Broker Reviews: Forex, CFDs and Trading Platforms

Based on trader opinions, July 2025 spreads and forex trading platform our forex broker reviews provide up-to-date ratings on the top regulated forex brokers.

Our broker reviews are reader supported and we may receive payment when you click on a partner site. For more information, visit our About Us page.

ECN Forex Brokers

About ECN Brokers

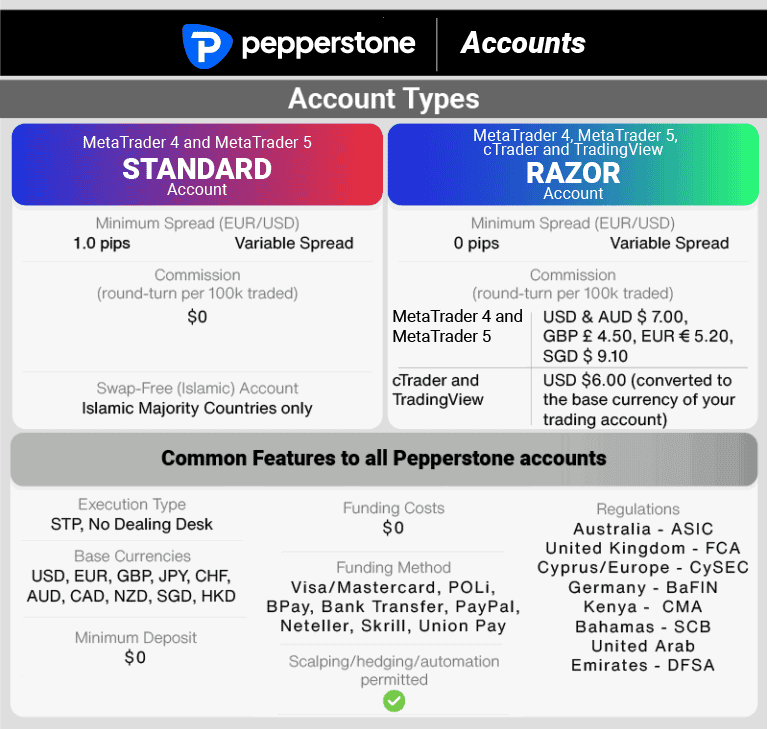

Forex brokers that charge a spread and commission are often termed ECN brokers. This means they have no dealing desk with a goal of not making a profit from the spread but rather a flat commission rate based on volume. Any remaining spread is determined by the market.

Most experienced Forex traders will choose an ECN forex broker as their overall fees are lower. They also have superior execution speeds with traders having direct access to other financial instructions and liquidity pools.

No Commission Brokers

About Non-Commission Brokers

Often termed as ‘standard accounts’ these brokers (or accounts) have no commissions. Instead, the Best Forex Brokers In Australia makes its money primarily from the spread (the difference between the buy and sell price). These spreads will differ based on the currency pair and the time of the day. Generally, the more major traded pairs such as the EUR/USD will have lower spreads than more exotic pairings.

Non-Commission brokers are normally the performance of beginner forex traders due to the simplicity of pricing. This can make it easier to calculate the profit/losses of trades. The downside is the overall fees may be higher compared to an ECN trading account.

Forex Broker For Beginners

Best Forex Brokers For Beginners

Unlike ECN or Non-Commission accounts, Best Forex Brokers In Australia are fixed spread accounts that don’t have floating spreads. This means that traders know the fees a broker will charge over time adding certainty when training. Often fixed spread brokers also will have other risk management tools included such as guaranteed stop losses.

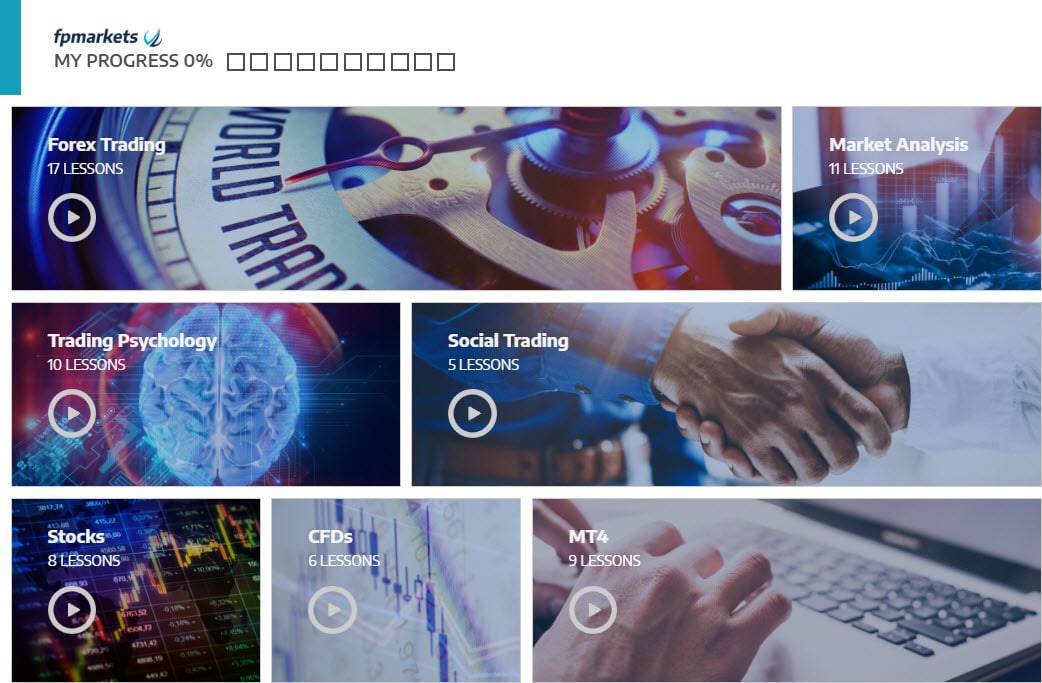

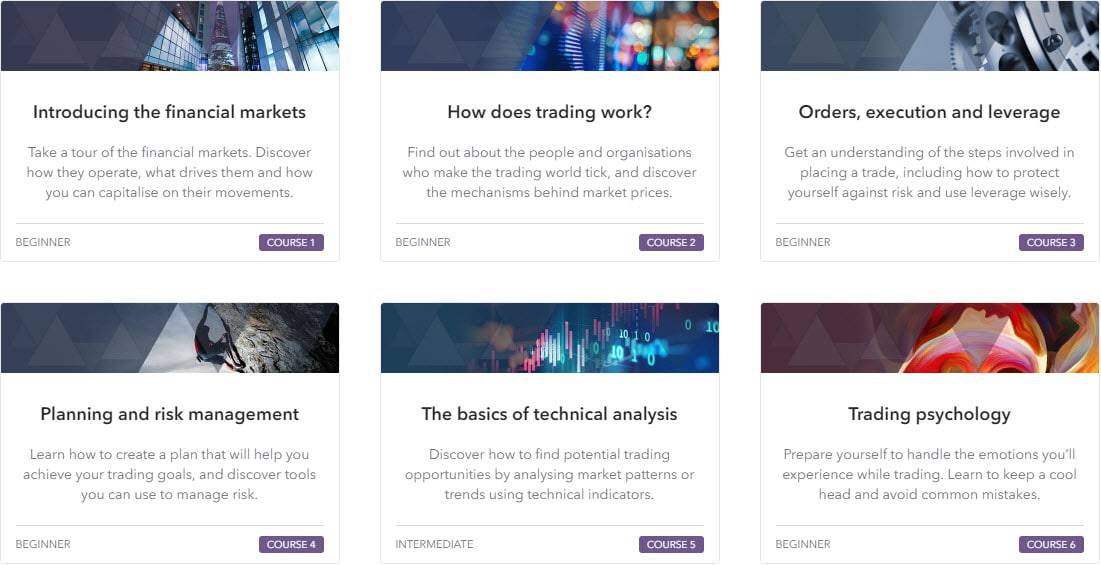

Fixed spread forex brokers have the highest fees so most experienced or algorithmic traders won’t consider this option. They also have the poorest execution speeds of the three broker sets. They are still the best forex broker for beginners as risk management tools can limit losses and their training facilities are the best for novice traders.

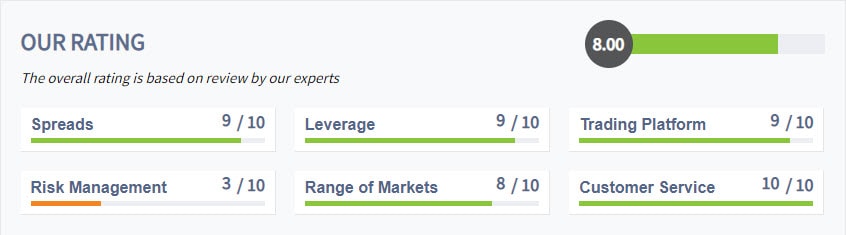

What makes a forex broker good depends on what a given trader finds important. Some favour low spreads or fast execution, some prefer low costs, while others find risk management tools important. This page has separated our brokers into 3 sections below based on the best ECN, no commission and beginner brokers.

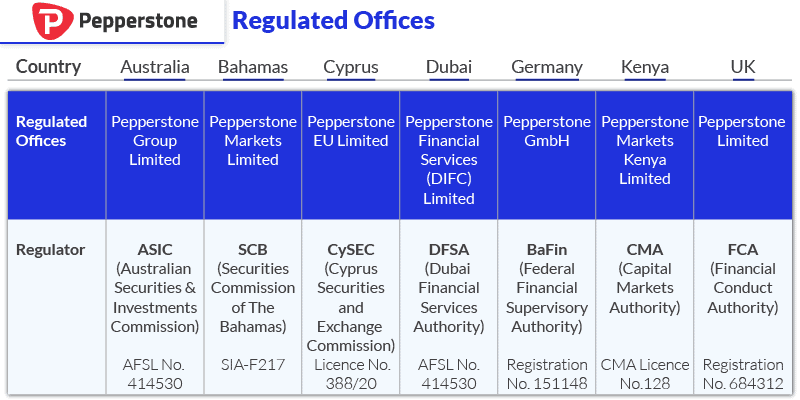

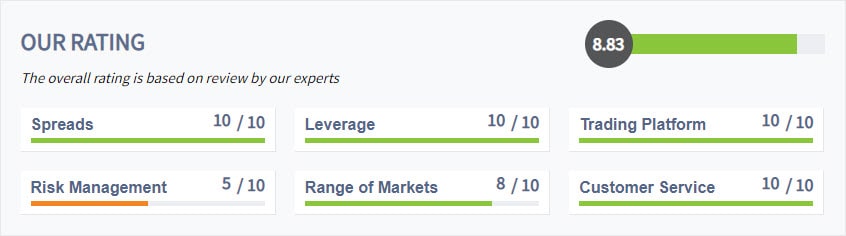

Pepperstone is the 2025 best forex broker based on:

Pepperstone is the 2025 best forex broker based on:

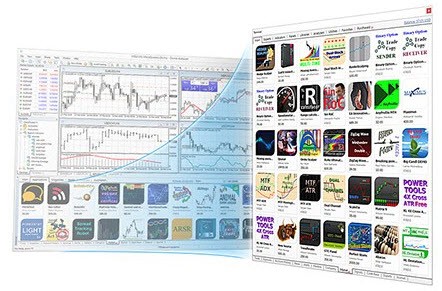

Another advantage of MT4 is the built-in Market. This allows for automated strategies (Expert Advisors) to be purchased.

Another advantage of MT4 is the built-in Market. This allows for automated strategies (Expert Advisors) to be purchased.

Other features of cTrader include:

Other features of cTrader include:

Ask an Expert

Wonder if you have any information on ” abbado.com” broker. They are into Forex and Cryptos with margin. Any helpful recommendations for brokers trading Cryptos, Forex, and Metals .

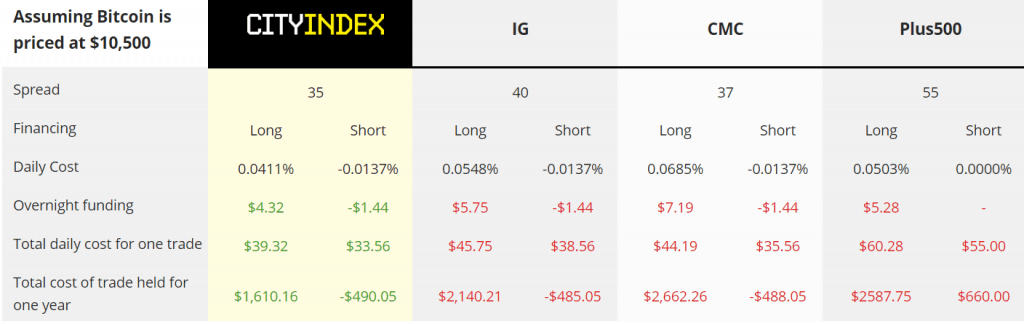

You can trade forward contracts using the Next Generation platform made by CMC Markets.