XM vs IC Markets: Which One Is Best?

XM is a commission-free forex broker, while IC offers Standard and tight ECN pricing accounts. Our forex team compared the XM vs IC Markets to see who offers the better spreads, trading platforms, accounts and CFD markets.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our comprehensive comparison covers the 10 most important trading factors. Here are five key differences between XM and IC Markets:

- XM offers a lower minimum deposit requirement than IC Markets, making it more accessible for beginners.

- IC Markets provides tighter spreads compared to XM, offering better value for traders.

- XM has a broader range of educational resources, beneficial for new traders.

- IC Markets excels in execution speeds, surpassing XM in this aspect.

- XM supports a wider variety of payment methods, offering greater flexibility for deposits and withdrawals.

1. IC Markets: Lowest Spreads And Fees

IC Markets and XM are online brokers that offer clients a range of forex and CFD products to trade. IC Markets is based in Sydney, while XM is owned by TradingPoint International, with their head office in Limassol, Cyprus. Both brokers accept clients from all over the globe and are overseen by multiple financial authorities.

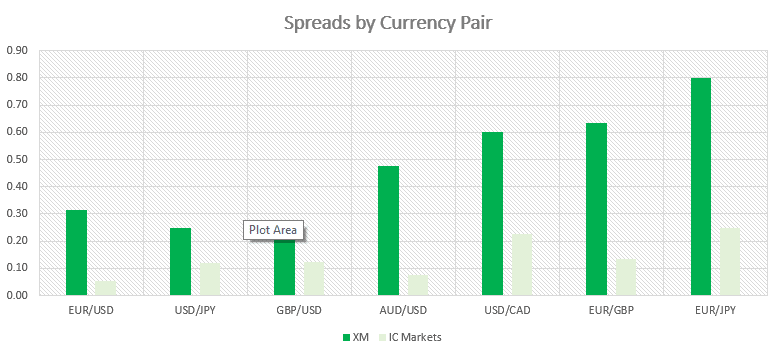

XM Spreads

| XM | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY | All-in Cost EUR/USD - Active | EUR/USD Standard Account |

|---|---|---|---|---|---|---|---|---|---|---|

| MyFxBook | 0.20 | 0.10 | 0.10 | 0.40 | 0.60 | 0.40 | 1.10 | 1.10 | N/A | N/A |

| BrokerChooser | 0.10 | 0.10 | 0.20 | 0.40 | 0.50 | N/A | N/A | N/A | N/A | N/A |

| ForexBrokers.com | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| CompareForexBrokers | 0.26 | 0.10 | 0.10 | 0.20 | 0.10 | 0.50 | 0.30 | 0.40 | N/A | N/A |

| XM | 0.70 | 0.70 | 0.60 | 0.90 | 1.20 | 1.00 | 1.00 | 1.50 | N/A | N/A |

| Consensus | 0.32 | 0.25 | 0.25 | 0.48 | 0.60 | 0.63 | 0.80 | 1.00 | N/A | N/A |

IC Markets Spreads

| IC Markets | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY | EUR/USD Standard Account |

|---|---|---|---|---|---|---|---|---|---|

| MyFxBook | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.20 | 0.70 | N/A |

| BrokerChooser | 0.00 | 0.10 | 0.00 | 0.00 | 0.20 | N/A | N/A | N/A | N/A |

| ForexBrokers.com | N/A | N/A | N/A | N/A | N/A | N/A | N/A | N/A | 0.62 |

| CompareForexBrokers | 0.19 | 0.24 | 0.27 | 0.23 | 0.45 | 0.27 | 0.30 | 0.82 | N/A |

| IC Markets | 0.02 | 0.14 | 0.23 | N/A | 0.25 | N/A | N/A | N/A | N/A |

| Consensus | 0.05 | 0.12 | 0.13 | 0.08 | 0.23 | 0.14 | 0.25 | 0.76 | 0.62 |

The graph below shows the consensus data with IC Markets having lower spreads in all major currency pairs.

Choosing A Broker

When choosing a broker, there are a number of considerations that should be taken into account. These include:

- Spreads and trading costs

- Trading execution and execution speed

- Account types

- Trading platforms

- Risk management tools

This review starts with a look at the trading fees. There is a large variation between brokerage costs from brokers, so looking at the broker’s spread costs is a good place to start. Low spreads generally result in lower trading costs. While a 1 pip difference in spreads between brokers might only be $10 USD, the costs will really add up when trading with multiple lots, leverage and frequent trading. So this review starts by looking at the broker’s spreads.

Spreads – No Dealing Desk vs Market Maker

The Account types of the type brokers are explained in detail in the next section, but it is well worth noting IC and XM’s pricing structure. While both are top forex brokers, IC Markets and XM provide different trading conditions.

IC Is A No Dealing Desk Broker

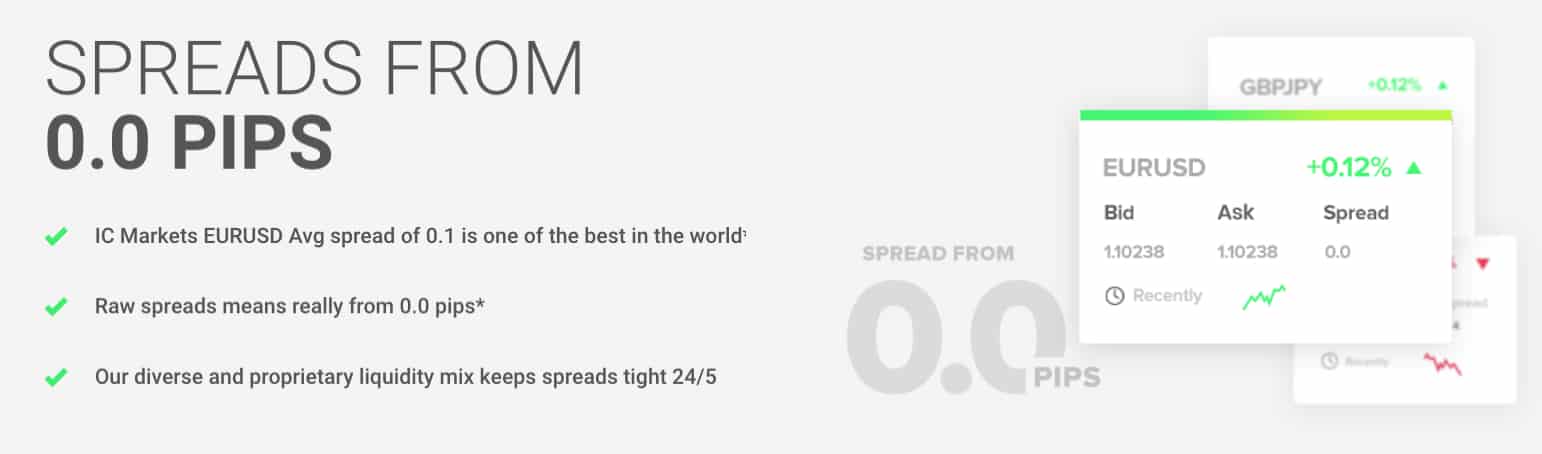

IC Markets is a no-dealing desk broker. IC Markets offer ultra-low spreads by using Straight-Through-Processing (STP) to connect their clients with liquidity providers using fast trading execution. IC Markets offer ultra-low spreads because the quotes provided come directly from the banks, hedge funds and investors with no price manipulation from the broker.

Instead of widening the spread to cover their costs, IC Markets applies a commission. With tight spreads and fast execution, ‘raw’ ECN-style brokers such as IC Markets provide excellent trading conditions for those focusing on scalping, day trading, or Expert Advisor strategies.

XM Is A Market Maker

XM Is A Market Maker

As a market maker broker, XM matches orders internally through their own liquidity sources. Although market maker brokers set their own bid/ask prices, XM uniquely guarantees no requotes. Normally a feature offered by ECN/STP no dealing desk brokers, XM uses ultra-fast execution to minimise the risk of slippage and, therefore, the need to provide requotes. In the event a price cannot be honoured, the broker uses the best available price rather than return with a new quote.

IC’s Raw Spreads vs XM’s Zero Spreads And XM’s Ultra Low Spreads

While XM and IC Markets offer different pricing structures, IC’s Raw Spreads account can be compared to XM’s Ultra Low account type (for traders outside Europe) and XM’s Zero Spread account (for traders in Europe). The account differences are demonstrated in the below table.

| XM vs IC Markets | XM Account Types | XM Commission Fees | IC Markets Account Types | IC Commission Fees |

|---|---|---|---|---|

| ECN-Style Account | 1. XM Zero Account (UK/EU Only) | $7 USD roundturn | 1. cTrader Raw Spread Account | $6 roundturn |

| 2. MetaTrader Raw Spread Account | $7 roundturn | |||

| Standard Accounts | 2. XM Standard | Commission Free | 3. Standard Account | Commission Free |

| 3. XM Micro | Commission Free | |||

| 4. XM Ultra-Low (Not available UK/EU) | Commission Free |

XM’s Ultra Low account is matched to prices from liquidity providers with a markup in the spread rather than a commission to cover costs. When compared with IC Markets Raw account and XMs Zero spreads accounts, once the $7 round turn commission fee is included, one can see the account prices are very comparable with other commission accounts. A $7 commission the equal to 0.7 pips. So if the Ultra-low account has a 7 pip difference from the other accounts, the cost is the same.

IC Raw Spreads vs XM's Ultra Low vs XM Zero vs other brokers | |||||

|---|---|---|---|---|---|

| 0.02 | 0.03 | 0.23 | 0.27 | 0.50 |

| 0.60 | 0.90 | 0.70 | 0.90 | 0.18 |

| 0.14 | 0.14 | 0.39 | 0.34 | 0.72 |

| 0.08 | 0.35 | 0.39 | 3.50 | 7.60 |

| 0.10 | 0.20 | 0.20 | 0.30 | 0.60 |

| 0.09 | 0.13 | 0.14 | 0.14 | 1.70 |

| 0.30 | 0.40 | 0.60 | 0.50 | 0.50 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-01

Calculating IC Raw Account vs XM Ultra-Low And XM Zero Accounts

For example, when trading the EUR/USD currency pair, the XM Ultra-Low account offers commission-free spreads of 0.80 pips compared to IC Markets Raw account and XM’s Zero accounts, which offer traders spreads of 0.10 pips plus a $7 commission fee. Using the table above:

- XM Ultra-low Overall Trading Costs, AUD/USD: 0.8 = $8

- XM Zero Overall Trading Costs, AUD/USD: 0.1 + $7 commission fee = $8

- IC Overall Trading Costs, AUD/USD: 0.1 + $7 commission fee = $8

While the above example suggests the spreads for each broker are the same or very familiar (remember the spreads are variable), CFB looked across a range of spreads and found IC Markets to offer the most value overall. AUD/JPY and USD/SGD, for example, show IC Markets to offer significantly better value.

- XM Ultra-low Overall Trading Costs, AUD/JPY: 1.9 = $19

- XM Zero Overall Trading Costs, AUD/JPY: 1.2 + $7 commission fee = $19

- IC Overall Trading Costs, AUD/JPY: 0.4 + $7 commission fee = $11

- XM Ultra-low Overall Trading Costs, USD/SGD: 1.6 = $16

- XM Zero Overall Trading Costs, USD/SGD: 1.5 + $7 commission fee = $23

- IC Overall Trading Costs, USD/SGD: 0.3 + $7 commission fee = $10

Given that AUD/JPY and USD/SGD are no major currency pairs, XM may have competitive on the major pairs that are in line with IC Markets but offer lower value for minor and exotic forex pairs.

IC’s Standard Spreads vs XM’s Micro & Standard Spreads

IC Markets and XM both offer commission-free standard spreads that suit infrequent or beginner traders wanting to avoid calculating complex commission costs. When the two brokers are compared, IC is the clear winner with average spreads of 1.40 for the AUD/JPY and EUR/GBP forex pairs, while XM offers 3.30 pips and 2.00 pips, respectively.

Commission Free, Standard Spread Comparison | |||||

|---|---|---|---|---|---|

| 1.00 | 1.50 | 1.00 | 1.27 | 1.30 |

| 1.60 | 3.00 | 2.30 | 1.80 | 2.10 |

| 1.40 | 4.90 | 2.50 | 2.50 | 2.60 |

| 1.40 | 3.20 | 1.90 | 1.30 | 1.90 |

| 1.18 | 1.80 | 1.45 | 1.40 | 1.80 |

| 1.20 | 1.20 | 1.30 | 1.20 | 1.20 |

| 0.50 | 1.10 | 0.60 | 0.70 | 1.20 |

| 1.40 | 2.40 | 1.60 | 1.40 | 2.10 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-01

Other Trading Costs

As well as spreads and commission fees, trading costs can be increased by inactivity fees and overnight financing fees (swap rates).

IC Markets:

- Inactivity Fee: No inactivity fees are incurred, regardless of how long a trading account is left dormant.

- Swap Rate: Positions held open overnight will incur an overnight financing fee that is determined from interest rate differentials applicable to the two currency pairs involved in the trade.

XM:

- Inactivity Fee: After 90 days of inactivity, traders are charged $5 per month. Once an account balance decreases to $0, your trading account will be archived.

- Swap Rate: Positions held open for longer than a day will be charged swap rates, based on tom-next interest rates.

Note, both brokers charge triple swap rates on Wednesday evenings.

Our Lowest Spreads and Fees Verdict

With no dealing desk (NDD) interference as well as the option of commission-free or ECN-style pricing, IC Markets generally offers better spreads and execution than XM. While the XM Zero account (which is only available to European traders) may match IC Markets spreads for some currency pairs, it fairs significantly poorly on other pairs as you can see on our IC Markets review page. IC Markets can, therefore, be said to offer better value when it comes to brokerage fees.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

2. Tie: Better Trading Platform

Both brokers offer a choice of popular trading platforms, with neither offering proprietary software as an alternative. All options provide advanced technical analysis tools and automated trading features, though market access varies between platforms.

| Trading Platform | XM | IC Markets |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | No | Yes |

| TradingView | No | Yes |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | Yes |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

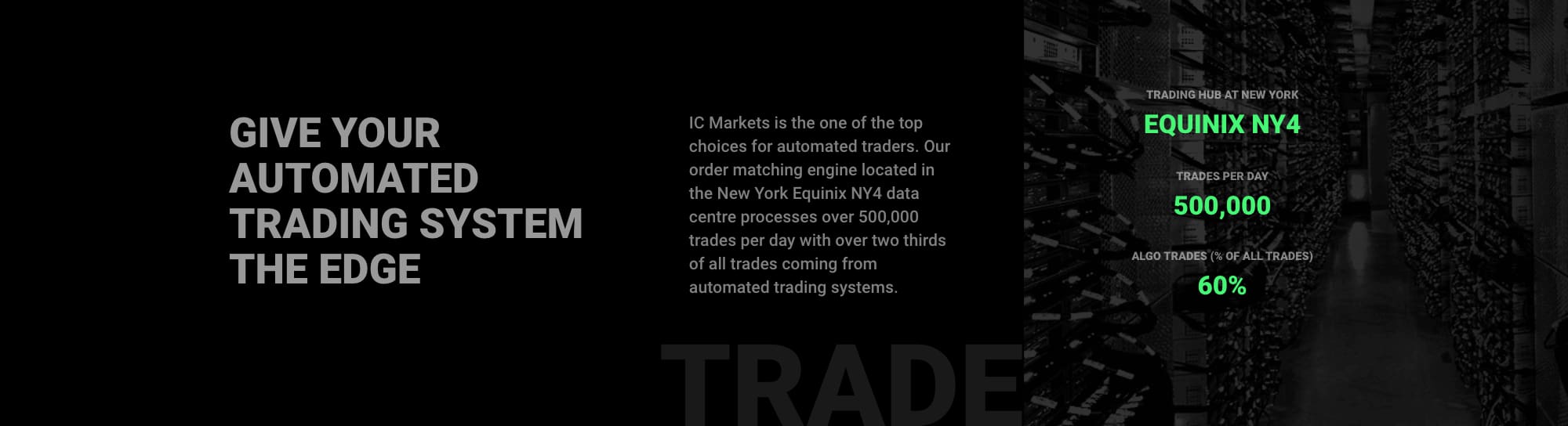

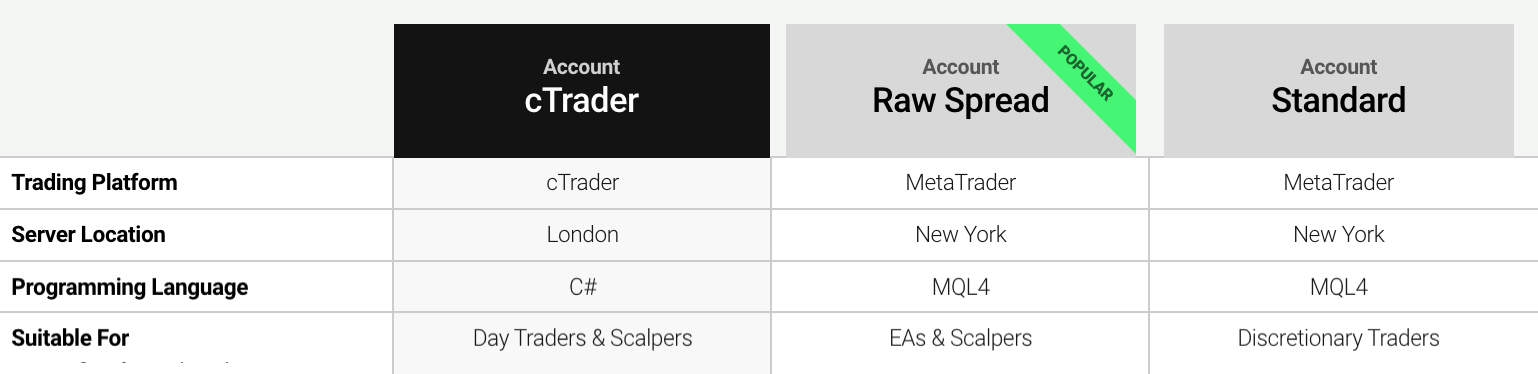

IC Markets Trading Platforms

In total, IC Markets offers three trading platform options. Standard account holders can choose between MetaTrader 4 (MT4) and MetaTrader 5 (MT5), while Raw Spread accounts also have the choice of cTrader. Commission fees, CFD product range and trading tools vary between each platform, yet all options provide access to low spreads and ultra-fast execution.

Another difference between IC Markets trading platforms is where servers are located. Equinix servers facilitating trading for IC’s MetaTrader Raw and Standard accounts are based in New York’s data centres, while cTrader’s server is based in London. Depending on where you are located, this may be important to gain the fastest execution speeds with minimal lag.

XM Trading Platforms

As an XM customer, you can choose between MetaTrader 4 and MetaTrader 5, with the main difference being the CFD product range available to trade. MT4 is a great option for those wanting to focus on the index, metals, energies and forex trading. Yet, if you are interested in trading shares with XM, you will need to use MT5.

Unlike IC Markets, XM only has one trade server located in London.

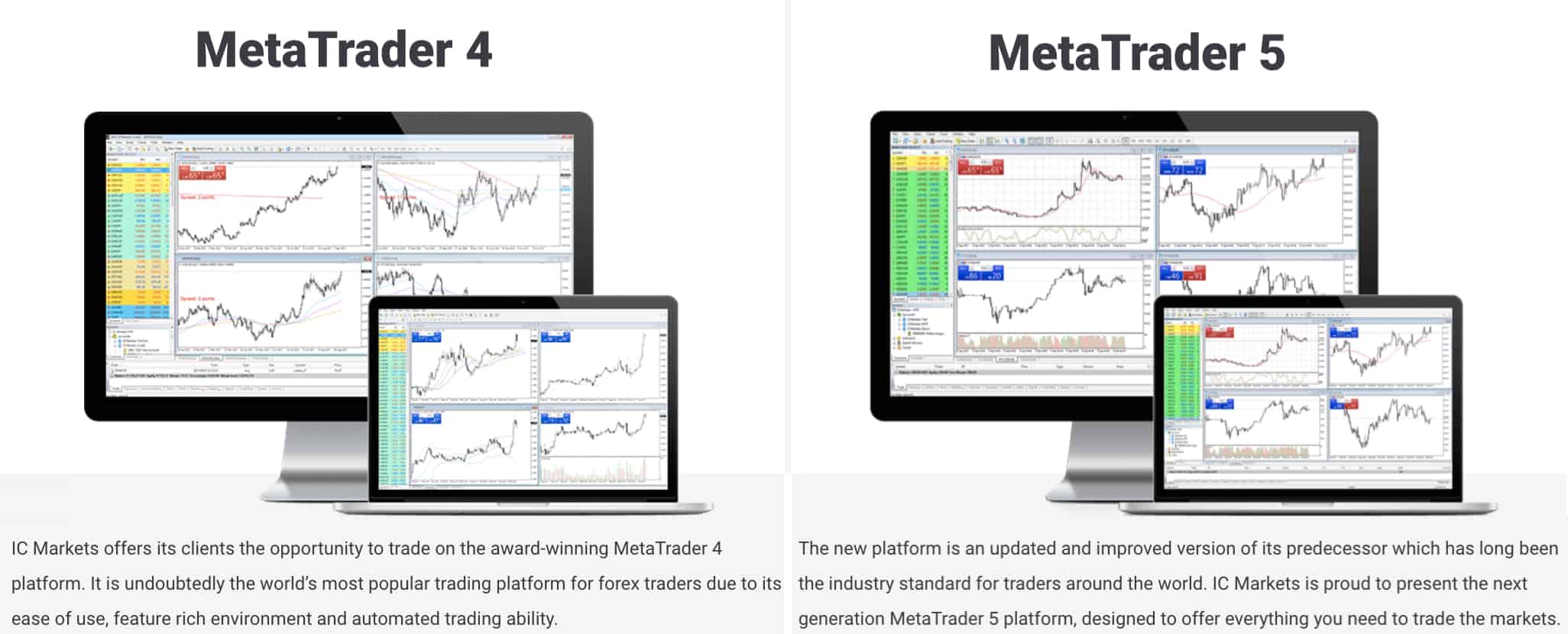

MetaTrader 4 And MetaTrader 5

Both IC Markets and XM offer the MetaTrader platforms. They are the two most popular platforms worldwide. MT4 is considered predominately a forex trading platform (although indices, crypto and commodities are available), while MT5 is a multi-asset platform offering share trading as well.

When using MT4 and MT5, IC and XM customers can automate trading via algorithmic strategies (Expert Advisors) or social-copy trading tools.

Expert Advisors

Using the MQL4 (MT4) or MQL5 (MT5) programming language, traders can write Expert Advisors (EAs) that automatically execute trades according to a set of preset conditions. Beginner traders who lack the experience to develop their own trading robots can download and buy EAs from MetaTrader’s Marketplace online.

To develop efficient Expert Advisors, traders can use MT4’s and MT5’s backtesting features. This allows you to test and optimise EAs against historical data to see how they perform. MT5’s backtesting tools offer improvements over MT4, with the ability to backtest multiple currency pairs at a time:

- MT4: Single thread with a single currency

- MT5: Multi-thread across multi-currencies

Social-Copy Trading

If you prefer to automate your trading via social-copy trading tools rather than EAs, MetaTrader platforms offer their proprietary copy trading software, Trading Signals. Available on both MT4 and MT5, Trading Signals enables you to follow and copy the trades of experienced traders, reducing the time spent researching opportunities and executing orders.

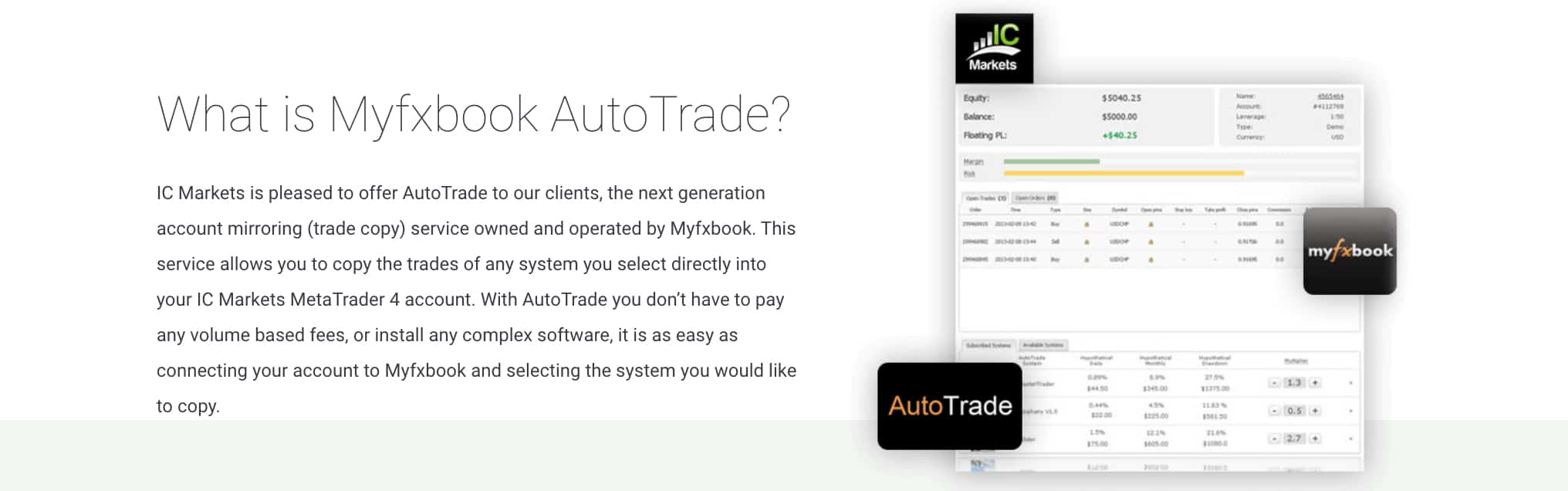

As well as the inbuilt social-trading tools provided by MetaTrader 4 and MetaTrader 5, users can also engage in social-copy trading by using third-party providers. Although XM does not offer these services, IC Markets provides a selection of account mirroring services to help customers automate trading:

- ZuluTrade: A social trading network where users can copy the strategies of traders that match their risk tolerance and investment objectives.

- Myfxbook AutoTrade: An account mirroring service that can be easily integrated into MT4.

Trading Tools

Trading Tools

Traders can utilise the advanced range of charting tools available on MT4 and MT5 to identify changes in financial markets and profitable strategies. While both platforms offer a solid range of technical analysis tools, MT5 provides a wider selection of features compared to its predecessor. As shown below, MT5 users gain access to a larger collection of indicators, objects and timeframes to perform technical analysis.

| Trading Tools Offered by IC Markets and XM | MetaTrader 4 | MetaTrader 5 |

|---|---|---|

| Technical Indicators | 30 | 38 |

| Graphical Objects | 31 | 44 |

| Timeframes | 9 | 21 |

| Expert Advisors/Algorithmic Trading | ✅ Both IC & XM | ✅ Both IC & XM |

| Backtesting | Single-thread, single currency | Multi-thread, multi currency |

| Programming Language | MQL4 | MQL5 |

| Trading Signals | ✅ Both IC & XM | ✅ Both IC & XM |

| ZuluTrade | Only IC Markets | Only IC Markets |

| Myfxbook AutoTrade | Only IC Markets | Only IC Markets |

| Hedging | ✅ | ✅ |

| Netting | ❌ | ✅ |

| One Click Trading | ✅ | ✅ |

| Pending Order Types | 4 | 6 |

| Share CFD Trading | ❌ | ✅ |

As well as the inbuilt trading tools available on MetaTrader 4, IC Markets offers a plug-in package consisting of 20 additional apps and technical indicators such as a correlation matrix and alarm manager.

cTrader

While XM clients are only offered MT4 or MT5, IC Markets customers signed up to a Raw Account type can choose cTrader as their trading platform. As with MT4, cTrader is predominately a forex trading software with no share CFDs offered by IC Markets on the platform.

cTrader users can enjoy an ECN-like trading environment with ultra-fast execution and IC Market’s Raw pricing. Like MetaTrader’s Expert Advisors, cTrader users can fully automate trading by developing cBots. Other features include:

- Advanced technical analysis tools

- Level 2 depth of market

- One-click trading

- Hedging and scalping allowed

Mobile Trading Apps And Platform Options

MT4, MT5 and cTrader are all available as a desktop or webtrader platform, as well as trading apps designed for Android and iOS devices. The mobile apps allow you to trade easily on the go, all providing an extensive range of mobile charting tools and order types.

Our Better Trading Platform Verdict

With advanced automated trading tools (EAs), extensive charting tools and CFDs, including Shares, MetaTrader 5 offers the best features when compared to MetaTrader 4 and cTrader. As IC Markets and XM both provide customers access to MT5, this round is a draw between the two online brokers.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

3. IC Markets: Superior Accounts And Features

XM is mainly a commission-free broker but does offer a commission ECN-style account to its European clients, while IC Markets offers both a standard or commission-based ECN-style pricing to all its clients. Both brokers offer swap-free account types for Muslim clients.

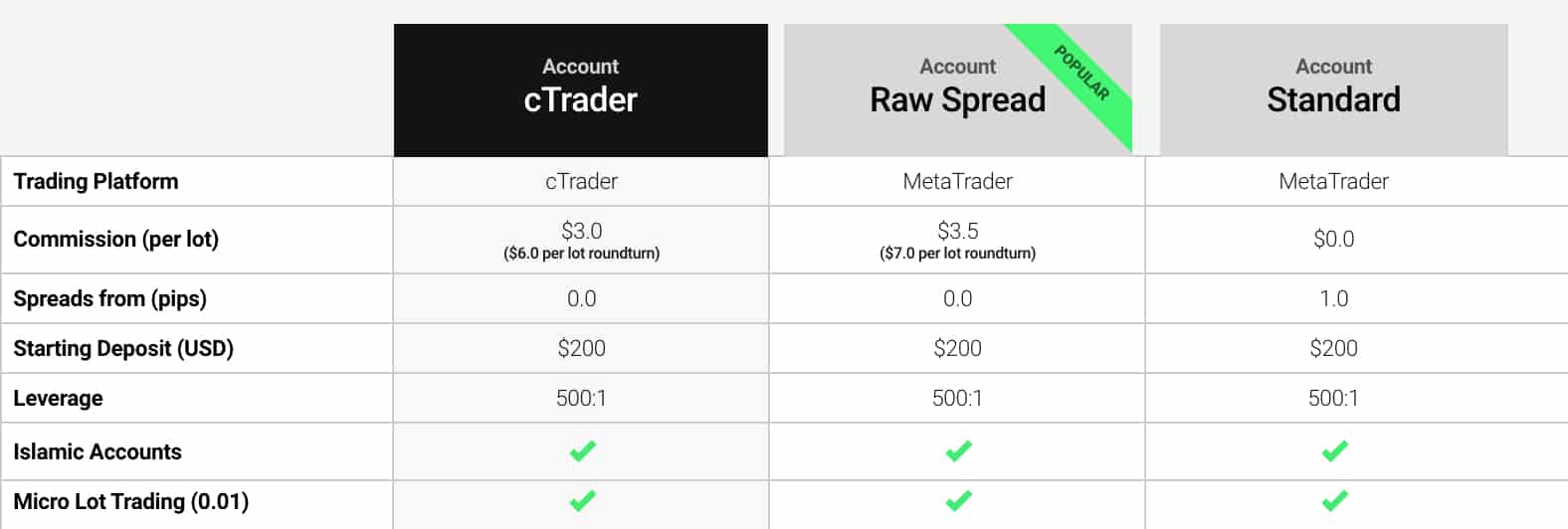

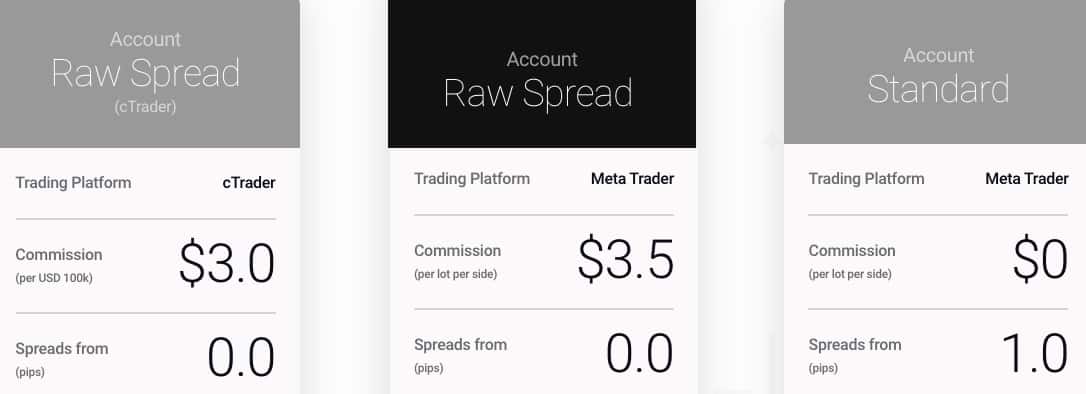

IC Markets Account Types

IC Markets offers three trading account types with different spreads and commission fee structures:

- Standard Account (MT4 or MT5) with no commissions

- Raw Spread Account (MT4 or MT5) with commission fees

- Raw Spread Account (cTrader) with commission fees

All IC Markets account types require an initial minimum deposit of $200 with 0.1 micro-lots volumes available to trade.

IC Markets Standard Account

IC Markets Standard Account

The broker’s commission-free account type provides access to spreads starting from 1.0 pip and is available on MetaTrader 4 or MetaTrader 5. With no commission fees, IC’s Standard account is a great option for low-volume or beginner traders wanting to avoid complex commission fee calculations.

IC Markets Raw Account: MetaTrader

Similar to an ECN account type, IC’s Raw Account provides access to institutional-grade pricing with minimum spreads starting from 0.0 pips.

Ideal for scalping, day trading and Expert Advisor strategies, IC connects Raw account holders to top-tier liquidity providers with fast order execution. As spreads are ultra-tight, averaging 0.1 pips, traders pay a flat rate commission fee of $7 round-turn.

IC Markets Raw Account: cTrader

Customers can also access ECN-style pricing with minimum spreads of 0.0 pips through the IC Markets Raw Spread Account designed for the cTrader platform. One of the major differences between the MetaTrader and cTrader Raw Accounts is trading costs with cTrader users paying a lower commission fee of $6 round turn.

You can view our cTrader vs MT4 comparison if you are unsure what platform is right for you. Regardless of account type, customers can set up their trading accounts using one of 10 base currencies offered by IC Markets: AUD, USD, NZD, JPY, SGD, GBP, EUR, CHF, CAD, and HKD

XM Account Types

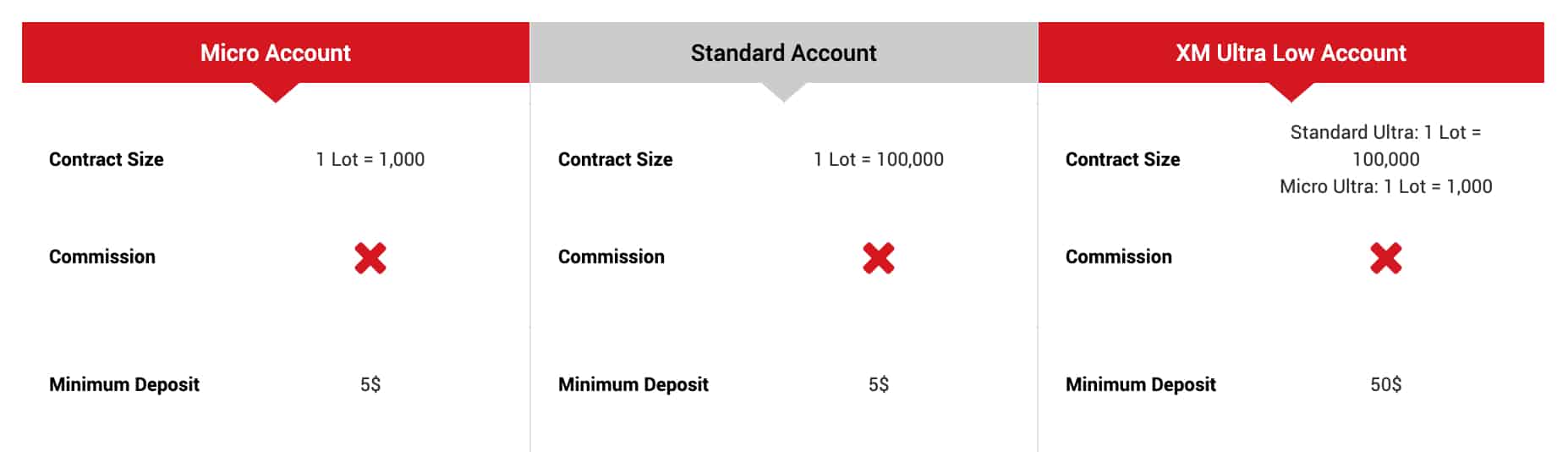

Four account types are offered by XM with varying minimum deposits, base currencies, spreads and lot sizes:

- Standard Account

- Micro Account

- Ultra-Low Account (Not offered to European/UK traders)

- Zero Account (Only available to EU/UK traders)

All XM account types are available on MetaTrader 4 and MetaTrader 5.

XM’s Standard Account

XM’s Standard Account

XM’s Standard Account offers commission-free trading with lot sizes of 100,000. A low minimum deposit of $5 is required to open a Standard Account.

- Lot size: 1 lot (100,000 units) = USD $10

- Base currencies: AUD, USD, GBP, EUR, CHF, JPY, RUB, PLN and HUF

XM’s Micro Account

For those wanting to trade smaller volumes, the XM’s Micro Account offers cent trading with micro-lots of 1000 units. With a low minimum deposit of $5 and no commission fees, the online broker Micro Account is a good option for beginner traders who want to build confidence trading lower volumes or lack the funds to trade larger lot sizes.

- Lot size: 1 micro lot (1,000 units) = USD 10 cents

- Base currencies: USD, GBP, AUD, EUR, JP, CHF, HUF, PLN and RUB

Additionally, XM’s Micro Account type allows traders to be more precise with their position sizing, with the ability to trade nano lots of 100 units by reducing your trading volume to 0.1 or mini lots of 10,000 by increasing your trade volume to 10 lots.

XM’s Ultra-Low Account

If you are based outside the United Kingdom and Europe, you can sign up for XM’s Ultra-Low Account, which provides access to tighter commission-free spreads than the broker’s Standard and Micro Accounts. While Standard and Micro accounts can trade minimum spreads from 1 pip, Ultra-Low accounts are offered spreads as low as 0.6 pips. A higher initial minimum deposit of $50 is needed, with traders able to select between standard or micro contract sizes.

- Standard lot: 1 standard lot = 100,000 units = USD $10

- Micro lot: 1 micro lot = 1,000 units = USD 10 cents

- Base currencies: USD, AUD, EUR, GBP, CHF, HUF and PLN

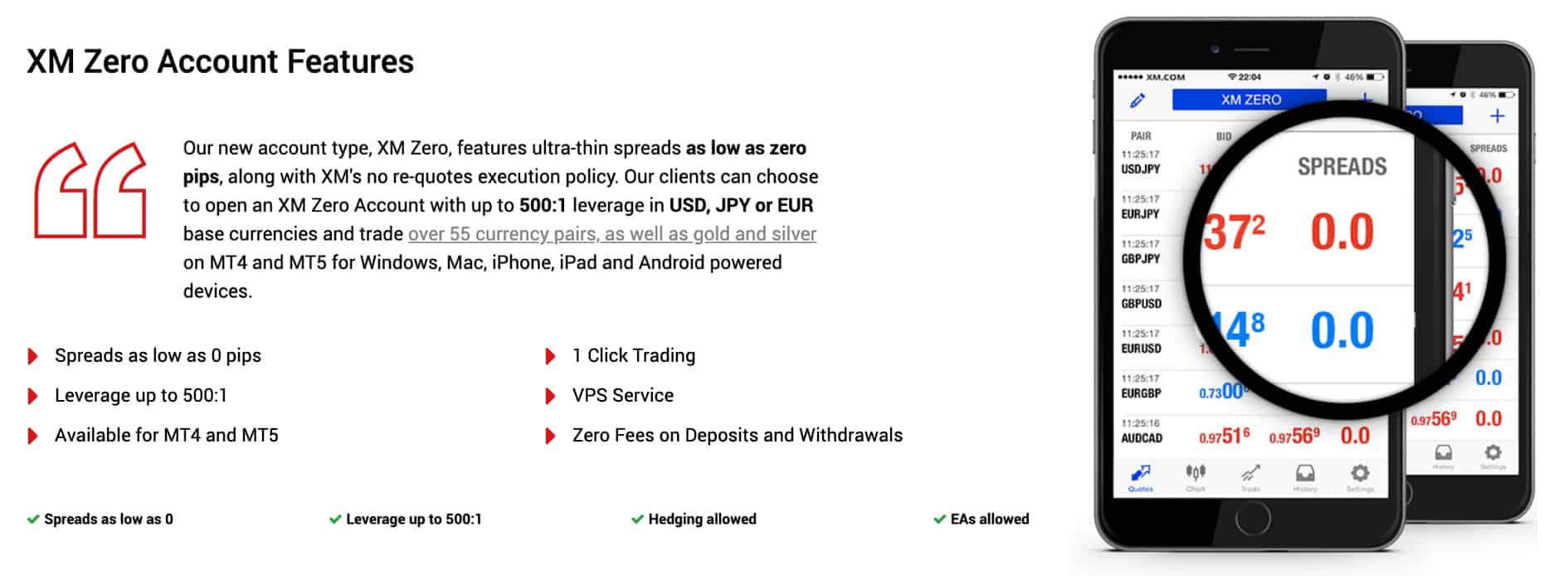

XM’s Zero Account (Europe/UK Only)

European and UK-based traders are able to sign up to XM’s ECN-style Zero Account. Instead of the Ultra-Low account, XM’s European and UK subsidiaries offer a commission-based trading account type. As spreads are much tighter, traders pay a flat rate commission of USD $3.50 per $100,000 traded. Zero Account holders trade standard contract sizes of 100,000 units per lot.

Although spreads can be as low as 0.0 pips, there are certain downsides to the Zero account such as limited market access (forex, gold and silver) and only three base currencies (USD, JPY or EUR).

Islamic Account Types

IC Markets Islamic Trading Accounts

All IC Markets account types and trading platforms are available as a swap-free Islamic account option with the same spreads and commission fees explained above. Instead of interest-based overnight financing fees, traders pay flat rate charges ranging from $5-$50 per lot, with fees tripling on Friday evenings.

XM’s Islamic Account

XM offers an Islamic account option for Standard, Micro, and Ultra-Low account types. As Islamic traders cannot earn or receive interest, XM provides a swap-free option that follows Islamic finance practises in accordance with Sharia Law. XM’s Islamic account features include:

- No interest charges (overnight financing fees) on positions held open longer than a day

- XM does not widen spreads offered to Islamic account holders

- Commission-free trading

- Depending on your location, maximum leverage of 500:1

Leverage When Trading CFDs

XM’s Leverage

The leverage offered to you will differ between XM branches. The broker’s European and Australian branches restrict leverage to 30:1, while traders based in the UAE can use 50:1 under Dubai’s DFSA trading rules.

If you are looking for higher leverage, XM’s offshore branch regulated by the International Financial Services Commission (IFSC) offers up to 888:1 when trading forex. Yet, please note forex is a complex instrument that comes with a high risk that’s amplified with leverage.

IC Markets Maximum Leverage

As with XM, the maximum leverage you are allowed to trade with as an IC Markets client depends on the subsidiary you are signed up to. IC Markets is overseen by three financial regulators, being:

- FSA: The Financial Services Authority of Seychelles

- ASIC: The Australian Securities and Investments Commission

- CySEC: The Cyprus Securities and Exchange Commission

The FSA in Seychelles allows brokers to offer high leverage up to 500:1 when trading forex. Individuals who live in stricter locations like Europe will be catered to by their CySEC subsidiary or, in Australia, their ASIC-regulated entity. In these regions, there are greater protections given to traders but also enforced restrictions such as leverage caps (30:1 on major currency pairs).

Which Account Is For You?

Which Account Is For You?

The right account to choose will depend on your style of trading. The table below summarises each account and if they are for you.

| Spreads only or Commission | Spreads | Lot Size | Region | Base Currencies | Trading Type | |

|---|---|---|---|---|---|---|

| IC Markets Standard Account | Spread only | Wider | Micro lots and above | International | AUD, USD, EUR, GBP, SGD, JPY, CHF, NZD, CAD, HKD | Discretionary trader, long term trader |

| IC Markets Raw Account | Commissions | Tightest | Micro lots and above | International | AUD, USD, EUR, GBP, SGD, JPY, CHF, NZD, CAD, HKD | Day Traders, Scalpers, EAs |

| XM Micro Account | Spread only | Widest | Nano lots and above | International | USD, AUD, EUR, GBP, CHF, HUF and PLN | Beginner traders, Discretionary traders |

| XM Ultra-Low Account | Spread only | Tight | Nano lots and above | Outside Europe | USD, AUD, EUR, GBP, CHF, HUF and PLN | Beginner traders, Discretionary traders, Scalpers |

| XM Zero Account | Commission | Tight | Micro ;ots and above | Europe only | USD, JPY or EUR | Day Traders, Scalpers, EAs |

| XM | IC Markets | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | Yes |

| Active Traders | No | Yes |

| Spread Betting (UK) | No | No |

Our Superior Accounts and Features Verdict

While your trading needs will determine which account is right for you, IC Market’s Raw account types are winners due to tight spreads and the broker’s ECN-style environment. Whether you want to use cTrader or MetaTrader, you will pay low commission fees and be able to access minimum spreads of 0.0 pips and average spreads of 0.1 pips.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

4. IC Markets: Best Trading Experience And Ease

When it comes to the overall trading experience, both XM and IC Markets have their unique strengths. From our in-depth analysis and our own testing, it’s evident that IC Markets stands out with its MT5 platform, being recognised as the best in this category. On the other hand, XM, with its market-making model, offers a different kind of trading environment that some traders might prefer.

- IC Markets is recognised for having the best MT5 platform.

- XM, as a market maker, provides a unique trading environment.

- IC Markets also shines with its standard account, being touted as the best.

- Both brokers have their own set of tools and features that cater to different trader needs.

| | Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank |

|---|---|---|---|---|

| XM | 148ms | 21/36 | 184ms | 28/36 |

| IC Markets | 134ms | 16/36 | 153ms | 22/36 |

In the world of forex trading, the experience can vary based on individual preferences. Some might lean towards a specific platform, while others might look for account types or tools that suit their trading style.

Our Best Trading Experience and Ease Verdict

Based on our findings, IC Markets offers a slightly better trading experience in terms of platform and account offerings.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

5. XM: Stronger Trust And Regulation

In forex trading, establishing a secure and transparent environment relies heavily on strong trust and regulation.

XM Trust Score

IC Markets Trust Score

1. Regulations

As CFDs and Forex are complex instruments, it is important to minimise the high risk of trading and avoid scams by signing up with a regulated broker. Most international brokers have multiple subsidiaries that are overseen by different financial authorities and, therefore, provide different levels of investor protection.

For example, FCA, ASIC and CySEC-regulated brokers are required to display clear risk warnings, segregate client funds, provide negative balance protection, and enforce leverage caps of 30:1.

IC Markets Regulation And Licences

IC Markets is well-respected by the international forex community, with over 100,000 customers worldwide. If you reside in Canada, the United States, Iran or Israel, you will not be able to register as an IC Markets client. Traders based elsewhere can choose from three IC subsidiaries:

- IC Markets Australia: Overseen by the Australian Securities and Investments Commission (ASIC) and holds an Australian Financial Services Licence (AFSL)

- IC Markets Europe: Regulated by the Cyprus Securities and Exchange Commission (CySEC). CySEC is a member of the European Securities and Markets Authority (ESMA)

- IC Markets Seychelles: Overseen by the Financial Services Authority of Seychelles (FSA)

IC Markets Negative Balance Protection

IC Markets customers registered with the UK and Australian branches will receive negative balance protection, while leverage is limited to 30:1 when trading major currency pairs. IC Markets Global (FSA) customers are offered a significantly higher leverage of 500:1, yet no negative balance protection is provided.

XM Regulation And Negative Balance Protection

XM offers negative balance protection to all customers, regardless of whether it’s a requirement of local financial authorities. Negative balance protection means that customers cannot end up in debt to their brokers, with open positions automatically closed if a trading account enters a negative balance due to unfavourable price movements. This level of investor protection may be particularly appealing to beginner traders who are concerned about losing more than they deposit.

While all XM branches provide Negative Balance Protection, additional investor protection may vary depending on the subsidiary you sign up to:

- XM Australia: Follows ASIC regulation

- XM Europe: Overseen by CySEC

- XM UK: Regulated by the FCA

- XM Dubai: Dubai Financial Services Authority (DFSA)

- XM Global: Regulated by the International Financial Services Commission, Belize (IFSC)

| XM | IC Markets | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) CYSEC (Cyprus) | ASIC (Australia) CYSEC (Cyprus) |

| Tier 2 Regulation | DFSA (Dubai) | |

| Tier 3 Regulation | FSC-BZ | FSA-S (Seychelles) SCB (Bahamas) |

2. Reputation

XM gets searched on Google more than IC Markets. On average, XM sees around 823,000 branded searches each month, while IC Markets gets about 201,000 — that’s 75% fewer.

| Country | XM | IC Markets |

|---|---|---|

| Colombia | 74,000 | 6,600 |

| Jordan | 74,000 | 1,600 |

| Argentina | 60,500 | 8,100 |

| Turkey | 60,500 | 6,600 |

| Philippines | 33,100 | 5,400 |

| Germany | 27,100 | 8,100 |

| United States | 27,100 | 4,400 |

| Indonesia | 18,100 | 3,600 |

| Morocco | 18,100 | 5,400 |

| Australia | 18,100 | 4,400 |

| Bolivia | 18,100 | 1,600 |

| Malaysia | 14,800 | 1,900 |

| Peru | 14,800 | 4,400 |

| Vietnam | 14,800 | 2,900 |

| Thailand | 12,100 | 5,400 |

| Singapore | 12,100 | 4,400 |

| Saudi Arabia | 12,100 | 2,400 |

| Ireland | 12,100 | 1,000 |

| Algeria | 9,900 | 1,600 |

| India | 8,100 | 33,100 |

| Poland | 8,100 | 3,600 |

| United Arab Emirates | 6,600 | 5,400 |

| Uruguay | 6,600 | 1,900 |

| Italy | 6,600 | 1,600 |

| Cambodia | 6,600 | 260 |

| Uzbekistan | 5,400 | 2,400 |

| Nigeria | 5,400 | 2,900 |

| Switzerland | 5,400 | 1,900 |

| Mexico | 5,400 | 1,600 |

| Tanzania | 5,400 | 1,000 |

| Hong Kong | 4,400 | 2,400 |

| Bangladesh | 4,400 | 4,400 |

| Taiwan | 4,400 | 2,400 |

| South Africa | 4,400 | 2,400 |

| Brazil | 3,600 | 6,600 |

| Pakistan | 3,600 | 5,400 |

| Ethiopia | 3,600 | 2,900 |

| Ecuador | 3,600 | 2,400 |

| New Zealand | 3,600 | 590 |

| Sri Lanka | 2,900 | 880 |

| Cyprus | 2,900 | 880 |

| Austria | 2,900 | 720 |

| Spain | 2,400 | 1,300 |

| Venezuela | 2,400 | 1,000 |

| Sweden | 2,400 | 1,600 |

| Portugal | 2,400 | 880 |

| France | 2,400 | 590 |

| United Kingdom | 1,900 | 2,400 |

| Canada | 1,900 | 880 |

| Botswana | 1,900 | 880 |

| Ghana | 1,900 | 590 |

| Egypt | 1,600 | 260 |

| Costa Rica | 1,600 | 170 |

| Netherlands | 1,300 | 1,300 |

| Chile | 1,000 | 720 |

| Japan | 1,000 | 320 |

| Dominican Republic | 880 | 390 |

| Uganda | 720 | 260 |

| Kenya | 590 | 480 |

| Greece | 590 | 720 |

| Panama | 590 | 260 |

| Mongolia | 480 | 210 |

| Mauritius | 260 | 480 |

74,000 1st | |

1,600 2nd | |

60,500 3rd | |

8,100 4th | |

27,100 5th | |

8,100 6th | |

18,100 7th | |

3,600 8th |

Similarweb shows a similar story when it comes to August 2025 website visits with XM receiving 8,619,000 visits vs. 2,290,000 for IC Markets.

3. Reviews

As shown below, XM has a Trustpilot rating of 3.6 out of 5 from around 2,800 reviews. IC Markets boasts a much higher rating of 4.8 out of 5, based on over 46,500 reviews. IC Markets significantly outperforms XM in Trustpilot ratings, with a much larger review base and higher customer satisfaction. XM is appreciated for its learning resources but faces criticism for customer service and fund handling. IC Markets is widely praised for its reliability and trading conditions.

Our Stronger Trust and Regulation Verdict

IC Markets and XM are overseen by multiple tier-1 financial authorities, with both brokers being viewed as trusted, reliable forex brokers by the international forex community. As XM offers negative balance protection to all clients, regardless of location, they provide the strongest investor protection overall.

*Your capital is at risk ‘75.18% of retail CFD accounts lose money’

6. IC Markets: Top Product Range And CFD Markets

XM and IC Markets both offer a wide range of asset classes ranging from Forex to Commodities to Share CFDs. As market access differs between MT4, MT5 and cTrader, the products you want to trade will help determine the best-suited trading platform and account type for you to choose.

XM CFD Trading

As an XM customer, you can trade over 1,000 financial instruments derived from Forex, Commodity, Equity Index, Precious Metal, Energy and Share asset classes. As a multi-asset trading platform, MetaTrader 5 users can access XM’s full product range, while MT4 traders can only trade Forex, Indices, Commodities and Precious Metals. A major downside to trading with XM is that they offer no cryptocurrency CFDs. XM’s full product range consists of:

- 57 different Forex pairs

- 8 Soft Commodities such as Coffee, Cocoa, Wheat and Corn

- 18 Cash Equity Indices and 12 Future Equity Indices, including the S&P 500, FTSE 100, ASX200 and Nikkei 225

- Highly liquid Precious Metal markets include spot Gold and Silver, as well as Palladium and Platinum Future CFDs

- 5 Energy Futures with different Oil and Gas products and contract sizes available

XM does not offer its full CFD product range to all traders. UK and European customers signed up to an XM Zero account type are limited to trading Forex and Precious Metals, while MetaTrader 4 users are unable to trade Share CFDs. If you are interested in Share trading, MetaTrader 5 is better suited as it is a multi-asset trading platform that offers more diverse market access.

IC Markets CFD Trading

IC Markets provides excellent market access with a greater range of asset classes than XM. As well as Forex, Index, Energy, Agriculture, Metal and Share CFDs, the broker also offers Bonds, Futures and Cryptocurrency CFDs, including:

- Over 60 major, minor and exotic currency pairs

- 17 of the world’s largest Equity Indices

- Precious Metals include Gold and Silver against the United States Dollar (USD) or Euro (EUR), as well as Platinum and Palladium against the USD

- Soft Commodities with wheat, coffee, sugar and soybean contracts are available

- Major Energy CFDs derived from Brent, Crude Oil and Natural Gas

- VIX Index CFD Futures, Crude Oil Futures, ICE Dollar Index Futures plus Brent and Crude Oil Futures

- 6+ government Bonds from Japan, Europe, the United States and the United Kingdom

- Over 120 Share CFDs across NYSE, NASDAQ AND ASX stock exchanges

- 10 major Crypto CFDs ranging from Bitcoin to PeerCoin to Ripple

Likewise to XM, Share CFD trading is only available when using MetaTrader 5. Futures are only available on MT4, while cTrader users are restricted to Forex trading and Equity Indices.

Our Top Product Range and CFD Markets Verdict

Although XM offers a good range of CFDs and over 1,000 Shares, IC wins this round due to offering more Forex pairs, an excellent selection of Cryptocurrency CFDs, plus a diverse collection of asset classes. To make the most of the market access offered by IC Markets, it is best to sign up for a Raw account type using MetaTrader 5, as cTrader and MT4 do not permit Share trading.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

7. XM: Superior Educational Resources

XM:

- Webinars: XM offers regular webinars that cover a range of topics from beginner to advanced.

- Video Tutorials: A comprehensive collection of video tutorials is available, catering to both novices and experienced traders.

- Economic Calendar: XM provides an up-to-date economic calendar, helping traders stay informed about major market events.

- Market Research: In-depth market research tools and analysis are provided to help traders make informed decisions.

- Trading Signals: XM offers trading signals to its users, aiding in decision-making.

- Educational Articles: A vast library of educational articles is available, covering various trading topics.

IC Markets:

- Webinars: IC Markets also hosts regular webinars, but they are less frequent compared to XM.

- Video Tutorials: While they offer video tutorials, the collection is not as extensive as XM’s.

- Economic Calendar: An economic calendar is available, but it lacks some of the features found in XM’s version.

- Market Research: IC Markets provides market research, but it’s not as detailed as XM’s offerings.

- Trading Signals: Trading signals are available, but they are not as robust as those provided by XM.

- Educational Articles: IC Markets has a decent collection of articles, but they don’t match the depth and breadth of XM’s library.

Our Superior Educational Resources Verdict

Based on our team’s testing and scoring, XM offers superior educational resources compared to IC Markets.

*Your capital is at risk ‘75.18% of retail CFD accounts lose money’

8. IC Markets: Superior Customer Service

Contact methods, availability and online resources all determine the quality of a broker’s customer support.

IC Markets Customer Service Levels

IC Markets offers excellent customer support via live chat, phone and email. Those trading with IC Markets ASIC and FSA-regulated branches can get in touch with the broker’s customer service team 24/7, while European and UK traders will need to contact IC between Monday and Friday.

IC Markets Education And Research

The online provides a great range of educational materials to assist all levels of experience, from beginner traders wanting to learn the basics to seasoned investors wanting to develop complex trading strategies and conduct advanced market research. Examples of resources include:

- Demo accounts to practise trading strategies and build confidence in trading

- Trading platform tutorials for MetaTrader 4 (MT4)

- Videos explaining topics such as MT4 order types and trading tools

- An information hub with articles discussing advanced technical and fundamental analysis

- An economic calendar available on MT5 or on the IC Markets website, as well as real-time forex news

XM Customer Service Levels

XM customers can get in touch with the broker’s customer support team via live chat, email, and phone. Unlike IC, no 24/7 assistance is provided, with traders only able to contact XM 24 hours a day, 5 days a week. Additionally, the broker’s website provides a comprehensive FAQ where many common forex trading queries are answered.

XM Research And Education

XM Research And Education

XM offers free educational courses, including:

- Demo accounts and MetaTrader tutorials

- Webinars presented by industry experts covering topics ranging from an introduction to trading to advanced areas i.e. technical analysis

- An economic calendar and a market newsfeed split into different asset classes

Our Superior Customer Service Verdict

With 24/7 customer service and educational materials for all levels of trading experience, IC Markets offers better client support overall.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

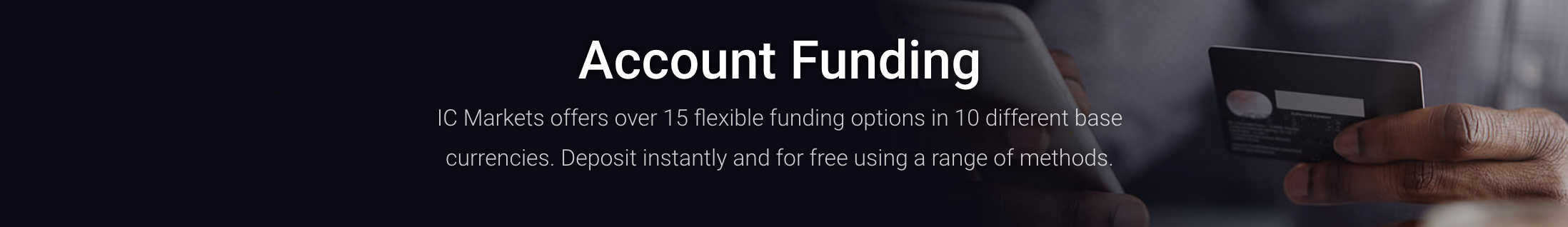

9. IC Markets: Better Funding Options

XM Funding Methods

As an XM customer, you can deposit and withdraw funds from your trading account using a range of credit card and e-wallet options. Available deposit and withdrawal methods offered by XM include:

| Visa | MasterCard/Maestro | ChinaUnionPay | Neteller | Skrill/Moneybookers |

| Sofort | CashU | Bitcoin | Bank Transfer | International Bank Wire |

All account funding options are fee-free unless you deposit less than $200 USD via international bank wire (in which case traders will face a $20 deposit fee).

IC Markets Funding Methods

IC Markets offer an even greater range of funding methods than XM, with an impressive 15 funding options available. Although IC Markets traders incur no fees when making deposits and withdrawals, accepted currencies and processing times vary between payment methods.

| Credit Card | Bank Transfer | Wire Transfer | Thai Internet Banking | Vietnamese Internet Banking |

| UnionPay | Neteller/Neteller VIP | Skrill | Bpay | Poli |

| FasaPay | Rapid Pay | Klarna | PayPal | Bitcoin Wallet |

As mentioned above, funding options vary between a broker’s subsidiary and location. For instance, if you are registered with IC Markets FCA regulated subsidiary, you are only able to deposit and withdraw funds via Credit and debit cards, Wire transfer, NETELLER and Skrill.

Our Better Funding Options Verdict

XM provides a good range of payment methods, yet unfortunately, smaller deposits less than $200 made by wire transfer carry a $20 fee. On the other hand, IC Markets offers some of the best funding methods available to retail investor accounts with no deposit and withdrawal fees, plus 15 different payment options to choose from.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

10. XM: Lower Minimum Deposit

XM has a lower minimum deposit of $5 against the minimum set by IC Markets at $200. IC Markets and XM have competitive minimum deposits, but how do they compare?

XM

| Minimum Deposit | GBP | USD | EUR | AUD |

|---|---|---|---|---|

| Credit Card / Debit Card | £5 | $5 | €5 | $5 |

| Bank Wire | £5 | $5 | €5 | $5 |

| Electronic Wallets | £5 | $5 | €5 | $5 |

IC Markets

| GBP | USD | EUR | AUD | |

|---|---|---|---|---|

| Credit Card / Debit Card | £200 Minimum Deposit | $200 Minimum Deposit | €200 Minimum Deposit | $200 |

| Paypal | £200 Minimum Deposit | $200 Minimum Deposit | €200 Minimum Deposit | $200 |

| Bank Wire | £200 Minimum Deposit | $200 Minimum Deposit | €200 Minimum Deposit | $200 |

| Skrill | £200 Minimum Deposit | $200 Minimum Deposit | €200 Minimum Deposit | $200 |

Our Lower Minimum Deposit Verdict

When it comes to the lower minimum deposit, XM clearly takes the lead with its minimal requirement of just $5.

*Your capital is at risk ‘75.18% of retail CFD accounts lose money’

So Is IC Markets or XM The Best Broker?

IC Markets is the winner because of its comprehensive trading platform, advanced features, and strong trust and regulation. The table below summarises the key information leading to this verdict.

| Criteria | XM | IC Markets |

|---|---|---|

| Lowest Spreads And Fees | Yes | No |

| Better Trading Platform | Yes | Yes |

| Superior Accounts And Features | Yes | No |

| Best Trading Experience And Ease | Yes | No |

| Stronger Trust And Regulation | No | Yes |

| Top Product Range And CFD Markets | Yes | No |

| Superior Educational Resources | No | Yes |

| Superior Customer Service | Yes | No |

| Better Funding Options | Yes | No |

| Lower Minimum Deposit | No | Yes |

XM: Best For Beginner Traders

For those just starting out in the trading world, XM offers a more beginner-friendly environment with its low minimum deposit and superior educational resources.

IC Markets: Best For Experienced Traders

For seasoned traders looking for advanced features and a comprehensive trading platform, IC Markets stands out as the preferred choice.

FAQs Comparing XM Vs IC Markets

Does IC Markets or XM Have Lower Costs?

IC Markets generally offers lower costs compared to XM. They have been recognised for their competitive spreads and low commissions. For instance, IC Markets boasts some of the tightest spreads in the industry. For a deeper dive into low commission brokers, you can check out this list on Lowest Commission Brokers.

Which Broker Is Better For MetaTrader 4?

Both IC Markets and XM offer MetaTrader 4, but IC Markets is often preferred for its advanced features and seamless integration. Their MT4 platform provides traders with a range of tools and resources to enhance their trading experience. If you’re keen on exploring more about the best MT4 brokers, here’s a detailed review of the best MT4 brokers.

Which Broker Offers Social Trading?

XM is known for its social trading features, allowing traders to copy the strategies of experienced traders. This approach is beneficial for those who might not have the time or expertise to analyse the markets themselves. Social or copy trading has gained immense popularity in recent years. For a comprehensive list of the best platforms offering this feature, you can visit this guide on the best social trading platforms.

Does Either Broker Offer Spread Betting?

Neither IC Markets nor XM offers spread betting. Spread betting is a unique form of trading popular in the UK and some other regions. It allows traders to bet on the direction of a financial market without owning the underlying asset. If you’re interested in brokers that do offer this service, here’s a comprehensive guide on the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, IC Markets is the superior choice for Australian forex traders. Founded in Sydney, IC Markets is ASIC regulated, ensuring a high level of trust and security for Australian traders. Their platform offers a range of tools tailored to the needs of the Australian market. Furthermore, being a homegrown broker, they have a deep understanding of the local trading environment. If you’re keen on exploring more about Australian forex brokers, here’s a detailed review of the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK traders, I believe XM holds a slight edge. They are FCA regulated, which provides a significant level of trust and security for UK-based traders. While IC Markets is also a strong contender in the UK market, XM’s regulatory status and tailored offerings for the UK market make them stand out. Additionally, their platform and tools are well-suited for the UK trading environment. For a deeper dive into the best platforms for UK traders, you can check out this comprehensive guide on the Best Forex Brokers In UK.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert