Broker Reviews: Forex, CFDs and Trading Platforms

Based on trader opinions, February 2026 spreads and forex trading platform our forex broker reviews provide up-to-date ratings on the top regulated forex brokers.

Written by Justin Grossbard

Updated:

- 67 Forex Brokers reviewed by our expert team

- 50+ years combined forex trading experience

- 14,000+ hours comparing brokers fee + features

- Structured and in-depth evaluation framework

Our broker reviews are reader supported and we may receive payment when you click on a partner site.

ECN Forex Brokers

About ECN Brokers

Forex brokers that charge a spread and commission are often termed ECN brokers. This means they have no dealing desk with a goal of not making a profit from the spread but rather a flat commission rate based on volume. Any remaining spread is determined by the market.

Most experienced Forex traders will choose an ECN forex broker as their overall fees are lower. They also have superior execution speeds with traders having direct access to other financial instructions and liquidity pools.

No Commission Brokers

About Non-Commission Brokers

Often termed as ‘standard accounts’ these brokers (or accounts) have no commissions. Instead, the Best Forex Brokers In Australia makes its money primarily from the spread (the difference between the buy and sell price). These spreads will differ based on the currency pair and the time of the day. Generally, the more major traded pairs such as the EUR/USD will have lower spreads than more exotic pairings.

Non-Commission brokers are normally the performance of beginner forex traders due to the simplicity of pricing. This can make it easier to calculate the profit/losses of trades. The downside is the overall fees may be higher compared to an ECN trading account.

Forex Broker For Beginners

Best Forex Brokers For Beginners

Unlike ECN or Non-Commission accounts, Best Forex Brokers In Australia are fixed spread accounts that don’t have floating spreads. This means that traders know the fees a broker will charge over time adding certainty when training. Often fixed spread brokers also will have other risk management tools included such as guaranteed stop losses.

Fixed spread forex brokers have the highest fees so most experienced or algorithmic traders won’t consider this option. They also have the poorest execution speeds of the three broker sets. They are still the best forex broker for beginners as risk management tools can limit losses and their training facilities are the best for novice traders.

What makes a forex broker good depends on what a given trader finds important. Some favour low spreads or fast execution, some prefer low costs, while others find risk management tools important. This page has separated our brokers into 3 sections below based on the best ECN, no commission and beginner brokers.

Pepperstone

The Best Forex Trading Platform

Pepperstone is the 2026 best forex broker based on:

Pepperstone is the 2026 best forex broker based on:

- The lowest spreads on numerous forex pairs and Lowest Commission Brokers

- Leverage of 30:1 leverage (Australia, Europe, The UK, South Africa, Dubai), 400:1 (Kenya) and 200:1 (all other countries)

- Trading platform options including MT4, MT5, cTrader and TradingView

- Range of products – Over 700 CFDs, and spread betting in the UK

- Award-winning customer service

Spreads

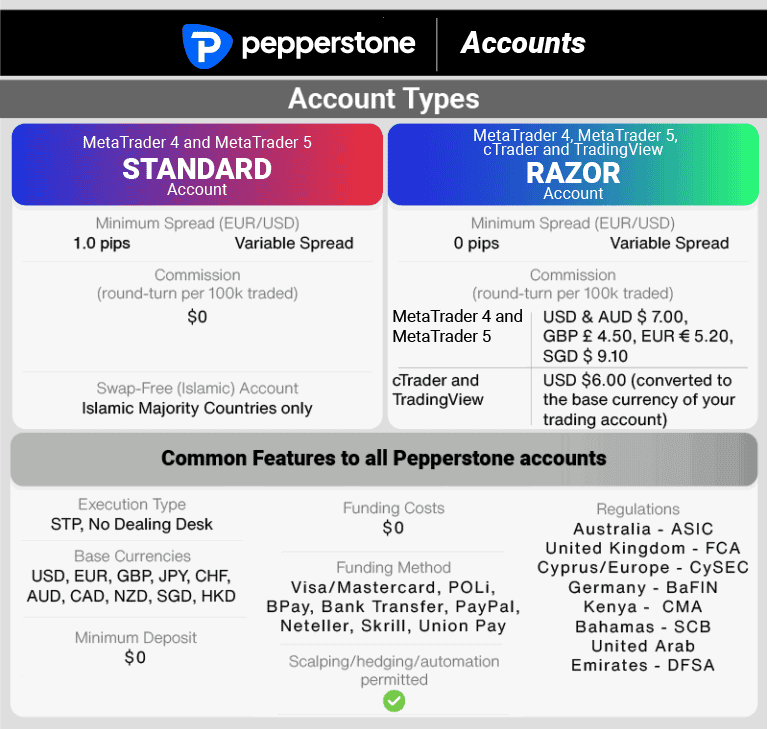

Pepperstone offers ultra-tight spreads through both its standard commission-free account and its ECN-style razor account. The average spreads of the top brokers shown below are taken straight from the broker’s websites and updated monthly.

If you are new to trading and looking for a user-friendly and simple account type, Pepperstone’s standard account will provide spreads from 0.6 pips with no commission fees. The no-commission account type is one of the most competitive worldwide for retail traders.

| 1.10 | 1.10 | 1.30 | 2.10 | 1.40 |

| 0.70 | 2.20 | 1.10 | 1.60 | 1.60 |

| 1.90 | 2.00 | 2.40 | 2.30 | 2.50 |

| 1.40 | 2.50 | 2.50 | 2.60 | 2.60 |

| 1.40 | 1.60 | 1.40 | 2.10 | 1.90 |

| 1.40 | 1.90 | 1.30 | 1.90 | 1.70 |

| 0.70 | 0.80 | 1.30 | 2.40 | 1.30 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-01

If you prefer an ECN-style trading environment, Pepperstone’s razor account offers spreads from 0.0 pips plus commission fees of AUD $7 round turn per 100,000 traded. The low average spreads combined with fast, no dealing desk (NDD) execution is well-suited to algorithmic traders and scalpers.

Pepperstone is a great choice for experienced forex traders as it uses STP technology to connect traders with liquidity providers and offers Lowest Commission Brokers.

Raw Spread comparison | |||||

|---|---|---|---|---|---|

| 0.10 | 0.10 | 0.20 | 1.10 | 0.40 |

| 0.08 | 0.35 | 3.50 | 0.73 | 0.65 |

| 0.10 | 0.20 | 0.30 | 1.00 | 0.50 |

| 0.10 | 0.20 | 0.30 | 0.20 | 0.20 |

| 0.16 | 0.29 | 0.54 | 0.68 | 0.70 |

| 0.20 | 0.40 | 0.50 | 0.70 | 0.70 |

| 0.10 | 0.40 | 0.50 | 0.90 | 1.40 |

| 0.10 | 0.50 | 0.60 | 0.40 | 0.60 |

| 0.38 | 0.92 | 0.70 | 0.86 | 1.21 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-01

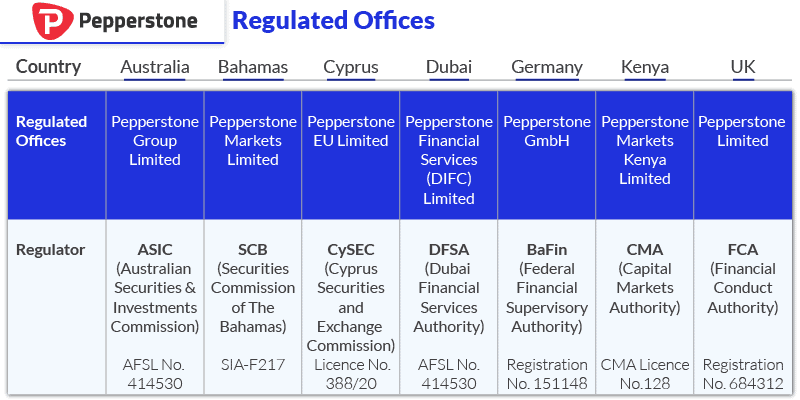

Pepperstone is an Australian forex broker founded in 2010. They are regulated by:

- The Australian Securities and Investments Commission (ASIC)

- The Financial Conduct Authority (FCA) in the United Kingdom

- The Federal Financial Supervisory Authority of Germany (BaFin)

- The Capital Markets Authority (CMA) of Kenya

- The Securities Commission of the Bahamas (SCB)

- The Dubai Financial Services Authority (DFSA).

As forex and CFDs are derivatives and therefore complex instruments, trading comes with a high level of risk. Pepperstone’s ‘tier 1’ regulators mean the trader’s funds are secure and the broker can be trusted by investors. The broker follows all local regulations, such as disclaimers and segregated client funds with additional protections in certain areas.

Pepperstone ReviewVisit Pepperstone

*Your capital is at risk ‘75.6% of retail CFD accounts lose money’

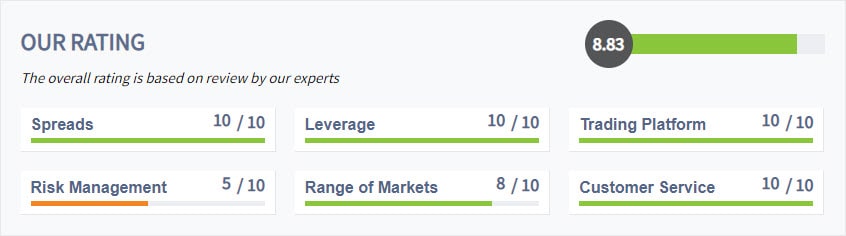

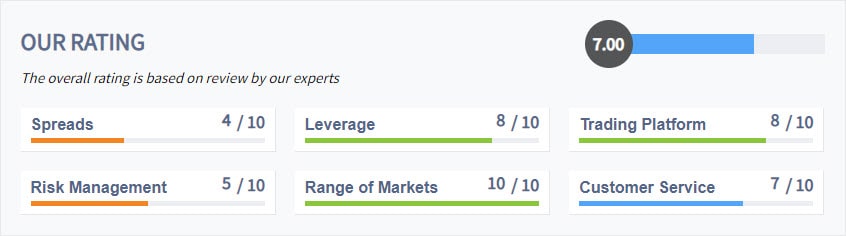

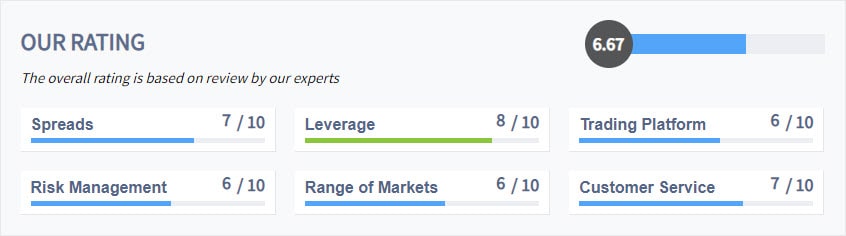

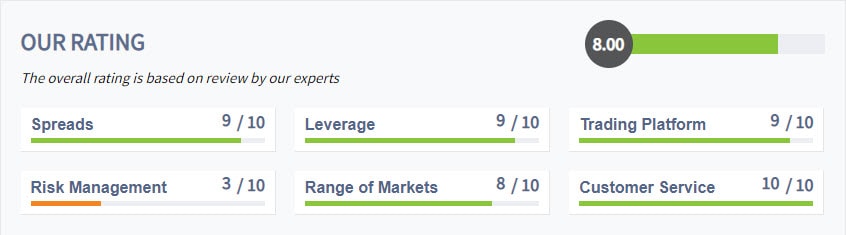

The overall rating is based on review by our experts

IC Markets

The Lowest Spread Broker

IC Markets have the lowest brokerage overall based on:

- Lowest spreads with ECN Pricing for major currency pairings

- Lowest Commission Brokers for ‘ECN’ account types

- No deposit or withdrawal fees

- No inactivity fees

- Competitive overnight swap fees

IC Markets offers ECN pricing, which is why they are able to offer some of the lowest spreads for many currency pairs. Not only does IC Markets have tight spreads, but the broker also has Lowest Commission Brokers costs for most base currencies including the GBP, USD, EUR and AUD.

IC Markets Raw Account Spreads | |||||

|---|---|---|---|---|---|

| 0.02 | 0.23 | 0.27 | 0.85 | 0.03 |

| 0.08 | 0.39 | 3.50 | 1.28 | 0.35 |

| 0.10 | 0.30 | 0.20 | 1.00 | 0.10 |

| 0.10 | 0.20 | 0.30 | 0.60 | 0.20 |

| 0.16 | 0.59 | 0.54 | 2.00 | 0.29 |

| 0.20 | 0.60 | 0.50 | 10.00 | 0.40 |

| 0.10 | 0.50 | 0.50 | 4.50 | 0.40 |

| 0.10 | 2.00 | 0.60 | 3.10 | 0.50 |

| 0.10 | 0.20 | 0.30 | 1.80 | 0.20 |

Avg. spreads are taken from each broker's website and updated monthly. Last update on 2026-01-01

Like Pepperstone, IC Markets was founded in Australia and holds an ASIC regulation license. In Europe, it holds CySEC regulation (Cyprus) and also has Seychelles regulation issued by the FSA. IC Markets offer a choice of MetaTrader 4, MetaTrader 5 and cTrader forex trading platforms. Traders outside Europe and Australia have a maximum leverage of 500:1, leverage for major currency pairs in Australia and Europe is 30:1 and 20:1 for minor and exotics.

ThinkMarkets

The Best Forex Broker For Beginners

A 2026 comparison of the best brokers for those new to forex trading found ThinkMarkets was the best beginner broker. This review found ThinkMarkets to be the best broker for beginners because:

- Negative balance protection included for all clients

- No minimum deposit requirements

- Commission-free Standard Account spreads from 0.4 pips

- Trading server hubs in UK, NY and HK for fast execution

- Three highly rated trading platforms for beginners

Founded in 2010, ThinkMarkets has its headquarters in London and Melbourne. The broker is regulated by ASIC, FCA, FSCA and FSA is an excellent choice for beginner traders as it has low minimum deposits meaning one can commence trading with a small investment and a standard accounts with spreads from 0.4 pip making the broker one of the best value for commission free trading in the industry. To give beginner brokers an extra level of security, all ThinkMarkets clients receive negative balance protection.

ThinkMarkets trading servers are located near major financial hubs in the UK, NY and HK meaning fast trading execution, which is critical to reducing slippage, especially when using their ThinkZero STP account, which has spreads from 0.0 pips and a commission of $3.50. Lastly, ThinkMarkets offer MetaTrader 4, 5 and their own developed platform ThinkTrader, the no.1 mobile trading app in the world. This app allows you can trade on the go using 80 indicators, 50 graphical tools and 14 different chart types.

eToro

The Best Broker For Social Trading

Established in Tel Aviv, Israel, eToro has offices in Cyprus, the UK and Australia. eToro differs from most brokers as it’s a social trading platform that allows traders to view, compare and share trading ideas and strategies with millions of other traders worldwide. eToro offers advanced trading tools such as the CopyTrader™ system to copy trades from other portfolios, and CopyPortfolios™ which is an investment fund of sorts where you can invest in a portfolio compiled from top eToro traders.

Key features of eToro include

- Social trading specialist FX platform for all trading levels

- Innovative tools – CopyTrader™ system, CopyPortfolios™

- Has one of the latest trading communities

- No commission fees

- Large range of cryptocurrencies for social trading

eToro strength as a social trading apps is helped not only by excellent tools but the size of its trading community, which means access to a large knowledge base for social success. This community can trade using a wide range of CFD products including 16 cryptocurrencies pairs, 2000 stocks, 145 ETFs, 14 commodities and 13 indices all available with no commission frees as eToro is a spread-only product.

eToro is regulated by CySEC, FCA and ASIC. They were featured highly in the best forex brokers in UK.

Fusion Markets

The Broker That Has The Lowest Brokerage

Brokerage when trading forex ranges from spreads, commissions and holding costs. Our forex broker fee comparison found that Fusion Market’s market-leading commissions (most of which were 50% lower than other brokers) made them the cheapest worldwide.

- Lowest commission fees in the industry from $2.25

- No minimum deposits

- Highly competitive spreads costs

- Transparent with brokerage fees

- Friendly Customer Support

Founded and headquartered in Melbourne in 2017, Fusion markets are regulated in Australia and Vanuatu and offers one of the best trading experience by applying ‘the Fusion Formula’. This formula combined ‘Low-Cost Trading + Friendly Support + Leading Technology’.

Low-Cost Trading is achieved in 3 ways:

- Industry-Lowest Commission Brokers: With commissions of $4.50 round-turn, this online broker offers the lowest commission’s costs in the forex market.

- Tight Spreads through STP trading execution – Fusion Market offers industry competitive tight spreads with Avg 0.12 for EURUSD, making it one of the best value for trading costs

- No hidden fees – Fusion Markets are transparent with their fees. They have no inactivity fees and or funding fees (except for international bank transfers) or inactivity fees.

In addition to low costs, Fusion markets offer ‘white gloves’ friendly customer service and leading technologies such as a blazing fast trade execution speed of 0.2 ms and MetaTrader 4 forex trading platforms.

XTB

The Recommended Broker For CFD Trading

Contract For Difference (CFDs) is more than just trading forex. They also allow the trading of cryptocurrencies to commodities and indices. Our Best CFD Brokers in Australia rewarded XTB as the best CFD broker.

- Over 1500 global markets for trading CFDs

- Award-winning proprietary CFD trading platform

- Great training material for beginners

- The in-depth market analysis material

- Dedicated account manager

Founded in Warsaw, Poland in 2002 under the name X-Trade and later changed to XTB, this CFD broker is one of the largest stock exchange-listed brokers. XTB offers a large range of financial products for trade on the market with 1500 instruments including 49 forex pairs, 42 indices, 22 commodities, 1755 stock CFDs, 113 ETF CFDs and 25 Crypto pairs. Spreads for forex start at 0.28 pips for EURUSD for its PRO trading account.

In addition to its excellent range of CFDs, XTB stands out for its choice of trading platforms and free features. XTB offers a choice of 2 trading platforms, its proprietary award-winning xStation 5 CFD trading platforms, which offers instant execution with an average trading execution speed of 85 ms, no requotes and MetaTrader 4.

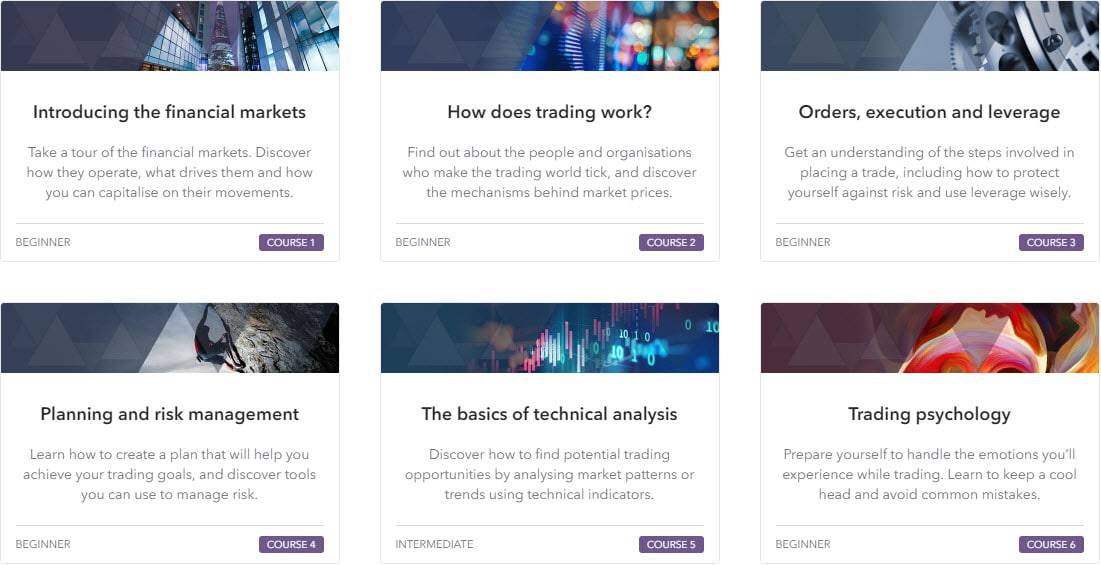

The broker also has a wealth of free tools including its online Trading Academy which offers multiple courses with an extensive range tailored for beginner traders. Lastly, XTB has a solid range of market analysis tools. One unique feature is its mobile trade alert via WhatsApp for the latest trading news.

XTB is regulated by FCA, CySEC, CNMV (Spain), KNF (Poland), IFSC (Belize)

*Your capital is at risk ‘77% of retail CFD accounts lose money’

easyMarkets

The Broker With Good Risk Management Features

easyMarkets offers an extensive range of risk management tools. One risk management feature traders will appreciate is guaranteed negative balance protection.

- Best range of risk management tools

- Innovative risk tools – dealCancellation, Freeze Rate

- Fixed rates regardless of market volatility

- No slippage guarantee

- Free guaranteed stop-loss, negative balance protection

Founded in 2001 with headquarters in Limassol (Cyprus) and regulated by ASIC and CySEC, easyMarkets (formerly easy-Forex) market maker with its main strength being its range of risk management tools usually included free of charge. easyMarkets operates with three 3 simple values: Simple, Honest, Transparent.

- Simple trading: through their in-house developed user-friendly trading platform and its large range of risk management tools such as free ‘guaranteed stop-loss’, guaranteed Negative Balance Protection, ‘dealCancellation’ (which allows you to reverse a trade if you change your mind) and ‘Freeze rate'(allows you to temporarily pause the screen so you can grab the quote before it changes).

- Honest trading: easyMarkets offers fixed spreads with a no slippage guarantee and is overseen by tier-1 regulators like CySEC and ASIC.

- Transparent trading: As a market maker, easyMarkets never changes its fixed spreads no matter how extreme market events might be.

Most of the easyMarkets risk management is included ‘free’ with each trade, which means they are paid for through the standard spreads prices. This means trader’s get good value for the prices paid, especially as easyMarkets do not have commission fees. easyMarkets offers a choice of 3 types of trading accounts including a VIP account and 64 forex currency pairs, 53 shares CFD, 3 cryptocurrencies, 5 metals, 5 energies, 7 soft commodities and 15 indices. easyMarkets also offers options and futures trading not often found with other brokers when trading financial markets.

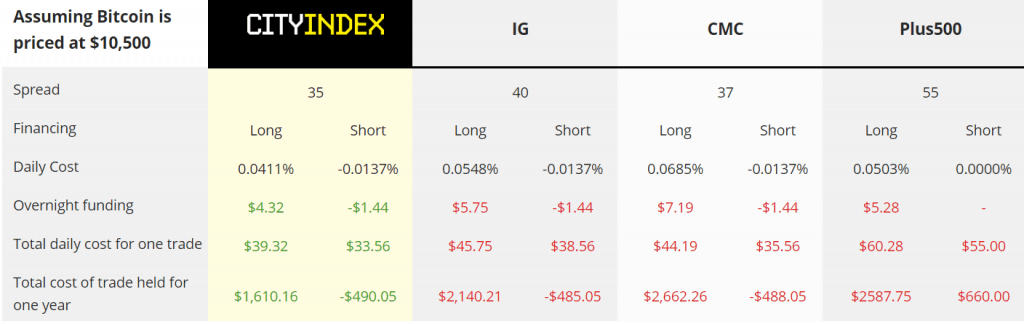

City Index

A Broker Recommended For Crypto CFDs

Individuals looking for Cryptocurrency CFDs such as Bitcoin should consider Forex.com (City Index) which has the lowest trading costs.

- Lowest Spreads for crypto CFD among major brokers

- Low overnight funding costs for cryptos

- Tight spreads with no commissions

- Large selection of free trading tools

- Market analysis from expert analysis

City Index is a No Dealing Desk Brokers broker and part of the Gain Capital umbrella who are listed on the NYSE and also own the CFTC regulated Forex.com in the USA. Regulated by ASIC, FCA, UAE Central Bank (United Emirates) and MAS (Singapore), the broker offers 2 types of retail investor accounts where one can choose from 2 trading platforms, AT Pro (with over 100 technical indicators) or MT4 and from over 4500 CFD markets, 84 currency pairs with spreads starting from 0.7 pips and no commissions.

The City Index product portfolio is very strong overall includes 21 indices, 4500+ shares CFD, 25+ hard and soft commodities and less common options such as bonds, interest rates and options and one of its major strengths; cryptocurrencies. City Index offers 6 of the most popular cryptos including Bitcoin, Ripple, Ethereum and Litecoin but where it shines is the low costs with some of the lowest spreads and swap rates on the market.

As a market maker rather than an ECN broker, City Index includes lots of free features, making their spreads excellent value. Included is the City Index trading academy which covers all City Index financial markets from beginner to advanced level and a wealth of trading tools including a research portal, built-in trading strategies for trading signals, Reuters news and expert market analysis.

City Index ReviewVisit City Index

Your capital is at risk ‘70% of retail CFD accounts lose money with City Index’

Best Trading Education

Trading any financial product requires training that can be completed either online or on-site. Currency trading has many elements for a trader to get used to, including the forex trading platform, key market events and dates, the use of leverage and automation. Each forex broker differs in their quality of training and the level that training courses are aimed.

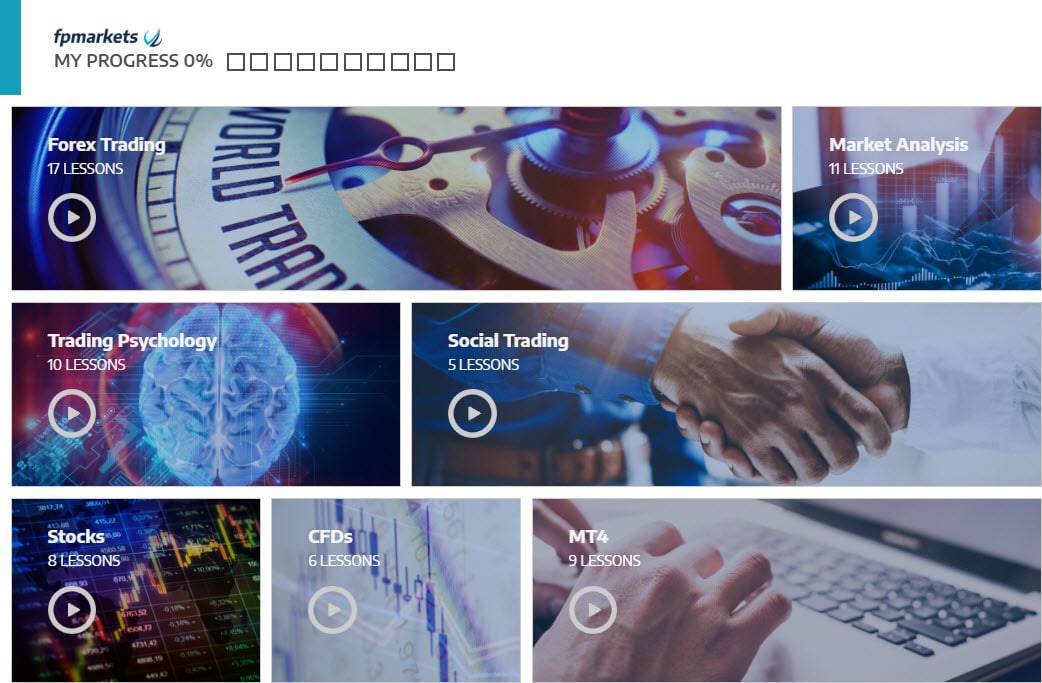

FP Markets

FP Markets has twice won the Investment Trends award for best educational material. Their best feature is their video tutorial with approximately 100 lessons to build up traders’ knowledge from beginner to expert. There are also dedicated training courses dedicated to each level of trader experience. Mixed in are webinars held frequently, including one at the start of the week to discuss upcoming events that may impact the market. There are also trading e-books which are ideal for those who want to learn about forex, shares and CFD while travelling.

FP Markets ReviewVisit FP Markets

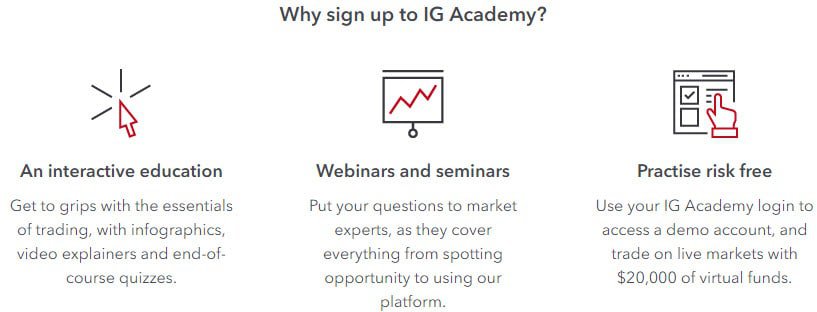

IG Group

IG Group, which is Australia’s largest retail foreign exchange broker was considered the second-best when it came to education. The IG Academy included interactive education, webinars, and seminars as well as a demo account to trade risk-free.

There are also articles, blogs, and exclusive videos provided by IG Markets. These online resources combined with the in-person seminars they hold periodically across Australia, which was why this FX broker was considered the best in the category.

CMC Markets

CMC Markets are close behind IG Markets who also have a high market share when it comes to retail foreign exchange in Australia. They have similar forex training features as IG, including videos, demo accounts and videos. An extra feature worth downloading is their eBooks which cover a range of training topics. These are catered for those new to forex trading and intermediate traders. Another popular feature is The Artful Trader Podcast which is where experienced traders are interviewed to hear their stories and tips. Training is multilingual making CMC Markets one of the Best Forex Brokers In Thailand and Besten Broker in Deutschland.

CMC Markets ReviewVisit CMC Markets

*Your capital is at risk ‘69% of retail CFD accounts lose money’

Pepperstone

Pepperstone came third based on their online videos and the availability of a dedicated account manager who can assist with training forex traders. Smart trading tools also provide training and market information within the MT4 trading platform. This was followed by FXCM who have ‘After work’ seminars to educate and keep traders up-to-date with elements impacting markets.

Best Forex Trading Platform

There are two types of forex trading platforms. The first is a shared platform that is created by a software company and is shared by many forex brokers. The big advantage of a shared platform is that it reduces the barrier long-term to switching forex brokers, as there won’t be a need to re-learn the platform. The second option is a propriety forex trading platform that is exclusively created and offered by a single forex broker. The advantage of a propriety platform is that features unique to that FX broker can be integrated into the software.

Reviewing each forex broker’s trading platform, it was clear that two platforms, cTrader and MT4 are the leaders in execution speeds, features and high adoption rate in the FX community making it easy to exchange trading strategies and programs (expert advisors) between traders.

MetaTrader 4 (MT4) by MetaQuotes

It is the most popular forex trading and analytical technology offered by forex brokers and used by retail foreign exchange traders. While the interface may seem old fashion, the platform is light and powerful, allowing for fast execution speeds. Traders can trade directly from charts, make pending orders and instant executions of implement stop-loss orders.

It’s widely accepted that the analytical functions with the strength of MT4. There are nine interactive charts allowing traders to review quotes and react to price movements within currency markets. There are also 30 technical indicators and 23 analytics objects to assist in analysing the market.

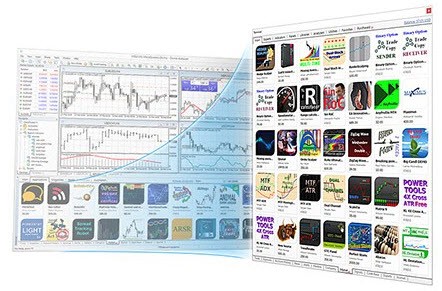

Another advantage of MT4 is the built-in Market. This allows for automated strategies (Expert Advisors) to be purchased.

Another advantage of MT4 is the built-in Market. This allows for automated strategies (Expert Advisors) to be purchased.

There are a plethora of Expert Advisor indicators and robots available for purchase. This can be done within the MT4 interface.

- Most trading applications of any forex trading platform

- Over 2,000 technical indicators and 1,700 trading robots

- A range of free and commercial options are available

There is also the functionality to copy deals automatically from other forex traders. There are free and paid signals that can be copied which vary based on logic, risk appetite resulting in differing profitability. You can learn about the Best MT4 Brokers on our comparison page.

cTrader by Spotware

It is an all-in-one CFD and forex trading platform with enhanced tools and features. It is the second most popular platform and has an interface that is more modern and attractive compared to MetaTrader 4. In addition to the rich charts, there is also level II pricing, advanced order types and fast execution.

One of the most popular features of the platform is cTrader copy. This allows anyone to make strategic decisions and charge a fee for others to copy trades. Another is cTrader automate, which allows traders to create their own automated robots. Unlike MetaTrader 4 this is based on C# API to write the code with a test environment provided to simulate trades with the robot.

Other features of cTrader include:

Other features of cTrader include:

- Open API allows FX traders to build and own their own applications for free.

- Fix API interface for trading with hedging accounts with no administration costs.

- A web-based version that requires no downloads while having most functionality

- Android and iOS applications so that trading can be done via mobile devices

cTrader overall is a technology-focused platform with enterprise-grade IBM hardware, ultra-low latency and those cross-connects liquidity providers. There has been over $40m USD invested in infrastructure, which has helped achieve 100% uptime over the past seven years.

The platform has 3ms internal processing time with over one million price updates each minute. View our list of the best cTrader brokers.

Pepperstone Has The Best Forex Trading Platform

Pepperstone was given the most votes because the forex broker offers both MetaTrader 4 and cTrader. Commission fees for Razor accounts are low on all platforms:

- MetaTrader platforms: Starting from $3.50 per side per 100,00 traded.

- cTrader: 0.0035% of the base currency, i.e. €3.50 if 100,000 units of the EUR/USD is being traded

The FX broker also offers advanced trading tools, allowing for enhanced features to enhance forex trading.

MT4 Alarm Manager

MT4 Alarm Manager

This tool allows traders to set up notifications or alerts that are triggered by trade-related events. Emails, web updates or an SMS can be sent as the alert mechanism. MT4 Connect

MT4 Connect

This is a centralised all-in-one portal including Pepperstone trading guides, economic calendar, RSS news feeds and the ability to fund the MT4 account and other account information. MT4 Correlation Trader

MT4 Correlation Trader

With the ability to compare competing markets, MT4 correlation highlights the similarities between markets in real-time or when different time periods are selected. MT4 Market Manager

MT4 Market Manager

Traders with a market manager can access features including making trades with a set percentage of equity by balance order limits. Trade information can also be monitored, including floating profit and loss. MT4 Excel Real-Time Data

MT4 Excel Real-Time Data

Traders can use visual basics for application programming skills or basic excel skills to monitor and analyse the market. This can help build financial models for sophisticated currency trading. MT4 Trade Terminal

MT4 Trade Terminal

This positional analysis tool is packed with features from stop-loss orders, expert close-up functions, and fast trading. Traders can also view pip size and value per pip as well as the functionality of one-click order cancellation. MT4 Sentiment Trading

MT4 Sentiment Trading

The Sentiment Trader provides an easy-to-read market sentiment rating for a particular market. The same sentiment data can be viewed historically to see the impact this has had on market direction. MT4 Session Map

MT4 Session Map

This feature presents trading hours across the world from Melbourne, New York to London. The map shows when a session is live as well as when they overlap. News events are also displayed helping identify liquidity opportunities. MT4 Stealth Orders

MT4 Stealth Orders

Traders can hide pending orders using this tool. This is done by waiting for the entry price to be hit when orders are placed whether it is a buy or sell order. It’s worth noting that slippage is higher using this stealth order functionality. MT4 Trade Simulator

MT4 Trade Simulator

This simulator provides analysis and profit-and-loss results on tested strategies. This allows detailed testing to be done quickly whether automatic or manual trading. Orders can also be placed (including trailing orders) using the simulator.

How To Select The Right Forex Brokerage Firm

Several factors should be considered when selecting the top forex broker to suit your currency trading needs.

- Brokerage fees: Forex broker’s fees are higher than many other financial services due to the complexity of forex trading and requirements such as leverage. The two forex brokerage fees. The first is spreads (the difference between the buy and ask price) which the broker may widen to make a profit. The second is commissions which are charged based on turnover. View the section below where the lowest brokerage firms are reviewed.

- Trading platform: Every foreign exchange broker uses FX trading platforms which can be a propriety or shared platform. Propriety tools often have unique features specific to the forex broker from dealCancellation to cryptocurrency trading. Shared forex trading platforms make it easy to change forex brokers over time as multiple brokers offer this software. The two most popular FX platforms are MetaTrader 4 and cTrader. In the UK traders can choose spread betting which limits which platform they can use.

- Leverage: All forex brokerage firms offer leverage as traditionally currency pairings movements are modest each day. Leverage allows individuals to trade multiple of their deposits. Higher leverage means increased profits or losses on trades. A high-risk environment is only appropriate for experienced traders. It’s important to note that most high-risk (leverage) forex brokers allow a lower leverage level to be selected.

- Risk Management: As leverage leads to amplified risk when currency trading is worth considering the risk management tools available. A standard tool most brokers offer includes stop-loss orders which exit a trade after a pre-set profit or loss is reached. This amount can be set in stone through a guaranteed stop-loss order (only available from some FX brokers) while negative balance protection ensures a trader doesn’t lose more than their deposit.

- Regulation: Another way to avoid risk is to choose a licenced broker such as an ASIC Regulated Brokers. The Australian Securities and Investment Regulation (ASIC) are the regulating body that all the forex brokers on Compare Forex Brokers have certification with through an Australian Financial Services Licence (AFSL). Past Forex scams and fraud from non-regulated FX brokers have highlighted the need to check certification before joining. Another leading regulator is the FCA (Financial Conduct Authority) in the UK. Another popular regulator is CySEC (Cyprus Securities and Exchange Commission).

- Customer Service: Due to the complexities associated with foreign exchange trading, there is regularly the need for customer service. It’s important to find a forex broker that offers the communication channels to suit you from live chat, e-mail to the call centre. Then there is a quality of customer service and hours available. There is the Investment Trends fx report which is based on real brokers rates for each broker’s customer service.

- Range Of Markets: While all foreign exchange firms offer the trading of major pairings such as the AUD/USD, only a handful offer exotic currencies. Then other markets are offered from indices, commodities, and cryptocurrency to EFTs trading. Some of the largest brokers also offer stockbroker services from trading on the Australian Stock Exchange to overseas markets such as the NYSE.

- Execution Speeds: With currency markets moving quickly (especially after announcements such as interest rates of job data) having an environment where trades can be quickly executed is essential. This requires tools that make it easy to make trades and servers that minimize latency and allows trading directly to global liquidity tools. Understanding the technical configuration of the broker can help understand their speed capacity.

- Funding Options: Selecting a forex broker that allows you to fund the account with a method that suits you is a high priority for individuals. This can range from direct debit, credit card to PayPal. These funding methods can also impact the amount of time that a trader needs to wait for the funds to be clear. Finally, it’s important to understand the funding and withdrawal costs of a method by each broker, as these costs can be significant.

- Education: All forex brokers have an online forex education section, but the quality varies significantly. Then there is the education offered by the customer service team, which can include a dedicated account manager. Some brokers also offer seminars to educate those new to currency trading, which may be a key draw-card to selecting that provider. This education could include articles or videos explaining some of the basic analysis theories like technical analysis. Overall, viewing the website is recommended to see if the education meets your requirements.

Background To This Foreign Exchange Broker Review Comparison

This comparison site is updated each month by the authors of compare forex brokers who have worked with the forex industry in the past. Only those currency brokers that are regulated were used in this comparison to help protect investors from poor quality operators overseas. Broker accounts were primarily chosen by their spreads and fees in this section, with additional options such as trading systems and leverage to filter by experience levels.

There are several guides to help select the right broker, including our Best Forex Brokers In Australia guide. You can also view our 5 effective trading tips, share vs. currency trading guide, commodities and overall Forex Trading strategies. If you see any element (no matter how basic) that may require updating, feel free to contact the authors using the Contact Us form. We aim to update this site regularly and provide dates on each page of when the last update was. We recommend that the website and tables be used as a guide when formulating your trading forex strategies to help make your decision easier. However, you should always click on the ‘view website’ button and review the information on the site first to ensure the broker suits your trading needs.

Forex Country Comparison Tables

Broker Vs Broker Comparisons

- Pepperstone vs IC Markets

- Pepperstone vs IG

- Pepperstone vs Admiral Markets

- Pepperstone vs eToro

- Hugosway vs Pepperstone

- Pepperstone vs XTB

- Pepperstone vs Tickmill

- Pepperstone vs Blueberry Markets

- IC Markets vs Axi

- XM vs IC Markets

- Trader’s Way vs IC Markets

- IC Markets vs FP Markets

- IC Markets vs Blueberry Markets

- FxPro vs IC Markets

- CMC Markets vs IG

- HugosWay vs Tradersway

- FxPro vs XM

- FP Markets vs IG

- KOT4X vs HugosWay

- Pepperstone vs Eightcap

- IC Markets vs Eightcap

- IC Markets vs ThinkMarkets

- Fusion Markets vs IC Markets

- BlackBull Markets vs IC Markets

- FP Markets vs Blueberry Markets

- Eightcap vs Fusion Markets

- Pepperstone vs BlackBull Markets

- Pepperstone vs Fusion Markets

- Eightcap vs IG

- Eightcap vs FXCM

- Eightcap vs City Index

- Fusion Markets vs ThinkMarkets

- Eightcap vs FP Markets

- Eightcap vs BlackBull Markets

- Eightcap vs Admirals

- Eightcap vs TMGM

- Eightcap vs AvaTrade

- Eightcap vs FXTM

- Eightcap vs eToro

- Pepperstone vs Swissquote

- Eightcap vs Swissquote

- Pepperstone vs FOREX.com

- Pepperstone vs TMGM

- Eightcap vs FOREX.com

- BlackBull Markets vs FXCM

- BlackBull Markets vs IG

- BlackBull Markets vs eToro

- BlackBull Markets vs easyMarkets

- BlackBull Markets vs BlueBerry Markets

- BlackBull Markets vs Axi

- FP Markets vs Axi

- BlackBull Markets vs Plus500

- BlackBull Markets vs Fusion Markets

- BlackBull Markets vs CMC Markets

- BlackBull Markets vs FXTM

- BlackBull Markets vs ThinkMarkets

- BlackBull Markets vs Go Markets

- BlackBull Markets vs TMGM

- BlackBull Markets vs OANDA

- BlackBull Markets vs SwissQuote

- BlackBull Markets vs XM

- Eightcap vs OANDA

- Eightcap vs XM

- Eightcap vs FxPro

- FP Markets vs Swissquote

- FP Markets vs FxPro

- FP Markets vs TMGM

- FP Markets vs XM

- FP Markets vs Fusion Markets

- FP Markets vs GO Markets

- FP Markets vs OANDA

- FXCM vs Admirals

- FXCM vs Fusion Markets

- eToro vs XTB

- eToro vs OANDA

- FXCM vs City Index

- eToro vs XM

- OANDA vs IG

- Pepperstone vs HYCM

- Pepperstone vs Trading 212

- Pepperstone vs Exness

- Blueberry markets vs Hugosways

- City Index vs FOREX.com

- FOREX.com vs Plus500

- FOREX.com vs ThinkMarkets

- FOREX.com vs FxPro

- City Index vs OANDA

- FOREX.com vs OANDA

- Exness vs IC Markets

- AvaTrade vs Plus500

- Avatrade vs eToro

Justin Grossbard

Having traded since 1998, Justin is the CEO and co-founded CompareForexBrokers in 2014. Justin has published over 100 finance articles from Forbes, Kiplinger to Finance Magnates. He has a master’s degree in commerce and has an active role in the fintech community. He has also published a book in 2023 on investing and trading.

Ask an Expert

Wonder if you have any information on ” abbado.com” broker. They are into Forex and Cryptos with margin. Any helpful recommendations for brokers trading Cryptos, Forex, and Metals .

You can trade forward contracts using the Next Generation platform made by CMC Markets.