IC Markets vs FXTM 2025

This review of IC Markets and FXTM reveals a fascinating trend, highlighting their exceptional features and platforms. So, which broker emerges as the true champion in this analysis? Dive into the findings of our comprehensive research to discover the answer!

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

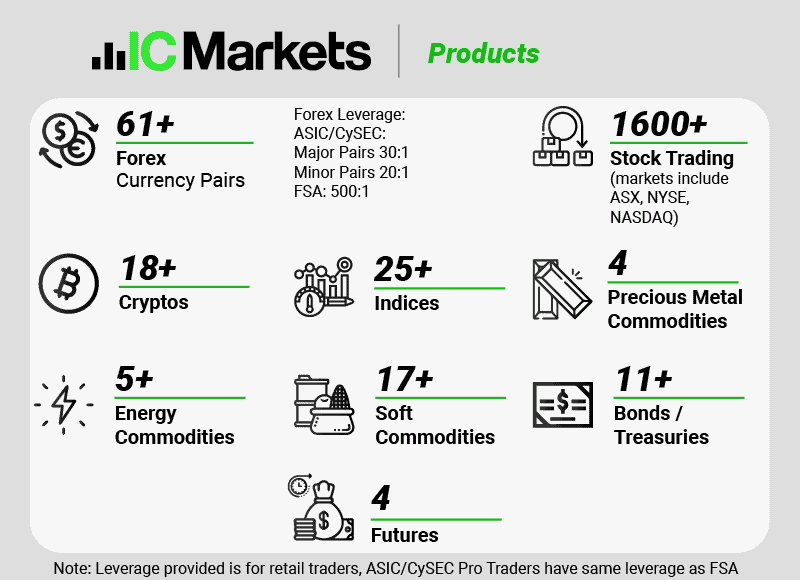

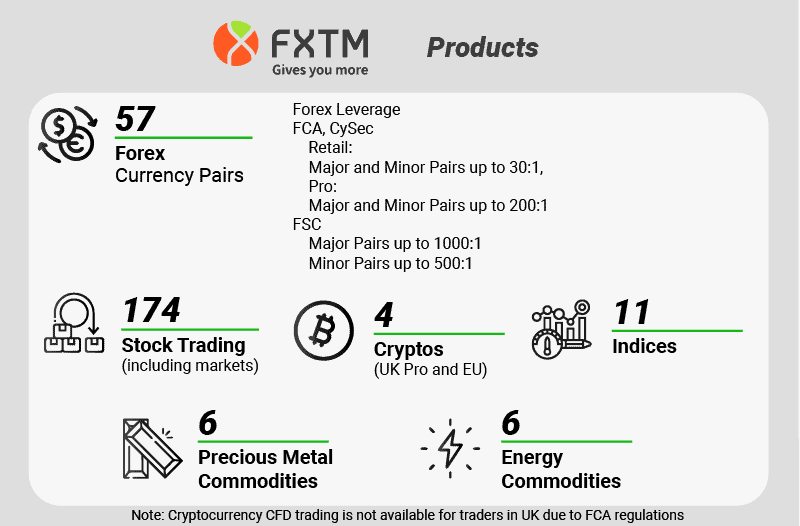

Markets and Instruments

Minor Pairs 20:1

Minor Pairs 20:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our full comparison covers the 10 most important trading factors. Here are ten key differences between IC Markets and FXTM:

- IC Markets offers 18+ cryptocurrency CFDs.

- IC Markets provides a maximum professional leverage of 500:1 in Australia.

- IC Markets has two types of ECN accounts.

- IC Markets’ minimum deposit across all account types is $200.

- IC Markets is regulated by both ASIC (Australia) and CySEC (Cyprus).

- FXTM offers three ECN account types.

- FXTM is primarily regulated by CySEC.

- FXTM provides multiple account types for all trading levels, including Cent, Standard, and ECN accounts.

- FXTM offers tight spreads on ECN accounts, perfect for high-frequency traders seeking lower trading costs.

- FXTM excels in offering extensive educational tools, including webinars, market analysis, and online courses.

1. Lowest Spreads And Fees – IC Markets

When evaluating forex brokers, it’s essential to consider various factors such as spreads, commission levels, and standard account fees. These elements significantly impact the overall trading experience and profitability. In this review, we will compare IC Markets and FXTM, focusing on their spreads, commission levels, and standard account fees. Through a thorough analysis of these factors, we strive to deliver a comprehensive overview of each broker’s offerings. This will empower you to make informed decisions that align with the latest trends and insights in forex trading for 2025.

Spreads

IC Markets is known for offering some of the lowest spreads in the industry. For EUR/USD, IC Markets provides spreads as low as 0.02 pips, compared to FXTM’s 0.1 pips, with the average industry spread being 0.22 pips. For AUD/USD, IC Markets offers spreads starting from 0.03 pips, while FXTM’s spreads are 0.5 pips, against the average industry spread of 0.47 pips. IC Markets offers an impressive average spread of just 0.29 pips, which is considerably lower than FXTM’s 0.96 pips and significantly better than the industry average of 0.75 pips.

| RAW Account | IC Markets Spreads | FXTM Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 0.29 | 0.96 | 0.75 |

| EUR/USD | 0.02 | 0.1 | 0.22 |

| USD/JPY | 0.14 | 0.6 | 0.38 |

| GBP/USD | 0.23 | 2 | 0.53 |

| AUD/USD | 0.03 | 0.5 | 0.47 |

| USD/CAD | 0.25 | 0.6 | 0.56 |

| EUR/GBP | 0.27 | 0.6 | 0.55 |

| EUR/JPY | 0.3 | 0.4 | 0.80 |

| AUD/JPY | 0.5 | 0.7 | 0.96 |

| USD/SGD | 0.85 | 3.1 | 2.29 |

Commission Levels

IC Markets and FXTM offer competitive commission rates; however, there are significant differences between the two. IC Markets charges a commission of $3.50 per lot, while FXTM charges $4.00 per lot. The minimum deposit requirement for IC Markets is $200, compared to FXTM’s $10. However, the recommended deposit for IC Markets is $200, whereas FXTM suggests a higher recommended deposit of $500. Both brokers offer SWAP-free accounts and no funding fees, making them cost-effective choices for traders.

| USD | AUD | GBP | EUR | |

|---|---|---|---|---|

| IC Markets | $3.50 | $4.50 | £2.50 | €2.75 |

| FXTM | $4.00 | N/A | N/A | N/A |

Our awesome team came up with this fee calculator. It’s totally exclusive to our traders. Check it out below.

Standard Account Fees

Regarding standard account fees, IC Markets offers competitive spreads starting from 0.62 pips for EUR/USD and 0.77 pips for AUD/USD. In contrast, FXTM offers spreads of 1.90 pips for EUR/USD and 2.00 pips for AUD/USD. These differences highlight the cost-effectiveness of IC Markets’ standard account, especially for traders who frequently trade these currency pairs.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 0.82 | 0.83 | 1.27 | 1.03 | 0.94 |

| 2.10 | 2.10 | 2.70 | 2.50 | 2.50 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 1.40 | 1.60 | 1.80 | 1.80 | 1.60 |

| 1.18 | 1.45 | 1.40 | 1.49 | 1.60 |

| 1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

| 1.40 | 1.90 | 1.30 | 1.60 | 1.50 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 10/01/2025

Both IC Markets and FXTM offer competitive trading conditions, but there are distinct differences in their account features. IC Markets stands out with its lower spreads and transparent commission structure, making it a cost-effective choice for many traders. FXTM, with its lower minimum deposit requirement and higher recommended deposit, provides an accessible entry point for new traders. In the ever-evolving world of forex trading, both brokers are dedicated to providing exceptional services and competitive trading conditions to their clients.Whether you prioritize lower spreads, commission levels, or account accessibility, IC Markets and FXTM have something to offer every trader.

Our Lowest Spreads and Fees Verdict

Clearly, IC Markets outshines the challenger in this category owing it to their lowest spreads and fees.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

2. Better Trading Platform – IC Markets

IC Markets and FXTM are highly regarded forex brokers that provide clients with a variety of trading platforms designed to elevate the trading experience. Both brokers feature access to the widely-used MetaTrader 4 and MetaTrader 5 platforms; however, IC Markets distinguishes itself by exclusively offering the cTrader platform. In this review, we will explore the MetaTrader platforms, advanced trading options, and copy trading capabilities of both IC Markets and FXTM, while also spotlighting the latest trends and insights in forex trading for 2025.

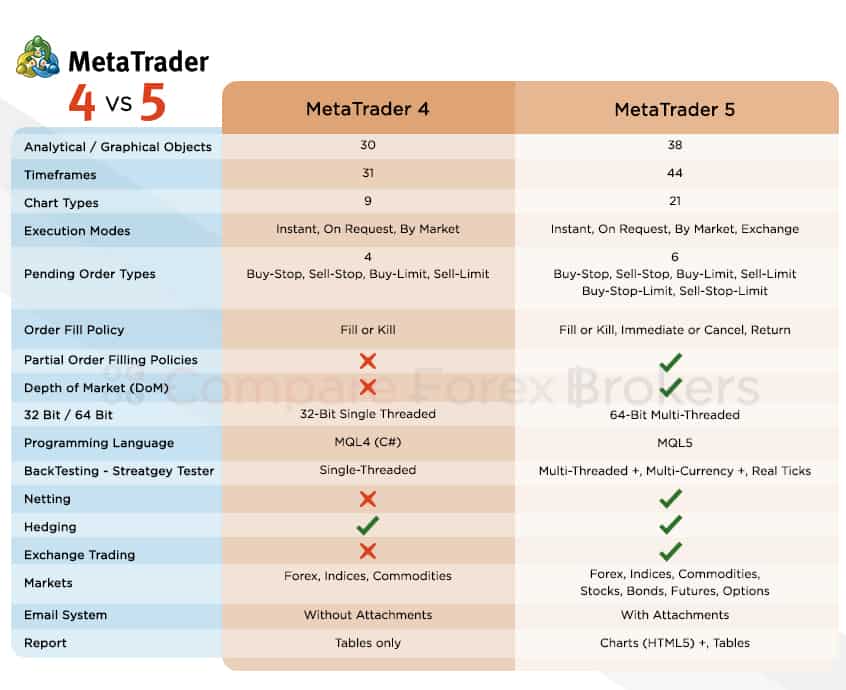

MetaTrader

MetaTrader 4 (MT4) Platform Comparison

IC Markets and FXTM both provide access to the highly esteemed MetaTrader 4 platform, renowned for its powerful features and intuitive interface. IC Markets’ MT4 software stands out as an exceptional choice for traders of all experience levels, from beginners to advanced, thanks to its remarkably low latency and lightning-fast order execution, boasting an impressive average execution speed of just 36.5 milliseconds. The MT4 server is located in the Equinix NY4 data centre. Both brokers’ MT4 platforms are compatible with Windows and Mac OSX and offer good mobile trading capabilities with apps for iOS and Android devices. The MT4 WebTrader is compatible with six browsers (Internet Explorer, Microsoft Edge, Mozilla Firefox, Google Chrome, Safari, and Opera).

| Trading Platform | IC Markets | FXTM |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | Yes | Yes |

| cTrader | Yes | No |

| TradingView | Yes | No |

| Copy Trading | Yes | Yes |

| Proprietary Platform | Yes | No |

We have created a software questionnaire if you are unsure what platform best suits your trading style. Based on six simple questions, we can recommend the best trading software for your trading needs.

MetaTrader 5 (MT5) Platform Comparison

Both brokerages grant access to the MetaTrader 5 platform, which is an even more powerful successor to MT4. Key features and benefits include:

IC Markets

– Raw pricing and deep interbank liquidity

– Low latency and ultra-fast order execution (MT5 servers located in the Equinix NY4 data centre)

– Level II pricing – discloses the entire range of available prices from IC Markets’ 25 liquidity providers

– A wider range of asset classes available to trade – 232 trading instruments across six asset classes

– Access to advanced MQL5 environment to develop and backtest EAs

– Position hedging

– No restrictions on limit orders and no limits on trade sizes

– Built-in Economic Calendar

FXTM

– A wider range of technical indicators, analytical objects, and timeframes compared to MT4

– More types of pending orders compared to MT4

– Richer interface customizability options compared to MT4

– Unlimited number of charts

– Depth of Market

– Access to a wider range of tradable assets, including CFDs, Stocks, and Futures

– Access to advanced MQL5 environment

– Netting and hedging position accounting system

clients.

Advanced Platforms

Along with the MetaTrader package, both IC Markets and FXTM offer one additional trading software option:

IC Markets

Offers the cTrader platform, known for superior chart and layout customization options, advanced analytics, full depth of market, and access to cAlgo and Smart Stop Out features.

FXTM

Offers the FXTM Trader mobile app, a proprietary software that features state-of-the-art charting tools, a one-click trading option, and allows trading across more than one device. A VPS is offered by the online broker to trade forex at faster execution speeds.

IC Markets and FXTM’s MT4 platforms have Windows and Mac OSX compatibility with good mobile trading capability – apps for iOS and Android devices. The MT4 WebTrader is compatible with six browsers (Internet Explorer, Microsoft Edge, Mozilla Firefox, Google Chrome, Safari, and Opera).

FXTM vs IC Markets MetaTrader 5 Platform Comparison

Both brokerages grant access to MT4’s even more powerful successor, the MetaTrader 5 platform. We can summarise its key features and benefits as follows:

- At IC Markets:

- Raw pricing and deep interbank liquidity

- Low latency and ultra-fast order execution (MT5 servers located in the Equinix NY4 data centre)

- Level II pricing – discloses the entire range of available prices that come directly from IC Markets’ 25 liquidity providers

- A wider range of asset classes available to trade – 232 trading instruments across six asset classes

- Access to advanced MQL5 environment to develop and backtest EAs;

- Position hedging

- No restrictions on limit orders and no limits on trade sizes

- Built-in Economic Calendar

- At FXTM:

- A wider range of technical indicators, analytical objects and timeframes compared to MT4

- More types of pending orders compared to MT4

- Richer interface customizability options compared to MT4

- Unlimited number of charts

- Depth of Market

- Access to a wider range of tradable assets, including CFDs, Stocks and Futures

- Access to advanced MQL5 environment

- Netting and hedging position accounting system

Copy Trading

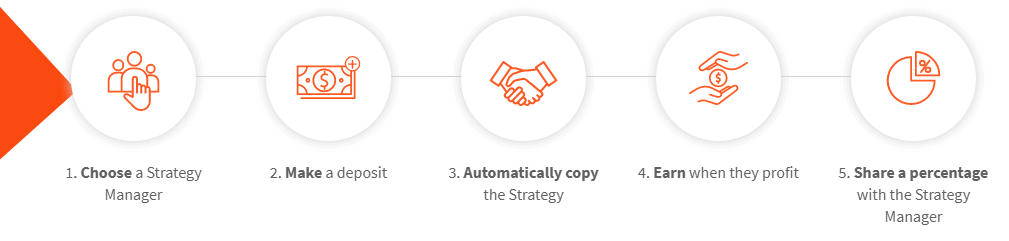

IC Markets provides clients with access to copy trading features such as ZuluTrade, Myfxbook AutoTrade, and MQL5. Meanwhile, FXTM grants access to its in-house copy trading platform, FXTM Trading Signals. This social trading network combines popular technical indicators and presents different scenarios, four Take-Profit levels, Stop Loss recommendations, and daily updates before the start of EU and US trading sessions.

IC Markets and FXTM both provide a variety of trading platforms and tools. IC Markets is notable for its exclusive cTrader platform and quick order execution, ideal for advanced traders. FXTM offers the FXTM Trader app and strong MetaTrader options for versatility. As forex trading evolves in 2025, both brokers focus on innovative solutions and competitive conditions, catering to different trader preferences.

Our Better Trading Platform Verdict

Our dedicated team can easily surmise that in this portion IC Markets takes home the crown due to their better trading platform.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

3. Superior Accounts And Features – Tie

Choosing a forex broker greatly impacts a trader’s experience. Brokers with competitive spreads, low commissions, and various account types help traders find suitable options. Features like demo accounts, swap-free options, and diverse instruments enhance flexibility. Tools like social and automated trading, plus good customer support, contribute to a satisfying and loyal trading experience.

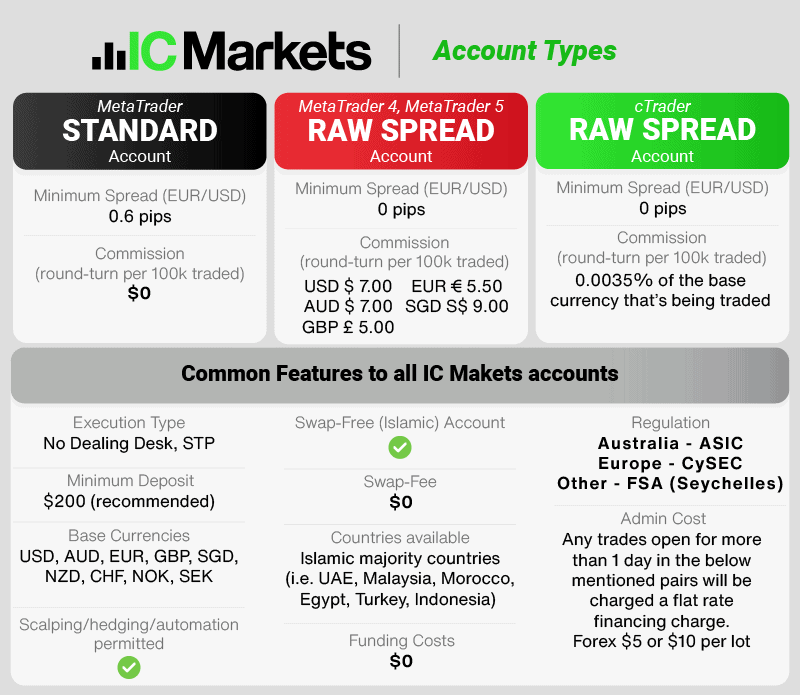

In the dynamic world of forex trading, both IC Markets and FXTM have meticulously crafted their account offerings to accommodate various trader preferences and financial objectives. As of 2025, IC Markets presents three distinct account types: the Standard Account, which boasts spreads starting at just 0.6 pips with no commissions; the MetaTrader Raw Spread Account, featuring spreads from 0.0 pips alongside a commission of $3.50 per lot per side; and the cTrader Raw Spread Account, also with spreads commencing at 0.0 pips, with a commission of $3.00 per $100k traded.

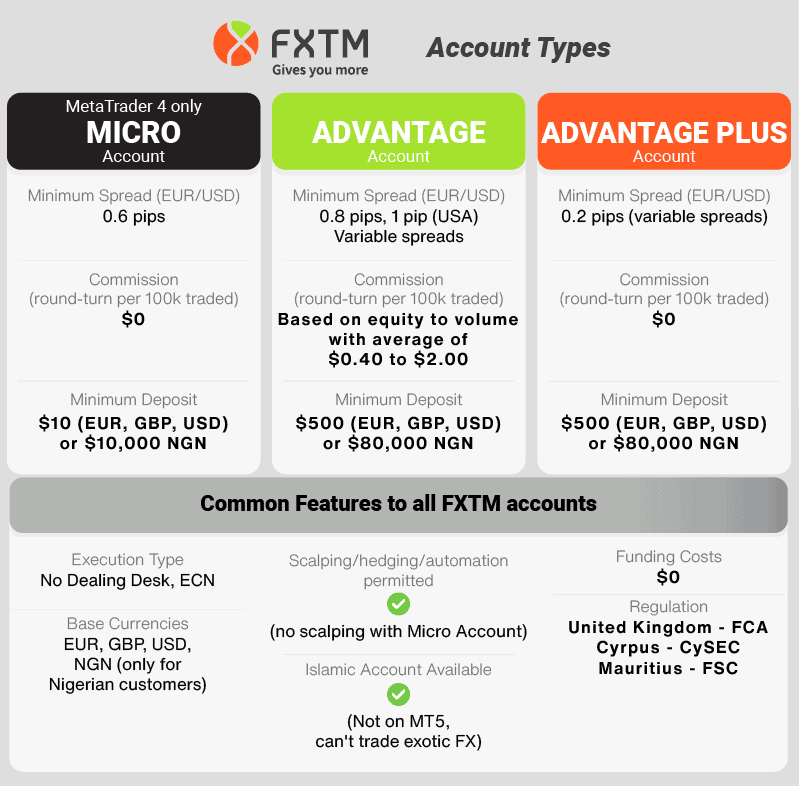

Conversely, FXTM has refined its offerings to three main account types, each tailored to suit different trading strategies and levels of experience.

This diverse array of account structures empowers traders to choose an option that aligns perfectly with their trading approach, whether that means prioritizing lower spreads, zero commissions, or preference for specific trading platforms.

| IC Markets | FXTM | |

|---|---|---|

| Minimum Deposit | $200 | From $10 |

| Number of Accounts | - 1 Standard account - 2 ECN accounts | - 3 Standard account - 3 ECN accounts |

| EUR/USD Standard Account Spreads | 1.1 pips | 1.9 pips |

| EUR/USD Raw Account Spreads | 0.1 pips | 0.3 pips |

| Commission (Raw Account) | -$3.0 per side per 100k units (cTrader account) -$3.5 per side per 100k units (MT4 account) | $2 per side per 100k units ($4.0 round-turn) |

| Range of Platforms | MT4,MT5 & cTrader | MT4, MT5 & FXTM Trader App |

| Maximum Leverage | 30:1 | - FXTM UK 1:30 - FXTM Global 1:2000 |

| Instruments | +230 | +250 |

| Social Trading | MyFxBook AutoTrade, MQL5 Signals and ZuluTrade | MQL5 Signals and FXTM Invest |

IC Markets’ Standard Account is tailored for traders who prioritize simplicity and zero commission fees. Clients can explore a wide array of trading instruments, featuring 60 currency pairs, 16 commodities, and 16 major stock indices, all available on the MetaTrader 4 and MetaTrader 5 platforms. With a minimum deposit requirement of $200 and leverage up to 1:500, this account accommodates various trading styles seamlessly. Significantly, IC Markets places no restrictions on trading strategies, permitting scalping and high-frequency trading without minimum order distance and a freeze level of 0. This blend of flexibility and competitive spreads starting from just 0.5 points makes IC Markets a highly attractive option for traders seeking an efficient and adaptable trading experience.

FXTM’s diverse Standard account offerings ensure traders of all levels can find an account suited to their trading style, whether focusing on forex, metals, or stock CFDs.

FXTM offers three types of Standard accounts to suit different trading styles:

Standard Account: A popular choice for forex traders, this account requires a minimum deposit of $100 and offers commission-free trading on FXTM’s MT4 platform. Traders can access 59 currency pairs, 5 spot metals, and 14 spot indices and commodity CFDs with floating spreads and instant execution.

Cent Account: Designed for beginners and those looking to trade with lower capital, this account can be opened with just $10. It supports commission-free trading of 25 major and minor forex pairs and 2 spot metals on the MT4 platform. The cent-based balance allows for smaller trade sizes, making it ideal for risk-conscious traders.

Stock CFDs Account: With a $100 minimum deposit, this account provides access to over 160 US and European stock CFDs on FXTM’s MT4 platform. Traders benefit from no commissions, spreads starting from $0.1, and leverage up to 1:5 for US shares and 1:3 for European shares.

FXTM’s diverse Standard accounts cater to all traders, whether they focus on forex, metals, or stock CFDs.

IC Markets and FXTM both present ECN-style accounts that grant traders direct market access, lightning-fast execution speeds, and highly competitive trading costs. IC Markets offers two distinct ECN accounts, while FXTM provides three, specifically designed to meet the needs of traders in search of institutional-grade trading conditions.

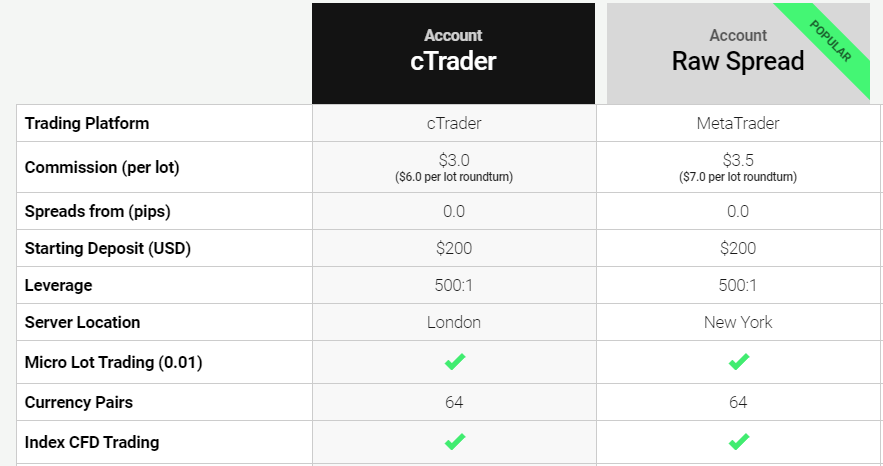

IC Markets ECN Accounts:

Raw Spread Account (MT4 & MT5): Traders can access 64 forex pairs, metals, and 15 major CFD indices with ultra-tight interbank spreads and low commission fees.

cTrader Raw Spread Account: Designed for advanced traders, this account is available on the cTrader platform with a reduced commission of $3 per side per 100,000 units traded, offering deeper liquidity and enhanced price transparency.

IC Markets offers an ECN model with no dealer intervention, providing direct access to liquidity and spreads from 0.0 pips, ideal for scalpers and algorithmic traders.

FXTM offers three ECN accounts that cater to various trading needs, featuring low costs, flexible commissions, and institutional pricing. All accounts provide direct market access with tight spreads and fast execution, making FXTM competitive for forex traders.

FXTM ECN Account Options:

ECN Account: Requires a $500 minimum deposit and provides access to 48 forex pairs, 3 spot metals, and 14 spot CFDs via MT4. Commission fees are dynamic, decreasing as clients trade more or maintain higher account equity.

ECN Zero Account: Available with a $200 minimum deposit, this account offers 48 forex pairs, 3 spot metals, and 14 spot CFDs on MT4, as well as 33 forex pairs and 2 spot metals on MT5. No commissions apply, making it an ideal choice for traders who prefer cost-efficient trading.

Pro Account: Designed for high-net-worth and professional traders, this account requires a $25,000 minimum deposit and grants access to 43 forex pairs and 2 spot metals on MT4. It features zero commissions and spreads from 0.0 pips, but traders must maintain the minimum deposit balance to retain access to institutional-grade pricing.

FXTM’s ECN accounts are ideal for traders seeking tight spreads, flexible commissions, and deep liquidity for a competitive trading experience.

In addition to their live account offerings, both IC Markets and FXTM provide a free demo account for users to explore. Both brokerages also cater to clients of the Muslim faith by offering an Islamic account option that is swap-free.

| IC Markets | FXTM | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | Yes | Yes |

| Swap Free Account | Yes | Yes |

| Active Traders | Yes | No |

| Spread Betting (UK) | No | No |

Our Superior Accounts and Features Verdict

Overall, both forex brokers are having their moment in the spotlight due to their superior accounts and features.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – IC Markets

Key factors for the best forex trading experience include advanced platforms, fast execution, competitive spreads, and excellent customer support. These elements help traders make informed decisions and manage accounts easily. A user-friendly interface, educational resources, and diverse trading tools enhance the experience. This review compares IC Markets and FXTM based on these criteria for EUR and AUD traders.

In forex trading, experience and ease of use are vital. After testing IC Markets and FXTM, we found that IC Markets excels with its user-friendly MT5 platform, while FXTM offers MT4 and MT5 for various trading needs. Both brokers provide extensive educational resources for traders.

Both IC Markets and FXTM offer seamless mobile trading experiences, but differences in platform features and educational resources may appeal to different traders. As we explore 2025 forex trading trends, it’s evident both brokers adapt to provide strong solutions for EUR, AUD, and USD trading.

| Limit Order Speed | Limit Order Global Rank | Market Order Speed | Market Order Global Rank | |

|---|---|---|---|---|

| IC Markets | 134ms | 16/36 | 153ms | 22/36 |

| FXTM | 248ms | 35/36 | 210ms | 31/36 |

Our Best Trading Experience and Ease Verdict

Based on our team’s comprehensive research, IC Markets come up trumps in this niche owing it to best trading experience and ease.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – Tie

In forex trading, trust and regulation are crucial. Regulated brokers follow strict standards, protecting traders from fraud and enhancing transparency, which builds confidence and attracts clients. This review will assess IC Markets and FXTM in providing a secure trading environment for EUR and AUD traders.

IC Markets Trust Score

FXTM Trust Score

We see here that IC Markets has a trust score of 61 compared to FXTM’s 60.

IC Markets and FXTM are both regulated, but IC Markets has stronger oversight with two Tier-1 licenses from ASIC and CySEC, making it a safer choice. It is also registered with Tier-3 Seychelles FSA. FXTM is regulated by CySEC, FCA, and FSCA, offering good investor protection. In 2025, traders looking for higher regulatory security in EUR, AUD, and USD markets may prefer IC Markets due to its stricter oversight and transparency.

Regulatory Compliance and Client Security: IC Markets vs. FXTM

FXTM is regulated by the UK’s Financial Conduct Authority (FCA) (License No. 777911), providing robust oversight and compliance with stringent financial regulations. In contrast, IC Markets (SC) is overseen by the Seychelles Financial Services Authority (FSA) (License No. SD018), which allows for a more flexible regulatory approach. Additionally, FXTM has obtained regulatory approvals from CySEC (Cyprus), FSCA (South Africa), and FSC (Mauritius) (Investment Dealer License No. C113012295), enhancing its global reach.

Both brokers implement rigorous security measures, such as segregating client funds at top-tier banks and utilizing SSL encryption to safeguard data. However, FXTM stands out by offering negative balance protection, ensuring that retail traders cannot lose more than their initial deposit—a vital safety feature in volatile markets.

Furthermore, both IC Markets and FXTM are part of the Cyprus Investor Compensation Fund (CIFs), which guarantees retail clients compensation should the broker default on its financial commitments. Nevertheless, FXTM excels in risk management with its automatic negative balance protection—an advantage not available to IC Markets in its Australian and global operations.

As we look ahead to 2025, traders in the EUR, AUD, and USD markets are likely to prefer FXTM for its comprehensive risk protection policies, catering to those who prioritize security. Meanwhile, IC Markets continues to attract traders seeking tighter spreads and direct market access.

IC Markets lacks a negative balance policy, so retail clients must manage money wisely to avoid debt.

| IC Markets | FXTM | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) CYSEC (Cyprus) | CYSEC (Cyprus) FCA (UK) |

| Tier 2 Regulation | FSCA (South Africa) | |

| Tier 3 Regulation | FSA-S (Seychelles) SCB (Bahamas) | FSC-M (Mauritius) CMA (Kenya) |

Reviews

As shown below, IC Markets holds an outstanding Trustpilot rating of 4.8 out of 5, based on over 46,000 reviews. FXTM, on the other hand, has a more modest Trustpilot score of 3.5 out of 5, from around 1,000 reviews. IC Markets clearly leads in both score and review volume, reflecting stronger and more consistent customer satisfaction. FXTM shows mixed feedback, with notable concerns around transparency and support.

Our Stronger Trust and Regulation Verdict

Both brokers are neck to neck in this niche by the reason of their stronger trust and regulation.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

6. Most Popular Broker – IC Markets

IC Markets gets searched on Google more than FXTM. On average, IC Markets sees around 246,000 branded searches each month, while FXTM gets about 40,500 — that’s 83% fewer.

| Country | IC Markets | FXTM |

|---|---|---|

| United Kingdom | 33,100 | 1,000 |

| South Africa | 9,900 | 1,000 |

| Thailand | 8,100 | 590 |

| India | 8,100 | 5,400 |

| Vietnam | 8,100 | 1,600 |

| Australia | 6,600 | 320 |

| United States | 6,600 | 1,600 |

| Spain | 6,600 | 390 |

| Germany | 5,400 | 320 |

| Pakistan | 5,400 | 880 |

| Brazil | 4,400 | 480 |

| France | 4,400 | 260 |

| United Arab Emirates | 4,400 | 1,000 |

| Morocco | 4,400 | 320 |

| Malaysia | 3,600 | 1,300 |

| Colombia | 3,600 | 260 |

| Italy | 3,600 | 210 |

| Singapore | 3,600 | 260 |

| Indonesia | 3,600 | 480 |

| Nigeria | 3,600 | 5,400 |

| Poland | 2,900 | 70 |

| Sri Lanka | 2,900 | 140 |

| Kenya | 2,400 | 1,300 |

| Mexico | 2,400 | 320 |

| Hong Kong | 2,400 | 390 |

| Philippines | 2,400 | 260 |

| Netherlands | 2,400 | 170 |

| Canada | 2,400 | 320 |

| Algeria | 2,400 | 590 |

| Bangladesh | 1,900 | 320 |

| Saudi Arabia | 1,900 | 260 |

| Peru | 1,600 | 170 |

| Egypt | 1,600 | 720 |

| Switzerland | 1,600 | 50 |

| Turkey | 1,300 | 720 |

| Argentina | 1,300 | 170 |

| Japan | 1,300 | 260 |

| Sweden | 1,300 | 50 |

| Taiwan | 1,000 | 320 |

| Ecuador | 1,000 | 140 |

| Dominican Republic | 1,000 | 70 |

| Portugal | 1,000 | 50 |

| Uzbekistan | 1,000 | 30 |

| Cyprus | 880 | 210 |

| Ireland | 880 | 30 |

| Ghana | 880 | 260 |

| Mongolia | 720 | 10 |

| Chile | 720 | 50 |

| Uganda | 720 | 170 |

| Venezuela | 720 | 210 |

| Ethiopia | 720 | 110 |

| Austria | 720 | 50 |

| Greece | 720 | 70 |

| Jordan | 590 | 170 |

| Mauritius | 480 | 40 |

| Costa Rica | 390 | 30 |

| Tanzania | 320 | 210 |

| Bolivia | 260 | 50 |

| Botswana | 260 | 70 |

| Panama | 260 | 20 |

| New Zealand | 210 | 30 |

| Cambodia | 170 | 110 |

33,100 1st | |

1,000 2nd | |

8,100 3rd | |

590 4th | |

6,600 5th | |

320 6th | |

4,400 7th | |

1,000 8th |

Similarweb shows a similar story when it comes to February 2024 website visits with IC Markets receiving 2,425,000 visits vs. 473,000 for FXTM.

Our Most Popular Broker Verdict

IC Markets is the more popular broker worldwide based on the number of Google branded searches and visits to the website.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

7. Top Product Range And CFD Markets – IC Markets

Market diversity is crucial in forex trading. In 2025’s dynamic landscape, a wide range of financial instruments gives traders a strategic edge. Brokers like IC Markets and FXTM offer diverse CFDs, allowing portfolio diversification across various asset classes. This helps traders respond to market changes and identify profit opportunities. As trading evolves in EUR, AUD, and USD, competitive spreads and deep liquidity are vital. This review will assess how IC Markets and FXTM rank in market diversity to assist in selecting the ideal trading platform.

IC Markets offers a wider range of financial markets than FXTM, with 8 asset classes versus 5. Both focus on Forex, but IC Markets has access to 61 currency pairs compared to FXTM’s 57. With increased volatility in the EUR/USD and AUD/USD pairs, traders can capitalize on price swings. IC Markets provides more flexible platforms and faster execution, while FXTM may attract those with specialized strategies. Both brokers remain competitive amid changing global currency markets in 2025.

IC Markets and FXTM offer diverse CFDs alongside forex, enabling portfolio diversification with indices, commodities, and cryptocurrencies. By 2025, increased volatility in major pairs has made CFD trading appealing, but it carries significant risks, especially with leverage. Retail clients must understand margin requirements and risks before trading. IC Markets offers broader access to asset classes than FXTM, which has a more focused selection. CFDs allow hedging and speculation but require caution due to their complexities and risks.

| CFDs | IC Markets | FXTM |

|---|---|---|

| Forex Pairs | 61 | 58 |

| Indices | 25 | 13 |

| Commodities | 4 Metals (Gold vs 6 currencies) (Silver vs 3 currencies) 8 Softs 5 Energies | 2 Metals (3 Gold crosses) 2 (Silver crosses) 4 Energies |

| Cryptocurrencies | 23 | 11 |

| Share CFDs | 2100+ | 1120 |

| ETFs | No | No |

| Bonds | 9 | No |

| Futures | Yes | No |

| Treasuries | 9 | No |

| Investments | Yes | No |

By 2025, IC Markets offers a broader range of CFDs than FXTM, with 25 Stock Index CFDs and over 23 cryptocurrencies, compared to FXTM’s 11 and fewer options. IC Markets also provides 26 commodity CFDs, while FXTM has 11. Additionally, IC Markets features 44 ASX, 106 NASDAQ, and 156 NYSE stock and ETF CFDs, whereas FXTM has 141 US and 50 European stock CFDs. IC Markets is also the sole provider of Bond CFDs, featuring 11+ contracts. As forex trading evolves, traders must understand CFD complexities due to the risks and potential profits from leverage.

*NOTE: Under new FCA guidelines, retail traders in the UK are no longer able to trade cryptocurrencies.

![]()

Our Top Product Range and CFD Markets Verdict

Undeniably, IC Markets stands out in this portion on the account of having top product range and CFD markets.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

8. Superior Educational Resources – IC Markets

Access to quality educational resources is crucial for forex trading, especially for pairs like EUR/USD and AUD/USD. Comprehensive materials such as webinars, articles, and courses enhance trading strategies and boost confidence. They help traders, whether novices or pros, adapt to market changes and navigate complexities. A strong educational foundation is key to anticipating market moves and achieving long-term success. When choosing a forex broker, ensure their educational offerings suit your learning style.

IC Markets and FXTM provide extensive educational resources for traders. IC Markets offers webinars, seminars, workshops, and a variety of video tutorials for all levels, plus market analysis articles, FAQs, and a glossary. FXTM features a similar educational portal with webinars, seminars, video tutorials, market insights, FAQs, a glossary, and trading calculators. Both brokers emphasize education, equipping traders with essential knowledge for the forex market.

IC Markets:

- Offers a comprehensive educational section on their website.

- Provides webinars, seminars, and workshops for traders.

- Features a wide range of video tutorials for beginners and advanced traders.

- Includes articles and insights on market analysis.

- Offers a dedicated FAQ section addressing common trading queries.

- Provides a glossary of trading terms for easy reference.

FXTM:

- Features an extensive educational portal with a variety of resources.

- Conducts webinars and seminars for traders of all levels.

- Offers detailed video tutorials covering various trading topics.

- Provides insightful articles on market trends and strategies.

- Includes a comprehensive FAQ section for traders.

- Offers a glossary and trading calculators for traders to use.

Our Superior Educational Resources Verdict

Based on our team’s perspectives, IC Markets ranks highest in this category as a result of their superior educational resources.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

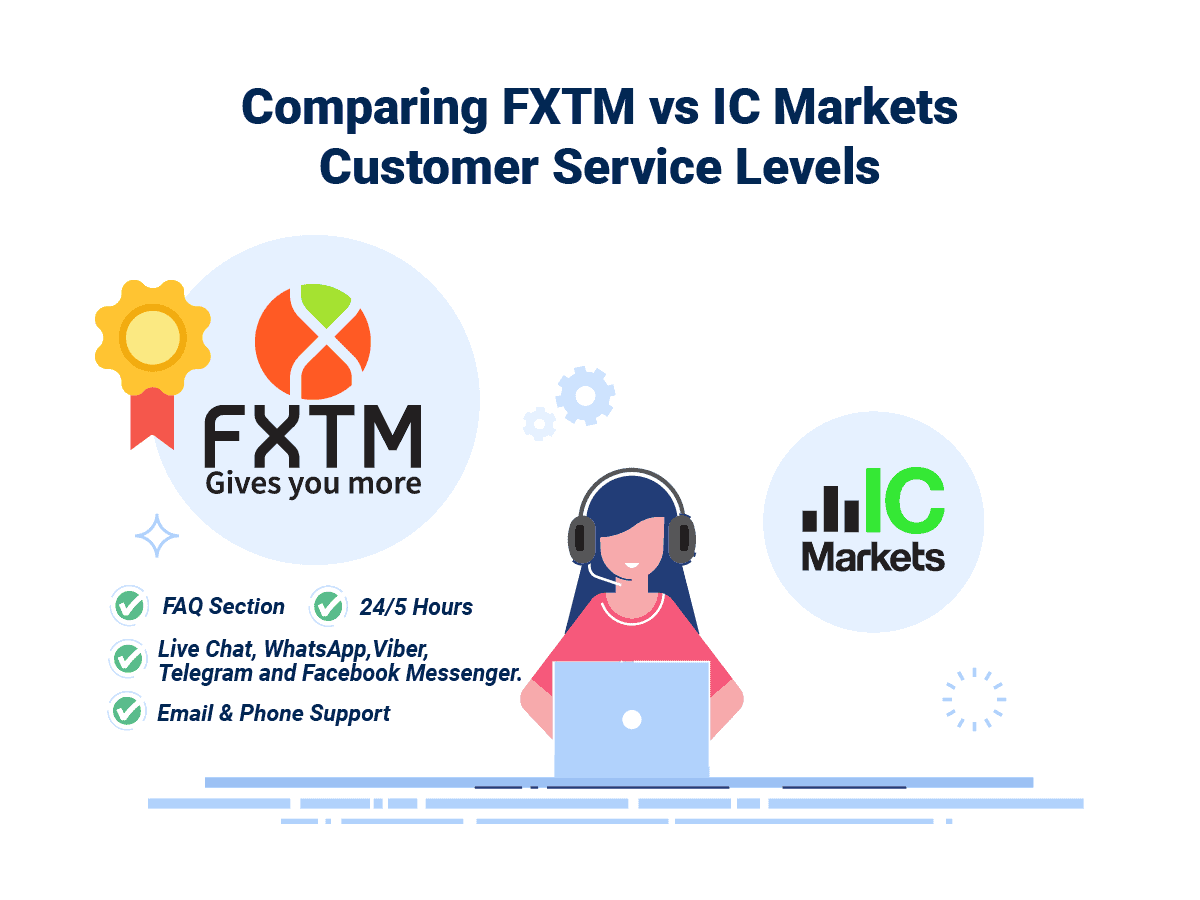

9. Superior Customer Service – FXTM

In forex trading, especially with pairs like EUR/USD and AUD/USD, superior customer service is essential. It’s not just about quick responses; it builds trust and support for traders. Brokers with 24/7 responsive support via live chat, phone, or email help resolve issues swiftly, allowing traders to continue their strategies confidently. Multilingual support is beneficial for international traders, ensuring effective communication. Exceptional customer service enhances satisfaction and trust, creating a better trading experience amid fast-changing market conditions.

In our 2025 review, professional customer support was crucial for forex traders dealing with volatile pairs like EUR/USD and AUD/USD. IC Markets and FXTM impressed us with their responsive and knowledgeable support. Both brokers provided immediate answers via live chat, enhancing the trading experience. IC Markets delivered efficient support, while FXTM offered additional communication options through WhatsApp, Viber, Telegram, and Facebook Messenger. These multi-channel services show their commitment to assisting traders, fostering confidence in fast-paced markets where quick decisions are vital.

IC Markets and FXTM provide various support channels, including live chat, email, and phone. IC Markets’ contact number is +61 (0)2 8014 4280, with toll-free options available, while FXTM can be reached at +357 25 55 87 77. Reliable customer service is crucial for addressing issues quickly, especially in the volatile forex markets of 2025. Both brokers ensure traders receive timely assistance for technical help, account inquiries, or trade support.

A key difference in customer support between IC Markets and FXTM is that IC Markets offers 24/7 assistance, beneficial for traders needing timely responses in fast-paced markets. In contrast, FXTM provides support only during business hours, which can hinder traders in different time zones or with urgent needs. Although FXTM’s support is strong during operating hours, the lack of weekend access may affect those requiring constant assistance. As forex trading becomes more volatile, 24/7 support can enhance the trading experience.

| Feature | IC Markets | FXTM |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 24/7 | 24/5 |

| Multilingual Support | Yes | Yes |

Both brokers provide excellent Forex education content on their websites.

| IC Markets | FXTM | |

|---|---|---|

| Forex Glossary | ✔ | ✔ |

| Economic Calendar | ✔ | ✘ |

| Forex Calculators | ✔ | ✔ |

| Video Tutorials | ✔ | ✔ |

| Web TV | ✔ | ✘ |

| Webinars | ✔ | ✔ |

| eBooks | ✘ | ✔ |

| Daily Research Blogs | ✔ | ✘ |

IC Markets provides a structured educational hub for traders, covering Forex basics, analysis, risk management, psychology, and trading plans. It equips traders with essential tools for the dynamic 2025 forex market. Similarly, FXTM offers free eBooks on key trading topics, helping traders enhance their skills and adapt to market changes, especially for major pairs like EUR/USD and AUD/USD. Both brokers support traders, from beginners to advanced, in their journey within the competitive forex market.

IC Markets, an Australian forex broker, provides extensive educational content for traders at all levels. Their video lessons cover essential topics like MT4 setup, order placement, and platform navigation. They also offer WebTV with daily market commentary in partnership with Trading Central, delivering key insights on trends and currency movements. These resources help traders make informed decisions amid increasing market volatility in 2025.

IC Markets, an Australian forex broker, provides extensive educational content for traders at all levels. Their video lessons cover essential topics like MT4 setup, order placement, and platform navigation. They also offer WebTV with daily market commentary in partnership with Trading Central, delivering key insights on trends and currency movements. These resources help traders make informed decisions amid increasing market volatility in 2025.

FXTM offers a collection of concise Forex trading videos organized into categories like Forex Basics, Trading Fundamentals, and Technical Analysis, among others. Additionally, this brokerage firm regularly hosts free Forex webinars to enhance traders’ knowledge and skills.

Finally, IC Markets delivers valuable insights into global markets through a series of daily publications on its Market Analysis blog. Although FXTM does not provide daily market analysis, its research team conducts monthly webinars that offer a comprehensive currency outlook and essential market insights.

Our Superior Customer Service Verdict

This time around, FXTM steals the show by the reason of their superior customer service.

*Your capital is at risk ‘73% of retail CFD accounts lose money’

10. Better Funding Options – IC Markets

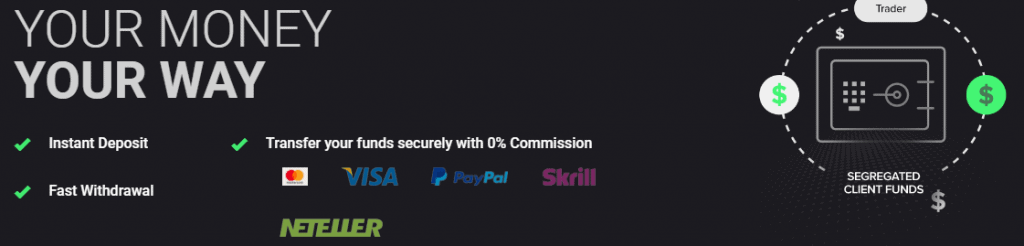

In 2025, diverse funding options are crucial for forex traders seeking flexibility. Brokers now offer various payment methods like bank transfers, credit/debit cards, digital wallets, and cryptocurrencies. Multiple options, especially with low fees, enable traders to easily manage deposits and withdrawals globally. Quick fund transfers enhance the trading experience, allowing traders to focus on the market while ensuring secure transactions.

In the 2025 forex market, diverse funding options are crucial for traders managing EUR/USD and AUD/USD positions. IC Markets and FXTM provide various methods for global clients. IC Markets offers convenient deposits and withdrawals through credit/debit cards, bank transfers, digital wallets, and cryptocurrencies, enhancing flexibility for traders.

FXTM offers a variety of funding methods, including credit/debit cards and bank transfers, with region-specific options for accessibility. This customization enhances trading efficiency for clients. Flexible funding is essential for seamless trading, especially in volatile markets.

| Funding Option | IC Markets | FXTM |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | Yes | No |

| Skrill | Yes | Yes |

| Neteller | Yes | No |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | No |

| Klarna | No | No |

Our Better Funding Options Verdict

Without a doubt, IC Markets gains traction in this category on account of their better funding options.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

11. Lower Minimum Deposit – IC Markets

In 2025, lower minimum deposits are making forex trading more accessible, especially for beginners and those with limited capital. Brokers are offering lower entry costs, allowing traders to start small, gain experience, and develop strategies without significant upfront investment. This change fosters inclusivity and encourages participation in the market.

Starting in 2025, IC Markets has a minimum deposit of $200 for all account types, ensuring consistency for traders. FXTM, however, offers varying minimum deposits based on the chosen account type, allowing traders to select according to their trading style and budget. This structure aids in balancing accessibility and account features for trading major pairs like EUR/USD or AUD/USD.

| Minimum Deposit | Recommended Deposit | |

| IC Markets | $200 | $200 |

| FXTM | $10 | $500 |

In 2025, IC Markets supports 10 base account currencies, including AUD, USD, JPY, and EUR, giving traders more flexibility in managing accounts, particularly in active markets. In contrast, FXTM allows deposits in only 7 currencies, offering fewer options for traders.

IC Markets offers 15 funding options with no fees for deposits or withdrawals, making it very competitive, alongside Pepperstone. In contrast, FXTM has 7 payment methods and no deposit fees, but does charge withdrawal fees based on the chosen method and currency. Overall, IC Markets’ fee-free approach provides an advantage for cost-conscious traders.

Withdrawing funds through credit cards, bank transfers, or e-wallets may involve varying fees depending on the method and broker. It’s crucial to review the broker’s fee schedule, as these charges can affect trading profitability, especially with volatile pairs like EUR/USD or AUD/USD. Always check for the latest updates from your broker before withdrawing.

| FXTM Withdrawal Fees | Processing Time | |

|---|---|---|

| Credit Card | 2 EUR/ 3 USD/ 2 GBP | Same business day |

| PayPal | 2% | Same business day |

| Skrill | No Commission | Same business day |

| Neteller | No Commission | Same business day |

At the same time, with IC Markets, clients can choose from the following account funding methods:

- Debit or Credit Card by Visa or MasterCard

- PayPal

- Neteller

- Neteller VIP

- Skrill

- UnionPay

- Bank transfer

- Bpay

- FasaPay

- POLi

- Thai Internet Banking

- Broker to Broker

- Rapidpay

- Klarna

- Vietnamese Internet Banking

In 2025, forex withdrawal times vary by method: debit/credit cards take 3-5 business days, e-wallets (PayPal, Skrill, Neteller) are instant, and bank wire transfers can take up to 14 days with a AUD 20 fee. Traders should plan withdrawals considering these times and fees amid market volatility.

Our Lower Minimum Deposit Verdict

Undoubtedly, IC Markets is riding high in this portion on account of their lower minimum deposit.

IC Markets ReviewVisit IC Markets

*Your capital is at risk ‘72.53% of retail CFD accounts lose money’

Our Final Verdict On Which Broker Is The Best: FXTM or IC Markets?

IC Markets takes the gold in this niche because it offers a more comprehensive range of services, better trading platforms, and superior educational resources. The table below summarises the key information leading to this verdict:

| Categories | IC Markets | FXTM |

|---|---|---|

| Lowest Spreads And Fees | ✅ | ❌ |

| Better Trading Platform | ✅ | ❌ |

| Superior Accounts And Features | ✅ | ✅ |

| Best Trading Experience And Ease | ✅ | ❌ |

| Stronger Trust And Regulation | ❌ | ✅ |

| Most Popular Broker | ✅ | ❌ |

| Top Product Range And CFD Markets | ✅ | ❌ |

| Superior Educational Resources | ✅ | ❌ |

| Superior Customer Service | ❌ | ✅ |

| Better Funding Options | ✅ | ❌ |

| Lower Minimum Deposit | ✅ | ❌ |

Best For Beginner Traders

FXTM is better suited for beginner traders due to its user-friendly interface and comprehensive educational resources.

Best For Experienced Traders

IC Markets is the preferred choice for experienced traders because of its advanced trading platforms and extensive range of financial instruments.

FAQs Comparing IC Markets Vs FXTM

Does FXTM or IC Markets Have Lower Costs?

IC Markets generally offers lower costs compared to FXTM. They are renowned for their competitive spreads, often starting from as low as 0.1 pips for major currency pairs. This makes them a top choice for traders looking to minimise trading costs. For a more detailed comparison on low commissions, you can check out this comprehensive guide on the lowest spread forex brokers in the UK.

Which Broker Is Better For MetaTrader 4?

Both FXTM and IC Markets offer MetaTrader 4, but IC Markets is often preferred due to its enhanced server speeds and additional tools. Their integration with MT4 is seamless, providing traders with a robust trading experience. If you’re keen on diving deeper into MT4 platforms, here’s a list of the best MT4 forex brokers in the UK.

Which Broker Offers Social Trading?

FXTM stands out when it comes to social trading, offering traders the opportunity to engage in copy trading. This feature allows less experienced traders to mimic the strategies of successful ones. Social trading has gained immense popularity in recent years, and if you’re interested in exploring more, you can find a detailed review of the best social trading platforms.

Does Either Broker Offer Spread Betting?

Neither IC Markets nor FXTM offer spread betting as part of their core services. Spread betting is a unique form of trading popular in the UK and some other regions, allowing traders to bet on the direction of market movements. If you’re interested in exploring brokers that specialise in spread betting, you can check out this comprehensive guide on the best spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, IC Markets is the superior choice for Australian forex traders. Founded in Sydney, IC Markets is ASIC regulated, ensuring a high level of trust and security for traders. Their deep liquidity and tight spreads make them a favourite among many Australian traders. Additionally, their local presence means they have a deep understanding of the Australian market. For a broader perspective on Australian forex brokers, you might want to explore this list of the Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK traders, I personally believe FXTM has a slight edge. They are FCA regulated, which provides a significant level of trust and security for UK-based traders. While both brokers offer robust trading platforms and tools, FXTM’s commitment to continuous innovation and their strong presence in the European market make them a top choice. If you’re keen on diving deeper into UK forex trading platforms, here’s a list of the best forex brokers in UK.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert