Saxo Markets vs Pepperstone 2026

We will review two of the best brokers in the industry of forex trading. These brokers offers great features and platforms, but only one will stand out through our team of experts’ extensive tests and research. Find out who will shine bright in this review. Read on.

Written by Noam Korbl

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

Regulations and Licenses

Brokerage

Markets and Instruments

Minor Pairs 10:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 20:1

Minor Pairs 16:1

*Cryptocurrency CFDs are not available to retail traders in the UK due to FCA regulations

*CFD trading is not available in the USA due to NFA and CFTC regulations, American traders spot trade in place of CFDs.

Trading Platforms + Tools

Overall

Our comprehensive comparison dives deep into the 10 most pivotal trading factors to discern the distinctions between Saxo Markets and Pepperstone.

- Saxo Markets offers a broader range of financial instruments.

- Saxo Markets demands a higher minimum deposit.

- Saxo Markets excels in providing a more diverse and comprehensive educational platform.

- Pepperstone provides a more user-friendly and intuitive platform, especially for beginners.

- Pepperstone offers a slightly more competitive pricing structure.

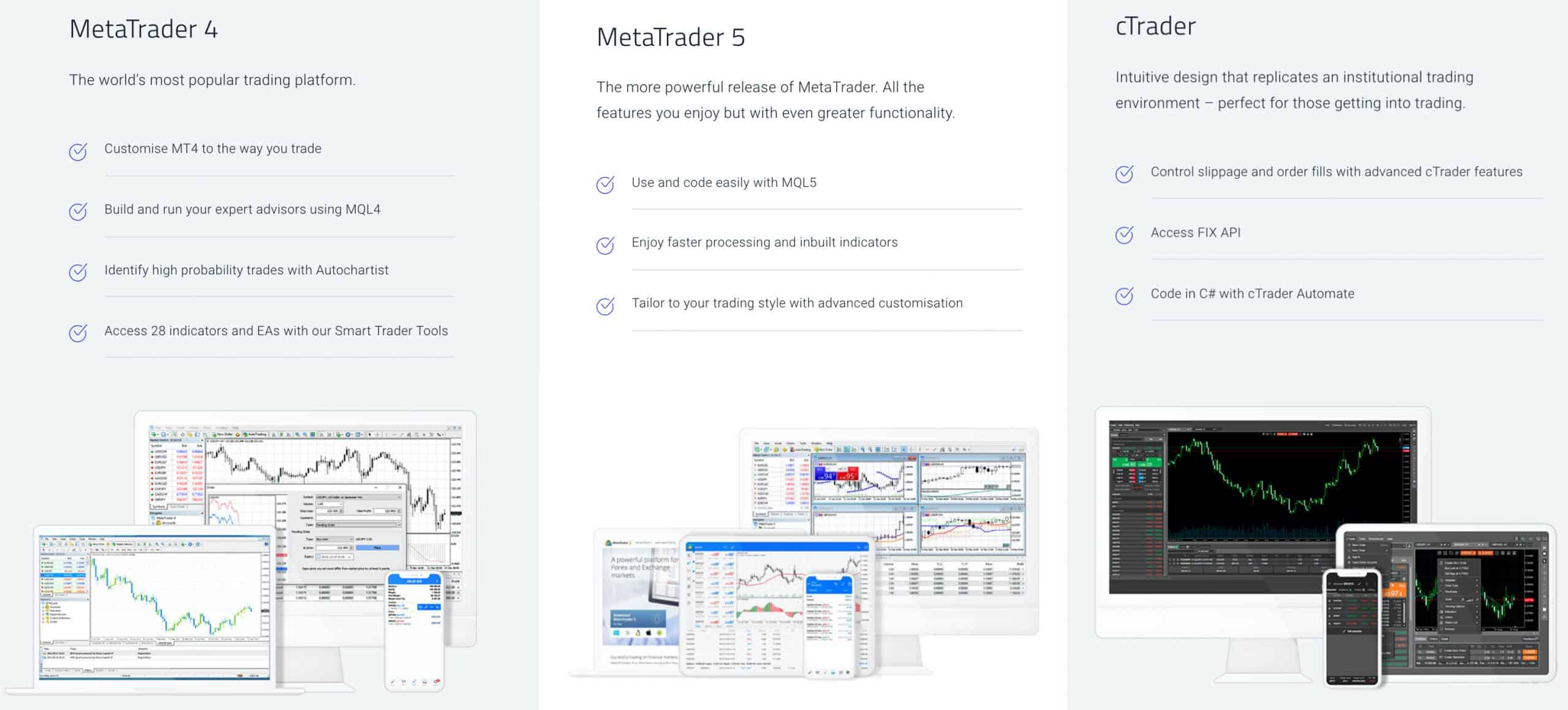

- Pepperstone provides MetaTrader 4, 5, and cTrader platforms.

1. Lowest Spreads And Other Fees – Pepperstone

When deciding between Saxo Markets and Pepperstone, it is essential to recognize their cost structures to enhance your trading strategy. Both brokers present competitive pricing; however, their methodologies vary significantly regarding account types, spreads, commissions, and additional fees. Here’s a comprehensive analysis of their cost structures.

Spreads

In a comparison between Pepperstone and Saxo Markets, both brokers provide competitive EUR/USD spreads at 1.10, closely mirroring the industry average of 1.2. However, Pepperstone slightly outperforms Saxo Markets in AUD/USD spreads, offering 1.1 compared to Saxo’s 1.2, though both are well within the industry standard of 1.5 pips. A significant difference lies in their minimum deposit requirements: Pepperstone allows traders to begin with just $0, while Saxo Markets mandates a minimum deposit of $2,000. This offers greater financial security but creates a higher barrier to entry.

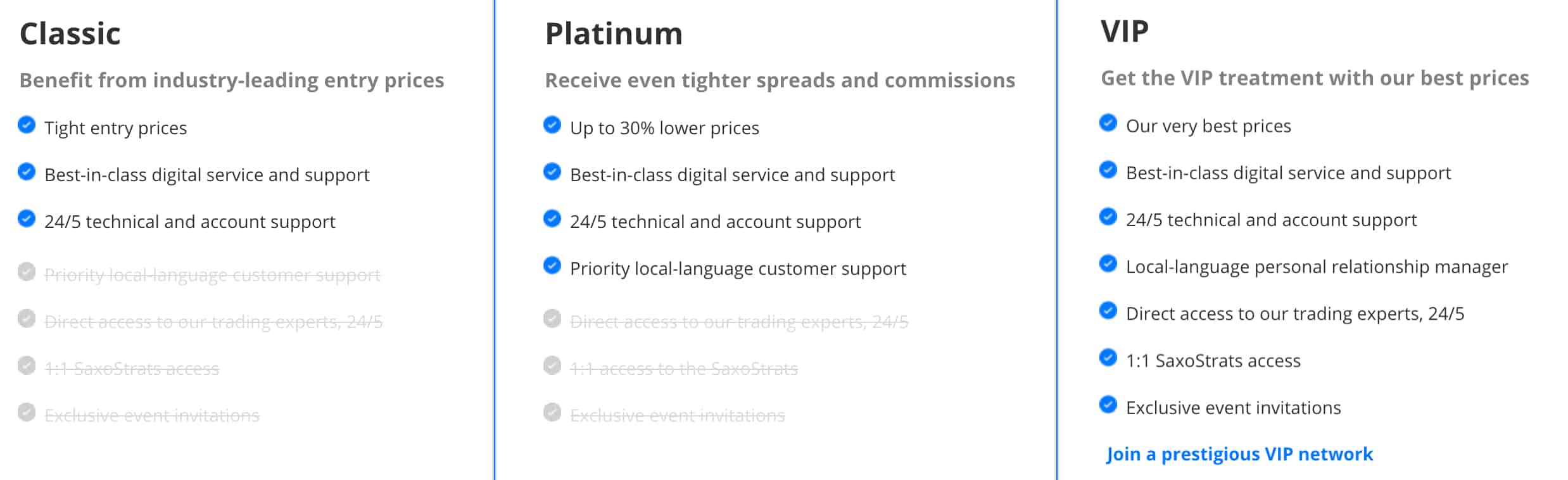

Pepperstone shines in raw spreads, especially within its Razor Account, where major forex pairs such as EUR/USD start at an impressive 0.0 pips. This makes it an ideal choice for active and high-frequency traders aiming to minimize execution costs. On the other hand, Saxo Markets features variable spreads across its account tiers—Classic, Platinum, and VIP—providing tighter spread options for those willing to invest more. Both brokers distinguish themselves by eliminating inactivity and funding fees, ensuring a cost-effective trading experience for all investors.

offers.

| Standard Account | Saxo Markets Spreads | Pepperstone Spreads | Industry Spreads |

|---|---|---|---|

| Overall Average | 1.7 | 1.35 | 1.7 |

| EUR/USD | 1.10 | 1.10 | 1.2 |

| USD/JPY | 2.2 | 1.2 | 1.5 |

| GBP/USD | 1.8 | 1.2 | 1.6 |

| AUD/USD | 1.10 | 1.10 | 1.6 |

| USD/CAD | 1.9 | 1.4 | 1.9 |

| EUR/GBP | 1.6 | 1.2 | 1.5 |

| EUR/JPY | 2 | 2.1 | 2.1 |

| AUD/JPY | 1.90 | 1.90 | 2.3 |

Commission Levels

Pepperstone offers an attractive low commission of $3.50 per lot per side on its Razor Account for traders using MetaTrader 4 and 5, while those utilizing cTrader benefit from an even more favorable commission structure. In contrast, Saxo Markets adopts a tiered commission model that decreases as trading volume increases, which is particularly appealing to institutional and high-net-worth traders. However, novice traders might perceive Saxo’s commission structure as somewhat pricier compared to Pepperstone’s clear and economical pricing model.

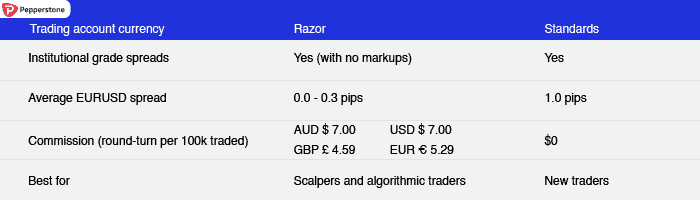

Pepperstone is a leading No Dealing Desk (NDD) broker that allows clients to trade with fixed spreads (Standard Account) or variable spreads (Razor Account) in an STP/ECN-like trading environment. You can view the Pepperstone Razor vs Standard accounts table if you want to understand the difference between the two account types.

Our dedicated and highly skilled team has put in significant effort to create the exclusive fee calculator featured below.

Standard Account Fees

Traders choosing a Standard Account with Pepperstone benefit from a commission-free model, featuring slightly higher spreads—an excellent option for casual traders seeking straightforwardness. In contrast, Saxo Markets presents a commission-free standard trading account as well; however, its significantly higher minimum deposit requirement may deter smaller retail traders. Moreover, Saxo applies inactivity fees for dormant accounts, a charge that Pepperstone does not impose.

In summary, Pepperstone stands out as the more budget-friendly option for traders focused on low spreads and transparent commissions. In contrast, Saxo Markets serves high-volume traders seeking to benefit from reduced costs available through their premium account tiers.

On the other hand, Saxo Markets is a Market Maker and, therefore, only offers fixed spreads, and these spreads can vary from current market prices. Saxo Markets and Pepperstone’s fixed spreads are wider yet inclusive of commission, while Pepperstone’s variable spreads are tighter and incur a flat rate commission fee.

Standard Account Spreads | |||||

|---|---|---|---|---|---|

| 1.10 | 1.10 | 1.30 | 1.30 | 1.30 |

| 1.10 | 1.10 | 1.60 | 1.80 | 2.20 |

| 1.13 | 1.01 | 1.71 | 1.66 | 1.12 |

| 1.20 | 1.30 | 1.30 | 1.50 | 1.10 |

| 1.18 | 1.45 | 1.40 | 1.49 | 1.60 |

| 1.40 | 1.60 | 1.40 | 1.60 | 1.80 |

| 1.40 | 1.90 | 1.30 | 1.60 | 1.50 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-01

Saxo Markets and Pepperstone present compelling pricing structures, yet their methods of execution are distinctly different. Saxo Markets operates as a Market Maker, offering fixed spreads that encompass commission fees, whereas Pepperstone provides tighter variable spreads along with a flat-rate commission. For traders seeking ECN-style spreads, the ultra-low commissions and pricing model offered by Pepperstone, especially on platforms like MT4, MT5, and cTrader, are likely to be more attractive.

Both brokers also implement swap rates for overnight positions, ensuring clear transparency in trading costs. Importantly, traders who adhere to Islamic finance principles can benefit from swap-free accounts at both Pepperstone and Saxo Markets, where interest is substituted with a flat-rate financing fee. Ultimately, the best choice will depend on each trader’s individual preferences regarding spread type, commission structure, and flexibility in trading platforms.

Our Lowest Spreads and Fees Verdict

Unquestionably, Pepperstone takes home the crown in this section, this is due to their lowest spreads and fees.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

2. Better Trading Platform – Pepperstone

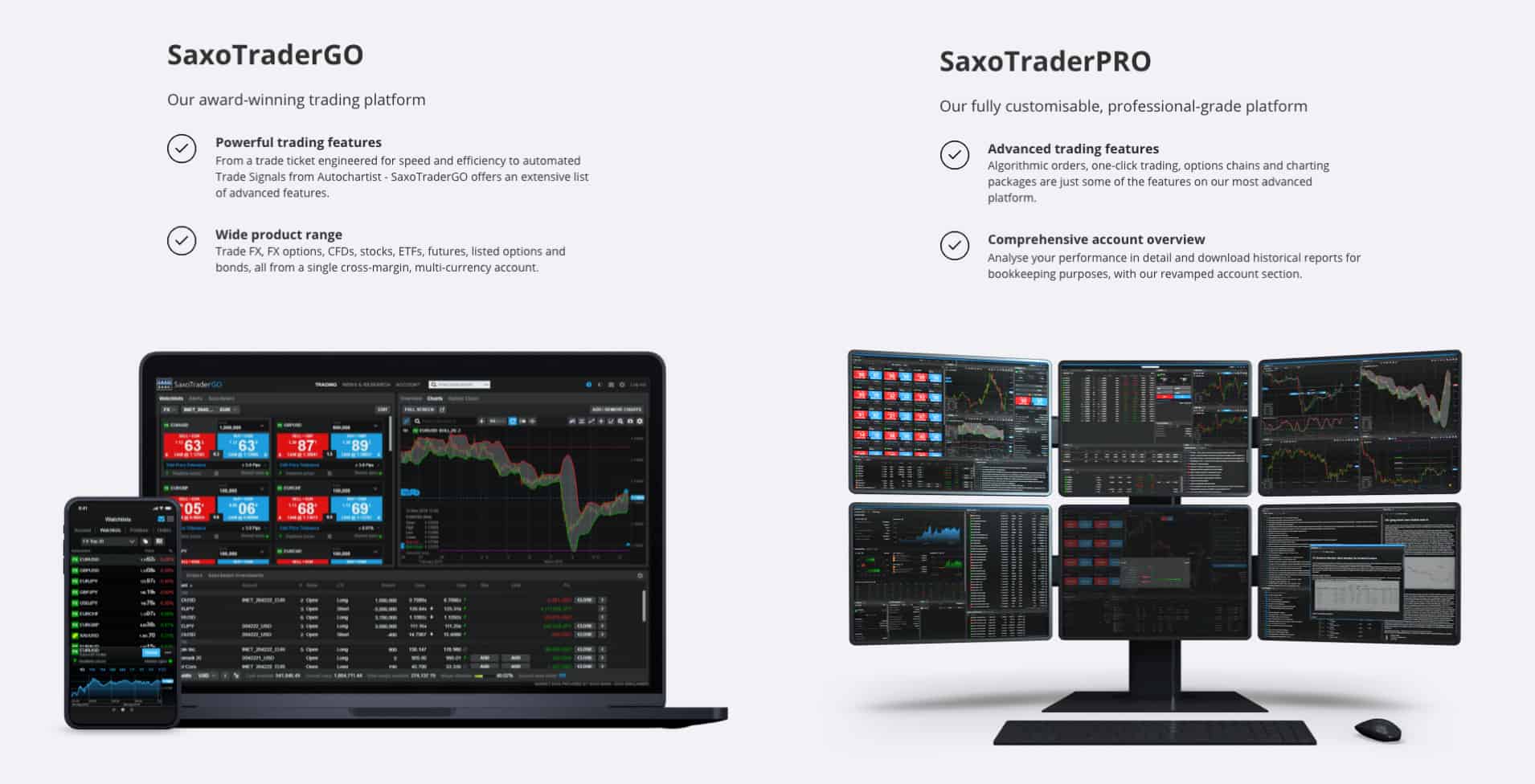

Selecting the right trading platform is crucial for a trader’s success, as it enhances efficiency, flexibility, and access to vital tools. Pepperstone and Saxo Markets stand out by offering advanced platforms tailored to various trading styles. Pepperstone capitalizes on the popular MetaTrader suite, while Saxo Markets showcases its proprietary platforms, SaxoTraderGO and SaxoTraderPRO, which boast institutional-grade features. Additionally, both brokers offer copy trading solutions, simplifying the process for traders to emulate the strategies of seasoned professionals.

| Trading Platform | Saxo Markets | Pepperstone |

|---|---|---|

| MetaTrader 4 | Yes | Yes |

| MetaTrader 5 | No | Yes |

| cTrader | No | Yes |

| TradingView | Yes | Yes |

| Copy Trading | No | Yes |

| Proprietary Platform | Yes | Yes |

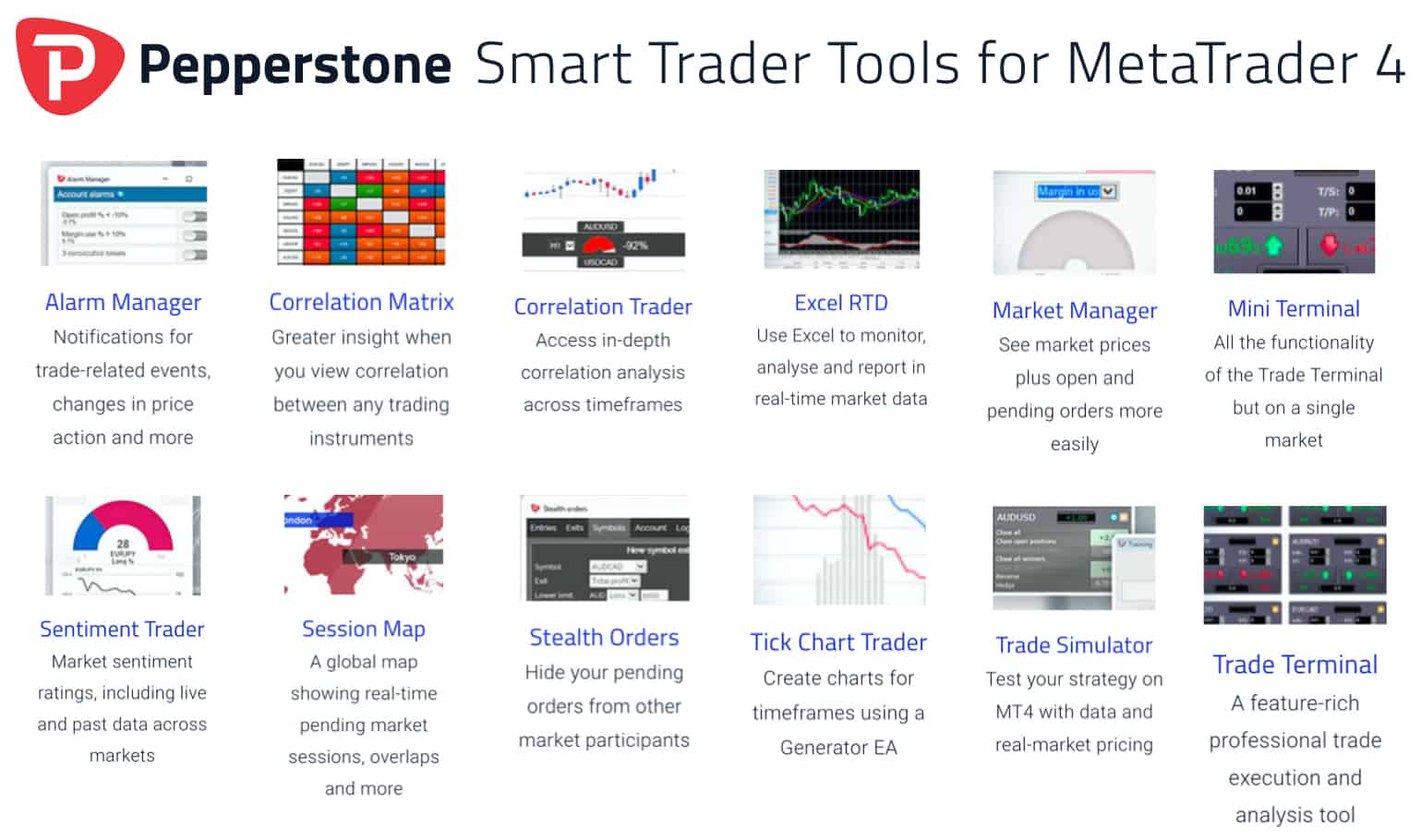

MetaTrader

Pepperstone distinguishes itself through seamless integration with MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both of which are celebrated for their exceptional automated trading features, sophisticated charting tools, and customizable indicators. With Pepperstone’s Razor Account, traders can maximize the potential of Expert Advisors (EAs) for algorithmic trading, benefitting from ultra-low spreads that guarantee optimal execution. In contrast, Saxo Markets does not accommodate MetaTrader users, choosing to focus on its proprietary platforms tailored primarily for professional traders, rather than those who depend on the capabilities of MetaTrader.

Advanced Platforms

Traders in search of top-tier trading technology need look no further than Saxo Markets, which offers SaxoTraderGO and SaxoTraderPRO. These platforms are crafted for institutional-grade trading, featuring exceptional risk management tools and access to deep liquidity. They support a diverse array of assets, extending beyond forex to include stocks, futures, and options, making them perfect for traders seeking multi-asset exposure. Alternatively, Pepperstone presents cTrader, a platform renowned for its user-friendly interface, one-click trading capabilities, and advanced order execution, catering to both manual and algorithmic traders alike.

Copy Trading

Both brokers offer copy trading solutions, yet they adopt distinct strategies. Pepperstone effectively integrates with DupliTrade and Myfxbook AutoTrade, empowering traders to automate their strategies by emulating professional traders. Additionally, it supports MetaTrader Signals, granting users access to thousands of strategy providers. In contrast, Saxo Markets presents SaxoSelect, a managed portfolio service where traders invest in professionally managed strategies instead of directly copying individual trades. While Pepperstone’s approach offers greater flexibility, SaxoSelect delivers a structured and hands-off investing experience.

Pepperstone and Saxo Markets provide unique trading platform experiences tailored to diverse trader needs. Saxo Markets offers proprietary platforms—SaxoTraderGO and SaxoTraderPRO—crafted for both novice and experienced traders, featuring advanced order types and multi-screen capabilities. On the other hand, Pepperstone shines with its extensive platform options, supporting MetaTrader 4, MetaTrader 5, and cTrader, making it ideal for algorithmic, manual, and copy trading. While Saxo Markets presents an institutional-grade environment perfect for seasoned investors, Pepperstone’s compatibility with leading industry platforms ensures flexibility, automation, and access to a wider trading community. Ultimately, traders should make their choice based on their trading style, preferred asset classes, and the specific features offered by each platform.

Our Better Trading Platform Verdict

Pepperstone, unmistakably, come up trumps in this category thanks to their better trading platform.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

3. Superior Accounts And Features – Pepperstone

For traders, selecting the ideal forex broker goes beyond merely seeking low spreads and rapid execution; it’s crucial to find an account structure that complements your specific trading style. Traders benefit from exceptional accounts and features, with competitive spreads, low commissions, and advanced tools. Brokers enhance the experience through demo accounts, swap-free options for Islamic finance, and varied financial instruments. Additionally, social trading, algorithmic execution, and strong customer support foster an efficient environment for all traders.

Pepperstone

Pepperstone continues to captivate both novice and experienced traders with its diverse account options. Traders can select a commission-free Standard account, which incorporates trading costs within the spread, or opt for the Razor account that features raw spreads starting at 0.0 pips with a competitive round-turn commission of $7 per 100k traded. This makes the Razor account particularly attractive for scalpers and algorithmic traders in search of deep liquidity and lightning-fast execution. Furthermore, Pepperstone’s Active Trader Program offers exceptional rewards for high-volume traders (USD $15 million+ monthly), providing premium rebates, dedicated account managers, and access to exclusive market insights. This positions Pepperstone as a top choice for professional traders who seek reduced trading costs and VIP treatment.

Saxo Markets

Saxo Markets presents a sophisticated tiered account structure tailored to various trading styles and needs. Clients can select from Classic, Platinum, or VIP accounts, each offering progressively lower trading costs along with exclusive advantages. High-volume traders using the Platinum and VIP tiers enjoy benefits such as tighter spreads, prioritized customer support, and access to distinctive market research and networking events. In contrast to Pepperstone’s variable spread model, Saxo Markets operates with fixed spreads, providing price stability, though this may come with marginally wider bid-ask differentials. Furthermore, Saxo’s extensive array of tradable instruments—including forex, stocks, bonds, and futures—delivers enhanced market diversity for professional traders seeking opportunities beyond just forex.

Both brokers present compelling account options, tailored to distinct trading preferences. Pepperstone’s Razor account and Active Trader Program excel in offering competitive pricing, ideal for scalpers and high-frequency traders. In contrast, Saxo Markets attracts high-volume traders with its tiered accounts, which feature progressively lower costs. Traders who prioritize raw spreads and ECN execution are likely to favor Pepperstone, while those in search of fixed spreads and a wider variety of asset classes may find Saxo Markets more appealing. Ultimately, the decision hinges on personal trading requirements, with both brokers providing robust platforms and exceptional trading experiences.

| Saxo Capital Markets | Pepperstone | |

|---|---|---|

| Standard Account | Yes | Yes |

| Raw Account | No | Yes |

| Swap Free Account | No | Yes |

| Active Traders | Yes | Yes |

| Spread Betting (UK) | No | Yes |

Our Superior Accounts and Features Verdict

Without a doubt, Pepperstone’s comes out on top in this category this is due to their superior accounts and features.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

4. Best Trading Experience And Ease – Pepperstone

When trading, to attain an exceptional trading experience, merely having access to the forex market is not sufficient for traders; it necessitates a harmonious integration of advanced platforms, rapid execution speeds, competitive spreads, and outstanding customer support. Traders thrive with seamless transaction execution, essential education, and advanced tools. A broker that offers user-friendly interfaces, transparency, and innovation supports effortless trading and long-term success.

Navigating the dynamic forex market demands a trading platform that combines robust features with intuitive usability. In our comprehensive analysis of Saxo Markets and Pepperstone, we scrutinized essential factors such as interface design, execution speed, and the accessibility of trading tools. Pepperstone stands out as a formidable option, offering the user-friendly MetaTrader 4 and MetaTrader 5 platforms, making it ideal for both novice and seasoned traders. Its platform guarantees effortless navigation, quick trade execution, and access to a diverse array of technical indicators and automation tools. Moreover, Pepperstone’s lightning-fast execution speeds significantly enhance trading accuracy, particularly for high-frequency traders.

Conversely, Saxo Markets provides a sophisticated trading environment through its proprietary platforms, SaxoTraderGO and SaxoTraderPRO. While these platforms deliver an extensive suite of trading tools and a wider range of financial instruments, they require a steeper learning curve, making them more suitable for professional and institutional traders. Nevertheless, Saxo Markets compensates for this with detailed market insights and customizable features that cater to those seeking advanced trading capabilities. In summary, Pepperstone excels in user-friendliness and execution speed, whereas Saxo Markets offers a diverse trading experience tailored for experienced traders.

Our Best Trading Experience and Ease Verdict

Evidently, Pepperstone come up trumps in this category due to their best trading experience and ease.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

5. Stronger Trust And Regulation – Saxo Markets

For traders in the industry, when choosing a forex broker, trust and regulation are truly important in ensuring a secure and transparent trading environment. Regulated brokers maintain high standards, protecting traders from fraud and unethical practices, which boosts confidence and market participation. Reputable brokers attract diverse clients, enhancing credibility and market presence. This review examines how Saxo Markets and Pepperstone’s regulatory frameworks influence the trading experience.

We see here that both brokers’ rating are on par. Pepperstone with a rating of 91 compared to Saxo Markets with 80.

Saxo Markets Trust Score

Pepperstone Trust Score

1. Regulations

Pepperstone is a globally acclaimed forex broker renowned for its robust regulatory adherence and transparency. It operates under the stringent supervision of esteemed financial authorities such as the Australian Securities and Investments Commission (ASIC), the Financial Conduct Authority (FCA), and the Dubai Financial Services Authority (DFSA). These regulatory agencies ensure that Pepperstone maintains high financial standards, safeguarding traders against fraud and malpractice. Boasting a secure trading environment and a solid reputation for reliability, Pepperstone has earned the confidence of traders across the globe.

Saxo Markets, a subsidiary of Saxo Bank A/S, stands out as a premier international fintech enterprise with a significant presence in key financial centers. Regulated by respected authorities including the Danish Financial Supervisory Authority (FSA), FCA, Swiss Financial Market Supervisory Authority (FINMA), and ASIC, Saxo Markets demonstrates a strong commitment to compliance. This adherence to rigorous regulations bolsters its credibility, promising traders a transparent and secure trading experience. Equipped with substantial regulatory support, Saxo Markets successfully attracts both institutional and retail traders in search of a dependable broker with a far-reaching global footprint.

| Saxo Markets | Pepperstone | |

|---|---|---|

| Tier 1 Regulation | ASIC (Australia) FCA (UK) MAS (Singapore) FINMA (Switzerland) | ASIC (Australia) FCA (UK) BaFin (Germany) CYSEC (Cyprus) |

| Tier 2 Regulation | SFC | DFSA (Dubai) |

| Tier 3 Regulation | SCB (Bahamas) CMA (Kenya) |

2. Reputation

Saxo Markets gets searched on Google more than Pepperstone. On average, Saxo Markets sees around 165,000 branded searches each month, while Pepperstone gets about 135,000 — that’s 18% fewer.

| Country | Saxo Markets | Pepperstone |

|---|---|---|

| Peru | 18,100 | 1,600 |

| Hong Kong | 14,800 | 1,000 |

| United Arab Emirates | 8,100 | 2,400 |

| India | 4,400 | 6,600 |

| Sweden | 4,400 | 390 |

| Poland | 3,600 | 2,900 |

| Bangladesh | 2,900 | 2,400 |

| Mexico | 2,900 | 1,600 |

| Algeria | 2,400 | 1,900 |

| Spain | 2,400 | 1,300 |

| Ecuador | 2,400 | 880 |

| Austria | 2,400 | 260 |

| Colombia | 1,900 | 4,400 |

| Thailand | 1,600 | 5,400 |

| Argentina | 1,600 | 3,600 |

| Brazil | 1,600 | 8,100 |

| Canada | 1,300 | 720 |

| Jordan | 1,000 | 480 |

| Malaysia | 1,000 | 9,900 |

| Vietnam | 1,000 | 4,400 |

| Switzerland | 1,000 | 390 |

| Cyprus | 880 | 1,300 |

| Indonesia | 720 | 5,400 |

| United States | 720 | 4,400 |

| Pakistan | 590 | 1,600 |

| Netherlands | 590 | 720 |

| Philippines | 590 | 2,900 |

| Uzbekistan | 390 | 880 |

| United Kingdom | 390 | 3,600 |

| Tanzania | 390 | 1,300 |

| Turkey | 320 | 4,400 |

| Italy | 320 | 1,600 |

| Singapore | 260 | 1,300 |

| Taiwan | 260 | 480 |

| Egypt | 260 | 2,400 |

| Ghana | 210 | 390 |

| Greece | 210 | 260 |

| Australia | 210 | 720 |

| Sri Lanka | 210 | 480 |

| Panama | 210 | 170 |

| Germany | 170 | 2,900 |

| Saudi Arabia | 140 | 1,000 |

| Morocco | 140 | 1,000 |

| Nigeria | 110 | 1,300 |

| Mauritius | 110 | 170 |

| Bolivia | 90 | 480 |

| Venezuela | 90 | 1,000 |

| Portugal | 70 | 590 |

| Uruguay | 70 | 390 |

| Cambodia | 70 | 390 |

| Ireland | 70 | 210 |

| South Africa | 50 | 6,600 |

| Mongolia | 50 | 210 |

| Ethiopia | 50 | 320 |

| Dominican Republic | 50 | 480 |

| Kenya | 50 | 480 |

| Uganda | 30 | 390 |

| Botswana | 20 | 320 |

| New Zealand | 20 | 210 |

| Chile | 20 | 590 |

| Japan | 10 | 590 |

| Costa Rica | 10 | 320 |

| France | 10 | 1,000 |

18,100 1st | |

1,600 2nd | |

14,800 3rd | |

1,000 4th | |

4,400 5th | |

6,600 6th | |

3,600 7th | |

2,900 8th |

Similarweb shows the same story when it comes to August 2025 website visits with Saxo Markets receiving 1,898,000 visits vs. 1,474,000 for Pepperstone.

3. Reviews

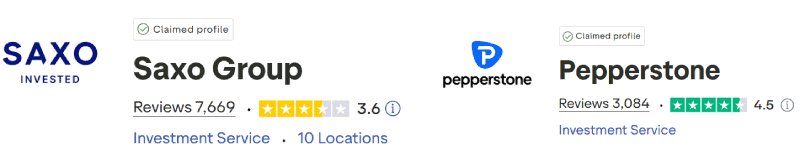

As shown below, Pepperstone holds a Trustpilot rating of 4.5 out of 5, based on over 3,000 reviews. Saxo Markets has a lower Trustpilot score of 3.6 out of 5, from around 7,700 reviews. Pepperstone is generally seen as more user-friendly and responsive, while Saxo Markets appeals to experienced investors but faces criticism for inconsistent service.

Our Stronger Trust and Regulation Verdict

This looks like someone is having its day in the sun. Saxo Markets ranks highest in this category owing this to their stronger trust and regulation.

Saxo Markets ReviewVisit Saxo Markets

*Your capital is at risk ‘65% of retail CFD accounts lose money’

6. Top Product Range And CFD Markets – Saxo Markets

Choosing the right forex broker is crucial for traders looking to diversify their portfolios and maximize market opportunities. A strong broker should offer a wide range of financial instruments like forex, commodities, indices, and cryptocurrencies, allowing traders to adapt strategies to market conditions. Diverse options enhance flexibility and profitability. This review examines Saxo Markets and Pepperstone, two top brokers known for their competitive offerings, helping traders find the platform suited to their goals.

| CFDs | Saxo Markets | Pepperstone |

|---|---|---|

| Forex Pairs | 327 | 94 |

| Indices | 29 | 27 |

| Commodities | 5 Metals 7 Energies 8 Softs | 33 Commodities 7 Metals, 4 Energies, 9 Softs, 13 Hard |

| Cryptocurrencies | 9 | 44 |

| Share CFDs | 9000+ | 1,200+ |

| ETFs | 1200 | 95 |

| Bonds | 8 | 0 |

| Futures | 0 | 42 |

| Treasuries | 8 | 7 |

| Investments | 0 | 0 |

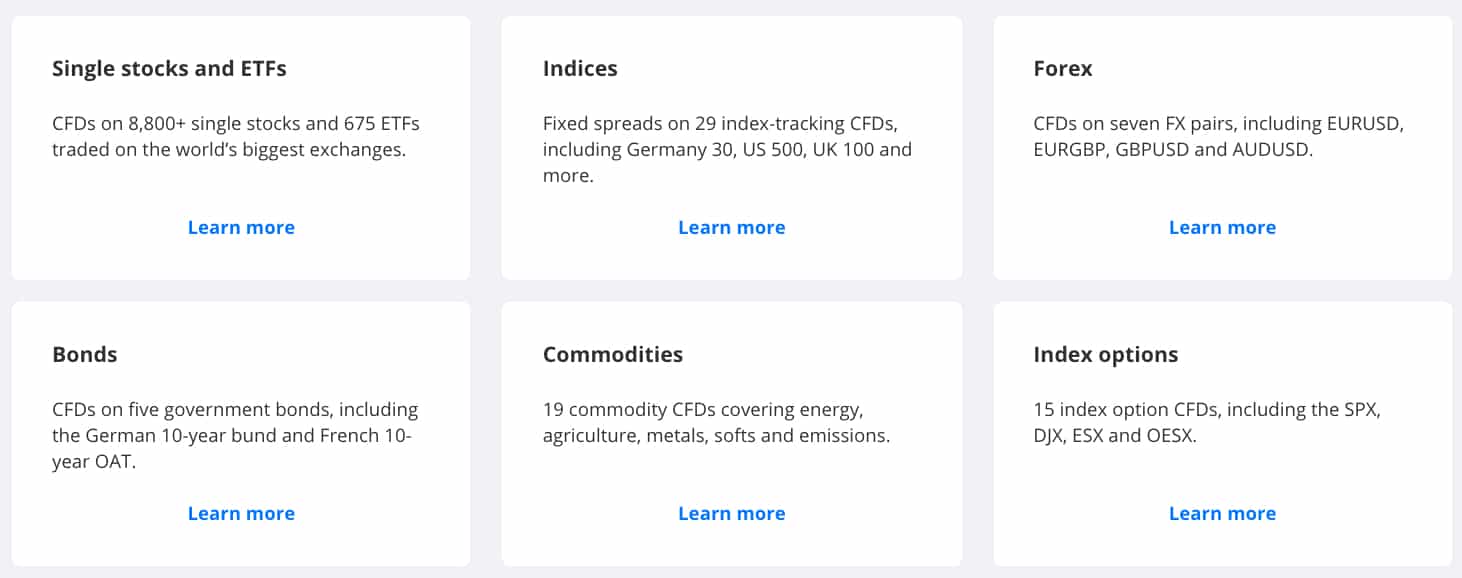

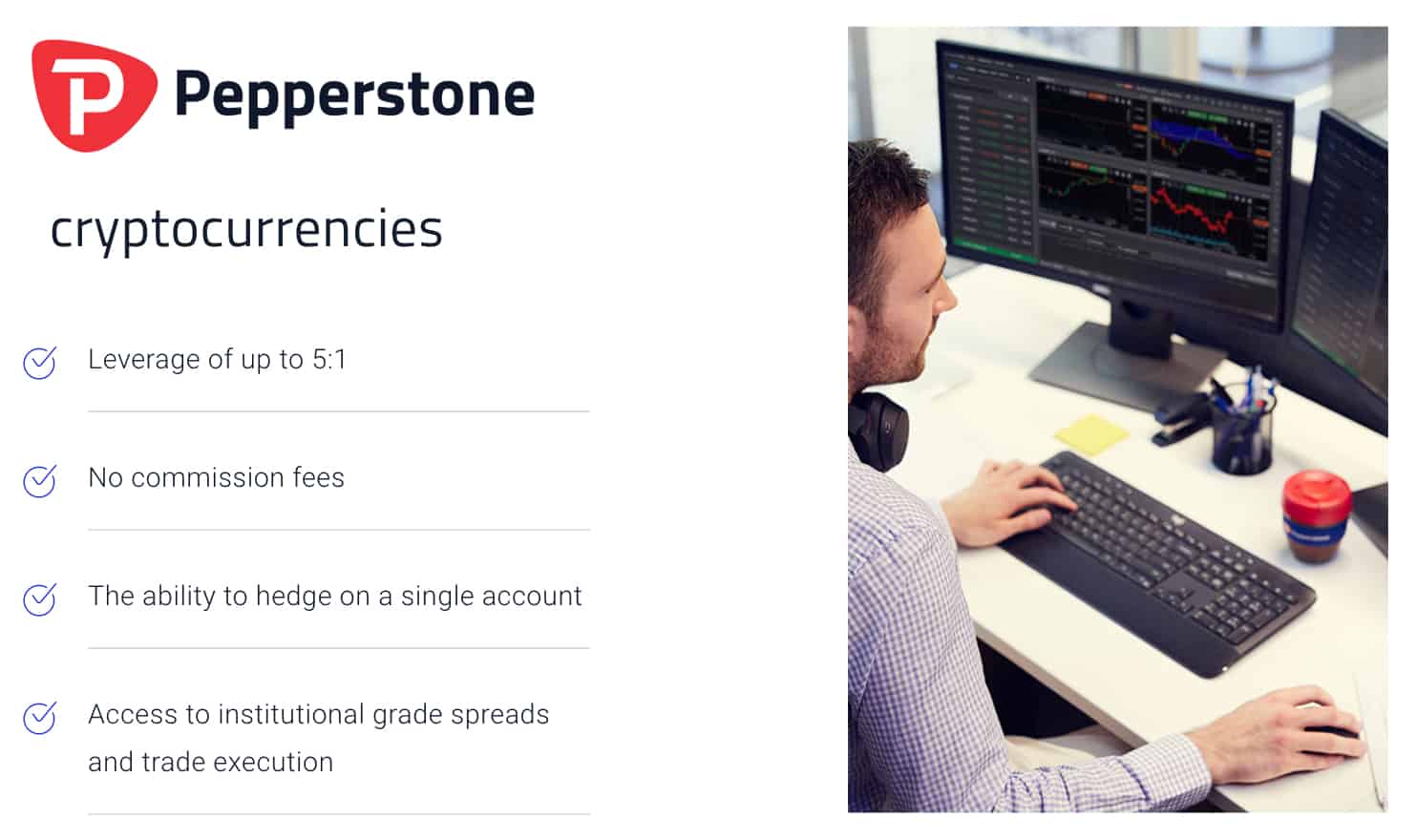

Pepperstone and Saxo Markets offer diverse product ranges, allowing traders to capitalize on various market conditions. Pepperstone primarily specializes in forex trading, yet it also offers access to a diverse range of financial instruments, including Index CFDs, Share CFDs, Commodities, Currency Index CFDs, and even 12 cryptocurrency CFDs. With competitive spreads and zero commission fees, traders can benefit from substantial leverage—up to 200:1 for forex and 100:1 for currency indices—particularly through Pepperstone’s SCB-regulated entity. However, it’s worth noting that leverage limits vary by region, with more restrictive caps in areas like the UK, Europe, and Australia. In contrast, Saxo Markets distinguishes itself with an expansive array of products, boasting thousands of CFDs across commodities, ETFs, futures, bonds, listed options, and mutual funds. Additionally, Saxo offers two key cryptocurrencies—Bitcoin and Ethereum—through Exchange Traded Notes (ETNs), effectively minimizing risks by eliminating leveraged exposure.

When it comes to Share CFDs, Pepperstone traders are limited to the MetaTrader 5 platform, accessing hundreds of stocks from major global exchanges with commissions as low as $0.02 per US share. Saxo Markets, however, provides access to over 8,800 stocks, with commission fees varying by exchange—ranging from 0.10% for Australian stocks to 0.20% for Singaporean shares. Both brokers adhere to stringent regulatory standards in the realm of cryptocurrency trading, although leverage limits vary by jurisdiction. Pepperstone’s SCB entity allows for leverage of up to 5:1 on crypto CFDs, while other regulated entities such as Saxo Markets impose a maximum of 2:1. Furthermore, UK retail clients are prohibited from trading crypto CFDs due to FCA regulations. In summary, Pepperstone attracts traders looking for high-leverage opportunities in forex and crypto, whereas Saxo Markets caters to those seeking a broader, institution-grade market portfolio.

Our Top Product Range and CFD Markets Verdict

Saxo Markets dominates this section due to their top product range and CFD markets.

Saxo Markets ReviewVisit Saxo Markets

*Your capital is at risk ‘65% of retail CFD accounts lose money’

7. Superior Educational Resources – Saxo Markets

In the very busy and complicated industry of forex trading, knowledge is just as valuable as execution speed. Superior educational resources play a crucial role in helping traders develop effective strategies, manage risk, and adapt to market shifts. From in-depth webinars and structured courses to insightful articles and video tutorials, top brokers equip traders with the tools needed to navigate the forex market with confidence. A strong educational foundation not only enhances decision-making but also fosters continuous growth—essential for long-term trading success.

Before trading, always keep in mind that education is just as important as speed of execution. Recognizing this, both Saxo Markets and Pepperstone offer extensive learning resources designed to help traders sharpen their strategies, manage risks, and stay ahead of market developments. With a wealth of offerings—including in-depth webinars, structured courses, video tutorials, and expert market analysis—these brokers equip traders of all experience levels with the essential tools to make informed decisions and enhance their trading journey continuously.

Saxo Markets distinguishes itself with a robust library of webinars, strategy-driven insights, and comprehensive market analysis, making it an ideal choice for those seeking advanced educational materials. Conversely, Pepperstone shines in accessibility, featuring a user-friendly “Learn to Trade Forex” section and straightforward guides that cover a variety of educational topics. Whether you’re a novice just starting out or an experienced trader honing your skills, both brokers offer the valuable knowledge needed to successfully navigate the complexities of forex trading.

Our Superior Educational Resources Verdict

Saxo Markets come up trumps in this niche, thanks to their superior educational resources.

Saxo Markets ReviewVisit Saxo Markets

*Your capital is at risk ‘65% of retail CFD accounts lose money’

8. Superior Customer Service – Pepperstone

In the business of forex trading, a broker with outstanding customer service is essential for a smooth forex trading experience.In a fast-paced market, immediate support is vital. Brokers like Saxo Markets and Pepperstone prioritize trader satisfaction with responsive 24/7 live chat, phone, and email support in multiple languages. This commitment enhances customer service, helping traders resolve issues quickly and build trust, enabling them to focus on their strategies.

Pepperstone excels with its award-winning, multilingual customer service, providing traders with 24/5 support through live chat, phone, and email. This commitment ensures that clients can quickly address issues and obtain expert assistance whenever necessary. In addition to exceptional customer support, Pepperstone enriches the trading experience with a robust array of educational resources, including online webinars, structured courses, and comprehensive training guides designed for traders at every skill level.

In contrast, Saxo Markets also offers 24/5 multilingual support, but it is limited to phone and email, notably lacking live chat, which diminishes its effectiveness. The reliance on a chatbot-based FAQ falls short of the personalized assistance available at Pepperstone. Nonetheless, Saxo Markets makes up for this limitation with an impressive selection of educational resources, such as webinars and the Saxo Academy, providing traders with valuable insights to enhance their strategies and maintain a competitive edge in the forex market.

| Feature | Saxo Markets | Pepperstone |

|---|---|---|

| Live Chat Support | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Yes | Yes |

| Support Hours | 9/5 | 24/7 |

| Multilingual Support | Yes | Yes |

Our Superior Educational Resources Verdict

It’s clear to see that Pepperstone excels great in this section, this is due to their superior educational resources.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

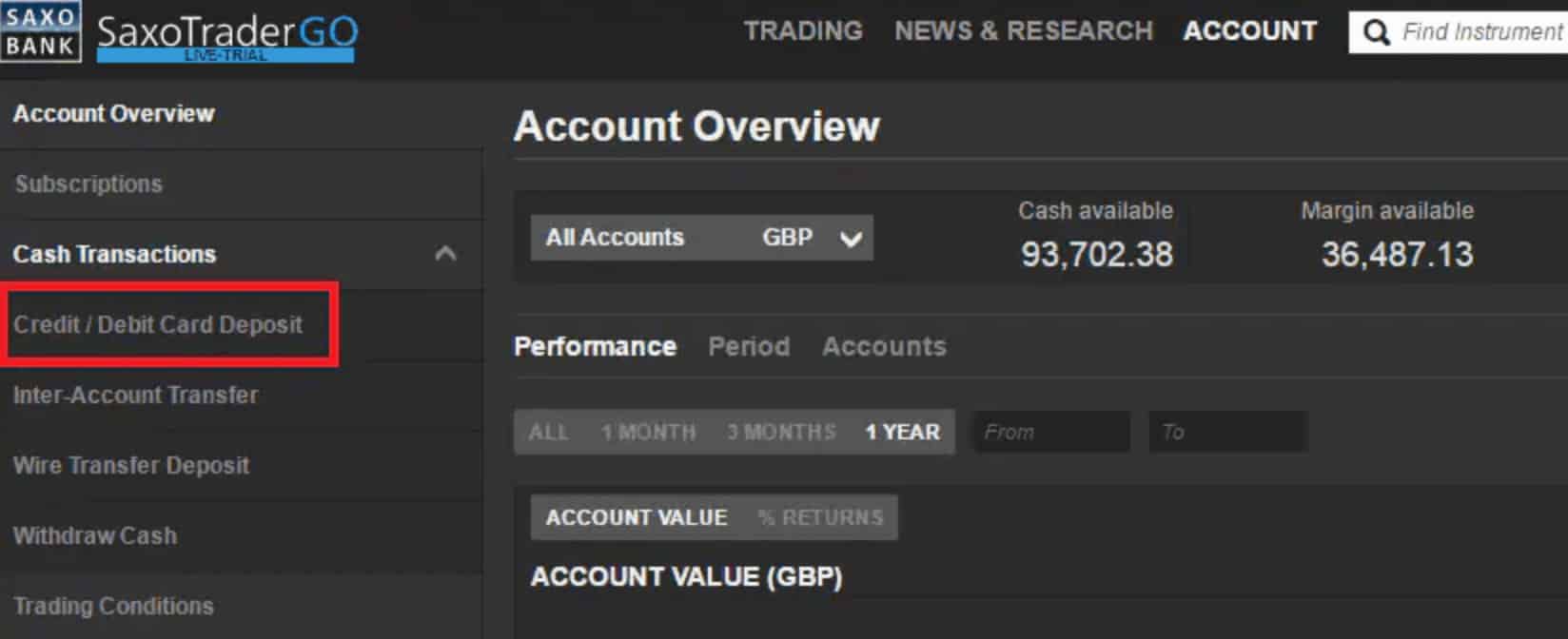

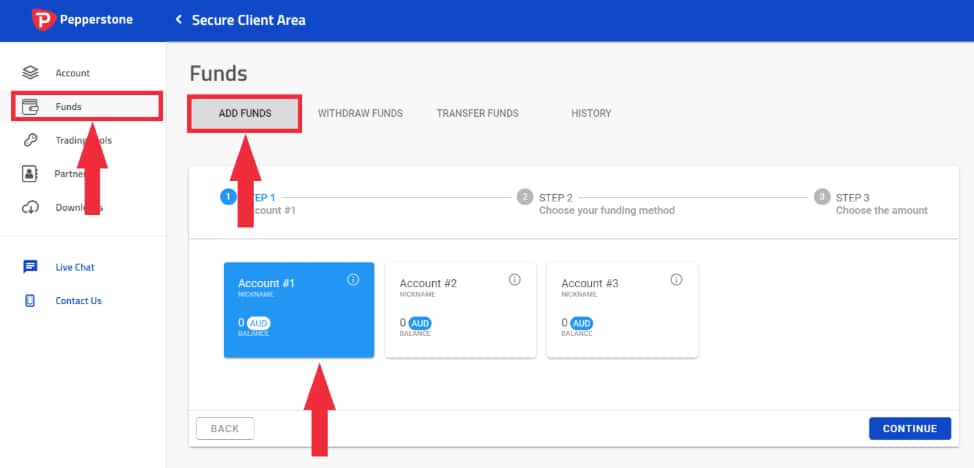

9. Better Funding Options – Pepperstone

Before trading, looking for brokers with efficient funding options are essential for a seamless trading experience, allowing traders to deposit and withdraw funds with ease. Top forex brokers offer diverse payment options like bank transfers, credit/debit cards, and digital wallets such as PayPal, Skrill, and Neteller, with some accepting cryptocurrency. Low fees and quick processing times allow traders to focus on market opportunities, highlighting funding efficiency as key in broker selection.

Pepperstone and Saxo Markets both provide fee-free deposits and withdrawals for most funding methods, ensuring cost-effective transactions for traders. However, their approach to payment options differs significantly. Pepperstone offers a broad range of deposit and withdrawal methods, including bank transfers, credit/debit cards, and e-wallets like PayPal, Skrill, Neteller, and BPay. While most transactions are free, international transfers incur a small AUD $20 fee. In contrast, Saxo Markets limits funding to bank transfers and credit/debit cards, with withdrawals restricted to bank transfers—potentially less convenient for traders seeking faster digital transactions.

Both brokers stand out for offering multiple base currencies, helping traders minimize conversion fees. Pepperstone supports nine major currencies, including USD, EUR, and GBP, while Saxo Markets provides a more extensive selection of 19 currencies, including AUD, SGD, JPY, and NOK. This flexibility allows traders to manage their funds more efficiently, reducing unnecessary currency conversion costs.

Our dedicated team of experts can surmise that Pepperstone rates better in the funding category due to its wider range of deposit and withdrawal methods, including popular e-wallets like PayPal, Skrill, and Neteller. Both brokers provide fee-free transactions for most methods, but Saxo Markets imposes more restrictions by allowing only bank transfers and credit/debit card deposits, with withdrawals permitted solely through bank transfers. While Pepperstone does have a small fee for international transfers, its greater flexibility makes it the preferred option for traders who value fast and convenient funding alternatives.

| Funding Option | Saxo Markets | Pepperstone |

|---|---|---|

| Credit Card | Yes | Yes |

| Debit Card | Yes | Yes |

| Bank Transfer | Yes | Yes |

| PayPal | No | Yes |

| Skrill | No | Yes |

| Neteller | No | Yes |

| Crypto | Yes | Yes |

| Rapid Pay | No | No |

| POLi / bPay | Yes | Yes |

| Klarna | No | No |

Our Better Funding Options Verdict

We can clearly say that Pepperstone outperforms the challenger in this niche due to their better funding options.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

10. Lower Minimum Deposit – Pepperstone

In the ever evolving and dynamic industry of forex trading, a lower minimum deposit opens the door to a broader range of traders, from beginners testing the waters to experienced investors looking for flexibility. Brokers with low or no minimum deposit requirements enhance accessibility, enabling traders to enter the market with minimal financial commitment. This fosters a dynamic trading environment for gaining experience and refining strategies

Minimum deposit requirements vary significantly between Pepperstone and Saxo Markets, reflecting their differing approaches to trader accessibility. Pepperstone stands out in the competitive trading landscape with a remarkably low initial deposit requirement of just AUD $200 for both its Standard and Razor accounts. This minimal barrier makes it an appealing choice for novice traders and those looking to enter the market with limited capital.

In stark contrast, Saxo Markets is geared towards high-net-worth individuals and professional traders, imposing significantly higher minimum deposit thresholds. Its Classic account requires an initial deposit of USD $10,000, which can be prohibitive for inexperienced traders. The Platinum account escalates this requirement to USD $200,000, while the elite VIP account demands a staggering USD $1 million minimum deposit. This tiered structure positions Saxo Markets as a premium broker tailored for institutional-grade trading, whereas Pepperstone remains an accessible and inclusive platform for traders of all experience levels.

| Minimum Deposit | Recommended Deposit | |

| Saxo Markets | $0 | - |

| Pepperstone | $0 | $200 |

Our Lower Minimum Deposit Verdict

Pepperstone steals the show in this portion, this is due to their lower minimum deposit.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘72% of retail CFD accounts lose money’

Our Final Verdict On Which Broker Is The Best: Pepperstone or Saxo Markets?

Pepperstone takes the crown in this niche by the reason of a more comprehensive range of services, lower fees, and a user-friendly platform suitable for both beginners and experienced traders. The table below summarises the key information leading to this verdict:

| Categories | Saxo Markets | Pepperstone |

|---|---|---|

| Lowest Spreads And Fees | No | Yes |

| Better Trading Platform | No | Yes |

| Superior Accounts And Features | No | Yes |

| Best Trading Experience And Ease | No | Yes |

| Stronger Trust And Regulation | Yes | No |

| Top Product Range And CFD Markets | Yes | No |

| Superior Educational Resources | Yes | No |

| Superior Customer Service | No | Yes |

| Better Funding Options | No | Yes |

| Lower Minimum Deposit | No | Yes |

Saxo Markets: Best For Beginner Traders

Saxo Markets is the ideal choice for beginner traders due to its user-friendly platform, comprehensive educational resources, and dedicated customer support.

Pepperstone: Best For Experienced Traders

While both brokers cater well to experienced traders, Pepperstone offers a more diverse product range and advanced trading tools, making it slightly more suitable for seasoned professionals.

FAQs Comparing Saxo Markets Vs Pepperstone

Does Pepperstone or Saxo Markets Have Lower Costs?

Pepperstone generally offers lower costs compared to Saxo Markets. Traders often prefer Pepperstone for its competitive spreads and reduced commission fees. For instance, Pepperstone’s average spread for major currency pairs is notably lower. Those keen on diving deeper into spread comparisons can refer to this comprehensive guide on lowest spread forex brokers in the UK.

Which Broker Is Better For MetaTrader 4?

Both Pepperstone and Saxo Markets support MetaTrader 4, but Pepperstone is often favored for its enhanced MT4 features and tools. The broker provides a seamless trading experience on MT4, complemented by advanced charting tools and expert advisors. For traders specifically looking for the best MT4 experience, this list of best MT4 brokers can be a valuable resource.

Which Broker Offers Social Trading?

Pepperstone offers social trading features, allowing traders to copy strategies from seasoned professionals. Saxo Markets, on the other hand, doesn’t have a dedicated social trading platform. Social trading can be a game-changer for many, especially beginners, as it allows them to leverage the expertise of experienced traders. For a detailed insight into the best platforms offering this feature, check out this guide on the best social trading platforms.

Does Either Broker Offer Spread Betting?

Pepperstone offers spread betting, while Saxo Markets does not. Spread betting is a popular financial derivative in the UK, allowing traders to speculate on the price movements of various assets without owning the underlying asset. For those interested in exploring spread betting further, especially on the MT4 platform, here’s a guide to the best MT4 spread betting brokers in the UK.

What Broker is Superior For Australian Forex Traders?

In my opinion, Pepperstone stands out as the superior choice for Australian forex traders. Founded in Australia and regulated by ASIC, Pepperstone has a strong reputation in the Australian market. Their commitment to transparency, competitive spreads, and advanced trading tools make them a top choice for many. Saxo Markets, on the other hand, is an international broker with its roots overseas. For a broader perspective on the best brokers in Australia, you can refer to this list of Best Forex Brokers In Australia.

What Broker is Superior For UK Forex Traders?

For UK forex traders, I believe Saxo Markets has a slight edge. Being FCA regulated and with a significant presence in the UK market, they offer a robust trading platform and a wide range of financial products. Pepperstone, although a strong contender, is originally from Australia. Saxo’s comprehensive research tools and educational resources cater well to the UK audience. For those looking to explore more options in the UK, here’s a detailed guide on the best forex brokers in UK.

Noam Korbl

Noam Korbl is the co-founder and has been a trader since 2014. He has Finance degree at Monash University and is an investor in shares and equities and successfully started and sold the online business Hearing Choices.

Ask an Expert

What are the disadvantages of Saxo Markets?

While Saxo is a good broker overall, some disadvantages to be aware of include high minimum deposits with their Platinum and VIP accounts, the broker is more expensive than their competitors and popular platforms like MT4, MT5, cTrader and TradingView are not available.

Does Saxo have an inactivity fee?

No,Saxo does not have an inactivity fee.