Pepperstone vs Swissquote 2026

Our comprehensive analysis of Pepperstone and Swissquote presents a fascinating comparison. Swissquote, established in 1996 as a bank, contrasts sharply with Pepperstone, a CFD broker founded in 2010. Join us as we delve deeper into the nuances of these two brokers. Keep reading!

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

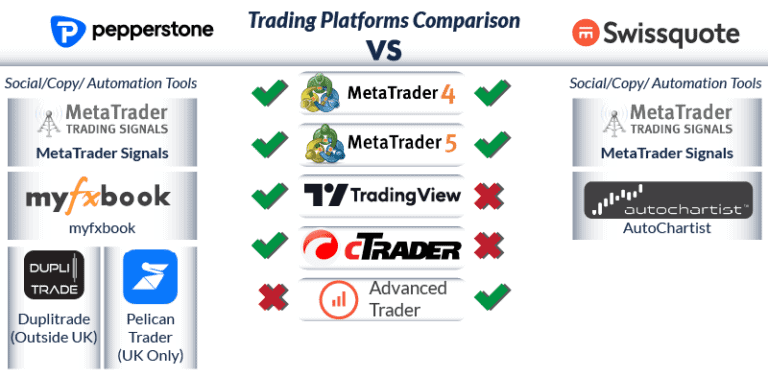

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors. Here are five noticeable differences between Pepperstone and Swissquote:

- Pepperstone was founded in 2010 and processes an average of $9.2bn USD in transactions daily.

- Pepperstone’s average spreads are generally lower, with a minimum spread of 0.6 pips on pairs like EUR/USD.

- Pepperstone provides a wide range of platforms, including MetaTrader 4, MetaTrader 5, and cTrader.

- Pepperstone received an ‘Excellent’ score of 4.7/5 stars on TrustPilot, mainly for great customer service.

- Swissquote offers MetaTrader and its proprietary platform, Advanced Trader.

- Swissquote started in 1996 and is also a bank.

- Swissquote received an ‘Average’ score of 3/5 stars on TrustPilot.

1. Lowest Spreads And Fees – Pepperstone

When it comes to forex trading, choosing a broker with the lowest spreads and fees is essential, as it directly affects trading costs. Lower spreads mean a smaller difference between the buying and selling price of a currency pair, reducing expenses on each trade. This is particularly advantageous for active traders, helping them minimize transaction costs and maximize profitability.

Spreads

In the ever-busy industry of forex trading, understanding the fee structures of your broker is crucial. Pepperstone offers competitive spreads, such as 1.1 pips for both EUR/USD and AUD/USD, while Swissquote’s spreads are generally higher at 1.7 pips for EUR/USD and 1.6 pips for AUD/USD. For other currency pairs, Pepperstone stays within industry standards, whereas Swissquote often exceeds them. Pepperstone requires no minimum deposit, although a $200 deposit is recommended, and charges a commission of $3.50 per lot. Swissquote, with a $1000 minimum deposit, charges a lower commission of $2 per lot. Both brokers offer SWAP-free accounts and do not charge funding fees. However, Pepperstone stands out by not imposing inactivity fees, unlike Swissquote, which deducts inactivity fees monthly until trading resumes or the account is closed. Despite Swissquote’s premium features, Pepperstone’s lower spreads, no minimum deposit requirement, and lack of inactivity fees make it a cost-effective choice for many traders.

| Standard Account | Pepperstone Spreads | Swissquote Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.40 | 2.04 | 1.7 |

| EUR/USD | 1.1 | 1.7 | 1.2 |

| USD/JPY | 1.2 | 1.6 | 1.5 |

| GBP/USD | 1.2 | 2 | 1.6 |

| AUD/USD | 1.1 | 1.6 | 1.6 |

| USD/CAD | 1.4 | 2.7 | 1.9 |

| EUR/GBP | 1.2 | 1.7 | 1.5 |

| EUR/JPY | 2.1 | 2.5 | 2.1 |

| AUD/JPY | 1.9 | 2.5 | 2.3 |

Commission Levels

Pepperstone charges a commission of $3.50 per trade, whereas Swissquote offers a more competitive rate of $2. However, Pepperstone stands out with a remarkable $0 minimum deposit requirement, significantly lower than Swissquote’s $1,000 threshold.

It’s essential to recognize that higher commission rates may include added features and advantages, such as sophisticated trading tools, educational resources, and superior customer support. Ultimately, selecting the right broker will hinge on each trader’s unique preferences and requirements.

Commissions:

Pepperstone: Charges a commission of $3.50 per trade on Razor accounts for forex trading.

Swissquote: Offers a lower commission rate of $2 per trade.

Minimum Deposit:

Pepperstone: Has a $0 minimum deposit requirement.

Swissquote: Requires a minimum deposit of $1,000.

Our team developed an exclusive fee calculator below, which, in most cases, indicates that Pepperstone’s RAW account type offers the lowest fees.

Standard Account Fees

In today’s competitive market, Pepperstone stands out with its attractive spreads for major currency pairs. For example, its EUR/USD spread is set at 1.10, perfectly aligning with industry norms. In contrast, Swissquote’s spread for the same pair is 1.70, reflecting a variance in their pricing strategies.

When examining the EUR/GBP pair, both brokers maintain a spread of 1.70, showcasing Pepperstone’s consistent competitive pricing across a variety of currency pairs.

Turning to the AUD/USD pair, Pepperstone again shines with a spread of 1.20, significantly better than Swissquote’s 1.60. Such discrepancies can considerably affect trading costs, particularly for high-volume traders.

For the USD/JPY pair, both brokers offer a spread of 1.60, indicative of the competitive rates prevalent in the current market.

Finally, Swissquote’s GBP/USD spread at 2.00 is noticeably higher than Pepperstone’s more favorable spread of 1.40, underscoring Pepperstone’s advantage in providing tighter spreads for this popular trading pair.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.10 | 1.10 | 1.30 | 1.30 | 1.30 |

| 1.70 | 1.60 | 1.70 | 2.00 | 1.60 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 1.20 | 1.30 | 1.30 | 1.50 | 1.10 |

| 0.94 | 1.48 | 1.45 | 1.68 | 1.90 |

| 1.20 | 1.41 | 1.47 | 1.47 | 1.61 |

| 1.52 | 2.08 | 1.46 | 1.87 | 1.67 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-02

Our Lowest Spreads and Fees Verdict

Due to their lowest spreads and fees, without a doubt, Pepperstone stands out as the clear winner, outpacing the competition.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

2. Better Trading Platform – Pepperstone

An superior trading platform is vital for brokers, significantly enhancing the user experience through advanced tools, rapid execution, and dependable performance. This attracts more traders, boosts trading volume, and enhances the broker’s reputation. Advanced technology helps traders make informed decisions, leading to greater success and satisfaction.

| Trading Platform | Pepperstone | Swissquote |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | No |

| TradingView | Yes | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

Metatrader

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are popular trading platforms for forex and CFDs. MT4 is known for its user-friendly interface and automated trading, while MT5 offers more features and asset classes. Both ensure fast execution, technical analysis tools, and expert advisor support for all traders.

Pepperstone and Swissquote both provide access to MT4 and MT5, as well as Copy Trading and their own proprietary platforms. However, Pepperstone distinguishes itself by offering CTrader and TradingView, which Swissquote does not feature.

CTrader stands out as a robust trading platform equipped with advanced charting tools, a wide array of technical indicators, and various timeframes that allow for thorough analysis. It facilitates algorithmic trading via cAlgo, making it easy for traders to automate their strategies. With rapid trade execution and Level II pricing, CTrader delivers transparent insights into market dynamics and pricing information.

TradingView is another premier charting platform celebrated for its sophisticated charting capabilities and customizable technical indicators, coupled with real-time data analysis. Its intuitive interface and responsive design cater to traders of all skill levels. Moreover, TradingView fosters a social trading environment where traders can share insights and follow each other’s strategies.

Advanced Platforms

Both brokers offer robust platforms with a variety of tools and features to enhance your trading experience. Do you have a specific preference or need more details on any particular platform?

Pepperstone

Pepperstone provides an extensive selection of trading platforms tailored to meet diverse trading styles and individual preferences:

- MetaTrader 4 (MT4): A popular platform for forex trading with customizable features and expert advisors.

- MetaTrader 5 (MT5): An advanced version of MT4 with more features and functionality.

- cTrader: Known for its intuitive design and institutional trading environment.

- TradingView: Offers powerful charting tools and social trading capabilities.

- Pepperstone Trading Platform: A proprietary platform with features like quick switch view, live streaming prices, and custom watchlists.

Swissquote

Swissquote offers a diverse selection of trading platforms to suit various trading styles:

- MetaTrader 4 (MT4): Widely used for forex and CFD trading with customizable options.

- MetaTrader 5 (MT5): Offers advanced features and improved functionality over MT4.

- Swissquote Trading Platform: A proprietary platform with advanced charting tools, real-time data, and a user-friendly interface.

- TradingView: Integrated for advanced charting and social trading features.

Both brokers provide powerful platforms equipped with a diverse range of tools and features designed to elevate your trading experience.

Copy Trading

Pepperstone delivers an exceptional copy trading experience through its innovative CopyTrading by Pepperstone app, created in collaboration with Pelican Exchange Ltd. This dynamic platform allows traders to easily explore and replicate the strategies of thousands of signal providers right within their MetaTrader 4 (MT4) or MetaTrader 5 (MT5) accounts. Furthermore, Pepperstone’s cTrader Copy empowers users to emulate the successful strategies of top traders or to showcase their own strategies for others to follow— all seamlessly integrated within the cTrader platform.

Swissquote, on the other hand, facilitates copy trading via the MetaTrader 4 and 5 platforms, which feature built-in capabilities to automate trades and mimic the strategies of accomplished traders. Users can access profiles of seasoned traders and automatically replicate their trades. However, it is worth noting that Swissquote lacks proprietary copy trading tools beyond what is provided within the MetaTrader platforms.

Our Trading Platform Verdict

For this category, Pepperstone secures first place thanks to their better trading platform.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

3. Superior Accounts And Features – Pepperstone

The success of a broker depends on the delivery of superior accounts and features fit for traders at every skill level. By ensuring flexibility, equipping clients with advanced tools, and enhancing trading conditions, brokers can appeal to a wide array of clients while elevating the overall trading experience. This strategy not only boosts client satisfaction and loyalty but also fortifies the broker’s position in the market, enhancing their competitiveness.

Pepperstone features an account system that requires no minimum deposit, though they recommend beginning with $200. Their extensive payment options include bank transfers, Visa/Mastercard credit and debit cards, as well as eWallets like Neteller, Skrill, PayPal, and UnionPay. In contrast, Swissquote mandates specific minimum deposits for each account, with a more limited range of funding options primarily centered around bank transfers and Visa/Mastercard.

When it comes to trading spreads, Pepperstone has a distinct advantage. Their average spreads are considerably lower, with pairs such as EUR/USD showcasing a minimum spread of just 0.6 pips. Swissquote, on the other hand, presents higher spreads that fluctuate based on the account type. For example, their UK/EU Premium account offers a minimum spread of 1.3 pips, while their Prime account matches Pepperstone’s 0.6 pips.

As for trading platforms, Pepperstone excels with a wide selection that includes the widely used MetaTrader 4 and 5, cTrader, and more. Swissquote provides both MetaTrader platforms as well, but also features its proprietary Advanced Trader platform, which incorporates TradingView charts and allows for the creation of custom tools.

| Pepperstone | Swissquote | |

|---|---|---|

| Standard Account | Yes | |

| Raw Account | Yes | |

| Swap Free Account | Yes | |

| Active Traders | Yes | |

| Spread Betting (UK) | Yes |

Our Superior Accounts and Features Verdict

In this section, we see that Pepperstone takes the cake due to their superior accounts and features.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – Pepperstone

In the industry of forex trading, delivering an exceptional trading experience requires more than just market access. Brokers must offer advanced trading platforms, fast execution speeds, competitive spreads, and strong customer support to meet traders’ diverse needs. With a user-friendly interface, educational resources, and powerful trading tools, brokers can enhance trader satisfaction, boost engagement, and build long-term loyalty in a highly competitive market.

After thoroughly exploring and studying both Pepperstone and Swissquote, I’ve discovered notable differences in their trading experiences. Pepperstone, in particular, excels in our evaluations as the top choice for MT4 trading. This distinction is a considerable benefit for traders who favor the MetaTrader 4 platform, celebrated for its intuitive interface and robust suite of tools.

- Pepperstone offers the best MT4 trading experience.

- They also shine in automation, with tools like Capitalise.ai enhancing the trading process.

- Swissquote, while robust, doesn’t quite match up to Pepperstone in terms of platform versatility.

- However, Swissquote’s proprietary platform, Advanced Trader, does offer unique features that some traders might appreciate.

While Swissquote has its advantages, particularly with its Advanced Trader platform, Pepperstone stands out with its superior offerings in MT4 and automation. The user-friendly interface, coupled with advanced tools, significantly enhances the trading experience, making it smoother and more efficient.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| Pepperstone | 77ms | 2/36 | 100ms | 10/36 |

| Swissquote | 258ms | 36/36 | 198ms | 30/36 |

Our Best Trading Experience and Ease Verdict

Based on our analysis and testing, Pepperstone dominates this are of expertise owing to their best trading experience and ease.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – A Tie

Offering superior accounts and features by brokers in forex trading is key to building a broker’s reputation and attracting a wide range of traders. By providing flexible options, advanced tools, and optimal trading conditions, brokers create a more dynamic and rewarding trading experience. This fosters trust, encourages higher trading activity, and strengthens the broker’s market presence.

Pepperstone Trust Score

Swissquote Trust Score

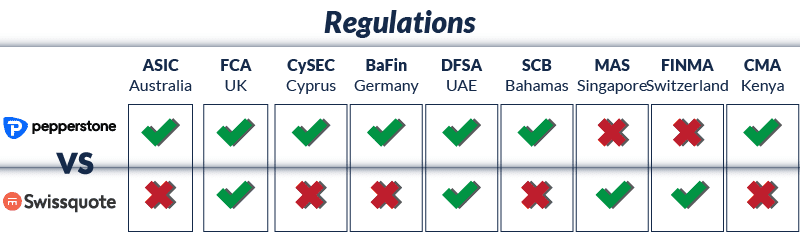

Regulations

We measure regulators in two regions. However, at the end of the day, make sure to use a broker regulated in the country you are trading from to maximise protection.

Pepperstone has five of the top regulators regulating them, alongside one second-tier regulator. These are:

- The Australian Securities and Investments Commission (ASIC) in Australia

- The Financial Conduct Authority (FCA) in the United Kingdom

- The Cyprus Securities and Exchange Commission (CySEC), across the European Union

- The Federal Financial Supervisory Authority (BaFIN) in Germany

- The Dubai Financial Services Authority (DFSA) in the United Arab Emirates

Traders outside any of the aforementioned regions will trade with the Pepperstone subsidiary based in the Bahamas, which is regulated by the Securities Commission Of The Bahamas (SCB).

In comparison, Swissquote has four top-tier regulators:

- The FCA in the UK

- The DFSA in the UAE

- The Monetary Authority of Singapore (MAS) in Singapore

- The Financial Market Supervisory Authority (FINMA) in Switzerland.

| Pepperstone | Swissquote | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) BaFin (Germany) CYSEC (Cyprus) | FCA (UK) CYSEC (Cyprus) MAS (Singapore) |

| Tier 2 Regulation | DFSA (Dubai) | DFSA (Dubai) MFSA (Europe) SFC CSSF FINMA (Switzerland) |

| Tier 3 Regulation | SCB (Bahamas) CMA (Kenya) |

Reviews

Pepperstone enjoys a strong Trustpilot rating of 4.5 out of 5, with over 3,000 reviews. Swissquote, in contrast, holds a more moderate rating of 3.7 out of 5, based on more than 3,300 reviews. Pepperstone is generally perceived as more responsive and trader-friendly, while Swissquote offers a wider array of services but receives more mixed feedback regarding user experience and support.

Our Stronger Trust and Regulation Verdict

It’s a standoff for both Pepperstone and Swissquotes, this is in light of their stronger trust and regulation.

Swissquote ReviewVisit Swissquotes

*Your capital is at risk ‘82.75% of retail CFD accounts lose money’

6. Most Popular Broker – Swissquote

Swissquote gets searched on Google more than Pepperstone. On average, Swissquote sees around 135,000 branded searches each month, while Pepperstone gets about 110,000 — that’s 18% fewer.

| Country | Pepperstone | Swissquote |

|---|---|---|

| France | 1,000 | 8,100 |

| Germany | 3,600 | 5,400 |

| United Kingdom | 5,400 | 2,400 |

| Italy | 1,900 | 1,900 |

| Spain | 1,900 | 1,900 |

| United Arab Emirates | 1,000 | 1,900 |

| Turkey | 1,600 | 1,300 |

| United States | 4,400 | 1,000 |

| South Africa | 2,900 | 1,000 |

| Thailand | 4,400 | 880 |

| India | 2,900 | 720 |

| Netherlands | 880 | 720 |

| Brazil | 6,600 | 720 |

| Saudi Arabia | 260 | 720 |

| Austria | 320 | 720 |

| Poland | 720 | 590 |

| Portugal | 480 | 590 |

| Greece | 210 | 590 |

| Singapore | 1,600 | 480 |

| Hong Kong | 3,600 | 480 |

| Cyprus | 480 | 480 |

| Mexico | 3,600 | 390 |

| Canada | 720 | 320 |

| Australia | 8,100 | 320 |

| Colombia | 3,600 | 320 |

| Argentina | 1,300 | 320 |

| Japan | 480 | 260 |

| Egypt | 390 | 260 |

| Sweden | 390 | 260 |

| Ireland | 260 | 260 |

| Malaysia | 4,400 | 210 |

| Taiwan | 1,000 | 210 |

| Indonesia | 1,600 | 170 |

| Morocco | 720 | 170 |

| Chile | 1,000 | 170 |

| Costa Rica | 480 | 170 |

| Panama | 320 | 170 |

| Philippines | 880 | 140 |

| Nigeria | 1,300 | 140 |

| Mauritius | 110 | 140 |

| Peru | 1,600 | 140 |

| Vietnam | 720 | 110 |

| Ecuador | 1,000 | 110 |

| Algeria | 390 | 90 |

| Uzbekistan | 140 | 90 |

| Pakistan | 1,300 | 70 |

| Dominican Republic | 880 | 70 |

| Venezuela | 390 | 70 |

| Jordan | 260 | 70 |

| Kenya | 4,400 | 50 |

| Cambodia | 320 | 50 |

| New Zealand | 170 | 50 |

| Bolivia | 1,300 | 40 |

| Bangladesh | 390 | 30 |

| Switzerland | 320 | 30 |

| Ghana | 260 | 30 |

| Sri Lanka | 320 | 20 |

| Tanzania | 720 | 20 |

| Uganda | 390 | 10 |

| Ethiopia | 390 | 10 |

| Botswana | 390 | 10 |

| Mongolia | 1,900 | 10 |

8,100 1st | |

1,000 2nd | |

5,400 3rd | |

3,600 4th | |

1,900 5th | |

1,900 6th | |

1,900 7th | |

1,000 8th |

Similarweb shows a different story when it comes to February 2024 website visits with Swissquote receiving 531,000 visits vs. 1,273,000 for Pepperstone.

Our Most Popular Broker Verdict

Swissquote is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

Swissquote ReviewVisit Swissquotes

*Your capital is at risk ‘82.75% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – Pepperstone

A comprehensive range of CFD products and access to various financial markets are crucial for success in forex trading, providing traders with enhanced opportunities to diversify their portfolios and efficiently manage risks. Engaging with multiple asset classes allows traders to respond adeptly to fluctuating market conditions, maximize profit potential, and refine their overall strategy. This diversification not only boosts trader engagement but also solidifies a broker’s competitive advantage.

Forex pairs are the most commonly traded CFD instrument, but there is also a wide range of other CFD products available, like indices, commodities, crypto, shares and ETFs.

| CFDs | Pepperstone | Swissquote |

|---|---|---|

| Forex Pairs | 94 | 80 |

| Indices | 27 | 10 |

| Commodities | 33 Commodities 7 Metals, 4 Energies, 9 Softs, 13 Hard | 10 |

| Cryptocurrencies | 44 | 0 |

| Shares | 1,170 | 15 |

| ETFs | 95 | 0 |

| Bonds/Treasuries | 7 | 5 |

| Other Products(Options,Futures) | No | 5 |

Evaluating forex brokers necessitates a clear understanding of their offerings and fee structures to make well-informed decisions. Among the industry leaders, Pepperstone and Swissquote stand out, presenting a diverse selection of currency pairs, leverage options, and trading platforms designed to accommodate various trading styles. In this section, we will explore their spreads, commissions, minimum deposits, and unique features, delivering a thorough comparison to assist traders in identifying the broker that aligns best with their requirements.

Currency Pairs:

- Pepperstone offers an impressive range of 94 currency pairs, providing traders with a wide variety of options to trade.

- SwissQuote offers 80 forex pairs, which is slightly less compared to Pepperstone.

Retail Leverage:

- Pepperstone caps retail leverage at 30:1 in tier-one regulatory regions (such as Australia, the UK, and Europe), 400:1 in Kenya, and 200:1 in other regions.

- SwissQuote offers retail leverage up to 30:1 across all regions.

Professional Leverage:

- Pepperstone provides professional traders in tier-one regulatory regions with access to 500:1 leverage.

- SwissQuote offers professional leverage up to 400:1 across all regions.

Other Products:

- Pepperstone has a strong offering in share trading, with over 1,000 stocks available for trading.

- SwissQuote does not offer CFDs in Switzerland due to local regulations.

Our Top Product Range and CFD Markets Verdict

Pepperstone excels in this section this is due to their top product range and CDF markets.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

8. Superior Educational Resources – Pepperstone

In the fast-paced and busy world of forex trading, having access to high-quality educational resources can be transformative. An extensive array of learning materials—spanning webinars, articles, video tutorials, and organized courses—empowers traders with the knowledge and skills necessary for making informed decisions and enhancing their strategies. A solid educational foundation not only nurtures ongoing growth and confidence but also paves the way for lasting success in the dynamic forex market.

Both Pepperstone and Swissquote offer extensive educational resources to support traders at all levels. Pepperstone offers an array of educational resources, including webinars, trading guides, and a specialized section for beginners, all enhanced by a demo account and a variety of learning tools. Swissquote complements its offerings with e-books, tutorials, and a comprehensive learning center, alongside market analysis and sophisticated trading tools. Both brokers are committed to fostering continuous learning through regularly updated materials, webinars, and seminars, empowering traders to stay informed and enhance their strategies effectively.

Pepperstone:

- Offers a comprehensive range of educational resources.

- Provides webinars, seminars, and trading guides.

- Features a dedicated section for beginner traders.

- Offers a demo account for practice and learning.

- Has a variety of tools and platforms to aid in learning.

- Their resources are regularly updated to stay relevant.

Swissquote:

- Also offers a wide range of educational materials.

- Provides e-books, tutorials, and market analysis.

- Has a dedicated learning centre for traders.

- Offers a demo account for newcomers to practice.

- Features advanced trading tools for enhanced learning.

- Regularly hosts webinars and seminars for continuous learning.

Our Superior Educational Resources Verdict

Based on our team’s testing, Pepperstone comes out on top in this category on the account of their superior educational resources.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

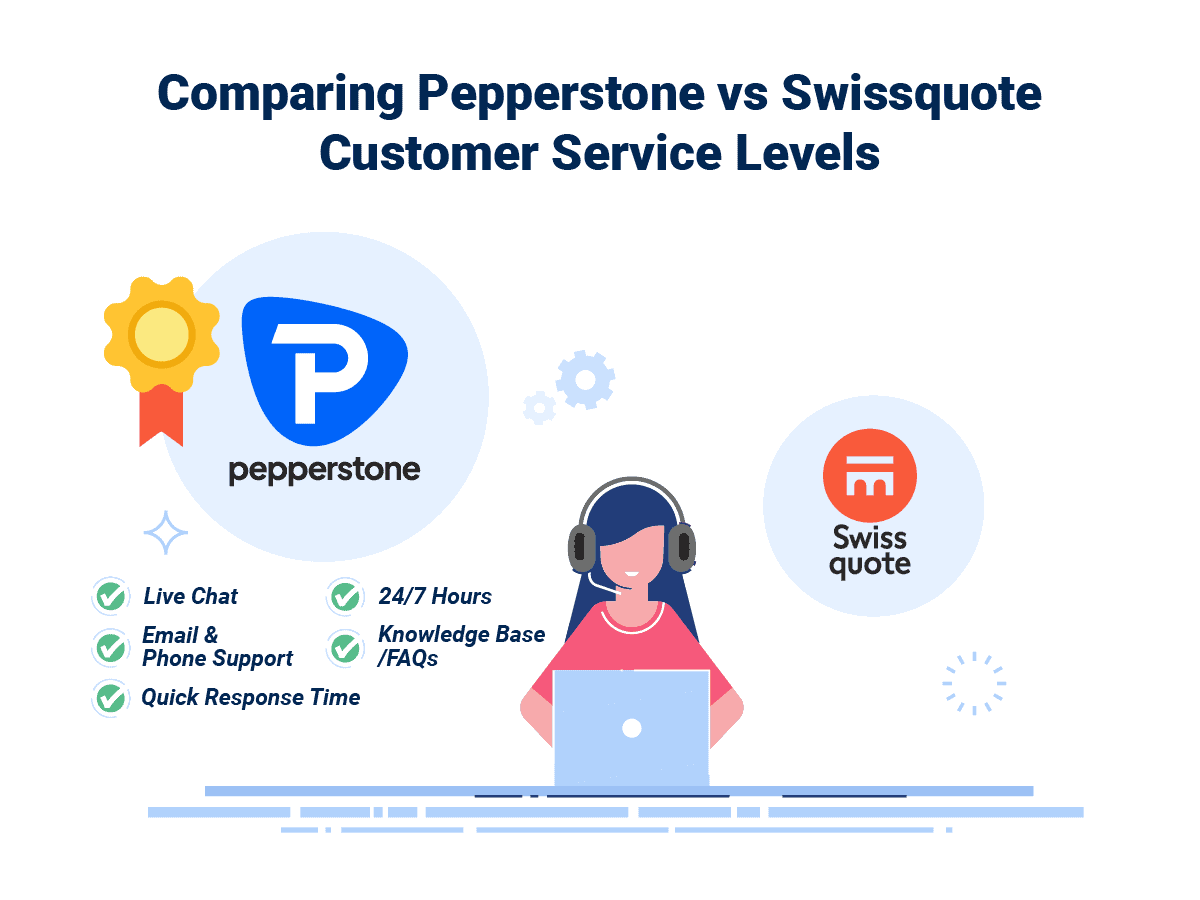

9. Superior Customer Service – Pepperstone

An attentive and knowledgeable support team can significantly impact your trading experience by offering prompt assistance with technical challenges, account management, and platform navigation. With 24/7 access to customer service via live chat, phone, or email, traders gain confidence and reduce potential disruptions. In the dynamic world of forex trading, where every second is crucial, efficient support not only facilitates seamless trading but also allows traders to concentrate on their strategies instead of troubleshooting issues.

From our in-depth analysis and testing, both Pepperstone and Swissquote have shown a strong commitment to customer satisfaction.

In forex trading, having dependable customer support is essential for smooth execution and effective issue resolution. Pepperstone excels with its 24/5 customer service, available through live chat, email, and phone, along with a thorough FAQ section for quick problem-solving. Similarly, Swissquote offers robust 24/5 support with a dedicated team reachable via phone, email, and live chat. Their extensive help center guarantees immediate assistance, reducing downtime and significantly boosting trading efficiency.

| Feature | Pepperstone | Swissquote |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/5 |

| Multilingual Support | Yes | Yes |

Both brokers provide strong support, but the quality of service can differ. Pepperstone is renowned for its rapid response times and a highly knowledgeable support team. In contrast, Swissquote, although also efficient, prioritizes offering comprehensive answers, ensuring that traders thoroughly grasp the solutions provided.

Our Superior Customer Service Verdict

Based on our team’s scores and testing, Pepperstone ranks highest in this portion this is on account of their superior customer serviee.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

10. Better Funding Options – Pepperstone

Efficient and flexible funding options revolutionize forex trading by enabling traders to manage their capital with ease. With a wide array of funding methods—ranging from traditional bank transfers and credit/debit cards to digital wallets like PayPal, Skrill, and Neteller, along with the increasing acceptance of cryptocurrencies—traders can enjoy swift, secure, and cost-effective transactions. By reducing fees and enhancing convenience, brokers not only boost trader satisfaction but also foster a more dynamic trading environment.

Both Pepperstone and Swissquote have developed comprehensive funding options to cater to their clients’ diverse needs.

Pepperstone provides an extensive range of deposit and withdrawal options, including bank transfers, credit/debit cards, and electronic wallets like PayPal, Skrill, and Neteller. Most deposits are free of charge, while withdrawals through Skrill or Neteller attract a nominal fee of 1 USD, and international bank transfer withdrawals carry a fee of 20 USD. While most deposits are processed instantly, withdrawals can take up to three days to complete.

Swissquote offers a range of conventional funding options, including bank transfers and credit/debit card payments. In addition to these traditional methods, they provide cutting-edge solutions like Lombard loans, which empower clients to leverage their securities portfolios for enhanced liquidity without the need to sell their assets. This strategic approach allows traders to capitalize on new market opportunities with greater efficiency.

Both brokers strive to elevate the trading experience by providing a variety of funding methods and financial solutions, ensuring clients enjoy flexibility and convenience in managing their accounts.

The table below provides a comprehensive comparison of the funding options available for both brokers:

| Funding Option | Pepperstone | Swissquote |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | No |

| Skrill | Yes | No |

| Neteller | Yes | No |

| Crypto | Yes | No |

| Rapid Pay | No | No |

| POLi / bPay | Yes | No |

| Klarna | No | No |

Our Better Funding Options Verdict

Based on the available funding options, Pepperstone clearly dominates this niche this is in light of their better funding options.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

11. Lower Minimum Deposit – Pepperstone

A reduced minimum deposit in forex trading paves the way for traders from diverse backgrounds, enhancing the accessibility and inclusivity of the market. By permitting newcomers to start with a modest investment, financial barriers are lowered, allowing beginners to acquire practical experience without taking on significant risk. This strategy not only encourages broader market participation but also empowers traders to refine their strategies and gradually build their capital over time.

Pepperstone accounts have no minimum deposit, but do recommend $200 to start with. To pay, you can use a bank transfer, Visa/Mastercard credit cards or debit cards or BPay/POLi in Australia. You could also use eWallets like Neteller, Skrill, PayPal and UnionPay.

Each of Swissquote’s accounts has a different minimum deposit, so be careful not to mix them up. Funding options are limited, these being bank, Visa and MasterCard.

For the UK/EU accounts: Premium has a $1000 minimum deposit in a base currency or the equivalent in USD. Prime is at $5000, and Elite and Prime are at $10,000.

Outside the UK and Europe, there are 3 accounts with minimum deposits for each Account being $1000 for Standard, $10,000 for Premium, and $50,000 for Prime.

| Minimum Deposit | Recommended Deposit | |

| Pepperstone | $0 | $200 |

| Swissquote | $1,000 | $0 |

Our Lower Minimum Deposit Verdict

Finally, our dedicated can surmise that Pepperstone takes the crown in this category by the reason of their lower minimum deposit.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘71.9% of retail CFD accounts lose money’

Our Final Verdict On Which Broker Is The Best: Swissquote or Pepperstone?

Pepperstone unquestionably leads the pack in this review because it consistently outperforms Swissquote in most of the key areas that traders value the most, from spreads and fees to trading platforms and customer service. The table below summarises the key information leading to this verdict:

| Categories | Pepperstone | Swissquote |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platform | Yes | No |

| Superior Accounts And Features | Yes | No |

| Best Trading Experience And Ease | Yes | No |

| Stronger Trust And Regulation | No | No |

| Top Product Range And CFD Markets | Yes | No |

| Superior Educational Resources | Yes | No |

| Superior Customer Service | Yes | No |

| Better Funding Options | Yes | No |

| Lower Minimum Deposit | Yes | No |

Best For Beginner Traders

For those just starting out in the trading world, Pepperstone offers a more user-friendly platform and comprehensive educational resources.

Best For Experienced Traders

For seasoned traders looking for advanced tools and competitive spreads, Pepperstone remains the top choice.

FAQs Comparing Pepperstone Vs Swissquote

Does Swissquote or Pepperstone Have Lower Costs?

Pepperstone generally offers lower costs compared to Swissquote. Specifically, Pepperstone boasts some of the industry’s most competitive spreads, often starting from as low as 0.0 pips for major currency pairs. This is especially evident when trading on their Razor account. For a more detailed comparison of broker commissions, you can visit this comprehensive guide on Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both brokers offer MetaTrader 4, but Pepperstone is often regarded as superior due to its enhanced tools and tighter spreads on this platform. Their integration with MT4 is seamless, providing traders with a robust trading experience. For those keen on exploring the best brokers for MetaTrader 4, this list of top MT4 brokers is a valuable resource.

Which Broker Offers Social Trading?

Pepperstone stands out when it comes to social or copy trading, offering various platforms and tools that facilitate this trading style. Swissquote, while having its strengths, doesn’t have as pronounced a focus on social trading as Pepperstone. For traders interested in diving deeper into social trading platforms, here’s a comprehensive review of the best social trading platforms.

Does Either Broker Offer Spread Betting?

Pepperstone offers spread betting, especially for UK traders. This form of trading is tax-free in the UK and is a popular alternative to traditional forex trading. Swissquote, on the other hand, does not have a pronounced focus on spread betting. For those interested in exploring spread betting further, here’s a comprehensive guide on the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, Pepperstone stands out as the superior choice for Australian forex traders. Not only is Pepperstone ASIC regulated, but it’s also an Australian-founded company, giving it a home-ground advantage. Swissquote, while a reputable broker, is based overseas. Pepperstone’s deep understanding of the Australian market, combined with its robust offerings, makes it a top pick. For a broader perspective on Australian forex brokers, you can check out this detailed review of the Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK traders, I personally believe Swissquote has a slight edge. Both brokers are FCA regulated, ensuring a high level of trust and security for UK traders. However, Swissquote’s global presence and its adaptability to various markets give it an advantage in the UK. While Pepperstone is a strong contender, Swissquote’s offerings are more tailored to the UK market. For more insights on the best brokers for UK traders, here’s a comprehensive list of top UK trading platforms.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

Is my money safe with Swissquote?

Yes, Swissquotes is a regulated broker so you can be sure your funds are kept in a segregated account.