that traders of all types will certainly benefit from:

- Alarm Manager – allows for alerts and notifications of important trading events

- Connect – a portal that provides a calendar with economic events of interest and news feeds

- Correlation Matrix – to help traders so they can determine correlations between assets and other markets

- Correlation Trader – to assist traders with finding similarities and differences between different markets

- Excel RTD – for analysis, monitoring and reporting through the use of Excel

- Market Manager– so that information from insights into existing orders, orders that are pending, and current market prices can be explored

- Sentiment Trader – live sentiment data is provided to help with trade decisions

- Stealth Orders – Used to hide your pending orders so other traders cannot copy your trading

- Trade Simulator– This helps you forecast likely profit and loss expectations using proven strategies

- Session Map– a map listing when markets are open throughout the world

- Trade Terminal– a screen showing a range of trading information on one screen

- Smart Lines – Profit and stop-loss positions are demonstrated via graphs and charts.

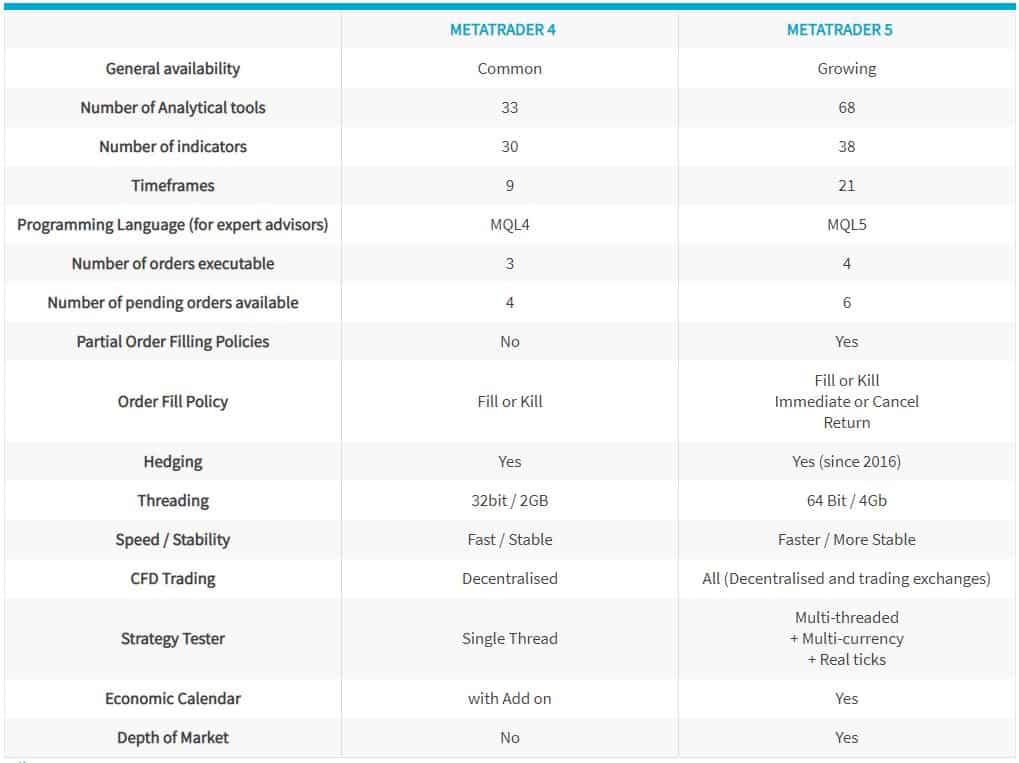

MetaTrader 5

This platform is an upgrade on MT4. While MT4 continues to be more popular, MT5 will become the primary platform made by MetaQuotes in time. This is because MT5 offers all the features MT4 offers and more. MetaQuotes have announced they will cease the development of new features for MT4, which is a good reason to start getting familiar with MT5.

cTrader

cTrader is a competitor to MT4. It performs many of the same functions MT4 does when it comes to trading but has a few different features. One useful feature is enhanced interface customisation and more advanced charting.

Overall, IC Markets offers a choice of platforms. If MT4 is chosen, traders have access to a wealth of tools to enhance the user’s trading experience.

The easyMarkets Forex Trading Platforms

easyMarkets has an in-house developed custom platform called ‘easyMarkets’. It offers a few unique features not offered by IC Markets.

- dealCancellation (see risk management section for explanation)

- No Slippage (see risk management section for explanation)

- Freeze Rate

- Guaranteed pending orders (see risk management section for explanation)

- Trading of foreign exchange and contracts for different products right within its platform

Overall, the easyMarkets platform’s key strength and point of difference are the ‘risk management’ tools offered.

Our Better Trading Platform Verdict

If you are a trader who prefers to minimise risk, the easyMarkets platform offers useful risk management tools. We like IC Markets because we feel all traders will benefit from the in-depth tools they provide.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

3. Superior Accounts And Features: IC Markets

The following account types are offered by easyMarkets: VIP, Premium and Standard. Accounts are very similar, but better spreads are offered with accounts requiring a higher deposit.

For Clients Outside The UK And Europe

For Clients In The UK And Europe

IC Markets Raw Account

- Lots trade size option range – 0.01/ 100 lots

- USD$7 commission for roundtrip swaps ($3.5 each way) applied for every 100k of volume traded

- IC Markets minimum deposit for Raw accounts is $200

- Spreads start at 0.0

- 1:500 Leverage (FSA branch) and 30:1 (ASIC and CySEC)

- Currency Pairs available = 64

- liquidity providers = 50

- Scalping

- Expert Advisors (EAs)

- Hedging

| IC Markets | easyMarkets | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | No |

| Swap Free Account | Yes | No |

| Active Traders | Yes | Yes |

| Spread Betting (UK) | No | No |

Our Superior Accounts and Features Verdict

IC Markets forex broker provides ECN accounts with narrower spreads and lower deposit requirements. We suggest considering IC Markets for your forex trading needs.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

4. Best Trading Experience And Ease: Tie

Having dived deep into the trading platforms of both IC Markets and easyMarkets, we’ve noticed some distinct differences that set them apart. IC Markets, for instance, offers the renowned MT5 platform, which our testing data also ranks as one of the best.

This platform provides traders with a seamless experience, advanced charting tools, and a user-friendly interface. On the other hand, easyMarkets has a custom platform that comes with unique features tailored to cater to both beginners and experienced traders.

- IC Markets offers MT5, known for its advanced functionalities and ease of use.

- easyMarkets’ custom platform provides unique risk management tools, enhancing the trading experience.

- Our testing data ranks IC Markets’ standard account among the best, ensuring a smooth trading journey.

- Both platforms prioritise user experience, ensuring traders have all the tools they need at their fingertips.

Our Best Trading Experience and Ease Verdict

In our journey of exploring various platforms, it’s evident that both these brokers have invested significantly in ensuring their users get the best trading experience possible. Whether you’re a newbie or a seasoned trader, both platforms cater to your needs, ensuring ease of use and efficiency.

5. Stronger Trust And Regulation: IC Markets

IC Makets Trust Score

easyMarkets Trust Score

High leverage can result in major earnings (even for minor price changes in currency spreads), provided price moments are in your favour. While the temptation to take advantage of the High Leverage Forex Brokers is great, leverage can also result in large losses. While high leverage might seem appealing, it needs to be used wisely.

Both brokers are regulated by the Australian Securities and Investments Commission (ASIC) in Australia and the Cyprus Securities and Exchange Commission (CySEC) in Europe. In these jurisdictions, the brokers offer the maximum allowable leverage of the ASIC and CySEC permit:

- Major currency pairs 30:1

- Minor currency pairs 20:1

Both brokers offer higher leverage via their offshore regulated entities. IC Markets operates globally through a subsidiary regulated in the Seychelles (FSA), where 500:1 leverage is permitted. easyMarkets has a subsidiary in the British Virgin Islands (FSC) where the broker is allowed to offer a maximum forex of 400:1.

| IC Markets | easyMarkets | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) CYSEC (Cyprus) | ASIC (Australia) CYSEC (Cyprus) |

| Tier 2 Regulation | ||

| Tier 3 Regulation | FSA-S (Seychelles) SCB (Bahamas) | FSC-BVI FSA-S (Seychelles) |

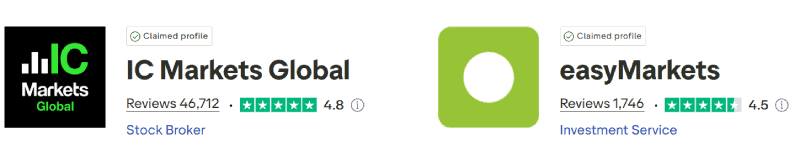

Reviews

As shown below, easyMarkets holds a 4.5/5 rating on Trustpilot, based on over 1,700 reviews. IC Markets, on the other hand, boasts a higher score of 4.8/5, from more than 46,500 reviews. IC Markets scores higher for user satisfaction and has a significantly larger review base, while easyMarkets remains a strong choice for beginners.

Our Stronger Trust and Regulation Verdict

If choosing a broker based on leverage, then choose IC Markets global branch overseen by the FSA where 500:1 leverage is available. Both brokers’ tier-1 regulated entities are restricted to 30:1 forex leverage.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

6. Most Popular Broker – IC Markets

IC Markets gets searched on Google more than easyMarkets. On average, IC Markets sees around 201,000 branded searches each month, while easyMarkets gets about 49,500 — that’s 75% fewer.

| Country | IC Markets | easyMarkets |

|---|---|---|

| India | 33,100 | 320 |

| Germany | 8,100 | 880 |

| Argentina | 8,100 | 1,600 |

| Colombia | 6,600 | 2,400 |

| Brazil | 6,600 | 2,400 |

| Turkey | 6,600 | 140 |

| Thailand | 5,400 | 480 |

| Morocco | 5,400 | 720 |

| Pakistan | 5,400 | 390 |

| United Arab Emirates | 5,400 | 320 |

| Philippines | 5,400 | 480 |

| United States | 4,400 | 720 |

| Bangladesh | 4,400 | 110 |

| Peru | 4,400 | 2,400 |

| Singapore | 4,400 | 720 |

| Australia | 4,400 | 110 |

| Poland | 3,600 | 18,100 |

| Indonesia | 3,600 | 390 |

| Nigeria | 2,900 | 320 |

| Vietnam | 2,900 | 320 |

| Ethiopia | 2,900 | 70 |

| South Africa | 2,400 | 320 |

| Hong Kong | 2,400 | 170 |

| Saudi Arabia | 2,400 | 590 |

| Uzbekistan | 2,400 | 210 |

| Ecuador | 2,400 | 320 |

| United Kingdom | 2,400 | 140 |

| Taiwan | 2,400 | 170 |

| Malaysia | 1,900 | 2,900 |

| Uruguay | 1,900 | 260 |

| Switzerland | 1,900 | 170 |

| Jordan | 1,600 | 1,000 |

| Algeria | 1,600 | 110 |

| Italy | 1,600 | 90 |

| Bolivia | 1,600 | 320 |

| Sweden | 1,600 | 90 |

| Mexico | 1,600 | 140 |

| Netherlands | 1,300 | 90 |

| Spain | 1,300 | 140 |

| Venezuela | 1,000 | 90 |

| Ireland | 1,000 | 390 |

| Tanzania | 1,000 | 70 |

| Canada | 880 | 70 |

| Botswana | 880 | 70 |

| Portugal | 880 | 720 |

| Cyprus | 880 | 170 |

| Sri Lanka | 880 | 50 |

| Greece | 720 | 40 |

| Chile | 720 | 50 |

| Austria | 720 | 480 |

| Ghana | 590 | 110 |

| France | 590 | 10 |

| New Zealand | 590 | 50 |

| Kenya | 480 | 20 |

| Mauritius | 480 | 10 |

| Dominican Republic | 390 | 70 |

| Japan | 320 | 30 |

| Cambodia | 260 | 320 |

| Egypt | 260 | 20 |

| Uganda | 260 | 110 |

| Panama | 260 | 30 |

| Mongolia | 210 | 170 |

| Costa Rica | 170 | 30 |

33,100 1st | |

390 2nd | |

9,900 3rd | |

720 4th | |

6,600 5th | |

2,400 6th | |

6,600 7th | |

1,900 8th |

Similarweb shows a similar story when it comes to August 2025 website visits with IC Markets receiving 2,290,000 visits vs. 362,851 for easyMarkets.

Our Most Popular Broker Verdict

IC Markets is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets: IC Markets

Regarding the range of products and CFD markets, both IC Markets and easyMarkets have unique features. IC Markets, as we’ve observed, offers a comprehensive range of trade options, making it an all-in-one broker for many traders. Their portfolio covers a wide spectrum, ensuring traders have multiple avenues to explore.

On the other hand, easyMarkets, while not as extensive as IC Markets in terms of the CFD suite, does offer a solid range of trading options. One standout feature of easyMarkets is its vanilla options, a distinct difference from the futures offered by IC Markets.

| CFDs | IC Markets | easyMarkets |

|---|---|---|

| Forex Pairs | 61 | 242 |

| Indices | 25 | 14 |

| Commodities | 4 Metals (Gold vs 6 currencies) (Silver vs 3 currencies) 8 Softs 5 Energies | 5 Metals 5 Energies 7 Softs |

| Cryptocurrencies | 23 | 3 |

| Shares CFDs | 2100+ | 60 (Varies by trading platform) (US, EU, AU, JA, HK exchanges) |

| ETFs | No | No |

| Bonds | 9 | No |

| Futures | Yes | No |

| Treasuries | 9 | No |

| Investment | Yes | No |

Our Top Product Range and CFD Markets Verdict

Based on the range of CFDs and markets available, IC Markets offers a more comprehensive product range, making it the preferred choice for traders looking for diverse trading options.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

8. Superior Educational Resources: IC Markets

In the realm of forex trading, continuous learning is paramount. Both IC Markets and easyMarkets understand this and have invested in providing top-notch educational resources for their users.

IC Markets, for instance, offers a plethora of webinars, video tutorials, and articles that cater to both beginners and seasoned traders. easyMarkets, on the other hand, has a structured educational suite that guides traders through the basics to more advanced topics.

- IC Markets provides a series of webinars that cover a wide range of trading topics.

- easyMarkets offers structured courses that guide traders step-by-step.

- Both brokers have a rich library of video tutorials to enhance visual learning.

- IC Markets boasts an extensive collection of articles that dive into intricate trading strategies.

- easyMarkets provides a glossary, ensuring traders understand the jargon used in the industry.

- Both brokers offer demo accounts, allowing traders to practice and hone their skills.

Our Superior Educational Resources Verdict

Based on our testing, IC Markets stands out with a more comprehensive educational suite, making it the top choice for traders keen on continuous learning.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

9. Superior Customer Service: IC Markets

The standard phone, online chat and email tools are available for customer service with both IC Markets and easyMarkets.

IC Markets Customer Service

IC Markets’ customer service team have several selling points that make it stand out compared to easyMarkets. These consist of:

- 24/7 customer service – accessible throughout the week regardless of whether the market is open or closed. ECN allows for trading at all hours so this availability can be helpful.

- Help Centre – Keyword search will suggest possible answers to the information you need.

- Emails – IC Markets provide the email address of their departments so you can address questions.

| Feature | IC Markets | easyMarkets |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/5 |

| Multilingual Support | Yes | Yes |

Customer Service With easyMarkets

easyMarkets only offer customer 24/5. The instant live chat function is available via their website and through trading platforms. Facebook Messenger and Viber messenger services can also be used to get in touch with easyMarkets. Clients in Australia can use a toll-free 1300 number when phoning in for support.

easyMarkets has a FAQs page listed under the educational resources, which are very helpful when seeking answers to common questions.

Those considering a Standard account or Premium account should note that access to a few features is not available. The table on the right shows the customer service features offered for each account.

Our Superior Customer Service Verdict

Both brokers offer excellent customer service; however, IC Markets is available for all traders throughout the week. This makes it best for all traders.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

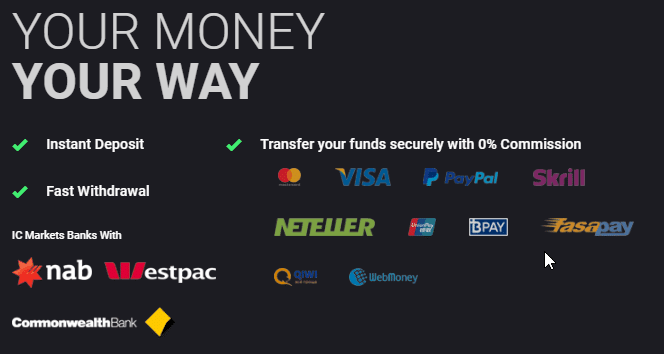

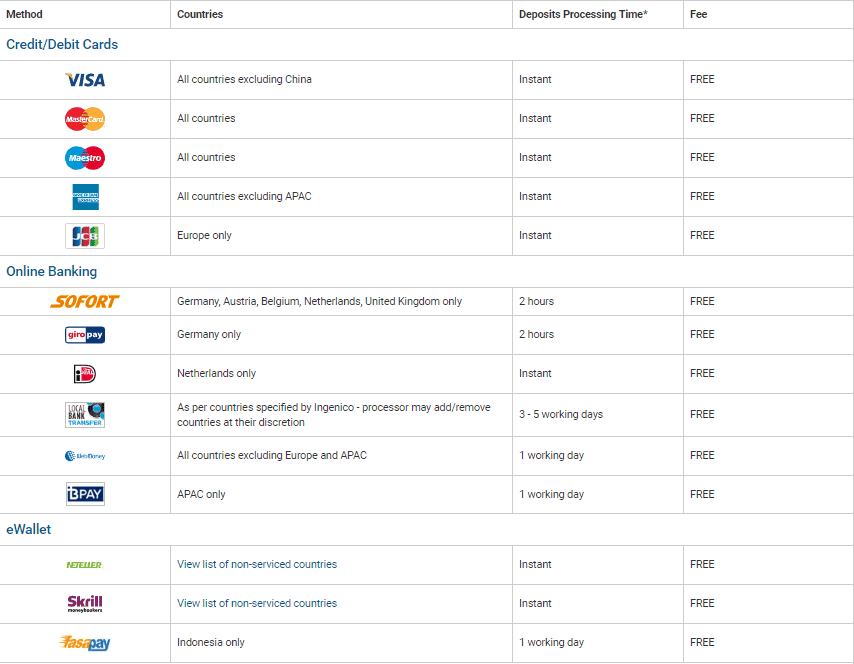

10. Better Funding Options: Tie

When analysing IC Markets and easyMarkets funding methods, we found that easyMarkets has a larger range of payment issuers and that these accounts don’t have fees. Traders in Australia should note that some of the payment issuers are not available in Australia, so it may not be of interest if you are trading from Australia.

IC Markets

The following methods are available with IC Markets to manage your funding. Credit and Debit Cards, Bank Wire Transfers, broker-to-broker transfers, Branch Cash Deposits, BPay Deposits, PayPal, Skrill, Neteller, WebMoney, QIWI, China Union Pay, and FasaPay. These deposits are usually instant with no fee charges for both IC Markets Account Types.

Domestic withdrawals are processed on the same day, and no fee is charged for this service. International withdrawals can take a maximum of 5 weekdays and have a charge of $25 AUD.

easyMarkets

All funds with easyMarkets are held segregated with Bankwest. ‘Bankwest’ is owned by CBA (Commonwealth Bank of Australia).

easyMarkets has a minimum withdrawal of $50 USD from bank accounts. e-Wallets and credit/debit card withdrawals do not require a minimum amount.

The table below demonstrates all the funding methods and their fees:

Our Better Funding Options Verdict

Neither IC Markets nor easyMarkets have fees for funds coming in or going out. Traders will need to decide which merchant they wish to use for funding and then check which broker offers their service.

11. Lower Minimum Deposit: IC Markets

When it comes to starting your trading journey, the initial deposit can be a significant factor. A lower minimum deposit allows new traders to begin trading without committing a large sum, making the platform more accessible to a broader audience. IC Markets and easyMarkets have competitive minimum deposit requirements, catering to novice and experienced traders.

The table below provides a quick comparison of the minimum deposit amounts required by each broker:

| | Minimum Deposit | Recommended Deposit |

| IC Markets | $200 | $200 |

| easyMarkets | $200 | NA |

It’s essential to note that while a lower minimum deposit can be enticing, traders should also consider other factors, such as the platform’s features, customer support, and overall trading experience. A broker’s reputation and reliability are just as crucial as the initial cost of entry.

Our Lower Minimum Deposit Verdict

IC Markets offers a more accessible entry point with a $0 minimum deposit, making it the preferable choice for traders looking to start with a lower initial investment.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

Is IC Markets or easyMarkets The Best Broker?

IC Markets is the winner because of its superior features in several categories, including lower spreads and fees, a better trading platform, and a more comprehensive product range. The table below summarises the key information leading to this verdict:

| Criteria | IC Markets | easyMarkets |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platforms | Yes | No |

| Superior Accounts And Features | Yes | No |

| Best Trading Experience | Yes | Yes |

| Stronger Trust And Regulation | Yes | No |

| CFD Product Range And Financial Markets | Yes | No |

| Superior Educational Resources | Yes | No |

| Better Customer Service | Yes | No |

| More Funding Options | Yes | Yes |

| Lower Minimum Deposit | Yes | No |

easyMarkets: Best For Beginner Traders

easyMarkets is better suited for beginner traders due to its user-friendly platform, fixed spreads, and unique risk management tools that provide a more predictable trading environment.

IC Markets: Best For Experienced Traders

IC Markets stands out for experienced traders with its ECN pricing, tighter spreads, advanced trading platforms, and a broader range of CFDs and markets available.

FAQs Comparing IC Markets Vs easyMarkets

Does easyMarkets or IC Markets Have Lower Costs?

IC Markets generally offers lower costs compared to easyMarkets. IC Markets is known for its competitive spreads, often starting from 0.0 pips for major currency pairs. On the other hand, easyMarkets offers fixed spreads which can be higher, especially during volatile market conditions. For a more detailed comparison of low-cost brokers, you can check out our comprehensive guide on the lowest spread forex brokers in the UK.

Which Broker Is Better For MetaTrader 4?

Both IC Markets and easyMarkets offer MetaTrader 4, but IC Markets is often preferred due to its enhanced execution speeds and tighter spreads on this platform. If you’re keen on exploring more about the best MT4 brokers, our comprehensive guide on the best MT4 forex brokers in the UK provides a detailed comparison. EasyMarkets, while offering MT4, also provides its custom platform with unique features.

Which Broker Offers Social Trading?

easyMarkets offers social trading features, allowing traders to follow and replicate the strategies of experienced traders. IC Markets, on the other hand, primarily focuses on providing advanced trading tools without a dedicated social trading platform. For those interested in diving deeper into social and copy trading, our comprehensive guide on the best social trading platforms offers a wealth of information.

Does Either Broker Offer Spread Betting?

Neither IC Markets nor easyMarkets offer spread betting as a primary service. Spread betting is a unique form of trading popular in the UK and offers tax benefits to traders. For those interested in exploring brokers that provide spread betting, our comprehensive guide on thebest spread betting brokers in the UK is a valuable resource. It’s essential to understand the risks and benefits associated with spread betting before diving in.

What Broker is Superior For Australian Forex Traders?

In my opinion, IC Markets stands out as the superior choice for Australian forex traders. Founded in Australia, IC Markets is ASIC-regulated, ensuring a high level of trust and security for traders down under. easyMarkets, while offering a solid platform, is based overseas. For Aussie traders, having a broker that understands the local market nuances can be invaluable. If you’re keen to explore more options tailored for Australian traders, I’d recommend checking out this comprehensive guide on the Best Forex Brokers In Australia. It’s always a good idea to choose a broker that aligns with your trading goals and understands the local market landscape.

What Broker is Superior For UK Forex Traders?

From my perspective, easyMarkets has a slight edge for UK forex traders. While both brokers offer solid platforms, easyMarkets is FCA-regulated, ensuring that UK traders have an added layer of security and trust. IC Markets, although offering a comprehensive trading environment, is primarily based overseas. For UK traders, it’s crucial to have a broker that’s attuned to the specific needs and regulations of the UK market. If you’re on the hunt for more options tailored for UK traders, I’d suggest diving into this detailed guide on the Best Forex Brokers In UK. It’s always wise to opt for a broker that not only offers great tools but also understands the intricacies of the local trading landscape.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Is IC Markets good for crypto?

Sure – IC Markets have about 20 crypto pairs to choose from, they are fine but there are brokers that have a bigger range like Eightcap and Pepperstone.