Pepperstone Review Of 2025

Pepperstone is our best-rated forex broker for its top trading experience, great platforms, range of products, low fee structure, and customer support levels. We recommend the razor account as it has the lowest trading costs with 0 pip spreads and a modest commission.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team (See our top 10 picks)

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers in the past 12 months

- Structured and in-depth evaluation framework (Our Methodology)

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

Pepperstone Summary

| 🗺️ Tier 1 Regulation | UK (FCA), Australia(ASIC), Germany(BaFIN),Cyprus(CySEC) |

| 🗺️ Tier 2 Regulation | UAE (DFSA) |

| 💱 Trading Fees | Low Spreads for Razor and Standard Accounts |

| 📊 Trading Platforms | MT4, MT5, cTrader, TradingView |

| 💰 Minimum Deposit | $0 |

| 💰 Funding Fee | $0 |

| 🛍️ CFDs Offered | Forex, Crypto, Commodities, Shares, Indices |

Why Choose Pepperstone

With a score of 98/100, we consider Pepperstone our best forex broker for 2025. Features we like are the brokers’ industry-leading execution speeds, excellent choice of trading platforms, over 90 currency pairs and support for specialised copy trading tools. Pepperstone’s sweet spot continues to be their Razor Account, which our tests found to have some of the lowest spreads of all brokers.

Despite these strengths, the broker does have some weaknesses. Their Forex education suite could do with a refresh, the funding methods are limited in some regions and their Standard account spreads are average.

Pepperstone Pros And Cons

- Lowest Spread - Standard Account

- Best Trading Platform Range

- Strong Regulation + Reputation

- No Share Trading Options

- Not Available For US Traders

- Limited Crypto Range

Open a demo accountVisit Broker

The overall rating is based on review by our experts

Trading Fees

Trading costs are one of the most critical aspects when choosing a broker as a trader. Costs add up each time you trade, so it pays to look for a broker with low spreads and commissions. In my opinion, Pepperstone consistently provides competitive spreads when trading their forex currency pairs.

Pepperstone offers three account types:

- Razor Account (Raw Account)

- Standards Account

- Swap Free Account

I recommend the Razor Account which has lower overall fees than their standard account. I generally recommend the standard account only if you are a beginner in trading since it has a more straightforward brokerage model.

1. Raw Account Spreads

In tests done by Ross Collins from the CompareForexBrokers team it was found that Pepperstone had the 5th lowest average spreads of the 39 raw accounts tested. Overall, Pepperstones’ average spread for the currency pairs tested was just 0.47 pips, which is well below the industry average of 0.72 pips.

While spreads can be as low as 0 pips with the Razor account, they will generally be slightly higher. The EUR/USD averages 0.10 pips wh, while the EURGBP and AUDUSD average 20 pips which are all very competitive. These low spreads are why I recommend Pepperstone to high-volume traders for hedging or scalping strategies.

|

ECN Broker Spreads

|

|||||

|---|---|---|---|---|---|

|

0.10 | 0.10 | 0.90 | 0.20 | 1.10 |

|

0.10 | 0.20 | 0.60 | 0.30 | 1.00 |

|

0.09 | 0.13 | 1.70 | 0.14 | 1.40 |

|

0.30 | 0.40 | 0.50 | 0.50 | 0.50 |

|

0.20 | 0.50 | 0.70 | 0.50 | 0.60 |

|

0.16 | 0.29 | 1.50 | 0.54 | 0.68 |

|

0.20 | 0.40 | 0.60 | 0.50 | 0.70 |

|

0.10 | 0.60 | 0.14 | 0.70 | 0.10 |

|

0.10 | 0.50 | 0.70 | 0.60 | 0.40 |

|

0.21 | 0.90 | 0.85 | 0.73 | 1.17 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 07/01/2025

The table below shows the tests results conducted by Ross Collins to find the average spread for each currency pair. These results are then compared to the industry average which is compiled from the 39 brokers Ross tested with along with each of the currency pairs used in the tests.

| Raw Account Spreads | Pepperstone | Average Spread |

|---|---|---|

| Overall | 0.47 | 0.72 |

| EUR/USD | 0.1 | 0.28 |

| USD/JPY | 0.3 | 0.44 |

| GBP/USD | 0.3 | 0.54 |

| AUD/USD | 0.2 | 0.45 |

| USD/CAD | 0.4 | 0.61 |

| EUR/GBP | 0.2 | 0.55 |

| EUR/JPY | 0.7 | 0.74 |

| AUD/JPY | 0.5 | 0.93 |

| USD/SGD | 1.5 | 1.97 |

2. Raw Account Commission Rate

Pepperstone’s Razor Account charges a commission of $3.50 per side (per 100k traded) for AUD and USD accounts in addition to the spread. For GBP accounts, the fee is £2.25, and for EUR, it’s €2.60. In my experience these commissions are on par with the industry average.

| Commission Fee | USD | AUD | GBP | EUR |

|---|---|---|---|---|

| Pepperstone Commission Rate | $3.50 | $3.50 | £2.25 | €2.60 |

| Industry Average Rate | $3.44 | $3.32 | £2.44 | €2.91 |

Use the calculator below to compare Pepperstone’s trading costs with competitors such as Eightcap, Axi and CMC Markets, adjusting for trade size, currency pair, and base currency.

Calculate Your Trading Costs Below

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

Total Fees

Commission

Spread Costs

Total

3. Standard Account Fees

A standard account is also offered from Pepperstone, with no commissions but higher spreads (compared to the RAW account). Spreads with this account start from 1.0, so I believe the raw account presents better value (even with the commission costs added to the spread).

Despite my preference for the RAW account, tests done by my colleague Ross Collins did find that spreads with Pepperstone for the Standard account are below the industry average. Then, when combined with all of Pepperstone’s offerings, there is still good value to be found.

In my opinion, the Standard Account works best for beginner traders looking for a simpler, all-in-one pricing model without commissions.

| Standard Acount Spreads | EUR/USD | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY | AUD/JPY |

|---|---|---|---|---|---|---|---|---|

| Pepperstone Average Spread | 1.1 | 1.3 | 1.3 | 1.2 | 1.4 | 1.2 | 1.8 | 1.5 |

| Industry Average Spread | 1.2 | 1.4 | 1.6 | 1.5 | 1.8 | 1.5 | 1.9 | 2.1 |

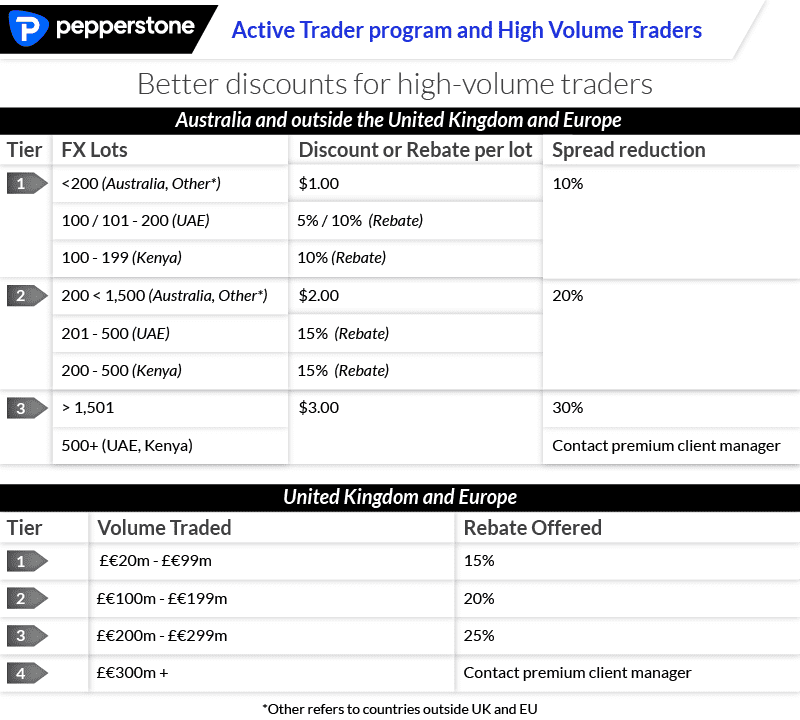

Discount for Active Traders

If you are a high-volume trader, you can get good discounts or rebates with Pepperstone’s active trader programme. The activate trader program does vary depending on if you are in the UK and Europe or outside these regions, and you will need to meet monthly trading requirements to be eligible.

4. Swap-Free Account Fees

A Swap-Free Account is available for traders of the Muslim faith who cannot pay or receive interest rates due to Islamic finance practices defined by Sharia law. Sometimes called an Islamic, it Account offers the same spreads as the standard account but an admin fee in place of swaps.

Swap-free trading is available with Forex and precious metals and incurs an admin charge of 100 USD per lot for every 5 rollover periods you hold your position.

This swap-free account is only available in countries with a majority Muslim population, such as Egypt, Malaysia, and the UAE.

5. Other Fees

When opening a trading account, many brokers charge ‘hidden’ fees on top of spreads but Pepperstone is not one of them. Here are the primary examples where Pepperstone doesn’t charge a fee:

- $0 Deposit Fee

- $0 Withdrawal Fee

- $0 Inactivity Fee

The main additional fee Pepperstone charges is overnight holding fees but all brokers charge this for long-term trades and their rates are comparatively similar.

My Verdict on Pepperstone Spreads

When combining the 2025 average spreads and commissions I found that Pepperstone provides some of the best pricing in the market . While the Standard account is useful, it is the Razor account that presents the best value. While each account will suit a particular style, this Razor vs Standard account looks at each account type to help you better understand which is for you.

In terms of overall trading costs, The CompareForexBrokers Team scored Pepperstone 8.5/10 for trading costs.

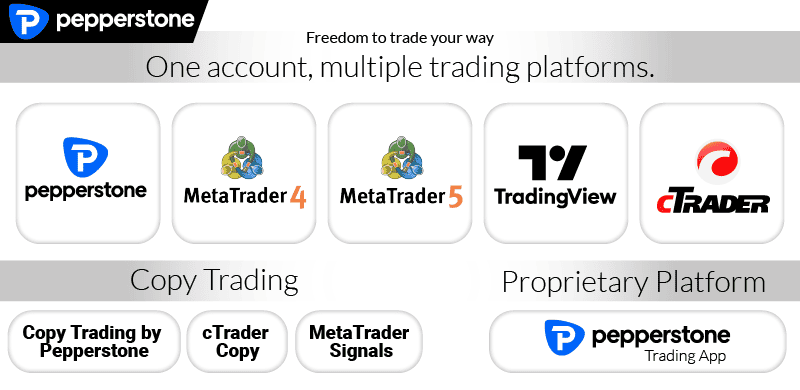

Trading Platforms

Pepperstone offers a suite of trading platform options including MetaTrader 4, MetaTrader 5, cTrader, TradingView and proprietary Pepperstone software.

| Trading Plaform | Available With Pepperstone |

|---|---|

| MetaTrader 4 | Yes |

| MetaTrader 5 | Yes |

| cTrader | Yes |

| TradingView | Yes |

| Proprietary Platform | Yes |

The CompareForexBrokers team created a trading platform selector so you can work out what trading software best matches your trading needs. I recommend you complete the short 5 step questionnaire which will help you determine your most suitable forex platform.

I like that Pepperstone has a variety of platforms to choose from as it means you can find the right platform to suit your trading style:

- MetaTrader 4 (MT4): The most popular forex trading platform globally, ideal for Forex trading and automated forex trading strategies.

- MetaTrader 5 (MT5): Offers the same automated trading features as MT4 but a wider range of tradable products including share CFDs. It also has a richer set of charts and technical analysis tools.

- cTrader: Forex platform with advanced automation and charting tools, suited to more experienced traders focusing on foreign exchange and scalping.

- TradingView: Combines advanced charting tools with a social trading community.

- Pepperstone Platform: Is best suited for beginners. The newly released Pepperstone app offers a user-friendly interface, making it an easy starting point if you are new to trading.

While the Pepperstone platform is currently only accessible through a webtrader platform and mobile apps, all other options are available. These options include as desktop software (Windows and Mac OS), trading apps (Android and iOS), and a webtrader platform online.

Additionally, free demo accounts are available to test platforms and strategies in a risk-free environment first. With MT4 and MT5, this demo account is good for 60 days but can be extended once you fund your account. cTrader and TradingView demo accounts do not have an expiry.

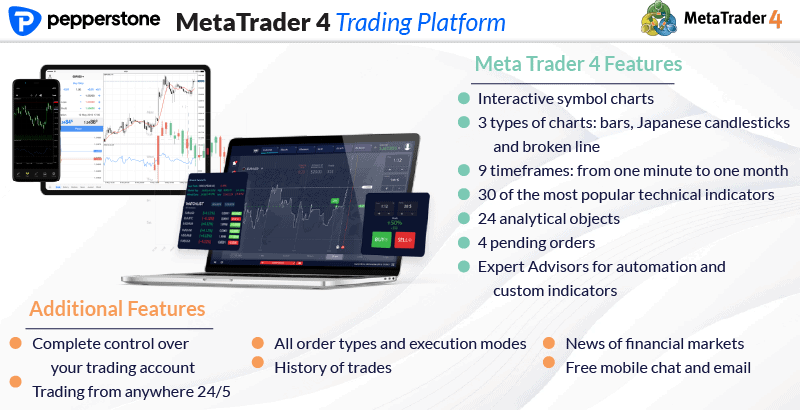

MetaTrader 4 (MT4)

I’ve perhaps used MT4 the most throughout my trading career because of its to-the-point interface and good balance of features. Developed by MetaQuotes, MT4 is one of the oldest mainstream platforms in the market, and is used by more retail traders than any other platform.

Why I use MT4:

- MT4 has a relatively intuitive interface, making it easy to navigate even for beginners.

- A massive community means readily available resources like custom indicators, Expert Advisors (EAs), and support forums.

- Great range of charting tools (31 analytical objects, 30 technical indicators and 9 timeframes)

- 4 pending order types (buy-stop, buy-limit, sell-limit, sell-stop) and three order execution types

- Ability to build your own Expert Advisors with MQL4 for automation and custom indicators

- Large EA marketplace to buy ready-made Expert AdvisorsIt is the most popular platform in the market with the largest range of free resources on the web.

Furthermore, if device flexibility is a priority for you, I can highly recommend MT4, as you can use it on Android, iOS, desktop (both Windows and Mac), and browser (via MT4 WebTrader). This is a great advantage if you are a trader and am busy because you can monitor positions, and manage them from anywhere.

Why you might not use it:

- Limited access to stock CFDs, focusing mainly on forex and indices.

- While still widely used, MT4 shows its age compared to newer platforms (like MT5) with more advanced features.

- MT4 is no longer being supported or developed by MetaQuotes, which is an indicator that MT5 might entirely supersede it in the future.

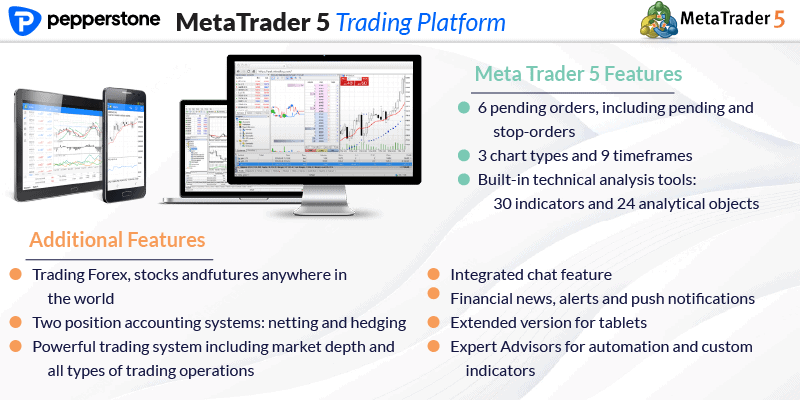

MetaTrader 5 (MT5)

MT5 is an upgrade on MT4, having far more capability in terms of the number of charts or analytical tools available, the range of products you can trade, and processing speeds.

Unlike MT4, which is designed for trading via decentralised exchanges (e.g. foreign exchange), MT5 is a multi-asset platform that offers more diverse market access. In Pepperstone’s case, it’s the addition of stock market CFDs since these are traded via a centralised exchange.

While the look and feel of MT5 vs MT4 do have some similarities, the change took some getting used to. Unlocking MT5’s full potential and features (over MT4) definitely takes some time.

But I’d say if you are an intermediate to advanced trader, it’s worth giving a try, as it’s essentially a more modern MT4 (with more features and capabilities).

Additional features included with MT5 (in addition to those found on MT4):

- Advanced charting tools including 44 analytical objects, 38 technical indicators and 21 timeframes (best for scalping)

- Has two extra pending order types not available with MT5 – buy-stop-limit and sell-stop-limit

- Access to real volume data unlike MT4 which limits tick volumes.

- Improved programming language with MQL5 which is said to be more manageable than MQL4 on MT4.

Furthermore, backtesting with 64-bit processing means MT5 has the power to transmit historical data related to a particular trading strategy, and MT4 which is 32-bit can only backtest with a particular pair.

If you’re unsure which MetaTrader platform best suits you then view our exclusive Pepperstone MT4 vs MT5 guide.

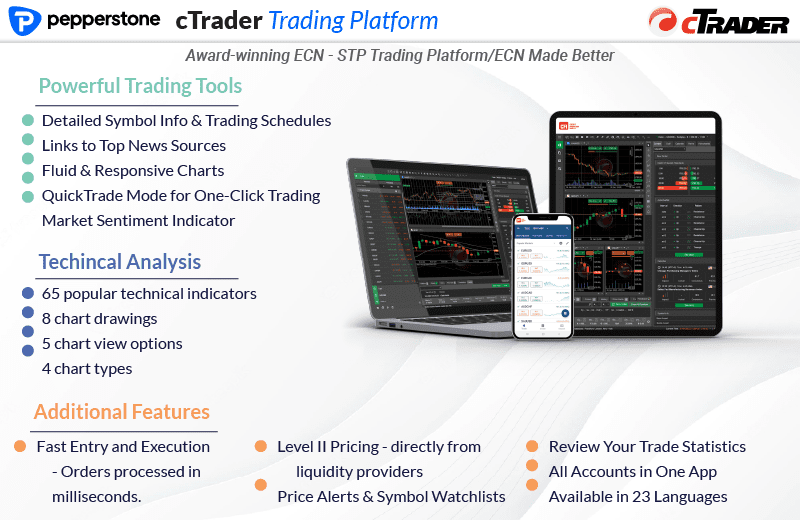

cTrader

From my observations, cTrader is more popular with experienced traders since it has extra charting tools that can be highly customised. Furthermore, it’s quite popular with scalpers since some believe that processing is faster. What I like about cTrader is its customisable interface and invaluable backtesting tools (which take some time to set up to give you accurate results).

Major benefits of the cTrader platform include:

- Direct access to interbank market depth to implement algorithmic-based FX trading systems called Depth of Markets (DoM).

- An interface that can be personalised with pre-set & detachable charts.

- Extensive backtesting facilities

- Faster processing ability

- Built for no dealing desk (i.e. ECN or STP) trading

- Integrates with cTrader Copy for copy trading and cAutomate for Automation

Based on my experience, cTrader is a unique platform because of its reliability and flexibility. Based on this, I’d say it’s worth trying out if you are an advanced trader. Compared to the other options, I would suggest if you are new to trading to try out more beginner-friendly platforms like MT4 instead.

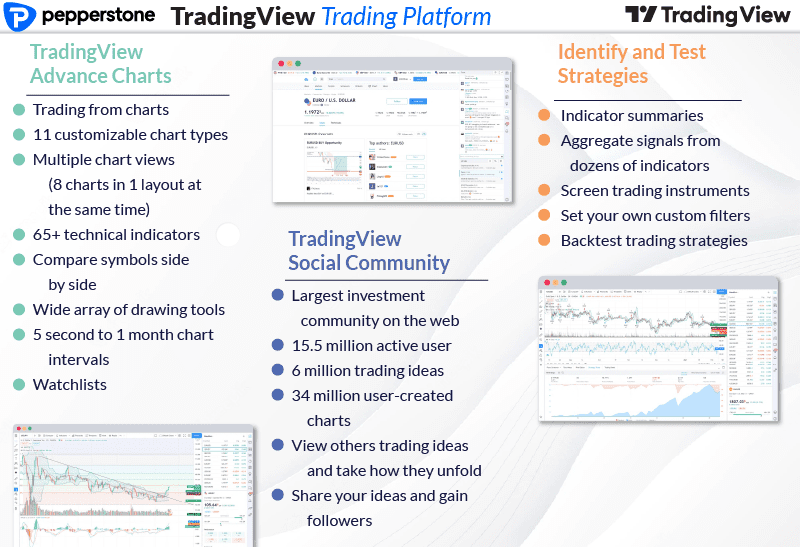

TradingView

TradingView is a chart powerhouse platform where you can analyse and trade directly via a large set of trading charts and other tools.

Boasting over 30 million users worldwide, this is one of the most used solutions for technical analysis and market screening, and you can’t go wrong using it; be you an advanced, intermediate, or a beginner trader.

Key Features of the TradingView App

- Access charts with advanced technical analysis tools

- Up to 8 charts per screen with different symbols, indicators, and time frames, with variations depending on your plan.

- Spread charts across as many as six monitors, with up to 8 charts per monitor.

- More than 90 drawing tools and hundreds of trading indicators for in-depth analysis.

- Extensive Chart intervals – from seconds to years; one can also customise chart intervals by numerical ranges.

Having used TradingView for years, I find this integration into Pepperstone simply perfect for use with pretty much any trading strategy. There is a wide selection of charting options and tools to help you with any trading setup. You can also test your strategies risk-free with a Pepperstone demo account.

One thing I’d caution about is for new traders to avoid over-relying on the different paid or free indicators, as these are a major marketing and selling point of TradingView.

Pepperstone Trading Platform

In my opinion, the trading platform of Pepperstone is a great option to trade CFDs on global markets: forex, commodities, indices, and cryptocurrencies. If you are a beginner or an experienced trader, this platform has an intuitive UI and features that make the trading experience smooth and easy to monitor for any opportunity.

Here’s what stands out with Peppersones proprietary platform:

- Ability to Quick Switch between charts means you can transition between charts to make changes in real-time, which is highly effective.

- Multi Charting Options and analysis features available on this platform go a long way in extracting the best insights on prevailing market trends.

- Technical Indicators & Risk Management for beginner traders.

- Custom Watchlists lets you follow other public ones to keep ahead in the market.

- Efficient Execution means this platform is very well placed to ensure smooth trading execution with razor-sharp spreads.

- Real-time updates on margins and performance.

In my opinion, Pepperstones’ proprietary trading platform ticks many boxes and is worth trying out if you like a balance of features. It also comes with a ready-to-use demo account to try out your strategy without touching real money.

iOS and Android for Mobile and Tablets

The mobile applications that this broker has for iOS and Android give it great mobile trading. The variety of platforms that this broker supports includes the following:

- MetaTrader 4

- MetaTrader 5

- cTrader

- TradingView

- Pepperstone Trading App

This way, you will have all the advanced tool sets in your pocket that you have on your desktop, with a smartphone or tablet. I also found them pretty user-friendly because they had intuitive interfaces to make managing accounts, analysing markets, and executing orders easy.

You can also download the Pepperstone CopyTrading mobile application, connect it to your account, and start copying selected signal providers. The mobile application was quite intuitive, and it took less than a minute to select the trader of my choice to copy.

Whether you monitor forex pairs such as USD/AUD or manage positions in other CFDs, these apps will keep you connected with the markets. As always, I suggest you trade mainly on your desktop or laptop and use mobile apps sparingly.

Verdict on Pepperstone Trading Platforms

The availability of MetaTrader 4, MetaTrader 5, cTrader and TradingView positions Pepperstone as a top contender. Their proprietary trading app also got high marks during my testing.

As a long-time user of all of these tools, I believe there is an offering of features for traders at every level. For the wide availability and good integration of trading platforms, I give Pepperstone a score of 10/10.

Social Trading

In 2025, Pepperstone introduced some quality-of-life updates and consolidated all its social trading offerings, replacing or upgrading older ones. This lets you as a trader use their social trading tools in an even more accessible way. Currently, the following social trading options are available on the platform:

Signal Start (Powered by Myfxbook)

Signal Start is a seamless way of connecting with expert strategies if you are a trader outside Australia, the EU, the UK and the UAE. A feature I appreciated with Signal Start was their 24/5 chat support and universal device accessibility.

Here are the core features of Signal Start for Pepperstone traders:

- Fast to use – just set up a MT4/5 Pepperstone Account, sign up for Signal Start and become a signal follower or provider.

- Automatically copy trades – no additional software needed.

- You can browse top-performing signal providers and access their metrics.

- Utilise performance and risk management tools on a single dashboard.

I think that it’s also great that your account stays connected continuously, so you don’t worry about missing a trade.

DupliTrade

Like Signal Start, DupliTrade is only available with Pepperstones’ offshore divisions and enables you to copy strategies from experienced traders. To access DupliTrade, you need to create a special Duplitrade account with a minimum deposit of $5,000.

Here is a brief overview of the features included:

- Pre-screened strategy providers for the best quality across the board.

- Automatically copy trades on your MT4 account.

- Easy to use interface to connect strategies to your Pepperstone account.

- Diversification and risk management-focused for better trading results.

A feature I really liked about DupliTrade was that Pepperstone let me practice using it on their demo account.

Copy Trading by Pepperstone

CopyTrading by Pepperstone is a dedicated app developed in partnership with Pelican Exchange Ltd., designed to help you sift through multiple signal providers and copy them directly through your MT4 or MT5 account.

Aimed at novice and intermediate traders, this functionality lets you do the following:

- Copy other successful traders in Pepperstone with ease from within the platform.

- Set custom risk parameters like position sizing and drawdown limits, and monitor performance via a user-friendly mobile dashboard.

- Filter signal is provided based on custom parameters, like markets traded, risk tolerance and overall performance.

All I had to do to use Pepperstones CopyTrading was to download the app after linking my account to it. The interface to filter traders was easy to figure out and copying traders took just a few clicks.

cTrader Copy

A formidable social trading utility, cTrader Copy is popular because of its unparalleled openness toward giving options and advanced settings. You can use your existing cTrader ID and simply go to the Copy section.

Here are the core cTrader Copy features:

- Full transparency over strategy provider trading history and performance.

- Ability to define your own copy parameters, including the option to allocate a fixed proportion of your funds.

- Easy integration within the cTrader platform for ease of management.

Something I found out while using cTrader Copy is that strategy providers see their own fees and sometimes set a minimum deposit to copy their trades.

MetaTrader Trading Signals

For traders using MetaTrader 4 or MetaTrader 5 (excludes UAE), you have access to MetaTrader’s large social trading community. While this is not supported by Pepperstone, all users of MT4 and MT5 can access this Signal by signing up via the MQL5 website.

Here is a quick overview of MetaTrader Trading Signals:

- Thousands of signal providers to choose from, rated by followers and past performance.

- Easy to use Integration with MT4/MT5, which allows you to subscribe to signals in just a few clicks.

- Adjustable risk and volume controls to fine-tune copied trades based on your preference.

A good thing about MT4/5 Trading Signals is that you can also try copy trading with a demo account to figure out how to set your risk parameters.

My Final Verdict on Pepperstone Social Trading

In 2025, Pepperstone has introduced and improved existing solutions for copy trading, emphasising ease of use and setup. These solutions ensure you can benefit as a novice or even an advanced trader with Pepperstone’s multiple offerings.

Trading Experience – Execution speed

Pepperstone offers excellent trading conditions including rapid execution with top-tier liquidity providers. By utilising tier-1 banks and institutions, Pepperstone doesn’t have any partial orders, therefore achieving an astonishing 99.92% fill rate on trades executed.

STP execution is the method of trade execution with no intervention by the dealing desk in order to ensure execution with no requotes.

| Overall Rank | Broker | Market Order Execution Speed (ms) | Limit Order Execution Speed (ms) |

|---|---|---|---|

| 1 | Blackbull Markets | 90 | 72 |

| 2 | Fusion Markets | 77 | 79 |

| 3 | Pepperstone | 100 | 77 |

| 4 | Octa | 91 | 81 |

| 5 | OANDA | 84 | 86 |

Of course, market execution can sometimes equate to slippage or gapping. Still, Pepperstone performed exceptionally well in our wide-ranging testing, finishing as the third-fastest broker in the world for overall execution speeds.

While using Pepperstone’s platforms, I found the trading experience to be smooth. Its MetaTrader 4 and 5, as well as cTrader, remain both intuitive and nimble. For these reasons, I give Pepperstone a perfect 10/10 for its Trading Experience.

Trust

Yes, Pepperstone is a safe broker with a trust score of 9.0 out of 10. Pepperstone uses segregated client funds to ensure added security and trust.

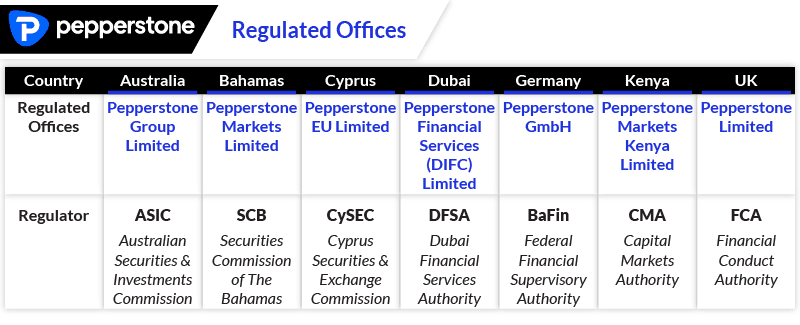

1. Regulation

Because Pepperstone is regulated by top-tier bodies such as ASIC (Australia), FCA (UK), and CySEC of Cyprus, Pepperstone has a deserved reputation as a transparency and broker you can trust. Customer reviews and my dealings with the team indicate that the broker is deeply concerned about client fund protection and keeping up with regulatory compliance.

| Pepperstone Safety | Regulators |

|---|---|

| Tier-1 | ASIC, FCA, BaFin, CySEC |

| Tier-2 | DFSA |

| Tier-3 | SCB, CMA |

For these reasons, I give Pepperstone a score of 9.0/10 for trustworthiness.

2. Reputation

Pepperstone was established in Melbourne, Australia in 2010, and therefore has over a decade of experience in the forex industry. More than 110,000 people search for Pepperstone monthly online, with no major regulatory issues on record since the broker was founded.

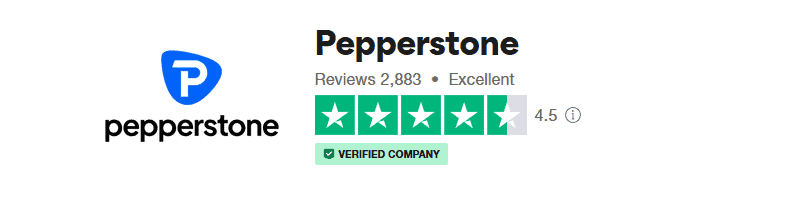

3. Reviews

Pepperstone has a TrustPilot score of 4.5 out of 5, with 2,883 reviews, demonstrating a strong level of client satisfaction and trust. With over 2,800 reviews as of 2025, this is a decent sample size, which shows that the broker is considered legitimate and trustworthy among other traders.

On TradingView’s review section, the broker has a slightly higher score of 4.6/5 from 24,700 reviews.

Final Verdict on Pepperstone’s Trustworthiness

Pepperstone’s high trust score of 81, combined with oversight from multiple tier-1 regulators, solidifies its position as a trustworthy and reliable online broker.

How Popular Is Pepperstone?

With an average daily trading volume of USD 9.2 billion, Pepperstone ranks among the world’s largest forex brokers. It also serves a broad client base, with over 400,000 traders globally relying on its services.

In terms of online visibility, Pepperstone sees approximately 110,000 Google searches per month. This places it as the 20th most searched forex broker in 2024 out of the 65 brokers we analysed.

The table below highlights Pepperstone’s regional search interest in 2024. Unsurprisingly, its strongest presence is in Australia (where it is headquartered in Melbourne) but also has notable search volumes in Brazil, the United Kingdom and Thailand, reflecting its significant international reach across the globe.

| Country | 2024 Monthly Searches |

|---|---|

| Australia | 8,100 |

| Brazil | 6,600 |

| United Kingdom | 5,400 |

| Thailand | 4,400 |

| Kenya | 4,400 |

| United States | 4,400 |

| Malaysia | 4,400 |

| Colombia | 3,600 |

| Germany | 3,600 |

| Mexico | 3,600 |

| Hong Kong | 3,600 |

| South Africa | 2,900 |

| India | 2,900 |

| Italy | 1,900 |

| Mongolia | 1,900 |

| Spain | 1,900 |

| Indonesia | 1,600 |

| Singapore | 1,600 |

| Peru | 1,600 |

| Turkey | 1,600 |

| Nigeria | 1,300 |

| Bolivia | 1,300 |

| Pakistan | 1,300 |

| Argentina | 1,300 |

| United Arab Emirates | 1,000 |

| Chile | 1,000 |

| Taiwan | 1,000 |

| France | 1,000 |

| Ecuador | 1,000 |

| Netherlands | 880 |

| Philippines | 880 |

| Dominican Republic | 880 |

| Morocco | 720 |

| Canada | 720 |

| Vietnam | 720 |

| Poland | 720 |

| Tanzania | 720 |

| Costa Rica | 480 |

| Japan | 480 |

| Portugal | 480 |

| Cyprus | 480 |

| Ethiopia | 390 |

| Botswana | 390 |

| Sweden | 390 |

| Uganda | 390 |

| Algeria | 390 |

| Venezuela | 390 |

| Egypt | 390 |

| Bangladesh | 390 |

| Switzerland | 320 |

| Panama | 320 |

| Austria | 320 |

| Sri Lanka | 320 |

| Cambodia | 320 |

| Saudi Arabia | 260 |

| Ireland | 260 |

| Jordan | 260 |

| Ghana | 260 |

| Greece | 210 |

| New Zealand | 170 |

| Uzbekistan | 140 |

| Mauritius | 110 |

2024 Average Monthly Branded Searches By Country

Australia

Australia

|

8,100

1st

|

Brazil

Brazil

|

6,600

2nd

|

United Kingdom

United Kingdom

|

5,400

3rd

|

Thailand

Thailand

|

4,400

4th

|

Kenya

Kenya

|

4,400

5th

|

United States

United States

|

4,400

6th

|

Malaysia

Malaysia

|

4,400

7th

|

Colombia

Colombia

|

3,600

8th

|

Germany

Germany

|

3,600

9th

|

Mexico

Mexico

|

3,600

10th

|

Deposit and Withdrawal

Pepperstone provides a selection of fee-free funding methods and is accessible with no initial deposit required.

What is the minimum deposit at Pepperstone?

There is no minimum deposit to open a Pepperstone account, but the broker recommends depositing at least 200 USD/AUD or 500 GBP/EUR. Regardless, you must ensure that your account has sufficient funds to meet the margin requirements for opening a trading position.

Account Base Currencies

Base currencies available include USD, AUD, NZD, CAD, HKD, SGD, GBP, EUR, JPY and CHF. The base currency matters because this is the currency in which your commission is calculated.

Deposit Options And Fees

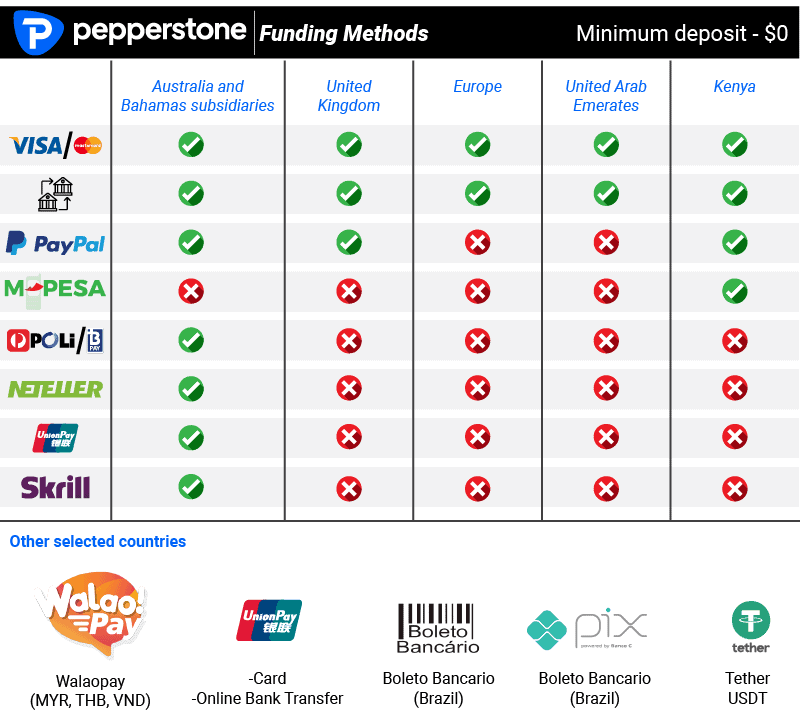

Pepperstone charges no deposit fees. Payment methods include the following, yet availability varies between regions as shown below.

For instance, PayPal is available with Pepperstone’s Australian and UK branches, but not in the Middle East.

Visa and Mastercard debit and credit cards, as well as bank transfers, are available with all Pepperstone subsidiaries.

One thing I do notice is that Pepperstone doesn’t have crypto wallet options.

| Payment Method by Location | Australia (ASIC Regulated) | UK (FCA Regulated) | Europe (CySEC & BaFin Regulated) | Kenya (CMA Regulated) | Dubai (DFSA Regulated) |

|---|---|---|---|---|---|

| Visa Debit/Credit Card | ✓ | ✓ | ✓ | ✓ | ✓ |

| Mastercard Debit/Credit Card | ✓ | ✓ | ✓ | ✓ | ✓ |

| Bank Transfer | ✓ | ✓ | ✓ | ✓ | ✓ |

| Online Bill Payment | ☓ | ☓ | ☓ | ☓ | ☓ |

| Union Pay | ✓ | ☓ | ☓ | ☓ | ☓ |

| PayNow | ☓ | ☓ | ☓ | ☓ | ☓ |

| PayPal | ✓ | ✓ | ✓ | ✓ | ☓ |

| Neteller | ✓ | ☓ | ☓ | ☓ | ☓ |

| Skrill | ✓ | ☓ | ☓ | ☓ | ☓ |

| Rapid Pay | ☓ | ☓ | ☓ | ☓ | ☓ |

| POLi / BPay | ✓ | ☓ | ☓ | ☓ | ☓ |

| Klarna | ☓ | ☓ | ☓ | ☓ | ☓ |

| MPESA | ☓ | ☓ | ☓ | ✓ | ☓ |

| Cryptocurrency / Digital Wallet | ☓ | ☓ | ☓ | ☓ | ☓ |

Withdrawal Options And Fees

Pepperstone charges no withdrawal fees. Payment methods differ between jurisdictions and Pepperstone branches. Other than PayPal, no e-wallet methods are available in the UK, Europe, Africa, or the UAE.

Clients in the UAE cannot use credit cards (only debit) unless they use a ‘professional trader’ account.

Ease To Open An Account

I and my colleagues awarded Pepperstone a score of 15 out of 15 for the account opening process. The entire experience, from beginning to end, was seamless.

During the sign-up process on Pepperstone.com, you are efficiently guided through which documents are required and informed about the various features the broker provides.

Verdict On Pepperstone Funding

Regarding deposit and withdrawal, it went relatively smoothly and was hassle-free, based on my experience. Funding options available with Pepperstone include credit cards, PayPal, and bank transfers.

The processing time was fast with no hidden fees applied for deposits. I would thereby give them a score of 9.0/10 regarding funding ease.

Product Range

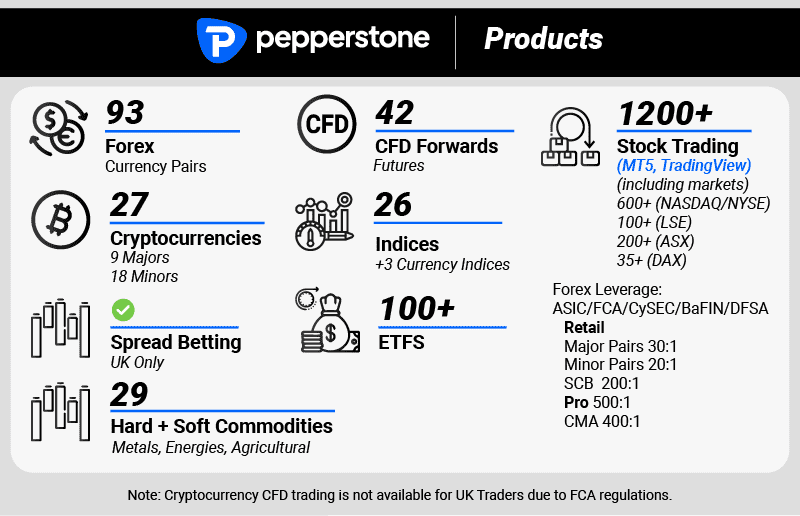

Pepperstone offers CFD trading on 1,200+ financial markets including forex pairs, indices, commodities, stocks, ETFs, and cryptocurrency.

CFDs

When trading CFDs (Contract for Difference) you speculate on the movements of financial markets without owning the underlying asset outright.

FX Trading

There are 93 currency pairs available consisting of 7 major, 9 minor, 17 exotics and 30 cross pairs. Major pairs consist of United States Dollar (USD) pegged currencies.

Indices

Pepperstone offers index CFDs that cover six indices in North America, seven across Australia, Asia and Africa and 10 across Europe and the UK. All indices are spread only products meaning there are no commission costs.

Commodities

All commodity products are spread only, meaning you as a trader pay no commission costs.

- Metals:Pepperstone offers the four precious metal CFDs: gold, silver, platinum, palladium plus high-grade copper.

- Energy: Energy CFDs include Spot Crude, Brent, natural gas, and gasoline.

- Soft Commodities: Pepperstone offers 16 soft commodities. These include cocoa, coffee, corn, hogs, oats, soybeans, soybean oil and soybean meal.

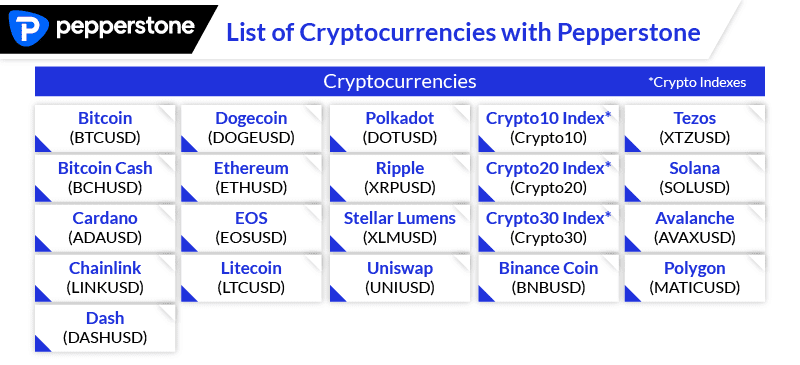

Cryptocurrencies

There are 27 cryptocurrency CFD options available and they have no commission costs in addition to the spread. As well as popular cryptocurrencies like Bitcoin, Bitcoin Cash, Ethereum, Dash and Litecoin, Pepperstone offers three crypto baskets:

- Crypto10

- Crypto20

- Crypto30

Disclaimer: cryptocurrency trading is not permitted in the UK.

ETFs

Pepperstone offers over 100 ETFs (Exchange Traded Funds) across over 35 countries. ETFs are a type of investment fund that focuses on a particular sector such as mining, energy, technology, bond markets and retail.

Share Trading

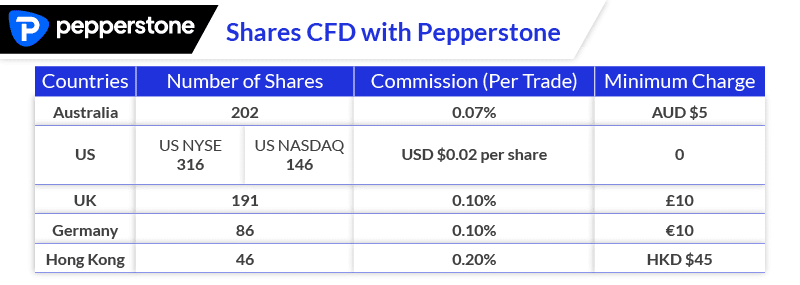

Share CFDs are available on the Australian (ASX), US (NASDAQ and NYSE), UK (LSD), German (XETRA.DE) and Hong Kong (HKEX) stock exchanges. All markets charge a commission per trade, except for US shares where the fee is $0.02 cents per share purchased.

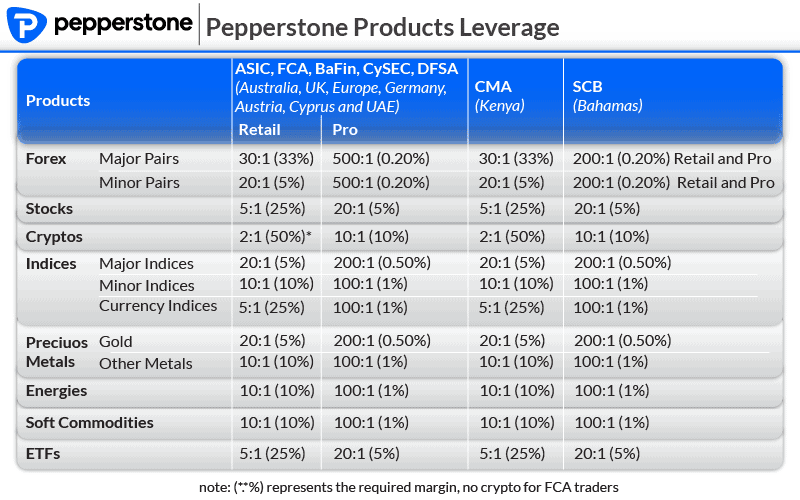

Leverage

The maximum leverage if you are a trader based in Australia, the UK, Germany, Austria, Cyprus, Kenya and the UAE (ASIC, FCA, BaFin, CySEC, DFSA regions) your maximum leverage as a retail trader is 1:30 for Major pairs, and 1:20 for Minor pairs. This goes up to 1:500 if you use the Pro Account.

Furthermore, you can use 1:5 for Stocks and 1:2 for cryptos, with up to 1:20 for Major indices, 1:10 for minor and 1:5 for currency indices. Gold is 1:20 and other metals 1:10. Energies and soft commodities leverage is up to 1:10, and ETFs are 5:1.

For traders based offshore operating under the SCB jurisdiction, the maximum leverage for retail is 1:200 for Major and Minor forex pairs, for Major indices and Gold. Minor and Currency Indices, Energies, Soft commodities and precious metals have up to 1:100 leverage.

Spread Betting

Pepperstone offers spread betting if you are UK-based, presenting a tax-efficient alternative to traditional CFD trading. This form of derivative trading allows you to bet on market movements without owning the underlying asset, yet profits are not subject to Capital Gains Tax (CGT) like with CFD profits.

You can read more about Pepperstone’s Spread Betting Offering here.

Verdict On Pepperstone Trading Products

As of 2025, Pepperstone’s range of markets includes over 1,200 instruments spanning forex, indices, commodities, cryptocurrencies, and stocks. A key update here is the addition of more stock CFDs and crypto pairs.

Due to the large variety of instruments, I rated their market offering at 9.5/10.

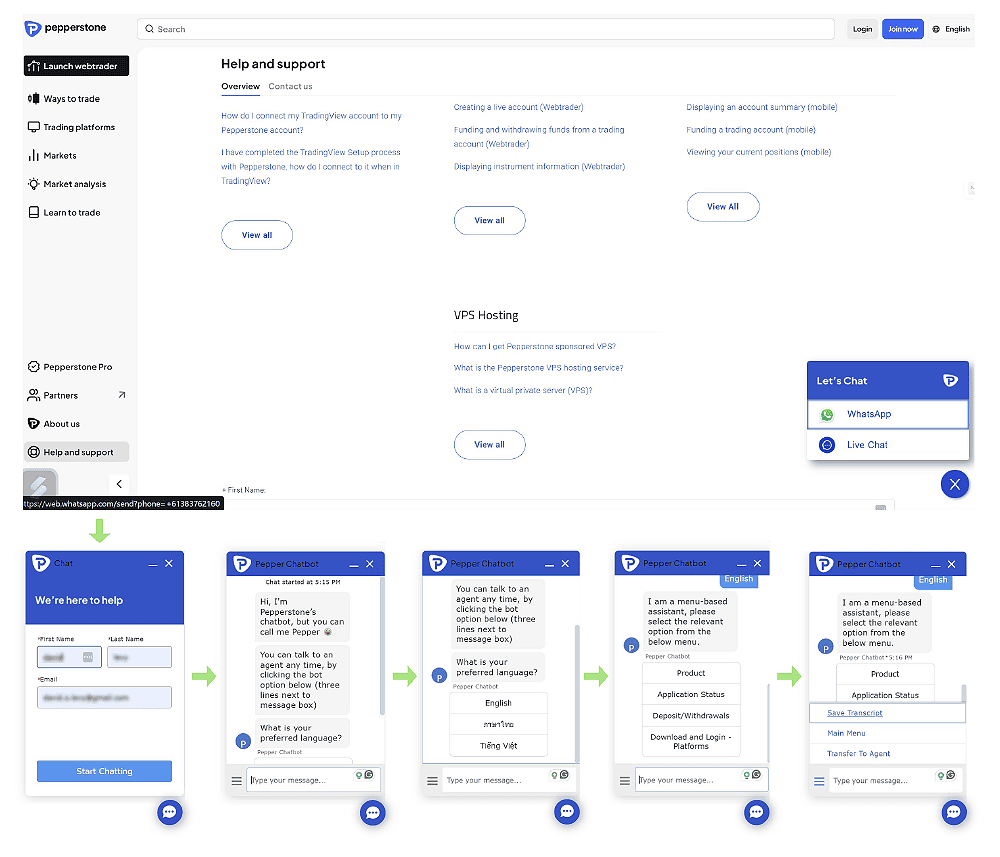

Customer Service

Pepperstone provides award-winning customer support, winning the Investment Trends “Overall Client Satisfaction Award” in 2022.

Key elements of Pepperstone’s excellent customer support include:

Personalised Customer Service

With years of experience in forex trading, I know how important responsive customer support is, so I wanted to try Pepperstone’s customer support for myself. Using their live chat feature, a human agent was available within seconds; no long wait or frustrating chatbots.

The representative answered my question about account funding and withdrawal options in a knowledgeable manner and informed me about the finer details, such as the time for transaction completion.

I took it a step further and dialled their support through the phone channel via Skype for Business. A minute later, I was transferred to a live agent who took up my case. I asked him more tricky questions, trying to challenge him to a test response, to which he answered in a concise manner.

Even more impressive, the support agent mentioned assigning me a dedicated account manager who could help strategise based on my trading goals. I think that this personal touch makes Pepperstone’s customer support stand out. If you’re like me—prioritising real, expert support—you’ll appreciate what they offer here.

24-Hour Support, 7 Days a Week

Pepperstone support is always available when the forex markets are open thanks to five offices in Melbourne, Shanghai, Dallas, Bangkok and London. This also provides local options for those forex traders located outside Australia.

Customer Support Channels

Customer support is available 24 hours a day via various methods, including phone, email, and live chat on the Pepperstone website.

Verdict on Pepperston Customer Support

Customer support has always been one of the high points of Pepperstone, and from personal experience, responses are prompt, and the staff is knowledgeable. The support team responds promptly and helps with solutions whether you contact them via live chat, email, or phone.

For customer service, I would give Pepperstone a 10/10.

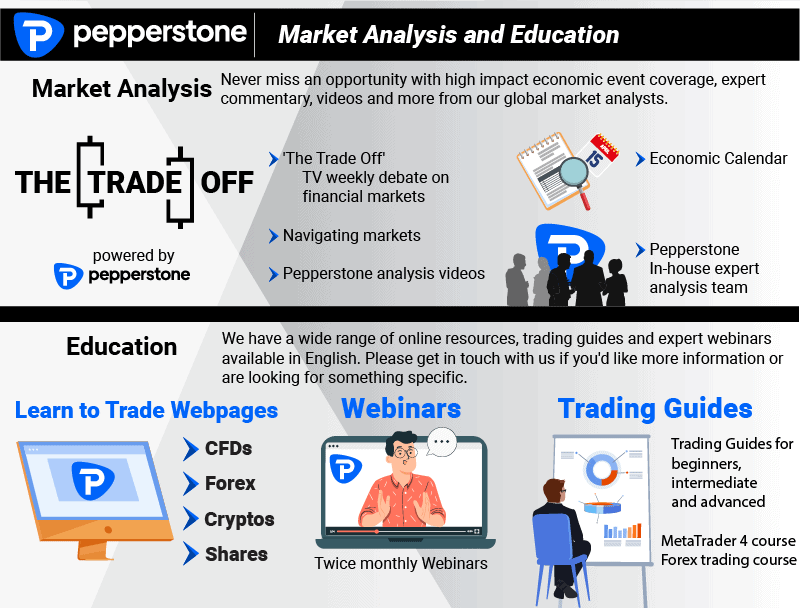

Research and Education

Pepperstone’s educational materials cover a wide range of topics, suitable for traders at every level. The training tools at Pepperstone range from beginner-friendly topics to those that even advanced traders can enjoy.

The more inexperienced trader will enjoy simple, understandable guides to acquaint them with forex trading and technical analysis. In contrast, advanced traders will benefit from detailed webinars exploring sophisticated strategies in depth and detailed market analysis.

- Market Analysis by Pepperstone – Regarding market analysis, Pepperstone provides several tools and resources that can help traders make better decisions with the help of fundamental analysis:

- The Trade Off’: A weekly debate into the latest trends and developments in the financial markets with diverse perspectives.

- ‘Navigating Markets’: In-depth analysis of significant market movements and events; crucial to understand market dynamics.

- ‘The Daily Fix’: Daily updates, insights into market changes, and what traders need to know to stay ahead.

All Trading Guides form a well-rounded series of articles and guides covering everything from fundamental analysis to trading psychology, all put together with the aim of enhancing your knowledge of the markets.

My Verdict on Pepperstone Education

Adding much value are the webinars, tutorials, and market analysis from Pepperstone’s education team. Their beginner guides, recently revised and enhanced, explained all these intricacies to me very succinctly.

Because of this, coupled with further inclusion in their new course offerings, I give Peppersome an Education score of 9.0/10.

Final Verdict On Pepperstone

In my final verdict, Pepperstone earns a high rating of 98/100, thanks to its low spreads, fast execution speeds, and robust tier 1 regulation.

The broker provides a range of CFDs, predominantly in equity, and caters to traders of every level with the following platforms: MetaTrader 4, MetaTrader 5, and cTrader, all featuring advanced tools for complete market analysis.

Moreover, the wide range of online education available on Pepperstone will be very helpful if you want to enrich your knowledge and skills in trading markets.

FAQs

Does Pepperstone Offer Spread Betting?

Yes, Pepperstone offers spread betting exclusively for traders in the United Kingdom. This form of derivatives trading allows UK clients to speculate on the price movements of financial instruments without directly owning them. On our sister site spread-bet.co.uk, the broker was named the best spread betting platform in the UK.

Spread betting with Pepperstone is a tax-efficient alternative to traditional CFD trading, as profits from spread betting are not subject to UK Capital Gains Tax (CGT).

What is the Minimum Deposit at Pepperstone?

No minimum deposit required to open a trading account with Pepperstone. However, the company recommends that clients deposit at least 200 US dollars or another currency equivalent as the initial deposit.

This is a recommendation to ensure that traders have enough money to comfortably trade, though clients are at liberty to start with an amount lower than that if they wish.

What Demo Account Does Pepperstone Offer?

The Pepperstone demo accounts remain active for 60 days with $50,000 in virtual cash; access to such accounts can be had through the MT4, MT5, cTrader and TradingView on Standard or Razor Account pricing.

Pepperstone provides as many as 10 demo accounts for traders with live funded accounts, which can be extended beyond the conventional 60 days.

You also get up to 5 demo accounts with them: two for MT4, one standard and one razor, one each for MT5, cTrader, and TradingView, without having a live account.

What Leverage Does Pepperstone Offer?

As a retail client trading at Pepperstone, you enjoy up to 30:1 leverage in majors and 20:1 in minors; if trading under jurisdictions such as SCB from the Bahamas, the leverage level rises to 200:1.

Professional traders in their own right enjoy higher leverage whereby these traders can execute trades with an upward of 500:1 leverage, no matter the governing regulator.

What Account Types Does Pepperstone Offer?

The various account types that Pepperstone offers to suit the needs of traders include the following: Razor Account: Best for advanced and professional traders, it offers tight spreads starting from 0.0 pips with a commission fee. It is the best for strategies such as scalping and high-volume trading.

- Standard Account: It has no commission and higher spreads, thus being simple for forex beginners.

- Swap-Free Account: It is targeted at traders who, for some religious reasons, cannot involve in swaps or interest. It offers the same conditions as a standard account but doesn’t include swap fees.

- Professional Account: It targets professional traders with higher options for leverage, up to 500:1, among other advanced trading features. In this regard, it would perfectly suit those accomplished traders with deeper knowledge of forex markets and a greater capacity for risk.

- Active Trader Program: This is not essentially an account type but a program targeting high-volume traders. It comes hand in-hand with benefits such as reduced commission rates among other customised trading solutions.

Each of these accounts is designed to cater to all levels of trading experience, from beginners to professional traders.

You can learn more about the difference between Pepperstone Razor vs Standard Accounts here.

About the Review

For the Pepperstone review, our team adhered to our strict methodology for evaluating forex fees. This entailed a detailed examination of Pepperstone’s published fee data and conducting live trading tests to assess the actual costs. By comparing these fees monthly and validating them through hands-on trading experiences using tools like the MT4 Spread Monitor, the review offers a thorough and factual analysis of Pepperstone’s fee structure, ensuring that traders have the most accurate and relevant information.

For more information, click here for our full Forex Fees methodology. There are also versus pages below including recently created HF Markets and TD Ameritrade.

Pepperstone Alternatives

Justin Grossbard

Having traded since 1998, Justin is the CEO and Co-Founded CompareForexBrokers in 2004. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a Masters and Commerce degree and has an active role in the fintech community. He has also published a book in 2023 on on investing and trading.

Pepperstone is the #1 Forex Broker Overall

Visit Verdict

Verdict

Fees

Fees

Trading Platforms

Trading Platforms

Safety

Safety

Funding

Funding

Product Range

Product Range

Support

Support

Market Research

Market Research

Ask an Expert

Is Pepperstone the best broker for MetaTrader?

Pepperstone is one of many brokers that offer MetaTrader 4 and one of the few that offers MetaTrader 5.

Pepperstone is a great choice for MetaTrader since they allow expert advisors (EAs) and allow you to integrate 3rd party apps such as MyFxBook for copy trading with the platform

As a bonus Pepperstone also include Smart Trader tools for 28 additional apps to give you even more trading features and their own exclusive Figaro Advanced Traders tools for yet more trading features.

I’m looking to open a Pepperstone account but I’m not sure if the standard or Razor account is better. I’m based in the UK. What account is more popular in my region?

We checked this with Pepperstone, in the UK the standard account is more popular, while in Australia the Razor account is more popular. Which account is better, depends on your needs, many traders don’t want to deal with the added complexity commissions add when trading so prefer the standard account but if you want to he tightest speads, then the Razor account is the way to go

Can I use Pepperstone’s Islamic account if I am based in the UK?

Pepperstone doesn’t make their swap-free account available as part of their 2022 Pepperstone Limited subsidiary which operates in the UK. So officially a swap-free account is not available for traders in the UK. You can always try reaching out and requesting directly with Pepperstone support team and see what happens

I am from India which broker should I choose

I would suggest you choose a broker from out best for beginner page. Check the navigation for the location.

That is up to you but we don’t cover Forex brokers in India so cannot really advise

What is the minimum leverage for pepperstone?

There is no minimum leverage requirement, on minimum margin requirement. The maximum leverage for Forex in Australia, UAE, The UK and Europe is 1:30 and 1:400 in Africa and 1:200 in other regions.

Is Pepperstone a good broker for beginners?

Pepperstone can be a good option for beginners as they have $0 minimum deposit, free demo accounts with all trading platforms and an award winning customer service team to help you get started. The broker also has good education tools to help your learn to trade. While their Razor account is suitable for all traders, their standard account is popular with beginners since the commission is built into the spread.

Can I use Islamic account?

Yes but only if you are trading with Pepperstone in the UAE or are based in a Islamic majority country such as Malaysia, Indonesia, much of the middle east and parts of Africa.